Market Reform FalloutUnderstanding the Aftershocks of Structural Change

Market reforms are often introduced with ambitious goals: boosting efficiency, improving transparency, attracting investment, and accelerating long-term economic growth. Governments, regulators, and international institutions promote reforms as necessary corrections to outdated systems. However, while reforms may promise long-term gains, they almost always generate short-term disruptions, unintended consequences, and social tensions. These consequences—known as market reform fallout—shape economic outcomes far more than policy announcements alone.

Market reform fallout refers to the economic, financial, social, and political aftershocks that emerge when structural changes alter how markets function. These aftershocks can be temporary or persistent, localized or systemic, depending on the scale, speed, and design of reforms.

Why Market Reforms Are Necessary—but Risky

Markets naturally evolve, but institutional rigidities often prevent them from adapting efficiently. Reforms are typically introduced to address:

Inefficiencies and monopolistic practices

Fiscal imbalances and rising public debt

Capital misallocation

Weak financial systems

Low productivity and competitiveness

However, markets are complex adaptive systems. Changing one rule often triggers reactions across employment, capital flows, consumption, and investor sentiment. The gap between policy intent and market reality is where fallout begins.

Short-Term Economic Disruptions

One of the most visible forms of market reform fallout is short-term economic instability.

1. Volatility in Financial Markets

Reforms related to taxation, subsidies, labor laws, or financial regulation can immediately affect earnings expectations. Equity markets often react with sharp volatility as investors reassess risk and profitability. Bond yields may spike if reforms raise inflation or fiscal uncertainty.

Currency markets are particularly sensitive. Capital account liberalization or interest rate reforms can trigger sudden inflows or outflows, leading to exchange rate instability.

2. Slower Growth During Transition

Structural reforms frequently slow economic activity in the short run. Removing subsidies raises input costs, tightening credit reduces liquidity, and deregulation disrupts established supply chains. Businesses often delay investment until policy clarity emerges, creating a temporary growth vacuum.

Employment and Labor Market Fallout

Labor markets are among the most affected areas during reforms.

Job Losses in Legacy Sectors

When governments liberalize industries or privatize public enterprises, inefficient firms often downsize or shut down. While reforms aim to reallocate labor toward productive sectors, the transition is rarely smooth. Workers in traditional industries face job losses before new opportunities emerge.

Informalization Risks

In developing economies, rigid labor reforms can unintentionally expand informal employment. Firms may avoid compliance costs by hiring contract or off-book workers, weakening job security and social protection.

Skill Mismatch

Reforms often favor capital-intensive or technology-driven sectors. Workers without relevant skills struggle to transition, widening inequality and fueling social resistance to reform agendas.

Social and Political Backlash

Economic fallout often spills into the social and political domain.

Rising Inequality

Market reforms may disproportionately benefit capital owners, skilled labor, and urban populations in the early stages. Rural communities, small businesses, and low-income households often bear higher costs through inflation, reduced subsidies, or job losses.

This perception—whether accurate or not—creates political resistance and erodes trust in institutions.

Public Protests and Policy Reversals

History shows that poorly communicated or rapidly implemented reforms can trigger widespread protests. Fuel price reforms, pension restructuring, and agricultural market liberalization are frequent flashpoints.

Political backlash may force governments to dilute or reverse reforms, reducing credibility and increasing policy uncertainty—often worsening the original problem.

Sector-Specific Fallout

Financial Sector Reforms

Banking and capital market reforms strengthen systems in the long run but can initially expose hidden weaknesses. Stricter norms often reveal non-performing assets, leading to credit contraction and reduced lending to businesses.

Agricultural Market Reforms

Reforms aimed at improving price discovery and market access may hurt small farmers if institutional support systems are weak. Without adequate storage, logistics, and bargaining power, farmers may face price volatility rather than stability.

Energy and Commodity Reforms

Removing price controls and subsidies improves fiscal discipline but raises costs for households and industries. Inflationary pressure often follows, forcing central banks to tighten policy—creating a feedback loop of slower growth.

Impact on Investment and Capital Flows

Reforms strongly influence domestic and foreign investment behavior.

Initial Capital Flight

Uncertainty around new rules, taxation, or regulatory enforcement can trigger short-term capital flight. Investors prefer clarity over optimism, and reform phases often involve ambiguity.

Long-Term Capital Attraction

If reforms succeed, they improve transparency, contract enforcement, and market depth. Over time, this attracts patient capital, foreign direct investment, and institutional participation. The challenge lies in surviving the transition phase.

The Role of Timing and Sequencing

One of the biggest determinants of reform fallout is sequencing.

Rapid reforms without institutional readiness amplify shocks

Gradual reforms reduce volatility but risk losing momentum

Poor coordination between fiscal, monetary, and structural policies magnifies instability

Countries that align reforms with business cycles and provide buffers—such as targeted welfare support or credit guarantees—experience milder fallout.

Lessons from Global Experience

Market reform fallout teaches several recurring lessons:

Communication matters as much as policy

Markets and citizens react less to reforms themselves and more to uncertainty around them.

Safety nets are non-negotiable

Without social protection, even economically sound reforms face rejection.

Institutions must evolve alongside markets

Courts, regulators, and enforcement mechanisms must adapt to new rules.

Reforms are political as well as economic

Ignoring distributional impacts leads to instability and reversals.

Conclusion: Fallout Is Not Failure

Market reform fallout is not a sign that reforms are flawed; it is evidence that markets are deeply interconnected with society. Structural change inevitably produces winners and losers, short-term pain and long-term gain. The true measure of reform success lies not in avoiding fallout—but in managing it intelligently.

Well-designed reforms anticipate disruption, protect vulnerable groups, maintain policy credibility, and allow markets time to adjust. When governments acknowledge fallout as part of the reform process rather than denying it, they increase the probability that reforms deliver sustainable growth, resilience, and inclusive prosperity.

In the end, market reforms reshape not just economies—but expectations, behavior, and trust. How leaders navigate the fallout determines whether reform becomes a foundation for progress or a trigger for prolonged instability.

Tradingindicators

Trading Plan for SuccessA Complete Blueprint for Consistent Profitability

Success in trading is rarely about finding the “perfect” indicator or the next hot stock. It is built on structure, discipline, and repeatable decision-making. A well-designed trading plan transforms trading from emotional speculation into a professional business process. This plan acts as a roadmap, guiding every trade before, during, and after execution. Without it, even talented traders eventually lose consistency.

A trading plan defines what to trade, when to trade, how much to trade, and when to exit. More importantly, it defines how a trader behaves under pressure. Below is a comprehensive breakdown of the essential components of a successful trading plan.

1. Defining Your Trading Objectives

Every successful trading plan begins with clear, realistic objectives. These goals should focus on process and consistency, not just profit.

