Trading

Lets Talk about Nifty I make educational content videos on Trading - Swing Trading in Indian markets especially

In this video I am talking about Nifty in general as a index nothing else - no direction - no predication - I am a setup and data backed trader and follow my setups and not general trends or bias shared commonly .

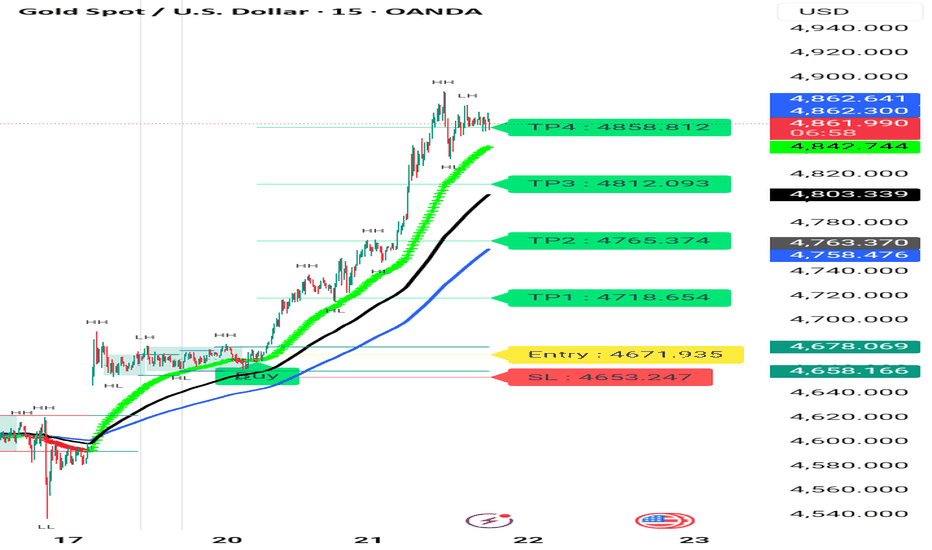

XAUUSD (Gold) | Technical Outlook | 22nd Jan'2026Gold continues to trade near 4,831, maintaining a strong bullish structure across all major timeframes. Price remains firmly above key moving averages (20/50/100/200), signaling sustained buyer control and trend continuation.

Momentum indicators support the upside, with RSI in bullish territory, MACD positive, and ADX above 35, confirming strong trend strength. Volatility remains elevated, suggesting sharp and directional price moves.

Key Levels to Watch

Support: 4,800–4,790 | 4,770–4,760 | 4,740–4,730

Resistance: 4,838–4,845 | 4,870–4,888

Major Breakout: Above 4,900

Bullish Bias

As long as Gold holds above 4,770–4,780, the trend remains bullish. A break and close above 4,845 could trigger momentum buying toward 4,870 → 4,900+. Pullbacks are expected to remain corrective.

Bearish / Correction

Bearish pressure emerges only below 4,770, with downside levels at 4,740 → 4,700 → 4,660. Trend reversal only if 4,630 breaks on a daily close.

Trading Focus

Buy on dips near 4,800–4,790

Sell only on breakdown below 4,770

Watch US PMI, GDP, Jobless Claims, Fed commentary & DXY for volatility

Conclusion

Gold remains firmly bullish, with the path of least resistance pointing higher unless key supports fail.

XAUUSD H1 – Liquidity Grab Completed, Buy the DipMarket Context

Gold has just completed a strong impulsive rally, leaving behind multiple liquidity pockets and imbalance zones below. The current pullback is technical in nature, serving as a rebalancing phase after expansion rather than a trend reversal.

From a macro perspective, safe-haven demand and a cautious Fed outlook continue to support Gold, keeping the broader bias tilted to the upside.

Technical Structure (H1 – MMF)

Market structure remains bullish with higher highs and higher lows.

The recent sell-off is a liquidity grab into previous demand zones.

No confirmed bearish CHoCH at this stage.

Price is still holding above the major H1 GAP liquidity zone.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Prefer BUY setups on pullbacks into:

BUY zone 1: 4,759 – 4,729

BUY zone 2 (deep): 4,669 – 4,600

Only execute BUYs after clear bullish reaction and structure hold.

