Gold Pullback Into Structure Support – Trend Continuation SetupGold has pulled back into a rising structure support zone after completing a strong upside move. Price is now retesting the trendline while holding above previous higher lows.

This type of setup is important because strong trends usually offer pullbacks before continuation. As long as price holds above the 4932 invalidation level, the bullish structure remains intact.

The buy zone around 4960–4980 aligns with trendline support and previous reaction area. If buyers defend this level, upside targets toward 5003, 5022 and 5045 come into play, with 5075 acting as the next major resistance.

There is no need to chase.

Either support holds and continuation happens,

or structure breaks and the setup is invalid.

Clear structure. Defined risk. Let price confirm.

⚠️ Disclaimer: This analysis is for educational purposes only. Trading involves risk. Always manage your position size and follow your own risk management rules.

Technical Analysis

#BANKNIFTY PE & CE Levels(16/02/2026)Bank Nifty is expected to open with a gap down around the 60100–60050 zone, indicating early weakness compared to the previous close. Price has already shown selling pressure in the last session and is now approaching a key intraday support area. The opening reaction near 60050 will be very important to decide the next directional move.

On the upside, 60050–60100 is acting as an immediate support band. If price sustains above 60050 and forms strong bullish candles on the 15-minute timeframe, a recovery trade can be considered by buying CE around 60050–60100 with upside targets at 60250, 60350, and 60450+. A strong breakout and hold above 60450 can further extend the rally toward 60550 and higher levels.

On the downside, if price fails to hold 60000 and breaks below 59950, fresh selling pressure may trigger. In that case, PE can be considered below 59950 with targets at 59750, 59650, and 59550. A sustained move below 59550 would confirm deeper intraday weakness.

Overall, with a gap down opening near support, avoid chasing trades in the middle range. Either wait for a confirmed bounce above 60050 or a clean breakdown below 59950. Maintain strict stop loss and trail profits according to momentum.

#NIFTY Intraday Support and Resistance Levels - 16/02/2026Nifty is expected to open with a gap down around the 25470–25450 zone, indicating initial bearish sentiment compared to the previous close. Price is currently trading below the immediate resistance zone of 25550 and has shown consistent selling pressure in the last session. The early reaction near 25450 will be crucial to determine whether this gap down extends further or results in a bounce.

On the upside, 25550 is acting as an important resistance level. If price reclaims 25550 with strong bullish momentum and sustains above it on the 15-minute timeframe, a long position can be considered above 25550 with targets at 25650, 25700, and 25750+. A clean breakout above 25750 may further push the index toward 25800 and higher levels. However, unless 25550 is decisively broken and sustained, upside moves should be treated as pullback rallies.

On the downside, if price breaks and sustains below 25450, fresh selling pressure may accelerate. Short positions can be considered below 25450 with targets at 25350, 25300, and 25250. If 25250 is breached with strong momentum, the next support zone near 25200–25180 could come into play. Traders should watch for strong bearish candles or breakdown retests for confirmation rather than entering on the first spike.

Overall, with a gap down opening and price trading below key resistance, the bias remains slightly bearish unless 25550 is reclaimed. Avoid trading in the consolidation zone between 25450 and 25550. Wait for a clear breakout or breakdown, maintain strict stop loss, and trail profits as per momentum to manage risk effectively.

NIFTY Rejection Zone at 25515–25535 – Sell on Rise SetupNifty is showing clear bearish intent, and price action suggests that 25515–25535 is emerging as a strong supply zone. This area has previously attracted selling pressure, and we expect sellers to defend it aggressively again.

As long as NIFTY trades below this resistance band, momentum favors the downside.

📌 Trade Plan:

Strategy: Sell on Rise

Resistance Zone: 25515 – 25535

Targets:

🎯 25450

🎯 25410

🎯 Extended target below 25400

Bias: Bearish below 25535

If price fails to sustain above the resistance zone, sellers could push the index back toward 25400 levels and potentially lower.

⚠️ Watch for rejection candles / lower high formation near resistance for better confirmation.

📌 Disclaimer

This analysis is strictly for educational purposes and not financial advice. Please consult your financial advisor and follow your own trading plan before taking any trades.

If you find this idea useful, hit the like button and share your views—your feedback helps us create better trading insights for the community.

🚀 Trade smart. Trade disciplined.