Instead of saying “I want to double my capital,” a better objective is:

Achieve consistent monthly returns with controlled drawdowns

Maintain a risk-reward ratio above 1:2

Avoid emotional or impulsive trades

Objectives must align with your capital, experience level, and time availability. A full-time intraday trader and a part-time swing trader will have very different goals. Clarity here prevents overtrading and unrealistic expectations.

2. Market Selection and Trading Instruments

A trading plan must clearly specify which markets you trade. Trying to trade everything—stocks, indices, forex, crypto, commodities—usually leads to shallow understanding and inconsistent results.

Choose markets based on:

Liquidity

Volatility suitable to your strategy

Your familiarity with price behavior

For example:

Index traders may focus on Nifty, Bank Nifty, or S&P 500

Equity traders may select a fixed watchlist of high-volume stocks

Derivatives traders may focus on futures or options with tight spreads

Mastery comes from specialization.

3. Time Frame and Trading Style

Your plan must define your primary time frame and trading style:

Scalping (minutes)

Intraday (5–30 minute charts)

Swing trading (daily charts)

Positional trading (weekly charts)

Each time frame demands different psychology, capital allocation, and patience. A trader switching time frames impulsively often violates risk rules and emotional control. Your plan should state clearly:

Entry time frame

Higher-time-frame trend reference

Exit time frame

Consistency here builds confidence and clarity.

4. Entry Strategy and Trade Setup Rules

A successful trading plan includes specific, rule-based entry conditions. Entries should never be based on gut feeling or news headlines alone.

Your plan should clearly define:

Market structure (trend, range, breakout)

Technical conditions (support/resistance, moving averages, patterns)

Volume or momentum confirmation

News or event filters

For example:

“I will enter long trades only when price is above the 50-day moving average, forms a higher low, and breaks resistance with strong volume.”

If a setup does not meet your written criteria, it is not a trade—no exceptions.

5. Risk Management: The Core of Survival

Risk management is the backbone of long-term trading success. A trading plan without strict risk rules is incomplete.

Key elements include:

Maximum risk per trade (usually 0.5%–2% of capital)

Fixed stop-loss placement based on market structure

Maximum daily and weekly loss limits

Position sizing formula

Professional traders focus more on how much they can lose than how much they can make. This mindset ensures survival during losing streaks and keeps emotions under control.

6. Exit Strategy and Profit Management

Many traders enter well but fail at exits. A complete trading plan defines both stop-loss and profit-taking rules in advance.

Exit rules may include:

Fixed target based on risk-reward ratio

Trailing stop based on moving averages or price structure

Partial profit booking

Time-based exits if price stalls

The goal is not to capture every point but to execute exits consistently. Discipline at exits separates professionals from amateurs.

7. Trade Management During the Position

Once a trade is active, emotions often peak. Your trading plan must define what you will and will not do during a trade.

Examples:

No moving stop-loss away from risk

No adding to losing positions

Trail stop only after price moves favorably

Do not watch lower time frames unnecessarily

This section protects you from fear, greed, and overconfidence while the trade is live.

8. Psychology and Emotional Discipline

Trading psychology is not optional—it is central to success. Your trading plan should address emotional behavior explicitly.

Key psychological rules include:

No revenge trading after losses

No overtrading after big wins

Take mandatory breaks after reaching daily loss limits

Accept losses as part of the business

A trader who controls emotions can execute even a simple strategy profitably over time.

9. Record-Keeping and Trade Journal

A trading plan must include a journaling system. Without data, improvement is impossible.

Your journal should track:

Entry and exit price

Reason for trade

Risk-reward ratio

Emotional state during the trade

Mistakes and lessons

Reviewing trades weekly or monthly reveals patterns in both performance and behavior. This is how traders evolve.

10. Review, Adaptation, and Continuous Improvement

Markets change, and a trading plan must evolve—without losing its core discipline.

Regular reviews should evaluate:

Win rate and expectancy

Drawdowns

Rule violations

Market conditions

Any change to the plan should be tested and documented. Random adjustments based on recent losses usually lead to inconsistency.

Conclusion

A trading plan for success is not a one-page checklist—it is a living document that defines your identity as a trader. It removes guesswork, limits emotional damage, and creates a repeatable process. Traders who follow a plan may still experience losses, but they avoid catastrophic failure and stay in the game long enough for probability to work in their favor.

In trading, discipline beats intelligence, structure beats prediction, and consistency beats excitement. A well-crafted trading plan is not just a tool—it is the foundation of sustainable success in financial markets.

Open Interest (OI) Analysis for Futures & Options TradersOpen Interest Analysis for Futures & Options Traders

Open Interest (OI) is one of the most powerful yet misunderstood tools in the derivatives market. While price and volume tell traders what is happening, open interest helps explain why it is happening and who is likely behind the move. For futures and options traders, OI analysis provides insight into market participation, strength of trends, potential reversals, and the behavior of smart money.

This makes OI a critical component for traders dealing in index futures, stock futures, options, and commodity derivatives.

What Is Open Interest?

Open Interest refers to the total number of outstanding derivative contracts (futures or options) that are currently open and not settled. Each contract represents a buyer and a seller, and open interest increases when new positions are created and decreases when positions are closed or squared off.

Key points:

OI increases when a new buyer and new seller enter a trade

OI decreases when an existing buyer and seller close their positions

OI does not change when one trader transfers a position to another

Unlike volume, which resets daily, open interest is cumulative and reflects ongoing market commitment.

Difference Between Volume and Open Interest

Many traders confuse volume with open interest, but both serve different purposes.

Volume measures how many contracts were traded during a specific period

Open Interest measures how many contracts remain open at the end of that period

High volume with low OI suggests short-term activity or intraday trading, while rising OI indicates fresh positions and conviction. Professional traders always study price, volume, and OI together.

Why Open Interest Matters in Trading

Open interest is important because it:

Confirms trend strength

Identifies new money entering or leaving

Signals long buildup or short buildup

Helps detect trend exhaustion

Improves options strategy selection

Reveals support and resistance zones

In derivatives trading, price movement without OI confirmation is often unreliable.

Open Interest Analysis in Futures Trading

1. Price Up + OI Up → Long Buildup

This indicates new buyers are entering the market with confidence.

Bullish trend confirmation

Strong upward momentum

Suitable for trend-following strategies

Example: Index futures rally with rising OI often suggests institutional buying.

2. Price Down + OI Up → Short Buildup

This signals fresh short positions entering the market.

Bearish trend confirmation

Indicates strong selling pressure

Often seen during market breakdowns

Professional traders use this to stay aligned with downside momentum.

3. Price Up + OI Down → Short Covering

This move is driven by short sellers exiting their positions.

Temporary rally

Weak bullish structure

Often occurs near resistance or after panic selling

Such rallies may fade once short covering ends.

4. Price Down + OI Down → Long Unwinding

This shows existing long positions are being closed.

