Swiggy LtdSwiggy - The chart shows a well-defined ascending channel pattern, and price action is moving steadily between the parallel trendlines, respecting both the support and resistance lines

The latest candle shows a bounce from the lower channel support, which indicates continuation of the uptrend within the channel.

Buy above 440 | Target 460 and 460 | Stop loss 430

Swiggy

INFY 1D Time frame📉 Current Market Snapshot

Current Price: ₹1,525.60

Previous Close: ₹1,509.70

Day's Range: ₹1,521.10 – ₹1,542.90

52-Week High: ₹2,006.45

52-Week Low: ₹1,307.00

Market Cap: ₹6,33,794 crore

P/E Ratio: 23.0

Dividend Yield: 2.82%

ROE: 28.72%

Debt-to-Equity Ratio: 0.09

Beta: 1.11

EPS (TTM): ₹65.63

Face Value: ₹5.00

VWAP: ₹1,529.86

Volume: 12,856,963 shares

ATR (14): ₹5.72

MFI: 71.75

BANKNIFTY 4H Time frameCurrent Snapshot

Current Price around: ₹54,713 - ₹54,600

Day’s Range (4H): ₹54,400 – ₹54,705

Previous Close: ₹54,216

Opening Price (4H): ₹54,554

Volume: Moderate

🔑 Key Support & Resistance Levels

Immediate Support: ₹54,550

Next Support: ₹54,400

Immediate Resistance: ₹54,705

Next Resistance: ₹55,000

📈 Trend & Indicators

Trend: Mildly bullish; trading around 50-hour moving average.

RSI (14): 62 – Neutral to slightly bullish.

MACD: Positive → indicating mild bullish momentum.

Moving Averages: Short-term averages indicate neutral to slightly bullish bias.

🔮 Outlook

Bullish Scenario: Sustained move above ₹54,705 may push toward ₹55,000.

Bearish Scenario: Drop below ₹54,550 could bring a retracement to ₹54,400.

Neutral Scenario: Consolidation between ₹54,550 – ₹54,705; breakout needed for directional move.

📌 Key Factors to Watch

Performance of major banking stocks in BANKNIFTY.

Economic indicators such as interest rates and RBI policy updates.

Global market cues including US indices, crude oil, and currency movements.

Swiggy cmp 439.05 by Daily Chart since listedSwiggy cmp 439.05 by Daily Chart since listed

- Support Zone 385 to 415 Price Band

- Resistance Zone 440 to 465 Price Band

- Rising Support Trendline well respected by Price momentum

- Bullish Cup and Handle followed by small Rounding Bottoms or a closely considerate VCP pattern

- Falling Resistance Trendline Breakout attempted with older Resistance Trendlines Breakout well sustained

- Volumes are spiking heavily at intermittent intervals and staying in close sync with the average traded quantity

ETERNAL LTDETERNAL – The stock trading in a rising parallel channel, making higher high and higher lows

Small consolidation (mini bullish flag) near the channel's upper half, which often leads to another upward leg if supported by volume.

If the stock breaks and sustains above 315 can get target 330 then 350. Manage the risk with strict SL at 300

Swiggy Ltd. Reserch ReportBuy/Sell/Hold Recommendation:

Given Swiggy’s strong revenue growth but continued losses and negative cash flows, the stock currently represents a high-risk, high-reward opportunity. Unless you have a high risk appetite and a long-term horizon, a "Hold" stance is appropriate—wait for visible margin improvement and positive cash flows before considering aggressive buying. For conservative investors, it’s best to avoid new buys until profitability and sustainable cash generation are in sight. Only enter or add if Swiggy shows concrete signs of turning profitable and scaling successfully.

HOld (Overvalued)

Swiggy Investment Report: Independent Strategic & Financial Outlook

Introduction

Swiggy, a leading player in India’s food delivery and quick commerce industry, continues to pursue aggressive growth and operational dominance, shaping its own strategic path amid sector challenges.

Financial Metrics

In FY25, Swiggy posted revenue of ₹15,227Cr but remained loss-making with a net deficit of ₹3,117Cr and negative EBITDA margins, reflecting heavy investment in technology, logistics, and expansion—especially in its Instamart quick commerce division. Capital expenditures and higher working capital are keeping free cash flows negative (-₹2,693Cr in FY25), underscoring the company’s high-growth, cash-consuming phase.

Strategic Progress & DCF Valuation

Swiggy’s management aims for positive cash flows and margin turnaround, with plans to steadily improve profitability by scaling operations and increasing efficiency. A detailed DCF analysis, based on realistic growth and margin improvement assumptions (cost of equity 11.79%, terminal growth 10%), implies an intrinsic value of around ₹143 per share—indicating the current market cap still prices in optimism about future execution.

Key Takeaways

Swiggy operates in a capital-intensive, competitive market, facing margin pressure but also strong revenue momentum.

Ongoing board and policy reforms reflect the company’s drive for operational maturity.

Long-term success hinges on rapid margin improvement, successful turnaround of Instamart, and conversion of scale into sustainable profits.

Conclusion

Swiggy’s independent outlook shows promise with its robust platform and growth potential, but significant risks remain until losses are narrowed and cash flows turn consistently positive. For investors, Swiggy presents a high-risk, high-reward bet—success will be determined by its pace of execution and ability to transition from investment-driven growth to profitable leadership in India’s booming delivery market.

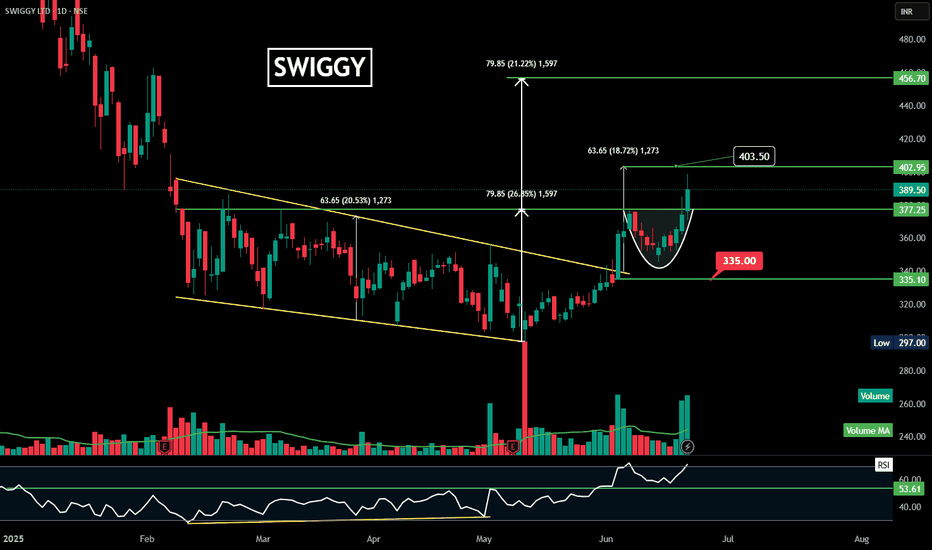

SWIGGY : Next Multi-bagger ??NSE:SWIGGY

🚀 SWIGGY LTD – Combined Technical + Fundamental Analysis

As of: 24 July 2025 | CMP: ₹420.50 |

📈 TECHNICAL ANALYSIS

🔷 Pattern: Cup and Handle Breakout

Cup & Handle pattern completed over 5 months (Feb–July 2025)

