XAUUSD – H4 Outlook: Liquidity ResetFebruary has opened with heightened volatility across global markets, and gold is no exception. After a strong upside run, XAUUSD has experienced a sharp corrective move, driven largely by deleveraging flows rather than a structural trend reversal.

Current price action suggests gold is entering a rebalancing phase, where liquidity is being cleared before the market can attempt a renewed push higher.

📈 Market Structure & Higher-Timeframe Context

Gold previously traded in a strong bullish structure, but the recent sell-off marked a clear market structure shift (MSS) on the H4 timeframe.

The impulsive decline swept sell-side liquidity below prior consolidation zones, a typical behavior after an extended rally.

Despite the speed of the drop, price is now approaching key support and demand areas, where selling pressure may begin to slow.

This type of move often reflects position reduction and risk-off behavior, not the end of the broader bullish narrative.

🔍 Key Zones to Monitor

Primary Support / Buy Zone: ~4,280 – 4,350

This area represents a strong demand zone where price may stabilize and form a base.

Short-Term Reaction Zone: ~4,450 – 4,500

A zone where price could oscillate during consolidation, suitable for short-term reactions rather than trend trades.

Sell-Side Liquidity Cleared:

The recent drop has already taken liquidity below previous lows, reducing immediate downside pressure.

Upside Rebalance Zones (FVG / Supply):

~4,850 – 4,900

~5,200 – 5,350

These areas are likely to act as resistance during any recovery phase.

🎯 Market Scenarios

Scenario 1 – Controlled Correction (Base Case):

Gold may continue to range or dip modestly into the 4,280–4,350 support zone, allowing the market to complete its liquidity reset. Holding this area would keep the broader bullish structure intact.

Scenario 2 – Recovery After Stabilization:

Once selling pressure is absorbed, price may begin a gradual recovery, targeting the 4,850–4,900 zone first. Acceptance above this level would open the door toward higher resistance areas.

Scenario 3 – Deeper Reset (Lower Probability):

A clean break below the main support would suggest a deeper correction, but at this stage, such a move would still be viewed as corrective within a larger cycle, not a full trend reversal.

🌍 Macro Backdrop (Brief)

The sharp sell-off in gold, silver, equities, and crypto reflects a global deleveraging wave, intensified by rising geopolitical risks and shifting risk sentiment. In such environments, gold often experiences short-term drawdowns, even as its longer-term role as a hedge remains intact.

This reinforces the idea that the current move is more about resetting positioning than changing long-term direction.

🧠 Lana’s View

Gold is not in a hurry.

After a powerful run, the market often needs to pause, rebalance, and absorb liquidity before the next meaningful expansion.

Lana remains patient, focusing on how price behaves around key H4 support zones, rather than reacting emotionally to volatility.

✨ Let the correction do its work. Structure will guide the next move.

Tradinggoldview

XAUUSD – Brian | H2 Technical AnalysisXAUUSD – Brian | H2 Technical Outlook – Consolidation & Range-Building Phase

After the recent sharp sell-off, gold is now transitioning into a consolidation phase on the H2 timeframe. The strong bearish impulse has slowed, and current price action suggests the market is shifting from directional movement into range-building and accumulation, rather than continuing lower immediately.

This type of behavior is typical after aggressive volatility, as the market reassesses value and balances supply and demand.

Market Structure & Current Behavior

Structurally, price has broken below the prior bullish leg and is now trading within a defined value range:

Selling pressure has eased following the downside expansion.

Price is rotating around the VAL and lower value areas, indicating acceptance rather than rejection.

Momentum is no longer impulsive, pointing to sideways development rather than trend continuation.

As long as price remains inside this value range, range trading conditions dominate.

Key Value & Liquidity Zones Upper Resistance / Supply

Sell Liquidity: 5,330

Sell Zone POC: 5,045

These zones act as overhead supply where upside attempts may be capped during consolidation.

Lower Support / Demand

VAL zone

Buy scalping POC: 4,673

This lower area represents short-term demand, where downside moves are more likely to stall during the accumulation phase.

Intraday Expectation

For today’s session:

Primary expectation: Sideways consolidation within the established range

Price is likely to rotate between value extremes rather than trend strongly

Breakouts require clear acceptance above resistance or below support to shift bias

Until such acceptance occurs, patience and range awareness are more effective than directional conviction.

Key Takeaway

After strong volatility, markets often pause to rebuild structure. For now, gold appears to be absorbing orders and forming balance, making consolidation the higher-probability scenario.

Refer to the chart for highlighted value zones and projected range behavior.

✅ Follow the TradingView channel to receive early market structure updates and intraday outlooks.

XAUUSD – D1 Mid-Term AnalysisXAUUSD – D1 Mid-Term Outlook: Volatility Reset Before the Next Structural Move | Lana ✨

Gold has just experienced a sharp and aggressive sell-off from the highs, marking a clear shift from expansion into a volatility reset phase. While the broader bullish trend has not been fully invalidated, price action now suggests the market is entering a medium-term rebalancing process, where liquidity and structure will play a decisive role.

At this stage, the focus moves away from short-term noise and toward key daily levels that will define the next swing direction.

📈 Higher-Timeframe Structure (D1)

The strong vertical rally has been followed by a deep corrective candle, indicating distribution and profit-taking at premium levels.

Price has broken below short-term momentum support but is still trading above major higher-timeframe trend structure.

This behavior is typical after an extended rally, where the market needs time to absorb supply and reset positioning before choosing the next medium-term direction.

The current structure favors range development or a corrective swing, rather than immediate continuation to new highs.

🔍 Key Daily Zones to Watch

Major Resistance Zone: ~5400 – 5450

This area represents strong overhead supply. Any recovery into this zone is likely to face selling pressure and should be treated as a reaction zone, not a breakout zone.

Strong Liquidity Level: ~5100

A key magnet for price. Acceptance above or rejection below this level will heavily influence medium-term bias.

Sell-Side Liquidity Zone: ~4680 – 4700

This is a critical downside target where stops and unfilled liquidity are resting.

High-Liquidity Buy Zone: ~4290

A major higher-timeframe demand area. If price reaches this zone, it would complete a deep correction within the broader bullish cycle and open the door for medium-term accumulation.

🎯 Medium-Term Trading Scenarios

Scenario 1 – Corrective Recovery, Then Sell Pressure (Primary):

Price may attempt a rebound toward 5100 or even the 5400–5450 resistance zone. As long as price remains below this resistance, rallies are more likely to be corrective, offering opportunities to reassess shorts or reduce long exposure.

Scenario 2 – Continuation of the Correction:

Failure to reclaim 5100 increases the probability of a continued move lower toward 4680–4700, where sell-side liquidity is resting.

Scenario 3 – Deep Reset and Structural Buy:

If downside momentum accelerates, a move toward the 4290 high-liquidity zone would represent a full medium-term reset. This area is where stronger buyers may re-enter and where the next swing-long narrative could begin to form.

🌍 Market Context (Medium-Term View)

Such sharp daily moves often occur during periods of macro repricing and sentiment shifts, forcing the market to rebalance expectations. In these environments, gold tends to oscillate between liquidity zones, rather than trend cleanly in one direction.

This makes patience and level-based execution more important than prediction.

🧠 Lana’s Perspective

The market is no longer in a “buy-every-dip” phase.

This is a transition environment, where gold needs to finish its liquidity work before the next sustained move develops.

Lana stays neutral-to-cautious in the medium term, focusing on reactions at daily liquidity zones, not emotional bias.

✨ Let the structure reset, let liquidity clear, and wait for the market to show its hand.

XAUUSD (H4) – Liam Weekly ForecastXAUUSD (H4) – Liam Weekly Outlook

Uptrend under pressure, but not broken | Focus on retests and reactions

Quick summary

Gold has experienced a sharp corrective move after an extended bullish run. The recent sell-off has broken the steep short-term uptrend, but price has not confirmed a full trend reversal on H4.

At this stage, the market is transitioning into a rebalancing phase. For the coming week, the edge is not in predicting direction, but in trading reactions at key structure, Fibonacci, and FVG levels.

Market structure overview

The prior bullish trend has lost momentum after a vertical expansion.

