Understanding the Inverted Head & Shoulders Pattern: TATACONSUM📈 Understanding the Inverted Head & Shoulders Pattern: Tata Consumer Products Case Study

Technical analysis often provides traders with powerful insights into potential market moves. One of the most reliable reversal patterns is the Inverted Head & Shoulders, which signals a shift from bearish to bullish sentiment. Let’s break down this pattern, its importance, and how it applies to Tata Consumer Products Ltd, currently trading near ₹1152 levels.

🔍 What is the Head & Shoulders Pattern?

Classic Head & Shoulders (H&S): A bearish reversal pattern formed after an uptrend OR sideways consolidation. It consists of three peaks:

Left Shoulder → A rise followed by a decline

Head → A higher rise followed by a decline

Right Shoulder → A lower rise followed by a decline

Inverted Head & Shoulders (IH&S): The bullish counterpart, formed after a downtrend or sideways consolidation. It consists of three troughs:

Left Shoulder → A decline followed by a rise

Head → A deeper decline followed by a rise

Right Shoulder → A higher low followed by a rise

The neckline connects the peaks (in IH&S, the resistance line). A breakout above this neckline confirms the bullish reversal.

🌟 Importance of the Pattern

1. Reliability: IH&S is considered one of the most dependable reversal signals.

2. Psychology: It reflects weakening selling pressure and strengthening buying interest.

3. Trend Reversal: Marks the transition from bearish consolidation to bullish momentum.

🎯 How to Enter After Neckline Breakout

1. Wait for Confirmation: Enter only after the price closes above the neckline with strong volume.

2. Retest Entry: Sometimes, price retests the neckline after breakout. This offers a safer entry point.

3. Avoid Premature Entry: Entering before breakout increases risk of false signals.

📏 Measuring the Target on Breakouts

The target is calculated by measuring the distance from the head (lowest point) to the neckline, then projecting it upward from the breakout point.

Target Price = Neckline Breakout Level + (Neckline − Head)

🛡️ Stop Loss Placement

1. Conservative SL: Just below the right shoulder low.

2. Aggressive SL: Below the head (deepest trough).

3. This ensures risk is managed if the breakout fails.

📊 Current Opportunity in Tata Consumer Products Ltd

1. Trading Level: Around ₹1185 (neckline zone).

2. Pattern Setup: Inverted Head & Shoulders nearing completion.

3. Bullish Potential: A breakout above ₹1185 could trigger a move toward Target levels as explained.

4. Risk Management: Stop loss near below right shoulder

✅ Key Takeaways

1. The Inverted Head & Shoulders is a strong bullish reversal pattern.

2. Always wait for neckline breakout confirmation before entering.

3. Targets are measured by projecting the head-to-neckline distance.

4. Stop loss discipline is crucial to protect against false breakouts.

Tata Consumer Products Ltd at ₹1185 offers a potential bullish opportunity if neckline breakout sustains.

Tataconsumerproducts

Tata Consumer (W): Bullish, Consolidation Breakout(Timeframe: Weekly | Scale: Logarithmic)

The stock is emerging from a 9-month sideways consolidation phase. While it has cleared the immediate resistance, the major test lies at the All-Time High (ATH) zone. The formation of bullish reversal candles on the weekly chart suggests buyers are regaining control.

📈 1. Trend & Structure (The "Box" Breakout)

- The Context: Since hitting its peak in Mar 2024, the stock has been trapped in a sideways "box" range.

- The Breakout: This week, the stock managed to close above the immediate horizontal resistance (approx. ₹1,170 - ₹1,180 ).

- Clarification on Resistance: It is important to note that while this is a breakout of the consolidation range, the major All-Time High resistance (around ₹1,240 - ₹1,253) is still just overhead. This is the final hurdle before "blue sky" territory.

🕯️ 2. Candlestick Analysis (The Bullish Signal)

- Hammer Candles: The last two weekly candles resemble Hammer formations (long lower wicks with small bodies).

- Interpretation: This indicates that every time sellers pushed the price down (towards ₹1,130-₹1,140), aggressive buying emerged to push it back up. This "rejection of lower prices" is a classic sign that the bottom is in.

📊 3. Indicators & Volume

- Volume Profile: Volume "dried up" significantly during the correction, and we are now seeing a gradual expansion in volume on up-weeks, indicating institutional accumulation.

- EMAs: The short-term EMAs are realigning into a bullish PCO (Price Crossover) state, confirming the trend shift.

- RSI: The RSI is rising from the mid-zone (above 50), showing that momentum is building without being overbought yet.

