USD/JPY Bullish Continuation Towards 149.00This USD/JPY (1H) chart shows a bullish setup:

Price is respecting the ascending channel (support & rejection lines).

Currently, price is near the FVG (Fair Value Gap) zone between 147.257 – 147.526, suggesting a possible retracement before continuation upward.

Both EMA 70 & EMA 200 are aligned closely, acting as dynamic support.

A long entry is expected from the FVG zone with a target point at 148.975 – 149.002.

Stop-loss lies below the FVG around 147.251.

👉 Overall bias: Bullish continuation towards 149.00 after filling the FVG.

Usdjpybuy

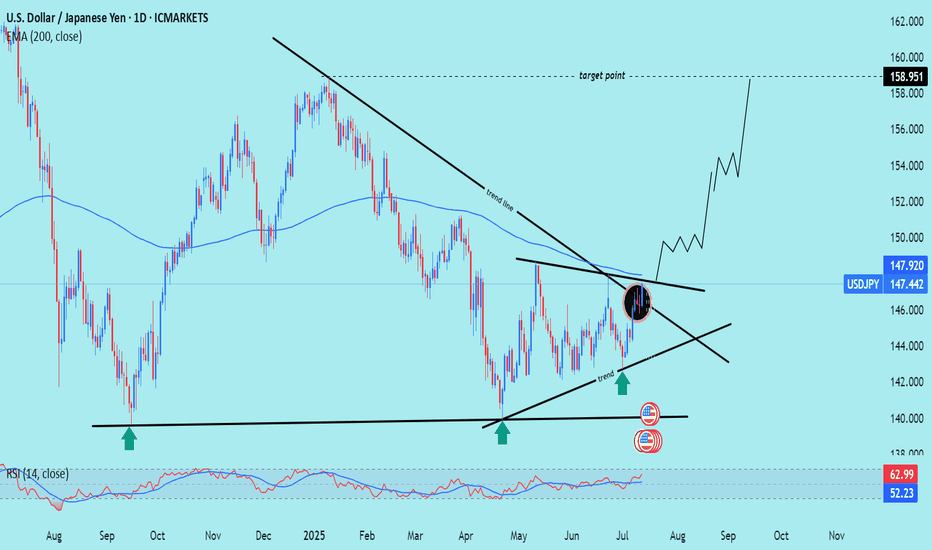

USD/JPY) LOGN TIME Analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the daily timeframe, highlighting a long-term downtrend reversal with potential for significant upside.

---

Analysis Summary

Pair: USD/JPY

Timeframe: Daily

Current Price: 147.442

Bias: Bullish breakout from a descending wedge structure.

---

Key Technical Insights

1. Descending Trendline Break:

Price has broken above the long-term downtrend line, signaling a reversal.

Breakout area is circled in yellow, confirming bullish intent.

2. Trendline & Structure Support:

Multiple rejections from the ascending support trendline (marked by green arrows) confirm accumulation and higher lows.

3. 200 EMA as Dynamic Resistance/Support:

Price is now above the 200 EMA (147.920) — a bullish signal, turning resistance into support.

4. RSI (14):

RSI at 62.99, approaching overbought territory, but still has room to push further.

---

Target Point

Target: 158.951

Based on measured move from wedge breakout and historical resistance level.

---

Trade Setup Idea

Direction Entry Stop-Loss Target

Buy 147.40–147.60 Below 145.80 158.95

Mr SMC Trading point

---

Summary

This chart signals a major bullish breakout on USD/JPY, with the break of a year-long downtrend structure, reclaiming the 200 EMA. If this breakout sustains, price could aim for 158.95 in the coming weeks.

Please support boost 🚀 this analysis)

