Part 1 Intraday Institutional Trading Strategies What Are Options? (Basic Definition)

Options are financial contracts that give the buyer the right (but not the obligation) to buy or sell an underlying asset (such as Nifty, Bank Nifty, stocks, commodities) at a pre-decided strike price, within a specific expiration time.

Two types of options:

1. Call Option (CE)

Gives the buyer the right to buy.

You buy a call when you expect the price to go up.

2. Put Option (PE)

Gives the buyer the right to sell.

You buy a put when you expect the price to go down.

But options are not just about direction. They involve time, volatility, market psychology, and risk management.

Trendingstocks

Part 2 Intraday Institutional Trading StrategiesOption Buyer

Pays premium

Limited loss (only premium)

Unlimited profit potential

Needs movement quickly

Time decay works against them

Option Seller

Receives premium

Limited profit (premium only)

High probability of profit

Time decay works in their favor

Must manage risk properly (because losses can be large)

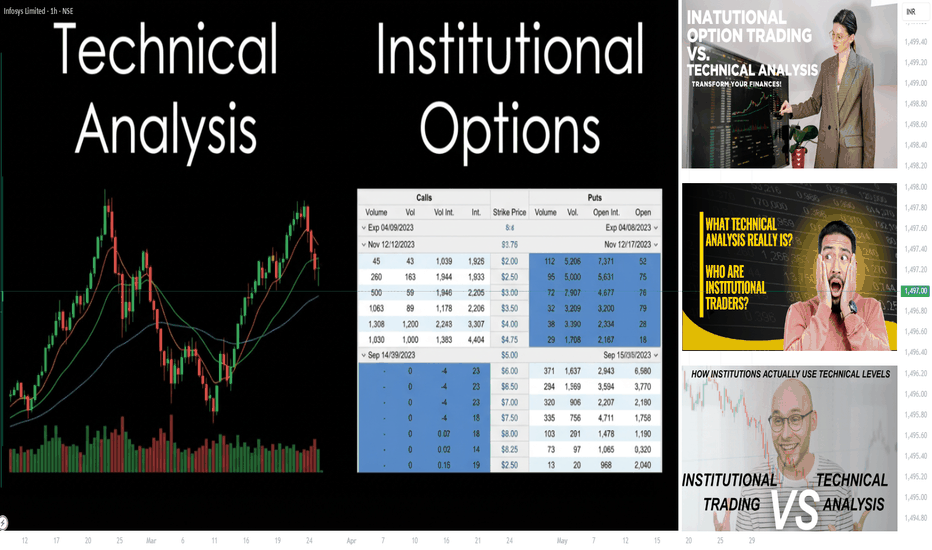

Part 2 Institutional Option Trading VS. Technical AnalysisWhy Option Prices Move

Option pricing is driven by four major forces:

1. Price Action (Directional Movement)

If the underlying goes up, call premiums rise.

If the underlying goes down, put premiums rise.

2. Time Decay (Theta)

Options lose value as they approach expiry.

Time decay accelerates sharply in the last week.

3. Volatility (Vega)

When implied volatility (IV) increases, option premiums rise.

When IV falls, option premiums drop.

4. Interest Rates & Dividends

Small effect for index options, more for stock options.

Part 1 Institutional Option Trading VS. Technical Analysis Important Option Terminology

Before going deeper, you must understand key terms.

1. Strike Price

The predetermined price at which the option can be exercised.

2. Spot Price

Current market price of the underlying asset.

3. Premium

Price of the option.

4. Expiration

The last date the option is valid (weekly or monthly).

5. Lot Size

Minimum quantity defined by the exchange.

6. ITM (In the Money)

Call: Strike < Spot

Put: Strike > Spot

7. ATM (At the Money)

Strike = Spot

8. OTM (Out of the Money)

Call: Strike > Spot

Put: Strike < Spot

Part 3 Institutional Option Trading VS. Technical AnalysisBest Practices for Option Traders

1. Use a strategy, not impulses

Enter with logic, not emotion.