Price has broken below the aggressive trendline, signaling trend exhaustion, not automatic reversal.

Current price action suggests a corrective structure with potential for range development or trend resumption after liquidity is rebalanced.

➡️ Bias remains neutral-to-bullish, conditional on how price reacts at key levels.

Key technical zones for the week

Primary buy-on-retest zone: trendline retest area around 4850 – 4900

This area has already shown reaction and acts as the first decision point for buyers.

Fibonacci 0.618 / key reaction zone: 5030 – 5050

A pivotal mid-range level. Acceptance above favors continuation; rejection keeps price corrective.

FVG + Fibonacci confluence: 5235 – 5260

This is a major imbalance zone. If price rallies into this area, expect strong reaction and two-sided trade.

Lower liquidity / value zone: 4540 area

This remains the deeper downside objective if higher levels fail to hold and the correction expands.

Weekly scenarios (Liam style: trade the level)

Scenario A – Trendline retest holds (bullish continuation)

If price continues to hold above the trendline retest zone and builds higher lows:

Look for bullish continuation toward 5030 → 5235

Break and acceptance above the FVG zone would reopen upside continuation potential.

Logic: This confirms the move as a healthy correction within a broader bullish structure.

Scenario B – Rejection from mid-range (extended correction)

If price fails to reclaim and hold above 5030 – 5050:

Expect choppy, corrective price action

Risk shifts toward a deeper pullback into 4540

Logic: Failure to hold the 0.618 zone keeps the market in rebalancing mode.

Scenario C – FVG test and rejection

If price rallies aggressively into 5235 – 5260:

This zone favors reaction and profit-taking

Acceptance above is required for any sustained bullish continuation.

Logic: FVG zones after strong sell-offs often act as distribution or reaction points before direction is decided.

Key notes for the week

Volatility remains elevated after the sell-off — expect false breaks.

Avoid mid-range trades without confirmation.

Let price prove acceptance or rejection at levels before committing.

This is a week for patience and execution, not conviction.

Weekly focus:

Will gold hold the trendline retest and rebuild higher, or fail at the 5030–5050 zone and rotate deeper into value?

— Liam

XAUUSD – Brian | 30M – Value Shift AfterXAUUSD – Brian | 30M – Value Shift After a Sharp Volatility Move

Gold has just experienced a significant volatility event, with price selling off aggressively from the highs before rebounding sharply. The market is now trading around a newly formed value area, a typical behavior when price transitions from expansion into a rebalancing phase. In this environment, value and POC levels tend to guide price more effectively than individual candles.

Macro Context (Brief)

Market sentiment remains sensitive to macro risks, including commodity volatility, geopolitical tensions, and monetary policy expectations. Gold ETF holdings have shown no meaningful change recently, suggesting no clear signs of institutional liquidation. The current volatility therefore appears more consistent with a positioning adjustment rather than a broader trend reversal.

Technical Analysis from the Chart (30M)

Following the sharp sell-off, price is now forming a well-defined trading range, with value areas acting as key reference points:

1) Upper Supply / Reaction Zones

POC – SELL: 5,531–5,526

The previous high-value zone, where selling pressure may re-emerge if price retraces higher.

Sell VAH: 5,365–5,369

The value area high, typically a reaction zone if distribution pressure remains present.

2) Current Balance Area

The 5,180–5,200 region is currently acting as a balancing zone after the volatility. Acceptance and consolidation above this area would increase the probability of a move back towards the VAH.

3) Lower Demand / Support Zones

POC Buy (scalping): 5,187

A short-term support area for technical reactions.

Buy VAL – Support: 5,058–5,064

The most important lower support zone. If a deeper liquidity sweep occurs, this area is likely to attract attention for potential absorption and short-term reversal.

Price Scenarios (Structure-Based)

Scenario A (Preferred if value holds):

Price holds above 5,180–5,200 → recovery towards 5,365–5,369 (VAH).

Scenario B (Rejection from above):

Price retraces into the VAH zone but faces clear rejection → rotation back towards the 5,187 / 5,180 area.

Scenario C (Deeper liquidation):

Loss of 5,180 → liquidity sweep into 5,058–5,064 (VAL) before attempting to rebuild.

Key Takeaway

In a rebalancing phase, value acceptance matters more than directional prediction. Focus on how price behaves around 5,180–5,200, the reaction at 5,365–5,369, and whether deeper support at 5,058–5,064 attracts meaningful buying interest.

Refer to the chart for detailed POC, VAH and VAL levels.

Follow the TradingView channel to receive early structure insights and join the discussion.

XAUUSD – M45 Tech AnalysisXAUUSD – M45 Technical Outlook: Strong Momentum, Now Watch Liquidity Reactions | Lana ✨

Gold has surged above $5,250, extending its buying position with strong momentum. Price action remains constructive, but as the market pushes deeper into premium territory, liquidity reactions become more important than raw momentum.

📈 Market Structure & Price Action

Gold continues to trade inside a well-defined ascending channel, confirming a strong bullish structure.

Multiple BOS (Break of Structure) points on the chart highlight persistent buyer control.

The recent leg higher was aggressive, indicating momentum-driven buying, but also increasing the likelihood of short-term reactions.

At current levels, the market is extended above value, which often precedes either consolidation or a controlled pullback.

🔍 Key Technical Zones on M45

Upper Supply / Reaction Zone: 5280 – 5310

This area represents a premium zone where price may face profit-taking or liquidity sweeps before choosing direction.

Immediate Support (Channel Mid / Retest Zone): 5200 – 5220

A key area where price could pull back and attempt to hold structure.

Strong Sell-Side Liquidity Zone: around 5050

Marked clearly on the chart, this is a deeper level where liquidity is resting and where stronger buyer reactions could emerge if the pullback extends.

As long as price remains inside the channel, the broader bullish bias stays intact.

🎯 Trading Scenarios

Scenario 1 – Extension With Caution:

If price continues higher into the 5280–5310 zone, expect increased volatility and potential short-term rejection. This area is better suited for risk management and observation, not aggressive chasing.

Scenario 2 – Healthy Pullback (Preferred):

A pullback toward 5200–5220 would allow price to rebalance liquidity while maintaining structure. Holding this zone supports continuation within the channel.

Scenario 3 – Deeper Liquidity Sweep:

If volatility expands, a move toward the ~5050 sell-side liquidity zone could occur before a stronger continuation leg develops.

🌍 Market Context (Brief)

Gold’s sharp move above $5,250 reflects ongoing demand for safe-haven assets amid persistent macro and geopolitical uncertainty. Strong daily gains reinforce bullish sentiment, but such vertical moves also tend to attract short-term profit-taking, making structure and liquidity levels critical.

🧠 Lana’s View

The trend is bullish, but not every bullish move is a buy.

At extended levels, Lana focuses on how price reacts at liquidity zones, not on chasing momentum.

✨ Respect the structure, stay patient near extremes, and let the market come to your levels.

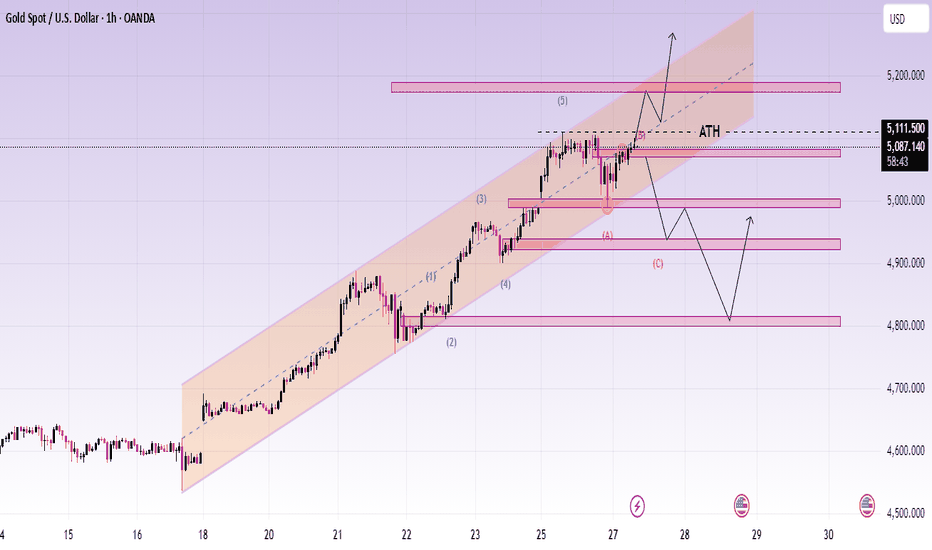

XAUUSD (H1) – Liam Plan (Jan 27) Bullish TrendQuick summary

Gold is still trending higher inside a clean rising channel, but price is now approaching a weak high / liquidity pocket where stop-runs are likely.

