Part2 Ride The Big Moves Intermediate Options Strategies

Bull Call Spread

When to Use: Expect moderate price rise.

How It Works: Buy a call at a lower strike, sell a call at higher strike.

Risk: Limited to net premium paid.

Reward: Limited to strike difference minus premium.

Example: Buy call at ₹100 (₹5), sell call at ₹110 (₹2). Net cost ₹3. Max profit ₹7.

Bear Put Spread

When to Use: Expect moderate decline.

How It Works: Buy put at higher strike, sell put at lower strike.

Risk: Limited to net premium paid.

Reward: Limited but cheaper than buying a single put.

Example: Buy put ₹105 (₹6), sell put ₹95 (₹3). Net cost ₹3. Max profit ₹7.

Tatasteel

Inflation NightmareIntroduction

Inflation—defined as the general rise in prices of goods and services over time—is a double-edged sword in any economy. When moderate, it can stimulate spending and investment. But when inflation spirals out of control, it becomes an economic nightmare that can erode savings, destroy purchasing power, disrupt businesses, and destabilize entire nations. An inflation nightmare is not merely about rising costs—it is a systemic, psychological, and financial breakdown that touches every layer of society.

This 3000-word exploration of the "Inflation Nightmare" will take you through its root causes, real-world examples, economic consequences, societal impact, central bank responses, and lessons for investors, policymakers, and citizens.

1. What Is Inflation?

Inflation is measured by tracking price increases across a basket of essential goods and services, usually using indices such as the Consumer Price Index (CPI) or Wholesale Price Index (WPI). A modest inflation rate (2–3% annually) is often considered healthy for economic growth. However, inflation turns into a nightmare when it exceeds manageable levels—either due to demand-pull factors (too much money chasing too few goods), cost-push dynamics (rising production costs), or monetary mismanagement.

Types of Inflation:

Creeping Inflation – Slow and steady; manageable.

Walking Inflation – Moderate; begins to affect spending and investment.

Galloping Inflation – High inflation (10%+ annually); dangerous.

Hyperinflation – Extreme, uncontrolled inflation (50%+ monthly); catastrophic.

2. Causes of an Inflation Nightmare

a. Monetary Policy Failure

Central banks print money to boost economic activity. But excessive money printing without corresponding growth in goods and services leads to inflation. When governments run large fiscal deficits and monetize debt, it can fuel this process.

Example: Zimbabwe in the 2000s printed massive amounts of currency, leading to hyperinflation of over 79.6 billion percent.

b. Supply Chain Disruptions

Events like wars, pandemics, or natural disasters disrupt supply chains, causing shortages. When supply drops but demand remains the same or increases, prices rise steeply.

Example: COVID-19 caused global supply shocks, while stimulus packages increased demand—fueling inflation globally.

c. Commodity Price Shocks

Inflation can also result from surging prices of vital commodities like oil, food, or metals. Since these are inputs to many industries, cost increases ripple throughout the economy.

Example: The 1973 oil embargo quadrupled oil prices, leading to stagflation (high inflation + stagnation).

d. Wage-Price Spiral

As prices rise, workers demand higher wages. Businesses pass increased labor costs onto consumers, creating a self-reinforcing cycle that’s hard to break.

3. The Mechanics of the Nightmare

a. Currency Devaluation

When inflation surges, a nation’s currency loses value—both domestically and internationally. Imports become expensive, debt burdens grow, and investor confidence drops.

b. Collapse of Savings and Pensions

As purchasing power erodes, fixed income sources like pensions become inadequate. Retirement savings lose value unless indexed to inflation.

c. Middle-Class Erosion

The middle class bears the brunt of inflation. Their incomes don’t rise as fast as prices, while the wealthy shift assets into inflation-protected investments, widening inequality.

d. Business Disruptions

Price instability affects inventory, planning, contracts, and wages. Businesses may delay investments, leading to job losses and reduced output.

e. Social Unrest

Food and fuel inflation can trigger protests, strikes, and even revolutions. The Arab Spring began with rising bread prices.

4. Historical Inflation Nightmares

a. Germany – Weimar Republic (1921–1923)

War reparations and excessive printing led to hyperinflation.

Prices doubled every few days; people used wheelbarrows to carry money.

Middle class lost their wealth, leading to political radicalization.

b. Zimbabwe (2000–2009)

Land reforms destroyed agricultural productivity.

The government printed money to cover expenses.

Monthly inflation reached 89.7 sextillion percent.

A loaf of bread cost Z$10 billion.

c. Venezuela (2010–Present)

Oil dependence, corruption, and mismanagement.

Currency collapsed; citizens rely on barter or foreign currency.

Basic items like toilet paper and flour became luxuries.

5. The Psychological Toll

An inflation nightmare is not just economic—it alters behavior, perception, and trust.

a. Hoarding Behavior

Fear of future price hikes makes people stockpile essentials. This worsens shortages and further fuels inflation.

b. Loss of Trust in Currency

When money loses value daily, it ceases to serve as a store of value. People seek hard assets like gold, real estate, or foreign currency.

c. Dollarization

In some countries, people abandon local currency altogether. In Zimbabwe and Venezuela, U.S. dollars and cryptocurrencies replaced the national currency in everyday use.

6. Central Bank Dilemma

Fighting inflation is a central bank's primary task. But during an inflation nightmare, tools become limited and the stakes higher.

a. Raising Interest Rates

Higher rates reduce borrowing and spending, cooling demand. However, excessive rate hikes can cause a recession or debt crisis.

b. Quantitative Tightening

Reversing previous monetary expansion helps control money supply, but may reduce market liquidity and risk financial instability.

c. Policy Credibility

Central banks must act decisively and maintain public confidence. Any delay or miscommunication can worsen the situation.

Example: The U.S. Federal Reserve’s delayed response in the 1970s led to persistent inflation. Paul Volcker's sharp rate hikes in the 1980s finally broke the cycle—at the cost of a deep recession.

Modern Inflation Risks (2020s and Beyond)

a. Global De-Dollarization

If global confidence in the U.S. dollar weakens due to debt and deficits, it could create worldwide inflation pressure.

b. Deglobalization

Protectionism, reshoring, and geopolitical tensions raise production costs globally.

c. Climate Change and ESG

Carbon taxes, green transitions, and resource scarcity may contribute to structural inflation.

d. Digital Inflation

Digital goods seem deflationary, but tech monopolies and algorithmic pricing may create price opacity and hidden inflation.

Conclusion

The "Inflation Nightmare" is not just about rising prices—it's about loss of control, confidence, and continuity. It reflects systemic cracks in policy, governance, production, and social structure. Whether triggered by reckless monetary policy, geopolitical shocks, or mismanagement, once inflation spirals beyond a threshold, it unleashes chaos across all sectors.

Understanding the anatomy of an inflation nightmare is essential for policymakers, investors, businesses, and citizens. While inflation is a natural economic phenomenon, preventing it from becoming a catastrophe requires foresight, discipline, and global coordination.

The past has shown us how devastating uncontrolled inflation can be. Let us not sleepwalk into another nightmare.

Intraday & Swing TradingIntroduction

Trading in the financial markets can be approached in many ways, but two of the most popular and widely practiced styles are intraday trading and swing trading. Both offer opportunities to capitalize on short-term price movements, yet they differ significantly in their strategies, holding periods, risk profiles, and psychological demands.

Whether you’re a beginner trying to choose your trading path or an intermediate trader refining your style, understanding the intricacies of intraday and swing trading is crucial. In this detailed guide, we’ll explore both trading approaches in depth and help you determine which might suit you best.

1. What is Intraday Trading?

Definition

Intraday trading, also known as day trading, involves buying and selling financial instruments (like stocks, options, forex, or futures) within the same trading day. The goal is to profit from short-term price fluctuations by entering and exiting positions before the market closes.

Key Characteristics

Timeframe: Minutes to hours; positions are closed before the market ends.

No overnight risk: All trades are squared off within the day.

High frequency: Multiple trades per day are common.

Focus on liquidity & volatility: Traders prefer highly liquid stocks that show good intraday movement.

2. What is Swing Trading?

Definition

Swing trading is a medium-term trading strategy that involves holding positions for several days to weeks. The aim is to profit from “swings” in the market — i.e., short- to medium-term price trends.

Key Characteristics

Timeframe: Several days to a few weeks.

Overnight holding: Positions are often held over multiple sessions.

Trend-based: Trades follow short- to medium-term trends.

Fewer trades: Compared to intraday trading, swing trading involves less frequent trading.