Avoid FOMO at premium levels.

Upside Targets

TP1: 4,817

TP2: 4,892

TP3: 4,898 (liquidity sweep zone)

Alternative Scenario

If price fails to hold above 4,729 and sweeps deeper liquidity into the GAP H1 zone, wait for re-accumulation signals before re-entering BUYs.

Invalidation

An H1 close below 4,600 invalidates the bullish setup and requires a full structure reassessment.

Summary

The broader trend remains bullish. The current move is a corrective pullback into liquidity, offering high-quality buy-the-dip opportunities. Patience and confirmation remain key — let price come to you.

XAUUSD – H2 Technical AnalysisLiquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD – Trendline broken, focus on Buying liquidityMarket Context

After a strong impulsive rally, Gold has broken below the short-term ascending trendline, signaling a technical correction and liquidity rebalancing phase. However, the higher-timeframe structure remains intact, and the current decline is still viewed as corrective rather than a trend reversal.

From a fundamental perspective, safe-haven demand and a cautious monetary policy outlook continue to support Gold. This keeps deeper pullbacks attractive for institutional accumulation rather than aggressive selling.

Structure & Price Action (H1)

Short-term bullish trendline has been broken → transition into a corrective phase.

No confirmed bearish CHoCH on H1 at this stage.

Price is rotating within a range, targeting liquidity pools below.

Multiple Demand + Liquidity + H1 GAP zones are located beneath current price.

Upper zones remain Supply / Liquidity Sell areas for potential reactions.

Key Levels to Watch

Supply / Liquidity Sell: 4,949 – 4,874

Mid reaction zone: 4,824

Primary BUY zone: 4,755 – 4,729

Deep BUY zone (H1 GAP – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Primary Scenario – Buy at Discount

Look for BUY setups at:

BUY zone 1: 4,755 – 4,729

BUY zone 2: 4,665 – 4,600 (H1 GAP & liquidity)

Entries only after clear bullish reactions and structure holding.

Avoid premature entries while price remains mid-range.

Upside Targets

TP1: 4,824

TP2: 4,874

TP3: 4,949 (upper liquidity sweep)

Alternative Scenario

If price fails to reach lower zones and holds above 4,824, wait for a break & retest to re-enter BUY positions in trend direction.

Invalidation

An H1 close below 4,600 invalidates the BUY bias.

Stand aside and reassess overall market structure.

Summary

The broader bullish bias remains intact, while the current move represents a healthy pullback for liquidity absorption. The optimal strategy is patience—BUY at discounted zones with confirmation, not by chasing price.

XAUUSD – Short-Term Trendline Broken, Focus on Buying Liquidity Market Context

After a strong impulsive rally, Gold has broken below the short-term ascending trendline, signaling a technical correction and liquidity rebalancing phase. However, the higher-timeframe structure remains intact, and the current decline is still viewed as corrective rather than a trend reversal.

From a fundamental perspective, safe-haven demand and a cautious monetary policy outlook continue to support Gold. This keeps deeper pullbacks attractive for institutional accumulation rather than aggressive selling.

Structure & Price Action (H1)

Short-term bullish trendline has been broken → transition into a corrective phase.

No confirmed bearish CHoCH on H1 at this stage.

Price is rotating within a range, targeting liquidity pools below.

Multiple Demand + Liquidity + H1 GAP zones are located beneath current price.

Upper zones remain Supply / Liquidity Sell areas for potential reactions.

Key Levels to Watch

Supply / Liquidity Sell: 4,949 – 4,874

Mid reaction zone: 4,824

Primary BUY zone: 4,755 – 4,729

Deep BUY zone (H1 GAP – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Primary Scenario – Buy at Discount

Look for BUY setups at:

BUY zone 1: 4,755 – 4,729

BUY zone 2: 4,665 – 4,600 (H1 GAP & liquidity)

Entries only after clear bullish reactions and structure holding.

Avoid premature entries while price remains mid-range.

Upside Targets

TP1: 4,824

TP2: 4,874

TP3: 4,949 (upper liquidity sweep)

Alternative Scenario

If price fails to reach lower zones and holds above 4,824, wait for a break & retest to re-enter BUY positions in trend direction.