Macro backdrop adds fuel for volatility: reports suggest the US is pressuring Ukraine toward territorial concessions as part of peace talks — this kind of uncertainty often keeps safe-haven demand supported, but it can also create fast spikes + fake breaks.

➡️ Today’s rule: follow the uptrend, but only buy at liquidity test points. No chasing highs.

1) Macro context (why spikes are likely)

If markets start pricing a forced compromise in the Ukraine conflict:

risk sentiment can swing quickly,

headlines can trigger instant pumps, then sharp retraces.

✅ Safe approach: let price hit your zones first, then trade the reaction — not the headline.

2) Technical view (H1 – based on your chart)

Price is respecting an ascending channel and building liquidity around key levels.

Key levels (from the chart):

✅ Support / buy liquidity zone: 4,995 – 5,000

✅ Flip / reaction zone: 5,047

✅ Upper resistance / supply: 5,142

✅ Weak High / liquidity target: 5,192.6

✅ Extension target (1.618): 5,240.8

Bias stays bullish while inside the channel, but near 5,192–5,240 we should expect liquidity sweep → pullback behavior.

3) Trading scenarios (Liam style: trade the level)

A) BUY scenarios (priority – trend continuation)

A1. BUY the pullback into the flip zone (cleanest R:R)

✅ Buy: 5,045 – 5,050 (around 5,047)

Condition: hold + bullish reaction (HL / rejection / MSS on M15)

SL (guide): below 5,030 (or below the reaction low)

TP1: 5,085 – 5,100

TP2: 5,142

TP3: 5,192.6

Logic: This is the best “trend-following” entry — buy support, sell into liquidity above.

A2. BUY deep liquidity sweep (only if volatility hits)

✅ Buy: 4,995 – 5,000

Condition: sweep + strong reclaim (fast rejection / displacement up)

SL: below 4,980

TP: 5,047 → 5,142

Logic: This is the strongest liquidity test zone on your chart — ideal for a bounce if price flushes.

B) SELL scenarios (secondary – reaction scalps only)

B1. SELL the weak high sweep (tactical scalp)

✅ If price runs 5,192.6 and shows rejection:

Sell: 5,190 – 5,200

SL: above the sweep high

TP: 5,142 → 5,085

Logic: Weak highs often get swept first. Great for quick mean reversion back into the channel.

B2. SELL extension (highest-risk, but best location)

✅ Sell zone: 5,235 – 5,245 (around 5,240.8)

Only with clear weakness on M15–H1

TP: 5,192 → 5,142

Logic: 1.618 extension is a common exhaustion pocket — don’t short early, short the reaction.

4) Key notes

Don’t trade mid-range between 5,085–5,142 unless you’re scalping with tight rules.

Expect false breakouts near 5,192 and 5,240 during headlines.

Best execution today = buy support, take profits into liquidity.

Question:

Are you buying the 5,047 pullback, or waiting for the 5,192 sweep to sell the reaction?

— Liam

XAUUSD - H1 Gold structurally bullishXAUUSD – H1 Gold remains structurally bullish near all-time highs| Lana ✨

Gold is extending its bullish momentum for a second consecutive session and continues to trade near all-time highs. Price action remains constructive, with the market holding above key structure while deciding between continuation or a deeper pullback into value.

📈 Market Structure & Trend Context

The short-term and medium-term structure remains bullish, with price respecting the ascending channel.

The recent push above previous highs confirms strong demand, but current price action also shows signs of consolidation near ATH.

This behavior is typical after an impulsive rally, where the market pauses to build acceptance or rebalance liquidity before the next directional move.

As long as price holds above the rising structure, the bullish thesis remains valid.

🔍 Key Technical Zones to Watch

ATH Reaction Zone: 5080 – 5110

This is a sensitive area where price may consolidate, fake out, or briefly reject before choosing direction.

Primary Pullback / Buy Zone: 5000 – 5020

A key structural level aligned with prior resistance-turned-support and the midline of the bullish channel.

Secondary Support (Deeper Pullback): 4920 – 4950

A stronger value area if volatility increases or liquidity is swept below the channel.

Upside Expansion Zone: 5180 – 5200+

If price accepts above ATH, this becomes the next upside objective within the channel.

🎯 Trading Scenarios (H1 Structure-Based)

Scenario 1 – Continuation Above ATH:

If price consolidates above 5080–5110 and shows acceptance, gold may extend toward 5180–5200. This scenario favors patience and confirmation rather than chasing immediate breakouts.

Scenario 2 – Pullback Into Structure (Preferred):

A pullback toward 5000–5020 would allow the market to rebalance liquidity and offer a higher-quality continuation setup. Holding this zone keeps the bullish structure intact.

Scenario 3 – Deeper Correction:

If price loses the primary support, the 4920–4950 zone becomes the next key area to watch for buyer response and trend defense.

🌍 Macro Context (Brief)

Gold continues to benefit from heightened geopolitical risks and ongoing trade uncertainty, reinforcing its role as a safe-haven asset.

At the same time, market attention is shifting toward the outcome of the two-day FOMC policy meeting on Wednesday, which may introduce volatility and short-term repricing.

This backdrop supports gold structurally, while also increasing the likelihood of sharp intraday swings around key levels.

🧠 Lana’s View

Gold remains bullish, but near ATH levels, discipline matters more than conviction.

Lana prefers buying pullbacks into structure, letting price confirm, and avoiding emotional trades during headline-driven volatility.

✨ Respect the structure, stay patient near the highs, and let the market come to your levels.

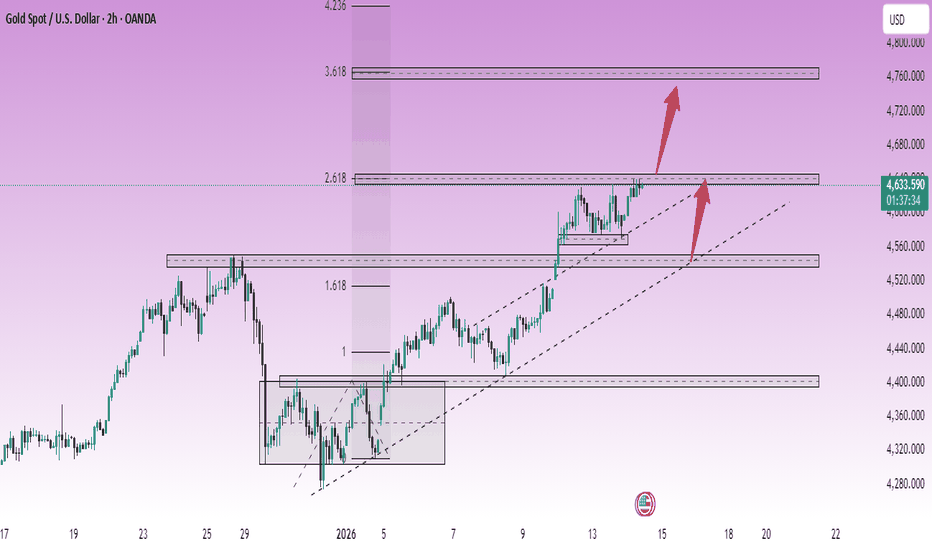

XAUUSD (H2) – Liam Weekly Risk StrategyXAUUSD (H2) – Liam Weekly Risk Plan

Late-stage rally into macro risk | Sell premium, buy liquidity only

Quick summary

Gold continues to push higher, driven by escalating geopolitical and macro risk:

🇺🇸🇮🇷 US–Iran tensions remain elevated

🏦 FOMC: ~99% Fed holds rates, with a high chance of hawkish guidance from Powell

🇺🇸 US government shutdown risk later this week

This is a classic environment for headline spikes and liquidity grabs. Price is now trading at premium levels, so the edge shifts to reaction trading, not chasing strength.