2. Risk Management

Never risk more than 1–2% of capital per trade.

3. Understand Volatility

Most retail losses come from ignoring IV.

4. Avoid Illiquid Options

Always trade high-volume strikes.

5. Prefer spreads over naked positions

Spreads reduce both risk and margin.

6. Don’t hold losing trades

Cut loss quickly; small loss is a big victory.

Part 1 Intraday Master Class Introduction to Option Trading

Option trading is a form of derivatives trading that gives market participants the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. Unlike traditional stock trading—where investors buy or sell shares outright—options allow traders to control risk, enhance returns, hedge portfolios, or speculate on price movements with relatively lower capital.

Options are widely used in equity markets, commodity markets, currency markets, and index trading. Over time, option trading has evolved from a niche hedging tool into a sophisticated financial instrument used by retail traders, institutional investors, hedge funds, and market makers.

Part 2 Institutional Trading VS. Technical AnalysisMoneyness of Options

Moneyness describes the relationship between the spot price and strike price.

1. In-the-Money (ITM)

Call: Spot > Strike

Put: Spot < Strike

2. At-the-Money (ATM)

Spot ≈ Strike

3. Out-of-the-Money (OTM)

Call: Spot < Strike

Put: Spot > Strike

ITM options have intrinsic value; OTM options are purely speculative.

Part 2 Intraday Institutional Trading Option Buyers vs Option Sellers

There are two sides to every option contract:

1. Option Buyer (Holder)

Pays a premium

Has limited risk (only premium paid)

Has unlimited profit potential (for calls)

Benefits from volatility

2. Option Seller (Writer)

Receives a premium upfront

Has limited profit (only premium earned)

Has potentially unlimited risk

Benefits when the market remains stable

Buyers look for big moves; sellers look for stability.

Part 4 Institutional Option Trading VS. Technical AnalysisOption Trading Rewards

Despite the risks, option trading offers powerful advantages:

1. Leverage

Small premium → large exposure.

2. Risk Defined Strategies

Spread strategies limit losses.

3. Income Generation

Option selling can create consistent income.

4. Hedging

Protect stock or portfolio risk.

5. Flexibility

Trade direction, volatility, range, even time.

Part 2 Technical Analysis Vs. Institutional TradingHedging with Options

Options are powerful risk-management tools.

Portfolio hedging during market crashes.

Protect profits without exiting positions.

Institutional investors heavily rely on options for downside protection.

For example, buying index puts during uncertain periods can safeguard long-term investments.

Part 1 Support and Resistance Option Buyers

Limited risk (premium paid).

Require strong price movement.

Benefit from volatility.

Time works against them due to time decay.

Option Sellers (Writers)

Limited profit (premium received).

Potentially unlimited risk (especially naked positions).

Benefit from time decay.

Prefer range-bound markets.

Part 2 Intraday Master Class Key Components of an Option Contract

Underlying Asset

The financial instrument on which the option is based (stock, index, commodity, currency).

Strike Price (Exercise Price)

The price at which the underlying can be bought or sold.

Expiry Date

The last date on which the option can be exercised.

Premium

The price paid by the buyer to the seller for the option.

Contract Size

The quantity of the underlying asset covered by one contract.

Trade with Volume: The Hidden Power Behind Price (In-Depth)1. What Is Volume in Trading?

Volume represents the number of shares, contracts, or lots traded during a specific time period. In equities, it is the number of shares exchanged; in futures and forex, it reflects contracts or tick volume. Every trade requires both a buyer and a seller, but volume measures how active and aggressive that interaction is.

High volume means strong interest and participation. Low volume means lack of commitment. Price can move on low volume, but such moves are fragile and often reverse. Sustainable trends almost always require expanding volume.

In simple terms:

Price shows direction

Volume shows strength

2. Why Volume Is More Important Than Indicators

Most indicators—RSI, MACD, moving averages—are derived from price. Volume, however, is raw market data, not a derivative. Institutions, hedge funds, and smart money cannot hide their volume. They may disguise orders, but accumulation and distribution leave volume footprints.

