PGIL - STWP Equity Snapshot

📊 STWP Equity Snapshot – PGIL (Pearl Global Industries Ltd)

(Educational | Chart-Based Interpretation)

Market Structure:

Price fell sharply from the recent high and moved into a known demand zone where buyers usually step in. From this area, buying interest appeared, highlighted by a bullish engulfing candle. This shows that buyers are active and willing to defend this level. However, price is still moving inside a broader range, so the overall trend has not yet changed. Strength is visible from support, but clear trend confirmation is still awaited.

Demand–Supply Structure:

Price declined strongly into a previous demand zone, where buyers reacted immediately and pushed prices higher. The bullish engulfing candle reflects short-term buying interest from this support area. However, price is still facing resistance at higher levels, which limits upside for now. This move should be seen as a reaction from demand rather than a confirmed breakout.

Key Levels – Daily Timeframe:

The support zones around 1398, 1349, and 1321 are areas where buyers have previously stepped in and defended price. The resistance zones near 1475, 1502, and 1552 are levels where selling pressure has appeared in the past. These levels are important because price has reacted here earlier and may do so again.

What the Chart is Saying:

The overall trend is still range-bound, meaning price is moving sideways rather than trending clearly. Momentum is slowly recovering from oversold levels, showing some improvement in buying interest. Buyers have successfully defended the demand zone, which has helped stop the recent fall. However, price may now spend some time consolidating before it decides the next clear direction.

CPR Impact:

PGIL is trading below a wide CPR, which shows that the market lacks strong directional confidence. Earlier attempts to move above the CPR did not hold, and this zone is now acting as resistance. A wide CPR usually leads to range-bound or corrective price action, which fits well with the current chart structure. As long as price remains below the CPR pivot, upside moves may face selling pressure. A sustained move and acceptance above CPR would be needed to signal any meaningful bullish shift.

Intraday Reference Levels (Structure-based):

The reference price zone near 1453 acts as the key area to watch in the short term. If support weakens, the risk area lies around 1356, where the structure may start failing. On the upside, zones between 1570 and 1648 are areas where price may react or pause. These levels indicate possible reactions, not predictions.

Swing Reference Levels (Hybrid Model | 2–5 days):

For the short swing view, the reference price zone remains around 1453. If demand fails, risk increases below 1353. If strength continues, higher zones between 1654 and 1805 come into focus as possible range expansion areas. These zones reflect potential movement within the range, not certainty.

Final Outlook (Condition-Based):

Momentum is moderate, showing some recovery but not strong acceleration. The trend remains range-bound, with no clear directional control yet. Risk is high because the move is a counter-trend recovery and price is also facing resistance from the CPR zone. Volume is moderate, supporting the move but not strong enough to confirm a trend change.

💡 STWP Learning Note

A strong candle at support shows interest, not confirmation.

Let price accept above resistance and CPR before assuming a trend change.

📘 STWP Approach

Observe price. Respect risk.

Let structure guide decisions — not emotions.

🚀 Stay Calm. Stay Clean. Trade With Patience.

⚠️ Disclaimer

This post is shared only for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

Technical Analysis

XAUUSD H1 – Liquidity Grab Completed, Focus on Buy the DipMarket Context

Gold has just completed a strong impulsive rally, leaving behind multiple liquidity pockets and imbalance zones below. The current pullback is technical in nature, serving as a rebalancing phase after expansion rather than a trend reversal.

From a macro perspective, safe-haven demand and a cautious Fed outlook continue to support Gold, keeping the broader bias tilted to the upside.

Technical Structure (H1 – MMF)

Market structure remains bullish with higher highs and higher lows.

The recent sell-off is a liquidity grab into previous demand zones.

No confirmed bearish CHoCH at this stage.

Price is still holding above the major H1 GAP liquidity zone.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Prefer BUY setups on pullbacks into:

BUY zone 1: 4,759 – 4,729

BUY zone 2 (deep): 4,669 – 4,600

Only execute BUYs after clear bullish reaction and structure hold.

Avoid FOMO at premium levels.

Upside Targets

TP1: 4,817

TP2: 4,892

TP3: 4,898 (liquidity sweep zone)

Alternative Scenario

If price fails to hold above 4,729 and sweeps deeper liquidity into the GAP H1 zone, wait for re-accumulation signals before re-entering BUYs.

Invalidation

An H1 close below 4,600 invalidates the bullish setup and requires a full structure reassessment.

Summary

The broader trend remains bullish. The current move is a corrective pullback into liquidity, offering high-quality buy-the-dip opportunities. Patience and confirmation remain key — let price come to you.