Happy Trading,

– The InvestPro Team

#NIFTY Intraday Support and Resistance Levels - 17/02/2026Nifty is expected to open flat around the 25680–25700 zone, indicating a neutral start near immediate resistance. Price has shown a strong recovery from lower levels and is now approaching the 25700–25710 resistance band, which will act as a key decision zone in the early session. Since the market is opening flat near resistance, the first 15–30 minutes will be crucial to confirm direction.

On the upside, if Nifty sustains above 25750 with strong bullish momentum and a solid 15-minute candle close, fresh long positions can be considered. A breakout above 25750 can trigger momentum toward 25850, 25900, and 25950+. Holding above 25750 will indicate strength and continuation of the current recovery structure.

On the downside, if the index fails to sustain above 25700 and breaks below 25700 with strong selling pressure, short positions can be considered. A breakdown below 25700 may lead to targets around 25600, 25550, and 25500. Further weakness below 25500 can extend the fall toward the next support zone near 25450–25400.

Overall, with a flat opening near resistance, avoid entering in the narrow range between 25680 and 25750. Wait for a clear breakout or breakdown confirmation, maintain strict stop loss, and trail profits properly as momentum builds.

Astral Chart Breakout – Bullish SetupAstral has delivered a solid breakout above 1590, with price sustaining above this key level. The breakout candle confirms strength, signaling strong momentum and opening the door for a potential rally.

📊 Technical Outlook

Breakout Zone (Support): 1590

Immediate Targets: 1700 → 1860

Trend: Bullish continuation as long as price holds above 1590

🔑 Key Notes

Watch for volume confirmation to validate breakout strength.

Consider a stop-loss below 1590 or the breakout candle’s low for risk management.

Sustained momentum could push price toward the higher resistance zone near 1860.

XAUUSD (Gold) | BEST TRADING SETUP | 13th Feb'2026Gold is trading near 4957 with short-term bearish pressure, while the higher timeframe trend remains bullish.

Lower timeframes show selling momentum, indicating a possible correction. However, the overall structure on Daily & Weekly charts still supports buying on dips.

Key Levels

Resistance: 4975 | 5000–5015

Support: 4930 | 4917 | 4889

Scenarios

🔼 Bullish: Break & sustain above 5000 → 5035+

🔻 Bearish: Breakdown below 4930 → 4917 → 4889

Volatility remains high — trade with proper risk management.

⚠️ Disclaimer:

This analysis is for educational purposes only and not financial advice. Trading in Forex/Commodities involves high risk. Please consult your financial advisor before taking any trade.

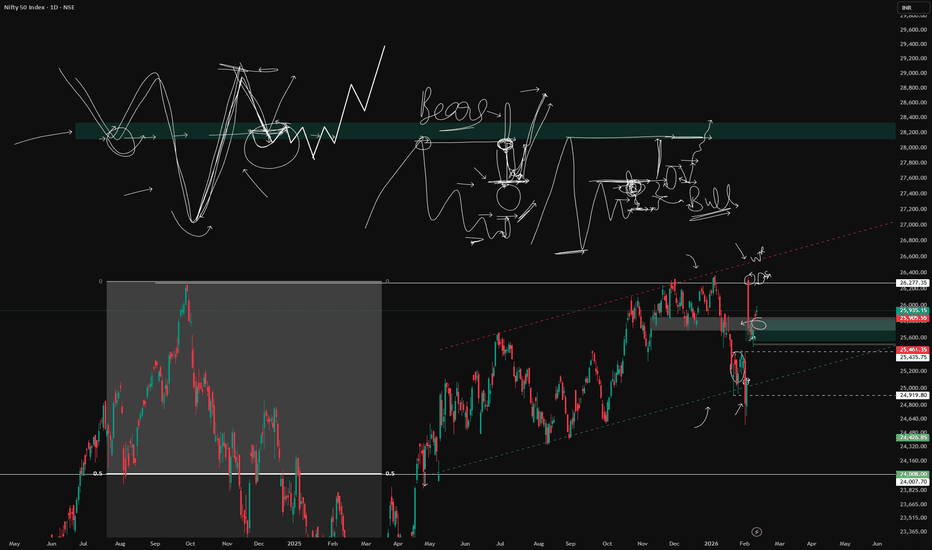

NIFTY 50 – 2H TF ANALYSIS FOR 10.02.26NIFTY currently trading around the 0.7 Fibonacci retracement (~25,838) which is acting as an immediate decision level.