Breakout Level: ₹409 (marked horizontal resistance)

CMP: ₹420.50 — breakout confirmed with strong volume

Cup Depth: ₹409 – ₹285 = ₹124

🔍 Indicators & Price Action:

Price vs 50 EMA ✅ Above (bullish short-term trend)

Price vs 200 EMA ✅ Above (bullish long-term trend)

Volume ✅ Breakout confirmed with surge

RSI ~63 (strong but not overbought)

🔧 Key Levels:

Support Resistance Swing Target

₹409 (Breakout retest) ₹445 / ₹480 ₹533 (measured move)

Technical Verdict:

Bullish breakout from a long base. With volume confirmation and improving fundamentals, Swiggy is poised for a multi-week rally.

=======================================

📊 FUNDAMENTAL ANALYSIS

📈 1. Revenue Growth

Swiggy has shown consistent and impressive topline expansion over the past 3 years:

Financial Year Revenue (₹ Cr) YoY Growth

FY22 ₹5,705 –

FY23 ₹8,265 +45%

FY24 ₹11,115 +34%

FY25 (Est.) ₹14,500 +30% est.

Growth Drivers:

🚀 Instamart (Grocery) – fastest-growing vertical

🍽️ Food Delivery – steady in Tier I, expanding in Tier II/III

📍 Strong presence in metros, improving reach in smaller cities

💰 2. Profit Trajectory

Swiggy was known for heavy cash burn pre-IPO, but is now nearing profitability:

Financial Year Net Profit/Loss (₹ Cr) EBITDA (₹ Cr)

FY23 -₹4,179 -₹3,363

FY24 -₹1,482 -₹1,115

FY25 (Est.) +₹75 (Profit) +₹350

📉 Losses reduced by over 60% in 12 months

🔁 EBITDA-positive since Q4 FY25 — a major turning point

🛠️ Cost control, reduced discounting, and Instamart’s scale driving margin growth

🌱 3. Future Growth Prospects

Swiggy is now strategically positioned to capture multiple long-term themes:

Segment Outlook Comments

Instamart 🌟 High Growth 60%+ YoY growth, core revenue driver by FY26

Food Delivery 🔁 Steady to Moderate Strong in metros; Tier II/III scaling slowly

Dineout + Genie 🧊 Low Growth Not major contributors, but strengthen ecosystem

New Revenue 🧠 Ads, cloud kitchens High-margin potential in FY26/FY27

🧾 IPO proceeds deployed into logistics & tech infra (no major debt)

📈 Possible MSCI/Nifty Next 50 inclusion in FY26

🔓 Optionality: Entry into fintech/payments, loyalty programs, and dark kitchens

🔚 COMBINED VIEW – TECHNICAL + FUNDAMENTAL

Technical Pattern ✅ Cup & Handle breakout at ₹409

Revenue Trend ✅ Strong CAGR ~36%

Profit Outlook ✅ Profitability by FY25 end

Future Potential ✅ High – Instamart + Ads + Tier-II expansion

Risk ⚠️ Valuation premium + ONDC threat remains

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Learn Institutional Trading Part-9🎯 Why Learn Advanced Option Trading?

Advanced option trading lets you:

✅ Profit in bullish, bearish, or sideways markets

✅ Use time decay to your advantage

✅ Limit risk while maximizing potential reward

✅ Create non-directional trades

✅ Build hedged and balanced positions

✅ Use data, not emotion for decision making

It shifts you from being a trader who hopes for direction to one who profits from market behavior — movement, volatility, time decay, and imbalance.

🧠 Core Concepts in Advanced Option Trading

1. Option Greeks

Understanding the Greeks is essential for advanced strategies.

Delta: Measures price sensitivity to the underlying (helps with directional trades).

Theta: Measures time decay. Option sellers use Theta to earn premium.

Vega: Measures sensitivity to implied volatility (IV).

Gamma: Measures how Delta changes — useful for adjustments and hedging.

Rho: Interest rate sensitivity (used in long-term options).

Greeks help you balance risk and reward and fine-tune your strategies based on volatility and time.

2. Implied Volatility (IV) & IV Rank

IV shows the market’s expectation of future volatility.

High IV = high premium; low IV = cheap premium.

IV Rank compares current IV to its past 52-week range — essential for deciding whether to buy or sell options.

💡 Advanced rule:

High IV + High IV Rank = Favor selling options

Low IV + Low IV Rank = Favor buying options

3. Multi-Leg Strategies

Multi-leg trades involve using more than one option to hedge, balance, or amplify your position.

Here are the most popular advanced option strategies:

🔼 Bullish Strategies

🔹 Bull Call Spread

Buy one lower strike Call, sell a higher strike Call

Profits if the market rises within a defined range

Lower cost than buying a single Call

🔹 Synthetic Long

Buy a Call and Sell a Put of the same strike

Replicates owning the underlying, but with options

🔽 Bearish Strategies

🔹 Bear Put Spread

Buy a higher strike Put, sell a lower strike Put

Profits if market falls within a defined range

🔹 Ratio Put Spread

Buy one Put, sell two lower-strike Puts

Low-cost or credit strategy with higher reward if price falls moderately

🔁 Neutral or Range-Bound Strategies

🔹 Iron Condor

Sell one Call spread and one Put spread

Profits if market stays between both spreads

Ideal in low volatility, sideways markets

🔹 Iron Butterfly

Sell ATM Call and Put, buy OTM wings

Profits from time decay and stable price

High Theta, limited risk and reward

🔹 Straddle (Buy/Sell)

Buy/Sell ATM Call and Put

Used when expecting high volatility (Buy) or low volatility (Sell)

🔹 Strangle

Buy/Sell OTM Call and Put

Lower cost than Straddle, wider profit zone

🛡️ Hedging Strategies

🔹 Protective Put

Hold underlying asset, buy a Put to limit downside

Like insurance for your long position

🔹 Covered Call

Hold stock, sell a Call to generate income

Profitable if the stock stays flat or rises slightly

🔹 Collar Strategy

Hold stock, buy Put and sell Call

Risk defined, reward capped — good for conservative investors

📊 Open Interest & Option Chain Analysis

Open Interest (OI) shows where the majority of contracts are built.

High OI + Price Rejection = Institutional Resistance/Support.

Watching Call/Put buildup gives clues about range, breakout zones, and expiry-day moves.

💡 PCR (Put Call Ratio): A sentiment indicator.