🎯 4. Future Scenarios & Targets

- 🐂 Target 1: ₹1,355 (Achievable once ₹1,253 is cleared).

- 🐂 Target 2: ₹1,570 (Long-term extension).

- 🛑 Support (The Safety Net): If the breakout fails, the stock will likely retest the demand zone at ₹1,040.7

Key Watchout

Watch the price action near ₹1,250. A high-volume close above this level is the "final confirmation" needed to activate the targets of ₹1,355+. Until then, it is a "buy on dips" setup.

Tata Consumer cmp 1100.20 by Daily Chart view*Tata Consumer cmp 1100.20 by Daily Chart view*

- Support Zone 1036 to 1070 Price Band

- Resistance Zone 1148 to 1180 Price Band

- Support Zone under testing retesting over past week

- Volumes surged heavily over the last 2 days of the week

- *Technical Indicators for EMA, MACD and RSI getting to positive mode*

Tata Consumer Prod. - Chart of the WeekNSE:TATACONSUM has a beautiful structure in the Weekly Timeframe that qualifies for my Chart of the Week idea. It saw Decent Volumes this week and closed above its recent swing high, with RSI and MACD Trending Upwards and Closing Above all Major Moving Averages.

About:

NSE:TATACONSUM is one of the leading companies of the Tata Group, with presence in the food and beverages business in India and internationally. It is the second-largest tea company globally and has significant market presence and leadership in many markets. In addition to South Asia (mainly India), it has presence in various other geographies including Canada, the UK, North America, Australia, Europe, the Middle East and Africa.

F&O Activity:

Significant Shorts are getting covered with 1050 PE OI Increasing Significantly.

Trade Setup:

It is Forming Like a Falling Wedge, it can test the upper edge and can give a good swing towards

1186-1190 Levels. So buy on Dips Until it closes below the Swing Low, ideally around the Marked Green Levels.

Target(Take Profit):

Around the Upper Edge of the Falling Wedge.

Stop Loss:

Swing Low Levels around 950-930.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

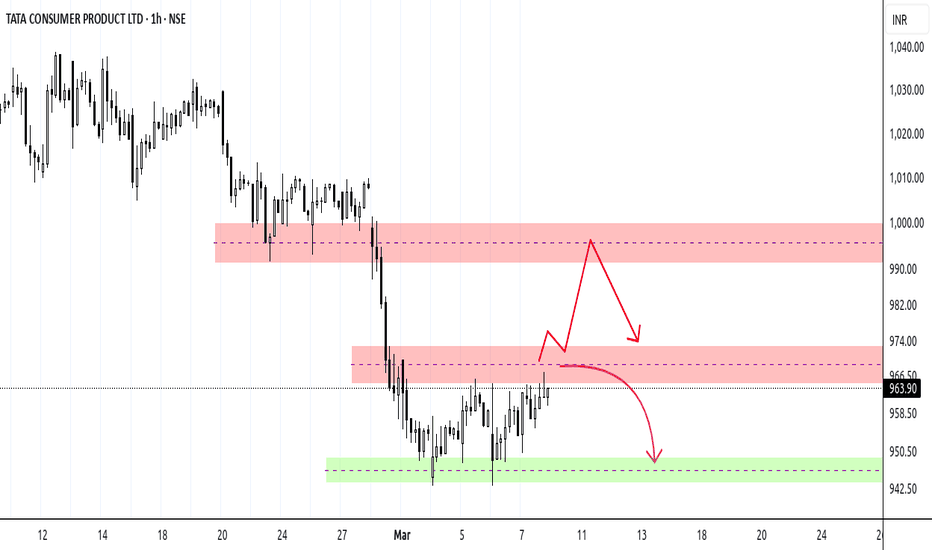

Tata Consumer - PossiblitiesStock mostly sideways to downtrend

Right now trading in Hourly Range

Standing at strong resistance area 965 - 975

If broader markets stay bearish to sideways, high possibility of stock turning bearish from the mentioned area till 950 or lower

If it goes bullish then its sure to stop near 980 to 1000 area, as that area is resistance plus flip zone

From 1000 it is bound to go lower till 960 - 940

Tata Consumer Products LTD - Technical - Weekly#TataConsumer includes operations both in🇮🇳 India and internationally. The Indian business focuses on branded ☕️tea, coffee, water, and various food products like salt, pulses, spices, and ready-to-eat meals. Internationally, #TCPL is known for its tea and coffee brands, with a strong presence in markets like the UK #Canada and the #USA

Hear is a 📉chart overview for your reference😍

Tata Cons. Prod. Cup and Handle BO.NSE:TATACONSUM today gave a Cup-and-Handle Breakout, with the RSI and MACD Showing Buy Strength as it crossed Major Levels.

