Top 5 Mindset Mistakes That Kill Your Trades⭐ Top 5 Mindset Mistakes That Kill Your Trades

Your strategy is not the problem — your mindset is.

Most traders lose because emotions control decisions.

Fix these 5 mindset mistakes, and your results change immediately.

1️⃣ Revenge Trading — Trading From Emotion, Not Logic 😡🔥

After a loss, many traders try to “win it back” immediately.

This leads to:

impulsive entries 🎯

oversized positions 💥

chasing price 🏃♂️💨

breaking rules 📉

Revenge trading is the fastest way to destroy your account.

✔️ Fix: Stop trading after a big emotional loss. Reset → Review → Return calm.

2️⃣ Fear & Greed — The Two Emotions That Control the Market 😰💰

Fear makes you exit too early.

Greed makes you hold too long.

They cause:

hesitation ❌

early exits 🏳️

chasing breakouts 🚀

ignoring risk limits ⚠️

Fear and greed create emotional, not technical trades.

✔️ Fix: Set TP/SL BEFORE entering — never adjust emotionally.

3️⃣ Overtrading & No Clear Plan 📊🌀

Trading randomly because “the chart looks good” is gambling.

Overtrading drains your money AND your discipline.

You overtrade when:

you want constant action 🎲

you feel FOMO 😵💫

you jump between setups ⚡

you trade every candle 🕒

✔️ Fix: Build a simple plan:

Entry rules ✏️

Exit rules 🎯

Risk per trade 📐

Trading times ⏰

Follow it with discipline.

4️⃣ Impatience — Forcing Trades Before They’re Ready ⏳⚡

Most losses come from entering too early or too late.

Impatience creates fake setups in your mind.

Signs of impatience:

entering before confirmation 🚦

exiting trades too early 😓

forcing a trade because you’re bored 😴

chasing volatility 💨

✔️ Fix: Wait for your confirmation signals.

Patience pays more than speed in trading.

5️⃣ Emotional Attachment to Losing Trades 💔📉

You hold a losing trade because:

you don’t want to accept the loss 😤

you hope the market “comes back” 🙏

your ego hates being wrong 💭

This mindset destroys accounts faster than anything else.

✔️ Fix: Treat losses as part of the statistical process — not personal failure.

🌟 Final Message

Controlling emotions is more powerful than any indicator.

Master your discipline, patience, and neutral mindset, and your trading results will transform.

Your mind is the real trading system. 🧠✨

Traderdiscipline

Your Trading Beliefs Were Programmed by Your Past–Rewire to Win!Hello Traders!

Ever wondered why you hesitate when it's time to take a trade, or why you cut winners too early and let losers run? It's not the chart — it's your subconscious programming . Most of our trading behaviors are rooted in past beliefs , experiences, and fears that have nothing to do with the market. If you want to level up, it’s time to rewire your mindset .

How Your Past Programs Your Trading Decisions

Fear of Loss Comes from Past Mistakes: A few bad trades early in your journey can make you overly cautious or hesitant to pull the trigger.

Greed is Reinforced by Random Wins: If you got lucky once without following rules, your brain links success with shortcuts.

Self-Doubt is Learned from Past Failures: Losing streaks can make you feel like you're "not cut out" for trading — even if it’s just part of the learning curve.

Overconfidence Comes from Unconscious Bias: If you had a few back-to-back wins, your mind assumes you’re always right — which leads to overtrading.

Rewire Your Mind for Trading Success

Acknowledge Your Programming: Write down patterns you repeat (like fear at breakout or regret after booking early) — awareness is the first step.

Replace Old Beliefs with New Ones: Example: Instead of “I always mess up,” try “I follow my system and improve with each trade.”

Create a Trading Affirmation Routine: Start your day with a mental reset — “I am disciplined, focused, and I trust my setup.”

Track Emotional Triggers in a Journal: Log your trades along with emotions — it helps break subconscious habits.

Rahul’s Tip

Your subconscious doesn’t care about candlesticks — it reacts to fear, identity, and habits. Rewire your trading beliefs the same way you train a muscle: repetition, awareness, and intent.

Conclusion

The market is not your enemy — your programming might be. Every trader who succeeds rewires their belief system with discipline, patience, and constant reflection. If you keep sabotaging your success, it’s not about strategy — it’s time to upgrade your mental operating system.

What trading belief did you have to unlearn to improve your performance? Share it in the comments below!

Every Mistake Was a Lesson. Every Profit Was Just a Moment!Hello Traders!

Today’s post is about a truth that took me years to fully understand — mistakes are your best teachers , and profits are just short-term moments. When I stopped getting emotional about profits and started focusing on what each trade taught me, my growth as a trader truly began.

Every mistake was a step forward. Every profit was just a part of the path.

