GARFIBRESGARWARE TECH FIBRES has formed a Bullish structure, made VCP pattern, volume is also visible.

Now it is at resistance, keep eyes on it as the breakout from here can give a good upside move.

Breaking ATH may boost it more. But definitely wait for the Re-test after the breakout.

📌 Re-test matters. Always!

Today I shared why waiting for a re-test is so important - with a real example.

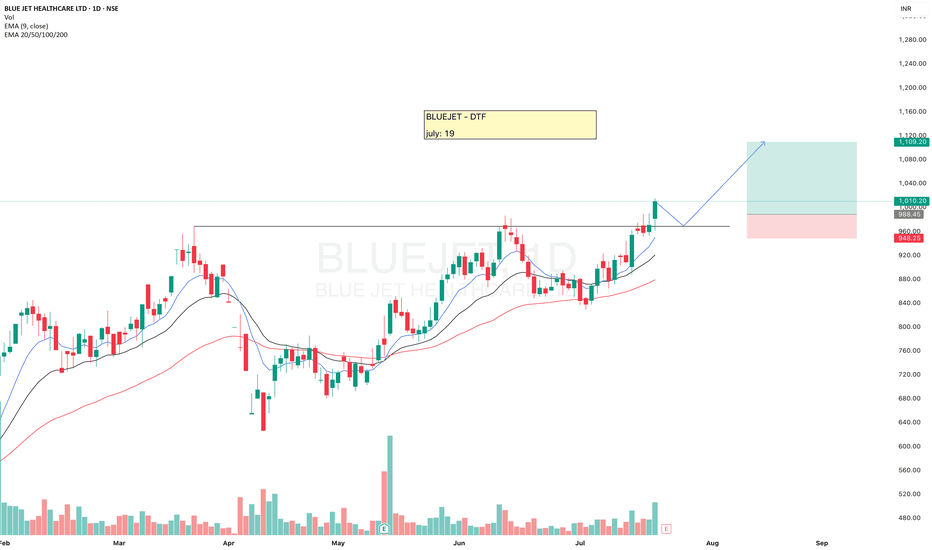

Check out the chart and analysis on BLUEJET in my recent post.

It’ll make you rethink your entries.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Technical Analysis

XAUUSD – The bullish surge isn't over yetGold just delivered an impressive breakout of nearly 500 pips on July 21, fueled by a weakening USD as U.S. housing and manufacturing data showed signs of slowing down. With a bleaker economic outlook and growing expectations that the Fed may cut interest rates in Q4/2025, investors are flocking back to safe-haven assets – and gold is shining bright.

Technically, XAUUSD remains firmly within a clearly defined ascending channel, with price action bouncing sharply off dynamic support. The metal is currently consolidating around the 3,400 zone – if buyers can hold this ground, the door toward 3,440 and beyond could swing wide open.

As long as gold holds above 3,347, bulls remain in full control. This might just be a healthy pullback before the next leg up – don’t miss out as the market gains momentum!

BTCUSDT – Rebounding from Fair Value Zone! Is the Bull Run Back?Bitcoin is building a strong base around the FVG support zone after rejecting the resistance trendline twice in a row. The current price structure is a textbook bullish setup: pullback – retest of liquidity zone – accumulation – and now prepping for a strong breakout.

Fair Value Gaps have been consistently filled and are acting as dynamic support, signaling that buyers are still in full control. RSI remains steady and not overheated – creating perfect conditions for a breakout.

Target: The 125,910 USDT area is the next clear price objective if BTC holds above the 116,082 USDT support zone.

Fundamental Catalyst: The crypto market is regaining strength after BlackRock officially confirmed its plan to expand its crypto ETF products – investor sentiment is back on the bullish side.