3. Tools & Indicators Used

Common Technical Indicators

Indicator Intraday Trading Swing Trading

Moving Averages EMA (5, 20), VWAP SMA (20, 50, 200)

RSI RSI (14) for quick overbought/oversold RSI for identifying pullbacks

MACD Less used due to lag Commonly used to confirm trends

Bollinger Bands For breakout strategies For range-bound swing trades

Volume Profile Key for entry/exit points Confirms breakout/breakdown

Support & Resistance Intraday levels like VWAP, pivots Daily, weekly levels matter more

Chart Timeframes

Intraday: 1-min, 5-min, 15-min charts.

Swing: 1-hour, 4-hour, daily charts.

4. Strategy Differences

Intraday Trading Strategies

Scalping

Super-fast trades, often held for seconds or minutes.

Requires tight spreads and high liquidity.

Momentum Trading

Buy assets showing strong upward or downward movement.

Follows news, earnings releases, or market momentum.

Breakout Trading

Enter when price breaks key levels (resistance/support).

High volume confirmation needed.

VWAP Reversion

Trade around Volume Weighted Average Price.

Mean reversion strategy used by institutions too.

Swing Trading Strategies

Trend Following

Enter trades in the direction of the prevailing trend.

Use moving averages and channels to ride the trend.

Pullback Strategy

Enter after a retracement in a trend.

Look for confirmation via candlesticks or RSI divergence.

Breakout Swing

Identify consolidation zones and enter on breakout.

Targets are based on previous swing highs/lows.

Support & Resistance Bounce

Buy at key support, sell at resistance.

Requires clear zones and strong candles for confirmation.

5. Risk Management Techniques

Intraday Trading

Stop-loss: Tight, usually 0.5–1.5% of capital.

Risk-to-Reward Ratio: Typically 1:2 or better.

Capital allocation: No more than 2% risk per trade.

Position sizing: Based on volatility (ATR) and SL.

Swing Trading

Stop-loss: Wider, often based on key support/resistance.

Risk-to-Reward: Usually 1:2 to 1:3.

Capital allocation: Diversified across a few trades.

Overnight risks: Consider earnings, news, gap-ups/downs.

6. Psychological Challenges

Intraday Trading Psychology

Stressful: Requires intense focus and fast decision-making.

Emotionally draining: Rapid changes may induce anxiety.

FOMO & Overtrading: Common due to market noise.

Patience & discipline: Needed to avoid chasing trades.

Swing Trading Psychology

Patience is key: Waiting for setups and letting trades develop.

Discipline: Not reacting emotionally to minor price swings.

Confidence: Trusting your analysis over multiple days.

Fear of overnight gaps: Especially during earnings season.

7. Pros and Cons

Intraday Trading

Pros:

No overnight risk.

Quick profits possible.

Many opportunities daily.

Leverage can enhance returns.

Cons:

Requires constant screen time.

High transaction costs.

Emotionally demanding.

Requires fast decision-making.

Swing Trading

Pros:

Less screen time needed.

Potential for larger profits per trade.

Can combine with full-time job.

Better suited for trend traders.

Cons:

Exposure to overnight risk.

Slower profit realization.

Can be affected by news and gaps.

Requires patience and broader analysis.

8. Which One Should You Choose?

Choose Intraday Trading If:

You can dedicate 3–6 hours daily to watch the market.

You enjoy fast-paced decision-making.

You’re good at technical analysis and price action.

You have a stable internet connection and good trading tools.

Choose Swing Trading If:

You have a full-time job or limited screen time.

You’re more patient and prefer holding trades longer.

You want to combine technicals with fundamentals.

You prefer trend-following strategies.

9. Important Tools & Platforms

For Intraday Traders

Brokerages with fast execution (e.g., Zerodha, Angel One, Upstox).

Charting platforms (TradingView, Chartink).

Screeners for intraday volume, price spikes, etc.

News feeds (Moneycontrol, CNBC, Twitter for live catalysts).

For Swing Traders

Daily/weekly screeners for breakouts or oversold stocks.

Fundamental filters (ROE, PE, EPS growth).

Economic calendar to watch major events.

Backtesting tools to test swing strategies.

10. Real-Life Example Comparison

Let’s assume a stock, XYZ, is trading at ₹200.

Intraday Trade:

Breaks intraday resistance at ₹202.

Buy at ₹202, target ₹206, SL at ₹200.

Risk: ₹2, Reward: ₹4 (1:2 RR).

Trade duration: 1 hour.

Swing Trade:

Breaks out from a 2-week consolidation at ₹200.

Buy at ₹202, target ₹215, SL at ₹195.

Risk: ₹7, Reward: ₹13 (1:2 RR).

Holding period: 7–10 days.

11. Combining Both Approaches

Some experienced traders combine both strategies:

Use intraday profits to fund swing positions.

Trade options intraday, while holding cash equities swing.

Use swing trade analysis to set intraday bias.

Hybrid trading can diversify risk and improve overall performance.

12. Common Mistakes to Avoid

In Intraday Trading:

Overtrading due to boredom.

Ignoring risk-reward ratios.

Trading illiquid stocks.

Reacting emotionally to market noise.

In Swing Trading:

Holding losers too long.

Lack of trade journal or analysis.

Ignoring macroeconomic factors.

No exit plan on profit.

Conclusion

Intraday and swing trading are both viable paths for active market participants. Intraday trading suits those seeking quick profits with high engagement, while swing trading appeals to those who prefer a more relaxed and trend-based approach.

Neither is inherently better — the choice depends on your personality, lifestyle, risk appetite, and financial goals.

Momentum, Swing & Day Trading StrategiesTrading in financial markets offers a variety of strategies suited to different timeframes, risk appetites, and goals. Among the most popular trading methodologies are Momentum Trading, Swing Trading, and Day Trading. These strategies, while overlapping in some aspects, are distinct in their approach to capitalizing on market opportunities. Each appeals to a particular type of trader and requires different skills, tools, and psychological traits.

This guide provides a deep dive into these three trading styles, helping aspiring traders understand how they work, what tools are needed, and how to determine which might be the best fit for their goals.

1. Momentum Trading

Definition

Momentum trading is a strategy that seeks to capitalize on the strength of existing market trends. Momentum traders aim to buy securities that are moving up and sell them when they show signs of reversing—or go short on securities that are moving down.

The underlying belief is that stocks which are already trending strongly will continue to do so in the short term, as more traders jump on the bandwagon.

Core Principles

Trend Continuation: Assets that exhibit high momentum will likely continue in their direction for a while.

Volume Confirmation: High volume typically confirms the strength of momentum.

Short-term holding: Positions are held for a few minutes to several days.

Relative Strength: Comparing the performance of securities to identify leaders and laggards.

Example Strategy

Identify stocks with high relative volume (5x or more average volume).

Look for breakouts above recent resistance with strong volume.

Enter the trade once confirmation occurs (price closes above resistance).

Use a trailing stop-loss to ride the trend while locking in gains.

2. Swing Trading

Definition

Swing trading involves taking trades that last from a few days to a few weeks in order to capture short- to medium-term gains in a stock (or any financial instrument). Swing traders primarily use technical analysis due to the short-term nature of the trades but may also use fundamental analysis.

This strategy bridges the gap between day trading and long-term investing.

Core Principles

Trend Identification: Traders look for mini-trends within larger trends.

Support & Resistance: Entry and exit points are often based on technical levels.

Risk-to-Reward Ratios: Focus on setups with favorable risk/reward profiles (typically 1:2 or better).

Market Timing: Entry and exit are more strategic and less frequent than day trading.

Example Strategy

Scan for stocks in a clear uptrend or downtrend.

Wait for a pullback to a key moving average or support zone.

Enter on a bullish/bearish reversal candlestick pattern.

Set stop-loss just below support or recent swing low.

Set target profit at next resistance level or use a trailing stop.

3. Day Trading

Definition

Day trading is a strategy that involves buying and selling financial instruments within the same trading day. Traders aim to exploit intraday price movements and typically close all positions before the market closes to avoid overnight risks.

This strategy demands intense focus, fast decision-making, and a strong grasp of technical analysis.

Core Principles

Speed: Executing trades rapidly and precisely.

Volume & Liquidity: Only liquid assets are traded to ensure quick execution.

Leverage: Often used to increase potential profits (and losses).

Volatility: The more a stock moves, the better for day trading.

Example Setup

Identify a high-volume stock with a news catalyst.

Wait for an opening range breakout.

Enter long/short based on breakout with tight stop-loss.

Set profit targets based on support/resistance or risk-reward ratio.