Bearish but often near support

Indicates trend exhaustion

Can lead to sideways movement or reversal

Smart traders watch for price stabilization after long unwinding.

Open Interest Analysis in Options Trading

Options OI provides even deeper insights because it shows market expectations across strike prices.

Call Option Open Interest

High Call OI indicates resistance

Call writing suggests bearish or neutral outlook

Call buying suggests bullish expectations

Put Option Open Interest

High Put OI indicates support

Put writing suggests bullish or neutral outlook

Put buying suggests bearish expectations

Put-Call Open Interest Ratio (PCR)

The PCR is calculated as:

PCR = Total Put OI / Total Call OI

Interpretation:

PCR < 0.7 → Overly bullish (market may correct)

PCR between 0.7–1.2 → Balanced market

PCR > 1.3 → Overly bearish (market may bounce)

PCR is best used as a sentiment indicator, not a standalone signal.

Open Interest Shifts and Strike Price Analysis

Options traders closely watch:

Change in OI rather than absolute OI

OI buildup near key strikes

Unwinding before major breakouts

If heavy Call OI at a strike starts unwinding while price approaches it, that resistance may break. Similarly, Put OI unwinding near support can signal downside risk.

Max Pain Theory and OI

Max Pain refers to the strike price where option buyers experience maximum loss and option sellers gain maximum profit at expiry. Markets often gravitate toward this level close to expiry due to option writers’ influence.

While not exact, Max Pain combined with OI analysis improves expiry-day precision trading.

Intraday OI Analysis

For intraday traders:

Rising price + rising OI = trend continuation

Sudden OI drop = position exit or profit booking

OI spikes near VWAP = institutional activity

Intraday OI analysis is especially effective in index futures and liquid stock futures.

Common Mistakes in Open Interest Analysis

Using OI without price confirmation

Ignoring OI change and focusing only on absolute values

Misinterpreting short covering as trend reversal

Trading OI without understanding market context

Over-relying on PCR alone

OI should always be part of a broader trading framework.

Combining OI with Technical Analysis

The best results come from combining OI with:

Support and resistance

Trendlines

Moving averages

Volume profile

Price action patterns

For example, a breakout above resistance with rising volume and rising OI is far more reliable than price alone.

Role of Open Interest for Smart Money Tracking

Institutional traders rarely chase price. They build positions gradually, which reflects in:

Rising OI at key price zones

Stable price with increasing OI (accumulation)

Sudden OI drop after sharp moves (distribution)

OI helps retail traders align with smart money behavior rather than emotional price moves.

Conclusion

Open Interest analysis is an essential skill for futures and options traders who want to understand market structure, sentiment, and positioning. While price shows the outcome of trading decisions, open interest reveals the commitment and conviction behind those decisions.

When used correctly, OI helps traders:

Confirm trends

Spot reversals early

Identify strong support and resistance

Improve risk management

Trade with institutional flow rather than against it

However, open interest should never be used in isolation. Its real power emerges when combined with price action, volume, and market context. Traders who master OI analysis gain a significant edge in navigating the complex world of futures and options trading.

GDP Surge or Stall: What’s Next for the Economy?1. What We Mean by “GDP Surge” and “Stall”

Gross Domestic Product (GDP) measures the total value of goods and services produced in an economy.

A GDP surge means faster‐than‐expected growth — stronger jobs, higher spending, business investment, and rising incomes.

A GDP stall means growth slows or stagnates — often due to weak demand, poor investment, rising costs, or external shocks.

Whether an economy surges or stalls depends on multiple factors — consumer confidence, corporate investment, government policy, global trade, inflation, and unexpected events like wars, pandemics, or climate disasters.

2. Recent Evidence: Where Growth Is Happening

• United States

The U.S. economy has shown unexpected resilience:

Recent data indicates consumer spending remains strong, supporting GDP growth even as inflation cools.

Analysts now forecast U.S. economic growth to outperform earlier expectations in 2026, helped by tax cuts and fading tariff impacts.

However, questions remain over how long this momentum can last, especially if fiscal and monetary support fades or trade tensions rise.

• Eurozone

Europe, despite expectations of stagnation, has consistently expanded:

The Eurozone posted unexpected GDP growth, outperforming forecasts and showing notable resilience across Germany, Spain, and France.

Still, growth is moderate overall, and with inflation near target levels, the region’s outlook remains balanced rather than exuberant.

• India

In the global context, India stands out:

Latest surveys show India’s economy is one of the fastest-growing major economies, with projections near 7%+ growth rates — far above most advanced economies.

That combination of strong domestic demand, investment expansion, moderated inflation, and sectoral resilience explains recent GDP benefits and helps offset slower global growth elsewhere.

3. Why the Economy Surges — and What Fuels It

a. Consumer and Business Spending

High consumer demand — when people keep buying — directly pushes GDP higher as retailers, services, and manufacturers see stronger sales.

Likewise, higher business investment in technology, capital equipment, and infrastructure supports growth by boosting productivity and future output.

b. Policy Support

Monetary easing (lower interest rates) and fiscal stimulus (government spending, tax cuts) have helped sustain growth in key economies by encouraging borrowing and investment.

c. Technological Change and Productivity

Advances in automation, artificial intelligence, and digital platforms can increase productivity — making labor and capital more efficient and pushing GDP upward.

4. Why Growth Sometimes Stalls

a. High Interest Rates and Tight Credit

When central banks raise interest rates to control inflation, borrowing costs rise. Businesses invest less, consumers pull back on big purchases, and growth slows.

Global projections suggest that high rates are contributing to slower demand in many economies, even where inflation is easing.

b. Trade Tensions and Protectionism

Trade disruptions — such as tariffs and barriers — make cross-border commerce more expensive and complicated. That weakens export demand and investment plans in both advanced and emerging markets.

c. Sluggish Investment

Investment remains subdued in many places, partly because of uncertainty about future demand, geopolitical risks, and weaker global trade growth.

d. Structural Challenges

Some economies face long-term drags from aging populations, weak labor force growth, or low productivity, making sustained rapid expansion difficult.

5. Global Outlook: Resilience but Slower Overall Growth

Broad based global forecasts suggest that while the world economy is avoiding a deep recession and maintaining growth, the pace is subdued relative to past decades:

• OECD Projections:

The global economy is expected to grow at a moderate pace (around 3.3% in 2025-26), with slowing activity in some major regions while others like emerging markets outperform.

• United Nations Report:

UN economists see continued sub-3% global growth in 2026 — still positive but below historical highs and with underlying vulnerabilities.

• Divergent Regional Growth:

China’s growth is slowing relative to past decades, Europe remains moderate, and the U.S. is stronger but still cooling relative to post-pandemic surges. Developing economies also face challenges even as they grow faster than advanced ones.

Overall, growth is likely to remain positive, but slower than writing it off as a “boom era” scenario.