📊 Market Structure:

• Overall structure still corrective (range bound after displacement)

• Sharp rejection candle near highs = possible distribution wick

• Price approaching higher timeframe supply

🧠 Key Levels:

🔼 Strong Supply Zone: 25,993 – 26,173

If price reaches this zone → look for bearish confirmation

🔽 Support Levels:

25,838 – Intraday decision level

25,477 – Major support (0.5 level)

24,573 – Swing low (liquidity pool)

📍 Trading Plan:

Bullish above 25,838 with continuation towards supply zone 25993-26173

Bearish only after rejection inside supply zone

Wait for confirmation (BOS / CHoCH / liquidity grab) — no blind entries.

Note: I am not a SEBI registered research analyst. Hence, this post is for Educational Purpose only.

Regards

Bull Man

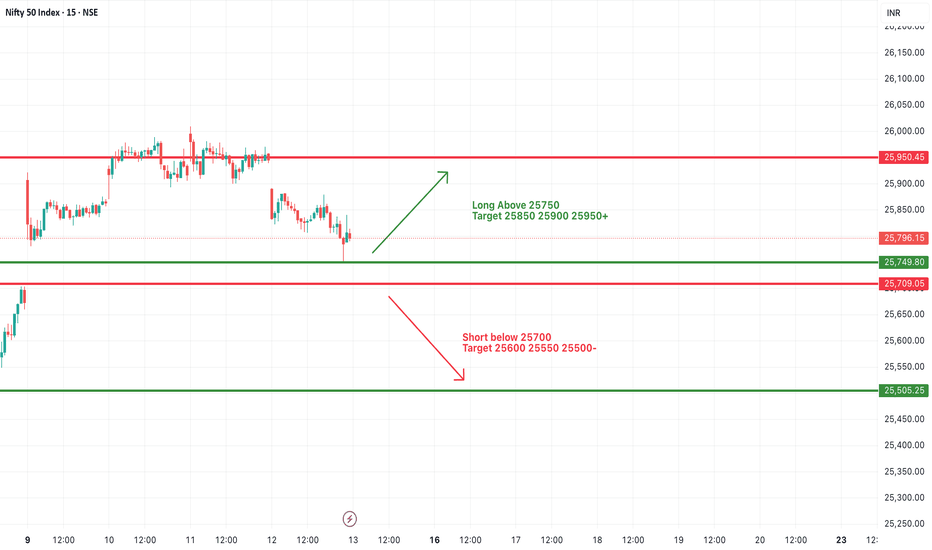

#NIFTY Intraday Support and Resistance Levels - 13/02/2026Nifty is expected to open with a gap down today around the 25780–25800 zone, indicating early weakness compared to yesterday’s close. Price is currently hovering just above the immediate support near 25750, which makes this level very crucial for the opening session. The first 15–30 minutes will decide whether we see continuation selling or a quick recovery move.

On the upside, 25750–25800 is acting as a short-term pivot zone. If price sustains above 25750 and shows strength with strong bullish candles, a long position can be considered above 25750 with targets around 25850, 25900, and 25950+. A proper breakout and hold above 25950 can further extend the rally toward 26000 levels.

On the downside, if price breaks and sustains below 25700, selling pressure may increase sharply. In that case, short positions can be planned below 25700 with targets near 25600, 25550, and 25500. A strong breakdown below 25500 would confirm deeper intraday weakness.

Overall, with a gap down opening near support, avoid aggressive trades in the middle range. Either wait for a confirmed bounce above 25750 or a clear breakdown below 25700. Maintain strict stop loss and trail profits as per momentum.