Tools Commonly Used Across All Strategies

Regardless of the strategy, traders typically use the following tools:

Charting Platforms: TradingView, ThinkorSwim, MetaTrader, NinjaTrader.

Screeners: Finviz, Trade Ideas, MarketSmith.

News Feed Services: Benzinga Pro, Bloomberg, CNBC, Twitter/X.

Brokerage Platforms: Interactive Brokers, TD Ameritrade, E*TRADE, Fidelity.

Risk Management Software: Used to calculate position sizing, stop losses.

Risk Management: The Cornerstone of All Strategies

No matter the strategy, risk management is essential. Key practices include:

Position Sizing: Never risk more than 1–2% of capital per trade.

Stop-Loss Orders: Automatically exits a losing trade at a predefined level.

Risk-Reward Ratio: Most successful traders seek at least a 1:2 ratio.

Diversification: Avoid overexposing to one sector or asset.

Conclusion: Which Strategy is Right for You?

Choosing the right trading strategy depends on your:

Time availability: Can you watch the markets all day?

Capital: Can you meet margin and liquidity requirements?

Personality: Are you calm under pressure, or do you prefer slower decision-making?

Experience level: Some strategies are more forgiving and suitable for beginners.

Master Institutional Trading✅ Introduction: What Is Institutional Trading?

Institutional trading refers to the strategies and market activities carried out by big players—like hedge funds, mutual funds, insurance companies, foreign institutional investors (FIIs), banks, and proprietary trading firms.

Unlike retail traders (individuals), institutions manage large capital, influence markets, and use advanced data-driven strategies to enter and exit positions silently and smartly.

"Master Institutional Trading" is all about learning how these big players operate, how they make decisions, and how you—an individual trader—can read their moves and trade alongside the smart money instead of against it.

🧠 Why Learn Institutional Trading?

Most retail traders lose money because they trade emotionally or follow the crowd. Institutional traders, on the other hand:

Follow data, not emotions

Trade with discipline and risk management

Use volume, price action, and order flow

Focus on capital protection as much as profits

Mastering Institutional Trading helps you:

Understand how smart money moves

Identify hidden demand and supply zones

Trade with precision using volume and price action

Avoid retail traps and manipulation zones

Develop a rule-based, professional approach

📘 What You Learn in Master Institutional Trading

Here’s what a full-fledged Master Institutional Trading program or strategy guide includes:

1️⃣ Market Structure: Understanding the Battlefield

Difference between retail and institutional behavior

Market cycles: Accumulation → Manipulation → Distribution

Price action and how institutions create fake breakouts

Liquidity hunting: How institutions trap retail traders

2️⃣ Smart Money Concepts

Smart money refers to capital controlled by professional institutions. You’ll learn:

How to track smart money footprints

Concepts like Order Blocks, Liquidity Zones, Fair Value Gaps (FVG)

Role of volume spikes and open interest in showing big trades

How smart money builds positions slowly to avoid moving the market

3️⃣ Volume Profile and Order Flow

Institutional traders focus on volume and flow, not indicators.

How to use Volume Profile (POC, Value Area High/Low)

Footprint charts and Delta analysis

How to read Buy vs Sell pressure

Spotting imbalances where smart money takes control

4️⃣ Institutional Candlestick Behavior

Candles tell a story—especially when institutional players are involved.

You’ll learn:

Master Candle setups

Break of Structure (BOS) and Change of Character (CHOCH)

Identifying manipulation wicks and liquidity grabs

Candlestick rejections at key institutional levels

5️⃣ Option Chain Analysis (Institutional Option Trading)

Institutions use options to hedge and speculate quietly.

Interpreting Open Interest (OI) data

Spotting institutional positions at strikes

Using PCR (Put Call Ratio) and Max Pain

Advanced option strategies like short straddles/strangles, iron condors

6️⃣ Institutional Risk Management

Institutions are masters of risk.

You will learn:

Capital allocation strategy

Stop-loss planning based on liquidity zones, not random points

Scaling into trades, position sizing

Trade management and profit-booking plans

7️⃣ Market Psychology & Trap Detection

Institutional traders create fake moves to trap retail traders.

How to avoid bull traps and bear traps

Understand news-based manipulation

The concept of dumb money vs smart money

Mindset training for following your edge

8️⃣ Building Your Institutional Strategy

The final goal is to trade like an institution, even with a small account.

You will build:

A structured plan based on smart money concepts

Entry/Exit criteria using price action + volume

Trade journaling system

Performance review framework

💼 Who Is This For?

"Master Institutional Trading" is ideal for:

Intermediate and advanced traders

Option traders looking to time entries better

Intraday, swing, and positional traders

Traders tired of using random indicators

Anyone serious about building a long-term profitable system

🧭 Real-World Application Examples

Bank Nifty Levels: Institutions often build positions using weekly options and defend key OI levels.

Nifty50 Zones: Watch for institutional buying during heavy dips or selling into rallies.

Futures Volume: A sudden spike in Bank Nifty Futures + Open Interest jump = Institutional entry.

Option Writers: At resistance zones, call writing increases sharply = probable reversal zone.

🎓 Conclusion

Mastering Institutional Trading is not about getting secret indicators or magic tips. It’s about understanding the market at its core—through price, volume, structure, and behavior of smart money.

Once you learn this, you stop following the herd. You become a confident, calm, data-driven trader who knows how to read the market like a pro.

🔹 Whether you're trading Nifty, Bank Nifty, stocks, or forex – the principles of institutional trading remain the same

Banknifty 1D Timeframe📈 Bank Nifty – Market Overview

Opening Price: Opened strong near 57,250–57,300.

Intraday High: Touched around 57,286 in early trading hours.

Intraday Low: Dropped towards 56,730 during mid to late session.

Current Trading Range: Between 56,730 and 57,280, with a mild negative bias.

Previous Close: Around 56,953.

Current Loss: Trading -0.3% to -0.5% lower compared to previous close.

🔍 Key Drivers Today

Private Banks Hold Strength: Stocks like HDFC Bank and ICICI Bank showed resilience, limiting the downside.

PSU Banks Under Pressure: Public sector banks including SBI, PNB, and Canara Bank underperformed, causing the index to drift lower.

Profit Booking Seen: After an early positive move, intraday profit booking pulled the index back.

Low Volatility: Reduced intraday swings, though a narrow downtrend was visible after the first hour.

📊 Technical Picture

Support Zone: Strong support is visible around 56,730–56,700. A breach could see a quick move toward 56,500–56,000.

Resistance Zone: Resistance remains at 57,250–57,300. If this level is crossed, the next upside target is around 57,500–57,700.

Trend Bias: Neutral to bearish for the day due to selling pressure after opening strength.

✅ Summary Conclusion

Bank Nifty is showing slight weakness today, mainly dragged by public sector banks. The index gave up early gains, but private banks kept the fall in check. Current range is 56,730–57,280. Watch for either a bounce above 57,300 or a break below 56,700 for the next clear trend direction.

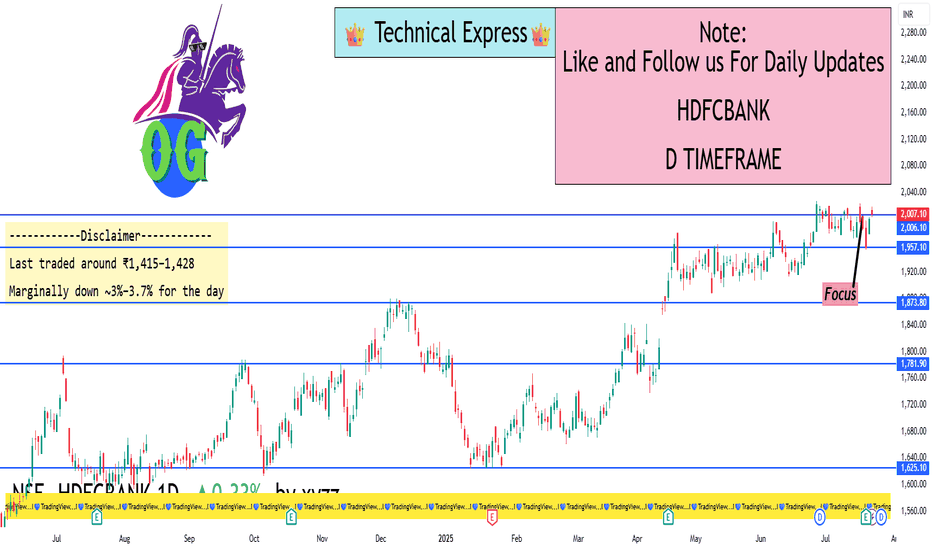

HDFCBANK 1D Timeframe📈 HDFC Bank – Intraday Overview

Opening Price: Opened strong around ₹2,005–₹2,010.

