Part 2 Institutionaal Intraday Trading Risk Management and Compliance

Institutional trading is governed by strict "Risk Parameters." A retail trader might risk their whole account on a "YOLO" trade; an institutional trader has hard stops programmed into their software.

Value at Risk (VaR): A statistical technique used to measure the level of financial risk within a firm over a specific time frame.

Position Sizing: No single intraday position is usually allowed to exceed a tiny percentage of the total fund to prevent a single "black swan" event from bankrupting the firm.

Compliance: Every trade is logged and monitored for "spoofing" (placing fake orders to manipulate prices) or "front-running" (trading ahead of a client's known order), both of which are highly illegal.

Trendisyourfriend

Part 1 Institutionaal Intraday Trading The Infrastructure: Speed and Connectivity

Institutional traders don’t use standard web-based brokers. They operate on direct market access (DMA) systems, connecting directly to stock exchange servers.

Co-location: Many firms pay premium fees to house their servers in the same data center as the exchange’s servers. This reduces "latency"—the time it takes for data to travel—to microseconds.

Dark Pools: To avoid moving the market price against themselves, institutions often trade in "Dark Pools." These are private exchanges where buy and sell orders are hidden from the public until the trade is executed.

High-Frequency Trading (HFT): A subset of institutional trading where algorithms execute thousands of orders per second. These firms don't look for big price moves; they look for fractions of a cent across millions of trades.

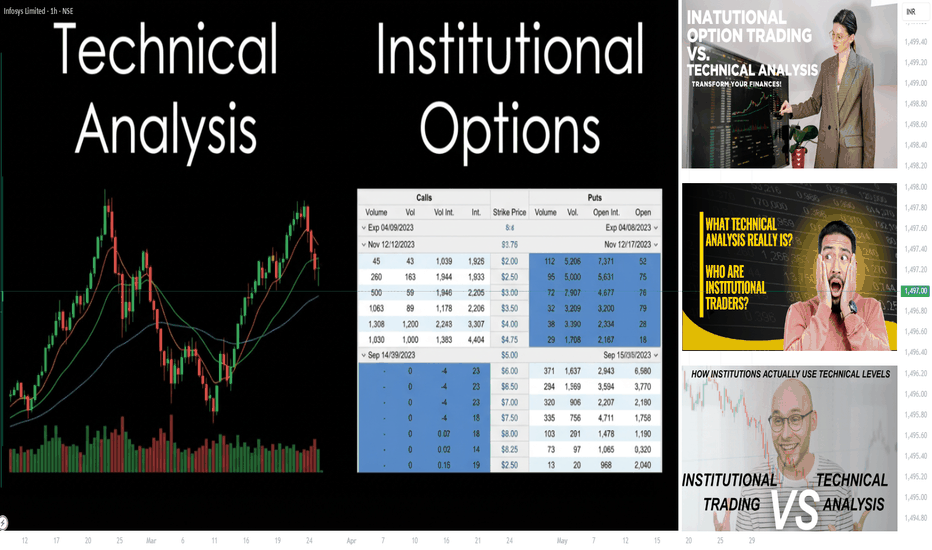

Part 4 Institutional Option Trading VS. Technical AnalysisTechnical Analysis Strategies

TA traders use:

Breakout trading

Trend-following

Support/resistance bounce

Momentum setups

Reversal patterns

Moving-average strategies

Price action scalping

Chart patterns (triangles, flags, head and shoulders etc.)

TA is visual + rule-based, not quantitative.

Part 2 Intraday Institutional Trading1. Long Call (The Bullish Bet)

This is the most straightforward strategy for a trader who expects a stock to skyrocket.

Setup: Buy a Call Option.

Market View: Bullish.

Risk: Limited to the premium paid.

Reward: Theoretically unlimited (as the stock price can rise indefinitely).

The Catch: The stock must rise enough to cover the cost of the premium and beat time decay (Theta). If the stock stays flat, you lose money.

2. Long Put (The Bearish Bet)

Used when you expect a sharp decline in the asset.

Setup: Buy a Put Option.

Market View: Bearish.

Risk: Limited to the premium paid.