Invalidation

An H1 close below 4,600 invalidates the BUY bias.

Stand aside and reassess overall market structure.

Summary

The broader bullish bias remains intact, while the current move represents a healthy pullback for liquidity absorption. The optimal strategy is patience—BUY at discounted zones with confirmation, not by chasing price.

Gold & Silver as Safe-Haven and Hedge AssetsWhat Is a Safe-Haven Asset?

A safe-haven asset is one that tends to retain or increase its value during times of market stress. When equities fall sharply, currencies weaken, or financial systems face instability, capital often flows into assets perceived as stable and trustworthy. Gold and silver are classic examples because they are:

Tangible and finite resources

Independent of any single government or central bank

Globally accepted stores of value

Unlike fiat currencies, which can be printed in unlimited quantities, precious metals have natural supply constraints. This scarcity underpins their long-term value and makes them reliable during crises.

Gold: The Ultimate Safe-Haven Asset

Gold is widely considered the purest safe-haven asset in global markets.

1. Store of Value Across Centuries

Gold has preserved purchasing power over extremely long periods. While paper currencies have repeatedly collapsed due to hyperinflation, political upheaval, or excessive debt, gold has consistently retained value. This historical trust makes it a natural refuge when confidence in financial systems erodes.

2. Hedge Against Inflation

Inflation reduces the real value of money. When prices rise and purchasing power falls, gold often performs well. This is because gold prices tend to adjust upward as investors seek protection from currency debasement. During periods of high inflation or negative real interest rates, gold becomes particularly attractive.

3. Protection Against Currency Devaluation

Gold is priced globally in US dollars, but its value transcends any single currency. When a domestic currency weakens—due to fiscal deficits, monetary easing, or balance-of-payments stress—gold often rises in local currency terms. For emerging markets, including India, gold has historically acted as a shield against rupee depreciation.

4. Crisis and Geopolitical Hedge

Wars, financial crises, pandemics, and banking failures often trigger a “flight to safety.” In such moments, gold demand surges from investors, central banks, and institutions. Central banks themselves hold gold as part of foreign exchange reserves, reinforcing its role as a monetary anchor.

5. Portfolio Diversification

Gold typically has a low or negative correlation with equities and bonds during stress periods. This makes it an effective diversification tool. Even a modest allocation to gold can reduce overall portfolio volatility and drawdowns during market crashes.

Silver: The Hybrid Safe-Haven Asset

Silver shares many characteristics with gold but has a dual identity—part monetary metal, part industrial commodity.

1. Monetary and Investment Demand

Like gold, silver has been used as money throughout history. It attracts investment demand during inflationary periods and financial uncertainty, especially from retail investors due to its lower price per unit compared to gold.

2. Industrial Utility

Unlike gold, a large portion of silver demand comes from industrial applications—electronics, solar panels, medical devices, batteries, and electric vehicles. This gives silver an additional growth driver tied to economic expansion and technological progress.

3. Inflation Hedge with Higher Volatility

Silver can act as an inflation hedge, but its price tends to be more volatile than gold. During strong economic recoveries or reflationary phases, silver often outperforms gold, while during sharp crises gold usually remains more stable.

4. Leverage to Gold

Historically, silver tends to amplify gold’s moves. When gold enters a strong bull market, silver often rises faster in percentage terms. This makes silver attractive to investors seeking higher upside, albeit with greater risk.

Gold vs Silver as Hedges

While both metals act as hedges, they serve slightly different roles:

Gold: Best for capital preservation, crisis protection, and stability

Silver: Better for growth-linked hedging and higher return potential

Gold is favored by central banks and conservative investors, while silver appeals more to tactical and cyclical investors.

Role During Economic Cycles

Recession or Crisis

Gold usually performs strongly

Silver may lag initially due to weaker industrial demand

High Inflation / Stagflation

Both gold and silver tend to rise

Silver can outperform if inflation coincides with supply constraints

Economic Recovery / Growth Boom

Gold may consolidate

Silver often benefits from rising industrial demand

Rising Interest Rates

Short-term pressure on both metals

Long-term performance depends on real interest rates (rates minus inflation)

Ways to Invest in Gold and Silver

Investors can gain exposure through multiple avenues:

Physical metals (coins, bars, jewelry)

ETFs and mutual funds backed by bullion

Sovereign gold bonds (especially relevant in India)

Futures and options for active traders

Mining stocks for leveraged exposure

Each method has different risk, liquidity, and cost considerations.