Intraday High: Touched approximately ₹2,018 during early trading.

Intraday Low: Maintained support around ₹2,000.

Current Price: Trading near ₹2,016, showing a gain of around +0.8% to +0.9%.

Previous Close: ₹2,005.

🔍 What’s Driving HDFC Bank Today

Positive Earnings Effect: Strong Q1 earnings with around 12% year-on-year profit growth, bonus share announcements, and dividends have boosted buying interest.

Sector Leadership: Among the strongest performers in the banking sector, helping to support indices like Nifty50 and Bank Nifty.

Consistent Volume: Healthy trading volumes indicate sustained institutional participation.

Strong Sentiment: Momentum remains high with overall positive cues from private banking space.

📊 Technical Summary

Support Level: Strong support exists around ₹2,000–₹2,005.

Resistance Level: Intraday resistance at ₹2,018 with major resistance near ₹2,027 (recent all-time high).

Trend Direction: Bullish trend, as it is making higher lows and maintaining strength above the psychological ₹2,000 mark

✅ Summary Conclusion

HDFC Bank is trading positively today with sustained momentum after strong earnings and corporate actions. Intraday action shows bullish strength above ₹2,000, with the possibility of new highs if it crosses ₹2,018–₹2,027 levels. Technical trend remains positive to bullish for the day.

Advance Option Trading📊 Advance Option Trading – Complete Professional Guide

Advance Option Trading focuses on mastering professional-grade strategies that go beyond simply buying Call and Put options. This approach uses multi-leg strategies, Option Greeks, and volatility analysis to help traders profit in bullish, bearish, sideways, or even volatile and low-volatility markets with better control over risk and reward.

This is how professional traders and institutions trade options — systematically, with probability, and smart risk management.

💡 What is Advanced Options Trading?

In Advanced Options Trading, you learn:

✅ Complex Strategies like Spreads, Straddles, Strangles, Iron Condor

✅ How to combine multiple options in one trade

✅ Reading and using Option Greeks to manage your trades

✅ Analyzing Implied Volatility (IV) to predict market reactions

✅ Managing risk and reward scientifically

🎁 What You Master in Advanced Option Trading

1. Option Greeks

Delta — How much option price moves with the underlying.

Theta — Time decay; how much premium you lose every day.

Gamma — Rate of change of Delta; helps in intraday adjustments.

Vega — Sensitivity to volatility changes.

Rho — Impact of interest rates (minor but useful).

➡️ Professionals use Greeks to adjust their positions and decide when to enter, exit, or hedge trades.

2. Volatility Trading

High IV Strategies → Sell Options (Iron Condor, Credit Spread).

Low IV Strategies → Buy Options (Straddle, Strangle).

IV Crush → Profit from fast drop in implied volatility after events (like earnings/news).

3. Advance Risk Management Techniques

Adjusting trades dynamically as price moves.

Hedging positions when necessary.

Avoiding big losses using proper position sizing.

Managing trades based on Greeks exposure

✅ Benefits of Advanced Options Trading

✅ Predictable Profitability — higher consistency

✅ Works in all market conditions

✅ Controlled Risk, Limited Loss

✅ Higher Win Rate Strategies

✅ Option Greeks help you stay professional

✅ Volatility analysis increases trade accuracy

📝 Who Should Learn Advanced Options Trading?

✅ Traders who know basics and want more control

✅ Those interested in hedging and capital protection

✅ Swing or positional traders wanting steady income

✅ Intraday traders aiming for high probability setups

Institution Option Trading📈 Institutional Option Trading – Complete Detailed Guide

Institutional Option Trading refers to how big financial institutions, such as banks, hedge funds, and proprietary trading firms, use options strategically in the market to manage risk, maximize profits, and control large positions with precision. This approach is highly systematic, data-driven, and based on volume, volatility, and liquidity analysis — very different from how retail traders trade options.

💡 What is Institutional Option Trading?

Institutions don’t gamble with options — they use options for:

✅ Hedging — Protecting big portfolios from market drops.

✅ Income Generation — Earning regular profits through premium selling.

✅ Directional Bets — Placing large directional trades with minimal risk.

✅ Volatility Trading — Making profits from changes in volatility without caring about market direction.

📚 Key Features of Institutional Option Trading

1. Focus on Liquidity

Institutions trade highly liquid options, usually:

Index Options (NIFTY, BANKNIFTY, SPX)

Blue-Chip Stocks (Apple, Reliance, TCS, Infosys)

Commodity Options (Gold, Crude Oil)

They avoid low-volume contracts and always trade in markets where they can enter and exit positions without slippage.

2. Use of Option Greeks

Institutions are masters of Option Greeks:

Delta for direction,

Theta for time decay profits,

Vega for volatility play,

Gamma for adjusting positions dynamically.

They don’t trade blindly but monitor how their positions react to price, time, and volatility changes.

3. Premium Selling Bias

Most institutional setups involve selling options (not just buying).

✅ Credit Spreads, Iron Condors, and Covered Calls are preferred.

Why? Because time decay works in their favor, giving consistent income.

4. Hedging Big Positions

Institutions always hedge their trades.

✅ Example: They may hold large stock positions and sell Covered Calls or buy Protective Puts to reduce risk.

✅ This creates balanced portfolios, minimizing market shocks.

✅ Institutional Trading Tools

Open Interest Analysis

Option Chain Data

IV (Implied Volatility) charts

Volume Profile & Market Profile

Real-time Greeks exposure tools

Delta-neutral hedging platforms

📝 Example of Institutional Option Trade

Scenario: NIFTY at 22,000, sideways expectation for next week.

✅ Strategy: Sell 22,500 Call, Sell 21,500 Put (Iron Condor).

✅ Buy hedges: 23,000 Call, 21,000 Put.

✅ Profit Range: If NIFTY stays between 21,500-22,500 → Max Profit.

✅ Risk Managed: Losses capped, steady time decay profit.

🚀 Benefits of Learning Institutional Option Trading

✅ Consistent income instead of gambling

✅ Risk protection using proper hedging

✅ Trade size management for scalability

✅ Ability to handle big accounts with steady growth

✅ Professional market understanding

Option Trading📈 Option Trading – Complete Beginner to Advanced Guide

Option Trading is a powerful method used in stock, forex, commodity, and index markets where you trade contracts (options) instead of buying the actual stock or asset. With options, you get the right, but not the obligation, to buy or sell an asset at a specific price within a specific time. This allows traders to profit in bullish, bearish, and sideways markets — with controlled risk and higher flexibility.

💡 What is Option Trading?

In simple words:

You buy or sell a contract, not the stock itself.

You can control big positions with less money (leverage).

You can make money even if the market goes up, down, or stays sideways.

🎁 Advantages of Option Trading

✅ Small capital, high profits with leverage

✅ Limited risk, especially in buying options

✅ Opportunity to earn in any market direction

✅ Flexible strategies for income, hedging, or speculation

✅ Ideal for short-term trades (1 day to a few weeks)

Simple Example:

You think NIFTY will rise from 20,000 to 20,500 in a week.

You buy a NIFTY Call Option (Strike Price: 20,000).

Pay premium ₹50.

If NIFTY moves to 20,500, your option value increases (maybe ₹200).

Profit = ₹150 per unit (₹200 - ₹50).

With small investment, you earn bigger returns.

✅ Basic Rules for Successful Option Trading

Trade with trend direction (use technical analysis).

Always check Open Interest & Volume.

Avoid holding close to expiry to avoid time decay (theta loss).

Start with single-leg options, move to spreads later.

Risk only 1-2% of your capital per trade.

🎯 Benefits of Mastering Option Trading

✅ Higher returns with lower capital

✅ Master multiple market conditions

✅ Ideal for intraday, swing, and positional trades

✅ Opportunity to hedge existing investments

✅ Fast skill growth in financial markets

New Hedging Opportunity: Gold Futures at IIBX1. What Is IIBX—and Why Are Gold Futures a Game Changer?

India International Bullion Exchange (IIBX), based in GIFT City, Gujarat, launched gold futures trading in July 2025.

This marks the first-ever opportunity for Indian entities to hedge gold price risk onshore but in US dollars with global pricing—bridging domestic participants and international benchmarks.

Unlike traditional futures on MCX, which are rupee-denominated and influenced heavily by Indian domestic factors, IIBX futures track international market dynamics, aligning with real-time global valuations.