Reward: Substantial (as the stock price drops toward zero).

The Catch: Similar to the long call, time is your enemy. You need a significant move down to profit.

Part 2 Technical VS. InstitutionalKey Terms You Need to Know

Before placing a trade, you have to speak the language. Every options contract is defined by four pillars:

Underlying Asset: The stock or ETF the option is based on (e.g., Apple, Tesla).

Strike Price: The predetermined price at which the option holder can buy or sell the stock.

Expiration Date: The "shelf life" of the contract. Unlike stocks, options do not last forever. If the stock hasn't moved your way by this date, the option expires worthless.

Premium: This is the price you pay to own the option. It’s the "entry fee."

Part 5 Option Trading Strategies Key Components of Option Trading

- Underlying Asset: The security (stock, index, commodity, etc.) the option is based on.

- Strike Price: Fixed price to buy/sell the asset.

- Expiry Date: Last day the option can be exercised.

- Premium: Price paid for the option contract.

- Lot Size: Number of shares/contracts per lot.

- Option Type: Call (buy) or Put (sell).

Part 1 Institutional Trading VS. Technical Analysis Option Trading Profits

Call Option Profit

- Buyer: Profit if underlying price > strike price + premium paid.

- Seller: Profit is the premium received (if option expires worthless).

Put Option Profit- Buyer: Profit if underlying price < strike price - premium paid.

- Seller: Profit is the premium received (if option expires worthless).

Profit Factors- Price Movement: Direction and magnitude.

- Volatility: Impacts option value.

- Time Decay: Options lose value over time.

Part 1 Institutional Intraday Trading ⭐What Is Option Premium?

Premium = Intrinsic Value + Time Value

Intrinsic Value

Actual value if exercised today.

If Nifty is 22,000 and call strike is 21,900:

Intrinsic value = 100.

Time Value

Extra value due to time left till expiry.

More time = more premium.

Less time = fast decay.

Part 4 Institutional Option Trading VS. Technical Analysis⭐Components of an Option Contract

Strike Price — the fixed price mentioned in the contract.

Premium — price you pay to buy the option.

Expiry Date — weekly/monthly expiry.

Underlying Asset — Nifty, Bank Nifty, stock, etc.

Option Type — Call (CE) or Put (PE).

Lot Size — options are traded in lots (example: Nifty = 50 units).

American vs European — India uses European, meaning exercised only at expiry.

Moneyness — whether option is ITM, ATM, or OTM.

Part 1 Intraday Institutional Trading What Are Options?

An option is a financial contract that gives you the right, but not the obligation, to buy or sell an asset at a fixed price—called the strike price—before or on a specific date—called the expiry.

There are two types of options:

1. Call Option

A Call Option gives the holder the right to buy the underlying asset at a fixed price before expiry.

Traders buy calls when they expect the price to go up.

Example: A call option with strike ₹100 on a stock trading at ₹95 becomes profitable if the stock rises above ₹100.

2. Put Option

A Put Option gives the holder the right to sell the underlying asset at a fixed price before expiry.

Traders buy puts when they expect the price to go down.

Example: A put option with strike ₹100 becomes profitable if the stock falls below ₹100.

Part 4 Institutional Option Trading VS. Technical AnalysisOption Trading Rewards

Despite the risks, option trading offers powerful advantages:

1. Leverage

Small premium → large exposure.

2. Risk Defined Strategies

Spread strategies limit losses.

3. Income Generation

Option selling can create consistent income.

4. Hedging

Protect stock or portfolio risk.

5. Flexibility

Trade direction, volatility, range, even time.

Part 3 Institutional Option Trading VS. Technical AnalysisBest Practices for Option Traders

1. Use a strategy, not impulses

Enter with logic, not emotion.

2. Risk Management

Never risk more than 1–2% of capital per trade.

3. Understand Volatility

Most retail losses come from ignoring IV.

4. Avoid Illiquid Options

Always trade high-volume strikes.

5. Prefer spreads over naked positions

Spreads reduce both risk and margin.

6. Don’t hold losing trades

Cut loss quickly; small loss is a big victory.