Limitations and Risks

Despite their strengths, gold and silver are not perfect hedges:

They do not generate income like dividends or interest

Prices can remain flat for long periods

Short-term volatility, especially in silver, can be high

Performance depends heavily on macro factors such as real interest rates and dollar strength

Therefore, they are best used as portfolio stabilizers, not return-maximizing assets.

Conclusion

Gold and silver remain indispensable components of a well-balanced investment strategy. Gold stands as the ultimate safe-haven—offering protection against inflation, currency erosion, systemic risk, and geopolitical uncertainty. Silver complements gold with its dual role as a monetary metal and industrial commodity, providing both defensive qualities and growth potential.

Crypto Regulation & Digital Assets (Context-Specific)Understanding Digital Assets and Cryptocurrencies

Digital assets broadly refer to assets represented in digital form using distributed ledger technology (DLT) or blockchain. These include cryptocurrencies (Bitcoin, Ethereum), stablecoins (USDT, USDC), utility tokens, security tokens, non-fungible tokens (NFTs), and tokenized real-world assets such as bonds or real estate. Cryptocurrencies operate on decentralized networks without central intermediaries, which is both their core innovation and the primary regulatory challenge.

Unlike traditional assets, crypto assets can be transferred globally within minutes, are often pseudonymous, and operate outside conventional banking rails. This disrupts existing regulatory frameworks designed for centralized intermediaries such as banks, exchanges, and clearing corporations.

Why Regulation Is Necessary

Crypto regulation is driven by several key concerns:

Investor Protection – Extreme price volatility, market manipulation, fraud, and lack of disclosure have led to significant retail investor losses.

Financial Stability – Large-scale adoption of unregulated crypto assets could pose systemic risks, especially if linked with traditional finance.

Money Laundering & Illicit Finance – Pseudonymity and cross-border transfers raise concerns around AML/CFT compliance.

Consumer Protection – Exchange failures, hacks, and loss of private keys can permanently erase user funds.

Monetary Sovereignty – Widespread crypto usage may undermine central banks’ control over monetary policy.

However, over-regulation risks stifling innovation, pushing activity into informal or offshore markets. Hence, regulators aim for a calibrated approach.

Global Regulatory Approaches: A Comparative View

Crypto regulation varies significantly across jurisdictions:

United States adopts a fragmented, enforcement-driven approach. Agencies like the SEC, CFTC, and FinCEN regulate crypto depending on whether assets are classified as securities, commodities, or payment instruments. Regulatory uncertainty remains high, especially around token classification.

European Union has taken a structured route through the Markets in Crypto-Assets (MiCA) framework, offering legal clarity, licensing norms, and consumer protection across member states.

China has imposed a near-complete ban on private cryptocurrencies while aggressively developing its digital yuan (e-CNY), reflecting a state-centric model.

Japan and Singapore represent balanced models, allowing crypto innovation under strict licensing, custody, and disclosure rules.

Emerging markets often focus on capital controls, financial stability, and consumer risks due to higher retail participation.

These differences highlight that regulation is shaped by economic priorities and risk tolerance.

India’s Context-Specific Regulatory Stance

India provides a clear example of context-specific crypto regulation. Rather than banning cryptocurrencies outright, India has adopted a restrictive but permissive approach:

Cryptocurrencies are not legal tender, but trading and holding are allowed.

A 30% tax on crypto gains and 1% TDS on transactions aim to track activity and curb speculation.

Crypto exchanges must comply with KYC, AML, and reporting norms under the Prevention of Money Laundering Act (PMLA).

Advertising and investor communication are monitored to prevent misleading claims.

This framework reflects India’s priorities: protecting retail investors, preventing misuse for illicit finance, and safeguarding monetary sovereignty, while still allowing blockchain innovation. India’s push for a Digital Rupee (CBDC) further reinforces the distinction between state-backed digital money and private crypto assets.

