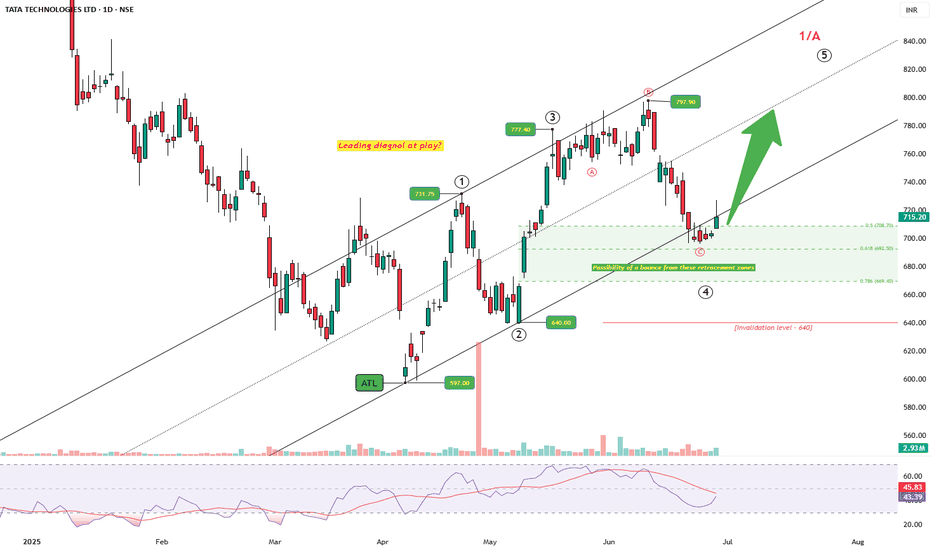

TATA TECH: Messy But Intentional — Diagonal at Work?After tagging the all-time low at 597, price started a steady climb. The structure unfolding looks like a potential leading diagonal, not a typical impulsive sprint. Wave 1 pushes up to 731.75, followed by a sharp drop to 640 — a classic deep Wave 2, but still holding above the origin. From there, Wave 3 stretches to 777.4, slightly longer than Wave 1, keeping things in check.

Then comes the messy drop — choppy, overlapping, three-legged, as Wave 4 of a diagonal. It lands right into the golden retracement zone, finding support between 0.5 and 0.786.

Now the price is bouncing back and is above 715, nudging towards the upper channel. If it sustains, Wave 5 could unfold next, aiming to breach the 797 high. But — and this is crucial — if price falls below 640, this structure breaks down. That would kill the diagonal count and force a rework.

RSI is curling up from oversold, hinting at renewed strength. Price, structure, and momentum — all are beginning to align. Let's see how the price strcuture unfolds in the coming week.

Tatatechnology

Engineering a better worldTata Tech - CMP 750

Incorporated in 1994, Tata Technologies Limited is a global engineering services company offering Product Development and Digital Solutions.

This is just to boost my confidence. No Suggestions for buying.

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial advisor before making any decisions.

Tata Technology cmp 874.30 Weekly Chart : Avoid A Falling KnifeTata Technologies cmp 874.30 by Weekly Chart view since listed

- Volumes seen steadily falling over past few days

- Stock Price well below the Falling Resistance Trendline

- Stock Price showing weakness under Falling Resistance Trendline

- Decent Support at 1000 broken down by continued selling pressure

- Stock hit All Time Low 869.80 today to closed just a tad bit higher

- CONSIDER Consciously to Catch a Falling Knife, NO matter having good fundamentals

TATATECH - Inverse H&S Pattern BreakoutTATATECH - Inverse H&S Pattern Breakout

The chart displays a classic Inverse Head and Shoulders pattern, which is often viewed as a signal of a potential upward trend reversal. This means that after a period of price decline, the stock might be gearing up for a move higher.

The left shoulder, head, and right shoulder are clearly visible, and the price appears to be moving above the neckline, indicating the possibility of a breakout.

Volume Increase:

There's a noticeable rise in trading volume on the right side of the chart, which signals growing interest. A strong volume during a breakout is usually a good sign that the price move has solid backing and could be sustained.

Breakout Momentum:

The stock has already started to break above the neckline, with prices moving upward, suggesting that the momentum is in favor of further gains.

Short-Term Trading Levels:

Here’s how you could approach this setup, considering entry, profit targets, and stop-loss points.

Entry Point:

Since the stock has already broken out from the neckline, it might be a good idea to enter near the current price of around ₹1,114, assuming the breakout continues.

Target Levels:

First Target (T1): ₹1,180 – This is the first potential resistance level where the price might encounter selling pressure, based on previous price behavior.

Second Target (T2): ₹1,224 – The second level to aim for, where the price has previously stabilized or paused.

Third Target (T3): ₹1,270 - ₹1,280 – The final short-term target, close to previous highs on the chart.

Stop-Loss:

To limit potential losses, a stop-loss can be set just under the neckline, around ₹1,060. This level gives some buffer for price fluctuations while protecting from a failed breakout.

Summary:

Entry Point: Around ₹1,114

Targets: ₹1,180, ₹1,224, ₹1,270-₹1,280

Stop-Loss: ₹1,060

Keep an eye on volume and price movement. If the volume stays strong, the breakout is more likely to continue, increasing the chances of hitting the target levels. However, if the price drops back below the neckline, the breakout could be false, and the setup may become invalid.