Part 1 Intraday Institutional Trading Strategies What Are Options? (Basic Definition)

Options are financial contracts that give the buyer the right (but not the obligation) to buy or sell an underlying asset (such as Nifty, Bank Nifty, stocks, commodities) at a pre-decided strike price, within a specific expiration time.

Two types of options:

1. Call Option (CE)

Gives the buyer the right to buy.

You buy a call when you expect the price to go up.

2. Put Option (PE)

Gives the buyer the right to sell.

You buy a put when you expect the price to go down.

But options are not just about direction. They involve time, volatility, market psychology, and risk management.

Can You Control Revenge Trading?Understanding, Managing, and Eliminating One of Trading’s Deadliest Habits

1. What Is Revenge Trading?

Revenge trading happens when a trader, after taking a loss (or a series of losses), abandons their plan and starts trading emotionally to “get the money back.” The market begins to feel personal. Every candle looks like an insult. Every loss feels unfair.

Instead of trading setups, the trader trades emotions.

Typical signs of revenge trading:

Increasing position size after a loss

Entering trades without confirmation

Overtrading the same instrument

Ignoring stop-loss rules

Trading immediately after a big loss without reflection

Revenge trading is not about strategy failure — it’s about emotional hijacking.

2. Why Revenge Trading Is So Dangerous

Revenge trading compounds mistakes. One small, manageable loss turns into:

Bigger losses

Loss of discipline

Loss of confidence

Eventually, loss of capital

Markets don’t punish traders — traders punish themselves by staying emotionally engaged when they should step away.

The irony?

Most traders who revenge trade are technically capable. They know support/resistance, indicators, patterns. What breaks them is psychology.

3. The Psychology Behind Revenge Trading

To control revenge trading, you must understand why it happens.

a. Loss Aversion

Humans feel losses 2–2.5 times more intensely than gains. Your brain is wired to “fix” pain immediately.

b. Ego and Identity

Many traders subconsciously link their self-worth to being right. A loss feels like:

“I am wrong” instead of “This trade didn’t work.”

So the ego demands redemption.

c. Fight-or-Flight Response

After a loss, stress hormones (like cortisol and adrenaline) spike. Logical thinking drops. Impulsive behavior rises.

You’re literally biologically less intelligent after a loss.

4. Can Revenge Trading Be Controlled?

Yes — but not by willpower alone.

Revenge trading is controlled through:

Systems

Rules

Environment design

Emotional awareness

Habit restructuring

Trying to “just be disciplined” almost never works.

5. Step-by-Step Ways to Control Revenge Trading

1. Define a Maximum Daily Loss (Hard Stop)

This is non-negotiable.

Example:

If you lose 2% in a day, you stop trading — no exceptions.

Why it works:

It removes decision-making during emotional stress

It protects capital and mindset

It trains respect for risk

Professional traders don’t trade every day. They trade when conditions and mindset align.

2. Mandatory Cooling-Off Period After a Loss

After a loss:

Step away for 10–30 minutes

No charts

No news

No social media

This allows your nervous system to reset.

If you re-enter immediately, chances are you’re trading emotion, not probability.

3. Trade Only Pre-Defined Setups

Write down:

Entry conditions

Stop-loss logic

Target logic

If a trade doesn’t meet all criteria, you are not allowed to take it — especially after a loss.

Revenge trades usually start with:

“This looks good enough.”

“Good enough” is where discipline dies.

4. Reduce Position Size After a Loss

Professional risk managers often reduce size after a losing streak, not increase it.

Why?

Confidence drops after losses

Execution quality declines

Emotional sensitivity increases

Smaller size keeps you engaged without emotional overload.

5. Keep a Trading Journal Focused on Emotions

Don’t just log:

Entry

Exit

P&L

Also log:

Emotional state before the trade

Emotional state after the loss

Whether rules were followed

Patterns will emerge. Most traders are shocked to see how often losses come from rule violations, not bad setups.

Awareness is the first layer of control.

6. Separate “Trading Time” from “Review Time”

Never analyze mistakes during live market hours.

After a loss:

Do not “fix” it immediately

Do not prove anything to the market

Review later when emotions are neutral.