PCR > 1: More Puts → Bearish

PCR < 1: More Calls → Bullish

⏱️ Time Decay & Expiry Trades

Advanced traders use weekly options to capitalize on Theta decay. Weekly expiry strategies include:

Short Straddles/Strangles

Iron Condors

Calendar Spreads

These strategies make use of:

Fast premium decay on Thursday/Friday

Stable market periods

Defined risk setups

🧠 Advanced Psychology & Risk Control

Professional option traders don’t overtrade or overleverage. They:

Follow the 1–2% risk per trade rule

Avoid trading during event-based spikes (e.g., budget, Fed speeches)

Take non-directional trades in consolidating markets

Focus on probability over prediction

Maintain a trading journal and review setups

🎓 Pro Tips to Master Advanced Option Trading

✅ Understand the Greeks — especially Theta & Vega

✅ Use multi-leg strategies to reduce risk and cost

✅ Follow IV Rank — don’t buy expensive options

✅ Use high reward-to-risk setups

✅ Track OI build-up and option chain flow

✅ Avoid gambling — options are tools, not lottery tickets

✅ Always use hedged positions, especially when selling options

🧘 Final Words: Become the Strategist, Not the Speculator

Advanced Option Trading is not about guessing where the market will go — it’s about constructing trades that win in multiple scenarios.

It empowers you to:

Manage risk like a professional

Generate regular income from time decay

Adjust and defend trades when things go wrong

Trade with confidence, not emotion

If you’re ready to move beyond basic buying and start mastering the real edge in options, advanced strategies are your next level. This is how institutions trade. This is how real consistency is built.

BANKNIFTY - 1D Timeframe📅 Current Market Status (as of July 18, 2025)

Closing Price: ₹56,283

Fall Today: –547 points (–0.96%)

Intraday Range: ₹56,205 (Low) to ₹56,849 (High)

52-Week Range: ₹43,199 (Low) to ₹57,817 (High)

2025 Performance So Far: Up around 9.5%

🧮 Moving Averages – All Are Negative

From 5-day to 200-day, all moving averages are giving SELL signals.

This confirms a strong downtrend.

Price is below every major moving average → means no strength for recovery yet.

📉 Support and Resistance Levels

Type Price Range

Support ₹55,800 – ₹56,000

Resistance ₹56,700 – ₹57,200

If the price falls below ₹55,800, we may see further fall toward ₹55,000.

For any upward trend to begin, Bank Nifty must close above ₹57,200.

⚠️ Market Mood – What’s Going On?

Strong Downtrend: Bears are in control; market is falling continuously.

High Volume on red candles: Big traders are selling heavily.

Oversold Condition: Market has fallen too much, may bounce a little.

High Volatility: Big movements (500–600+ points) can happen daily.

✅ Easy Summary

Overall Trend: Bearish (Downtrend)

Short-Term Possibility: Small upward bounce may come due to oversold indicators

But: No proper recovery signal until Bank Nifty moves above ₹57,200

Traders should be cautious – trend is still weak and selling pressure is high.

🔮 What to Watch Next?

RSI Above 35: Could be an early sign of recovery.

MACD Crossover: Needed for trend reversal.

Low Red Candle Volume: Means selling may be ending.

₹55,800 Support: If this breaks, further downside likely

Trade Like Istitution Why Learn to Trade Like Institution?

Financial markets are not random. They are highly manipulated and structured systems, controlled by major financial entities. When you trade like institution, you stop guessing and start understanding:

Where the big players place their orders.

How liquidity zones work.

Why certain price levels are targeted before major moves.

How you can identify smart money footprints and follow the dominant trend.

This approach teaches you to trade strategically, patiently, and professionally — eliminating the emotional rollercoaster most traders experience.

What You Will Learn in “Trade Like Institution”

✅ Smart Money Trading Concepts

Understand how institutions manipulate markets, create liquidity, and trap retail traders. Learn the basics of accumulation, manipulation, and distribution phases.

✅ Market Structure and Order Flow

Read the market from an institutional perspective using pure price action and market structure analysis. Identify break of structure (BOS) and change of character (CHoCH) signals that reveal when the market is about to move.

✅ Order Block Identification

Learn to locate order blocks, where institutions place their large orders. These zones are often the key areas where price reverses or explodes in a specific direction.

✅ Liquidity Zones and Stop-Loss Hunting

Discover how to identify liquidity pools, understand stop-loss hunting techniques, and position yourself for trades after liquidity grabs.

✅ Risk Management Like Institutions

Master the art of risk management, learning how big players manage risk efficiently to stay profitable long-term, even after losses.

✅ High-Probability Trade Setups

Get access to reliable entry techniques with precise stop-loss placement and optimal reward-to-risk setups that minimize risk and maximize returns.

✅ Live Market Application

Learn through real-world market examples, live sessions, and chart analysis to see how institutional concepts apply in active markets like forex, stocks, indices, and crypto.

Who Should Learn to Trade Like Institution?

This course is designed for:

📊 New traders who want to start the right way without falling into retail traps.

💡 Intermediate traders who have experience but struggle with consistency.

💼 Full-time or part-time traders who wish to level up their skills.

📈 Investors who want to actively manage and grow their wealth.

🎯 Ambitious traders who want to make trading a serious and professional income source.

Benefits of Trading Like Institution

✅ Stop being a victim of market manipulation and start trading with the market movers.

✅ Eliminate confusion, follow clean price action, and trade with confidence.

✅ Avoid low-probability trades by understanding where the real market action happens.

✅ Build strong discipline and follow a professional trading process.

✅ Achieve long-term profitability by managing risk like professionals.

✅ Become a confident, independent trader capable of thriving in any market condition.

Trading success comes from learning the truth behind market movements and following the professional path. This course will completely transform your approach to the markets. With Trade Like Institution, you’ll stop guessing, start predicting, and trade with an edge just like the top institutional traders do every single day

GIFT Nifty Signals Bullish Start🏛️ What is GIFT Nifty?

Let’s start with the basics.

GIFT Nifty is the new name for what used to be known as the SGX Nifty—a derivative contract that mirrors the Nifty 50, but is traded outside India.

It now runs on the GIFT City platform (Gujarat International Finance Tec-City).

It gives traders, especially foreign institutional investors (FIIs), the ability to trade in Nifty futures even before the Indian market opens.

Think of it as an early indicator of how the Nifty 50 might perform when the Indian market opens at 9:15 am.

✅ Important: GIFT Nifty is NOT a separate index.

It simply reflects the expected movement of the Nifty 50 index, based on global market cues and overnight developments.

🧠 Why Did SGX Nifty Become GIFT Nifty?

Until July 2023, the Nifty futures were traded on the Singapore Exchange (SGX).

But to bring more liquidity and volume back to Indian shores and to establish India as a global financial hub, the trading of Nifty derivatives was moved from Singapore to the GIFT IFSC platform.

Thus, SGX Nifty became GIFT Nifty.

📈 Why GIFT Nifty’s Morning Move Matters

Each morning, traders, analysts, media houses, and even retail investors check GIFT Nifty levels.

Why?

Because it acts as a directional clue. Here’s how:

If GIFT Nifty is up by 100 points, it’s a sign that Nifty 50 is likely to open higher.