6. Risks That Could Stall Growth

Even with resilient headline figures, several risks could flip a surge into stagnation or contraction:

• Escalating Trade Frictions

New tariffs or retaliatory measures could slow global commerce, reduce export demand, and further dampen investment.

• Debt and Financial Stress

High public and private debt raises the risk of financial stress, especially if borrowing costs stay elevated.

• Climate and Extreme Events

Recent warnings stress that many economic models underestimate severe climate risks — such as storms, droughts, and supply disruptions — which can cause sharp economic losses.

• Policy Missteps

Tight monetary policy that overshoots, or fiscal tightening that reduces demand too quickly, can push economies toward stagnation.

7. Policy Paths Forward: Surge vs Stall

The future trajectory depends largely on policy choices governments and central banks make:

• Keeping Inflation in Check Without Killing Growth

Central banks face a balancing act:

Ease too soon → inflation could reignite.

Hold too long → GDP growth slows.

Careful calibration of interest rates and inflation expectations remains essential.

• Fostering Investment and Innovation

Policies that incentivize private investment, support R&D, and modernize infrastructure can help sustain growth momentum, especially in manufacturing and services.

• Trade Cooperation and Stability

Reducing trade frictions, reinforcing predictable rules, and maintaining open markets can boost global growth prospects by encouraging cross-border commerce.

• Climate Resilience and Sustainable Growth

Investing in climate adaptation and green technologies reduces risks from extreme weather and supports new economic sectors.

8. Likely Scenarios: What Comes Next

Moderate Growth Continues

In this base case, global growth stays positive but moderate (~2.5–3.5%), inflation gradually eases, and labor markets remain stable. Growth varies across regions — strong in emerging Asia, moderate in North America, slower in Europe.

Growth Surprise (Upside)

If trade barriers come down, investment picks up, and technological productivity accelerates faster than expected, economies could surge moderately above forecasts without overheating.

Stall or Soft Landing

If monetary tightening is prolonged, trade tensions escalate, or major external shocks occur (e.g., energy crisis or financial stress), growth could slow markedly, approaching stagnation without a deep recession.

9. Individual Nations and Growth Stories

While global averages matter, individual countries tell unique stories:

India is projecting robust growth near or above 7%, driven by strong consumption, investment, and reform momentum.

Eurozone continues modest growth with resilience in domestic demand, despite global headwinds.

United States shows upside momentum but remains sensitive to policy changes and global conditions.

10. Final Takeaway

In short:

✅ GDP Surge is possible in certain economies buoyed by consumer demand, productivity gains, and smart policies.

✅ GDP Stall remains a real risk globally due to high interest rates, trade tensions, weak investment, and external shocks.

📌 The next few years won’t be a simple boom or bust — more likely, we’ll see sub-3% global growth, with pockets of strength and weakness depending on policy and structural forces.

Part 4 Technical Vs. Institutional Option TradingAdvanced Option Trading Strategies Explained1. Straddle/Strangle- Straddle: Buy call and put at same strike, profit from big price moves (volatility).

- Strangle: Buy call and put at different strikes, profit from big moves with lower cost.

2. Iron Condor- Sell OTM call and put spreads, profit from low volatility (price staying within range).

3. Butterfly Spread- Buy and sell options at multiple strikes, profit if price stays near middle strike.

4. Calendar Spread- Buy and sell options with same strike but different expiries, profit from time decay differences.

5. Ratio Spreads- Buy and sell options in different ratios, profit from volatility changes or direction.

AUROPHARMA 1 Month View📌 Current Price Context

Last traded / current price: ~₹1,207–₹1,208 on NSE.

📊 Key Technical Levels (1-Month View)

🔹 Pivot Point

Pivot (daily): ~₹1,200 – centre of recent price action.

📈 Resistance Levels

R1: ~₹1,226–₹1,228 — first meaningful resistance above current price.

R2: ~₹1,245–₹1,247 — higher resistance zone from classic pivot analysis.

R3: ~₹1,271–₹1,275+ — extended resistance from upper pivot range.

These resistances correspond to areas where price has previously found sellers or consolidation over the last few weeks.

📉 Support Levels

S1: ~₹1,181–₹1,182 — first support just below pivot region.

S2: ~₹1,155–₹1,156 — secondary support from recent swing lows.

S3: ~₹1,136–₹1,138 — deeper support area if market weakens further.

These support zones align with recent range lows and moving average clusters over a monthly period.

📊 Moving Averages & Trend

20-day / 50-day / 100-day EMAs and SMAs are currently around ₹1,164–₹1,192 range — near price but showing neutral-to-slightly bullish bias on daily charts.

Price trading above most short and mid-term moving averages suggests short-term strength if levels hold.

📈 Oscillators / Momentum (Short-term indication)

RSI near mid-to-bullish levels (~58–68) indicating no extreme overbought condition yet.

Momentum suggests neutral-to-slightly uptrend in the recent 1-month timeframe.

📍 Summary (1-Month Technical View)

Bullish breakout zone:

• Above ~₹1,226 → may accelerate toward ₹1,245 / ₹1,270+

Key neutral range:

• ₹1,181–₹1,226 — consolidation band to watch intra-month

Bearish trigger (pullback):

• Below ~₹1,155 → risk of deeper test of ₹1,136+ support

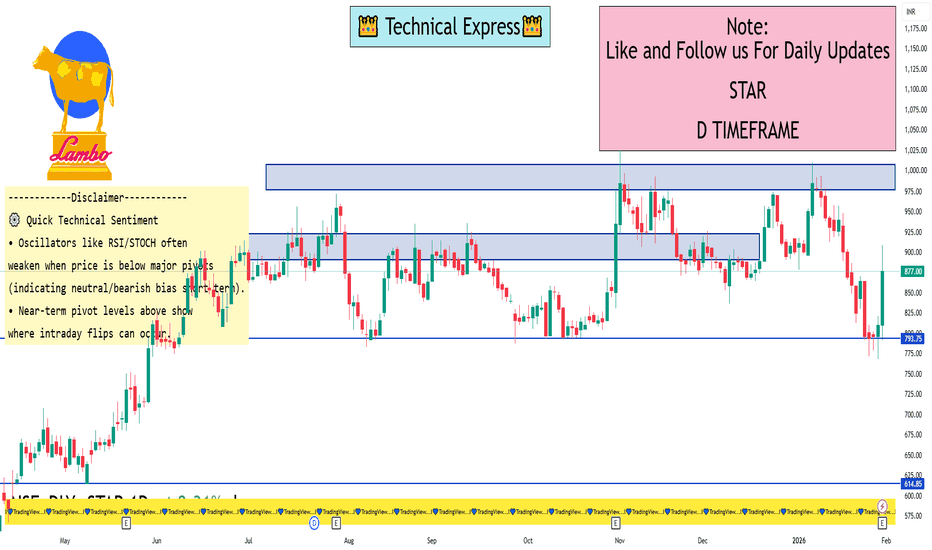

STAR 1 Day View 📌 Live Price Snapshot

• Current price: ~₹877.00 on NSE (Last traded)