Markets reward patience, not urgency.

7. Accept That Losses Are the Cost of Business

This mindset shift is crucial.

Losses are:

Rent you pay to stay in the market

Data points, not judgments

Inevitable in probabilistic systems

Once you truly accept that losses don’t need to be recovered immediately, revenge trading loses its grip.

6. Long-Term Habits That Eliminate Revenge Trading

a. Process Over Profits

Judge your day by:

Rule-following

Execution quality

Not by money made or lost.

b. Fewer Trades, Better Trades

Overtrading fuels emotional spirals. High-quality traders often take very few trades.

c. Capital Preservation First

Your first job is not to make money — it’s to stay in the game.

7. Final Truth About Revenge Trading

Revenge trading isn’t a character flaw.

It’s a human response to uncertainty, loss, and ego.

You don’t eliminate it by being tougher.

You eliminate it by being structured.

The moment you stop trying to “beat the market” and start trying to execute your edge calmly, revenge trading fades.

Remember:

The market will always be there tomorrow.

Your capital and mindset might not be — if you don’t protect them today.

Focus on Market: Meaning, Importance, and Strategic ImpactWhat Does “Focus on Market” Mean?

Market focus refers to the systematic attention given to market dynamics, including:

Price movements and trends

Supply and demand forces

Institutional and retail behavior

Macroeconomic indicators

Sectoral rotation

Sentiment and risk appetite

Rather than acting on assumptions or emotions, a market-focused approach relies on evidence, observation, and adaptability.

Why Market Focus Is Critical

1. Markets Are Forward-Looking

Markets do not wait for news to become official. Prices often move before economic data, earnings, or policy announcements. A focused market participant reads early signals such as:

Bond yield movements

Currency strength or weakness

Volume and volatility changes

Institutional positioning

Those who ignore these signals usually react late.

2. Risk Management Depends on Market Awareness

Risk is not static—it changes with market conditions. During stable periods, leverage may seem harmless. During volatile phases, the same leverage can destroy capital.

A strong market focus helps in:

Adjusting position size

Identifying regime shifts (bull, bear, sideways)

Protecting capital during uncertainty

In markets, survival comes before profits.

3. Market Focus Separates Noise from Signal

Modern markets are flooded with information: news headlines, social media opinions, analyst calls, and rumors. Without focus, participants get distracted and confused.

Market focus trains the mind to ask:

Is this information already priced in?

Is price confirming the narrative?

Who benefits from this move—smart money or emotion?

Price action often tells the truth before words do.

Focus on Market in Trading

For traders, market focus is everything.

1. Understanding Market Structure

Markets move in trends, ranges, and transitions. A focused trader recognizes:

Higher highs and higher lows (uptrend)

Lower highs and lower lows (downtrend)

Consolidation and accumulation

Trading against structure is gambling, not strategy.

2. Institutional Behavior

Large institutions move markets through:

Volume

Liquidity zones

Order flow

Retail traders who focus only on indicators miss the bigger picture. Market focus shifts attention to:

Support and resistance zones

Breakouts with volume

False breakouts and stop hunts

This is where smart money leaves footprints.

3. Psychology and Sentiment

Fear and greed drive short-term market moves. Extreme optimism often appears near tops, while panic emerges near bottoms.

A market-focused trader watches:

Volatility spikes

Put-call ratios

Sudden sentiment reversals

Markets reward discipline, not excitement.

Focus on Market in Investing

For investors, market focus does not mean constant trading—it means contextual awareness.

1. Market Cycles

Markets move in cycles:

Expansion

Peak

Contraction

Recovery

Understanding where the market stands helps investors decide:

When to accumulate

When to reduce exposure

When to rotate sectors

Long-term success depends on buying value at the right time, not just buying good companies.

2. Sector and Asset Allocation

A focused investor tracks:

Sector leadership (IT, banking, energy, FMCG)

Asset class performance (equities, bonds, commodities)

Global capital flows

Money moves in waves. Those who follow the flow outperform those who stay rigid.

3. Macro Alignment

Interest rates, inflation, currency trends, and fiscal policy influence markets deeply. Ignoring macro factors can lead to misjudging even strong fundamentals.