Trade Setup:

It can be a Good 1:1 RISK-REWARD Trade with the recent base being crucial and the Size of the Cup as the Target on the upside as it usually is for cup & Handle Breakout.

Target(Take Profit):

1087 Levels for Swing/Positional Trader.

Stop-Loss:

Around 926 For Swing Trader and a Recent Base of 880.35 for Positional Trader.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT Below your views.

Meanwhile, check out my other stock ideas below until this trade is activated. I would love your feedback.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Trade Alert : Tata Consumer Product, breaking out with INHS Technical Analysis:

Trading Above 20 EMA : good for short term

Broken out from INHS pattern with good volume

Good Volume

Trading Setup

Buy at cmp unless gap down opening

Target would be :1026-1060

short Term SL would be : 955

Risk Reward Ratio : 2.6

Note : Market is volatile nowadays, so keep your size as per risk appetite

Chart says everything itself: Educational post

Please check all snaps shared here

Educational post

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Tata Consumer cmp 972.80 by Weekly Chart viewTata Consumer cmp 972.80 by Weekly Chart view

- Price Range 865 to 890 Support Zone

- Price Breakout sustained above Falling Resistance Trendline

- Volumes are steady and edging above the avg traded quantity

- Bullish "W" or probable Double Bottom around the Support Zone area

- Weekly Support at 920 > 865 > 780 with Resistance at 1045 > 1120 > 1190

About to Break Key LevelsNSE:TATACONSUM about to break key levels with nearing completion of a cup and handle chart pattern on Daily time frame, Good Accumulation Seen from July to Sep. 2024 around Post Rights Issue to Acquire two companies Capital Foods (Ching's) and Organic India to strengthen their product portfolio further. 1154-1168 Will be a Good Zone to add or wait for the breakout of 1255 Levels.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Tata Consumer Product about to creat a New Life Time HighHello Traders,

Tata Consumer Product is in a Way to new Life Time High. Moving forward with the H&L pattern. With this move the Momentum indicator has also given a Signal to Buy the Stock.

But let the move to be Confirmed .

Higher probability is That it can break above the Highs,

Weekly & Monthly RSI above 60 range .

Daily is slightly crossing above the Range.

Multiple Confirmation.

Keep This stock in Radar to capture the Good Momentum.

For Educational Purpose only.

Thank You

TATACONSUM - Ichimoku Bullish Breakout Stock Name - TATA Consumer Products Ltd

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 824

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

Tata Consumer breakoutTata Consumer - Short Term Range Breakout Idea

When the price crosses the range, it is likely to continue in that direction. Intraday traders then use the breakout as the entry point. In simple words, the opening range breakout strategy means taking a position when price breaks above or below the previous day's high or low

Tata Consumer Products is an Indian fast-moving consumer goods company with its corporate headquarter in Mumbai, and is a part of the Tata Group. Its registered office is located in Kolkata. It is the world's second-largest manufacturer and distributor of tea and a major producer of coffee.

TATA CONSUMER PRODUCTS broke triangle patternNSE:TATACONSUM a less known company with well known products like TATA salt, TATA tea, Tetley green tea and Starbucks and much more, have finally broken out of its triangle consolidation after 6 failed attempts in the past one year.

Fundamentally & financially strong with consistent group in revenue & profits, low dept to assets ratio, consistent dividend yield, reasonable PE ratio, consistent FII holding, increasing market share seems like a good scrip to have in our portfolio.

Price wise current price 837.45 is just 5.8% below its all time high of 889, hence this might be a costly entry and the breakout is not with very high momentum. Also the DIIs consistently reducing their state from March 2021.

However, from its pros perspective, even in short term if this scrip corrects a bit, averaging out will not be a bad option, as in long term it seems to be healthy.

Entry : 820 to 840

Target : Trailing stop loss with partial profits booking method at every 5% up movement

Exit : SL1 800 (resistance break), SL2 780 (support break), long term holders can average instead of exit

Key note : Always follow proper risk management to avoid losing capital from false breakouts as this is common.

Caution : This is a knowledge sharing analysis, not a call.

Tata Consumer Fut intraday 5th Aug 2022Reference Point

PDH - 801.35

VAH - 797

POC - 791

VAL - 787

PDL - 783

One can Trade on the breakout of PDH/VAH or PDL/VAL or Trade Reversal Near PDH/VAH or PDL/VAH.

I am Not Sebi Registered, This is just for educational and research purposes. Do not trade without your Financial Advisor.

I won't be liable if you lose money because of this idea.