Strong Bullish Momentum and Volume SurgeAUBANK (8.41%)

Bullish Momentum Building

AUBANK is showing promising bullish signs across several technical indicators. A Bullish Marubozu candlestick has formed, complemented by an RSI Breakout, signaling a shift toward bullish momentum. The stock has broken out of the Bollinger Bands, with VWAP and Volume confirming the strength of this move.

Resistance Levels: 684-702-733

Support Levels: 634-602-584

Entry: @/above 669.90

Stop Loss: @/below 590.75

Volume Analysis: A significant volume breakout was observed on April 23rd, surpassing the average volume of 4.65M, suggesting strong market interest and buying power.

Swingtrade

NORTHERNARC | Simple Price action Textbook CT breakout confirmed on the Daily chart:

✅ Strong demand zone formation with clear upward push

✅ Multiple volume spikes signaling institutional activity

✅ Clean Counter-Trendline (CT) breakout

✅ Hidden resistance line (dotted) also broken — extra confluence

✅ Immediate supply zone above marked for next watch

Breakout candle closed strong with momentum. Setup aligns with high-conviction strategy criteria — watching price action near supply for continuation or base formation.

Breakout with Bullish Engulfing Confirmation | Daily Chart🏦 SBI LIFE INSURANCE CO LTD – Breakout with Bullish Engulfing Confirmation | Daily Chart

📅 Date: April 28, 2025

📈 Timeframe: Daily Chart

🔍 Stock: SBI Life Insurance Co Ltd (NSE)

📌 Technical Overview:

SBI Life is showing strong bullish momentum on the daily chart after breaking out above a key horizontal resistance around ₹1,584.

The price has formed a Bullish Engulfing candlestick pattern, indicating renewed buyer strength, backed by heavy volume.

🧩 Chart Pattern:

Strong horizontal resistance at ₹1,584 (now acting as support).

Bullish Engulfing candle printed around ₹1,736.10, showing strong rejection of lower levels.

Price structure continues to maintain higher highs and higher lows – a positive sign for bulls.

🔍 Key Price Levels:

Support Zones: ₹1,584(marked in red)

Major Support: ₹1,372.55(green horizontal line)

Current Market Price (CMP): ₹1,736.10

A sustained move above ₹1,736 with rising volume could potentially take the stock towards higher psychological levels around ₹1,800+.

📊 Volume Analysis:

Strong volume breakout observed during the recent rally.

Volume spike supports the validity of the bullish breakout, indicating increased buying interest.

🧠 Observational Bias:

As long as SBI Life holds above ₹1,584, the short-term to medium-term bias remains positively bullish. Any healthy pullbacks near ₹1,580–₹1,600 zones could offer better risk-reward setups for positional traders.

MARICO - Breakout & Retest Setup!Overview & Observation:

1. 70% Fib support zone.

2. Good volume support

3. Breakout & Retest done.

Trade Plan:

1. Eyeing 20% upside with 10% SL

2. RRR is okay, not great!

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

Bullish Momentum with RSI and Bollinger BreakoutMOTILALOFS (6.16%)

Bullish Trend and Breakout

MOTILALOFS is showing strong bullish momentum, with a Bullish Marubozu candlestick signaling the continuation of upward momentum. The RSI Breakout and Bollinger Band Breakout both point to an increase in buying pressure. The volume has seen a notable uptick, confirming the strength of the bullish move.

Resistance Levels: 787-805-834

Support Levels: 740-711-693

Entry: @/above 775.95

Stop Loss: @/below 653.65

Volume Analysis: Volume has been significantly higher than average, with a noticeable volume of 8.29M on 23rd April. This suggests that institutional or large players might be entering the stock.

Muthoot Microfin LTD – Major Breakout in Play!🟦 Blue Line: 200 DEMA

Still overhead, but the recent price action indicates a potential shift in trend. Price reclaiming above this zone will be another bullish confirmation.

📌 Breakout Highlights:

Counter Trendline Breakout: Price shattered the CT-based trendline with high volume.

W-Bottom Formation: A textbook double bottom structure is visible with neckline breakout.

Green Path: Illustrates the bullish trajectory already played out post breakout.

Red Zone: Key resistance turned support — now a potential demand zone on retest.