Retail traders often get trapped because they trade patterns without volume confirmation. A breakout without volume is usually a false breakout. A reversal without volume is often a temporary pullback. Volume filters noise and exposes real intent.

3. Volume Confirms Trends

A healthy trend must be supported by volume.

In an uptrend, volume should increase during upward moves and decrease during pullbacks.

In a downtrend, volume should expand on declines and contract on rallies.

If price makes higher highs but volume declines, it signals weak participation—a warning of trend exhaustion. This phenomenon is known as volume divergence, and it often appears near major tops and bottoms.

Trend traders use volume to decide whether to hold, add, or exit positions. When volume confirms trend direction, staying in the trade becomes statistically favorable.

4. Volume and Breakouts

Breakouts are one of the most traded setups, but also one of the most failed—mainly because traders ignore volume.

A true breakout requires:

Expansion in volume

Wide-range candles

Acceptance above resistance or below support

If price breaks resistance on low volume, it suggests lack of institutional interest. Such breakouts are often stop-hunts designed to trap retail traders. High-volume breakouts, on the other hand, indicate fresh money entering the market, increasing the probability of follow-through.

Professional traders often wait for volume confirmation before entering, even if it means missing the first few points.

5. Volume at Support and Resistance

Support and resistance levels gain significance when combined with volume. When price approaches support:

Rising volume suggests strong buying interest

Falling volume suggests buyers are weak

At resistance:

High volume with rejection indicates distribution

High volume with breakout indicates absorption of supply

Institutions accumulate positions quietly near support with moderate volume, then push price higher with explosive volume. Similarly, they distribute near resistance before major declines. Observing volume behavior at key levels reveals who is in control—buyers or sellers.

6. Accumulation and Distribution

One of the most powerful uses of volume is identifying accumulation and distribution phases.

Accumulation occurs when large players buy gradually without moving price much. Volume increases, but price stays in a range.

Distribution occurs when institutions sell into retail buying enthusiasm. Volume remains high, but upside progress stalls.

These phases often precede major moves. Traders who recognize accumulation early can enter before breakouts. Those who spot distribution can exit before crashes. Volume is the only reliable tool to detect these silent transitions.

7. Volume Indicators and Tools

While raw volume itself is powerful, several indicators help interpret it:

Volume Moving Average: Compares current volume to historical norms.

On-Balance Volume (OBV): Tracks cumulative buying and selling pressure.

Volume Profile: Shows where trading activity is concentrated across price levels.

VWAP (Volume Weighted Average Price): Used heavily by institutions for intraday bias.

Accumulation/Distribution Line: Measures whether volume favors buyers or sellers.

These tools don’t replace price action—they enhance it. The best traders combine volume analysis with structure, not indicators alone.

8. Volume in Intraday Trading

In intraday trading, volume is even more critical. The first hour of trading often sets the tone for the day. High volume during opening range breakouts signals institutional participation. Low volume midday moves are often fake and best avoided.

Scalpers use volume spikes to enter momentum trades. Intraday reversals are most reliable when they occur with climactic volume, indicating exhaustion. Without volume, intraday setups lack edge.

9. Volume in Different Markets

Volume behaves differently across markets:

Equities: Actual traded volume is transparent and highly reliable.

Futures: Centralized volume makes it ideal for volume analysis.

Forex: Uses tick volume, which still correlates strongly with real activity.

Crypto: Volume is crucial due to manipulation; fake moves often occur on thin volume.

Regardless of market, the principle remains the same: strong moves require strong participation.

10. Common Mistakes Traders Make with Volume

Many traders misunderstand volume by:

Using volume alone without context

Ignoring volume at key levels

Overtrading low-volume markets

Assuming high volume is always bullish or bearish

Volume must always be read relative to price action and market structure. It is not directional by itself—it explains why price is moving.