Why is this significant?

India is the world’s second-largest consumer of gold—by introducing a dollar-denominated, globally priced futures contract, IIBX allows traders and jewellers to hedge currency and commodity risk simultaneously.

This initiative reduces dependence on foreign exchanges like COMEX or Singapore and supports RBI/IFSCA's goal to develop a robust, transparent bullion trading ecosystem domestically.

2. Who Can Use These Futures—and How Do They Hedge?

Eligible Participants:

Qualified jewellers

Bullion dealers

Refineries

TRQ (Tariff Rate Quota) holders (currently 441+, with more in the pipeline)

Any business entity with gold-related risk exposure

Hedging Scenarios:

Jewellers: Protect import cost from rising gold prices. If they expect gold to cost $2,000/oz in three months, they can lock in prices via futures.

Refiners and Dealers: Manage margin volatility and ensure stable profit spreads regardless of gold price shifts.

TRQ operators: Offset exposure to tariff-based import risks.

Hedging Mechanics:

Buy futures if expecting price increases, offsetting rising import cost.

Sell futures (short positions) to hedge inventory or production, locking in current prices.

Since trades occur in US dollars and settle physically or in cash, participants hedge both commodity and currency risk.

3. Contract Features: What IIBX Has Built-In

📃 Specifications:

Contract unit: 1 kg gold (approx 32.15 oz)

Denomination: U.S. dollars per Troy ounce

Tick size: $0.01 per oz

Minimum trading size: 1 kg; maximum 10 kg per order

Contracts listed: Three consecutive months plus all even-months in a 13-month window (total 8 concurrent maturities)

Trading hours: 09:00–23:30 IST—keeping sync with global gold trading sessions

Risk & Margin Management:

Initial margin: At least 6% of contract value or calculated via Value‑at‑Risk (VaR)

Extreme Loss Margin (ELM): 1% buffer

Daily Mark-to-Market (MTM) settlement

Collateral controls: Members cannot fully exhaust collateral—risk-reduction thresholds are triggered at 85–90%

Concentration & spread margins: Encourage diversification by offering margin benefits for calendar spreads

Settlement:

Daily MTM in USD

Final settlement: Cash or physical delivery, based on pre-declared intent

These features ensure transparency, member protection, and global alignment—while maintaining strong oversight by IIBX and IFSCA.

4. What Makes This Hedging Opportunity Unique Now

💱 Hedge Gold and Currency Simultaneously

Standard MCX contracts hedge gold price risk but not USD/INR fluctuations.

With IIBX’s Dollar-based futures, businesses effectively lock both gold and currency exposures in one contract—critical for imports and exports.

🌍 Real-Time Global Price Alignment

IIBX uses Bloomberg’s XAU–USD spot pricing, so domestic hedges match international market moves.

This synchronisation is ideal for global trading, arbitrage, and better risk pricing.

🏛 Onshore Containerization of Hedging

Previously, Indian entities hedged overseas or bypassed through subsidiaries abroad.

Now, they can do it in GIFT City via Indian AD banks—streamlining compliance, saving on setup costs, and avoiding legal complexities.

🚀 Liquidity Boost via LES

IIBX launched a Liquidity Enhancement Scheme to incentivize market makers through rebates and reduced fees.

This seeds the market with tight spreads, better execution, and deeper order books over time.

5. Practical Use Cases for Gold Futures Hedging

✅ A. Jeweller Importer's Playbook

Estimate gold import date/volume

Sell equivalent IIBX futures at current prices

On expiry or near import — either physically take delivery or unwind position

Lock in gold cost, simplifying pricing and margin management

✅ B. Bullion Dealer/Retailer

Holds inventory — buys futures to guard against price drop

Over time, MTM fluctuations offset spot inventory gains/losses

Enables accurate working capital forecasting

✅ C. Refinery Example

Producing gold bars from scraps or raw gold

Sells refined gold in INR, but raw gold bought internationally in INR/USD

Hedging reduces mismatch, stabilizes profit margins

✅ D. Speculative/Arbitrage Traders

Play price differentials between MCX and IIBX

Exploit basis arbitrage or global/regional price plays

(Though speculative traders must be cautious of margin and regulatory requirements

7. Broader Impacts & Market Implications

🌐 Strengthening GIFT City Ecosystem

Diversifies offerings beyond forex and securities to bullion

Supports India’s vision of GIFT City as a global commodity hub

💰 Incentivizing Domestic Financial Institutions

AD banks can provide clients with hedging capabilities

Banks earn commissions and fees while helping reduce gold dependence on cash markets

🔄 Reducing Reliance on Overseas Exchanges

By offering global pricing and technology in India, overseas trading reductions save costs and complexity

🧰 Integration with Spot & Physical Markets

IIBX also operates spot segments for gold and silver

Interlinked spot-futures structure enables improved cash management and delivery coordination

8. Outlook: What Traders and Businesses Should Do Now

Assessment: Evaluate gold/currency exposures in your business (imports, inventory, exports)

Registration: Engage with AD banks for required approval and collateral setup

Education: Use IIBX’s website tutorials and circulars to understand margining and settlement norms

Start Small: Begin with a 1–2 contract hedge; monitor margin and execution

Expand Strategy: From spot hedges to calendar spreads and global arbitrage

For traders, domestic traders and arbitragers, a new tool has entered their toolbox—one that can level the playing field vs global participants.

9. Final Thoughts

The launch of Gold Futures on IIBX is a major evolution in India’s financial markets. It brings a sophisticated hedge mechanism—previously only available via overseas platforms—into the regulatory fold of GIFT City, in US dollars, tied to international prices. For jewellers, dealers, refiners, importers, and treasury teams, this is a powerful new instrument.

If adopted well, over time, it may reduce India’s dependence on international exchanges, bring more trading depth, and reduce gold price volatility for domestic stakeholders—all while supporting GIFT City’s vision as a world-class financial hub.

Rise of Algorithmic & Momentum-Based Strategy Innovation🧠 Introduction

The world of trading has changed drastically in recent years. Gone are the days when investors made decisions based on gut feeling, tips from friends, or simply following news headlines. Today, technology and data dominate the markets. A big part of this transformation is due to two fast-evolving areas of strategy:

Algorithmic Trading (Algo Trading)

Momentum-Based Trading Strategies

Together, these innovations are not just making trading faster—they're making it smarter, more scalable, and, in some cases, more profitable. Let’s explore this rise of strategy-driven trading in simple, relatable terms.

⚙️ What Is Algorithmic Trading?

Algorithmic trading (or "algo trading") refers to using pre-programmed computer code to buy and sell stocks or other financial assets. These programs follow specific sets of rules and conditions like:

Price movements

Volume changes

Timing of the trade

Technical indicators

News sentiment (in advanced models)

Instead of a human watching charts all day, the algorithm scans multiple assets simultaneously and executes trades at lightning speed when conditions are met.

🔍 Why Is It Popular?

Speed: Algos react in milliseconds.

Accuracy: Reduces human errors.

Discipline: Emotions like fear or greed don’t interfere.

Scalability: Can track hundreds of instruments at once.

⚡ What Is Momentum-Based Trading?

Momentum trading is based on a simple principle:

"What is going up will likely keep going up (at least for a while), and what is going down will keep going down."

Momentum traders try to ride these price trends. They don’t care much about why something is moving—they care that it is moving.

A momentum-based strategy focuses on:

Relative Strength Index (RSI)

Moving Averages

Breakouts above previous highs

Volume surges

In today’s digital world, most momentum strategies are now executed through algorithms, bringing us to the heart of this innovation wave.

💡 Why Is Strategy Innovation Booming in 2025?

1. Availability of Real-Time Data

In the past, getting real-time stock prices or volume data was expensive or difficult. Today, thanks to modern brokers and APIs, anyone can access tick-by-tick data in real time. This has democratized trading innovation.

2. Cloud Computing & Machine Learning

Cloud platforms like AWS, GCP, and Azure now allow even small traders to run complex models. Add machine learning to the mix, and you can build:

Predictive price models

Auto-optimizing strategies

Real-time anomaly detectors

This tech stack is fueling rapid innovation in custom algos and momentum-based systems.

3. Rise of API Brokers

Brokers like Zerodha (via Kite Connect), Upstox, and Dhan offer APIs that allow traders to:

Place trades programmatically

Access order books

Monitor positions via code

This has opened the doors for retail coders and quant enthusiasts to create strategies from their bedrooms—something only institutions could do a decade ago.