Yellow Path: A healthy retest scenario could play out, offering better R:R entries. A pullback to the neckline before continuation would be ideal.

🔔 Keep it on your radar — structure, volume, and trend all align for a bullish bias.

HBL Engineering Ltd 🔍 1D (Daily Timeframe) Analysis: Context and Macro Structure

Structure and Key Zones:

Price is trading at ₹523.40, showing bullish intent after a recent swing low and a clean market structure shift (MSS) around April 1st.

Fair Value Gaps (FVGs) around ₹445–₹475 have been respected with a strong bullish reaction from the OB (Order Block).

There is an old bearish FVG between ₹545–₹565 that is yet to be fully mitigated.

Current price is consolidating under a small internal liquidity zone (marked blue box).

Bias:

Bullish short-term bias as price broke market structure to the upside and is now in a re-accumulation range.

Likely targets include:

Target 1: ₹545 (old supply/FVG zone)

Target 2: ₹565 (full FVG mitigation & potential liquidity sweep above recent highs)

Daily Stop-Loss Ideas:

Below ₹475 (last bullish OB/FVG zone) makes sense if taking swing longs.

⏰ 1H (Hourly Timeframe): Mid-Level Refinement

Observations:

Price made a clean Break of Structure (BOS) and CHOCH indicating a reversal around April 15th.

Strong OB formed near ₹510–₹514, has been tapped into and respected.

Volume Imbalance (VI) around ₹517–₹521 now acting as dynamic support.

Price is now in a tight range under previous high liquidity (PWH zone).

Liquidity Pools:

Above: Weak High & recent equal highs around ₹529–₹532 (magnet)

Below: PDH & OB zones near ₹510 could attract a quick liquidity grab before reversal.

Trade Idea (Intraday to Swing):

Entry Zone: ₹517–₹521 (discount OB + VI)

Stop Loss: ₹510.5 (below 1H OB + liquidity)

Target 1: ₹530 (internal high)

Target 2: ₹545 (daily FVG)

RR: Around 1:2.5 to 1:3

This trade would be based on a liquidity sweep + continuation model — a smart money setup.

⏱ 15M (Execution Timeframe): Entry Precision

Observations:

Multiple CHOCH and BOS signals around the ₹521–₹523 region.

A micro-FVG and a CMSL (consolidated mitigation zone) formed after sharp rally on April 21.

Price is now revisiting this zone, offering an ideal scalp-to-swing entry setup.

Ideal Execution Plan:

Entry Zone: ₹520.5–₹523 (FVG + CMSL)

Confirmation: Look for a bullish engulfing / break of lower timeframe CHOCH in this zone

Stop Loss: ₹518.5 (below VI zone)

Scalp Target: ₹529–₹530 (PWH)

Swing Target: ₹545+ (1D FVG zone)

🧠 ICT + SMC Narrative: What’s the Market Maker Doing?

Liquidity Engineering: The market has engineered equal highs on both 15M and 1H — textbook setup for a liquidity raid.

Displacement + Retracement: Bullish displacement occurred. Now the retrace into an OB/VI zone creates a high-probability re-entry.

Order Flow: Strong bullish OB on 1D and 1H has held. Order flow is bullish.

📌 Summary of Trade Setup

Element Value

Bias Bullish

Entry ₹520.5–₹523

Stop Loss ₹518.5 (tight) / ₹510.5 (swing)

Target 1 (Scalp) ₹530

Target 2 (Swing) ₹545–₹565

Risk:Reward (approx) 1:2.5 to 1:3

Invalidated Below ₹510 (swing bias changes)

CUP & HANDLE ON THE CHART - IS BAJAJ FINSERV READY FOR LIFTOFF?Symbol - BAJAJFINSV

Bajaj Finserv Ltd. is a leading Indian financial services company engaged in insurance, lending, asset management, and wealth advisory. It operates through its subsidiaries like Bajaj Finance and Bajaj Allianz, making it a major player in the sector. The company is classified as a Systemically Important Non-Deposit taking NBFC.

Bajaj Finserv has recently shown a strong bullish breakout after forming a cup and handle pattern on the larger TF charts - A widely recognized bullish continuation setup. The breakout has occurred with notable volume, lending credibility to the move and signaling the potential for a sustained uptrend.