11. Volume and Risk Management

Volume also helps with risk management. Trades entered on high volume have better liquidity, tighter spreads, and smoother execution. Low-volume trades increase slippage and false signals. Professionals prefer trading instruments with consistent, healthy volume.

Stop-loss placement improves when volume is considered. Stops placed beyond high-volume nodes are less likely to be hunted.

12. The Institutional Perspective

Institutions think in terms of liquidity, not indicators. Volume tells them where liquidity exists. Retail traders who learn volume analysis begin to think like institutions—waiting for confirmation, avoiding thin markets, and aligning with dominant flows.

Volume is the bridge between retail charts and institutional reality.

Conclusion

Trading with volume transforms how you see the market. It shifts your focus from prediction to confirmation, from hope to evidence. Price can lie, patterns can fail, and indicators can lag—but volume reveals participation, strength, and intent.

If price is the story, volume is the truth behind it.

Traders who master volume stop chasing moves and start positioning alongside smart money. In the long run, volume is not just an indicator—it is a strategic edge that separates consistent traders from emotional gamblers.

Smart Money Secrets: How Institutions Really Control the Markets1. Smart Money Thinks in Liquidity, Not Indicators

Retail traders focus on indicators like RSI, MACD, or moving averages. Smart money focuses on liquidity—where orders are resting.

Liquidity exists at:

Previous highs and lows

Trendline breaks

Obvious support and resistance

Round numbers (100, 500, 1000)

Stop-loss clusters

Institutions need large volumes to enter or exit positions. They cannot buy or sell all at once without moving price against themselves. So instead, they hunt liquidity, pushing price toward areas where retail stops and pending orders sit.

That’s why price often:

Breaks resistance, then reverses

Sweeps a low before rallying

Triggers stop-losses before the real move

These are not random moves. They are liquidity grabs.

2. Accumulation and Distribution Are the Core Game

Smart money operates in phases, not single trades.

Accumulation Phase

Institutions accumulate positions when:

Price is moving sideways

Volatility is low

Sentiment is negative or boring

Retail interest is minimal

This phase often looks like a “range” or “consolidation.” Retail traders get chopped, frustrated, and exit—while smart money quietly builds positions.

Expansion (Markup or Markdown)

Once enough positions are accumulated:

Price breaks out aggressively

Volume expands

News suddenly turns positive (or negative)

Retail traders chase the move

Distribution Phase

At the top or bottom:

Price again moves sideways

Volatility compresses

Retail believes the trend will continue forever

This is where institutions offload positions to emotional traders.

Smart money buys boredom and sells excitement.

3. Smart Money Uses Time as a Weapon

Retail traders want quick profits. Smart money uses time to exhaust them.

Institutions are patient. They can hold positions for weeks or months. During this time:

Price may move slowly or erratically

Fake breakouts trap traders

Multiple stop hunts occur

Most retail traders quit right before the real move begins.

Time-based manipulation is why:

Breakouts fail repeatedly before succeeding

Strong moves come after long consolidation

Trends feel “obvious” only after they’ve already run

4. News Follows Smart Money, Not the Other Way Around

A major secret is this: smart money positions itself before news becomes public.

Institutions don’t wait for:

Earnings announcements

Rate decisions

Economic data

Instead, they anticipate outcomes and use news as a liquidity event.

That’s why you often see:

Price moving before news

“Good news” causing a market drop

“Bad news” triggering rallies

News gives smart money an excuse to:

Trigger stops

Exit positions

Reverse trends

Retail traders react to headlines. Smart money uses them.

5. False Breakouts Are a Feature, Not a Bug

One of the most painful experiences for retail traders is the false breakout. For smart money, false breakouts are essential tools.

They serve three purposes:

Trigger stop-losses

Induce breakout traders to enter

Provide liquidity for institutional entries

When price breaks a key level and quickly returns, it often signals:

Smart money has completed accumulation

Liquidity has been collected

The real move is coming in the opposite direction

This is why experienced traders wait for confirmation after the trap, not the breakout itself.

