AI and Technology Stocks: A Comprehensive Overview1. Understanding AI and Technology Stocks

Technology stocks broadly include companies engaged in software development, hardware manufacturing, cloud computing, semiconductors, networking, and IT services. Within this sector, AI stocks are a subset focused on companies that develop artificial intelligence solutions, including machine learning, natural language processing, computer vision, and robotics. Leading AI stocks are often also technology companies but with a significant focus on AI-enabled products or services.

Major players in AI and technology include companies such as Microsoft, NVIDIA, Alphabet (Google), Amazon, Meta Platforms, Tesla, and Intel. Each of these companies leverages AI differently: NVIDIA through AI chipsets, Microsoft and Google via AI cloud services and software, Amazon through AI-driven logistics and recommendation engines, and Tesla with AI for autonomous vehicles.

2. Drivers of Growth in AI and Technology Stocks

Several macro and microeconomic factors have driven the growth of AI and technology stocks:

Cloud Computing and Big Data: The adoption of cloud infrastructure has expanded rapidly, with AI algorithms requiring massive computational power and storage. Companies providing cloud solutions, like Amazon Web Services, Microsoft Azure, and Google Cloud, benefit from both AI and broader technology trends.

AI Integration Across Industries: AI is no longer confined to tech companies. Financial services, healthcare, automotive, retail, and manufacturing increasingly implement AI for efficiency, predictive analytics, and automation. This cross-industry adoption fuels revenue growth for AI technology providers.

Semiconductor Demand: AI applications rely heavily on GPUs and specialized AI chips. Companies like NVIDIA and AMD have become central to AI development, as their processors are critical for training large language models and running complex AI workloads.

Automation and Productivity: AI enhances operational efficiency by automating repetitive tasks, improving decision-making through predictive analytics, and reducing costs. This value proposition makes AI investments appealing both to enterprises and investors.

Research and Innovation: AI research, including breakthroughs in natural language processing (NLP), computer vision, reinforcement learning, and generative AI, has accelerated. Investment in R&D strengthens competitive moats for technology companies, which is reflected in stock valuations.

3. Investment Characteristics of AI and Technology Stocks

Investing in AI and technology stocks has distinct characteristics:

High Growth Potential: AI and tech stocks often outperform traditional sectors due to their growth-oriented nature. Revenue growth rates in AI-focused companies can be exponential, driven by adoption of AI tools, cloud computing, and SaaS (Software as a Service) solutions.

Volatility: High growth comes with high volatility. AI and technology stocks are sensitive to market sentiment, technological shifts, regulatory changes, and macroeconomic conditions like interest rates. Short-term price swings can be significant, requiring investors to have a long-term perspective.

Valuation Challenges: Many AI and tech stocks trade at premium valuations relative to earnings, reflecting expected future growth rather than current profitability. Metrics such as price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-revenue (EV/R) are often higher than the broader market, reflecting investor optimism.

Network Effects: Many AI and tech companies benefit from network effects. For example, social media platforms like Meta gain value as user engagement increases, while cloud platforms become more entrenched as enterprises build ecosystems on them.

Recurring Revenue Models: AI and software companies often rely on subscription-based models, providing predictable and recurring revenue streams. SaaS and AI-as-a-Service offerings contribute to long-term profitability and valuation stability.

4. Key Sectors within AI and Technology

AI and technology stocks span multiple sub-sectors:

Semiconductors: The backbone of AI computing, companies like NVIDIA, Intel, AMD, and Qualcomm dominate chip production for AI, data centers, and edge computing.

Cloud Computing and SaaS: AI-driven cloud services are essential for enterprise digital transformation. Microsoft, Amazon, Salesforce, and Snowflake exemplify this sector.

Autonomous Vehicles and Robotics: AI powers autonomous driving, drones, and industrial robotics. Tesla, Waymo, Boston Dynamics, and ABB leverage AI for automation, which opens new revenue streams.

Cybersecurity: AI is crucial in threat detection, anomaly detection, and automated response systems. Companies like Palo Alto Networks, CrowdStrike, and Fortinet integrate AI into their cybersecurity solutions.

Consumer Technology and Platforms: AI enables recommendation systems, personalization, and smart devices. Apple, Alphabet, and Meta integrate AI into consumer products and services to enhance engagement and monetization.

5. Trends Shaping AI and Technology Stocks

Several trends are shaping the AI and technology sector:

Generative AI: Generative AI models like ChatGPT, DALL-E, and other large language models have opened new commercial applications, from content creation to automated coding, fueling investor enthusiasm.

AI Democratization: Cloud-based AI platforms enable smaller companies to adopt AI without heavy infrastructure investment, broadening market adoption and creating new investment opportunities.