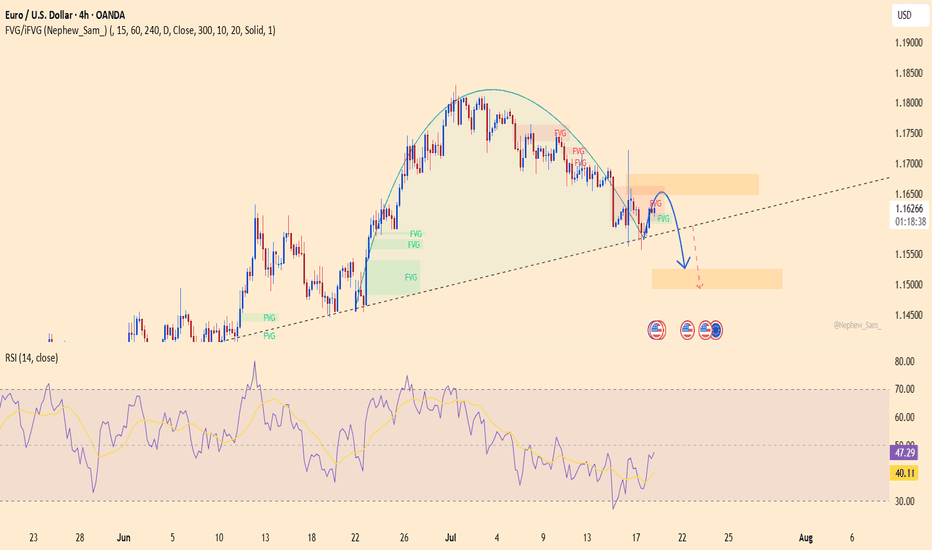

EURUSD – Trend broken, bearish momentum accelerating!EURUSD is maintaining a clear downtrend structure within a well-defined descending channel, with consistently lower highs forming. Fair Value Gaps (FVGs) keep getting rejected, signaling that sellers are firmly in control. The current scenario points to a technical bounce toward the 1.164 zone, followed by a likely rejection back down to the lower boundary near 1.148.

Technical signals confirm the bearish bias as price respects both the trendline and the supply zones, failing to break above recent resistance levels.

On the fundamental side, the ECB has recently struck a more dovish tone due to cooling inflation, while the USD is regaining strength amid expectations that the Fed will keep rates elevated longer — all of which continue to pressure the euro lower.

XAUUSD – Breakout or Continued Accumulation?Gold continues to respect a solid bullish structure within an ascending price channel. After a healthy pullback from recent highs, the price has retested a key technical support area and is showing signs of a strong rebound.

Current price action reveals that the market is respecting both the FVG zone and the rising support line—clear signals that smart money is still leaning toward the buy side. The next bullish targets lie around the upper resistance zone.

From a macro perspective, weaker-than-expected U.S. retail sales have placed downward pressure on the dollar, fueling speculation that the Fed may soon pivot toward easing. This adds momentum to gold’s upside potential.

NIFTY Technical Breakdown – Rising Wedge Pattern🔻 NIFTY Technical Breakdown – Rising Wedge Pattern

The Nifty 50 has broken down from a rising wedge pattern on the daily timeframe, a bearish reversal formation that often signals distribution at the top.

📉 Key Observations:

Rising wedge breakdown after extended rally

RSI bearish divergence confirming weakness

MACD crossover turning negative

Volume gradually decreasing during the rise, indicating exhaustion

ADX flattening, showing weakening trend strength

📌 Support Levels to Watch:

23,783 – Key swing support

22,798 – Previous breakout zone

📌 Sectoral Rotation:

Defensive sectors like Pharma & FMCG are gaining strength

FII selling pressure, rising DXY, and global uncertainty continue to weigh on sentiment

⚠️ Outlook:

Caution warranted in the short term. Watch for sustained close below 24,900 for further downside confirmation. Macro and global cues to play a key role ahead.

💬 What’s your view on Nifty's near-term direction?

#Nifty50 #TechnicalAnalysis #RisingWedge #MarketOutlook #TradingView #ChartStudy #IndiaMarkets #BearishSetup #NiftyBreakdown #Puneet0130

GOLD WEEKLY OUTLOOK | JULY 21–25 GOLD WEEKLY OUTLOOK | JULY 21–25

Get Ready for a New Trading Week 🇮🇳

🔍 Market Recap:

Gold showed a strong bullish reversal late last week after sweeping liquidity around the FVG ZONE near 3310. Price quickly surged toward the OBS SELL ZONE around 335x–336x.