6. Smart Money Respects Market Structure

Institutions operate within market structure, not random entries.

Key structure concepts include:

Higher highs and higher lows (bullish control)

Lower highs and lower lows (bearish control)

Break of structure (trend shift)

Change of character (early reversal signal)

When structure breaks:

Smart money adapts

Positions are reduced, hedged, or reversed

Retail traders often hold losing positions hoping structure will “come back.” Institutions exit without emotion.

7. Risk Management Is the Ultimate Edge

Smart money does not aim for perfection—it aims for survival and consistency.

Core principles:

Small risk per trade

Asymmetric reward (small risk, large upside)

Accepting losses as business expenses

Never being emotionally attached to a bias

Institutions win not because they predict every move, but because their losers are controlled and their winners are allowed to run.

Retail traders often do the opposite.

8. Smart Money Thinks in Probabilities, Not Certainty

There is no “sure shot” trade in smart money thinking.

Instead:

Every trade is a probability bet

Bias is adjusted as new data appears

Flexibility is valued over ego

Institutions are comfortable being wrong quickly. Retail traders try to be right at all costs.

9. Retail Sentiment Is a Contrarian Indicator

One of the oldest smart money secrets is this:

When the majority is confident, risk is highest.

Institutions monitor:

Retail positioning

Social media sentiment

Option flows

Crowd behavior

Extreme optimism or pessimism often marks:

Market tops

Market bottoms

Smart money doesn’t follow the crowd—it feeds on it.

10. The Real Secret: Discipline Over Intelligence

The final truth is uncomfortable: smart money is not always smarter—it is more disciplined.

They have:

Rules they don’t break

Systems they trust

Emotions removed from execution

Most retail traders fail not because of lack of knowledge, but because of:

Overtrading

Revenge trading

Ignoring risk

Emotional decision-making

Smart money wins because it treats trading as a process, not a thrill.

Conclusion

Smart money secrets are not hidden in complex indicators or secret formulas. They are visible in price behavior, liquidity, structure, and human psychology. Institutions exploit impatience, emotion, and predictability. Retail traders who learn to think like smart money—waiting, observing, managing risk, and respecting structure—move from being liquidity providers to informed participants.

The market is not against you—but it rewards those who stop reacting and start thinking like capital, not crowds.

Part 1 Intraday Institutional Trading ITM, ATM, OTM Options

These describe where the current price is compared to strike price.

a) ITM – In The Money

Call: Current price > Strike

Put: Current price < Strike

ITM options cost more.

b) ATM – At The Money

Current price ≈ Strike price

Most volatile and liquid.

c) OTM – Out of The Money

Call: Current price < Strike

Put: Current price > Strike

OTM is cheaper but risky; goes to zero quickly on expiry.

Part 2 Technical Analysis Vs. Institutional Option Trading Key Components of an Option Contract

Every option contract has a few standard elements:

a) Strike Price

The price at which you can buy (call) or sell (put) the underlying asset.

b) Premium

The price you pay to buy the option.

Think of it like a ticket price to take the trade.

c) Expiry Date

Options expire on a fixed date (weekly/monthly).

If not exercised, they lose value after expiry.

d) Lot Size

You cannot buy 1 share option.

Every option contract has a fixed lot size (e.g., Nifty = 50 units).

Part 1 Technical Analysis Vs. Institutional Option Trading What Are Options?

Options are financial contracts that give you the right, but not the obligation, to buy or sell an asset at a specific price before a certain date.

Two types of options:

Call Option – Right to buy

Put Option – Right to sell

Options are written on assets like:

Stocks

Index (Nifty, Bank Nifty)

Commodities

Currencies

Biggest Mistakes New Traders Make (A Detailed Guide)1. Trading Without Proper Education

One of the biggest mistakes new traders make is jumping into live markets without learning the basics. Many start trading after watching a few YouTube videos or copying trades from Telegram or WhatsApp groups. They don’t understand market structure, risk management, or how price actually moves.