• Today’s range: ₹791 – ₹908.40

• 52-Week range: ₹513.05 – ₹1,025.00

📊 Daily Pivot & Key Levels (1-Day Timeframe)

These are approximate pivot, support and resistance levels based on the most recent pivot analysis published today:

📍 Pivot Point

Central Pivot: ~ ₹850.8

🛑 Resistance Levels

R1: ~ ₹868.1

R2: ~ ₹891.0

R3: ~ ₹908.3

(These are short-term upside barriers where price may slow/reverse)

🟩 Support Levels

S1: ~ ₹827.9

S2: ~ ₹810.6

S3: ~ ₹787.7

(These are immediate downside zones where price could find buying interest)

📌 How to Use These Levels Today

✔ Bullish view:

• Above Pivot ₹850.8 → watch for closing above R1 (~₹868) to strengthen upside bias.

• Breaking and holding above R2 (~₹891) could extend toward R3 (~₹908).

✔ Bearish/Range view:

• Failure below Pivot ₹850.8 or S1 (~₹827.9) increases odds of deeper correction toward S2/S3.

• Intraday rejections at R1/R2 can signal short-term sellers.

Part 3 Institutional VS. TechnicalHow Option Premium Works

The premium is the price of the option. It has two parts:

1. Intrinsic Value

The real value if exercised today.

For calls:

Intrinsic = Spot Price – Strike Price

For puts:

Intrinsic = Strike Price – Spot Price

2. Time Value

Extra value due to remaining time before expiration.

Options with more time left are more expensive because:

There’s more chance the trade will go in your favor.

Volatility increases the uncertainty (and potential profit).

Part 4 Technical Analysis Vs Institution Option TradingA. When to Buy Options

Breakout from consolidation

High volume at breakout

Trend confirmed

IV low → premiums cheap

Clear direction available

B. When to Sell Options

Range-bound market

No trending structure

IV high → premiums expensive

Event after event → IV crash expected

GMDCLTD 1 Day View 📌 Live / Latest Price (approx)

Current NSE Price: ~₹568–₹572 range at latest update.

📊 Daily Pivot, Support & Resistance Levels

(Based on recent pivot calculations for the daily timeframe)

🔵 Pivot (central reference)

Daily Pivot: ~₹566.1–₹572.3 – key mid-point for bias.

🟥 Resistance Levels (Upside Targets)

R1: ~₹571.8–₹575.1

R2: ~₹575.1–₹586.0

R3: ~₹580.8–₹607.5

(Strong upside barriers where price may face selling pressure)

🟩 Support Levels (Downside Floors)

S1: ~₹562.8–₹562.9

S2: ~₹557.1–₹560.6

S3: ~₹553.8–₹548.9

(Important near-term supports on the daily chart)

How to read these:

Above Pivot → bullish bias

Below Pivot → bearish bias

Break & sustain above R1/R2 → potential to test R3

Fail near Resistance or break below S1 → watch deeper supports

📌 Intraday Trading Range

Based on observed price action today (intraday high/low so far):

Day High: ~₹576–₹577

Day Low: ~₹559–₹560

This range offers a reference for intraday support/resistance — trade setups often consider failing below the low or breaking above the high for momentum plays.

Part 3 Institutional vs. TechnicalOption Trading StrategiesHere are some popular option trading strategies:

1. Long Call/Put- Long Call: Buy call option to bet on price increase.

- Long Put: Buy put option to bet on price decrease.

2. Covered Call- Sell call option on stock you own to generate income.

3. Protective Put- Buy put option on stock you own to hedge against losses.

4. Straddle- Buy call and put options at same strike price and expiry to profit from volatility.

5. Spread Strategies- Bull Call Spread: Buy call at lower strike, sell call at higher strike.

- Bear Put Spread: Buy put at higher strike, sell put at lower strike.

BTC/USD 1 Month Time Frame 📈 Real‑Time BTC/USD Snapshot

Bitcoin live price (BTC → USD):

≈ $89,200 – $89,300 USD based on recent aggregated market data.

Over the past month, Bitcoin’s price has fluctuated between:

High ≈ $97,759

Low ≈ $86,181

with a net mild upside in the 30‑day range.

📊 Key 1‑Month Support & Resistance Levels

🚧 Resistance Levels

These are ceilings where price has historically struggled to rise above:

$95,800 – $97,800 — upper resistance band near recent 1‑month highs.

$100,000 psychological level — big round‑number resistance, important if price approaches it again.

$103,500+ — longer technical resistance above $100K (higher timeframe).

Short‑term focus: a close above $96K–$97K could signal short‑term bullish momentum.

🛟 Support Levels

These are floors where price finds buying interest:

$88,900 – $89,000 — current intermediate support around today’s price band.

$86,000 – $87,000 — stronger support range near recent lows.

$84,000 – $84,200 — volatility support zone (lower boundary).

Bearish risk: if price drops below $86K, the next deeper support is near $84K–$83K.

🧠 How to Use These Levels

Traders: Use $88,000, $86,000 as potential swing supports; $95,000 and above as breakout targets.

Long‑term holders: These levels help understand volatility zones, but long‑term trends require larger time frame analysis.

PART 3 TECHNNICAL VS. INSTITUTIONALWhy Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

Index Rebalancing Impact — A Deep Dive1. What Is Index Rebalancing?

Index rebalancing is the periodic process by which an index provider adjusts the constituents and weightings of an index to ensure it continues to represent its stated objective. Most indices follow predefined rules based on market capitalization, liquidity, free float, sector classification, or fundamental criteria. Over time, stock prices move, companies grow or shrink, and new firms emerge while others decline. Rebalancing realigns the index with its methodology.

For example:

A market-cap-weighted index increases the weight of stocks that have risen in value and reduces those that have fallen.

A factor index (value, momentum, quality) updates its holdings based on changes in factor scores.

A benchmark like Nifty 50 or S&P 500 may add or remove companies based on eligibility rules.

Rebalancing typically occurs quarterly, semi-annually, or annually, depending on the index.

2. Why Rebalancing Has Market Impact

The real impact comes not from the index itself, but from the trillions of dollars benchmarked to indices. Passive funds—ETFs, index mutual funds, pension mandates—are forced buyers and sellers. When an index changes, these funds must trade, regardless of valuation or fundamentals.

This creates:

Predictable flows

Temporary demand–supply imbalances

Short-term price distortions

In markets like India, where ETF penetration is growing rapidly, index rebalancing effects have become increasingly visible.