DeFi, NFTs, and New Regulatory Challenges

Beyond cryptocurrencies, regulators face challenges in newer segments:

DeFi platforms operate without centralized intermediaries, making accountability and compliance difficult. Smart contracts replace institutions, raising questions about liability and governance.

NFTs blur the line between art, collectibles, and financial assets. While many NFTs are cultural or creative, others resemble speculative investment products.

Stablecoins pose systemic risks if widely adopted, especially when backed by opaque reserves. Global regulators increasingly demand reserve transparency and redemption guarantees.

Context matters here: countries with advanced financial markets focus on systemic risk, while others prioritize consumer protection and capital controls.

CBDCs vs Cryptocurrencies

Central Bank Digital Currencies represent the regulatory counterbalance to private crypto assets. CBDCs aim to combine the efficiency of digital payments with the trust and stability of central banks. For governments, CBDCs offer better transaction traceability, reduced cash dependence, and improved financial inclusion.

In contrast to decentralized cryptocurrencies, CBDCs are centralized, regulated, and aligned with monetary policy. Many regulators view CBDCs not as replacements but as alternatives that reduce the need for private crypto adoption, especially for payments.

The Future of Crypto Regulation

The future of crypto regulation is likely to be principle-based rather than prohibition-based. Key trends include:

Clear classification of digital assets (payment tokens, utility tokens, security tokens).

Licensing and capital adequacy norms for exchanges and custodians.

Strong custody, audit, and disclosure requirements.

Global coordination through bodies like the FATF to manage cross-border risks.

Regulation of intermediaries rather than protocols, especially in DeFi.

Importantly, regulators are increasingly adopting a “same risk, same regulation” approach, ensuring that crypto activities posing similar risks to traditional finance are regulated comparably.

Conclusion

Crypto regulation and digital assets cannot be governed by a one-size-fits-all framework. Each country’s approach reflects its economic maturity, financial stability concerns, technological adoption, and policy objectives. While excessive regulation can suppress innovation, under-regulation can expose economies to financial and consumer risks. The optimal path lies in context-specific, adaptive regulation that evolves alongside technology.

XAUUSD (H4) – Liam PlanMacro tailwinds remain, but price is extended | Trade reactions, not emotions

Quick summary

Gold remains supported by a strong macro backdrop:

📌 Fed hold probability in January: 95% → USD/yields capped.

📌 Geopolitical tension (Kremlin praising Trump over Greenland, NATO cracks) adds safe-haven demand.

Technically, price has pushed aggressively into upper expansion territory. At this stage, the edge is reaction trading at key levels, not chasing strength.

Macro context (why volatility stays elevated)

With the Fed very likely holding rates in January, markets are highly sensitive to USD and yield shifts.

Rising geopolitical noise keeps gold bid, but also increases the risk of headline-driven spikes and liquidity sweeps.

➡️ Conclusion: directional bias is secondary to execution quality. Trade levels + confirmation only.

Technical view (H4 – based on the chart)

Gold is trading inside a rising channel, currently extended toward the upper Fibonacci expansion.

Key levels to focus on:

✅ Major sell Fibonacci / wave top: 4950 – 4960

✅ Sell wave B / reaction zone: 4825 – 4835

✅ Buy entry / structure support: 4730 – 4740

✅ Sell-side liquidity: 4520 – 4550 (below structure)

Price is stretched above the mid-channel — conditions where pullbacks and rotations are statistically more likely than clean continuation.

Trading scenarios (Liam style: trade the level) 1️⃣ SELL scenarios (priority – reaction trading)

A. SELL at Fibonacci extension (primary idea) ✅ Sell zone: 4950 – 4960 SL: above the high / fib extension TP1: 4830 TP2: 4740 TP3: 4550 (if momentum accelerates)

Logic: This is an exhaustion area aligned with wave completion and fib extension — ideal for profit-taking and mean rotation, not trend chasing.

B. SELL wave B reaction ✅ Sell: 4825 – 4835 Condition: clear rejection / bearish structure on M15–H1 TP: 4740 → 4550

Logic: Classic corrective wave zone. Good for tactical shorts within a broader volatile structure.