Trading is a skill, not a shortcut to fast money. Without understanding concepts like support and resistance, trends, volatility, position sizing, and psychology, traders are essentially gambling. Education doesn’t guarantee success, but lack of education almost guarantees failure.

2. Unrealistic Profit Expectations

New traders often expect to double their money in weeks or become full-time traders within months. Social media plays a major role in creating these illusions by showcasing only winning trades and luxury lifestyles.

In reality, consistent trading success takes years. Professional traders focus on process, not daily profits. Unrealistic expectations push beginners to overtrade, use excessive leverage, and take unnecessary risks—all of which lead to rapid losses.

3. Poor Risk Management

This is the number one reason traders blow up their accounts.

New traders often risk too much on a single trade, sometimes 10–50% of their capital. They believe one good trade will “change everything.” When the market moves against them, the damage becomes irreversible.

Successful traders focus on capital protection first. They typically risk only 1–2% per trade. Without risk management, even a good strategy will fail. You can be right 60% of the time and still lose money if your losses are uncontrolled.

4. Not Using Stop Losses Properly

Many beginners either don’t use stop losses at all or move them emotionally. When a trade goes against them, they hope the price will come back. Hope is not a trading strategy.

Markets don’t care about your entry price. A stop loss is a tool to protect your capital and your psychology. Avoiding stop losses leads to large, unexpected losses that wipe out weeks or months of gains.

5. Emotional Trading (Fear and Greed)

New traders are highly emotional. Fear makes them exit winning trades too early. Greed makes them hold losing trades too long. After a loss, revenge trading kicks in—placing impulsive trades to recover money quickly.

Emotions cloud judgment. Professional traders accept losses as part of the business. Beginners take losses personally, which leads to impulsive decisions. Mastering emotions is more important than mastering indicators.

6. Overtrading

Overtrading happens when traders take too many trades without valid setups. Beginners feel they must be in the market all the time. If the market is open, they feel obligated to trade.

This behavior increases transaction costs, mental fatigue, and mistakes. Quality matters far more than quantity. Some of the best traders take only a few high-probability trades per week.

7. Strategy Hopping

New traders constantly switch strategies. One week it’s price action, next week indicators, then options scalping, then crypto futures. After a few losses, they abandon the strategy and look for a “better one.”

Every strategy has losing streaks. Without consistency, traders never master anything. Success comes from executing one well-defined strategy over hundreds of trades, not from constantly chasing the next shiny method.

8. Ignoring Trading Psychology

Many beginners focus only on technical analysis and ignore psychology. They believe indicators will solve everything. But trading is a mental game.

Discipline, patience, confidence, and emotional control matter more than entry techniques. Without psychological stability, even the best strategy will fail under pressure. Traders must learn to follow rules even when emotions are high.

9. No Trading Plan

Trading without a plan is like driving without a destination. New traders often enter trades randomly without knowing:

Why they entered

Where they will exit if wrong

Where they will take profit

How much they are risking

A trading plan creates structure and accountability. Without it, decisions become emotional and inconsistent, leading to unpredictable results.

10. Blindly Following Tips and Signals

Many beginners rely on tips, paid signals, or social media “experts.” They don’t know why a trade is taken or how risk is managed. When trades fail, they blame others instead of improving their own skills.

Signals create dependency. Real traders build independence. Learning how to analyze and execute trades yourself is essential for long-term success.

11. Overusing Indicators

New traders often clutter charts with too many indicators. This creates confusion and conflicting signals. More indicators do not mean better analysis.

Price itself is the most important indicator. Indicators should support decisions, not replace thinking. Simplicity improves clarity and execution.

12. Not Keeping a Trading Journal

Most beginners don’t track their trades. Without a journal, they repeat the same mistakes again and again without realizing it.

A trading journal helps identify strengths, weaknesses, emotional patterns, and strategy flaws. Growth is impossible without self-review.

13. Trading With Money They Can’t Afford to Lose

Trading with borrowed money or essential savings adds extreme emotional pressure. Fear of loss leads to poor decisions and panic exits.