3. Types of Index Rebalancing Effects

a) Weight Adjustment Effect

Even if no stock is added or removed, weights change. A stock whose market cap has increased will see higher demand from index funds, while a laggard may face selling pressure. This often leads to price drift in the days leading up to the rebalance.

b) Addition Effect

When a stock is added to a major index:

Index funds must buy it

Liquidity improves

Analyst coverage often increases

Empirically, additions tend to experience short-term price jumps around the announcement and effective date. This is known as the index inclusion premium.

c) Deletion Effect

Stocks removed from indices face forced selling, often resulting in:

Short-term price drops

Higher volatility

Reduced liquidity

Over the long term, many deleted stocks stabilize, but the immediate impact can be sharp.

4. Announcement Date vs. Effective Date

Index rebalancing impact typically unfolds in two phases:

Announcement Date

Index provider announces changes

Active traders and arbitrage funds position early

Prices often react immediately

Effective Date (Rebalance Day)

Passive funds execute trades, often at the close

Spikes in volume and volatility

Temporary price pressure peaks

In highly liquid markets, much of the impact is front-run before the effective date. In less liquid stocks, the bulk of the move can happen on the rebalance day itself.

5. Liquidity and Market Structure Matter

The magnitude of index rebalancing impact depends heavily on liquidity.

Large-cap, liquid stocks: Impact is usually modest and short-lived.

Mid-cap and small-cap stocks: Effects can be dramatic, with multi-day price swings.

Free-float adjustments: Changes in free float can trigger large reweights even if fundamentals are unchanged.

In India, small-cap index rebalancing often leads to outsized moves, because passive AUM is large relative to daily traded volumes.

6. Sector and Factor Index Rebalancing

Rebalancing isn’t limited to broad market indices.

Sector indices rebalance when sector classifications change or relative sizes shift.

Factor indices (momentum, low volatility, value) rebalance more frequently and aggressively.

Factor rebalancing can create crowded trades:

Momentum indices buy recent winners and sell losers, reinforcing trends.

Low-volatility indices may dump stocks that become volatile during market stress, worsening drawdowns.

This mechanical behavior can amplify market cycles.

7. Short-Term Distortions vs. Long-Term Reality

A crucial point: index rebalancing does not change fundamentals. Revenue, earnings, and cash flows remain the same. The price impact is largely technical.

Short term:

Prices may overshoot

Volatility rises

Correlations increase

Long term:

Prices often mean-revert

Fundamental performance reasserts itself

This creates opportunities for disciplined investors who can distinguish between flow-driven moves and genuine fundamental changes.

8. Strategies Around Index Rebalancing

Professional investors actively design strategies to exploit these effects:

Index inclusion arbitrage: Buy stocks likely to be added before the announcement.

Event-driven trading: Trade the announcement-to-effective date window.

Contrarian strategies: Buy deleted stocks after forced selling exhausts.

Liquidity provision: Provide liquidity to index funds on rebalance day at favorable prices.

However, these strategies are competitive and require precise execution and cost control.

9. Risks and Unintended Consequences

Index rebalancing also introduces systemic risks:

Price inefficiency: Mechanical flows override price discovery.

Crowding: Too much capital chasing the same index names.

Volatility spikes: Especially near market closes on rebalance days.

Feedback loops: Rising prices lead to higher weights, attracting more inflows.

In extreme cases, this can lead to index bubbles, where valuation becomes secondary to index membership.

10. Growing Importance in Modern Markets

As passive investing grows, index rebalancing impact is becoming more powerful. Markets are increasingly shaped not just by fundamentals, but by rules, calendars, and flows. For long-term investors, understanding rebalancing helps avoid emotional reactions to short-term noise. For active traders, it provides a repeatable, data-driven edge.

Conclusion

Index rebalancing is a mechanical process with very real market consequences. It drives predictable buying and selling, creates short-term distortions, and occasionally offers attractive trading opportunities. While the impact is usually temporary, its influence on liquidity, volatility, and price behavior is undeniable. In today’s markets, ignoring index rebalancing means missing a key piece of the puzzle that explains why prices sometimes move without any obvious fundamental reason.

TATASTEEL 1 Week Time Frame 📌 Current Price Snapshot

Tata Steel is trading around ₹183–₹185 on the NSE.

📊 Weekly Technical Levels (Support & Resistance)

🟢 Resistance Levels (Upside Targets)

These are zones where price may face selling pressure or struggle to break above on a weekly basis:

1. ₹188 – ₹190 — Immediate key resistance, near recent highs/52-week high zone.

2. ₹192 – ₹195 — Next resistance if the stock decisively clears ₹190 on weekly closes.

3. ₹195 + — Higher psychological area and extended targets for bullish continuation.

👉 Bullish trigger: Weekly close above ₹188–₹190 strengthens upside momentum.

🔴 Support Levels (Downside Zones)

These act as buying interest zones if the stock pulls back:

1. ₹181 – ₹182 — Immediate support keeping the uptrend intact.

2. ₹178 – ₹180 — Stronger base zone from recent swing lows & pivot cluster.

3. ₹174 – ₹176 — Deeper support if the key zones above break.

👉 Bearish risk: Weekly close below ₹178 could lead to tests around the ₹172–₹175 zone.

📉 Weekly Trend & Indicators

Long-term trend on weekly appears neutral–bullish with moving averages generally supportive and RSI around neutral–positive.

Market news also shows price recently hitting or near 52-week highs, indicating strong sector interest.

📌 How to Use These Levels on Weekly Timeframe

Bullish Scenario

Stay above ₹181–₹182 on weekly close → strengthens chance towards ₹188–₹190 resistance.

Above ₹190 weekly → next targets ₹192–₹195 and beyond.

Neutral/Range Scenario

Trading between ₹178–₹188 → range-bound movement likely; buy near support, sell near resistance.

Bearish Scenario

Weekly close below ₹178 → risk testing lower supports ₹174–₹176 / ₹172–₹175 area.

The Resurgence of India’s Public Sector Banking PowerHistorical Challenges Faced by PSU Banks

For a long time, PSU banks struggled under the weight of stressed assets, particularly after the corporate lending boom of the mid-2000s. Aggressive lending to infrastructure, power, steel, and telecom sectors, combined with economic slowdowns and policy bottlenecks, led to a sharp rise in NPAs. Weak credit appraisal systems, governance challenges, and limited autonomy further constrained performance. As a result, profitability declined, capital adequacy weakened, and market valuations remained subdued compared to private sector banks.

Government-Led Reforms and Recapitalization

A major catalyst behind the rise of PSU banks has been decisive government intervention. Large-scale recapitalization programs injected much-needed capital into banks, strengthening their balance sheets and enabling them to meet regulatory requirements. The government also initiated governance reforms, including improved board oversight, professional management practices, and performance-linked accountability. These steps restored stability and provided PSU banks with the confidence to resume lending activity.

