Understanding the Inverted Head & Shoulders Pattern: TATACONSUM📈 Understanding the Inverted Head & Shoulders Pattern: Tata Consumer Products Case Study

Technical analysis often provides traders with powerful insights into potential market moves. One of the most reliable reversal patterns is the Inverted Head & Shoulders, which signals a shift from bearish to bullish sentiment. Let’s break down this pattern, its importance, and how it applies to Tata Consumer Products Ltd, currently trading near ₹1152 levels.

🔍 What is the Head & Shoulders Pattern?

Classic Head & Shoulders (H&S): A bearish reversal pattern formed after an uptrend OR sideways consolidation. It consists of three peaks:

Left Shoulder → A rise followed by a decline

Head → A higher rise followed by a decline

Right Shoulder → A lower rise followed by a decline

Inverted Head & Shoulders (IH&S): The bullish counterpart, formed after a downtrend or sideways consolidation. It consists of three troughs:

Left Shoulder → A decline followed by a rise

Head → A deeper decline followed by a rise

Right Shoulder → A higher low followed by a rise

The neckline connects the peaks (in IH&S, the resistance line). A breakout above this neckline confirms the bullish reversal.

🌟 Importance of the Pattern

1. Reliability: IH&S is considered one of the most dependable reversal signals.

2. Psychology: It reflects weakening selling pressure and strengthening buying interest.

3. Trend Reversal: Marks the transition from bearish consolidation to bullish momentum.

🎯 How to Enter After Neckline Breakout

1. Wait for Confirmation: Enter only after the price closes above the neckline with strong volume.

2. Retest Entry: Sometimes, price retests the neckline after breakout. This offers a safer entry point.

3. Avoid Premature Entry: Entering before breakout increases risk of false signals.

📏 Measuring the Target on Breakouts

The target is calculated by measuring the distance from the head (lowest point) to the neckline, then projecting it upward from the breakout point.

Target Price = Neckline Breakout Level + (Neckline − Head)

🛡️ Stop Loss Placement

1. Conservative SL: Just below the right shoulder low.

2. Aggressive SL: Below the head (deepest trough).

3. This ensures risk is managed if the breakout fails.

📊 Current Opportunity in Tata Consumer Products Ltd

1. Trading Level: Around ₹1185 (neckline zone).

2. Pattern Setup: Inverted Head & Shoulders nearing completion.

3. Bullish Potential: A breakout above ₹1185 could trigger a move toward Target levels as explained.

4. Risk Management: Stop loss near below right shoulder

✅ Key Takeaways

1. The Inverted Head & Shoulders is a strong bullish reversal pattern.

2. Always wait for neckline breakout confirmation before entering.

3. Targets are measured by projecting the head-to-neckline distance.

4. Stop loss discipline is crucial to protect against false breakouts.

Tata Consumer Products Ltd at ₹1185 offers a potential bullish opportunity if neckline breakout sustains.

TATACONSUM

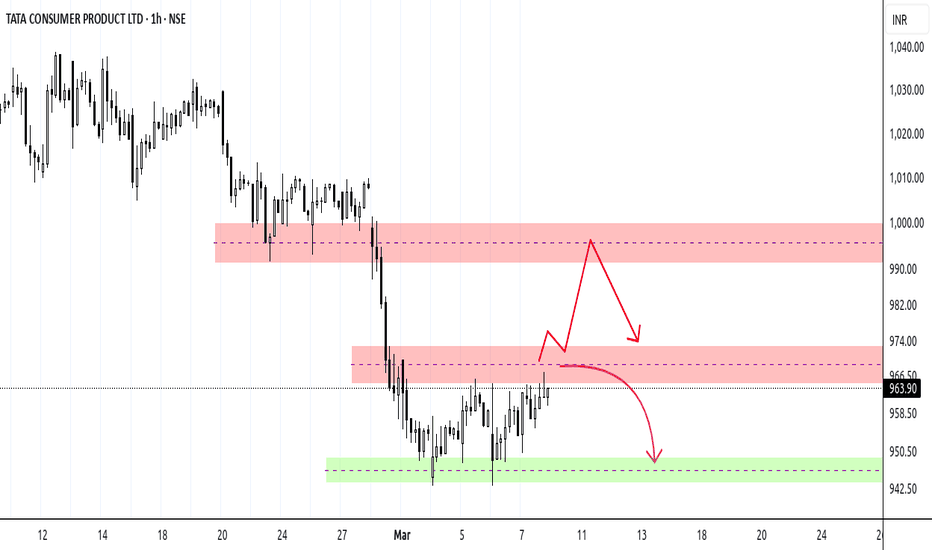

Tata Consumer - PossiblitiesStock mostly sideways to downtrend

Right now trading in Hourly Range

Standing at strong resistance area 965 - 975

If broader markets stay bearish to sideways, high possibility of stock turning bearish from the mentioned area till 950 or lower