Macro context (supportive, but dangerous to chase)

Geopolitical stress keeps safe-haven demand alive.

A hawkish Fed message can trigger sharp USD/yield reactions, even if rates are unchanged.

Government shutdown headlines often produce fast whipsaws, not clean trends.

➡️ Conclusion: volatility will increase, but direction will be decided at liquidity levels — not by the news itself.

Technical view (H2 – based on the chart)

Gold is in a strong bullish structure, but price has entered a late-stage expansion after multiple impulsive legs.

Key levels from the chart:

✅ Major SELL zone (premium / exhaustion): 5155 – 5234

✅ Current impulsive high area: ~5060

✅ Buy-side liquidity (already built): 4700 – 4800

✅ Sell-side liquidity / value zone: 4550 – 4600

The structure suggests a high probability path: push higher to clear buy-side liquidity → rotate lower into sell-side liquidity.

Trading scenarios (Liam style: trade the level)

1️⃣ SELL scenarios (priority – distribution at premium)

A. SELL at premium extension (primary idea)

✅ Sell zone: 5155 – 5234

Condition: rejection / loss of momentum on M15–H1

SL: above the high

TP1: 5000

TP2: 4800

TP3: 4600 (sell-side liquidity)

Logic: This zone represents late buyers and FOMO entries. Ideal area for distribution and mean rotation, especially during macro headlines.

B. SELL failed continuation

✅ If price spikes above 5060 but fails to hold (fake breakout):

Sell on lower-TF breakdown

TP: 4800 → 4600

Logic: Headline-driven spikes often fail after liquidity is taken.

2️⃣ BUY scenario (secondary – value only)

BUY only at sell-side liquidity

✅ Buy zone: 4550 – 4600

Condition: liquidity sweep + strong bullish reaction

TP: 4800 → 5000+

Logic: This is the first area where long-term buyers regain R:R advantage. No interest in buying above value.

Key notes for the week

Expect false breaks around FOMC.

Reduce size during Powell’s speech.

Avoid mid-range entries between 4800–5000.

Patience pays more than prediction.

What’s your bias this week: selling the 5155–5234 premium zone, or waiting for a deeper pullback into 4600 liquidity before reassessing?

— Liam

XAUUSD – H1 Outlook: New All-Time HighXAUUSD – H1 Outlook: New ATH, Now Watch the Pullback Structure | Lana ✨

Gold has printed fresh all-time highs and is now trading near the $5,100 psychological area. After six consecutive bullish sessions, the trend is still strong — but at these levels, the market often needs a controlled pullback to rebalance liquidity before the next expansion.

📌 Quick Summary

Trend: Bullish (strong momentum, new ATH)

Timeframe: H1

Focus: Don’t chase highs → wait for pullback into structure

Key idea: Pullback → hold support → continuation toward upper supply

📈 Market Structure & Price Action

Price is moving inside a bullish expansion leg, and the current area is a typical “extended” zone where volatility can increase.

A pullback toward the first clean structural support is healthy and often needed after a steep rally.

As long as price holds above key supports, the bias remains continuation, not reversal.

🔍 Key Zones From the Chart

1) Upper Supply / Profit-taking Area

5100–5130 (approx.)

This is the area where price is likely to face selling pressure / profit-taking, especially after a vertical rally.

2) Primary Support (Pullback Buy Zone)

5000–5020

This is the most important “structure retest” area on the chart — a logical zone for price to rebalance before continuation.

3) Deeper Value Zone (If Pullback Extends)

4750–4800 (Fibo value cluster on chart)

If the market pulls deeper, this becomes the more attractive value zone to watch for stronger reactions.

4) Major Demand Zone (Extreme Support)

4590–4630 (lower purple demand area)

This is a deeper base zone if the market shifts into a larger correction.

🎯 Trading Scenarios (Structure-Based)

✅ Scenario A (Primary): Buy the Pullback Into Structure

Buy Entry: 5005 – 5015

SL: 4995 – 5000 (8–10 points below entry)

TP Targets (scale out):

TP1: 5065 – 5075 (retest of recent high)

TP2: 5100 (psychological milestone)

TP3: 5125 – 5135 (upper supply / extension zone)

TP4: 5150+ (if breakout accepts)

Idea: Let price come back to support, confirm, then ride the trend — no chasing.

✅ Scenario B (Alternative): Deeper Pullback Into Value

If price fails to hold 5000–5020 and dips deeper:

Buy Entry: 4760 – 4790

SL: 4750 – 4755

TP Targets:

TP1: 4900

TP2: 5000

TP3: 5100

TP4: 5125 – 5135

🌍 Macro Context (Short & Relevant)

Gold’s upside momentum is being supported by:

Safe-haven flows amid ongoing geopolitical and trade uncertainty

Expectations of further Fed easing

Continued central bank buying

Strong inflows into ETFs

This backdrop helps explain why pullbacks are more likely to be profit-taking and positioning, not a structural trend change.

✨ Lana’s View

Gold is bullish — but the best trades usually come from patience, not excitement.

At ATH levels, Lana prefers buying pullbacks into structure, scaling out into targets, and letting the market do the work.

Part 2 Institutional Trading Vs. Technical AnalysisWhat Is an Option Contract?

An option contract is a legal agreement that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period.

Each option contract has four essential components:

Underlying Asset – Stock, index, commodity, currency, etc.

Strike Price – The price at which the underlying can be bought or sold.

Expiration Date – The date when the option contract expires.

Premium – The price paid by the option buyer to the seller (writer).

There are two parties in every option trade:

Option Buyer (Holder) – Pays the premium, has rights.

Option Seller (Writer) – Receives the premium, has obligations.

XAUUSD (H4) – Liam Buying StrategyXAUUSD (H4) – Liam Continuation Plan

Trend remains strong, but price is extended | Buy pullbacks, not highs

Quick summary

Gold continues to trade firmly within a strong bullish structure. Macro pressure on safe-haven demand has eased slightly as US–EU geopolitical and trade tensions cool, while rising oil prices (supported by Saudi Aramco’s demand outlook) keep inflation expectations alive.

Despite the bullish trend, price is currently extended near the upper range, so execution today should focus on buying pullbacks at structure, not chasing breakouts.

Macro context (supportive, but less explosive)

Reduced geopolitical friction between the US and Europe has eased panic-driven flows.

Oil prices pushing higher keeps inflation expectations sticky, limiting downside pressure on gold.

USD remains relatively stable (USD/CAD holding firm), suggesting gold strength is structure-driven rather than pure fear trade.

➡️ Conclusion: trend-friendly environment, but volatility is now more technical than headline-driven.

Technical view (H4 – based on the chart)

Gold is respecting a clean ascending trendline, with impulsive legs followed by shallow pullbacks.

Key levels from the chart:

✅ Upper extension / continuation target: 5000+ zone

✅ Bullish continuation buy zone: 4580 – 4620 (previous breakout + fib support)

✅ Trendline support: dynamic (ascending)

✅ Deeper correction support: 4400 – 4450

Price is currently trading above the 1.618 fib expansion, which increases the probability of short-term consolidation or pullback before continuation.

Trading scenarios (Liam style: trade the level)

1️⃣ BUY scenarios (priority – trend continuation)

A. BUY pullback into structure (preferred setup)

✅ Buy zone: 4580 – 4620

Condition: hold above trendline + bullish reaction on M15–H1

SL: below structure / trendline

TP1: recent high

TP2: 4900

TP3: extension toward 5000+

Logic: This zone aligns with prior resistance turned support and fib retracement — a higher-probability continuation entry than buying highs.

B. BUY deeper dip (only if volatility increases)

✅ Buy zone: 4400 – 4450

Condition: strong rejection / liquidity sweep

TP: 4580 → 4800+

Logic: This is the last clean structural support within the current trend. A dip here would likely be corrective, not trend-ending.