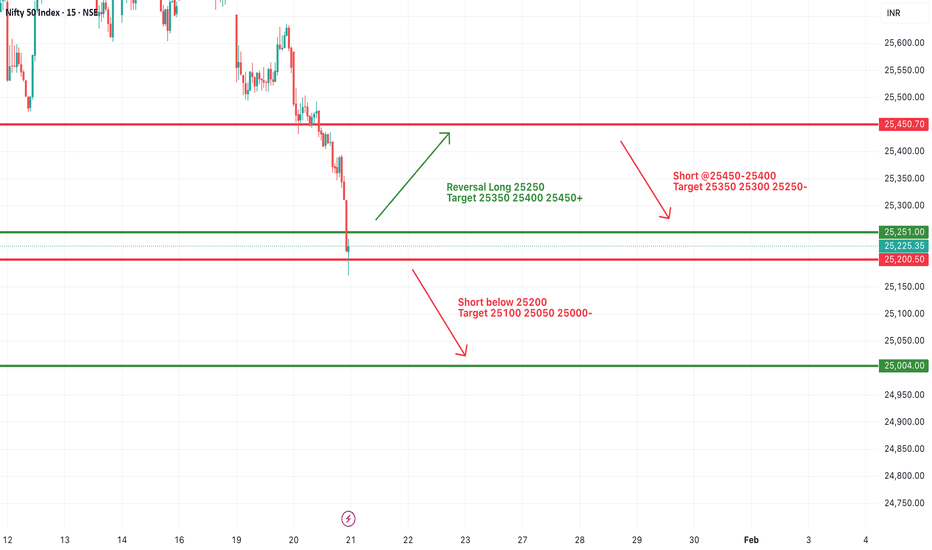

#NIFTY Intraday Support and Resistance Levels - 21/01/2026A flat opening is expected in Nifty, indicating continued consolidation after the recent sharp decline and volatile price action near lower demand zones. The index has shown strong selling pressure from higher levels and is now hovering close to a critical support area, suggesting that the market is at an important decision point. Early trade is likely to remain range-bound with heightened volatility, as both buyers and sellers assess whether the recent support will hold or break further.

On the support side, the immediate demand zone is placed around 25,250–25,200. This area has already witnessed a sharp reaction, indicating short-term buying interest and the possibility of a technical bounce. If Nifty manages to hold above 25,250, a reversal long setup may come into play with upside targets of 25,350, 25,400, and 25,450+. Any pullback followed by strong bullish candles or higher low formation near this zone can be used as a confirmation for intraday or short-term long trades, keeping strict stop-losses below the support.

On the upside, the immediate resistance lies near 25,450–25,400, which is a previous breakdown zone. Sustaining above this level is crucial for bulls to regain control. Failure to cross this resistance may again attract selling pressure, keeping the index trapped in a sideways-to-bearish structure. Hence, profit booking is advised near resistance levels for long positions, and fresh longs should be considered only on a decisive breakout with volume confirmation.

On the downside, a clear break below 25,200 would weaken the structure further and open the door for fresh short trades. In such a scenario, downside targets are placed at 25,100, 25,050, and 25,000, which are the next major psychological and technical support levels. Below 25,000, the selling momentum can accelerate, so traders should be cautious and trail profits aggressively in short positions.

Overall, the broader trend remains bearish with short-term consolidation, and today’s flat opening suggests a wait-and-watch approach during the initial phase of the session. Traders should focus on level-based trading, avoid chasing moves, and strictly follow risk management. Directional clarity is expected only after a confirmed breakout above resistance or a breakdown below the key support zone.

[INTRADAY] #BANKNIFTY PE & CE Levels(21/01/2026)A flat opening is expected in Bank Nifty, indicating indecision after the recent sell-off and rejection from higher levels. The index is currently trading below its immediate resistance zone, reflecting weak momentum and cautious sentiment among market participants. Early trade is likely to remain volatile but range-bound, as both buyers and sellers wait for confirmation near the marked support and resistance levels before committing to fresh positions.

On the upside, the key resistance zone is placed near 59,550–59,600. If Bank Nifty manages to sustain above 59,550, it can trigger a buy-on-breakout setup with upside targets of 59,750, 59,850, and 59,950+. A move above this zone would indicate short-covering and fresh buying interest, potentially leading to a recovery rally towards the upper resistance band near 59,950. Long trades should be considered only after clear acceptance above resistance with stable price action.

On the downside, the immediate support is seen around 59,450–59,400. Failure to hold this level can invite fresh selling pressure, making buy PE options favorable for downside moves. In such a case, targets are placed at 59,250, 59,150, and 59,050, where partial profit booking is advisable. A stronger breakdown below 58,950–58,900 would further weaken the structure and open deeper downside targets near 58,750, 58,650, and 58,550, which are major demand zones and potential bounce areas.