If it’s down by 75 points, it hints at a gap-down opening.

It reflects the sentiment of global markets, overnight US cues, geopolitical risks, and FII mood.

📊 Example:

GIFT Nifty trading at 22,450 (up 80 points)

Yesterday’s Nifty close: 22,370

→ Bullish sign → Indian markets may open with a gap-up of 70–100 points.

📌 What Does “Bullish Start” Mean?

A bullish start means the market is expected to open on a positive note—meaning, the index (like Nifty or Sensex) may start the day higher than the previous day’s closing.

This can happen due to:

Strong global cues (e.g., Dow Jones, Nasdaq closing higher)

Positive FII activity

Good earnings announcements

Supportive macroeconomic data

Favorable government or budget policy

Cooling of global tensions or crude oil prices

So, when GIFT Nifty shows a positive movement before 9 am, traders call it a bullish pre-market setup.

🔍 Real-World Example – July 18, 2025

On July 18, 2025:

GIFT Nifty was up by 55 points, indicating a positive start.

This came after a volatile weekly expiry on Thursday.

Strong earnings expected from companies like Reliance, JSW Steel, L&T Finance added to positive sentiment.

US markets closed flat, but no major negative surprise.

FIIs were net sellers, but DIIs absorbed selling pressure.

→ All this combined gave a green signal from GIFT Nifty to the domestic market.

💼 How Traders Use GIFT Nifty in Strategy

✅ 1. Pre-Market Planning

GIFT Nifty gives early clues, so:

Intraday traders plan opening range setups

Option traders adjust straddles/strangles based on expected gap

F&O traders look at overnight position rollover

✅ 2. Risk Management

A weak GIFT Nifty warns of gap-downs due to global negativity.

This allows traders to:

Hedge long positions

Tighten stop-losses

Avoid aggressive morning trades

✅ 3. Sectoral Rotation

If GIFT Nifty is up, focus shifts to high-beta stocks like Bank Nifty, Reliance, Adani Group, etc.

If it's down, defensive plays like FMCG and Pharma may perform better.

🧮 How to Read GIFT Nifty Properly?

Here are 3 simple tips:

✔️ Tip 1: Compare with Previous Day’s Nifty Close

If GIFT Nifty > Last close → Gap-up expected

If GIFT Nifty < Last close → Gap-down likely

✔️ Tip 2: Watch Global Cues

Dow/Nasdaq closing + crude oil + USD/INR = impact GIFT Nifty

If all show strength, GIFT Nifty usually reacts positively

✔️ Tip 3: Use With FII/DII Data

Bullish GIFT Nifty + FII Buying = Strong setup

Bullish GIFT Nifty + FII Selling = Weak opening might reverse later

🌎 GIFT Nifty & Global Linkage

India is now deeply linked with:

US markets (Nasdaq, S&P 500)

Crude oil

Dollar Index

Global interest rate policies (Fed, ECB)

So if:

US markets crash overnight → GIFT Nifty reacts instantly

Crude oil falls sharply → Positive for India → GIFT Nifty turns green

📍 Important: GIFT Nifty Is Not Always Accurate

Sometimes GIFT Nifty shows bullish signs, but:

Domestic news (politics, budget) pulls market down

FII/DII data surprises post-opening

Index gaps up but then reverses during the day

That’s why traders use GIFT Nifty as a clue, not a guarantee

🚦 Final Thoughts – Why You Should Watch GIFT Nifty

GIFT Nifty is like the morning alarm for the market:

It tells you what’s likely to happen before the bell rings.

Gives you a head start to plan your trades.

Helps spot sectoral strength, F&O positioning, and market mood.

Nifty 50 – 1 Day Timeframe✅ Closing Summary:

Closing Price: ₹24,968.30

Change: −₹143.55 (−0.57%)

Opening Price: ₹25,108.55

Intraday High: ₹25,144.20

Intraday Low: ₹24,919.10

Nifty 50 traded in a narrow but bearish range throughout the session, losing nearly 0.6%, as market sentiment remained weak due to earnings pressure and global cues.

🔍 Key Reasons for the Decline:

Banking Sector Drag:

Major private sector banks like Axis Bank reported weaker-than-expected earnings, sparking a broad sell-off in financials.

Financial stocks make up a large portion of Nifty 50, pulling the entire index lower.

Cautious Investor Sentiment:

Global uncertainty regarding U.S. Federal Reserve interest rate decisions and economic slowdown concerns weighed on overall risk appetite.

Investors are also being cautious ahead of major Indian corporate earnings from companies like HDFC Bank, ICICI Bank, Reliance Industries, and others.

Foreign Institutional Selling (FII):

FIIs continued to sell Indian equities, especially large-cap financials and IT stocks.

This added selling pressure even as some domestic institutional investors tried to buy the dips.

Technical Weakness:

The index slipped below the 25,000 psychological support level, a sign of short-term technical weakness.

Intraday recoveries were capped near resistance, confirming the bearish tone.

📈 Technical Outlook (Short-Term):

Support Zone: ₹24,900 to ₹24,850

This is the next critical area. If broken, further decline toward ₹24,600 is likely.

Resistance Zone: ₹25,150 to ₹25,300

Bulls need to reclaim this zone for the trend to turn positive again.

Momentum Indicators:

RSI: Slipping below 45, showing weakening momentum.

MACD: Bearish crossover; trend remains under pressure.

Volume: Slightly above average, indicating serious selling interest at the top.

📆 Recent Trend Performance:

1-Day Return: −0.57%

1-Week Return: −0.35%

1-Month Return: +2.10%

6-Month Return: +12.8%

1-Year Return: +10.9%

Nifty 50 remains in a medium- to long-term uptrend, but short-term correction is underway, largely due to sector-specific drag and earnings volatility.

🧠 What Traders & Investors Should Know:

Day Traders: Watch for quick reversals near support at ₹24,900; consider shorting near resistance if recovery fails.

Swing Traders: Wait for either a bullish reversal candle or RSI bounce before entering fresh long positions.

Long-Term Investors: Despite the dip, the market remains healthy. This could be a buy-on-dip opportunity, especially in sectors like auto, pharma, and capital goods that are holding well.

💬 Conclusion:

Nifty 50 showed weakness on July 18 due to negative earnings surprises and bearish sentiment in financials. While technical indicators suggest short-term downside pressure, the broader long-term trend remains intact. Key support at ₹24,900 is crucial. A bounce from that zone can trigger a recovery, but a sustained break below it could accelerate the decline

FMCG & ConsumptionThink about your daily life — the toothpaste you use, the biscuits you eat, the shampoo you prefer, the tea you drink, the food delivery app you order from. Every one of these touches a part of the FMCG & consumption sector.

Now multiply that by 1.4 billion Indians, and you realize the size of this engine.

In 2025, the FMCG (Fast-Moving Consumer Goods) and consumption-driven stocks are at the center of a powerful story — one shaped by:

India's rising middle class

Rural income revival

Urban premiumization

Growth of e-commerce and quick commerce

Digital payments & new-age D2C (Direct-to-Consumer) brands

This isn't just a theme — it's a structural growth trend that never goes out of fashion.