4. Market Volatility & Liquidity

Modern markets, especially post-COVID and now with geopolitical unrest, are fast-moving and noisy. Traditional long-term investing sometimes feels too slow. This has created fertile ground for short-term strategies like intraday momentum and algo scalping.

🧬 Types of Momentum-Based Algo Strategies Gaining Popularity

1. Breakout Algos

Entry: When price breaks above a resistance level or 52-week high.

Exit: After achieving target return or on breakdown.

2. Mean Reversion Momentum

Belief: Stocks that over-extend eventually revert back to mean.

Algo buys on dips and sells on peaks, based on Bollinger Bands or Moving Average deviations.

3. Relative Momentum Rotation

Focus: Switch between sectors/stocks showing strongest momentum.

Example: If Auto sector shows higher returns than Pharma over 4 weeks, the algo reallocates capital into Auto.

4. High-Frequency Momentum

Based on volume spikes, price speed, and Level-2 data.

Needs co-location or ultra-low latency to profit from small tick movements.

📊 Real-World Examples (2025 Trends)

Nifty and Bank Nifty Momentum Bots

Retail algo traders now use trend-following strategies on Nifty weekly options, taking intraday calls when the index crosses VWAP + 2%.

SME IPO Listing Day Momentum Plays

Some traders have built algos that scan listing price action and jump in when a stock breaks opening highs with volume.

AI-Augmented Algos

AI-powered bots use NLP (Natural Language Processing) to analyze earnings calls, company announcements, and even tweets. If sentiment is strongly positive, they take long positions.

🧠 Benefits of These Innovations

✅ For Retail Traders:

Better access to tools once exclusive to hedge funds.

Ability to automate their edge.

Save time watching screens all day.

✅ For Institutions:

Lower execution costs.

Scalable strategies across global markets.

Statistical models reduce dependence on human traders.

🧱 Challenges and Limitations

❌ Overfitting in Backtests

Just because a strategy worked in the past doesn't guarantee future success. Many algos “look perfect” in backtests but fail in live trading.

❌ API Latency and Downtime

Retail infrastructure is not as reliable as institutional setups. Brokers may experience order delays or API failures.

❌ Regulation Risk

SEBI and global regulators are watching algo trading closely. Flash crashes or manipulative algos can bring scrutiny and even bans.

❌ Emotional Disengagement

Too much automation can make traders disconnected from market context. Sometimes, manual intervention is needed.

🧭 What’s the Future of These Strategies?

🔮 1. AI + Algo = Self-Learning Bots

The next wave of bots may not follow fixed rules. They may adapt automatically by learning from market behavior—almost like an evolving trader.

🔮 2. Regulation Around Algo Trading

Expect more regulation in 2025–2026 to ensure fairness and stability. SEBI may require audits or sandbox testing before public deployment.

🔮 3. Community-Based Innovation

Open-source algo trading platforms (like Blueshift, QuantConnect, etc.) are becoming collaborative hubs where traders share and upgrade each other's strategies.

🔄 How Can a Retail Trader Start?

✅ Step 1: Learn Python or Use No-Code Platforms

Python is the language of algo trading. If you can’t code, use platforms like AlgoTest, Tradetron, or Streak.

✅ Step 2: Start Small

Begin with paper trading or small capital. Don’t go all-in until you have confidence and historical data.

✅ Step 3: Choose a Clean Strategy

Start with something simple—like RSI + Moving Average crossover, and backtest on Nifty.

✅ Step 4: Track Metrics

Measure win ratio, drawdown, average profit per trade. Good algo traders analyze more than they trade.

✍️ Final Words

The rise of algorithmic and momentum-based strategy innovation is reshaping India’s trading landscape. It’s making the game smarter, faster, and more competitive. But like every tool, it depends on how you use it. These strategies aren’t magic bullets—they're systems that require patience, research, and constant optimization.

For traders willing to invest in knowledge and tools, the opportunities are exciting. For those hoping to “copy-paste” quick riches, the market may prove costly.

In 2025 and beyond, the best traders may not be those with the sharpest eyes—but those with the smartest code.

SEBI’s Derivatives Market Reforms & Jane Street Fallout1. The Bigger Picture: Why SEBI Intervened

India is currently the world’s largest equity derivatives market in terms of contracts traded. On expiry days, the trading volume in index derivatives—especially options—is often more than 300 times higher than that of the cash market. This unprecedented scale might sound like a success story at first glance, but SEBI, the Securities and Exchange Board of India, saw warning signs flashing bright red.

Over the past few years, retail traders have swarmed into the derivatives space, especially index options like Bank Nifty and Nifty 50. Most of them are drawn in by the promise of quick profits and leveraged exposure. However, a SEBI study revealed that 91% of retail traders in derivatives ended up losing money. That’s an alarming statistic. It signaled that the market was becoming speculative rather than investment-oriented.

Additionally, the structure of the market had become heavily tilted towards short-tenure options—weekly, and even daily expiries—turning it into a speculative playground. This over-dependence on weekly contracts resulted in wild swings, sharp intraday moves, and extreme volatility, especially on Thursdays (the weekly expiry day). This environment wasn't healthy—neither for long-term investors nor for the broader financial ecosystem.

SEBI saw this as a structural issue and decided to take bold steps to reform the derivatives market and make it safer, more rational, and more sustainable.

2. SEBI’s Core Reforms: Changing the Game

a) Extending Contract Tenure

One of the biggest problems SEBI identified was the overuse of ultra-short-term contracts. Weekly options had become the norm, with traders focusing on short bursts of market movement rather than making informed investment or hedging decisions.

To counter this, SEBI is planning to extend the tenure of derivative contracts. This means:

Less frequent expiries.

Longer-dated instruments becoming more liquid.

Reduced scope for expiry-based volatility and manipulation.

By pushing the market toward longer expiry contracts (like monthly and quarterly), SEBI wants to encourage thoughtful strategies, proper hedging, and discourage fast-money, short-term gambling.

b) Discouraging Retail Over-Speculation

Retail participation in the F&O market has skyrocketed, but most retail traders don’t fully understand the risks involved. SEBI has already taken several steps to discourage reckless speculation, such as:

Reducing the number of expiries per month.

Increasing the lot size of index futures and options, making it harder for small-ticket traders to over-leverage.

Introducing detailed risk disclosures on broker apps to educate traders about potential losses.

These steps are aimed at protecting small investors and bringing more stability to the market.

c) Focusing on the Cash Market

India’s cash equity market is relatively underdeveloped when compared to its derivatives segment. SEBI aims to rebalance this. By encouraging growth in the cash market, SEBI hopes to reduce the over-reliance on F&O and create a healthier, more resilient market structure.

3. The Jane Street Controversy: What Happened?

In July 2025, SEBI dropped a regulatory bombshell by banning Jane Street, a major US-based high-frequency trading (HFT) firm, from Indian markets. This wasn’t just a slap on the wrist—it was a full-blown interim order with massive consequences.

The Allegations:

SEBI alleged that Jane Street engaged in manipulative expiry-day strategies over a multi-year period. Here’s what SEBI believes happened:

In the morning of expiry days, Jane Street allegedly bought large volumes of index-heavy stocks. This artificially pushed the index higher.

At the same time, they opened short positions in index options, betting that the index would fall later.

In the afternoon, they unwound their stock positions, which pulled the index down.

As the index dropped, their short options positions profited heavily.

This strategy allowed them to make massive profits on expiry days, using their firepower to allegedly manipulate both the cash and derivative markets.

SEBI’s Action:

Barred Jane Street from trading in Indian markets.

Ordered them to deposit over ₹4,800 crore (~$570 million) in suspected unlawful gains.

Accused the firm of using its dominant market position to rig expiry-day movements.

Jane Street, of course, denied the allegations, claiming that their trades were legal arbitrage and part of liquidity provisioning. They are challenging the order in court, but the damage—both reputational and market-wide—has already been done.

4. The Immediate Fallout: Markets Take a Hit

The ban on Jane Street had a chilling effect on the market. Here's what followed:

a) Volume Drops

Jane Street was a major market maker in India’s derivatives space, especially on expiry days. After the ban:

F&O volumes dropped by over 30%.

Index options saw significantly reduced liquidity.

The premium turnover on the NSE fell by nearly 36%.

This wasn’t just a temporary blip. It revealed how dependent the Indian market had become on a few HFT firms to provide liquidity and manage spreads.

b) Volatility Dips

Interestingly, India’s volatility index (VIX) dropped to multi-month lows post the ban. With fewer players like Jane Street aggressively trading expiry moves, the markets became calmer. While this might seem good, too little volatility can reduce trading opportunities and narrow market participation.

c) Wider Spreads and Execution Slippage

With fewer market makers and less volume, traders—especially institutions—began facing wider bid-ask spreads. That means it became more expensive to execute trades, especially in large quantities. This can hurt mutual funds, FIIs, and even large domestic traders.

5. Broader Implications for the Indian Market

a) SEBI’s Strength as a Regulator

This episode showcases that SEBI is serious about enforcing discipline, even if it means challenging a global giant like Jane Street. That sends a strong signal to both domestic and international players: India’s markets are not a free-for-all.

b) Liquidity Vacuum

With Jane Street gone, there's a temporary liquidity vacuum. Other firms are cautious, unsure if they might be targeted next. SEBI needs to strike a balance—encouraging good players while weeding out bad behavior.

c) Investor Confidence and Market Maturity

While retail traders might find the new reforms and lower volatility frustrating, long-term investors and institutions are likely to benefit from a more predictable and transparent market.

6. Legal Battle and Global Ramifications

Jane Street has taken the legal route, depositing the required funds while appealing the SEBI ban. Depending on how the case proceeds:

It could set new legal precedents in Indian market jurisprudence.

It may influence how SEBI handles future cases involving algorithmic or HFT trading.

Other global firms might review or revise their India strategies, balancing opportunity with regulatory risk.

If SEBI wins the case, it strengthens its position as a tough, credible regulator. If Jane Street wins, it may force SEBI to revisit how it defines and regulates market manipulation, especially in the algo/HFT space.

7. What This Means for You (the Trader/Investor)

For Retail Traders:

Expect fewer sharp expiry-day moves. Strategies based on quick, expiry-day scalping may need to be adapted.

Market may feel slower, but potentially safer.

You’ll need to focus more on strategy, research, and planning, instead of gambling on weekly moves.

For Institutions:

Market access costs may rise due to wider spreads.

Less volatility may reduce arbitrage and quant trading opportunities.

Need for more diversified trading models, including participation in the cash and bond markets.

For Market Observers and Policy Thinkers:

This is a rare opportunity to watch a major regulatory shift unfold.

India’s market is transitioning from being a trader’s playground to an investor’s ecosystem.

8. What Comes Next?

SEBI will likely roll out more reforms—stricter monitoring, revised rules for expiry days, and enhanced surveillance.

New market makers may enter the space, possibly Indian firms or global ones with stronger compliance protocols.

Jane Street’s legal outcome will influence how aggressively foreign algo firms operate in India going forward.

✍️ Final Word

The SEBI vs Jane Street saga is more than a single enforcement action—it’s a symbol of India’s market maturity. By reforming derivatives and holding big players accountable, SEBI is trying to create a safer, more balanced market for everyone—from retail investors to institutional giants.

The road ahead may involve some pain—lower volumes, fewer trading thrills—but the foundation being laid could ensure a more sustainable, fair, and globally respected financial market

Sensex 1D Timeframe✅ Current Market Status:

Closing Price: ₹82,452.00

Change: –148.32 points

Percentage Change: –0.18%

Day’s Range: ₹82,300.70 – ₹82,892.30

52-Week Range: ₹65,302.20 – ₹83,822.00

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹82,200 – minor trendline support

Support 2: ₹81,800 – recent bounce zone

Support 3: ₹81,000 – strong institutional buying level

📌 Resistance Zones:

Resistance 1: ₹82,900 – intraday high rejected

Resistance 2: ₹83,400 – multi-session top

Resistance 3: ₹83,800 – all-time high zone

🕯️ Candlestick Pattern:

Candle Type: Bearish body with upper wick

Formation: Reversal candle after a small bounce

Implication: Supply seen near highs; indicates hesitation in buying

📈 Indicator Status (1D Timeframe):

Indicator Value & Signal

RSI (14) ~45 – Neutral but slipping downward

MACD Bearish crossover – sellers gaining control

20 EMA ~₹82,780 – Price below this level (short-term bearish)

50 EMA ~₹82,000 – May act as dynamic support soon

📊 Price Structure Summary:

Sensex is in a tight range between ₹81,800 and ₹83,400.

The price rejected from ₹82,900, showing sellers are active.

If ₹82,200 breaks, we might see movement toward ₹81,800 and ₹81,000.

A bullish breakout will only occur above ₹83,400 with strong volume.

🧠 Market Sentiment & Institutional View:

Volatility: Moderate — no extreme panic or euphoria

Volume: Average — no big accumulation seen

Smart Money Activity: Likely waiting near breakout levels or lower discount zones (₹81,000)

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Key Range: ₹81,800 – ₹83,400

✅ Buyers' Entry Point: Above ₹83,400

⚠️ Sellers' Trigger: Below ₹82,200 or ₹81,800 for more downside

Learn Institutional Trading Part-9🎯 Why Learn Advanced Option Trading?

Advanced option trading lets you:

✅ Profit in bullish, bearish, or sideways markets

✅ Use time decay to your advantage

✅ Limit risk while maximizing potential reward

✅ Create non-directional trades

✅ Build hedged and balanced positions

✅ Use data, not emotion for decision making

It shifts you from being a trader who hopes for direction to one who profits from market behavior — movement, volatility, time decay, and imbalance.

🧠 Core Concepts in Advanced Option Trading

1. Option Greeks

Understanding the Greeks is essential for advanced strategies.

Delta: Measures price sensitivity to the underlying (helps with directional trades).

Theta: Measures time decay. Option sellers use Theta to earn premium.

Vega: Measures sensitivity to implied volatility (IV).

Gamma: Measures how Delta changes — useful for adjustments and hedging.

Rho: Interest rate sensitivity (used in long-term options).

Greeks help you balance risk and reward and fine-tune your strategies based on volatility and time.

2. Implied Volatility (IV) & IV Rank

IV shows the market’s expectation of future volatility.

High IV = high premium; low IV = cheap premium.

IV Rank compares current IV to its past 52-week range — essential for deciding whether to buy or sell options.

💡 Advanced rule:

High IV + High IV Rank = Favor selling options

Low IV + Low IV Rank = Favor buying options

3. Multi-Leg Strategies

Multi-leg trades involve using more than one option to hedge, balance, or amplify your position.

Here are the most popular advanced option strategies:

🔼 Bullish Strategies

🔹 Bull Call Spread

Buy one lower strike Call, sell a higher strike Call

Profits if the market rises within a defined range

Lower cost than buying a single Call

🔹 Synthetic Long

Buy a Call and Sell a Put of the same strike

Replicates owning the underlying, but with options

🔽 Bearish Strategies

🔹 Bear Put Spread

Buy a higher strike Put, sell a lower strike Put

Profits if market falls within a defined range

🔹 Ratio Put Spread

Buy one Put, sell two lower-strike Puts

Low-cost or credit strategy with higher reward if price falls moderately

🔁 Neutral or Range-Bound Strategies

🔹 Iron Condor

Sell one Call spread and one Put spread

Profits if market stays between both spreads

Ideal in low volatility, sideways markets

🔹 Iron Butterfly

Sell ATM Call and Put, buy OTM wings

Profits from time decay and stable price

High Theta, limited risk and reward

🔹 Straddle (Buy/Sell)

Buy/Sell ATM Call and Put

Used when expecting high volatility (Buy) or low volatility (Sell)

🔹 Strangle

Buy/Sell OTM Call and Put

Lower cost than Straddle, wider profit zone

🛡️ Hedging Strategies

🔹 Protective Put

Hold underlying asset, buy a Put to limit downside

Like insurance for your long position

🔹 Covered Call

Hold stock, sell a Call to generate income

Profitable if the stock stays flat or rises slightly

🔹 Collar Strategy

Hold stock, buy Put and sell Call

Risk defined, reward capped — good for conservative investors

📊 Open Interest & Option Chain Analysis

Open Interest (OI) shows where the majority of contracts are built.

High OI + Price Rejection = Institutional Resistance/Support.

Watching Call/Put buildup gives clues about range, breakout zones, and expiry-day moves.

💡 PCR (Put Call Ratio): A sentiment indicator.