2️⃣ BUY scenario (secondary – only on reaction)

BUY at structural support ✅ Buy zone: 4730 – 4740 Condition: hold + bullish reaction (HL / rejection / MSS on lower TF) TP: 4825 → 4950 (scale out)

Logic: This is a key flip zone inside the rising channel. BUY only if price proves acceptance — no blind dip buying.

Key notes (risk control)

Market is extended → expect fake breaks and sharp pullbacks.

Avoid mid-range entries between levels.

Reduce size during geopolitical headlines.

Confirmation > prediction.

What’s your play: selling the 4950 fib extension, or waiting for a clean reaction at 4730–4740 before reassessing?

— Liam

Part 4 Learn Institutional TradingPut Options (PE)

A Put Option Buyer expects the market to go down.

A Put Option Seller expects market to remain above the strike.

1. PE Buyer Example

Bank Nifty = 49,000

You buy 48,800 PE at ₹100.

If Bank Nifty falls to 48,500:

Intrinsic value = 48,800 - 48,500 = 300

Profit = 300 - 100 = 200

If Bank Nifty stays above 48,800:

PE buyer loses premium.

2. PE Seller Example

You sell 48,800 PE at ₹100

If Bank Nifty stays above 48,800 → Seller profits full premium.

If it falls → Seller loses point by point.

Part 1 Ride The Big Moves What Are Options?

Options are financial derivatives—meaning their value is derived from an underlying asset such as stock, index, commodity, etc. They are contracts between two parties: the option buyer and the option seller (writer).

There are two types of options:

Call Option (CE) – Right to buy the asset at a fixed price.

Put Option (PE) – Right to sell the asset at a fixed price.

The key point:

The buyer has a right but no obligation. The seller has an obligation but no rights.

TATASTEEL 1 Week Time Frame 📌 Current Price Snapshot

Tata Steel is trading around ₹183–₹185 on the NSE.

📊 Weekly Technical Levels (Support & Resistance)

🟢 Resistance Levels (Upside Targets)

These are zones where price may face selling pressure or struggle to break above on a weekly basis:

1. ₹188 – ₹190 — Immediate key resistance, near recent highs/52-week high zone.

2. ₹192 – ₹195 — Next resistance if the stock decisively clears ₹190 on weekly closes.

3. ₹195 + — Higher psychological area and extended targets for bullish continuation.

👉 Bullish trigger: Weekly close above ₹188–₹190 strengthens upside momentum.

🔴 Support Levels (Downside Zones)

These act as buying interest zones if the stock pulls back:

1. ₹181 – ₹182 — Immediate support keeping the uptrend intact.

2. ₹178 – ₹180 — Stronger base zone from recent swing lows & pivot cluster.

3. ₹174 – ₹176 — Deeper support if the key zones above break.

👉 Bearish risk: Weekly close below ₹178 could lead to tests around the ₹172–₹175 zone.

📉 Weekly Trend & Indicators

Long-term trend on weekly appears neutral–bullish with moving averages generally supportive and RSI around neutral–positive.

Market news also shows price recently hitting or near 52-week highs, indicating strong sector interest.

📌 How to Use These Levels on Weekly Timeframe

Bullish Scenario

Stay above ₹181–₹182 on weekly close → strengthens chance towards ₹188–₹190 resistance.

Above ₹190 weekly → next targets ₹192–₹195 and beyond.

Neutral/Range Scenario

Trading between ₹178–₹188 → range-bound movement likely; buy near support, sell near resistance.

Bearish Scenario

Weekly close below ₹178 → risk testing lower supports ₹174–₹176 / ₹172–₹175 area.

XAUUSD H1 – Liquidity Grab Completed, Focus on Buy the DipMarket Context

Gold has just completed a strong impulsive rally, leaving behind multiple liquidity pockets and imbalance zones below. The current pullback is technical in nature, serving as a rebalancing phase after expansion rather than a trend reversal.

From a macro perspective, safe-haven demand and a cautious Fed outlook continue to support Gold, keeping the broader bias tilted to the upside.

Technical Structure (H1 – MMF)

Market structure remains bullish with higher highs and higher lows.

The recent sell-off is a liquidity grab into previous demand zones.

No confirmed bearish CHoCH at this stage.