Let’s break it down step-by-step.

🧼 What is FMCG & Consumption Sector?

FMCG stands for Fast-Moving Consumer Goods. These are everyday products people buy frequently:

Food & beverages (biscuits, noodles, soft drinks, snacks)

Personal care (soap, shampoo, deodorant)

Household items (detergent, floor cleaner, toothpaste)

Over-the-counter (OTC) products (balms, cough syrup, nutrition)

The Consumption theme expands on this to include:

Retail (organized & unorganized)

Quick commerce (Blinkit, Zepto)

E-commerce (Amazon, Flipkart, Nykaa)

Food delivery (Zomato, Swiggy)

Apparel & footwear (Trent, Aditya Birla Fashion)

Durables & electronics (TVs, fridges, fans, phones)

So whether it’s Maggi or Myntra, Parle-G or Paytm Mall — it all fits under Consumption.

🔥 Why FMCG & Consumption Is Trending in 2025

Let’s look at what’s driving this sector today:

1️⃣ Rural Demand Is Rebounding

After 2 years of low rural growth due to inflation and erratic monsoons, 2025 has brought strong crop output, stable agri prices, and more cash in hand.

Rural India forms over 40% of FMCG consumption, especially:

Entry-level soaps, snacks, tea

Sachet products

Local brands

Companies like Dabur, HUL, Marico, and Emami have all confirmed rural growth is picking up fast.

2️⃣ Premium Urban Consumption Is Booming

At the same time, India’s cities are upgrading:

Tier-2 cities now demand premium face creams, health foods, organic juices

Young consumers are choosing branded wear, subscription boxes, and gourmet snacks

Working women are driving personal care product sales

Urban India is moving from price to value, and that’s a goldmine for consumer brands.

3️⃣ Quick Commerce Is Changing Habits

Apps like Blinkit, Zepto, Swiggy Instamart are:

Delivering goods in 10–20 minutes

Creating new demand cycles (midnight snacking, impulse buys)

Becoming a new channel for FMCG sales

For FMCG companies, this means higher turnover and visibility, especially for smaller SKUs (sachets, ₹5/₹10 packs).

4️⃣ Direct-to-Consumer (D2C) Boom

New-age startups like:

Mamaearth (beauty, baby care)

WOW Skin Science (natural shampoos)

BoAt (audio & smart accessories)

Licious (fresh meats)

…are bypassing traditional stores and selling directly online.

This model:

Cuts middlemen

Boosts margins

Creates brand intimacy

And now many of these brands are listed or IPO-ready, adding fire to the consumption story.

5️⃣ China+1 & Make in India Push

Many global companies now manufacture in India, not China:

Personal care

Cosmetics

Packaged foods

This reduces costs, improves supply chains, and boosts exports of Indian FMCG brands too.

📈 Stock Market Performance (2023–2025)

Let’s take a look at how some top names have performed:

Stock Jan 2023 Price July 2025 Price Return

ITC ₹340 ₹460+ 35%

Hindustan Unilever ₹2,500 ₹2,800+ 12%

Dabur ₹550 ₹675+ 22%

Nestle India ₹18,000 ₹24,000+ 33%

Zomato ₹55 ₹195+ 250%+

Nykaa ₹120 ₹180+ 50%

Mamaearth (Honasa) ₹320 (IPO) ₹460+ 44%

Quick commerce, D2C and food delivery stocks have been top gainers.

Traditional FMCG majors are more slow & steady compounders.

🛒 Segments Inside FMCG & Consumption

Let’s divide this into sub-themes:

🍪 1. Packaged Foods & Beverages

Britannia (biscuits)

Nestle India (Maggi, chocolates)

Tata Consumer (tea, coffee, salt)

Varun Beverages (Pepsi bottling)

Bikaji, Prataap Snacks (local snacks)

🧼 2. Personal & Household Care

HUL (Dove, Surf Excel, Lifebuoy)

Dabur (Chyawanprash, Vatika)

Marico (Parachute, Saffola)

Godrej Consumer (Goodknight, Cinthol)

Emami (Fair & Handsome, Navratna)

🛍️ 3. Retail Chains & Apparel

Trent (Westside, Zudio)

V-Mart

Avenue Supermarts (D-Mart)

Aditya Birla Fashion (Pantaloons, Van Heusen)

Shoppers Stop

🍕 4. Online Food & Quick Commerce

Zomato

Jubilant Food (Domino’s)

Devyani International (KFC, Pizza Hut)

Zepto (IPO coming soon)

Blinkit (part of Zomato)

💄 5. Beauty & D2C Personal Care

Honasa (Mamaearth)

Nykaa

Lotus Herbals (Private)

WOW Skin Science (IPO Expected)

💡 Why Traders and Investors Love This Sector

✅ Always in Demand – Recession or boom, people still need soap and toothpaste.

✅ Strong Brand Power – Consumer loyalty = pricing power = margin stability.

✅ Low Capex Businesses – High return on capital, especially for asset-light D2C models.

✅ Growth via Premiumization – Indians are trading up from "cheap" to "value".

✅ Earnings Predictability – FMCG companies often beat or meet earnings estimates.

📊 How to Trade or Invest in This Theme

🎯 For Long-Term Investors:

Pick 3–4 companies across segments:

One traditional FMCG major (HUL, ITC)

One high-growth food player (Nestle, Varun Beverages)

One retail/delivery stock (Zomato, Trent)

One new-age D2C story (Mamaearth, Nykaa)

Hold for 3–5 years. These stocks are slow compounders with low risk + decent reward.

📉 For Traders:

Look for volume breakouts after consolidation

Track monthly updates on rural/urban growth

Trade around quarterly results and guidance

Use options strategy around earnings for volatility plays (like Zomato)

⚠️ Risks to Watch Out For

Risk Explanation

Inflation Pressure Higher input costs (milk, palm oil) hurt margins

Valuation Concerns Some D2C stocks may be overpriced

Competition from Local Players Especially in rural and Tier-3 cities

Dependency on Monsoon A weak monsoon can dent rural demand

🚀 The Road Ahead (2025–2030)

India is expected to:

Add 250 million middle-class consumers by 2030

See online retail double in size

Witness over 500 million people shop on mobile phones

Grow FMCG exports to Asia & Africa

The Indian consumption engine is just starting up. This isn't a temporary trend — it’s a secular, multi-decade opportunity.

✅ Conclusion

The FMCG & consumption story in India is:

Stable during slowdowns

Explosive during booms

Universal in reach — touching every home, city, and village

Now evolving rapidly with D2C, quick commerce, and premiumization

Whether you're an investor looking for consistent compounding or a trader looking for smart momentum plays, this is one of the most powerful sectors to focus on in 2025 and beyond

Difference Between Technical Analysis and Option Chain Analysis✅ 1. What is Technical Analysis?

Technical Analysis (TA) is the art and science of predicting future price movements based on historical price and volume data.