Why Mistakes Matter More Than Profits

Mistakes Show You the Flaws: You learn where your emotions or system failed.

Lessons Stick Longer: Losses force you to reflect, while profits are often forgotten.

Mistakes Build Awareness: You become more careful and sharp next time.

Profits Can Be Random: You may win even on a wrong trade — which teaches nothing.

How Focusing Only on Profits Can Hurt You

Overconfidence Rises: One good trade may make you take 3 bad ones.

You Ignore Process: You start caring only about P&L, not setups.

Emotional Swings Increase: Wins excite you, losses hit harder.

No Growth Happens: You chase results, not improvement.

What Changed When I Started Valuing Lessons Over Profits

My Journal Became Honest: I stopped hiding my bad trades from myself.

I Focused on Execution: Win or lose — I checked if I followed my rules.

My Emotions Settled: I didn’t get too happy or too upset anymore.

Growth Became Visible: Week by week, my decision-making got better.

Rahul’s Tip

If you only celebrate profits, you miss the real growth.

Start asking yourself after every trade — “What did I learn?”

That question will take you further than any winning streak.

Conclusion

Mistakes carry meaning. Profits are just snapshots.

The more you value lessons, the more consistent you become.

Build your trading journey on what you learn — not just what you earn.

Thanks for reading!

If this post connected with you, do like and share it with other traders.

Follow for more such real trading insights and psychology posts.

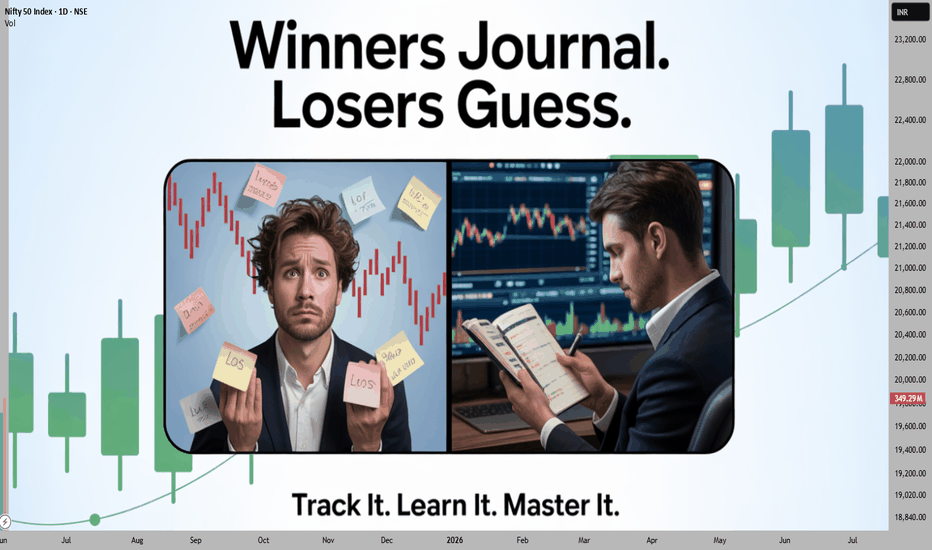

Trading Journal: The Habit That Separates Winners from Losers!Hello Traders!

Ever wonder why some traders consistently grow while others repeat the same mistakes for years? It’s not just about strategies — it’s about self-awareness . And nothing builds that better than maintaining a Trading Journal .

If you're serious about improving in trading, this habit alone can be your game-changer.

What is a Trading Journal?

A logbook of your trades — not just entries and exits, but your thinking, emotions, market context, and outcomes.

More than numbers — it captures your mindset, mistakes, missed opportunities, and lessons.

Used by professionals — almost every successful institutional or full-time trader maintains some form of journal.

What Should You Record in Your Journal?

Date: Trade taken date

Symbol / Index: Stock or Index name

Trade Type: Options / Futures / Equity

Entry / Exit Level: Price at which trade was executed

SL / Target: Planned stoploss and target levels

Qty: Quantity traded

Direction: Long / Short

Strategy Used: E.g. VWAP Bounce, Reversal Setup, Gamma Zone, etc.

Emotional State: Mindset during trade (honest reflection)

Outcome: Profit / Loss / Breakeven

Mistake / Learning Point: What did you learn?

Screenshot Link: (Optional – chart for review)

Why Journaling Works Like Magic

Reveals Patterns: You’ll spot repetitive mistakes or winning setups.

Builds Discipline: Helps you follow your plan instead of emotional reactions.

Boosts Confidence: Reviewing past successful trades gives mental clarity.

Speeds Up Growth: Traders who journal improve 2x faster — because they actually learn from their trades.

Rahul’s Tip

You don’t need fancy tools — even a Google Sheet or Notion page works. The key is consistency and honesty . And if possible, attach a screenshot with markups for each trade — it’s worth gold during review.