Resolution of NPAs and Improved Asset Quality

One of the most significant contributors to the revival of PSU banks is the sharp improvement in asset quality. The introduction of the Insolvency and Bankruptcy Code (IBC) created a structured mechanism for resolving stressed assets. Through recoveries, write-offs, and better provisioning practices, gross and net NPAs declined substantially across major PSU banks. Improved asset quality reduced credit costs, directly boosting profitability and strengthening investor sentiment.

Robust Credit Growth and Economic Recovery

India’s economic recovery and sustained growth momentum have provided a favorable backdrop for PSU banks. Rising demand for credit from infrastructure, manufacturing, MSMEs, agriculture, and retail segments has supported healthy loan growth. Government-led capital expenditure on roads, railways, defense, and renewable energy has especially benefited PSU banks, given their strong presence in project financing and public sector lending. This renewed credit cycle has translated into higher interest income and better utilization of capital.

Digital Transformation and Operational Efficiency

PSU banks have made significant strides in digital transformation, narrowing the gap with private sector peers. Investments in core banking systems, digital payment platforms, mobile banking apps, and fintech partnerships have improved customer experience and operational efficiency. Automation and data analytics have enhanced risk management and credit monitoring, reducing the likelihood of future asset quality stress. These technological upgrades have helped PSU banks remain competitive in an increasingly digital financial ecosystem.

Improved Profitability and Financial Metrics

As asset quality improved and credit growth picked up, PSU banks began reporting strong financial results. Many leading PSU banks have posted record profits, supported by lower provisioning requirements, stable net interest margins, and improved cost management. Capital adequacy ratios have strengthened, return on assets has improved, and balance sheets appear more resilient. This financial turnaround has been a key driver behind the rising stock market performance of PSU bank shares.

Investor Confidence and Market Re-Rating

The improved fundamentals of PSU banks have not gone unnoticed by investors. After years of underperformance, PSU bank stocks have seen significant re-rating in the equity markets. Domestic institutional investors and retail participants have shown renewed interest, attracted by improving earnings visibility, reasonable valuations, and strong dividend potential. The rising performance of PSU banks has also contributed positively to broader banking and financial sector indices.

Strategic Role in Financial Inclusion and Social Objectives

Beyond profitability, PSU banks continue to play a vital role in financial inclusion and social development. They are instrumental in implementing government schemes such as Jan Dhan Yojana, Direct Benefit Transfers (DBT), Mudra loans, and agricultural credit programs. Their extensive branch network in rural and semi-urban areas enables them to support inclusive growth while simultaneously expanding their customer base. This dual role of commercial performance and social responsibility strengthens their long-term relevance.

Challenges That Remain

Despite the impressive rise, PSU banks still face challenges. Competition from agile private banks and fintechs remains intense. Maintaining asset quality during rapid credit expansion requires disciplined risk management. Governance reforms must be sustained to ensure autonomy, transparency, and accountability. Additionally, global economic uncertainties, interest rate volatility, and sector-specific stress could test the resilience of PSU banks in the future.

Outlook: A Sustainable Revival

The rise of PSU banks marks a structural shift rather than a short-term recovery. With cleaner balance sheets, stronger capital positions, improved governance, and supportive macroeconomic conditions, PSU banks are well-positioned to sustain growth. Their role in financing India’s infrastructure push, supporting MSMEs, and expanding financial inclusion will remain crucial in the coming years. If reforms continue and risk management remains prudent, PSU banks are likely to emerge as stable, profitable, and trusted institutions in India’s financial landscape.

Conclusion

The resurgence of PSU banks represents one of the most significant success stories in India’s financial sector in recent times. From grappling with severe stress to delivering strong financial performance, PSU banks have demonstrated resilience and adaptability. Their rising trajectory reflects the combined impact of policy reforms, economic recovery, and internal transformation. As they continue to evolve, PSU banks are set to play a central role in shaping India’s growth story, reinforcing confidence in the public sector banking system, and contributing to long-term economic stability.

Candle Patterns How Candle Patterns Work with Market Structure

Candles do not work well in isolation. Their true power emerges when aligned with:

Support/Resistance Levels

Trend Direction

Breakouts and Pullbacks

Volume Profile Zones (HVN, LVN)

For example:

A Hammer at support = reliable reversal.

A Doji at resistance = caution for buyers.

Engulfing pattern after liquidity sweep = strong reversal.

Market structure helps validate candlestick signals and improve accuracy.

Sub-Brokers in the Indian Stock MarketRole, Structure, Opportunities, and Challenges

The Indian stock market is one of the fastest-growing financial markets in the world, supported by a wide network of intermediaries who connect investors with stock exchanges. Among these intermediaries, sub-brokers play a crucial role. They act as an important bridge between registered stockbrokers and retail investors, especially in semi-urban and rural regions of India. Understanding sub-brokers is essential for anyone looking to participate in the Indian securities market, either as an investor or as a market intermediary.

Meaning of Sub-Brokers in India

A sub-broker is an individual or entity that acts on behalf of a registered stockbroker to assist investors in trading securities. Sub-brokers do not have direct membership with stock exchanges such as NSE (National Stock Exchange) or BSE (Bombay Stock Exchange). Instead, they operate under a main broker (also called a trading member) and help clients open trading and demat accounts, place trades, and understand market products.

Sub-brokers are registered with SEBI (Securities and Exchange Board of India) and must comply with its regulations. Their primary role is client acquisition and servicing, while the execution of trades and clearing is handled by the main broker.

Regulatory Framework and Registration

SEBI governs the functioning of sub-brokers in India to ensure transparency, investor protection, and ethical conduct. To become a sub-broker, an individual or firm must:

Register with SEBI through a registered stockbroker

Fulfill eligibility criteria such as educational qualifications and certification (e.g., NISM certification)

Pay the prescribed registration fees

Comply with SEBI’s code of conduct

Sub-brokers must also adhere to KYC (Know Your Customer) norms, anti-money laundering guidelines, and regular compliance reporting. In recent years, SEBI has streamlined and modernized regulations, encouraging digital onboarding and higher accountability.

Role and Functions of Sub-Brokers

Sub-brokers perform multiple functions in the Indian market ecosystem:

Client Acquisition

One of the most important roles of a sub-broker is to bring new investors into the stock market. They leverage personal relationships, local presence, and trust to onboard clients who may not be comfortable dealing directly with large brokerage firms.

Investor Education and Guidance

Sub-brokers educate clients about equity, derivatives, mutual funds, commodities, and other financial instruments. They help investors understand market risks, trading strategies, and regulatory requirements.

Account Opening and Documentation

They assist clients in opening trading and demat accounts, completing KYC formalities, and linking bank accounts.

Order Placement and Trade Support

Sub-brokers help clients place buy and sell orders through the broker’s trading platform and provide support during market hours.