It’s like checking a stock’s past behavior on a chart to guess what it might do next.

🧠 How Does It Work?

Uses charts (candlestick, line, bar)

Studies patterns (head and shoulders, cup & handle, flags, etc.)

Applies indicators (RSI, MACD, Moving Averages, Bollinger Bands)

Identifies support & resistance levels

Helps time entry and exit points

📊 What Does It Tell You?

Is the stock trending up or down?

Is it overbought or oversold?

Where are strong support/resistance zones?

Is a breakout or breakdown happening?

🧰 Tools Used in Technical Analysis:

TradingView, Chartink, Zerodha Kite, Upstox Pro, etc.

Indicators: RSI, MACD, EMA, VWAP, Supertrend

Patterns: Breakout, Double Top, Flag Pattern, etc.

✅ 2. What is Option Chain Analysis?

Option Chain Analysis is specific to derivatives trading. It looks at open interest (OI), premiums, and strike prices to understand what option traders are betting on.

It helps you decode the behavior of big players (institutions) in the options market — especially on indices like Nifty, Bank Nifty or liquid stocks like Reliance, HDFC Bank, etc.

🧠 How Does It Work?

An option chain shows all available strike prices and their:

Call (CE) and Put (PE) premiums

Open Interest (OI) — how many contracts are outstanding

Changes in OI — fresh buying/selling activity

Volume traded

Implied Volatility (IV) — market’s expectations of volatility

📊 What Does It Tell You?

Where is the market expecting resistance? (High Call OI = resistance)

Where is the market expecting support? (High Put OI = support)

What are option writers (big players) doing?

Is the market bullish, bearish, or neutral?

🧰 Tools Used in Option Chain Analysis:

NSE Website (Option Chain)

Sensibull, Opstra, QuantsApp, StockMock

Open Interest Analysis Tools

PCR (Put Call Ratio)

Max Pain Theory

⚖️ Key Differences: Technical Analysis vs Option Chain Analysis

Feature Technical Analysis Option Chain Analysis

Used For Any stock, index, or crypto Only in derivatives (Options)

Data Based On Price, volume, chart patterns OI, strike prices, premiums, IV

Who Uses It? All traders (equity, F&O, forex, crypto) Mostly F&O traders and option

Time Horizon Intraday to long-term Intraday to expiry-based

📌 Practical Example (Nifty)

🔍 Technical View:

Nifty is making higher highs, higher lows

RSI = 60 → Momentum is still strong

20 EMA is acting as support

➡️ Suggests bullish trend — buy on dips

📈 Option Chain View:

Highest Call OI at 24,000 → Strong resistance

Highest Put OI at 23,500 → Strong support

Put writing increasing at 23,600 → Bulls defending this level

➡️ Suggests market may stay between 23,500–24,000

🎯 When to Use Which?

Situation Use This

Want to analyze a stock's trend Technical Analysis

Trading non-derivativ e stocks Technical Analysis

Intraday scalping Both (TA + OI levels)

Trading Nifty/Bank Nifty Options Option Chain Analysis

Looking for expiry range predictions Option Chain

Want to confirm breakout strength Combine both!

💡 Best Strategy: Combine Both!

Professional traders don’t treat these as either-or.

They often use:

📉 Technical analysis to find chart setups

🧠 Option chain data to confirm big player positions

Example:

A breakout on chart + strong Put OI at breakout level = high-probability trade.

✅ Summary

Aspect Technical Analysis Option Chain Analysis

Based on Charts, price, volume OI, premiums, strike data

Used for All trading instruments Only options

Helps in Timing trades, spotting patterns Predicting expiry range

Tools RSI, MACD, Patterns, EMAs OI, IV, Max Pain, PCR

Users Retail + institutional traders Mainly option traders, F&O players

🚀 Final Thought

Both tools are powerful in their own right. But when used together, they give you a 360° edge in the markets.

Technical analysis shows you what's happening on the chart.

Option chain analysis shows you what traders expect to happen behind the scenes.

Mastering both is the true trader’s advantage

What is FII and DII✅ What is FII and DII?

These are two major types of investors who invest huge amounts of money in the Indian stock market.

Acronym Full Form Meaning

FII Foreign Institutional Investor Big investors from outside India

DII Domestic Institutional Investor Big investors within India

🧠 Let’s Understand Them One by One:

🔵 FII – Foreign Institutional Investor

These are large investment firms, hedge funds, mutual funds, pension funds, insurance companies, etc. from outside India.

They invest in Indian equity markets, debt markets, bonds, etc.

Registered with SEBI to invest in Indian markets

📌 Examples:

Morgan Stanley

BlackRock

Goldman Sachs

Vanguard

JP Morgan Asset Management

🎯 Why They Invest in India?

Growth opportunity in Indian economy

Higher returns compared to developed markets

Long-term story of India = bullish

🔥 When FII inflow increases:

Nifty, Sensex, Bank Nifty usually go up

Especially impacts large-cap stocks (Reliance, HDFC, ICICI Bank)

🔴 DII – Domestic Institutional Investor

These are big Indian institutions that invest in Indian markets.

Includes:

Mutual Funds (like SBI MF, ICICI Pru MF)

Insurance companies (LIC, HDFC Life)

Banks (SBI, HDFC Bank treasury)

Pension funds (EPFO)

📌 They manage common people's money, and invest in:

Equity (stocks)

Debt (bonds, government securities)

🎯 Why DIIs Matter?

Provide stability to markets

When FIIs sell, DIIs often support the market by buying

📊 FII vs DII - Key Differences

Factor FII DII

Based I Foreign Countries India

Regulated By SEBI SEBI

Invest In Equity, Bonds, Derivatives Equity, Bonds, Mutual Funds

Impact On Market Highly volatile, quick to enter/exit More stable, long-term investing

Popular Examples BlackRock, JP Morgan, Nomura LIC, SBI Mutual Fund, ICICI Pru MF

🧭 Why Traders Watch FII/DII Data Daily

📈 FII/DII Activity Shows Market Mood

When FIIs are buying, markets often trend up

When FIIs are selling, markets can become volatile

When DIIs are buying, they may be supporting the market

Example:

"FII bought ₹2,500 Cr, DII sold ₹500 Cr"

→ Strong bullish sign, smart money is entering

🔄 What Happens When FIIs Sell and DIIs Buy?

FIIs sell during global tension or USD strength (they pull out money)

DIIs buy at dips to average out long-term positions

This creates volatility but also buying opportunities

🧠 Final Thoughts

FII = Foreign money → fast movers, sensitive to global news

DII = Indian money → stable investors, long-term focused

Daily FII/DII data tells us where smart money is flowing

📌 Smart traders always check FII/DII data before taking major trades — especially in Nifty, Bank Nifty, Reliance, Infosys, HDFC twins

PSU & Defence Stock Boom🏢 First, What Are PSU & Defence Stocks?

🔹 PSU Stocks

"PSU" stands for Public Sector Undertaking — companies where the Government of India holds a majority stake (more than 51%).