Market focus ensures investments are aligned with:

Economic trends

Policy direction

Liquidity conditions

Focus on Market in Business Strategy

Businesses that lose market focus lose relevance.

1. Customer-Centric Thinking

Markets are driven by customer needs. Companies must constantly ask:

What problem are we solving?

How are customer preferences changing?

Who is disrupting our space?

Market focus keeps businesses adaptive instead of defensive.

2. Competitive Intelligence

Monitoring competitors’ pricing, innovation, and positioning helps firms:

Adjust strategy early

Protect market share

Identify untapped opportunities

Markets punish complacency faster than mistakes.

3. Innovation and Timing

Even great ideas fail if timing is wrong. Market focus helps businesses launch:

When demand is rising

When cost structures are favorable

When regulation supports growth

Timing is often more important than brilliance.

Focus on Market for Policymakers

Governments and central banks must stay deeply market-focused.

Interest rate decisions affect bonds, equities, currencies

Policy missteps can trigger capital flight

Clear communication stabilizes markets

A market-focused policy framework balances growth, inflation, employment, and financial stability.

Challenges in Maintaining Market Focus

Despite its importance, market focus is difficult because of:

Emotional biases

Information overload

Short-term distractions

Overconfidence

Successful market participants build systems, rules, and discipline to stay objective.

Conclusion

Focus on the market is the foundation of intelligent decision-making in trading, investing, business, and policy. Markets are complex, adaptive systems that reward awareness, flexibility, and discipline while punishing ignorance and ego.

Those who truly focus on the market:

Listen more than they predict

Observe more than they react

Adapt more than they insist

In the end, the market does not care about opinions—it only respects understanding, preparation, and execution.

Part 2 Technical Analysis Vs. Institutional TradingHedging with Options

Options are powerful risk-management tools.

Portfolio hedging during market crashes.

Protect profits without exiting positions.

Institutional investors heavily rely on options for downside protection.

For example, buying index puts during uncertain periods can safeguard long-term investments.

Part 1 Technical Analysis Vs. Institutional Trading Volatility and Option Trading

Volatility is the backbone of option pricing.

Types of Volatility

Historical Volatility – Past price movement.

Implied Volatility (IV) – Market’s expectation of future volatility.

High IV → Expensive options.

Low IV → Cheap options.

Option sellers prefer high IV, while buyers prefer low IV with upcoming expansion.

Part 1 Support and Resistance Option Buyers

Limited risk (premium paid).

Require strong price movement.

Benefit from volatility.

Time works against them due to time decay.

Option Sellers (Writers)

Limited profit (premium received).

Potentially unlimited risk (especially naked positions).

Benefit from time decay.

Prefer range-bound markets.

Part 2 Intraday Master Class Key Components of an Option Contract

Underlying Asset

The financial instrument on which the option is based (stock, index, commodity, currency).

Strike Price (Exercise Price)

The price at which the underlying can be bought or sold.

Expiry Date

The last date on which the option can be exercised.

Premium

The price paid by the buyer to the seller for the option.

Contract Size

The quantity of the underlying asset covered by one contract.

Part 1 Intraday Master Class Introduction to Option Trading

Option trading is a form of derivatives trading that gives market participants the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. Unlike traditional stock trading—where investors buy or sell shares outright—options allow traders to control risk, enhance returns, hedge portfolios, or speculate on price movements with relatively lower capital.

Options are widely used in equity markets, commodity markets, currency markets, and index trading. Over time, option trading has evolved from a niche hedging tool into a sophisticated financial instrument used by retail traders, institutional investors, hedge funds, and market makers.

Part 1 Intraday Institutional Trading ITM, ATM, OTM Options

These describe where the current price is compared to strike price.

a) ITM – In The Money

Call: Current price > Strike

Put: Current price < Strike

ITM options cost more.

b) ATM – At The Money

Current price ≈ Strike price

Most volatile and liquid.

c) OTM – Out of The Money

Call: Current price < Strike

Put: Current price > Strike

OTM is cheaper but risky; goes to zero quickly on expiry.