Overall, the broader structure suggests a sell-on-rise and range-trading strategy unless a decisive breakout above resistance occurs. Traders should avoid aggressive positions during the initial flat phase and instead focus on level-based trades with strict stop-loss management. Scalpers and intraday traders can capitalize on moves near support and resistance, while positional traders should wait for a confirmed directional breakout before taking larger exposure.

MASTEK - STWP Equity Snapshot________________________________________

📊 STWP Equity Snapshot – MASTEK

(Educational | Chart-Based Interpretation)

________________________________________

📌 Market Structure (Simple View)

Price has moved up sharply from a recent low, showing strong buying interest.

After the rally, price has paused and is moving sideways in a tight range.

This pause is happening above the rally midpoint, which keeps the structure positive.

👉 Buyers are still in control unless price breaks below the base.

________________________________________

🔄 Rally–Base Structure (Simple Explanation)

Strong rally shows clear bullish intent

Base is tight, showing selling pressure is weak

No sharp rejection from the top

Buyers are accepting higher prices

Risk is clearly visible below the base

This is a healthy pause, not weakness.

________________________________________

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 2243

Risk Reference (If price weakens): 2149

Observed Upside Zones: 2337 → 2432

These are reaction areas, not predictions.

________________________________________

📌 Swing Reference Levels

(Hybrid Model | 2–5 days | Observational)

Reference Price Zone: 2243

Risk Reference (If support breaks): 2101

Higher Range Zones (If strength continues): 2432 → 2573

These levels reflect the bigger structure, not short-term noise.

________________________________________

📊 What the Chart is Saying (Very Simple)

Trend is up

Momentum is strong

Consolidation is healthy

Buyers are defending the base

Breakdown only if price closes below the base low

________________________________________

📈 Final Outlook (Condition-Based)

Momentum: Strong

Trend: Up

Risk: Moderate

Volume: Supportive

________________________________________

💡 STWP Learning Note

Strong rallies usually pause before moving further.

A tight base helps define risk and improves discipline.

Structure matters more than speed.

________________________________________

⚠️ Disclaimer

This post is shared only for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

________________________________________

📘 STWP Approach

Observe price. Respect risk.

Let structure guide decisions — not emotions.

🚀 Stay Calm. Stay Clean. Trade With Patience.

________________________________________

ETHUSD – Daily Timeframe AnalysisETH is currently trading in an upward trend, forming higher lows, which shows bullish strength in the market. Price is respecting the ascending trendline, indicating buyers are still in control.

🔹 Entry Zone:

Price is reacting near the trendline support, making this a buy-on-dip opportunity.

🔹 Stop Loss:

Placed below the recent support zone to protect against trend failure.

🔹 Targets:

Target 1: Previous resistance / minor supply zone

Target 2: Major resistance area above (strong selling zone)

🔹 Market Structure:

Higher Highs & Higher Lows ✅

Trendline support holding ✅

Bullish continuation setup 🚀

⚠️ Risk Management:

Always wait for confirmation and manage position size properly. This setup works best if the trendline continues to hold.

📌 Bias: Bullish

📌 Timeframe: 1D

📌 Asset: ETHUSD

Gold Price Action Update-Clean Breakout with Clear Targets AheadGold has finally broken above the falling trendline, confirming a short-term shift in momentum. The breakout is clean, and price is now holding above the breakout area, which keeps the bullish continuation scenario active.

As long as price respects the highlighted support zone, pullbacks can be used for long opportunities toward the marked upside targets. A break below the invalidation level would cancel this setup, so risk management remains key.

This is a structure-based trade, not a chase.

KEY LEVELS

Entry Zone: 4671 – 4668

1st Target: 4678

2nd Target: 4684

Final Target: 4690

Stop Loss: 4660

Disclaimer

This analysis is for educational purposes only and should not be considered financial advice. Trading involves risk. Please do your own research and use proper risk management.

#NIFTY Intraday Support and Resistance Levels - 20/01/2026A flat opening is expected in Nifty, indicating continued consolidation after the recent corrective move. The index is currently trading below the previous resistance zone, suggesting that the overall bias remains cautious in the near term. Early price action is likely to remain range-bound, with volatility expected around the marked support and resistance levels. Traders should be patient during the opening minutes and wait for price confirmation near key levels before initiating positions.

On the upside, the immediate resistance zone is placed around 25,750–25,800. A sustained move and acceptance above 25,750 can trigger a reversal long setup, indicating that buyers are regaining control. If this breakout holds, Nifty may gradually move towards 25,850, followed by 25,900 and 25,950+, where fresh supply and profit booking can be expected. Long trades should only be considered if the index shows strong price acceptance above this zone with supportive volume.

On the downside, the 25,700–25,650 region remains a crucial intraday support. Any rejection from the resistance zone or failure to hold above 25,700 can lead to a reversal short setup. In such a scenario, downside targets are seen at 25,650, 25,550, and 25,500, which are important demand areas. A decisive breakdown below 25,450 will further weaken the structure and can open the gates for deeper downside towards 25,350, 25,300, and 25,250, where buyers may attempt a defensive bounce.

Overall, the market structure suggests a sell-on-rise or range-trading environment unless a strong breakout above resistance occurs. Traders should focus on level-based trading with strict stop-loss discipline and avoid overtrading during sideways moves. Scalping and short-term trades near support and resistance will be more effective than positional trades until Nifty shows a clear directional breakout.

[INTRADAY] #BANKNIFTY PE & CE Levels(20/01/2026)A flat opening is expected in Bank Nifty, indicating indecision after the recent volatile moves. The index is opening near the 59,800–59,900 zone, which continues to act as a short-term balance area where buyers and sellers are actively competing. This suggests that the market is still in a consolidation phase and is waiting for a clear trigger to decide the next directional move. Early price action is likely to remain choppy, with whipsaws possible near key intraday levels.

On the upside, the crucial level to watch remains 60,050–60,100. A sustained move and acceptance above this zone will indicate renewed buying strength. If Bank Nifty manages to hold above 60,050, bullish momentum can gradually build, opening the path for CE buying opportunities. In such a scenario, upside targets are placed at 60,250, followed by 60,350, and 60,450+, where strong supply zones are expected. A breakout above these levels may also invite short covering, accelerating the move higher.

On the downside, the 59,950–59,900 area is acting as immediate intraday support. Any rejection or failure to sustain above this zone may increase selling pressure. A breakdown below 59,900 can trigger PE buying, with downside targets at 59,750, 59,650, and 59,550. If weakness extends further and the index slips below 59,450, it would confirm bearish dominance, opening deeper downside levels toward 59,250, 59,150, and 59,050.

Overall, the structure suggests a range-bound and level-based trading session unless a decisive breakout or breakdown occurs. Traders should avoid aggressive early entries and focus on confirmation-based trades near the mentioned levels. Scalping and short-term positional trades with strict stop-loss and disciplined risk management will be more effective than directional bets until the market clearly breaks out of this consolidation range.

#NIFTY Intraday Support and Resistance Levels - 19/01/2026Based on the current structure of the Nifty 50 chart, a gap-down opening is expected, which clearly reflects cautious sentiment at the start of the session. The index is opening below the recent consolidation zone, indicating that sellers are still active and buyers are not yet confident to push prices higher at the open. This kind of opening generally leads to a range-bound to volatile first half, where the market tests nearby support and resistance levels before showing any clear directional bias.

From a technical perspective, the 25,700–25,750 zone is acting as an important short-term decision area. This level has previously behaved as both support and resistance, making it a critical region to watch today. If Nifty manages to hold above 25,700 and shows strength, there is a possibility of a reversal long setup. Sustained price action above 25,750–25,800 can attract buying interest, and in that case, the upside targets remain 25,850, 25,900, and 25,950+. Such a move would indicate short covering and intraday recovery after the gap-down opening.

On the downside, if the index fails to sustain above 25,700 and breaks down decisively below this level, selling pressure is likely to increase. A clean breakdown below 25,700 can open the door for further downside towards 25,650, 25,550, and 25,500. This would confirm that the gap-down opening is being accepted by the market and that bears remain in control for the session. Any rejection from the 25,950–26,000 resistance zone would further strengthen the bearish intraday outlook.

Overall, the market structure suggests a sell-on-rise or level-based trading approach rather than aggressive directional trades at the open. Traders should avoid early impulsive entries and instead wait for confirmation near the marked levels. If price stabilizes and forms a base near support, a controlled reversal trade can be planned. Otherwise, continued weakness below support levels may offer short-selling opportunities with strict risk management. The session is likely to remain volatile and level-driven, making patience and discipline crucial for today’s trades.

[INTRADAY] #BANKNIFTY PE & CE Levels(19/01/2026)Based on the current chart structure, Bank Nifty is indicating a gap-down opening below the 59,950 level, which is an important short-term pivot zone. This gap-down suggests early weakness and cautious sentiment at the opening, especially after the index failed to sustain above the previous resistance band. However, the broader structure still shows that the market is trading within a well-defined range, and the day’s direction will largely depend on how price behaves around the marked support and resistance levels.

