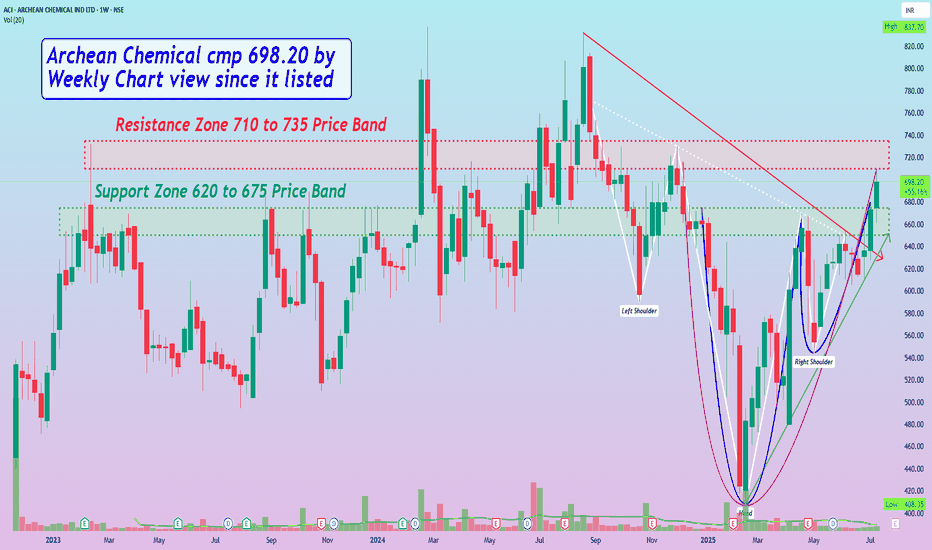

Archean Chemical cmp 698.20 by Weekly Chart view since it listedArchean Chemical cmp 698.20 by Weekly Chart view since it listed

- Support Zone 620 to 675 Price Band

- Resistance Zone 710 to 735 Price Band

- Volumes flattish, need to increase for Resistance Zone Breakout

- Bullish Rounding Bottom inclusive of Cup & Handle pattern completed

- A logically considerate slanting Bullish Head & Shoulder pattern too, has completed

- Falling Resistance Trendline Breakout sustained and Rising Support Trendline respected

Technicalchartsetup

SWSolar Sterling & Wilson cmp 335.10 by Daily Chart viewSWSolar cmp 335.10 by Daily Chart view

- Support Zone 280 to 305 Price Band

- Resistance Zone 340 to 365 Price Band

- Bullish VCP Pattern completed on stock chart

- Volumes spiking heavily at regular intervals by demand based buying

- Resistance Zone Neckline Breakout maybe seen unfolding in the near future

Escorts Kubota cmp 3410.90 by the Weekly Chart viewEscorts Kubota cmp 3410.90 by the Weekly Chart view

- Support Zone 3000 to 3150 Price Band

- Resistance Zone 3450 to 3600 Price Band

- 2 Bullish Rounding Bottoms done, 3rd in completion stage

- Volumes needed to push for fresh breakout across Resistance Zone

- Falling Resistance Trendline Breakout attempted by the current status

- Rising Support Trendline is well respected and sustained by price momentum

Sterlite Technologies cmp 114.55 by Weekly Chart viewSterlite Technologies cmp 114.55 by Weekly Chart view

- Support Zone 71 to 81 Price Band

- Resistance Zone 120 to 132 Price Band

- 2nd Falling Resistance Trendline Breakout attempted

- 1st Falling Resistance Trendline Breakout done and sustained

- Volumes spiked heavily over past few days by demand based buying

- Repeated Bullish Rounding Bottoms indicate probable Breakout above Resistance Zone neckline

LIC Housing Finance cmp 637.05 by Daily Chart viewLIC Housing Finance cmp 637.05 by Daily Chart view

- Support Zone 600 to 625 Price Band

- Resistance Zone 660 to 685 Price Band

- Rising Support Trendline seen well respected

- Volumes have spiked heavily today by demand based buying

- Breakout seemingly sustained for Double Falling Resistance Trendlines

- Support Zone acting as neckline for Multiple Bullish Technical Chart patterns

- Most common Technical Indicators BB, EMA, MACD, RSI, SAR trending positively

- Bullish Rounding Bottoms with considerate Cup & Handle and a faintly observant Head & Shoulders too