PCR > 1: More Puts → Bearish

PCR < 1: More Calls → Bullish

⏱️ Time Decay & Expiry Trades

Advanced traders use weekly options to capitalize on Theta decay. Weekly expiry strategies include:

Short Straddles/Strangles

Iron Condors

Calendar Spreads

These strategies make use of:

Fast premium decay on Thursday/Friday

Stable market periods

Defined risk setups

🧠 Advanced Psychology & Risk Control

Professional option traders don’t overtrade or overleverage. They:

Follow the 1–2% risk per trade rule

Avoid trading during event-based spikes (e.g., budget, Fed speeches)

Take non-directional trades in consolidating markets

Focus on probability over prediction

Maintain a trading journal and review setups

🎓 Pro Tips to Master Advanced Option Trading

✅ Understand the Greeks — especially Theta & Vega

✅ Use multi-leg strategies to reduce risk and cost

✅ Follow IV Rank — don’t buy expensive options

✅ Use high reward-to-risk setups

✅ Track OI build-up and option chain flow

✅ Avoid gambling — options are tools, not lottery tickets

✅ Always use hedged positions, especially when selling options

🧘 Final Words: Become the Strategist, Not the Speculator

Advanced Option Trading is not about guessing where the market will go — it’s about constructing trades that win in multiple scenarios.

It empowers you to:

Manage risk like a professional

Generate regular income from time decay

Adjust and defend trades when things go wrong

Trade with confidence, not emotion

If you’re ready to move beyond basic buying and start mastering the real edge in options, advanced strategies are your next level. This is how institutions trade. This is how real consistency is built.

Learn Institutional Trading Part-7🎯 What is Institutional Trading?

Institutional trading is the process by which large entities — such as investment banks, hedge funds, mutual funds, and proprietary trading firms — participate in the market using large volumes of capital. These institutions don’t follow the strategies used by most retail traders. Instead, they use techniques that are based on market structure, liquidity, and logic, not indicators or news.

When you master institutional trading, you learn how to think like the smart money. You understand why price moves, not just how. This knowledge allows you to anticipate large moves instead of reacting to them late.

🔍 Key Concepts to Master

✅ Market Structure Phases

Institutions move through four major phases:

Accumulation – Quiet buying or selling in a range

Manipulation – False moves to trap retail traders

Expansion – Sharp move in the real direction

Distribution – Profit-taking while the crowd enters late

Understanding these phases helps you spot entries early and avoid fakeouts.

✅ Liquidity & Stop Hunts

Institutions need liquidity to enter large positions. They often drive price toward zones full of stop-losses or breakout traders, then reverse the market. These areas are called liquidity pools.

Retail traders get stopped out — smart traders enter after the trap, with the institutions.

✅ Order Blocks & Imbalances

Institutions often leave footprints through large unbalanced candles or zones (called order blocks and fair value gaps). These areas act as magnets for future price moves. Mastering these zones gives you high-accuracy entries with solid risk-reward.

💼 Why It Works

Retail traders lose because they follow emotion and indicators. Institutional traders win because they:

Wait for precision setups

Manage risk with discipline

Trade based on logic, structure, and liquidity

Don’t chase trades — they let the market come to them

When you master institutional trading, you adopt this same mindset. You become patient, calculated, and consistent

Learn Institutional Trading Part-4📌 What is Institutional Trading?

Institutional trading refers to the strategies, mindset, and techniques used by large financial institutions when they participate in the markets. These entities trade with huge volumes and require liquidity, accuracy, and control in their execution.

Unlike retail traders who might buy or sell a few lots or shares, institutions often enter with millions of dollars at a time. If they enter the market carelessly, they would move the price against themselves. Hence, they use highly calculated and strategic methods to enter and exit positions without creating obvious footprints.

These strategies are often referred to as Smart Money Concepts (SMC) — techniques that revolve around price manipulation, liquidity traps, and understanding market structure.

🎯 Why Do You Need to Learn Institutional Trading?

Most retail traders lose because:

They chase price.

They follow lagging indicators.

They get trapped in fake breakouts.

They trade based on emotions, not logic.

Institutional trading flips that mindset. You learn to:

Trade with the big players, not against them.

Identify where the real buying and selling is happening.

Understand why price reverses suddenly — often after retail entries.

Predict market moves based on logic and liquidity, not noise.

By learning how institutions think and act, you become a more disciplined, data-driven trader with higher probability setups and better risk management.

🧠 Core Concepts of Institutional Trading

Let’s dive into the most important concepts every institutional trader must understand:

1. Market Structure

Institutions operate within clear phases of market movement:

Accumulation: Smart money quietly builds positions in a range.

Manipulation: They fake breakouts or induce retail traders to create liquidity.

Expansion: The actual move begins in the intended direction.

Distribution: They offload their positions to late traders before reversing.

If you can identify these phases, you’ll always know where you are in the market — and what’s likely to come next.

2. Liquidity Pools

Liquidity is the fuel institutions need to place trades. They don’t use limit orders like retail traders. Instead, they seek zones with large clusters of stop-losses, pending orders, and breakout trades to enter and exit positions.

These zones are:

Swing highs and lows

Trendline breaks

Support/resistance levels

Retail breakout levels

You’ll often see the market spike into these areas and reverse — that’s not a coincidence. That’s institutional activity.

3. Order Blocks

An order block is a candle (usually bearish or bullish) where institutions placed large orders before a major market move. These zones often act as future supply and demand levels, where price returns to fill orders again.

Order blocks help you:

Identify powerful entry points.

Predict reversals or continuations.

Understand institutional footprints on the chart.

4. Fair Value Gaps (FVG)

A Fair Value Gap is a price imbalance between buyers and sellers — often created when institutions enter with speed and aggression. The market typically returns to fill this gap before continuing the trend.

FVGs are great for:

Entry confirmations

Predicting retracements

Identifying imbalance zones where price is “unfair”

6. Inducement & Mitigation

Inducement: Institutions create fake signals to trick retail traders into entering, generating the liquidity they need.

Mitigation: Institutions revisit previous zones to close old trades or rebalance positions — often creating hidden entries.

These tactics show how institutions intentionally manipulate price to maximize their position efficiency.

📊 Tools Institutional Traders Use

While many retail traders rely heavily on indicators like RSI, MACD, or Bollinger Bands, institutional traders focus more on:

Price action

Volume analysis

Open interest in options/futures

Liquidity maps

Time-based market behavior (sessions: London, NY, Asia)

Their edge comes from understanding what the market is doing, not what an indicator is telling them.

🧱 Institutional Risk Management

Institutions don’t gamble. Every trade is backed by:

Precise entry, stop-loss, and take-profit levels

Predefined risk percentages

Diversification and hedging

Capital allocation rules

They don’t revenge trade. They don’t overtrade. They focus on high-probability setups with calculated risk.

Retail traders can learn from this by:

Sticking to a trading plan

Managing emotions

Risking only a small % of their capital

Focusing on quality over quantity

📈 Institutional Trading in Action (Example)

Let’s say the market has been ranging for 3 days. Suddenly, price spikes up through a resistance level — a breakout! Retail traders jump in long.

But then, within minutes, price reverses sharply downward. Stop-losses are hit. Panic sets in.

What happened?

Institutions induced a breakout, used retail stop-losses as liquidity, filled their short positions, and now the real move — downward expansion — begins.

Understanding this flow helps you trade with the move, not against it.

👨🏫 Who Should Learn Institutional Trading?

This approach is ideal for:

Day traders looking for accurate short-term moves

Swing traders seeking strong trend setups

Options traders who want to align positions with institutional flow

Forex and crypto traders who want to stop chasing signals and start following structure

🚀 Benefits of Learning Institutional Trading

✅ Higher accuracy entries

✅ Better reward-to-risk ratios

✅ Less emotional trading

✅ Deeper understanding of price movement

✅ Freedom from lagging indicators

✅ Long-term trading consistency

🎓 Final Thoughts: Become the Hunter, Not the Hunted

Retail traders are often the prey in a game designed by institutions. But by learning institutional trading, you flip the script. You become the hunter — identifying setups, planning moves, and acting with precision.

Institutional trading is not about being right every time — it's about being strategic, calculated, and aligned with the flow of money

AI & Algo-Based Automated Trading🤖 What Is Algorithmic Trading?

Algorithmic Trading, or simply Algo Trading, is when computer programs automatically place buy/sell orders based on pre-defined rules, without human intervention.

Imagine giving your laptop a checklist like:

“If Nifty goes above 22,500 AND RSI is above 60 AND volume is high, then BUY.”

The computer will monitor the market 24x7—and the moment this condition is met, it will execute the trade automatically in milliseconds.

This kind of rule-based, automated trading using programs is Algo Trading.

🧠 What Is AI in Trading?

AI-based trading goes a step further.

Unlike basic algos that follow fixed rules, AI can learn, adapt, and improve with experience—just like humans.

Using technologies like:

Machine Learning (ML)

Natural Language Processing (NLP)

Neural Networks

Predictive Analytics