2️⃣ SELL scenario (counter-trend, tactical only)

❌ No swing SELL bias while price holds above the ascending trendline. Shorts only make sense as very short-term scalps at highs with clear lower-TF rejection.

Key notes

Strong trends punish impatience — wait for pullbacks.

Avoid entries mid-leg after impulsive candles.

If price accelerates vertically without retrace, stand aside.

What’s your approach: waiting for the 4580–4620 pullback to join the trend, or staying flat until a deeper correction toward 4450?

— Liam

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Liquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD – Trend-Following StrategyXAUUSD – Trend-Following Plan: Prefer Buying the Dip (H1)

Gold is still holding a bullish short-term structure with higher highs and higher lows. The recent push up shows buyers are in control, so my main focus is NOT chasing price, but waiting for a clean pullback into key support to join the trend with controlled risk.

🎯 MAIN SCENARIO – BUY THE DIP (Priority)

Buy Zone: 4687 – 4690

Stop Loss: Below 4655

Take Profits:

TP1: 4735 – 4745

TP2: 4780

TP3: 4804 – 4808

Why this zone?

4687–4690 is the key area highlighted on the chart as a major level. After price pushed above it, this zone can act as new support (previous resistance becomes support). If price retests and holds with clear rejection (wicks, bullish engulfing, strong bounce), this is the higher-probability buy location in line with the trend.

🔁 SECONDARY SCENARIO – DEEP BUY AT LIQUIDITY / IMBALANCE

Buy Zone: 4620 – 4600 (Liquidity Imbalance area)

Stop Loss: Below 4575

Take Profits:

TP1: 4687

TP2: 4735

TP3: 4780+

Why this zone?

The chart shows a clear liquidity imbalance below price that has not been fully filled. If the market performs a deeper sweep (stop-hunt / flush), this zone becomes a strong candidate for a trend continuation buy with better R:R.

📊 TECHNICAL VIEW (What the chart is telling us)

Price is still trading within a bullish structure and respecting the rising trendline.

The latest impulse up suggests active demand, not just a weak drift.

The most logical approach is to let price come to you: buy support, not breakout candles.

The upside magnet remains the 4804–4808 area, which is also the next major reaction zone.

🌍 MACRO CONTEXT (Keep it simple)

Gold remains supported in the broader environment where risk sentiment can shift quickly.

Unless USD strength returns aggressively, pullbacks are more likely to be bought than to start a full bearish reversal.

That’s why the plan stays trend-following: wait for dips and execute with discipline.

🧠 EXECUTION RULES (Discipline > Opinions)

No FOMO buys at extended highs.

Only take the trade inside the planned zones and only with confirmation.

Risk per trade stays controlled (1–2% max). If the idea is wrong, cut it fast and reassess—no “hope trading.”

📌 SUMMARY

Bias: Bullish (H1)

Strategy: Buy the dip at 4687–4690, or deeper at 4620–4600

Targets: 4735–4745 → 4780 → 4804–4808

If you want, I can also rewrite this in a shorter TradingView-post style (more punchy, fewer words) while keeping the same levels and rules.

XAUUSD – Intraday retracementXAUUSD – Intraday Pullback & Continuation Setup | Lana ✨

Gold is entering a technical correction phase after testing the ATH zone, while the medium-term bullish structure remains intact. Today’s move looks more like a controlled pullback to rebalance liquidity, not a trend reversal.

📉 Current Price Behaviour

Price has reacted from the ATH supply zone, forming a short-term lower high.

The market is currently testing the rising trendline, which is a key dynamic support in this bullish cycle.

As long as price holds above structural support, the broader bias stays bullish.

This correction is technically healthy after a strong impulsive leg.

🔑 Key Technical Zones to Watch

Sell test / rejection zone: ATH area

Short-term sellers are active here, causing the current pullback.

Buy zone 1: 4495 – 4498

A former value level and trendline confluence zone, suitable for reaction buys.

Buy zone 2: 4442 – 4446

Stronger support and deeper liquidity area if the pullback extends.

These zones are where buyers are expected to step back in.

📈 Trading Scenarios

Primary scenario:

Wait for price to complete the pullback into 4495–4498, then look for bullish confirmation to rejoin the trend.

Alternative scenario:

If sell pressure increases, the 4442–4446 zone becomes the key level to watch for stronger buy reactions.

A clean hold above the trendline keeps the upside structure valid, with ATH retest as the next objective.

🌍 Fundamental Context

According to CME FedWatch, the market is pricing in a 95% probability that the Fed keeps interest rates unchanged in January.

The probability of a January rate cut remains very low at 5%.

Expectations for March also lean toward no change, with rate cuts still uncertain.

This reinforces a stable macro backdrop for gold, where pullbacks are more likely to be driven by profit-taking and positioning, rather than a shift in monetary policy.

🧠 Notes

This is a pullback within an uptrend, not a bearish reversal.

Focus on buying value, not chasing highs.

Let price confirm at key zones before entering.

✨ Stay patient, respect the structure, and let the market come to your levels.

XAUUSD – Uptrend remains intactXAUUSD – The uptrend is still intact; we just need that decisive break.

Gold is maintaining a strong bullish momentum within the rising channel, consistently printing higher lows. However, price is now approaching a psychological resistance cluster, so the next move could easily include a sharp shakeout to sweep liquidity before the market commits to direction.

Macro context

In periods where markets are sensitive to news flow and interest-rate expectations, gold often finds support from safe-haven demand. But when price is trading at elevated levels, the optimal approach remains the same: don’t chase candles — only act when price reaches key technical zones.

Technical view (H1)

The primary trend remains bullish, with price respecting the rising trendline.

The current area sits in a “premium” zone (prone to profit-taking / sharp pullbacks).

Two key clusters stand out on the chart:

Near psychological resistance: 4630–4640

Next psychological resistance: 4765 (expanded upside target)

Key levels

Near resistance: 4630–4640

Major resistance: 4760–4765

Support / pivot level: 4540 (previous resistance, now potential support)

Deeper support: 4400 (base zone, only relevant if a strong reversal develops)

Trading scenarios

Scenario 1: Trend BUY (priority)

Condition: Price holds above 4630–4640 and continues forming bullish structure.

Entry: Buy the pullback at 4605–4615

SL: 4595

TP1: 4685–4700

TP2: 4760–4765

This is the cleanest setup: a mild retracement, then continuation with the trend.

Scenario 2: Safer BUY on support retest

If price spikes down to sweep liquidity:

Entry: Buy 4540–4545

SL: 4528

TP: 4630 → 4685 → 4765

4540 is a key line in the sand — as long as it holds, the uptrend stays strong.

Scenario 3: Reaction SELL (short-term only)

Only consider sells if there’s clear rejection at resistance:

Sell: 4760–4765

SL: 4778

TP: 4685 → 4635 → 4540

Or, if price fails to hold 4630–4640 and closes weak:

Sell: 4625–4635

SL: 4650

TP: 4545

Conclusion

The dominant trend remains bullish, but price is pressing into psychological resistance — so execution must be “right level, right reaction.” The priority remains buying with the trend, and only selling if there’s a clean rejection at 4765 or a confirmed failure to hold 4630–4640.

👉 If this plan helps, follow LiamTradingFX for daily XAUUSD updates as early as possible.

Discipline Wins: The Foundation of Consistent Profits for TraderUnderstanding Discipline in Trading

Discipline in trading means the ability to follow a predefined plan regardless of emotions, market noise, or short-term outcomes. It involves executing trades according to rules, managing risk consistently, and accepting losses as a normal part of the process. A disciplined trader does not trade based on excitement, fear, greed, or social influence. Instead, every decision is intentional, measured, and aligned with long-term objectives.

Most traders fail not because their strategy is bad, but because they lack the discipline to execute it properly. They enter early, exit late, increase position size impulsively, or abandon their system after a few losses. Discipline keeps the trader aligned with probability, patience, and process.

Discipline vs. Strategy: Why Discipline Matters More

A common misconception is that success comes from finding the best strategy. In reality, an average strategy executed with strong discipline often outperforms an excellent strategy executed without discipline. Even the most profitable trading systems experience drawdowns. Without discipline, traders interfere with the system during losing phases, destroying its long-term edge.