These companies operate in key sectors like:

Defence manufacturing

Railways

Energy (oil, gas, coal)

Power

Finance

Infrastructure

They have a long history of stability, but until recently, they were seen as slow-moving or inefficient.

🔹 Defence Stocks

These include companies that:

Make defence equipment (fighter jets, missiles, radars, warships)

Work with the Indian Armed Forces or export to global defence clients

Provide electronics, software, and parts for defence systems

In India, many defence companies are also PSUs, such as:

Bharat Electronics (BEL)

Hindustan Aeronautics (HAL)

Bharat Dynamics (BDL)

Mazagon Dock Shipbuilders

Cochin Shipyard

📈 Why Are PSU & Defence Stocks Booming in 2025?

Here are the main drivers behind this massive rally:

✅ 1. Make in India + Atmanirbhar Bharat (Self-Reliance)

The government wants India to become self-reliant in defence production, reducing dependency on imports.

Key points:

Ban on importing 450+ defence items that must now be made locally

Big push to increase defence exports

Support to Indian PSUs to ramp up production

Result: More contracts for Indian defence companies = higher revenues and profits.

✅ 2. Massive Order Books

Many PSU defence companies are sitting on huge order books, sometimes 5–7x their annual revenue.

Examples:

BEL: Order book of ₹65,000+ crore

HAL: Got ₹45,000+ crore order for fighter jets + helicopters

Mazagon Dock: Building submarines and destroyers for Navy

Bharat Dynamics: Orders for missiles, torpedoes

The market loves visibility — and order books give confidence in future earnings.

✅ 3. Government Capex Boom

India’s Union Budget 2025 has focused heavily on:

Defence capex: ₹6 lakh crore+ earmarked for the military

Railways & infrastructure spending

Indigenisation of key technologies

This benefits PSU stocks like:

RVNL, IRCON, RITES (railway infra)

BEL, BDL, HAL (defence manufacturing)

BHEL, Cochin Shipyard (industrial & shipbuilding)

✅ 4. PSU Re-Rating + Efficient Management

For years, PSUs were seen as "government-run, slow, and inefficient."

But things have changed:

Better transparency

Higher dividend payouts

Restructuring of loss-making units

More professional management

Now, investors are re-rating these companies — giving them better valuations than before.

✅ 5. Retail & FII Interest

Retail investors are loving PSU stocks because:

Many trade below ₹100–300 levels (psychologically attractive)

High dividend yields (5–10%)

Visible government support

FIIs are entering because:

Valuations are still reasonable

These sectors have strong growth tailwinds

India is among the top 5 global defence spenders

✅ 6. Global Geopolitics

With rising global tensions (Russia-Ukraine, China-Taiwan), countries are increasing defence spending.

India is emerging as a credible exporter of:

Radars

Drones

Warships

Missiles

This has opened up global demand for Indian defence PSUs.

🧾 Real-World Success Stories

Let’s look at some stocks that delivered multibagger returns recently:

Stock Price (Jan 2023) Price (July 2025) Gain %

Mazagon Dock ₹450 ₹2,400+ 400%+

BEL ₹95 ₹320+ 230%+

HAL ₹1,100 ₹4,300+ 290%+

IRFC ₹25 ₹120+ 380%+

RVNL ₹30 ₹300+ 900%+

This is not just hype. These stocks rallied due to:

Strong earnings

Better efficiency

Clear government push

Long-term order visibility

📊 Technical Outlook (July 2025)

PSU Index (NSE PSU Bank + Infra):

At all-time highs

Weekly RSI: Strong, but near overbought (watch for healthy correction)

Trend: Bullish

Defence Stocks:

Many in stage 2 rally (post-consolidation breakout)

Delivery volumes high = institutional buying

F&O interest rising in BEL, HAL, IRFC

🔍 Best PSU & Defence Stocks to Watch (2025–26)

🚀 Defence PSU Leaders

Stock Why It's Hot

BEL Radar, electronics, missile systems, exports

HAL Fighter jets, helicopters, strong order book

BDL Missile maker, strategic tech player

Mazagon Dock Submarine, destroyers, Navy contracts

Cochin Shipyard Exports + defence orders

🛤️ Railway + Infra PSUs

Stock Why It’s Hot

IRFC Rail project financer, consistent income

RVNL Railway EPC projects, delivery volume spike

IRCON Infra + overseas rail projects

RITES Consultancy + export contracts

🔋 Power & Energy PSUs

Stock Sector Focus

BHEL Power infra, defence components

NTPC Renewable + base power growth

ONGC Oil exploration, dividend stock

🧠 Should You Invest Now?

✅ Pros:

Many PSU stocks still offer value despite big rally

Dividends are attractive (3%–8%)

Government is unlikely to reduce support before 2026 elections

Sector is in a long-term structural uptrend

❌ Risks to Consider:

Valuations may be overheated in some names

Any global peace news may reduce defence urgency

PSU stocks may correct if general market sentiment turns negative

Political uncertainty (pre-election) can cause temporary sell-off

📌 What’s the Strategy for Traders?

📅 Short-Term Traders:

Look for breakouts with high delivery volume

Ride trends on daily/weekly chart

Use trailing stop-loss to lock in profits

Don’t chase upper circuits blindly

🕰️ Swing Traders:

Focus on 3–5 week setups

Use support-resistance, trendlines, 50 EMA entries

Look for consolidation + breakout patterns (e.g. flags, cup-handle)

🪙 What’s the Strategy for Long-Term Investors?

Identify quality PSU stocks with high ROE, low debt, and strong order book

Enter on pullbacks or minor corrections

Hold for 2–5 years horizon

Reinvest dividends to build compounding returns

Don’t fall for “cheap but junk” stocks — quality matters

📚 Final Thoughts

The PSU & Defence Stock Boom of 2025 is driven by real, structural changes, not just hype.

India is becoming a global defence player, and PSU companies are finally being run like businesses — with efficiency, innovation, and profitability.

This rally may pause or cool off in between — but the multi-year story is far from over.

💡 "In a country that wants to defend itself, build itself, and grow itself — PSU & defence are the frontlines."

Swiggy: a probable long trade➡️Entered this with a stop loss of 374

➡️21 ema support

➡️Consumption theme has been picking up and I am hopeful that this scrip would be a beneficiary of the theme

➡️supply zone may act as a demand zone

➡️the volume on negative days have been meagre in comparison to the volume on positive days

SWIGGY |cup & handle breakout **Swiggy Ltd.** based on your latest chart:

> **Swiggy (NSE)** forming cup & handle breakout above ₹389.50 ☕🚀

> Cleared descending channel with authority

> RSI 53.61 → room to run

> Volume 🔥 51.8M = strong conviction

> Next resistances: ₹402.95 / ₹456.70

> Target zone: ₹520–₹570+

> Momentum + structure = tasty trend cooking 🛵📈

> #Swiggy #BreakoutStocks #CupAndHandle #StocksToWatch

Want to add a thumbnail or carousel for this one? I can whip up captions, chart overlays, or even turn this into a visual thread.