By Friday’s close, however, price reacted sharply to a confluence of technical zones (OBS + FIBO) and settled below the VPOC, hinting at a potential short-term top.

📉 Outlook for July 21–25:

📌 No major economic events are lined up next week.

⚠️ However, geopolitical tensions, global trade policies, and military news could bring sudden volatility.

Stay alert for unexpected liquidity spikes!

🧠 Technical Setup – H1 Mid-Term View:

Gold has been forming multiple Fair Value Gaps (FVGs) due to aggressive bullish moves.

While price has reached new highs, lower FVG zones remain unfilled – creating a strong possibility of a retracement.

🔁 Expected Scenario:

We may see price retrace to the 3310–3305 zone to fill these gaps, then potentially resume bullish movement.

📍 Trading Strategy for the Week:

🔸 Wait for price to enter lower FVG zones

🔸 Look for early BUY signals at key confluence areas such as:

CP zones

Fibonacci retracement levels

Volume/price reaction levels

🎯 Bullish Target Zones:

Primary target remains: 333x – 336x

If momentum continues after the pullback, we could see a move toward the Buy Side Liquidity near 3371.749

✅ Key Reminders for Indian Traders:

🚫 Avoid emotional buying at highs (no FOMO!)

📏 Stick to your TP/SL rules – risk management is critical, especially during uncertain global headlines

📊 Stay focused and trade with a plan

🌟 Wishing you a restful weekend. Come back refreshed and ready to dominate the charts next week!

🚀 Good luck & happy trading

MAHLIFEMAHLIFE looks good.

Small pullback for the Entry will be good. Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

BLUEJETBLUEJET looks strong.

It gave breakout, a small pullback will be good for the Entry as it is bit far away from 20ema, once it touches the 20ema then we may expect a good upside move.

Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

PVRINOXPVRINOX is looking good.

Making VCP pattern, equal highs and HL formation and good volume. Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

EURUSD on the verge – a trap waiting for the carelessThis pair has just completed a classic rounding top, with a sharp rejection near 1.16500. Buying momentum is fading, RSI is dropping, and the recent retest of the broken trendline might have been the final warning – the “kiss of death” could already be in play.

On the fundamental side, the U.S. keeps fueling the dollar: consumer spending is rising, jobless claims are falling, and the Fed shows no sign of easing up. Meanwhile, the ECB is still searching for direction, leaving the euro exposed and vulnerable.

If the current support level breaks, EURUSD could slide quickly to lower zones. This is no longer a time for hope – it’s time to choose a side and act.

XAUUSD: breakout risk is approachingXAUUSD has been consolidating in a tight range since early July. Despite multiple bounces from support, price has failed to deliver a clear breakout, signaling weakening buying pressure. The current structure leans bearish, with momentum turning increasingly negative.

On the news front, the U.S. economy continues to show strong recovery: rising consumer demand, falling unemployment, and surging USD and bond yields. This puts significant pressure on gold – a non-yielding asset in a high-interest environment.

If price breaks below the bottom of the range, the downside could accelerate sharply in the near term. Buyers should remain extremely cautious in this setup.

EURUSD under pressureEURUSD is moving within a well-defined descending channel, forming consistent lower highs and lower lows. The price has recently rejected the resistance zone near 1.16100, showing signs of continued bearish momentum.

On the fundamental side, stronger-than-expected U.S. retail sales—especially in the core figure—have boosted the U.S. dollar, putting downward pressure on the euro. Coupled with ongoing concerns about Eurozone economic growth, the pair is likely to continue its decline toward the 1.15400 support area. RSI remains below the neutral zone, confirming short-term bearish bias.

Traders should watch closely for reactions at support to assess further short opportunities.

Gold wavers under pressure from strong U.S. retail dataXAUUSD is currently fluctuating within a price box, showing weaker bullish attempts and failing to break above the nearest resistance zone. Selling pressure is mounting as price continues to be rejected at the top and is approaching the medium-term ascending trendline — a key support level.