Discipline ensures consistency in execution. Markets operate on probabilities, not certainties. Only disciplined repetition allows the statistical edge of a strategy to play out over time. Without discipline, randomness dominates results.

Emotional Control: The Core of Discipline

Trading is a psychological game disguised as a financial one. Fear and greed are the two dominant emotions that disrupt discipline. Fear causes traders to exit winning trades too early or avoid valid setups. Greed pushes traders to overtrade, overleverage, or hold positions beyond their logical exit points.

Discipline acts as a shield against emotional decision-making. When traders follow rules instead of emotions, they reduce impulsive behavior. Emotional control does not mean eliminating emotions; it means not acting on them. A disciplined trader feels fear and excitement but still follows the plan.

Risk Management: Discipline in Action

Risk management is where discipline becomes tangible. Consistent traders define their risk before entering a trade and never violate it. This includes setting stop losses, position sizing correctly, and limiting overall exposure.

A disciplined trader understands that capital preservation is more important than profit maximization. One undisciplined trade with excessive risk can wipe out weeks or months of steady gains. By respecting risk limits every time, traders ensure longevity in the market.

Discipline in risk management also means accepting small losses without hesitation. Traders who refuse to take losses often turn small mistakes into catastrophic ones. Discipline turns losses into controlled business expenses rather than emotional failures.

Discipline Creates Consistency, Not Perfection

Consistency in trading does not mean winning every trade. It means producing repeatable behavior and stable performance over time. Discipline ensures that the trader shows up every day with the same mindset, the same rules, and the same respect for the process.

Markets are unpredictable in the short term, but disciplined actions produce predictable results over the long term. This is why professional traders focus more on daily execution quality than on daily profit and loss.

Avoiding Overtrading Through Discipline

Overtrading is one of the biggest account killers. Many traders feel the need to be constantly active, believing that more trades equal more profits. Discipline teaches patience—waiting only for high-quality setups that match predefined criteria.

A disciplined trader understands that not trading is also a trading decision. Sitting out during unclear market conditions protects capital and mental energy. Fewer, well-planned trades often outperform frequent impulsive ones.

Discipline Builds Trust in Yourself

When traders follow their rules consistently, they begin to trust their own process. This self-trust is critical for long-term success. Without it, traders constantly second-guess themselves, jump between strategies, and remain emotionally unstable.

Discipline creates confidence not from winning trades, but from knowing that every action taken was correct according to the plan. Even losing trades feel manageable when they are the result of disciplined execution.

Discipline and Long-Term Thinking

Short-term thinking destroys traders. Focusing on daily profits leads to emotional decisions and unnecessary pressure. Discipline shifts focus toward long-term growth, equity curves, and performance metrics.

Consistent traders treat trading as a business, not a lottery. They measure success in months and years, not hours and days. Discipline aligns actions with long-term sustainability rather than short-term excitement.

Developing Trading Discipline

Discipline is not a talent; it is a skill developed through structure and repetition. Creating a written trading plan, maintaining a trading journal, setting daily rules, and reviewing performance regularly all contribute to stronger discipline.

Routine is a powerful tool. Trading the same markets, at the same time, with the same rules reduces randomness and emotional stress. Discipline grows when actions become habitual rather than reactive.

Discipline Wins in Every Market Condition

Markets change—trending, ranging, volatile, or quiet—but discipline remains constant. Strategies may need adjustment, but disciplined behavior never goes out of style. Traders who rely on discipline adapt calmly, while undisciplined traders panic and overreact.

In volatile markets, discipline prevents emotional blowups. In slow markets, it prevents boredom-driven trades. In winning streaks, it prevents overconfidence. In losing streaks, it prevents revenge trading.

Conclusion: Discipline Is the Real Edge

At its core, discipline is the true competitive advantage in trading. It allows traders to survive uncertainty, manage risk, control emotions, and execute consistently. While indicators, tools, and strategies can be learned by anyone, discipline must be earned through effort and self-awareness.

Consistent profits do not come from predicting the market, but from mastering oneself. Traders who embrace discipline accept that success is built one well-executed decision at a time. In the long run, discipline always wins—because markets reward those who respect process over impulse.

Part 1 Master Candle Stick Patterns Risks in Option Trading

Options require deep understanding. Some risks include:

A. Time Decay (Theta)

Option value reduces every day.

B. Volatility Crush

Premium falls rapidly when volatility decreases (common after events).

C. Low Liquidity

Wider bid–ask spreads can increase trading cost.

D. Large Losses for Sellers

Shorting options without hedges can be very risky.

E. Emotional Trading

High leverage leads to overtrading.

Financial Market Guides1. What Are Financial Markets?

Financial markets are systems that facilitate the buying and selling of financial instruments such as stocks, bonds, currencies, commodities, and derivatives. They connect savers (investors) with borrowers (corporations and governments), enabling efficient allocation of capital. Prices in these markets reflect collective expectations about growth, inflation, risk, and future cash flows.

Financial market guides simplify this complex ecosystem by breaking markets into understandable components, explaining participants’ roles, and highlighting the forces that drive price movements.

2. Purpose of Financial Market Guides

The primary purpose of financial market guides is education and decision support. They help market participants:

Understand market structure and instruments

Analyze risk versus return

Interpret macroeconomic and microeconomic signals

Develop investment or trading strategies

Avoid common behavioral and structural mistakes

For new investors, guides provide foundational literacy. For experienced traders, they offer frameworks to refine strategies and adapt to changing market regimes.

3. Major Types of Financial Markets Covered in Guides

A well-structured financial market guide typically explains the following core markets:

a. Equity Markets

Equity markets involve the trading of company ownership through shares. Guides explain concepts such as market capitalization, earnings, valuation ratios, sector rotation, and corporate actions. They also cover different styles like growth, value, dividend, and momentum investing.

b. Fixed Income Markets

Bond markets focus on debt instruments issued by governments and corporations. Financial guides explain interest rates, yield curves, credit risk, duration, and how monetary policy impacts bond prices. Fixed income is often highlighted as a stabilizing force in portfolios.

c. Foreign Exchange (Forex) Markets

Forex markets determine currency values and are the most liquid markets globally. Guides explain exchange rate mechanisms, currency pairs, central bank policies, and global capital flows. Forex is often linked closely with trade balances and macroeconomic stability.

d. Commodity Markets

Commodity markets include energy, metals, and agricultural products. Guides explain supply-demand cycles, geopolitical influences, inflation hedging, and the concept of commodity supercycles.

e. Derivatives Markets

Derivatives such as futures, options, and swaps derive value from underlying assets. Financial market guides emphasize their dual role—risk management (hedging) and speculation—while also warning about leverage-related risks.

4. Market Participants Explained

Financial market guides clearly define who participates in markets and why:

Retail Investors: Individuals investing personal capital

Institutional Investors: Mutual funds, pension funds, insurance companies

Hedge Funds & Prop Traders: Focused on alpha generation

Central Banks: Manage monetary policy and financial stability

Corporations: Raise capital and hedge risks

Understanding participant behavior helps explain liquidity, volatility, and price trends.

5. Role of Macroeconomics in Financial Market Guides

One of the most critical elements of any financial market guide is macroeconomic analysis. Markets do not move in isolation—they respond to:

GDP growth

Inflation trends

Interest rate changes

Employment data

Fiscal and monetary policy

Guides often explain economic cycles (expansion, peak, recession, recovery) and how different asset classes perform across these phases. This macro lens is essential for long-term investing and global asset allocation.

6. Risk Management and Capital Preservation

Financial market guides emphasize that risk management is more important than returns. Common risk concepts include:

Market risk

Credit risk

Liquidity risk

Leverage risk

Behavioral risk

Guides explain tools such as diversification, position sizing, stop losses, asset allocation, and hedging strategies. The core message is clear: survival comes first, profits come second.

7. Behavioral Finance and Psychology

Modern financial market guides increasingly incorporate behavioral finance. Human emotions—fear, greed, overconfidence, and panic—often drive irrational decisions. Guides help readers recognize cognitive biases such as:

Herd mentality

Loss aversion

Confirmation bias

Recency bias

By addressing psychology, financial market guides aim to improve discipline, consistency, and long-term performance.