Only risk capital you can emotionally and financially afford to lose. Peace of mind is a hidden edge in trading.

Conclusion

New traders don’t fail because markets are impossible. They fail because they underestimate the complexity of trading and overestimate their readiness. The biggest mistakes—poor risk management, emotional trading, lack of discipline, and unrealistic expectations—are completely avoidable.

Trading is a marathon, not a sprint. Success comes from patience, continuous learning, self-awareness, and strict risk control. If new traders focus on survival first and profits second, they give themselves a real chance to succeed in the long run.

Automated Trading Strategies: The Future of Modern TradingHow Automated Trading Works

An automated trading system operates through a combination of strategy logic, market data, and execution mechanisms.

Strategy Logic

This is the brain of the system. It defines when to enter a trade, when to exit, how much to trade, and how to manage risk. Rules may be based on technical indicators, price action, statistical models, or even machine learning.

Market Data Feed

Real-time or historical price data is required for the strategy to analyze market conditions. Accuracy and low latency are critical, especially for high-frequency or intraday strategies.

Execution Engine

Once the conditions are met, the system automatically sends buy or sell orders to the broker or exchange, ensuring precise and timely execution.

Risk Management Module

Automated strategies often include predefined stop-loss levels, position sizing rules, and maximum drawdown limits to protect capital.

Popular Types of Automated Trading Strategies

1. Trend-Following Strategies

Trend-following is one of the most widely used automated strategies. These systems aim to capture sustained price movements by identifying trends using indicators such as moving averages, MACD, or ADX.

Logic: Buy when price is above a long-term average; sell when it falls below.

Strength: Works well in strong, directional markets.

Weakness: Struggles in sideways or choppy conditions.

Trend-following algorithms are popular because of their simplicity and adaptability across asset classes such as stocks, forex, commodities, and cryptocurrencies.

2. Mean Reversion Strategies

Mean reversion strategies are based on the idea that prices tend to return to their historical average after extreme movements.

Logic: Buy when price deviates significantly below the mean; sell when it rises too far above.

Tools: Bollinger Bands, RSI, Z-score.

Strength: Effective in range-bound markets.

Weakness: Can fail badly during strong trends.

These strategies require strict risk controls because markets can stay “overbought” or “oversold” longer than expected.

3. Breakout Strategies

Breakout strategies focus on identifying key price levels such as support and resistance. When price breaks out of these levels with momentum, the algorithm enters a trade in the direction of the breakout.

Logic: Buy above resistance; sell below support.

Confirmation: Volume expansion or volatility increase.

Strength: Captures strong momentum moves.

Weakness: Vulnerable to false breakouts.

Automated breakout systems are commonly used in index futures, commodities, and intraday equity trading.

4. Arbitrage Strategies

Arbitrage strategies exploit price inefficiencies between related markets or instruments.

Examples include:

Statistical arbitrage between correlated stocks

Index arbitrage between futures and cash markets

Crypto exchange arbitrage

Strength: Low directional risk.

Weakness: Requires speed, low transaction costs, and advanced infrastructure.

Arbitrage is dominated by institutional traders but simplified versions are accessible to retail traders today.

5. High-Frequency Trading (HFT)

High-frequency trading involves executing thousands of trades per second to capture very small price movements.

Logic: Speed-based micro opportunities

Infrastructure: Co-location, ultra-low latency networks

Strength: Consistent small profits

Weakness: Extremely competitive and capital intensive

HFT is largely inaccessible to retail traders but represents the extreme end of automated trading.

6. News and Event-Based Strategies

These strategies react to economic data releases, earnings announcements, or geopolitical events.

Logic: Trade volatility spikes after news

Data: Economic calendars, earnings feeds

Strength: Exploits predictable volatility patterns

Weakness: Slippage and execution risk

Automation is critical here because human reaction time is too slow.