On the news front, U.S. core retail sales surged, boosting expectations for a stronger USD, which in turn weighs on gold prices. However, a slight uptick in unemployment claims may help slow the dollar’s momentum.

If buyers fail to defend this critical support, the bullish structure risks being broken, potentially signaling a shift toward a clearer downtrend. On the flip side, the price box could still act as a consolidation phase before another bullish leg.

XAUUSD – The Bullish Wave Emerges, Target Closer Than Ever!Gold has broken out of its previous descending channel, confirming a trend reversal. Current price action is forming higher lows while consistently filling Fair Value Gaps (FVGs) – a clear sign that institutional money is flowing back in.

The next key target is the previous high near 3,399, where some short-term profit-taking may occur. However, if buyers can defend the support zone around 3,348, the chances of breaking above resistance will increase significantly.

On the news front, the U.S. dollar is weakening as housing and industrial production data show signs of slowing, fueling speculation that the Fed may pause further rate hikes this year.

18/07 Gold Outlook – Final Friday Liquidity Moves Ahead!🟡 Gold Outlook – Final Friday Liquidity Moves Ahead!

Will Gold maintain its bullish pace or face weekend volatility? Stay ahead of the market!Why Gold is Moving – Key Macro Drivers

Gold bounced back sharply after a dip caused by stronger-than-expected US economic data. Here’s what Indian traders need to keep in mind:

📊 Rate cut hopes remain high as US core inflation remains sticky.

💣 Middle East tensions continue, with Israel launching more airstrikes on Syria.

🌐 Trade war risks increase as EU threatens $84B in tariffs on US goods.

🟡 Gold is acting as a safe haven in times of inflation concerns and global uncertainty.

👉 All of these factors support gold’s upside — especially heading into the weekend when low liquidity can cause price swings.

📉 Technical Picture – Zones in Play

Gold reversed from FLZ H2 (3310) — a key liquidity and demand zone. Sellers took profits, triggering a surge in buy volume. The price has since tested the OBS Sell Zone + Continuation Pattern (CP) around 334x with strong resistance.

Today, we expect price to revisit lower liquidity pools on the M30–H2 timeframe before the next breakout.

🧭 Key Levels for Friday – Watch Closely

✅ Buy Zone: 3318 – 3316

SL: 3312

TP Targets: 3322 – 3326 – 3330 – 3335 – 3340 – 3345 – 3350 – 3360

💼 Scalp Buy Zone: 3326 – 3324

SL: 3320

TP: 3330 – 3335 – 3340 – 3345 – 3350 – 3360

⚠️ Sell Zone: 3363 – 3365

SL: 3370

TP: 3360 – 3355 – 3350 – 3346 – 3342 – 3338 – 3335 – 3330

🔔 Important Notes for Indian Traders

Today is Friday, and even though there’s no major economic news, the risk of liquidity sweeps and volatility is high. Protect your capital with solid risk management and stick to your TP/SL strategy.

📌 Plan your entries from strong technical zones and don’t chase price — let the market come to you.

ELECONELECON seems to be ready to give an upside move.

Good volume may push it, above 20ema.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Radhika Jeweltech – Classic Contraction PatternTimeframe: Weekly

Structure Observed: Contraction Pattern between Trendlines

Volume: Significant recent uptick 📊

Key Zones:

🔴 Supply Zone above 123

🟢 Dynamic Support from ascending trendline

🟠 Active counter-trendline now breached

After months of lower highs and higher lows, the price has been squeezing into a classic contraction pattern between a descending orange trendline (acting as counter-trendline resistance) and a rising green trendline providing consistent support.

This week’s candle has decisively broken above the descending trendline on strong relative volume.

With the weekly close due tomorrow, all eyes remain on how the candle settles — will it sustain this breakout structurally or retreat below the trendline?

📌 Important Note: This is a technical observation — not a trade recommendation.