8. Trading vs. Investing Frameworks

Financial market guides clearly distinguish between trading and investing:

Trading: Short- to medium-term, price-driven, timing-focused

Investing: Long-term, value-driven, fundamentals-focused

Guides explain various styles such as swing trading, position trading, day trading, and index investing, helping participants choose approaches aligned with their capital, time availability, and risk tolerance.

9. Importance of Market Cycles and Regimes

Markets move in cycles, not straight lines. Financial market guides teach readers how to identify:

Bull and bear markets

High-volatility vs. low-volatility regimes

Risk-on and risk-off environments

Recognizing these regimes helps investors adjust strategies instead of applying one-size-fits-all approaches.

10. Technology, Data, and Modern Markets

Contemporary financial market guides also cover the impact of technology:

Algorithmic and high-frequency trading

Data analytics and quantitative models

Online trading platforms

Artificial intelligence and machine learning

Technology has improved access and efficiency but has also increased competition and speed, making education even more critical.

11. Long-Term Value of Financial Market Guides

The true value of financial market guides lies not in predicting markets, but in building a structured mindset. They teach participants how to think probabilistically, manage uncertainty, and continuously adapt. Markets evolve, but core principles—risk, cycles, discipline, and valuation—remain constant.

For individuals aiming to build wealth, protect capital, or pursue professional trading, financial market guides act as enduring references that grow more valuable with experience.

Conclusion

Financial market guides are essential tools for navigating the complexity of global finance. They combine theory, practical frameworks, and real-world insights to help participants understand how markets function, why prices move, and how risks can be managed. In an environment defined by uncertainty and constant change, a strong foundation built through financial market guides is one of the most powerful advantages any market participant can possess.

Whether you are an investor, trader, student, or professional, mastering the concepts outlined in financial market guides is a critical step toward long-term success in the financial world.

Global Macro Trading: Profits from Big Economic TrendsGlobal macro trading is one of the most intellectually demanding and wide-ranging approaches in financial markets. Unlike strategies that focus on individual stocks or short-term price patterns, global macro trading is built around understanding large-scale economic, political, and monetary forces that shape asset prices across the world. Traders operating in this domain attempt to anticipate how changes in interest rates, inflation, currencies, geopolitics, and global growth cycles will influence markets and then position themselves accordingly across multiple asset classes.

At its core, global macro trading seeks to answer a simple but powerful question: How will major economic events and policy decisions affect global financial markets? The answers, however, require deep analysis, patience, and the ability to manage risk in an uncertain and constantly evolving environment.

Foundations of Global Macro Trading

Global macro trading emerged prominently in the late 20th century, especially through hedge funds that capitalized on major macroeconomic shifts. Legendary investors such as George Soros demonstrated how identifying structural imbalances—such as unsustainable currency pegs or misaligned interest rate policies—could lead to outsized profits. The famous trade against the British pound in 1992 is often cited as a classic example of global macro thinking in action.

The foundation of global macro trading lies in macroeconomics. Traders analyze economic indicators such as GDP growth, inflation rates, employment data, trade balances, and fiscal deficits. Central bank policies play a particularly crucial role, as interest rate decisions, quantitative easing, and liquidity conditions directly influence currencies, bonds, equities, and commodities.

Asset Classes Used in Global Macro Trading

One of the defining features of global macro trading is its flexibility across asset classes. A global macro trader is not restricted to equities alone. Instead, positions may be taken in:

Currencies (Forex): Often the most active arena for global macro traders, as exchange rates respond quickly to interest rate differentials, capital flows, and geopolitical developments.

Fixed Income (Bonds): Government bond yields reflect inflation expectations, monetary policy, and economic growth, making them central to macro views.

Equities and Equity Indices: Used to express views on economic expansion, recession risks, or sector-level impacts of macro policies.

Commodities: Assets like oil, gold, and agricultural products are influenced by inflation, supply shocks, geopolitical tensions, and global demand cycles.

Derivatives: Futures, options, and swaps are frequently used to gain leveraged exposure or hedge risks efficiently.

This multi-asset approach allows global macro traders to construct diversified portfolios that reflect a coherent macro thesis.

Top-Down Analytical Approach

Global macro trading follows a top-down approach. Traders begin with the global economy, then narrow their focus to regions, countries, and finally specific instruments. For example, a trader might believe that rising inflation in the United States will force the Federal Reserve to maintain higher interest rates for longer. This macro view could translate into a stronger U.S. dollar, pressure on emerging market currencies, falling bond prices, and sector rotation within equity markets.

Such analysis requires synthesizing information from multiple sources: economic data releases, central bank statements, political developments, and even demographic and technological trends. Unlike short-term trading strategies, global macro positions are often held for weeks, months, or even years, as macroeconomic trends typically unfold over longer time horizons.

Discretionary vs Systematic Global Macro

Global macro trading can broadly be divided into discretionary and systematic approaches. Discretionary macro traders rely heavily on human judgment, experience, and qualitative analysis. They interpret economic narratives, policy intentions, and geopolitical risks, adjusting positions as new information emerges.

Systematic global macro traders, on the other hand, use quantitative models and algorithms to identify macro trends. These models may analyze interest rate differentials, momentum across asset classes, or historical relationships between economic variables. While systematic strategies reduce emotional bias, they still depend on robust data and sound economic logic to remain effective across changing market regimes.

Many large hedge funds combine both approaches, using quantitative models to support or challenge discretionary views.

Risk Management in Global Macro Trading

Risk management is especially critical in global macro trading due to the scale and leverage often involved. Macro trades can be highly profitable, but they can also be volatile, particularly when markets react unexpectedly to political decisions or sudden economic shocks.

Effective risk management includes position sizing, diversification across themes and regions, and the use of stop-losses or options for downside protection. Scenario analysis is also common, where traders evaluate how their portfolios might perform under different economic outcomes, such as recession, stagflation, or financial crisis.

Liquidity risk must also be considered, especially during periods of market stress when correlations rise and exits become more difficult.

Role of Geopolitics and Policy

Unlike many other trading styles, global macro trading places significant emphasis on geopolitics and policy decisions. Elections, wars, trade disputes, sanctions, and international agreements can have profound effects on currencies, commodities, and capital flows. For instance, a sudden escalation in geopolitical tension may drive investors toward safe-haven assets like gold or U.S. Treasury bonds.

Fiscal policy, including government spending and taxation, also plays an increasingly important role. Large stimulus packages, rising public debt, or austerity measures can reshape growth expectations and market sentiment, creating opportunities for macro traders who correctly anticipate these shifts.

Advantages and Challenges of Global Macro Trading

The primary advantage of global macro trading is its broad opportunity set. Because it spans multiple markets and regions, traders are rarely constrained by a lack of ideas. Major economic transitions—such as inflation cycles, energy transitions, or shifts in global supply chains—can create powerful, long-lasting trends.

However, the challenges are equally significant. Macroeconomic forecasting is inherently uncertain, and markets often move ahead of data or react in counterintuitive ways. Timing is a persistent difficulty; a trader may have the correct long-term view but still suffer losses if the market moves against the position in the short term.

Additionally, global macro trading demands continuous learning, as economic structures, policy frameworks, and market dynamics evolve over time.

Conclusion

Global macro trading represents a sophisticated and holistic approach to financial markets. By focusing on the big picture—economic cycles, monetary policy, and geopolitical forces—this strategy aims to capture large, directional moves across asset classes. It rewards deep understanding, disciplined risk management, and the ability to adapt to changing global conditions.

For traders and investors who enjoy analyzing the world through an economic lens and are comfortable with uncertainty, global macro trading offers a powerful framework to navigate and potentially profit from the complex interconnectedness of the global financial system.

Microstructure Trading Edge: Unlocking Profits from Market1. Foundations of Market Microstructure

At its core, market microstructure studies how prices emerge from the interaction of buyers and sellers. Prices do not move randomly; they respond to supply-demand imbalances reflected through orders. These orders are visible (limit orders) or invisible (market orders, hidden liquidity, iceberg orders). The continuous battle between liquidity providers (market makers) and liquidity takers (aggressive traders) determines short-term price movements.