Edge Computing and IoT: AI integration in Internet of Things (IoT) devices allows real-time processing at the edge, expanding applications in smart homes, industrial automation, and healthcare monitoring.

Mergers and Acquisitions: Large tech companies are acquiring AI startups to accelerate innovation, expand capabilities, and secure talent, impacting stock valuations and sector dynamics.

Regulatory Focus: Governments worldwide are exploring AI regulation to address ethical concerns, data privacy, and job displacement. While regulation can limit certain practices, clear rules may also enhance investor confidence in sustainable AI adoption.

6. Risks and Challenges

Investing in AI and technology stocks carries risks:

Market Volatility: High-growth AI and tech stocks are sensitive to interest rate changes, inflation, and market cycles, which can create sharp declines during downturns.

Competition: Rapid innovation attracts competition. Startups can disrupt established players, while large firms must continually innovate to maintain dominance.

Regulatory Risks: AI-specific regulations, antitrust concerns, and data privacy laws may affect profitability and business models.

Ethical and Social Implications: AI adoption raises questions about job displacement, algorithmic bias, and misuse, which could impact public perception and lead to policy intervention.

Valuation Risk: High valuations mean that even minor setbacks or earnings misses can trigger large corrections in stock prices.

7. Investment Strategies

Investors approach AI and technology stocks differently based on risk tolerance and objectives:

Growth Investing: Focused on high-growth AI and tech leaders, anticipating long-term revenue and market expansion.

Diversification: Using ETFs or mutual funds like the Global X Artificial Intelligence & Technology ETF (AIQ) to mitigate company-specific risks while gaining exposure to the sector.

Thematic Investing: Targeting AI, cloud computing, robotics, or cybersecurity themes within the broader technology space.

Long-Term Horizon: Many AI technologies require years to reach maturity, so patient capital tends to benefit from the compounding growth of leaders in the space.

8. Outlook

The outlook for AI and technology stocks remains bullish, driven by continuous innovation, expanding applications, and increasing global digitalization. However, volatility, regulatory developments, and competitive pressures will shape the trajectory. Investors who focus on high-quality companies with strong AI integration, robust balance sheets, and scalable business models are likely to capture the sector's long-term growth.

AI and technology stocks are more than just market trends—they represent a paradigm shift in the global economy, influencing productivity, business models, and societal interaction. While the ride can be volatile, the potential rewards are significant for investors willing to embrace innovation and understand the transformative impact of AI and technology.

Techstocks

Tech & AI Upside: Opportunities, Drivers, and Future Outlook1. Growth Drivers of Tech and AI

The upside potential of tech and AI is rooted in several structural growth drivers. First, digital transformation across industries is accelerating. Organizations, from healthcare and finance to manufacturing and retail, are increasingly adopting digital tools to improve efficiency, enhance customer experiences, and gain competitive advantages. AI applications such as predictive analytics, natural language processing, and computer vision are becoming central to these transformations. For instance, AI-driven supply chain optimization can reduce costs and improve delivery times, while AI-based financial models can enhance risk management and investment strategies.

Second, the proliferation of data fuels AI growth. The explosion of digital information—ranging from transaction records and social media interactions to IoT sensor data—is creating a rich ecosystem for AI algorithms to analyze and learn from. Advanced machine learning models thrive on large datasets, enabling better predictions, automation, and personalization. For example, recommendation engines in e-commerce and streaming platforms use AI to process massive datasets, leading to improved engagement and monetization.

Third, advancements in computational infrastructure have significantly increased AI’s potential. The development of high-performance GPUs, TPUs, and cloud-based AI platforms has enabled the training of increasingly complex models that were previously infeasible. AI models such as large language models and generative AI can now perform tasks ranging from content creation and code generation to medical diagnostics and drug discovery, opening new markets and revenue streams.

Finally, favorable investment trends support tech and AI expansion. Venture capital and private equity investments in AI startups continue to rise, reflecting strong investor confidence in the sector’s long-term growth. Governments and corporations are also increasing funding for AI research, recognizing its potential to drive national competitiveness and industrial leadership.

2. Market Opportunities Across Industries

The upside of tech and AI is not limited to the software industry; it spans virtually every sector of the economy. In healthcare, AI-powered diagnostics, predictive analytics, and personalized treatment plans are improving patient outcomes while reducing costs. Companies leveraging AI to analyze medical images, monitor patient vitals, or design new drugs are poised to redefine healthcare delivery and pharmaceutical innovation.