Intraday Structure & Key Observations

- The 59,950–60,050 zone has acted as a crucial decision-making area in recent sessions. A gap-down below this zone indicates that sellers are active, but confirmation will only come if price sustains below this level after the first 15–30 minutes.

- The 60,050–60,110 region now becomes an immediate resistance. Any pullback towards this zone should be closely watched for rejection or acceptance.

- The upper resistance near 60,450 remains a major supply zone. Only a strong breakout and sustained move above this level would shift the intraday bias clearly towards bullish continuation.

Bullish Scenario (CE Side)

- If Bank Nifty manages to recover and sustain above 60,050, it may indicate that the gap-down was a false breakdown or an opening trap. In such a case:

- Buying opportunities can be considered above 60,050–60,100 with confirmation.

- Upside targets would be 60,250, 60,350, and 60,450+.

- Price acceptance above 60,110 with strong candles would strengthen the bullish case.

This scenario would reflect strong buying interest at lower levels and could lead to a short-covering move.

Bearish Scenario (PE Side)

- If the index fails to reclaim 59,950 and continues to trade below it:

- Selling pressure is likely to dominate.

- Below 59,950–59,900, downside targets open up at 59,750, 59,650, and 59,550.

- A deeper breakdown below 59,450 can accelerate the fall towards 59,250, 59,150, and 59,050.

- This would confirm that the gap-down opening is being accepted by the market, indicating a bearish continuation day.

Trading Approach & Risk Management

- Expect initial volatility due to the gap-down opening; avoid aggressive trades in the first few minutes.

- Wait for price confirmation near key levels rather than predicting direction.

- Trade with strict stop-losses and consider partial profit booking at intermediate targets.

- If price remains stuck between 59,950 and 60,050, the session may turn into a range-bound or whipsaw day.

Overall View

The immediate bias remains cautious to bearish due to the gap-down opening below 59,950. However, a quick recovery above 60,050 can neutralize this weakness. Today’s trade will be purely level-based, and discipline will be key. Let the market confirm direction before committing to larger positions.

TECHM - STWP Equity Snapshot________________________________________

📊 STWP Equity Snapshot – Tech Mahindra

(Educational | Chart-Based Interpretation)

________________________________________

📌 Market Structure (Simple View)

Price has moved up strongly from a well-defined support area

Recent candles show active buying

Price is now near an earlier resistance zone

👉 Strength is visible, but price is at an important decision area

________________________________________

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 1681

Risk Reference (If price weakens): 1548

Observed Upside Zones: 1840 → 1945

These are reaction zones, not predictions.

________________________________________

📌 Swing Reference Levels

(Hybrid Model | Observational)

Reference Price Zone: 1681

Risk Reference (If support breaks): 1482

Higher Range Zones (If strength sustains): 2078 → 2375

These levels reflect the bigger structure, not short-term noise.

________________________________________

🔑 Key Levels – Daily Timeframe

Support Areas: 1620 | 1570 | 1539

Resistance Areas: 1701 | 1731 | 1782

These are zones where price has paused or reacted earlier.

________________________________________

📊 What the Chart is Saying (Very Simple)

Trend is recovering, not fully trending yet

Momentum is strong recently, but near resistance

Volume supports the recent up move

Price may pause or consolidate before the next move

________________________________________

📈 Final Outlook (Condition-Based)

Momentum: Moderate

Trend: Range to Recovery

Risk: High (near resistance)

Volume: High

________________________________________

💡 STWP Learning Note

Strong candles look exciting, but discipline matters more.

Let price accept above resistance before assuming continuation.

________________________________________

⚠️ Disclaimer

This post is shared only for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

________________________________________

📘 STWP Approach

Observe price. Respect risk.

Let structure guide decisions — not emotions.

🚀 Stay Calm. Stay Clean. Trade With Patience.

________________________________________

RBL Bank Shows a Powerful Cup Pattern Breakout on Weekly ChartRBL Bank has completed a textbook Cup & Handle pattern on the weekly timeframe, signaling a meaningful shift from a long consolidation phase into a fresh bullish trend. The rounded base formation highlights a gradual transition from distribution to accumulation, indicating growing confidence among long-term market participants.

The most critical development is the decisive breakout above the handle resistance zone, which had previously acted as a strong supply area. This breakout is supported by strong price expansion and follow-through candles, confirming that buyers are in control. Such breakouts from multi-month bases often lead to sustained trending moves rather than short-lived rallies.

From a price projection standpoint, the measured move of the cup suggests an initial upside target around 380+, followed by an extended projected target near 440+ if momentum continues to build. The current structure also shows healthy consolidation above the breakout level, which is a positive sign and often acts as a base for the next leg higher.