Relationship Management

Personalized service is a key strength of sub-brokers. They maintain long-term relationships with clients, offering customized solutions and timely support.

Types of Sub-Brokers in India

Sub-brokers in India can be broadly classified into different categories:

Individual Sub-Brokers: Independent professionals operating in a specific locality

Franchise Sub-Brokers: Operating under a brokerage brand with office infrastructure

Remisiers: Focus mainly on client referrals and earn commission without handling operations

Digital Partners: Sub-brokers associated with online or discount brokers, focusing on digital client acquisition

Each type differs in terms of responsibilities, revenue sharing, and operational involvement.

Revenue Model and Earnings

Sub-brokers earn income through commission sharing with the main broker. The revenue depends on:

Trading volume generated by clients

Brokerage structure (percentage-based or flat fee)

Number of active clients

Product mix (equity, derivatives, commodities, mutual funds)

Typically, sub-brokers receive 40% to 70% of the brokerage generated by their clients. Those with a strong client base and high trading volumes can earn substantial and recurring income. However, earnings are not fixed and depend heavily on market activity.

Importance of Sub-Brokers in the Indian Market

Sub-brokers have been instrumental in expanding the reach of the Indian stock market. Their importance includes:

Financial Inclusion: Bringing first-time investors into the market

Regional Penetration: Serving small towns and rural areas

Trust-Based Relationships: Offering comfort to investors unfamiliar with online trading

Market Awareness: Promoting financial literacy and investment culture

Even with the rise of discount brokers and online platforms, sub-brokers remain relevant due to their personalized approach.

Impact of Technology and Changing Market Structure

Technology has significantly transformed the role of sub-brokers. Online trading platforms, mobile apps, and digital KYC have reduced manual processes. Modern sub-brokers now focus more on advisory, education, and relationship management rather than just order placement.

At the same time, the growth of discount brokers has increased competition, putting pressure on traditional commission-based models. Sub-brokers who adapt by offering value-added services such as portfolio guidance, research insights, and financial planning are better positioned for long-term success.

Challenges Faced by Sub-Brokers

Despite their importance, sub-brokers face several challenges:

Regulatory Compliance: Increasing compliance requirements demand time and resources

Margin Pressure: Lower brokerage rates reduce earnings

Technological Adaptation: Need to stay updated with digital platforms

Market Volatility: Income fluctuates with market conditions

Client Expectations: Investors expect faster service and expert-level guidance

To survive and grow, sub-brokers must continuously upgrade skills and services.

Future of Sub-Brokers in India

The future of sub-brokers in India is evolving rather than disappearing. While pure execution-based roles may decline, advisory-driven and relationship-focused sub-brokers will remain in demand. SEBI’s emphasis on investor protection and transparency will further professionalize the sub-broker ecosystem.

Sub-brokers who embrace technology, diversify product offerings, and focus on long-term client value will continue to play a significant role in India’s capital markets.

Conclusion

Sub-brokers are a vital part of the Indian stock market structure. They act as trusted intermediaries, educators, and facilitators for millions of investors. Despite facing regulatory and competitive challenges, sub-brokers continue to contribute to market growth and financial inclusion. As the Indian market matures, the role of sub-brokers will shift from simple intermediaries to comprehensive financial partners, ensuring their relevance in the years to come.

METALIETF 1 Week Time Frame 📊 Current Context (Latest Price)

• The ETF is trading around ₹11.6–₹11.8 (mid‑Jan 2026 data).

📈 Weekly Technical Levels (Pivot‑Based Support / Resistance)

From the weekly pivot point analysis:

Weekly Pivot Point (Center): ~ ₹11.38

This is a key level — above it suggests bullish bias on weekly charts.

Weekly Resistance Levels:

R1: ~ ₹11.71 — first upside target/resistance

R2: ~ ₹12.28 — secondary resistance zone

R3: ~ ₹12.61 — further supply zone if momentum continues

Weekly Support Levels:

S1: ~ ₹11.05 — initial support on pullbacks

S2: ~ ₹10.81 — next support below

S3: ~ ₹10.48 — deeper weekly support

Central Pivot Range (CPR):

Top CPR ~ 11.51

Bottom CPR ~ 11.26

This band often acts as a weekly equilibrium zone — trading above it keeps bulls in control.

📌 Summary – Weekly Key Levels

Level Type Price (₹)

Weekly Resistance 3 (R3) ~11.52

Weekly Resistance 2 (R2) ~11.28

Weekly Resistance 1 (R1) ~11.06

Weekly Pivot ~10.82

Weekly Support 1 (S1) ~10.60

Weekly Support 2 (S2) ~10.36

Weekly Support 3 (S3) ~10.14

HINDZINC 1 Week Time Frame 📌 Current Context (mid‑Jan 2026)

• The stock is trading around ~₹640‑₹654 on NSE.

📊 1‑Week Key Levels (Support & Resistance)

🔄 Weekly Pivot (Standard)

Pivot (weekly baseline): ~₹615‑₹642 (varies slightly by method)

📈 Resistance Levels

R1: ~₹642‑₹677 (immediate weekly resistance)

R2: ~₹677‑₹688 (secondary supply zone)

R3: ~₹704‑₹706+ (higher hurdle)

📉 Support Levels

S1: ~₹579‑₹614 (first weekly support band)

S2: ~₹552‑₹580 (next downside cushion)

S3: ~₹516‑₹553 (deeper support zone)

📉 Weekly Swing Range (Indicative)

Likely weekly range for HINDZINC over next 4–5 sessions:

➡️ Upside: ~₹675‑₹705+ (on strong bullish momentum)

➡️ Downside: ~₹550‑₹580 (if markets soften)

This range assumes standard weekly pivot behavior and typical momentum — actual moves may vary with broader market catalysts like metals index moves or commodity price shifts.

Part 2 Intraday Master ClassTypes of Options

There are two primary types of options:

a) Call Option

A call option gives the buyer the right to buy the underlying asset at the strike price before or at expiry. Traders buy call options when they expect the price of the underlying asset to rise.

Buyer’s risk: Limited to the premium paid

Buyer’s reward: Potentially unlimited

Seller’s risk: Potentially unlimited

b) Put Option

A put option gives the buyer the right to sell the underlying asset at the strike price before or at expiry. Traders buy put options when they expect the price to fall.

Buyer’s risk: Limited to the premium paid

Buyer’s reward: Significant but capped by the price going to zero

Seller’s risk: Substantial

Part 1 Intraday Master Class What Is Option Trading?

An option is a financial derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (called the strike price) on or before a specific date (known as the expiry date). The seller (or writer) of the option, on the other hand, has the obligation to fulfill the contract if the buyer chooses to exercise the option.

Option trading involves buying and selling these contracts in the derivatives market. In India, options are commonly traded on stocks and indices such as NIFTY, BANK NIFTY, and FINNIFTY.