In finance, AI is transforming investment management, fraud detection, and customer service. Robo-advisors and algorithmic trading platforms leverage AI to optimize investment strategies, while banks use AI-driven systems to detect anomalous transactions in real-time, significantly reducing fraud risk.

In manufacturing and logistics, AI is revolutionizing production efficiency, predictive maintenance, and supply chain management. Smart factories equipped with AI-powered robotics and IoT sensors can reduce downtime, improve product quality, and respond more rapidly to market demand. Similarly, AI-driven logistics platforms optimize routes and inventory management, leading to cost savings and faster delivery.

Consumer technology also presents vast opportunities. AI enhances user experiences through voice assistants, personalized recommendations, augmented reality applications, and intelligent devices. Social media, streaming services, and e-commerce platforms increasingly rely on AI to retain users and boost engagement. Generative AI, which can create text, images, audio, and even video content, is unlocking entirely new forms of digital creativity and content monetization.

3. Economic and Competitive Implications

The rise of AI is reshaping the competitive landscape. Companies that successfully integrate AI into their operations gain a distinct advantage, often achieving higher efficiency, lower costs, and better customer satisfaction. This creates a “winner-takes-most” dynamic in many markets, particularly in areas like cloud computing, AI platforms, and enterprise software. Tech giants such as Microsoft, Google, and Amazon are leveraging their AI capabilities to dominate cloud services, productivity tools, and consumer applications, while startups focus on niche innovations that address specific industry pain points.

Economically, AI and technology adoption drive productivity gains and job creation, although they also present challenges related to workforce displacement. Routine and repetitive tasks are increasingly automated, leading to shifts in labor demand toward higher-skill roles in AI development, data science, cybersecurity, and digital strategy. Governments and institutions face the task of balancing innovation with workforce reskilling initiatives to ensure inclusive economic growth.

4. Investment Opportunities in Tech and AI

From an investment perspective, the upside in tech and AI is reflected in both public and private markets. Public equities in AI-focused technology companies offer exposure to companies with proven business models, large datasets, and scalable platforms. Companies specializing in cloud computing, AI chips, cybersecurity, and enterprise software are particularly attractive due to their strategic importance and recurring revenue models.

Private investments, including venture capital and private equity, provide exposure to high-growth AI startups that may become the next generation of market leaders. These investments carry higher risk but offer significant potential rewards if the startups successfully develop disruptive technologies and achieve market traction. Additionally, thematic ETFs and mutual funds focused on AI and technology provide diversified exposure to the sector, allowing investors to benefit from broad AI adoption without concentrating risk in a single company.

5. Challenges and Considerations

Despite the substantial upside, tech and AI adoption also faces challenges. Ethical concerns around privacy, bias, and accountability are increasingly scrutinized by regulators and society. AI systems trained on biased data can perpetuate discrimination, while widespread data collection raises questions about consent and security. Companies must prioritize responsible AI development, transparency, and regulatory compliance to maintain public trust.

Moreover, technological complexity and talent shortages can limit AI implementation. Developing, deploying, and maintaining advanced AI systems requires highly specialized skills, creating competitive pressures for top talent. Companies that fail to attract and retain AI experts may struggle to compete effectively.

Cybersecurity risks are another concern. As AI becomes more integrated into critical systems, vulnerabilities in AI models can be exploited, leading to financial losses, reputational damage, or systemic disruption. Robust cybersecurity protocols and AI model validation are essential to mitigate these risks.

6. Future Outlook

Looking ahead, the upside of tech and AI remains substantial. Emerging trends such as generative AI, autonomous systems, quantum computing, and AI-driven biotech applications have the potential to create entirely new industries and redefine existing ones. Generative AI, in particular, is already disrupting creative industries, software development, and customer engagement, with the potential to automate complex tasks previously thought to require human creativity.

Moreover, AI’s integration with other technologies, including IoT, blockchain, and 5G networks, will enable new business models and operational efficiencies. For instance, smart cities leveraging AI and IoT can optimize traffic flow, energy usage, and public safety, while AI-enabled blockchain systems can enhance supply chain transparency and security.

Overall, the upside of tech and AI is characterized by transformative potential, broad applicability across sectors, and significant economic impact. Companies, investors, and policymakers that understand and harness these opportunities while managing associated risks are likely to benefit from long-term growth and innovation leadership.

Conclusion

The tech and AI sector offers unparalleled upside potential, fueled by data proliferation, computational advancements, digital transformation, and strong investment support. Opportunities span multiple industries, from healthcare and finance to manufacturing and consumer technology, with AI enabling efficiency, innovation, and enhanced user experiences. While ethical, regulatory, and technical challenges exist, the long-term prospects remain robust, with emerging technologies poised to redefine markets and create new economic frontiers. Stakeholders that strategically invest in AI innovation, talent, and responsible adoption are positioned to capitalize on one of the most significant growth stories of the 21st century.

