GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

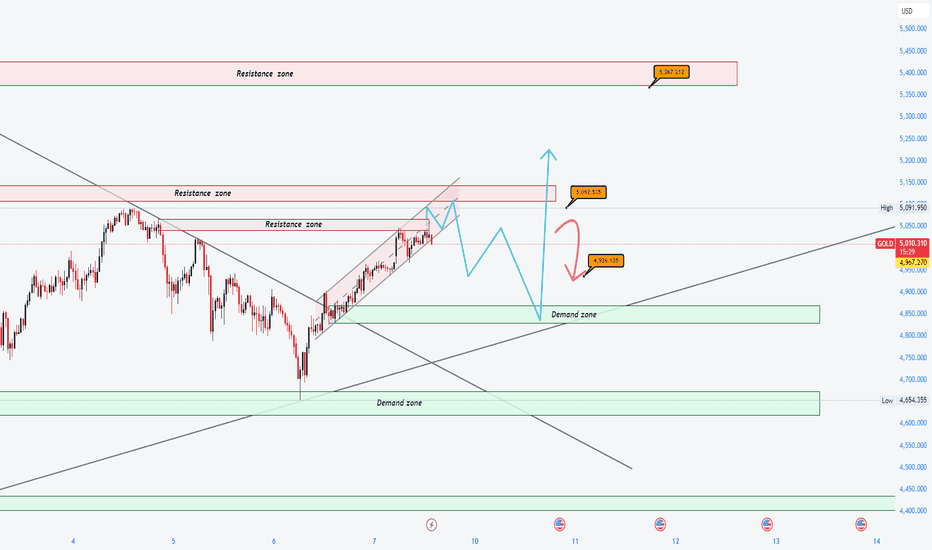

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined

Technicalanalytic

GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

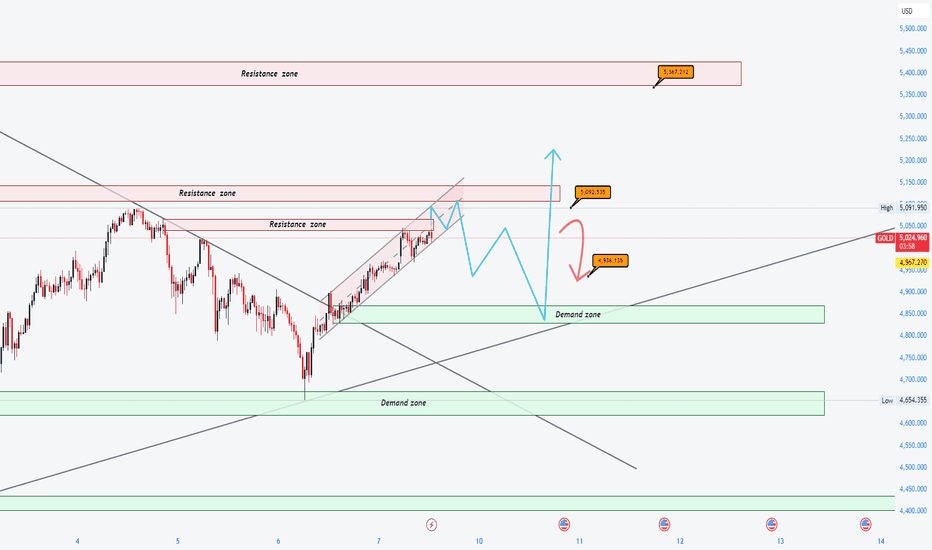

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined