USDJPY

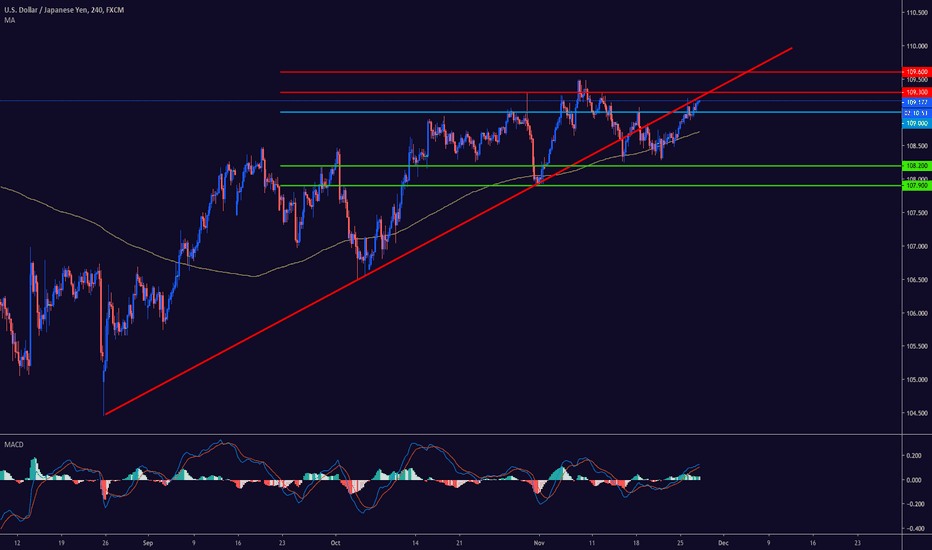

USDJPY WEEKLY FORECASTThe pair is favored to remain in a cycle higher in wave (1) from the 8/26/19 lows where the daily is turning up. The 4 hour right side is up from the 107.63 lows where wave 4 ended. While a pullback remains above the 109.75 lows where the hourly is turning up the pair can see the 111.00 -111.50 area in wave 5 of (1) before it corrects the cycle up from the 8/26/19 lows

LONG SETUP FOR USDJPYhe pair is favored to remain in a cycle higher in wave (1) from the 8/26/19 lows where the daily is turning up. The 4 hour right side is up from the 107.63 lows where wave 4 ended. While a pullback remains above the 109.76 lows where the hourly is turning up the pair can see the 111.00 -111.50 area in wave 5 of (1) before it corrects the cycle up from the 8/26/19 lows.

Don't miss the great Sell opportunity in USDJPYTrading suggestion:

. There is still a possibility of temporary retracement to suggested resistance line (108.87).

if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. USDJPY is in a range bound and the beginning of Downtrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 33.

Take Profits:

TP1= @ 107.83

TP2= @ 106.77

TP3= @ 105.24

SL= Break below S2

Possible short movement on USD/JPYTDI telling us to go short, but because it is counter trend will just wait for the correct pattern coming out of the EMAS to get in.

We should expect a small bearish move of about 22 pips, take it as a little pullback of the high bullish move that started on December 12

USDJPY 108.20 major supportThe US dollar remains under downside pressure against the Japanese yen, following the release of more weak data from the US economy. From a technical perspective, the USDJPY pair is extremely weak while trading below the 108.60 support level. Going forward, a break under the 108.20 level exposes the USDJPY pair to heavy technical selling towards the 107.50 level and possibly lower.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.15 and 109.40 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY bearish under 108.90The US dollar has fallen back under the 108.90 level against the Japanese yen currency, making the pair technically bearish over the short-term. Continued weakness under this key area could provoke further losses towards the 108.20 level. The USDJPY pair could capitulate to technical selling if the 108.20 support level is broken.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.40 and 109.65 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY 110.00 possibleThe US dollar continues to target towards 110.00 level against the Japanese yen as the greenback remains well-supported across the board. The recent high around the 109.60 level provided a signal that the USDJPY intends to push higher over the shor-term. The 110.90 level could be the overall upside objective for medium-term bulls if the 110.00 resistance level is overcome.

• The USDJPY pair is only bullish while trading above the 109.30 level, key resistance is found at the 109.60 and 110.0 levels.

• The USDJPY pair is only bearish while trading below the 109.30 level, key technical support is found at the 109.15 and 109.00 levels.