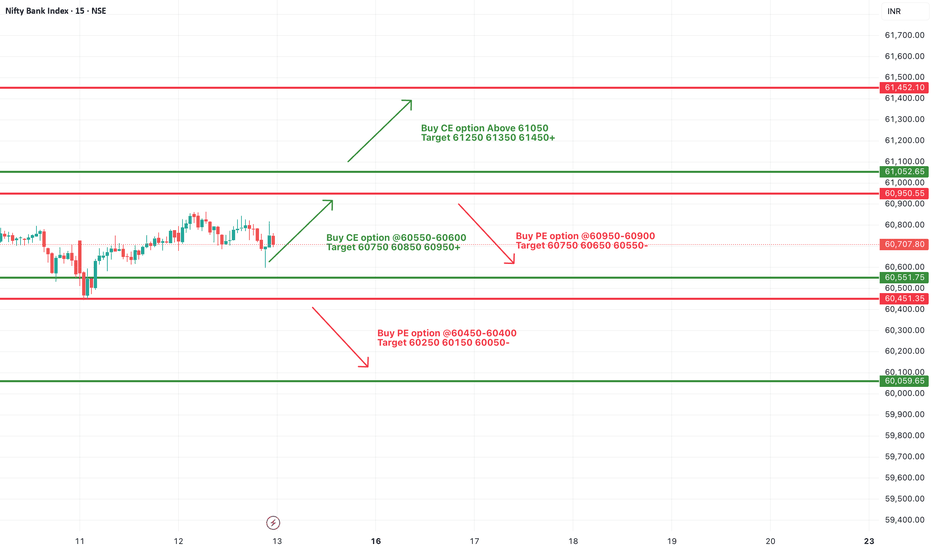

#BANKNIFTY PE & CE Levels(13/02/2026)Bank Nifty is expected to open with a slight gap down today around the 60700–60750 zone, indicating mild early weakness compared to yesterday’s close. Price is currently trading near an important intraday support area around 60550. The overall structure suggests that the market is opening near a decision zone, where either a bounce or further downside continuation can develop depending on the first 15–30 minutes’ price action.

On the upside, 61050 remains a strong resistance level. A sustained move and 15-minute candle close above 61050 can trigger bullish momentum, where CE options may perform well with targets around 61250, 61350, and 61450+. However, considering the gap down opening, traders should wait for confirmation instead of immediately chasing longs near resistance.

On the downside, if price breaks below 60550 and sustains, selling pressure can intensify. In that case, PE positions can be considered around 60450–60400 with targets near 60250, 60150, and 60050. A clean breakdown below 60050 would further weaken the intraday trend and may open the door for extended downside.

Overall, with a gap down opening near support, the first hour will be crucial. Either we may see a quick recovery toward 60950–61050 (gap filling attempt) or continuation selling below 60550. Avoid trading in the middle zone and focus only on breakout or breakdown levels with proper stop loss and trailing management.

What is Short Selling? – The Beginner’s GuideShort selling is the practice of selling securities that an investor does not currently own. The investor sells them with the expectation that the price will decline. Later, the investor buys them back at a lower price to earn a profit.

In simple words, short selling means selling a borrowed instrument and buying it back later at a lower price. If the price rises instead of falling, the short seller incurs a loss. This process is also known as shorting.

I am trying to explain the basic concept and its features.

SEBI allows retailers, domestic mutual funds, and institutional investors to short sell. However, banks and insurance companies are not permitted to participate.

Key Features of Short Selling in Indian Market

Short selling allows traders to sell a stock they do not own, with the expectation of buying it back at a lower price. Below are the key features in the Indian market:

• All types of investors can participate in short selling

• Investors can earn a fee by lending shares to short sellers

• It helps provide liquidity to the market

• Assists in correcting overvalued stock prices

• Promoters may misuse it for price manipulation (risk factor)

• Investors must disclose borrowing arrangements before placing the order

📈 Benefits of Short Selling

Short selling provides opportunities for both traders and market efficiency.

1️⃣ Allows traders to profit during falling markets

2️⃣ Investors earn from price declines

3️⃣ Requires comparatively lower capital (especially in derivatives)

4️⃣ Simple execution process in F&O segment

5️⃣ Unlike the cash market, you can sell without owning (via futures). Sometimes futures trade at a premium to spot price

🎯 Why You Should Short Sell

There are mainly two core reasons:

1️⃣ Trading & Profit Opportunities

Short selling enables traders to profit in bearish market conditions.

2️⃣ Hedging

Used to protect long-term investments.

Investors offset the risk of long positions by taking short positions in related instruments.

🔄 Types of Short Selling (India)

There are two primary types:

• Covered Short Selling

Shares are borrowed before selling. Delivery can be arranged properly.

• Naked Short Selling

Shares are sold without arranging borrow in advance.

This is restricted/not preferred due to regulatory risks and lack of documentary proof.

👥 Types of Short Sellers

Certain categories of market participants prefer short selling:

• Hedgers – Use short positions to reduce risk on long holdings

• Speculators – Trade purely for directional profit

• Day Traders – Actively short based on intraday setups

Major short activity is usually done by hedgers and speculators.