The stock is currently trading just above its breakout point, and a retest of the breakout zone 1980-2000 is possible. This area now acts as a strong support and provides an attractive entry opportunity for long positions.

Based on the technical pattern, the medium-term target for the move is projected at around 2450, implying an upside of nearly 22% from current levels. The pattern’s depth and the strength of the breakout support this target.

For risk management, a stop loss around 1800 is suggested, just below the handle's base, providing a good risk-to-reward setup.

The formation and breakout from the cup and handle pattern on a higher time frame adds strong bullish conviction to Bajaj Finserv’s chart. For investors looking to ride a medium-term trend with favorable risk-reward dynamics, this may be an opportune moment to enter or accumulate.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

Gulshan Polyols Ltd - Downtrend Breakout Attempt!Want more such charts?

📬 Join our community — message us via profile bio link!

(Gulshan Polyols Ltd)

🗓️ Date: April 18, 2025

🔍 Technical Breakdown:

✅ Breakout in Progress

Stock has been respecting a descending trendline since August 2024.

Price is currently testing the trendline resistance, with today's candle showing a potential breakout.

Closing above this trendline will confirm breakout with short-term bullish bias.

🔄 Support & Resistance Levels

🧱 Support Zone: ₹157.74 – ₹160.56

📉 Resistance Trendline: Around ₹200 – ₹205 zone

📈 Next Resistance: ₹225, followed by ₹250

📊 Volume Analysis

A volume spike of 363.66K supports today’s breakout candle

Indicates strong interest and buying pressure building up near resistance

🧠 Interpretation:

This chart represents a classic trendline breakout structure:

Price forming higher lows

Buyers gradually absorbing selling pressure at resistance

Volume confirming strength

A daily close above ₹205 can be considered as breakout confirmation.

Targets post-breakout could range between ₹225 – ₹250 in coming sessions.

📌 Key Levels to Watch:

Support Zone: ₹157 – ₹160

Breakout Confirmation: Above ₹205

Upside Targets: ₹225 and ₹250

🏢 Company Fundamentals (Snapshot):

Sector: Chemicals & Ethanol

Specialty: Manufacturer of industrial chemicals, ethanol, and food-grade products

Growth Drivers:

Rising demand for ethanol blending in fuel

Diversified product portfolio

Government policy tailwinds on ethanol

⚠️ Disclaimer:

This analysis is for educational and informational purposes only. Please consult your financial advisor before making any trading decisions.

Nifty Bottom Forming? “Be Greedy When Others Are Fearful”Hello Everyone, i hope you all will be doing good in your life and your trading as well. Let's discuss about nifty and analysis some next move.

Guy's after a sharp correction in Nifty, signs of a potential bottom are finally emerging. Yesterday’s price action, supported by strong volume and the appearance of an Abandoned Baby candlestick pattern , indicates that we might have witnessed a key reversal day. The price held firm near a crucial support zone, and with most stocks near 52-week lows, we could be staring at a solid bounce opportunity.

This is exactly when smart money starts accumulating — when fear is high and hope is low. A price rally towards the upper channel resistance looks probable, provided Nifty sustains above the breakout zone.

echnical Highlights:

Reversal Signal: Formation of Abandoned Baby pattern near support

Volume Spike: Indicates possible institutional buying near bottom

Support Zone: Price reversed from key area, aligning with earlier channel lows

Resistance Target: 23,200-23,300 – upper boundary of the falling channel

Market Outlook:

With the broader market showing deep corrections across sectors (some 30–35% down from highs), this zone could be a powerful accumulation range. From Banking, Pharma, Chemicals, to IT and FMCG , many sectors are offering long-term value. As global sentiment improves and short-term panic fades, we may see Nifty lead a recovery move supported by sector rotation.

Rahul’s Tip

Bottoms aren’t confirmed by green candles alone, but by conviction + price behavior near support. Stay calm, follow structure, and let the chart do the talking.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share. And Do you think this was the bottom for Nifty? Drop your thoughts and let’s discuss below!

HINDUSTAN FOODS Swing Trade (Long)Strong buyers entered again trapping the sellers on monthly time-frame and making a liquidity pool.

On daily time-frame price is in up-trend and is going up by sweeping lows.