If it goes bullish then its sure to stop near 980 to 1000 area, as that area is resistance plus flip zone

From 1000 it is bound to go lower till 960 - 940

TATACONSUM: Upcoming Price Surge Projection

Timeframe: 4h

NSE TATACONSUM has formed a correction on the 4-hour timeframe chart. A closer look at wave A reveals it consists of three distinct waves, indicating it can't be labeled as an impulse. The security has broken below the 50, 100, and 200 EMA, with the Average True Range (ATR) at 15 .

Currently, the price is developing wave (iv) of wave C within wave (B). Wave (B) has already reached 100% of wave A, and with bullish sentiment, the price could surge from this point. However, we need confirmation through a breakout of the sub-structure. After wave (B) is completed, traders can use wave (iv) as an entry point to confirm a long setup. Fibonacci clusters indicate potential levels at 1189 - 1246 - 1296. Risky traders entering right after the completion should confirm their position with a lower high.

We will provide further updates soon.

- KP (Trade Technique)

Tata Consumer Product about to creat a New Life Time HighHello Traders,

Tata Consumer Product is in a Way to new Life Time High. Moving forward with the H&L pattern. With this move the Momentum indicator has also given a Signal to Buy the Stock.

But let the move to be Confirmed .

Higher probability is That it can break above the Highs,

Weekly & Monthly RSI above 60 range .

Daily is slightly crossing above the Range.

Multiple Confirmation.

Keep This stock in Radar to capture the Good Momentum.

For Educational Purpose only.

Thank You

TATACONSUM | Swing Trade📊 Details

Tata Consumer Products Ltd. is one of the leading companies of the Tata Group, with presence in the food and beverages business in India and internationally. It is the second largest tea company globally and has significant market presence and leadership in many markets. In addition to South Asia (mainly India), it has presence in various other geographies including Canada, UK, North America, Australia, Europe, Middle East and Africa.

Disclaimer: This analysis is solely for educational purposes and does not make me a SEBI registered analyst.

If you found this analysis helpful, I encourage you to like and share it. Your observations and comments are also welcomed below. Your support, likes, follows, and comments motivate me to consistently share valuable insights with you.

🔍 More Analysis & Trade Setups 🔍

For more technical analysis and trade setups, make sure to follow me on TradingView: www.tradingview.com

Simple Trade Setup | TATA CONSUMER | 26-04-2022 [INTRADAY]NSE:TATACONSUM

Observations:

1) On 1day time frame, it is near critical level of the range. If it gives breakdown then we can see a good downfall and if it takes support from it then the bounce up will be good.

Please refer below chart : 1day time frame.

-------------------------------------

Trade Setup for 26-04-2022

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

Swing SetupEXPLANATION : This is a 4 hour time frame chart of TATACONSUM . It has formed Inverted cup and handle pattern , If stock give a strong breakdown and broke its demand zone with volumes and has retested the same. I am bearish on TATACONSUM .

If you like this analysis give a Like // Follow for more updates , let me know in comments below :)

TATACONSUM pre-market intraday analysis and setup🎇Hello Traders👋

Today i have made a post on TATACONSUM 1hr

I hope you find this post helpful and informative👍

The targets and stoploss would be given in the charts or they would be according to pivot points

Thank You

—DISCLAIMER—

I am not a SEBI registered financial advisor

Please consider your consultant's advise a must , all the setups posted here will be considered as informative and helpful post

I shall not be responsible for your profits and losses

A Good 60min demand for Swing trading , Coinsiding Daily Demand.60mn zone Rally Base Rally Pattern,

Coinsiding with 4hr and Daily demand zone,

High Probaility Zone

Swing trade setup

Wait for price to retrace back to 60min demand.

Trend = Uptrend E

Entry = 777.20

Stop loss = 770.70

Target = 803.25

4 RR Setup