Conclusion

If you're not journaling, you're just guessing. Start this habit from today and see how fast your trading mindset evolves. This is the edge nobody talks about — but every winner quietly uses.

Do you maintain a trading journal? Or plan to start now? Let’s talk below!

Trade Regret Psychology – Why Even Winning Trades Hurt Now!Hello Traders!

Today’s post dives deep into the psychological side of trading, especially a silent killer most traders ignore — Trade Regret. It’s that uncomfortable feeling where even a profitable trade feels disappointing — because you “could’ve held longer,” “entered earlier,” or “taken more quantity.” If you often end your sessions feeling frustrated despite gains, this one’s for you.

What is Trade Regret?

Trade Regret refers to the emotional pain traders feel after placing or exiting a trade — regardless of outcome.

Common forms: “I exited too early,” “I missed the big move,” or “Why didn’t I size up?”

It creates unnecessary self-doubt and affects your next trades — often leading to revenge trades, overtrading, or FOMO.

How to Manage & Overcome Trade Regret

Set Clear Trade Plans: Define your entry, stop, and target before you take the trade. Stick to the process.

Journal Every Trade: Write why you took the trade and why you exited — this adds logic and removes emotion.

Accept Imperfection: You’ll never catch the top or bottom. Focus on consistency, not perfection.

Reward Process Over Outcome: Celebrate following your system, not just making money.

Use Partial Booking Strategies: Trail some quantity for big moves, book some at fixed levels to reduce post-trade stress.

Why It Hurts Even When You Win

Comparison Trap: You compare your trade with what the market eventually did — not what your system allowed.

Social Media Influence: Seeing others post “perfect entries” makes you question your decision.

No Defined System: If your trades are impulsive, regret is guaranteed because there’s no structure to justify your action.

Rahul’s Tip

The market doesn’t reward perfection — it rewards discipline. Review your trades weekly, not emotionally after every trade. Build confidence by tracking how many trades followed your system — not how many were “perfect.”

Conclusion

Trade Regret is normal — but it’s manageable. Focus on execution, not outcome. When you become process-driven, both profits and peace of mind improve together.

Have you faced trade regret even after winning? Share your story and how you handled it in the comments below!

Trading Mindset: Mastering the Battle Between Emotions and LogicHello Traders!

In today’s post, we’re going to dive deep into one of the most crucial factors in trading: Trading Mindset . As traders, the biggest battle we face is the constant clash between emotions and logic . This battle can determine whether you succeed or fail in the market. Let's explore this fight and how to navigate it effectively.

The Emotional Trader:

Emotions can lead traders to make irrational decisions based on fear , greed , or frustration . These emotions can lead to impulsive actions that harm long-term profitability.

Fear: Fear often leads traders to exit a trade too early, locking in small profits. Fear of losses can result in hesitation, missing out on opportunities even when the market is in a favorable position. This fear can also lead to avoiding trades altogether.

Greed: Greed pushes traders to hold onto winning positions for longer than necessary, hoping for higher profits. While it might work occasionally, it often leads to larger losses when the market reverses unexpectedly.

Frustration: After a losing trade, frustration can cloud a trader’s judgment. In a bid to recover, traders may start revenge trading—taking unplanned and impulsive positions to "get back" the lost money. This often results in deeper losses.

The Logical Trader:

The logical trader, on the other hand, uses patience, discipline, and risk management to drive their actions. They focus on strategy rather than reacting to short-term market fluctuations.

Patience: The logical trader understands that trading isn’t about instant rewards. They wait for the right setups that fit their strategy, taking their time to ensure they’re making calculated moves. This patience is key to managing emotions.

Risk Management: A crucial part of trading logic is managing risk. The logical trader sets clear stop losses , calculates position size, and never risks more than they are willing to lose. They understand that losing is part of the game, but managing losses is what keeps them in the game long-term.

Discipline: Discipline in trading means sticking to your plan, no matter what the market is doing. A trader with strong discipline follows their strategy, ignores the noise, and avoids making emotional decisions.

Key Takeaways:

Mastering emotions is essential. Traders who can manage their fear, greed, and frustration make better, more rational decisions. Emotional control is the key to long-term success.

Logic and strategy are the backbone of successful trading. It’s not about making quick decisions or chasing the market—it’s about having a clear plan and executing it consistently.

Consistency and discipline are the true markers of successful traders. A trader who consistently follows a strategy and manages emotions can weather both market highs and lows.

Conclusion:

Trading is not just about reading charts and making decisions based on market data. It's about managing your mindset . The battle between emotions and logic is ongoing, but understanding how to balance both will make you a much better trader. Emotions can cloud judgment, but with the right mindset, you can make logical decisions that lead to success.