Swiggy Base and Trendline BONSE:SWIGGY gains as Morgan Stanley starts coverage with 'overweight' rating; sees 22% upside.

On Daily Chart, it Could Signal a 35% Breakout - Here's the Exact Level Every Trader is Watching

Price Action Analysis:

The chart reveals a classic consolidation phase following Swiggy's IPO debut in November 2024. After an initial surge to highs around 465 levels post-listing, the stock underwent a significant correction, falling to lows near 297 in March 2025. Currently trading at 362.75, the stock shows signs of building a base in the 310-370 range.

Volume Analysis:

Volume patterns indicate institutional interest with notable spikes during key price movements. The stock gained nearly 17% on its trading debut, signalling growing investor confidence in food and grocery delivery firms. The recent volume of 22.31M shares suggests active participation, though lower than peak trading days.

Key Technical Levels:

Support Levels:

- Primary Support: 305-310 (marked by green horizontal line)

- Secondary Support: 297 (March 2025 low)

- Critical Support: 280 (psychological level)

Resistance Levels:

- Immediate Resistance: 370-375 (red horizontal line marking recent highs)

- Major Resistance: 420-430 (post-IPO consolidation zone)

- Ultimate Target: 465 (all-time high)

Base Formation:

The stock has formed a rectangular consolidation base between 310-370 levels over the past 3-4 months. This 4-month base-building phase indicates potential accumulation by institutional investors, typical behaviour post-IPO as initial volatility settles.

Technical Patterns:

A descending trendline resistance (marked in white) from the March highs is being breached. The current price action suggests a potential breakout from this falling wedge pattern, which is typically bullish.

Trade Setup:

Entry Strategy:

- Conservative Entry: 375+ on breakout above resistance with volume confirmation

- Aggressive Entry: 365-368 on current levels for base play

Exit Levels:

- Target 1: 400 (intermediate resistance)

- Target 2: 430 (major resistance zone)

- Target 3: 465 (all-time high retest)

Stop Loss:

- For breakout trade: 355 (below recent consolidation)

- For base play: 305 (below primary support)

Position Sizing and Risk Management:

- Risk per trade: Maximum 2% of portfolio

- Position size calculation: (Portfolio value × 2%) ÷ (Entry price - Stop loss)

- For a 100,000 portfolio: (100,000 × 2%) ÷ (365 - 305) = 33 shares maximum

- Reward-to-risk ratio: 1:2.5 minimum

Sectoral and Fundamental Backdrop:

NSE:SWIGGY food delivery business achieved profitability in March, with a current market cap of 83,088 crores and revenue of 15,227 crores. However, the company still reports losses of 3,117 crores, indicating it's in a growth investment phase.

The IPO was priced at ₹390 per share, raising ₹11,327.43 crores, providing substantial capital for expansion. The company operates a hyperlocal on-demand delivery model, connecting nearby restaurants and service providers to customers, with diversification into grocery delivery (Instamart) and logistics services.

The food-tech sector in India remains attractive due to increasing digitization and changing consumer behaviour. Recent antitrust concerns regarding discount practices by fast-delivery companies, including Swiggy, indicate regulatory scrutiny, which could impact future growth strategies.

Risk Factors:

- High cash burn rate despite revenue growth

- Intense competition with Zomato, Zepto and other players

- Regulatory challenges in the quick commerce space

- Market volatility affecting new-age tech stocks

My Take:

The technical setup suggests accumulation phase completion with potential for a significant move higher, supported by improving fundamentals in the core food delivery business, achieving profitability. Follow the Strict Trade Plan as Explained Above.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

"Swiggy Karo, Phir Jo Chahe Karo!"Swiggy CMP 385

Swiggy Ltd

About

Founded in 2014, Swiggy Ltd is a new-age, consumer-first technology company offering users an easy-to-use convenience platform, accessible through a unified app.

Key Points

Business Model - Swiggy operates a diversified hyperlocal commerce platform through its unified app - ''SWIGGY'' The company, known for pioneering hyperlocal commerce in India, offers a range of services through five main segments:

Food Delivery - Launched in 2014, this core segment enables users to browse, order, and have meals delivered from a wide network of restaurant partners. Swiggy monetizes this by charging fees from restaurants, delivery charges, and platform-based advertising opportunities.

Gross Order Value: Food Delivery GOV reached ₹247,174.41 million in fiscal 2024.

Average Order Value Rs.408 in FY24

Delivery Fee collected as a % of GOV : 3.11%

Cost of Delivery as a % GOV: 14.31%

Out-of-Home Consumption Includes services for dining and events, such as Dineout (for restaurant reservations and promotions) and SteppinOut (events management). Swiggy leverages its established restaurant partnerships to extend user engagement beyond home deliveries.

Quick Commerce Instamart, launched in 2020, offers fast delivery of groceries and household items, leveraging a network of “dark stores” to achieve rapid delivery times. This segment is expanding with new product categories and cities.

This is just to boost my confidence. No Suggestions for buying. I will keep checking and updating my mistake if last post gone wrong...

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial Adviser before making any decisions.

Swiggy cmp 374.15 by Daily Chart view since listed**Swiggy cmp 374.15 by Daily Chart view since listed*

- Support Zone 325 to 350 Price Band

- Resistance Zone 385 to 408 Price Band

- Rising Support Trendline seems been well respected

- Falling Resistance Trendline Breakout seems sustained

- *Multiple Bullish Rounding Bottoms plus considerate Head & Shoulders below Resistance Zone*

SWIGGY | Falling Channel Breakout | Good VolumeBased on the images you've uploaded, here's a detailed analysis and summary of the SWIGGY LTD chart:

---

### **Chart Pattern and Technical Overview:**

* **Falling Channel:**

The price action was contained in a downward-sloping channel, marked by two yellow trendlines (upper and lower boundaries).

This pattern reflects a period of consolidation within a larger downtrend.

* **Breakout:**

Recently, the price has broken out of this descending channel, closing above the upper trendline around the 335.00 level.

Such a breakout is typically considered bullish, suggesting a potential trend reversal or at least a short-term move to the upside.

* **Volume Confirmation:**

A significant increase in volume accompanied the breakout, confirming the strength of this move.

High volume breakouts generally have a higher probability of sustaining.

* **Price Targets & Measurements:**

* The breakout target is projected based on the height of the channel (approx. 63.65 points).

* Measured breakout target:

$\text{Breakout level (335.00)} + \text{Channel height (63.65)} = 403.50$.

* Current price: 362.75.

* Immediate resistance zone near 403.50.

---

* **Volume:**

* Today’s volume (52.63M) is above the 50-day average (14.02M).

* This indicates strong interest and participation by traders.

---

### **Key Levels:**

✅ Support: **335.00**

✅ Resistance: **403.50**

✅ Low: **297.00**

---

### **Conclusion & Implication:**

The breakout from the falling channel with strong volume suggests a potential bullish continuation towards 403.50, as long as 335.00 holds as support. Watch for further volume spikes and price action near the target zone to determine sustainability.

---