Price is still holding above the major H1 GAP liquidity zone.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Prefer BUY setups on pullbacks into:

BUY zone 1: 4,759 – 4,729

BUY zone 2 (deep): 4,669 – 4,600

Only execute BUYs after clear bullish reaction and structure hold.

Avoid FOMO at premium levels.

Upside Targets

TP1: 4,817

TP2: 4,892

TP3: 4,898 (liquidity sweep zone)

Alternative Scenario

If price fails to hold above 4,729 and sweeps deeper liquidity into the GAP H1 zone, wait for re-accumulation signals before re-entering BUYs.

Invalidation

An H1 close below 4,600 invalidates the bullish setup and requires a full structure reassessment.

Summary

The broader trend remains bullish. The current move is a corrective pullback into liquidity, offering high-quality buy-the-dip opportunities. Patience and confirmation remain key — let price come to you.

PCR Trading Strategies How to Trade Options

Many brokers today allow access to options trading for qualified customers. If you want access to options trading, you will have to be approved for both margin and options with your broker.

Once approved, there are four basic things you can do with options:

Buy (long) calls

Sell (short) calls

Buy (long) puts

Sell (short) puts

XAUUSD (H4) — Bond Selloff, Yields UpPullback Opportunity or Rejection at the Top?

Gold is still holding a bullish structure on the H4 chart, but the rebound in global yields can easily trigger sharp swings around key resistance. Today’s approach is simple: trade the zones, not the noise.

I. Executive Summary

Primary trend: H4 uptrend remains intact.

Trading bias: Prefer BUY on pullbacks into demand; consider SELL only with clear rejection at Fibonacci resistance.

Key zones:

Sell: 4774–4778

Buy: 4666–4670

Value Buy: 4620–4625

Rule: Enter only after zone touch + confirmation (rejection / micro-structure shift).

II. Macro & Fundamentals (optimized & concise)

Global bond selloff: Bond selling is spreading globally; Japan’s 40-year JGB yield hitting 4% signals broad, persistent yield pressure.

US yields rebounding: Higher US yields (10Y–30Y) raise the opportunity cost of holding gold → short-term bearish pressure for XAUUSD.

Risk premium still alive: Geopolitical tension and tariff headlines keep markets sensitive, supporting defensive flows and limiting deep downside.

Fundamental takeaway: Rising yields can drive a pullback, but the broader risk backdrop favors a correction within an uptrend, not a full reversal (unless structure breaks).

III. Technical Structure (from your chart)

1) H4 overview

Price is extended after a strong impulse and is now consolidating, while structure still prints Higher Highs / Higher Lows.

The ascending trendline remains supportive → the higher-probability play is buying dips into demand rather than chasing price.

2) Key zones

Fibonacci Sell zone: 4774 – 4778 (major supply / resistance — profit-taking and rejection risk)

Buy zone: 4666 – 4670 (shallow pullback within trend)

VL / Value Buy: 4620 – 4625 (deeper pullback — higher-quality dip if yields spike again)

Lower support zones remain a contingency for a deeper flush.

IV. Trading Plan (Brian style — 2 scenarios)

⭐️ PRIORITY SCENARIO — BUY (trend continuation)

Idea: As long as the H4 uptrend holds, look to buy pullbacks into demand with confirmation.

Option A — Buy pullback: 4666 – 4670

SL: below 4620 (more conservative: below 4616–4610 depending on volatility/spread)

TP: 4716 – 4740 – 4774 – 4800

Option B — Value Buy (if a deeper sweep happens): 4620 – 4625

SL: below the nearest H4 swing low / below 460x (risk preference dependent)

TP: 4666 – 4716 – 4774 – 4800

Confirmation cues (optional):

Strong rejection wick at the buy zone, or

H1 micro-structure break back to the upside, or

Liquidity sweep then close back above the zone.

⭐️ ALTERNATIVE SCENARIO — SELL (rejection at Fibonacci resistance)

Idea: With yields rising, gold may react sharply at the top — treat this as a reaction trade, not a macro trend reversal call.

Sell zone: 4774 – 4778 (SELL only if price rejects clearly)

SL: above 4788 – 4800

TP: 4740 – 4716 – 4670

Important: If H4 closes and holds above 4778 (acceptance), the bias shifts to buying pullbacks instead of forcing shorts.