⚠️ Risks of Short Selling

Every financial instrument carries risk. Short selling has unique risks:

• Unlimited loss potential if price rises sharply

• Short squeeze can push prices higher instead of lower

• Going against the trend can be dangerous

• Timing is critical – short sellers must act quickly

• Unlike long investors, waiting indefinitely is not an option

🏁 Conclusion

Short selling is not an “easy money” strategy.

It is closer to speculation than traditional investing.

While profit potential exists in falling markets, losses can also be significant.

Success requires:

✔ Proper risk management

✔ Clear entry and exit plans

✔ Understanding of market structure

✔ Discipline

Trade wisely. Risk smartly.

XAUUSD (Gold) | BULL VS BEAR SETUP | 12th Feb'2026Gold maintains a strong uptrend with moving averages aligned upward and momentum indicators supporting buying pressure. The current dip appears corrective unless price breaks below key support.

Key Levels

* Resistance: 5092 – 5100 – 5119

* Support: 5050 – 5032

Trade Plan

* Buy near 5050–5055 → TP: 5085 / 5100 | SL: Below 5035

* Breakout buy above 5092 → TP: 5110+ | SL: 5075

Bearish Only If

* Sell below 5025 → TP: 5005 / 4975

* Bias: Buy on dips unless 5030 breaks.

⚠ Use proper risk management.

#NIFTY Intraday Support and Resistance Levels - 12/02/2026Nifty is expected to open flat today, with price trading near 25945–25950 and no major gap compared to yesterday’s close. The structure clearly shows consolidation just below the psychological 26000 level. The market is currently moving in a tight range, indicating indecision and reduced volatility in the opening phase.

The immediate resistance is placed around 26000–26050, with a major resistance zone near 26250. A strong breakout and sustained move above 26000 can trigger fresh bullish momentum. If Nifty gives a clean 15-minute candle close above 26000, long positions can be considered for targets around 26150, 26200, and 26250+. However, traders should wait for proper confirmation because false breakouts are common in flat openings.

On the downside, 25900 is acting as an important intraday support. If price breaks and sustains below 25900, selling pressure may increase. In that case, short positions can be considered for targets around 25850, 25800, and 25750. A breakdown below 25750 would further weaken the intraday structure and may extend the fall toward the 25650 zone.

Overall, with a flat opening and clear consolidation zone between 25900 and 26000, the market is likely to remain range-bound initially. Traders should focus on breakout levels instead of entering trades in the middle of the range. Proper stop loss and trailing strategy will be important until the index gives a decisive directional move.

#BANKNIFTY PE & CE Levels(12/02/2026)Bank Nifty is expected to open flat today, with no major changes compared to yesterday’s closing levels. The overall structure remains range-bound, and price is still trading between clearly defined support and resistance zones. Since there is no significant gap up or gap down, the market is likely to respect the same key levels during the initial session, and traders should focus on reaction around these zones rather than expecting immediate breakout momentum.

On the upside, the immediate resistance zone remains around 60950–61050. A strong move and sustained trading above 61050 can trigger fresh bullish momentum. In that case, CE buying can be considered with upside targets around 61250, 61350, and 61450+. However, confirmation is important. A simple spike above resistance without follow-through should be avoided, and traders should wait for a 15-minute candle close above the breakout level before entering aggressive long positions.

In the middle range, 60550–60600 continues to act as an important intraday pivot zone. As long as price sustains above this level, the bias remains slightly positive and dips may get bought. CE buying near this zone can offer targets towards 60750, 60850, and 60950+. This area is likely to act as decision-making support during the first half of the session.

On the downside, if Bank Nifty fails to hold 60550 and breaks below 60450–60400 with strong selling pressure, PE buying can be considered for targets around 60250, 60150, and 60050. A clean breakdown below 60050 would further weaken the structure and may lead to extended downside movement.

Overall, with a flat opening and no major structural change, the market is expected to remain level-based and reactive. Traders should avoid overtrading in the opening minutes and wait for confirmation near key support and resistance. Proper risk management and trailing stop loss will be important, especially if the index continues to consolidate within the current range before giving a decisive move.

Gold Squeezing Into Resistance – Breakout Loading?Gold is currently compressing between a rising short-term channel and a broader resistance trendline. Price is holding structure well, and buyers are gradually pushing higher lows into resistance.

What makes this setup interesting is the tightening range. When price compresses like this, it usually leads to expansion. If buyers manage to break and hold above the upper trendline, the upside continuation zone marked on the chart becomes active.