Risk management remains clearly defined in this setup. As long as the price holds above the breakout support zone near 280–290, the bullish structure stays intact. Any sustained breakdown below this area would invalidate the pattern and shift the outlook back to neutral or corrective.

Overall, RBL Bank appears to be transitioning into a new medium-to-long-term uptrend, backed by a strong chart structure and favorable risk–reward dynamics. This makes it a compelling setup for positional traders and investors who prefer structurally confirmed breakouts with clear targets and controlled downside risk.

NIFTY Sell on Rise | Options Trade with Defined RiskNIFTY continues to respect the upper trendline resistance, indicating a bearish bias in the near term. Price action suggests a sell-on-rise opportunity as long as the index trades below this resistance zone.

📉 Index View (Spot):

Resistance Zone: 25,750

Downside Targets: 25,650 – 25,600

Rejection from this zone could trigger another leg lower toward the mentioned targets.

📌 Trade Setup (Options Strategy)

Instrument: NIFTY 25,800 CE (20th Jan Expiry)

Buy Zone: ₹125 – ₹115

Target: ₹190

Invalidation / Risk: ₹95 (closing basis)

💡 Trade Logic:

As long as ₹125 holds, momentum remains favorable for an upside move in the option premium. A pullback into the buy zone may offer a low-risk, high-reward setup, aligned with volatility expansion near resistance.

⚠️ Risk Management is Key

Use strict stop-loss discipline

Adjust position size according to your risk appetite

Avoid overtrading in volatile conditions

📌 Disclaimer

This analysis is strictly for educational purposes and not financial advice. Please consult your financial advisor and follow your own trading plan before taking any trades.

If you find this idea useful, hit the like button and share your views—your feedback helps us create better trading insights for the community.

🚀 Trade smart. Trade disciplined.

Happy Trading,

– The InvestPro Team

#NIFTY Intraday Support and Resistance Levels - 16/01/2026Based on the current price structure and the levels marked on the chart, the market is expected to open flat with no major deviation from the previous session’s range. Nifty is currently trading near a well-defined demand–supply zone, indicating indecision and consolidation rather than a strong directional bias. As long as the index holds above the 25,750–25,800 support area, there is a possibility of a technical pullback or reversal on the upside. A sustained move above this zone can attract fresh buying interest, with upside targets placed around 25,850, followed by 25,900 and 25,950 levels. This zone will act as an important intraday trigger, and confirmation should ideally come with strong price acceptance and volume.

On the downside, the 25,700 level remains a critical breakdown point. If Nifty fails to sustain above this level and slips below 25,700, selling pressure may intensify, opening the path for a decline towards 25,650, 25,550, and potentially 25,500. This makes the lower support band extremely important for intraday traders, as a breakdown below it can quickly change the market sentiment to bearish. Until a clear breakout or breakdown is seen, the overall structure suggests range-bound movement, and traders are advised to be patient and wait for confirmation near key levels rather than taking aggressive positions at market open.

Overall, the market context remains neutral to mildly cautious, with flat opening expectations and stock-specific or level-based opportunities likely to dominate the session. Strict risk management is recommended, along with partial profit booking near targets, as volatility may increase once the index moves decisively out of the current consolidation range.

Union Bank of India: Long-Term Head & Shoulders PatternUnion Bank of India has delivered a decisive long-term breakout on the monthly timeframe after completing a classic Inverse Head & Shoulders pattern, marking a major structural shift in trend. The pattern has been in formation for several years, with a well-defined left shoulder, a deep head near the bottoming zone, and a higher right shoulder, clearly reflecting gradual accumulation after prolonged weakness.

The most important technical development is the clean breakout above the neckline resistance, which had capped price action for multiple years. This neckline breakout is supported by strong bullish candles, indicating conviction from long-term participants rather than short-term speculation. Such breakouts on higher timeframes often signal the beginning of a multi-year uptrend rather than a temporary rally.

From a projection perspective, the measured move derived from the head-to-neckline height suggests a primary upside target near the 240+ zone, followed by an extended target around 280+. If momentum sustains and the broader banking sector remains supportive, the structure also opens the door for a long-term projected target near 325+, aligning with the full pattern height projection shown on the chart.

Risk remains clearly defined in this setup. As long as the price holds above the neckline breakout zone, the bullish structure remains intact. Any sustained move back below this level would weaken the breakout thesis and shift the view back to consolidation. This makes the trade favorable from a risk–reward standpoint, as downside risk is limited relative to the potential upside.

Overall, Union Bank of India is transitioning from a prolonged basing phase into a new bullish cycle. Such high-timeframe pattern breakouts are often accompanied by volatility in the initial phase, but structurally they favor positional and long-term investors, especially when managed with disciplined risk control.