If Nifty holds current levels of 23000, (ie. if Nifty is not bearish) then there are high chances of

HINDUSTAN FOODS reaching the target levels.

1:5 Risk to Reward

Follow me for more such simple trade setups based on Trend and Liquidity.

Happy Trading!

Ice Cream King Ready to Melt Resistance & Fly High!Hello everyone, i have Brought a stock which has given neat & clean breakout of a consolidation period with huge volume spurt, this is a ICEMAKER stock, as we all know summer almost has been started so these type of stocks will start roaring up let's start with discussing about the company.

About the Company:

Vadilal Industries Ltd , founded in 1907, is India’s 2nd largest ice cream brand , holding a 16% market share in the organized ice cream market. The company dominates the cones, cups, and candy segments and also exports frozen fruits, vegetables, and ready-to-eat products worldwide.

Technical Setup & Trade Plan

The stock is showing bullish momentum, breaking out from consolidation with strong volume confirmation. Historically, Vadilal sees increased demand in summer, making this a favorable seasonal play. Please check chart above for the Levels like entry, exit stop loss and targets!

Why i found This Stock impressive?

Seasonal Upside: Peak demand for ice cream during summer boosts sales .

Market Leader: Strong position in India's growing frozen food segment.

Technical Breakout: Bullish price action with volume support.

Fundamental ratio:

Market Cap

₹ 3,071 Cr.

Current Price

₹ 4,272

High / Low

₹ 5,143 / 3,164

Stock P/E

19.7

Book Value

₹ 915

Dividend Yield

0.04 %

ROCE

27.1 %

ROE

31.0 %

Face Value

₹ 10.0

Industry PE

28.7

Debt

₹ 155 Cr.

EPS

₹ 217

Promoter holding

64.7 %

Intrinsic Value

₹ 2,125

Return over 5years

40.8 %

Debt to equity

0.24

Net profit

₹ 156 Cr.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

PGEL Swing Trade with 1:6 RRPGEL is in up-trend in Weekly and Daily time-frames.

It has grabbed liquidity from previous day low.

1:6 Risk to Reward. (on a safer side you can take 1:5 RR trade by increasing your SL a bit).

if Nifty holds current levels of 23000 (ie. not bearish), then PGEL has high chances of reaching Targets.

Happy trading!

Hbl Engineering | Multi-Timeframe Breakout & Hidden Hurdles📈 Stock: HBL ENGINEERING LTD (NSE)

💰 CMP: ₹520.10 (+10.07%) - While making this Post

Key Highlights:

✅ Breakaway Gap: Opened above Critical Trendline (CT) resistance, confirming strength.

✅ Hidden Hurdle Cleared: The smaller trendline helped identify fakeouts vs. real breakouts.

✅ Strong Volume: High buying interest signals institutional participation.

✅ Next Resistance: ₹624.30 (MTF Hurdle) – a key level to watch.

🚀 Now watch for follow-through! Thoughts? Drop them below! 👇

sumitomo chem india ltd | Wtf major breakout!📌 counter trendline (ct) – The yellow line that acted as resistance for the stock during its downtrend. The price has now broken above this, indicating a potential reversal.

📌 hidden line (hl) – The white line marking a key resistance level. Once this was breached, it signaled strong bullish momentum.

📌 trendline (t) – The green line acting as a long-term support. As long as the stock respects this trendline, the bullish structure remains intact.

📊 volume confirmation – A noticeable increase in volume suggests strong buyer interest, adding weight to the breakout.