USDJPY trendline watchThe US dollar has moved back towards key trendline resistance against the Japanese yen currency, although price has so far rejected the upside attack. The USDJPY pair is still vulnerable to further downside while trading below the October monthly price high. Overall, Sino-US trade news is dictating the moves in the USDJPY pair, the short-term trend is now neutral.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 108.20 and 107.90 levels.

USDJPY sell ralliesThe US dollar remains vulnerable to further losses against the Japanese yen currency as market sentiment towards Sino-US trade talks is fragile. The USDJPY pair is likely to suffer a strong decline once a confirmed breakout below the 107.90 level occurs. Going forward, selling any rallies towards the 109.00 resistance level appears to be the best short-term trading strategy.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 107.90 and 107.50 levels.

USDJPY 107.50 possibleThe US dollar remains under pressure against the Japanese yen, following reports that the first phase of the Sino-US trade deal could be delayed until next year. The USDJPY pair is increasingly likely to test towards the 107.50 support level, with the 106.90 level extended weekly support. Going forward, USDJPY traders have few reasons to be bullish while price trades under the 109.00 level.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 107.50 and 106.90 levels.

USDJPY possible breakdownThe US dollar is starting to appear weak against the Japanese yen currency, following multiple technical rejections and bearish lower highs. The USDJPY pair is likely to target the 107.50 level at a minimum this week if a breakout below the 108.20 level occurs. Going forward, only a sustained breakout above the 109.30 level can negate the bearish outlook surrounding the USDJPY pair.

• The USDJPY pair is only bullish while trading above the 109.30 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 109.30 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY upside failureThe US dollar has come back under pressure against the Japanese yen currency after suffering a heavy technical rejection around the 109.00 level. The balance of power is with sellers while price trades below the rising trendline on the daily time frame. Overall, a break below the 108.20 support level exposes the USDJPY pair to further losses towards the 107.50 level.

• The USDJPY pair is only bullish while trading above the 108.68 level, key resistance is found at the 109.00 and 109.40 levels.

• The USDJPY pair is only bearish while trading below the 108.68 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY trendline breakThe US dollar is still trading on the defensive against the Japanese yen currency as the pair continues to fall back from the 109.00 resistance are. Major trendline support for the USDJPY pair has now been broken and is currently located at around the pivotal 108.60 level. Going forward, the USDJPY pair could fall towards the 107.50 level if the 108.20 support level is broken.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY testing lowerThe US dollar is trading lower against the Japanese yen currency after a technical break below the 108.90 support level. Further intraday losses towards the 108.20 level remain possible while the USDJPY pair trades below the important 108.90 level. Overall, sustained gains above the 109.30 level are needed to encourage a technical test of the 110.00 resistance level.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.60 and 108.20 levels.

USDJPY 110.00 still possibleThe US dollar is increasingly bullish against the Japanese yen currency, following a sharp bounce from the pivotal 108.60 support level. The USDJPY pair is likely to test towards the 110.00 level if the 109.60 resistance level is overcome later today. Overall, an even stronger rally towards the 110.80 level is still possible, as the USDJPY pair continues to exhibit bullish price action.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.20 and 107.90 levels

USDJPY 109.30 test comingThe US dollar continues to press higher against the Japanese yen currency, following the recent reversal from the 107.90 support. An upcoming technical test of the 109.30 level is on the horizon, with a breakout above the October high likely to spark a rally towards the 110.00 level. Overall, the daily time frame shows the presence of an extremely large inverted head and shoulders pattern.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.30 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 107.90 and 107.30 levels

USDJPY new lowThe US dollar is coming under increasing pressure against the Japanese yen, with the pair falling to a fresh multi-week trading low. The USDJPY pair risks a deeper decline towards the 107.30 level if the 107.90 support level is broken over the coming sessions. Overall, USDJPY sellers now have the upper hand in the short-term while price trades below the 108.60 resistance level.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.00 and 109.30 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 107.90 and 107.30 levels

USDJPY 109.30 neededThe US dollar is trading around the 109.00 level against the Japanese yen as overall market sentiment towards the pair increases. The USDJPY pair now needs to rally above the 109.30 resistance level to encourage a major upside technical breakout towards the 110.00 level. Caution is still advised when trading the USDJPY pair until a breakout above the 109.30 level takes place.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.30 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.25 and 107.90 levels