Gold Hits Resistance Inside Rising Channel | Short-Term PullbackHello Everyone, i hope u all will be doing good in your life and your trading as well, let;s analyise Gold as it is trading inside a rising channel, but price is currently facing strong resistance near the channel top. The recent move shows signs of rejection, which opens the door for a short-term pullback, not a trend reversal.

This is a counter-trend short focused only on a corrective move. As long as price stays below the marked resistance zone, selling pressure can continue toward lower channel support. Buyers are still in control on higher timeframes, so shorts should remain quick and disciplined.

Key Levels

Short Zone: Near channel resistance

Pullback Targets: 4625 → 4610 → 4597

Invalidation: Above 4660

Disclaimer This analysis is for educational purposes only and should not be considered as financial advice. Trading involves risk. Please do your own research and use proper risk management before taking any trade.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

If this update helped, like and follow for regular updates.

XAUUSD (H4) – Trendline break confirmedXAUUSD (H4) – TRENDLINE BREAK CONFIRMED, NOW IT’S ALL ABOUT BUYING THE DIP.

Macro context

Safe-haven flows are still supporting precious metals as geopolitical uncertainty rises. Headlines around the US–Venezuela situation and political pushback can keep price action reactive, meaning sharp spikes and liquidity sweeps are very possible before the market commits to the next leg.

Technical view (H4)

The bullish structure remains intact: higher highs + higher lows.

Price has broken the trendline/resistance and is holding above the “buy resistance” area around 4550 → a positive sign for continuation.

The 1.618 Fibonacci extension above is a major liquidity magnet, but also a zone where short-term profit-taking can trigger a pullback.

Key levels

Pivot support: 4550–4545

Deeper support: 4475–4455 (balance area inside the rising channel)

Target resistance: 4760–4770 (Fibo 1.618 / “sell Fibonacci” zone)

Trading scenarios

Scenario 1: Trend-following BUY (preferred)

Entry: Buy pullback 4552–4560

SL: 4540

TP1: 4635–4660

TP2: 4720–4740

TP3: 4760–4770

Plan: wait for a clean reaction at the new support after the breakout, then ride the trend.

Scenario 2: Safer BUY after a deeper liquidity sweep

If price dumps hard on thin liquidity/news:

Entry: Buy 4475–4455

SL: 4435

TP: 4550 → 4635 → 4760

Scenario 3: Reaction SELL (short-term only)

Only if there’s a clear rejection at the highs:

Sell zone: 4760–4770

SL: 4785

TP: 4685 → 4635 → 4550

Conclusion

H4 bias stays bullish after the trendline break. The best approach is no chasing — wait for a dip into 4550 to buy with structure. SELL is only a tactical reaction if price rejects hard at the 1.618 extension.

👉 Follow LiamTradingFX to get my XAUUSD plans early every day.

XAUUSD (Gold) | BULL VS BEAR | Technical Level Gold (XAUUSD) | Strategy: Buy on Dip & Breakdown Trade | Timeframe: Intraday

Buy on Dip Strategy (Trend-Following)

* Trade Type: Buy Stop

* Entry: 4,603

* Target 1: 4,616

* Target 2: 4,632

* Stop Loss: 4,588

View:

* This setup aligns with the higher-timeframe bullish trend. Buying above 4,600 indicates continuation strength, targeting recent resistance zones. Ideal if price holds above the intraday pivot.

Breakdown Strategy (Risk-Off Move)

Trade Type: Sell Stop

* Entry: 4,586

* Target 1: 4,574

* Target 2: 4,566

* Stop Loss: 4,601

View:

This trade activates only if key support breaks, signaling short-term bearish momentum and profit booking. Suitable during USD strength or sudden risk-off sentiment.

XAUUSD (Gold) | Technical Outlook | 15th Jan'2026XAU/USD – Gold Technical Analysis

Price: 4,604 | Intraday: -0.47%

Gold is trading near 4,600 after a minor pullback. While short-term momentum shows selling pressure on lower timeframes, the overall trend remains strongly bullish on Daily, Weekly, and Monthly charts. Price continues to hold well above key moving averages (20, 50, 100, 200), keeping the broader uptrend intact.

Key Levels

Resistance: 4,616 → 4,632 → 4,648

Support: 4,598 → 4,586 → 4,551

Pivot: 4,599

Bullish Scenario

Above 4,600, buyers may push Gold toward 4,616–4,632. A strong breakout can extend gains toward 4,648.

Bearish Scenario

Below 4,586, selling pressure may increase, dragging price toward 4,566–4,551 (intraday correction).