RSI previously showed bearish pressure, but momentum has stabilized and is now recovering. That shift supports the breakout scenario — as long as structure remains intact.

No need to predict aggressively.

If resistance breaks and holds, continuation is valid.

If price drops back below the structure and the marked risk area, the idea is invalid.

Simple structure. Clear risk. Let price confirm.

⚠️ Disclaimer

This analysis is for educational purposes only. Trading involves risk. Always manage position size and follow your own risk management plan.

Feb 12 Setup: Consolidative, Not ComplacentFeb 12 Setup: Consolidative, Not Complacent

Nifty sits in the upper half of the 25,500–26,300 rectangle. Bulls hold the edge, but conviction is thin. Gift Nifty indicates a flat-to-green open near 25,970–26,000. Expect a narrow early range. US non-farm payrolls tonight is the only catalyst that matters. 🧵

#Nifty

2/ Technical: Breakout or Fakeout?

Price is above key EMAs. RSI at 58–60, neutral-bullish. MACD positive but histogram cooling. The tape is telling you momentum is intact but tired. 26,000–26,050 is the heavy call OI wall. A clean break here triggers short-covering toward 26,200–26,400. Without it, expect rejection.

#TechnicalAnalysis

3/ The Support Structure You Must Respect

Immediate floor: 25,900–25,850, strong put concentration. Below that, 25,800 is the line in the sand. A decisive close below 25,800 opens 25,700–25,500, where the 50-DMA sits. That is the trend-defining zone. Until then, dips are buyable—but scale, don't slam.

#Derivatives

4/ Derivatives: Resistance Is Visible, Fear Is Not

26,000 is the maximum call OI strike. Sellers are entrenched. PCR remains mildly supportive (>1 in spots). IV is compressed—ATM vol at 10–13%. Low vol in a range-bound regime favours option sellers, not buyers. Gamma is low near ATM. A vol spike requires a US data surprise.

#OptionsMarket

5/ Sector Rotation: Follow the Flow

Autos, healthcare, PSU banks, metals—these are the receiving ends of institutional rotation. IT remains under pressure; AI disruption is now a valuation reset, not a narrative. Do not short defensives aggressively, but do not catch falling knives either.

#StockMarketIndia

6/ US Non-Farm Payrolls: The Exogenous Variable

Tonight's US jobs data is the single biggest risk event. Strong print = risk-on, weak print = global sell-off. Indian IT and USD/INR will react first. Position size appropriately. This is not a night for hero trades. Survival trumps speculation.

#USJobs

7/ FII Flows: The Reversal Must Sustain

FIIs bought ₹820 Cr yesterday. A second consecutive day of buying above ₹1,000 Cr validates the reversal. Without it, this is just a short-covering blip in a longer-term selling trend. Watch the dollar and US yields. They lead, FIIs follow.

#FII

8/ My Bias: Range Expansion Favours the Upside

I am not bearish. I am also not bullish. I am range-bound with an upside tilt. 25,800–26,200 is the high-probability zone for Feb 12. A breakout above 26,050 is tradable with a 26,400 target. A breakdown below 25,800 requires immediate defensiveness. Size conservatively pre-data.

#QuantFinance

Breakdown or Breakout – Gold Compression Phase🔎 Market Context

• Gold is compressing within the 5000 – 5080 range

• Accumulation phase after the previous sharp sell-off

• Volatility is contracting → expansion is likely soon

• CPI & Non-Farm Payrolls are key catalysts

➡ Do not predict direction. Wait for a confirmed breakout.

📌 Strategic Zones

Resistance: 5078–5080 | 5100 | 5148 | 5200 | 5300 | 5345

Support: 5000 | 4980 | 4850 | 4830 | 4600 | 4400

• 5078–5080: Upper boundary of the range

• 5000: Lower boundary of the range

• 4980: Market structure decision level

⚖ Trading Bias

• Above 5080 → Favor upside continuation (Wave C extension)

• Below 4980 → Bullish structure breaks → favor downside

• Inside 5000–5080 → Compression phase, avoid FOMO

⚠ Key Notes

• Major data releases may cause false breakouts

• Wait for candle close confirmation

• Volatility likely to increase → manage risk carefully

• Avoid trading mid-range without clear edge

#BANKNIFTY PE & CE Levels(11/02/2026)Bank Nifty is expected to open with a gap-up, indicating positive sentiment at the start of the session. This kind of opening generally brings initial buying interest, but traders should stay alert near the immediate resistance zones as gap-up openings often see early profit booking before a clear direction is established.