Nuvoco Vistas Corp cmp 381.50 by Weekly Chart view since listedNuvoco Vistas Corp cmp 381.50 by Weekly Chart view since listed

- Support Zone 335 to 355 Price Band

- Resistance Zone 395 to 415 Price Band

- Volumes generated over past few days based on expected good results outcome

- Darvas Box - Stock trading between 292 to 415 price range since Breakdown in Feb 2022

- Multiple Bullish Rounding Bottoms completed within Darvas Box indicative of probable breakout attempted

TFCILTD - Massive Cup & Handle Breakout | Daily Chart📊 TFCILTD – Massive Cup & Handle Breakout | Fib 100% Retest | RSI Overbought | Volume Surge | Daily Chart

📅 Chart Date: July 6, 2025

📍 CMP: ₹262.65 (+8.48%)

📈 Symbol: NSE:TFCILTD

🔍 Technical Analysis Summary

☕ Cup & Handle Pattern Breakout

Price broke out above the Cup & Handle neckline near ₹258.50 and hit the Fibonacci 100% extension at ₹262.65.

Clean rounding bottom formation visible, followed by bullish handle and sharp breakout.

📐 Fibonacci Retracement (from swing low ₹93.85 to high ₹262.65)

50.00% – ₹177.02

61.80% – ₹196.65

✅ 100.00% – ₹262.65 (just achieved!)

📈 RSI Indicator (14)

RSI at 78.02, clearly in overbought territory – indicating momentum strength, but a minor pullback is likely.

RSI consistently above 70 for the past few sessions reflects strong trend continuation.

📊 Volume

Volume surged to 4.14M, supporting the breakout. Confirmation of pattern breakout is validated by this volume spike.

🏁 Key Technical Levels

Breakout Zone (Neckline): ₹258.50 ✅

CMP: ₹262.65

Next Resistance: Blue Sky Zone (New Highs)

Support on Retest: ₹258.50 → ₹230.67

Major Support: ₹177.02 (Fib 50%)

💡 Trade Setup Idea

Entry: On breakout confirmation above ₹258.50 or on retest

Stoploss: Below ₹230

Target: Open sky above ₹262 → Trend-following zone

Risk Level: Medium-High (due to overbought RSI)

⚠️ Disclaimer: This is an educational chart setup and not trading advice. Please conduct your own research and risk management.

📣 Follow @PriceAction_Pulse for more such clean breakouts and chart pattern analysis!

🔁 Drop a comment if TFCILTD is on your radar for the next breakout rally 📈

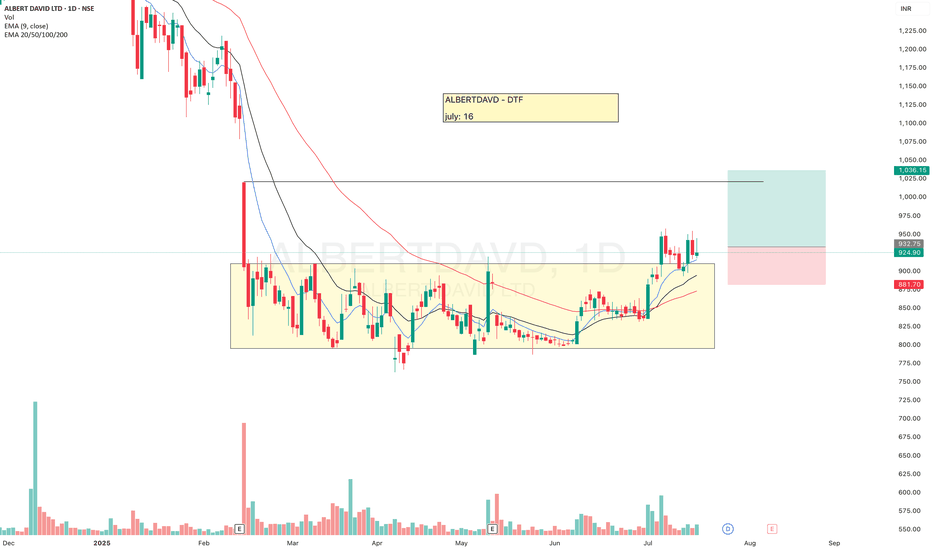

ALBERTDAVDAfter a long consolidation ALBERTDAVD has given breakout, now we may expect a good move from here.

Keep eyes on it.

✅ If you like my analysis, please follow me here as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.