TATA TECHNOLOGIES LTD FALLING WEDGE BREAKOUTTata Technologies Limited

It has shown Termendous breakout with

3 weekly higher high closing candles which will lead to two big green candles in short term-

for a target of 1400.

Then it will consolidate before starting next leg of run-

For target second that is of 1830.

TATA TECH - Potential Multi-baggerPrice Analysis & Overview:

1. Good volumes

2. RRR is favourable

3. Structure reversal

4. Looks the stock is bottomed out now.

Trade Plan:

Entry - CMP (I have entered today around 1051)

SL - 5-7%

TP- 1:3,1:4,1:5

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Views are personal. I share whatever I do. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

Tata Technology Volume Spike A significantly large volume spike has been seen recently with a break of trend line a good price to enter would be above 1060 with Stop loss of last Low around 930 taget for longterm would be ath and swing can be 1:2.

Note: always enter the trade with predefined stop loss that too calculated ,not risking more than 10% of the capital.

Kudos

Trading setup for Tata Technology1. Lower Tops and Lower Bottoms: This pattern suggests that the stock was in a downtrend after its initial listing, with each high being lower than the previous high and each low being lower than the previous low.

2. Consolidation: Since July 2024, the stock has been consolidating at lower levels. This typically indicates a period of stabilization where the price is moving within a range, suggesting accumulation by investors. During this phase, the stock might not be making significant gains but is building a base.

3. Breakout: The stock has recently broken above the downtrend line with high volume. This breakout from a downtrend line, especially when accompanied by high volume, is often seen as a bullish signal. It suggests that buying interest is strong and the stock may be poised for an upward move.

4. Bullish Implications: The combination of consolidation at lower levels and a breakout with high volume can be interpreted as a positive signal. It indicates that the selling pressure has subsided and there could be potential for further gains if the bullish momentum continues.

Trade Setup:

Buy Entry: Consider buying the stock if it trades above ₹1040.

Stop-Loss (SL): Set your stop-loss at ₹980 to manage risk.

Target: The target is open-ended, meaning you expect the price to rise significantly, but you will need to monitor for potential exit points based on further analysis or changes in market conditions.

It’s always wise to stay updated with any fundamental changes or news that could impact the stock and adjust your strategy accordingly. Good luck with your trade!

***Disclaimer : This is my personal view, please trade after consultation with your financial advisor. I am neither a SEBI Register RA or RIA.

Regards

Arvind Kumar Yadav, Cfa

Arvind Share Academy

Tata Technologies Ltd - Breakout OpportunityDate : 21-Aug-2024

LTP : Rs. 1,025.45

Next Resistances: (1) Rs. 1,073 --> (2) Rs. 1,115 --> (3) Rs. 1,147 --> (4) Rs. 1,179

SL : Rs. 970 on daily close basis

Technical View:

• NSE:TATATECH is going through down trend since it's listing in Nov-2023.

• After touching the high of 1,400 on listing day, NSE:TATATECH has retraced 31% to 970.10 level.

• On 21-Aug-2024, NSE:TATATECH has broke out from it's 9 month old down trend with higher than average volume.

• NSE:TATATECH is trading above 20 DMA and 50 DMA. On 16-Aug-2024 it has closed above 20 DMA and on 21-Aug-2024 it has closed above 50 DMA.

• RSI is already in buy zone and trading at 64.

• MACD has already crossed over it's signal line and about to cross 0 line.

• Looking good to start an uptrend from here onwards.

Like the analysis? Boost/Like this idea and follow my ID.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. My ideas are published for learning purpose only and are available to everyone at no cost/charge.

BLOCKBUSTER IPO AT ITS SUPPORT LEVELTata came back to IPO market with an this company in 2023 in almost 2 decades. Issued at price of Rs. 500, listed at 1200 but finally it has cooled and can be added from investment perspective for long term. NSE:TATATECH around 1000 with breakout possible in few weeks looks exciting with very small stop loss of 5%.

It’s just the beginning…. Read it…So now TATATECH has started to bounce back…

From the volume chart you can see volumes have been decreasing with smaller red candles and last day it bounced back with a green candle and more volume than earlier.

From here it will go to 1400 in upcoming days and maybe spend a day or two around it.

And once it goes above 1400 it will go to 1800-1900 for now, and if market wants to make it overvalued it may go 2400 or above.

I’ll keep you guys updated as stock moves.

One can check my past posts as well. Please follow me and like my posts if you like it. It will motivate me to bring up more unbiased updates for you guys.

ADORWELDVolatility Contraction Pattern is popularized by Mark Minervini, who is a two times US Investing Champion. Last year he won the championship with a record-beating 300+% in the year. He primarily uses VCP for his trading setups. It is a twist on the ascending triangle pattern with some variation.

It has the following characteristics:

The Stock must be in stage 2 uptrend.

A period of price consolidation must take place in thebase.

Price consolidation occurs after a stock has moved up in the price, the consolidation (or correction) is a constructive chart pattern that allows the stock to digest the bullish price movement.

Price volatility must contract through the base (from left to right).

During this period of price consolidation the stock price will correct.

Price must correct through a series of smaller contractions.

Each contraction should be tighter than the last, representing the absorption of more weak holders. Ideally this pattern has between2-4 contractions.