On the upside, the 60550–60600 zone is the first crucial support area to hold. Sustaining above this region can trigger fresh long positions, with upside targets placed at 60750, 60850, and 60950+. A stronger bullish continuation will be confirmed only if Bank Nifty moves and sustains above 61050, where positional call buying can aim for higher levels around 61250, 61350, and 61450+.

On the downside, any rejection or failure to hold above 60950–61000 can invite selling pressure. A reversal short setup may emerge near this zone, with downside targets towards 60750, 60650, and 60550. If weakness deepens and the index breaks below 60450–60400, selling momentum could extend further towards 60250, 60150, and 60050, which act as important demand areas.

Overall, despite the gap-up opening, the market may initially remain volatile within defined levels. Traders are advised to wait for price confirmation near key supports and resistances, avoid impulsive entries, and manage risk strictly, as today’s move is likely to be driven by how Bank Nifty behaves around the 60550 and 61050 zones.

Big Vs Small Breakaway Gaps and Old concepts Revision In this video, I have revised all the old concepts I have been sharing taking only 1 thing as my main object which is Nifty, I believe 1 instrument, 1 strategy can change your life but it takes many concepts - combined together to get to that strategy, its simple yet difficult .

No Bias - No forecast only talking about general trends of the markets and concepts

Gold Price Update: Trendline Breakout with Clear Risk DefindGold has broken above the falling trendline, and this move is important not because of one candle, but because of the change in structure. After a prolonged corrective phase, price is now holding above the breakout level, which signals that buyers are starting to step in.

What I like about this setup is the clarity. The breakout is clean, risk is clearly defined below the structure, and price is now trading in an area where continuation becomes more likely if buyers maintain control.

There is no need to chase the move. As long as price holds above the breakout zone, the upside continuation scenario remains valid. If price falls back below the marked risk area, the idea is invalidated. Simple and objective.

This is not about prediction.

It’s about reacting to what price is already showing.

⚠️ Disclaimer

This analysis is for educational purposes only. Markets involve risk. Always manage your position size and trade according to your own risk management rules.

GOLD BULLISH TRIANGLE PATTERN | BULLISH BREAKOUT Gold is currently consolidating within a tight symmetrical triangle following a corrective pullback, indicating a period of compression ahead of a potential expansion move. Price action continues to hold above the key demand zone around 5030, which remains a critical structural support.

Multiple rejections from the upper boundary of the consolidation suggest building bullish pressure. A decisive breakout and sustained acceptance above the 5045–5048 resistance zone would confirm bullish continuation and signal the next leg higher.

On confirmation, upside momentum is expected to target 5055, followed by an extension toward 5065, aligning with projected measured-move objectives from the triangle breakout.

A failure to hold above 5030 would invalidate the bullish bias and expose price to deeper downside correction, negating the current setup.

GOLD before Non-Farm: Sideways or a Trap?🌍 Macro Background

Continuing to monitor U.S. – Iran tensions and whether escalation occurs.

Japan: maintaining a weak JPY → USD remains supported.

A heavy news week ahead:

FED speeches (today)

Labor market data

Inflation data later this week

👉 Market sentiment remains cautious, waiting for a clearer directional catalyst.

📈 Trend & Structure

Overall price structure remains unchanged: Gold is in the final phase of a corrective rebound.

Upside momentum still exists, but limited, while reversal risk is increasing.

Price is consolidating near resistance → sideways conditions are favored.

🔴 Resistance – 🟢 Support

🔴 Resistance: 5,050 – 5,100

🟢 Near support: 4,980 – 4,950

🟢 Additional support: 4,930 – 4,936

🟢 Deeper support: 4,880 – 4,850

📊 Trading Scenarios

✅ Primary scenario (higher probability): Sideways – range trading

Sell reactions around 5,050

Condition: rejection candles / bearish confirmation

Buy technical pullbacks at support zones

Focus on M15 – H1, quick and disciplined trades.

⚠️ Alternative scenario (lower probability): Bullish breakout

Mandatory condition: H1 close clearly above 5,100

Only then consider buying the breakout.

🧠 Risk Management

Avoid holding large positions during:

FED speeches

Labor market & inflation releases

No FOMO — wait for candle confirmation.