Role of Artificial Intelligence and Machine Learning

Modern automated trading increasingly incorporates AI and machine learning techniques. These systems can:

Detect complex, non-linear patterns

Adapt to changing market conditions

Optimize parameters dynamically

Examples include neural networks, reinforcement learning agents, and predictive models trained on large datasets. While powerful, AI-based systems are also prone to overfitting and require rigorous testing.

Backtesting and Optimization

Before deploying any automated strategy, it must be thoroughly backtested on historical data.

Key considerations:

Realistic transaction costs

Slippage and latency

Avoiding curve-fitting

Out-of-sample testing

A strategy that performs well historically but fails in live markets is often the result of poor testing or over-optimization.

Advantages of Automated Trading

Emotion-Free Trading: Eliminates fear and greed

Consistency: Executes rules exactly as designed

Speed: Faster than manual trading

Scalability: Can monitor multiple markets simultaneously

Discipline: No impulsive decisions

These benefits make automation particularly appealing for systematic and professional traders.

Risks and Challenges

Despite its advantages, automated trading is not risk-free.

Technical Failures: Connectivity issues, software bugs

Market Regime Changes: Strategies can stop working

Over-Optimization: Good backtests, poor live results

Black Swan Events: Extreme moves can break models

Successful automated traders continuously monitor, refine, and adapt their systems.

Conclusion

Automated trading strategies represent a powerful evolution in how financial markets are traded. By combining disciplined rules, advanced analytics, and high-speed execution, these systems offer traders the ability to operate with precision and consistency that manual trading struggles to achieve. However, automation is not a shortcut to guaranteed profits. It requires deep market understanding, robust risk management, and constant evaluation.

In the modern trading landscape, the edge does not come from predicting the future—but from building systems that respond intelligently to uncertainty. Automated trading, when used wisely, transforms trading from an emotional gamble into a structured, repeatable process.

Senores Pharma cmp 823.40 by Daily Chart view since it listedSenores Pharma cmp 823.40 by Daily Chart view since it listed

- Support Zone 765 to 805 Price Band

- Resistance Zone 835 to ATH 876.50 Price Band

- Stock Price trending upside within Rising Price Channel

- Volumes are running well in sync under avg traded quantity

- Majority Technical Indicators EMA, BB, MACD, RSI trending positively

Stocks Breaking Out with VolumeA resistance level is a price area where a stock usually struggles to move higher. Many traders sell there, so the price keeps getting pushed down. You can think of it like a ceiling that the stock keeps hitting but cannot cross.

A breakout of resistance happens when the price finally moves above this ceiling and closes strongly above it. This means buyers have overpowered sellers. It often signals that the stock may start a new upward move because the earlier selling pressure has been absorbed.

When a stock breaks out with high volume , it becomes more reliable. Volume shows participation. High volume means many traders and institutions are buying, not just a few people. This adds strength and conviction to the move, increasing the chances that the breakout will continue instead of failing.

In simple terms:

Breakout without volume = weak signal.

Breakout with volume = more trustworthy signal

That’s why traders often say, “ Volume confirms the breakout .”

Here are a few stocks that broke out of a resistance with volume-

1. BirlaSoft:

The stock is breaking out of its previous peak with a higher average volume

2. Avenue Supermart:

Creating a higher high after long time. Although there are overhead supply zones, higher volume suggests that this could be a new beginning.

3. IOC:

Straight ride from 150 support zone to a high looking strong.

Which one do you think is stronger?

Do you hold any of them?

Do write in the comment section your views on them.

📣Disclaimer:

Everything shared here is meant for education and general awareness only. It’s not financial advice, nor a recommendation to buy, sell, or hold any asset. Do your own research, manage your risk, and make sure you understand what you’re getting into.

Part 2 Ride The Big MovesLot Size

Options trade in lots, not single units.

Lot size varies by instrument.

Why Are Options Popular?

Low upfront premium.

Leverage.

Sophisticated hedging.

High liquidity.

European vs American Options

Indian index options are European — can only be exercised on expiry.

Stock options are American — can be exercised any time (but rarely done).