A microstructure trading edge begins with understanding:

Bid-ask spread behavior

Order book depth and imbalance

Trade aggressiveness

Execution priority (price-time priority)

Market impact and slippage

Traders who understand these mechanics can anticipate short-term price changes before they appear on traditional charts.

2. Order Flow as the Core Edge

Order flow is the heartbeat of microstructure trading. It represents the real-time flow of buy and sell orders hitting the market. Unlike indicators derived from historical prices, order flow is leading, not lagging.

A microstructure edge emerges when a trader can:

Identify aggressive buyers or sellers

Detect absorption (large players absorbing market orders)

Spot exhaustion of one side of the market

Read delta divergence (difference between price movement and volume imbalance)

For example, if price is not falling despite heavy selling pressure, it may indicate strong institutional absorption—often a precursor to a reversal. This insight is invisible to standard indicators but clear to order-flow-aware traders.

3. Bid-Ask Spread and Liquidity Dynamics

The bid-ask spread reflects the cost of immediacy. When liquidity is abundant, spreads are tight; when liquidity dries up, spreads widen. Microstructure traders exploit this by understanding when liquidity is likely to vanish or surge.

Key liquidity-based edges include:

Trading during spread compression phases

Avoiding periods of liquidity vacuum (news events, market open/close)

Identifying fake liquidity (spoofing-like behavior or pulled orders)

Recognizing thin books that allow small volume to move price significantly

Professional traders often enter positions just before liquidity expands and exit before it contracts, minimizing transaction costs while maximizing price efficiency.

4. Market Participants and Their Footprints

Different market participants leave distinct footprints:

Retail traders: small size, emotional execution, market orders

Institutions: large size, patient execution, iceberg orders

Market makers: spread capture, inventory management

High-frequency traders (HFTs): speed-based arbitrage, queue positioning

A microstructure edge comes from recognizing who is likely active at a given moment. For instance, sudden bursts of small aggressive orders often indicate retail participation, while steady absorption with minimal price movement points to institutional involvement.

Understanding participant behavior helps traders align themselves with stronger hands instead of fighting them.

5. Price Impact and Execution Efficiency

Every order moves the market to some degree. The relationship between trade size and price movement is known as market impact. Microstructure traders aim to minimize adverse impact while exploiting others’ poor execution.

This edge is particularly strong in:

Scalping strategies

High-frequency mean reversion

VWAP and TWAP deviations

Opening range and closing auction trades

Traders who understand execution mechanics can enter positions at optimal times, reducing slippage and improving net profitability—even if their directional bias is only slightly better than random.

6. Information Asymmetry and Short-Term Alpha

Microstructure trading thrives on information asymmetry, not in the illegal sense, but in the structural sense. Some traders react faster, interpret data better, or understand context more deeply.

Sources of microstructure information advantage include:

Faster interpretation of order book changes

Real-time trade classification (buyer-initiated vs seller-initiated)

Contextual awareness (news + order flow alignment)

Knowledge of exchange-specific rules and quirks

Because microstructure edges operate on very short timeframes, they decay quickly—but when executed repeatedly, they compound into meaningful alpha.

7. Microstructure Across Timeframes

Although often associated with scalping, microstructure is relevant across timeframes:

Ultra-short-term: tick-by-tick order flow and queue dynamics

Intraday: liquidity zones, VWAP interactions, session highs/lows

Swing trading: entry timing refinement using lower-timeframe microstructure

Position trading: identifying institutional accumulation/distribution phases

Even long-term traders gain an edge by using microstructure to optimize entries and exits, improving risk-reward without changing their core thesis.

8. Technology and Tools Behind the Edge

Modern microstructure trading relies heavily on technology:

Depth of Market (DOM)

Time & Sales

Volume profile and footprint charts

Order flow analytics

Low-latency execution platforms

However, tools alone do not create an edge. The real advantage comes from interpretation, context, and discipline. Many traders see the same data, but only a few understand what matters and when.

9. Risks and Limitations of Microstructure Trading

While powerful, microstructure trading is not without challenges:

High transaction costs if overtrading

Psychological pressure from fast decision-making

Edge decay due to competition and automation

Overfitting patterns that do not persist

A sustainable microstructure edge requires strict risk management, continuous adaptation, and an understanding that not every market condition is suitable for microstructure-based trades.

10. Conclusion: Why Microstructure Creates a Lasting Edge

The microstructure trading edge lies in seeing the market as a living process rather than a static chart. By focusing on how trades are executed, how liquidity behaves, and how participants interact, traders gain insight into price movements before they fully develop.

In an era where traditional indicators are widely known and arbitraged, microstructure offers a deeper, more nuanced layer of understanding. While it demands skill, discipline, and experience, it rewards traders with precision, timing, and consistency—qualities that define long-term success in modern financial markets.

Ultimately, microstructure trading transforms the trader from a passive observer of price into an active reader of market intent, where every order tells a story and every imbalance creates opportunity.

Part 8 Trading Master ClassImportant Points for Traders

✔ Always check IV (Implied Volatility)

High IV → Selling strategies

Low IV → Buying strategies

✔ Avoid naked selling unless hedged

Unlimited risk is dangerous.

✔ Start with defined-risk strategies

Vertical spreads, iron condor, butterfly

✔ Probability matters more than profit per trade

Most professionals use credit spreads for consistency.

✔ Adjust if market moves aggressively

Rolling helps avoid full losses.

Understanding the Hidden Dangers Behind High ReturnsRisks in Option Trading:

Option trading is often marketed as a powerful financial tool that allows traders to earn high returns with relatively low capital. While it is true that options provide flexibility, leverage, and multiple strategic possibilities, they also carry significant risks that are frequently underestimated, especially by new traders. Understanding these risks is critical before participating in options markets, as a lack of awareness can quickly lead to substantial and sometimes irreversible losses. Option trading is not merely about predicting market direction; it involves time sensitivity, volatility dynamics, pricing models, and psychological discipline. Below is a detailed discussion of the major risks involved in option trading.

1. Leverage Risk

One of the most attractive features of option trading is leverage. With a small amount of capital, traders can control a large notional value of an underlying asset. However, leverage is a double-edged sword. While it magnifies gains, it equally magnifies losses. A small adverse movement in the underlying asset can result in a disproportionately large loss on the option position. In some cases, especially with selling options, losses can exceed the initial investment. Traders who misuse leverage often face rapid capital erosion, making leverage risk one of the most dangerous aspects of option trading.

2. Time Decay (Theta Risk)

Unlike stocks, options are wasting assets. Every option has an expiration date, and as that date approaches, the option loses value due to time decay, known as theta. Even if the underlying asset remains stable, the option’s premium can decline daily. This risk is particularly severe for option buyers, as they must not only be correct about market direction but also about timing. Many traders experience losses simply because the expected price movement did not occur fast enough before expiration.

3. Volatility Risk

Option prices are highly sensitive to changes in volatility, measured by implied volatility (IV). A trader may correctly predict the direction of a stock, index, or commodity, yet still incur losses if volatility contracts after entering the trade. For example, buying options during periods of high implied volatility can be risky because a subsequent volatility drop can reduce option premiums sharply. This phenomenon, often referred to as “volatility crush,” is common after events like earnings announcements. Volatility risk makes option pricing complex and less intuitive for beginners.

4. Unlimited Loss Risk in Option Selling

Selling options, especially naked calls or naked puts, carries potentially unlimited or very large losses. When selling a call option without owning the underlying asset, there is theoretically no limit to how high the price can rise, exposing the seller to unlimited risk. Similarly, selling naked puts can lead to massive losses if the underlying asset collapses. While option selling may generate consistent small profits, one adverse market move can wipe out months or even years of gains.

5. Liquidity Risk

Not all options are actively traded. Some options contracts suffer from low liquidity, leading to wide bid-ask spreads. This means traders may have to buy at a higher price and sell at a much lower price, increasing transaction costs and reducing profitability. In illiquid options, exiting a position quickly during adverse market conditions can be difficult or impossible, further amplifying losses. Liquidity risk is especially relevant in far-out-of-the-money options or contracts with distant expiration dates.

6. Pricing Complexity and Model Risk