Tatamotorsdvrpricetrendanalysis

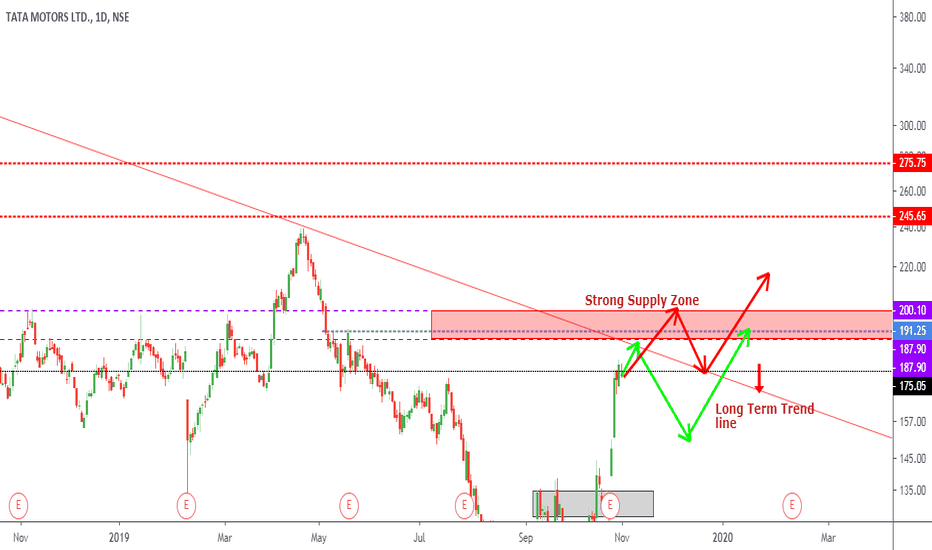

Tata Motors Supply and Demand Zones TradingDear Traders,

Tata motors are very close to the supply zones, I am expecting the two way track method of travelling with the price action. Either it will break the long term trend line, for me it is difficult to do because need one more better results to break the trend , but if it do so then it will take rest on the trend line for a while before it take off.

Case 2: If it resist by the trend line then we will see some correction towards the 150 Zones for buying opportunity as many of them missed the current flight, so they will get another opportunity to be on board.

I have shared my tata motors Supply and demand zone video, those who missed, please go thru the below mention link for ore clarification.

Thanks & Regards,

Deepak

Support us by Giving LIKE COMMENT SHARE for new people get rewarded by learning.

Please feel free to contact me for further clarification.

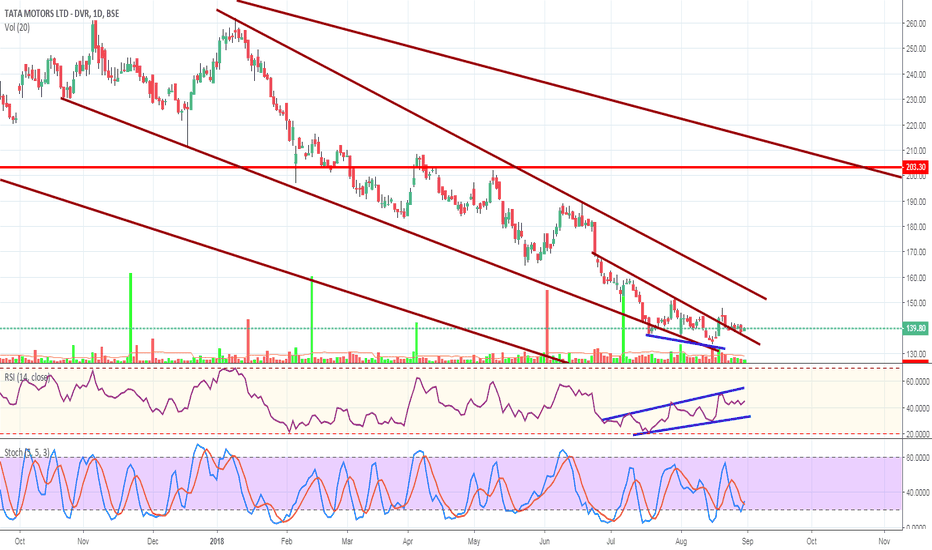

Tata Motors | Bear FlagTata Motors, which has been already week on the back of Brexit and JLR performances has traded along a bearish Price action recently. Apparently we could observe a Bear Flag pattern which suggests a very deep drop in price. According to the pattern the stock is set to fall to 125 and that is a big 25% fall. Noticeable supports are at 160 and 152.

(Disclaimer: Our charts and contents are just for the purpose of analysis, learning and general discussion. Do not consider these as trading tips or investment ideas. Trading in Stocks, Futures and Options carry risk and is not suitable for every investor. Hence it is important to do your own analysis before making any investment or trading decisions based on you personal circumstances and it is always better to take advice from professionals)

A Quick ride from the TATA MOTORS DVR-Food for the bear market!1.Bullish reverse divergence

2. Expected support from the ML touch of the pitchfork

3.Take profit level chosen conservatively in the 0.382 fibo level of the bounce intra kumo cloud...

4.There is a possibility of piercing the kumo and reaching the 0.618 level but i wont count that, as there are too many trends to breakout from, and specially when the broader market sentiments are doubtful in the long run, and no fundamentals in sight, except q4 numbers... we have to watch an CANSLIM it to the pattern we are receiving here....

Disclaimer... Trade active....Not an investment/trading recommendation.....