What’s your take on this setup? 📈

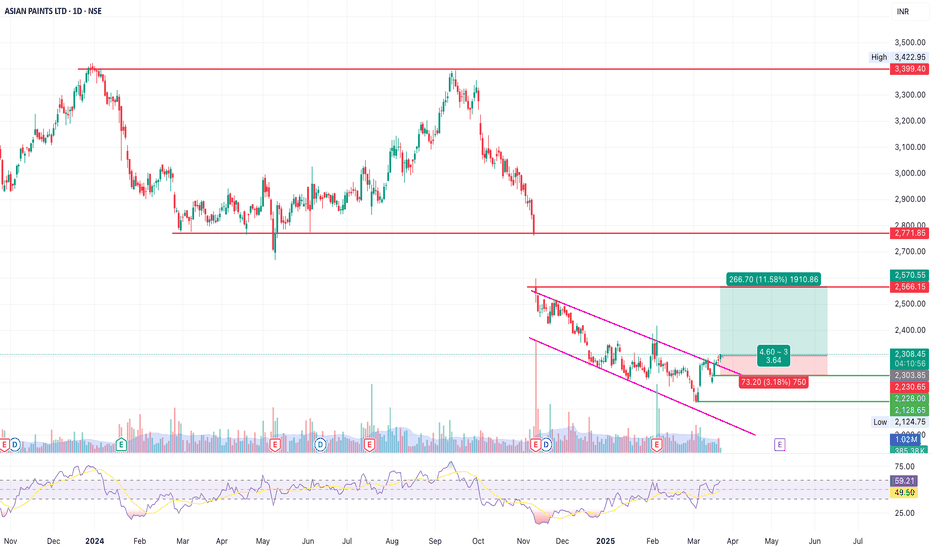

Asian Paints Ltd (NSE: ASIANPAINT) - Breakout AnalysisAsian Paints is showing a potential breakout from a falling wedge pattern, which is a bullish reversal pattern.

Key Observations:

Pattern Formation: The stock has been in a falling wedge since November 2024 and is now attempting a breakout.

Breakout Confirmation: The price has moved above the wedge's upper trendline and is testing it as support. A confirmed breakout could push the stock towards higher levels.

Support & Resistance Levels:

Immediate Support: ₹2,228

Breakout Level (Entry): ₹2,301

Target 1: ₹2,566

Target 2: ₹2,771

Major Resistance: ₹3,399

Indicators & Volume Analysis:

✅ RSI (Relative Strength Index): RSI is around 49.44, rising towards 58.31, indicating increasing momentum. A breakout above 50 could confirm bullish strength.

✅ Volume Analysis: Volume has been picking up, signaling buying interest. A surge in volume post-breakout will add conviction.

✅ Risk-to-Reward Ratio: 1:3.64, making this a favorable trade setup.

Verdict: Bullish

The stock is showing signs of a trend reversal with a potential breakout from the falling wedge.

Plan of Action:

BUY at ₹2,301 once the breakout is confirmed with volume.

Stop Loss: ₹2,228 (below recent support).

Target 1: ₹2,566

Target 2: ₹2,771

Trailing Stop Loss: Move stop-loss higher as the stock progresses.

A breakout above ₹2,301 with strong volume could trigger a momentum rally. Keep an eye on volume and RSI for further confirmation. 🚀

IEX : Swing Trade#IEX #Swingtrade #wpattern #patterntrading #momentumstock

IEX : Swing Trade

>> W pattern Visible

>> Good Strength in Stock

>> Good Volume Buildup Recently

>> Upside Potential of 15%

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings.

Note : Markets are still Tricky and can go either ways so don't be over aggressive while choosing & planning your Trades, Calculate your Position sizing as per the Risk Reward you see and most importantly don't go all in

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

Bharat Rasayan | 2200-Day Uptrend Holding Strong, Ct breakoutThe green trendline represents a massive 2200-day uptrend, acting as a strong support level.

A counter-trendline breakout (182 days long) has just occurred, breaking the red resistance line with momentum.

The yellow zone has been respected three times over 1170 days, indicating a strong supply zone—a breakout above this can trigger a major move.

Recent base formation followed by a breakout adds to the bullish structure.

Volume remains low, likely due to the stock trading in 5-digit territory.

Watchlist Ready? Let’s Ride the Trend!

Gold Faces Strong Resistance – Is a Drop Coming?Hello everyone , i hope you all will be doing good in your life and your trading as well. Let's discuss about Gold (XAU/USD) which is facing strong resistance at the upper boundary of a descending channel on the 1H timeframe, indicating a potential bearish move ahead. After multiple attempts to break above, the price has been rejected, signaling that sellers are stepping in at higher levels. If the price sustains below 2,905, we could see further downside towards 2,880, followed by 2,840, and eventually 2,813. The stop loss for this trade setup is placed at 2,935, above the recent resistance. Volume analysis also confirms selling pressure, adding conviction to the bearish outlook. If the price fails to hold support, this could lead to a deeper correction within the channel. Stay cautious and manage risk accordingly!

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.