Hidden Channels & Fib Golden Zone : Beauty of Price ActionObservational Post only Showcasing how price action works using historical price points only

Observe how price elegantly respects this counter trendline on the weekly chart (red line), forging consistent lower highs through precise rejections. A subtle parallel channel lurks beneath, acting as a hidden guardian. Channels like these shield against fakeouts, confirming pure breakouts only when breached alongside key lines.

Shifting to the monthly view, the Fib retracement from swing low to high highlights the golden zone (50 to 61%, white shaded), a magnet for retracements where price often pauses or reverses with stunning symmetry.

This interplay reveals price action's beauty: layers of structure working in harmony, rewarding patient observers.

Disclaimer: This is for educational purposes only, showcasing historical price action observations. Not financial advice. Always conduct your own analysis and manage risk appropriately.

$DYDX PRICE OUTLOOK | 3000%+ POTENTIAL FROM MACRO SUPPORT?DYDX/USDT PRICE OUTLOOK | Macro Support & High R:R Setup

DYDX is currently trading at a major higher-timeframe demand zone on the 2-week chart, following an extreme ~99.45% drawdown from its all-time high. Historically, such deep retracements often precede long-term re-accumulation phases, especially when aligned with structural support.

Market Structure Overview

Price remains within a multi-year descending channel active since 2022. The current price action is testing the lower boundary of this channel, which aligns with a clearly defined horizontal accumulation zone ($0.15–$0.20). This creates a strong confluence-based support region.

Technical Confluence

Descending channel support respected on HTF

Strong historical demand at $0.15–$0.20

~99% retracement from ATH completed

Compression near support suggests potential volatility expansion

Bias remains bullish as long as HTF structure holds

Upside Levels (If Breakout Confirms)

Resistance 1: $0.84

Resistance 2: $2.19

Resistance 3: $4.39

ATH Supply Zone: $27.85

A confirmed HTF close above descending trendline resistance would validate a structural trend reversal. The measured move from this base projects toward $3.85, representing a potential ~3200% upside from current levels.

Invalidation

Any 2-week candle close below $0.15 invalidates the accumulation thesis and requires reassessment.

Conclusion

This setup reflects a classic falling-wedge / descending-channel structure meeting historical demand. While risk remains elevated, the risk-to-reward profile is asymmetric at this level. Patience, confirmation, and position sizing are essential.

Analysis Type: Technical Analysis

Timeframe: Long-Term / Positional

Bias: Accumulation → Trend Reversal (Conditional)

TA only. Not financial advice. Always manage risk.

Part 1 Technical VS. Institutionalinstitutional trading focuses on large-scale transactions, often executed by financial institutions like banks, hedge funds, or pension funds. They typically have access to significant capital and advanced market insights, and their trades can influence market trends.

On the other hand, technical trading relies on analyzing price charts, patterns, and indicators to make decisions. Technical traders look at historical price movements and use tools like moving averages, support and resistance levels, and oscillators to predict future price movements.

In summary, institutional trading is more about the scale, resources, and market impact, while technical trading is more about patterns, price action, and chart-based strategies.

$PUMP PRICE OUTLOOK | 500%–1000% POTENTIAL? #PUMP Is Trading In A Bullish Expansion Zone After Breaking Long-Term Descending Resistance On The Daily Chart.

Price Has Completed A Prolonged Distribution → Correction Phase And Is Now Showing Early Reversal Signals.

Current Technical Structure:

✅ Long-Term Descending Trendline Break Confirmed

✅ Descending Wedge Breakout Structure

✅ Strong HTF Demand Zone Holding (0.0023–0.0021)

✅ Multiple Support Reclaims Indicate Accumulation

✅ Strength Signal: Bullish Above $0.0021

CryptoPatel Targets: $0.00449 / $0.00644 / $0.00872 / $0.015 / $0.026

As Long As PUMP/USDT Holds Above $0.0021, The Bullish Bias Remains Intact.

This Is A High-Risk, High-Reward Accumulation Setup With Asymmetric Upside Potential.

Invalidation: Daily Close Below $0.0021

TA Only. Not Financial Advice. DYOR.