Intraday Trading Strategy

Buy on dips: 4,590–4,600 | SL: below 4,566 | Targets: 4,616 / 4,632

Sell below: 4,586 (confirmation) | SL: 4,616 | Targets: 4,566 / 4,551

Bias: Bullish trend with short-term volatility.

AXISBANK - STWP Equity Snapshot________________________________________

📊 STWP Equity Snapshot – AXISBANK

(Educational | Chart-Based Interpretation)

________________________________________

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 1308

Risk Reference (If price weakens): 1231

Observed Upside Zones: 1401 → 1462

These levels show where price may pause, react, or move faster during short-term action.

________________________________________

📌 Swing Reference Levels

(Hybrid Model | 2–5 days | Observational)

Reference Price Zone: 1308

Risk Reference (If support fails): 1210

Higher Range Zones (If strength continues): 1503 → 1649

Swing levels help understand bigger price movement, not day-to-day noise.

________________________________________

🔑 Key Levels – Daily Timeframe

Support Areas: 1266 | 1232 | 1211

Resistance Areas: 1320 | 1341 | 1375

These are zones where price previously reacted, either by stopping, reversing, or moving faster.

________________________________________

📌 What the chart is showing (Simple view)

Trend is up

Price recently moved strongly with good volume

Earlier resistance was tested and crossed

Some resistance ahead is still weak

This means buyers are active, but price may pause at higher levels.

________________________________________

📊 Chart Structure & Indicator Summary

Structure: Higher highs and higher lows

Trend: Up

Momentum: Moderate

RSI: Around 61 – strong but not overbought

Volume: Above average – healthy participation

________________________________________

🔍 STWP Market Read

AXISBANK is showing positive price structure with improving momentum.

However, since price has already moved fast, risk remains high at higher levels.

Strength is visible — but patience and risk control matter here.

________________________________________

📈 Final Outlook (Condition-Based)

Momentum: Moderate

Trend: Up

Risk: High

Volume: Moderate

________________________________________

💡 STWP Learning Note

Strong charts do not mean easy trades.

Focus on structure, risk per trade, and review, not prediction.

________________________________________

⚠️ Disclaimer

This post is shared only for educational and informational purposes.

It is not a recommendation or investment advice.

Please consult a SEBI-registered financial advisor before making any trading or investment decision.

________________________________________

📘 STWP Approach

Observe price. Respect risk.

Let structure guide decisions — not emotions.

🚀 Stay Calm. Stay Clean. Trade With Patience.

________________________________________

💬 Did this snapshot help you understand the chart better?

🔼 Boost to support structured learning

✍️ Share your views in comments

🔁 Forward to someone learning price action

👉 Follow for simple, clean STWP insights

If you want, next I can:

Convert this into a TradingView-ready post

Or make a fixed simple template for all bank stocks

#NIFTY Intraday Support and Resistance Levels - 14/01/2026A flat opening is expected in Nifty, with the index trading near the 25,700–25,750 zone, which continues to act as an important intraday pivot area. The broader structure remains weak after the recent sharp decline, and price action suggests consolidation rather than immediate trend reversal.

On the upside, a reversal long can be considered only if Nifty sustains above 25,750–25,800. A confirmed hold above this zone may trigger short covering and pull the index towards 25,850, 25,900, and 25,950+. However, upside momentum is likely to remain limited unless price decisively reclaims the 25,950 resistance.

On the downside, 25,700 remains a crucial breakdown level. If the index slips below 25,700, fresh selling pressure may emerge with downside targets at 25,650, 25,550, and 25,500. The 25,500 area is a strong support, and any sustained break below it can extend weakness further.

Overall, the market remains range-bound with a bearish bias. Traders should wait for a clear breakout above resistance or breakdown below support, follow strict risk management, and avoid aggressive positions during the initial phase of the session.

[INTRADAY] #BANKNIFTY PE & CE Levels(14/01/2026)A flat opening is expected in Bank Nifty, with price hovering around the 59,500–59,600 zone, which is acting as an intraday equilibrium area. Recent price action shows range-bound behavior with sharp intraday swings, indicating indecision and a lack of fresh directional cues.

On the upside, a sustained move above 59,550 will be important to trigger bullish momentum. If the index holds above this level, CE buying can be considered with upside targets at 59,750, 59,850, and 59,950+. A decisive breakout above 59,950 may open the door for a stronger recovery move.

On the downside, rejection near current levels and a break below 59,450–59,400 can invite selling pressure. In that case, PE positions may work for targets at 59,250, 59,150, and 59,050, where strong support is placed near 59,050. A breakdown below this support could accelerate downside momentum.

Overall, the structure remains range-bound. It is advisable to trade only after a clear level breakout or breakdown, maintain strict stop-losses, and avoid overtrading until a decisive move emerges.