Dell Technologies Inc (DELL) – Accelerating Toward AI LeadershipCompany Snapshot:

NYSE:DELL is transforming from a traditional hardware player into an AI-driven, high-margin solutions provider, underpinned by strategic GPU partnerships and a shift toward recurring software revenue.

Key Catalysts:

AI Data Center Momentum 🔌

Deep collaborations with NVIDIA and AMD enable Dell to deploy cutting-edge GPUs across its server portfolio—critical infrastructure for AI workloads and enterprise compute.

Recurring Revenue Growth 💼

Double-digit gains in software and services are reducing cyclicality, driving margin expansion, and making the business model more resilient and predictable.

Capital Return Strength 💰

Dell returned $1B+ to shareholders last quarter, including a 20% dividend increase, backed by $2.2B in free cash flow—demonstrating strong capital discipline and confidence.

Investment Outlook:

Bullish Entry Zone: Above $108–$110

Upside Target: $175–$180, supported by Dell’s AI-enabled pivot, margin tailwinds, and shareholder-friendly capital strategy.

🧠 Dell’s AI infrastructure push and software-driven transformation position it as a top-tier tech compounder.

#Dell #DELL #AIInfrastructure #DataCenters #NVIDIA #AMD #TechStocks #RecurringRevenue #Dividends #Buybacks #GrowthStock #AIComputing

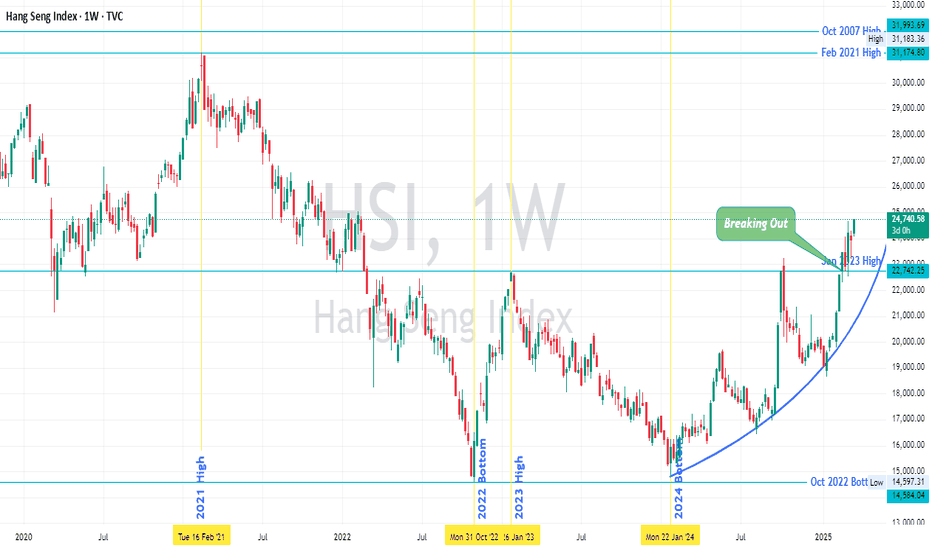

Hang Seng Index (HSI) 's Price Action vis-à-vis Major PivotsHSI seems to have broken out of last year's high (Oct 2024) and Jan 2023 high, and retested it too.

The index is about 67% from Jan 2024 low.

The next major pivot is Feb 2021 High, after that Oct 2007 High and then Jan 2018 High (all are marked on chart).

The price seems to be gaining momentum and moving parabolically, as marked on chart.

It seems price will move higher over months, of course there would be retracements.

As always it won't be as predictable as I have hypothesized above.

Nevertheless at this juncture price action is positive and depending upon price action further into the months the hypothesis will succeed or fail.

Trade Safe

Why Wipro may be headed up to new highsWipro seems to have completed a W-X-Y correction at its recent lows. Note that X wave is a triangle which is clearly evident. The subsequent upmove can be charted out as an 1-2 with waves 3-4-5 still awaited

A lot of the India IT stocks are headed up - see recent posts on Mindtree/TCS

Naukri: Inverse H&SNaukri had a great run from Rs 1600 in March. Its nearly 3.5X in less than a year. It seems an Inverse H&S is being formed. It should consolidate at the 4850 levels for a few days/weeks.

The Zomato story definitely has some link here. Coulds be that existing shareholders are selling to apply in the IPO. Nevertheless, it seem sit will consolidate at 4850 levels, before moving to a new high of Rs 6800.