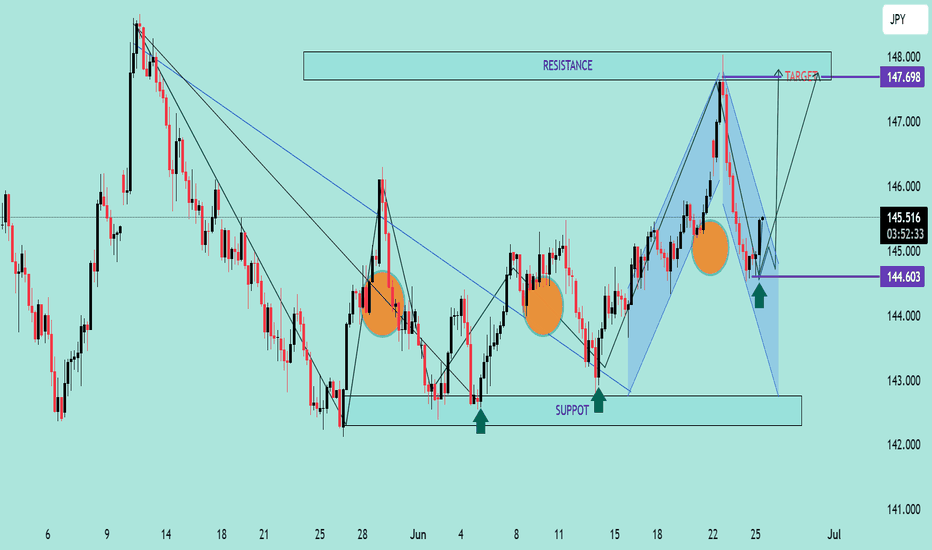

USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

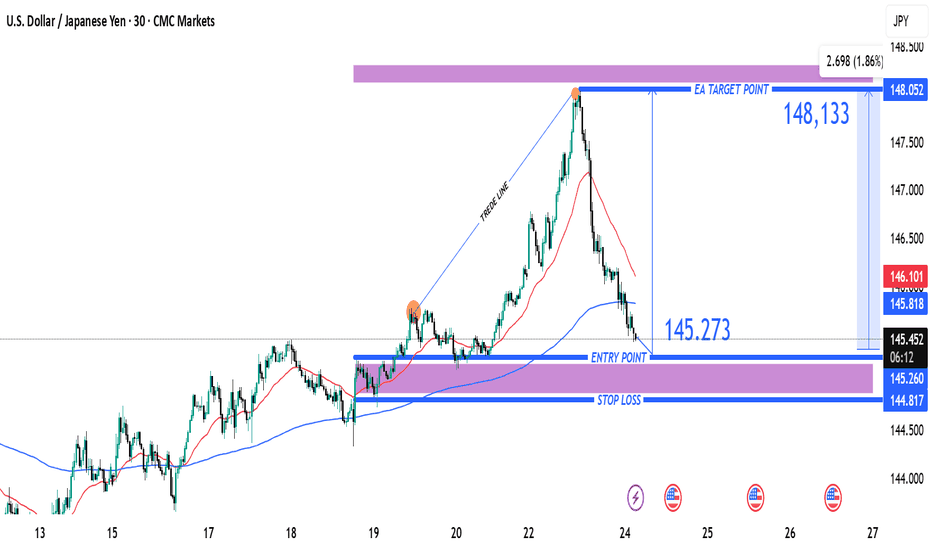

USD/JPY Bullish Reversal Trade Setup – Key Support Test at 145.2Entry Point: 145.273 (highlighted in blue)

Stop Loss: ~144.817–145.260 (purple zone)

Target Point (TP): 148.133 (upper resistance zone)

📉 Recent Price Action:

Price peaked near 148.05 before reversing sharply and breaking the trendline.

The market is currently testing the support zone (near the 145.273 entry level).

Moving averages (red = short-term, blue = long-term) show a crossover to the downside, suggesting short-term bearish momentum.

📈 Trade Setup:

Strategy Type: Long (Buy) Setup

Risk/Reward: Favorable, approximately 1:2+

Entry Zone: The current price is close to the entry level at 145.273, making this a timely area to watch for a bounce or confirmation.

⚠️ Risk Factors:

If price breaks below 144.817, the setup becomes invalid.

Short-term momentum is still bearish; confirmation (like a bullish engulfing candle or support hold) is important before entering.

✅ Confirmation Triggers for Entry:

Strong bullish candlestick pattern near entry zone.

RSI or MACD bullish divergence (not shown but useful to check).

Volume spike on bounce from support.

USD/JPY Long Trade Setup – Key Support Rebound Targeting 148.674Entry Point:

Price: 143.373

The chart suggests initiating a long (buy) position at this level, which is just slightly below the current market price.

Stop Loss:

Price: 141.707

Positioned below a strong support zone. This level protects the trade from excessive downside risk if the price breaks down.

Target Point:

Price: 148.674

The target is clearly defined, indicating a potential gain of approximately 5.991 points, or 4.20% from the entry.

🟪 Support/Resistance Zones

The purple boxes indicate demand (support) and supply (resistance) zones.

The lower zone (entry/stop area) shows a historically significant support range that has been tested multiple times (indicated with orange circles).

The upper purple zone marks the take-profit area, which coincides with previous resistance.

📊 Moving Averages

Blue Line: 200 EMA (Exponential Moving Average) – acting as dynamic resistance.

Red Line: 50 EMA – price is currently trading below it, indicating bearish short-term pressure but potential for reversal.

🧠 Trade Idea Summary

Bias: Bullish (long position)

Risk-Reward Ratio: Favorable

Risk: ~1.67 points (from 143.373 to 141.707)

Reward: ~5.3 points (from 143.373 to 148.674)

Approx. R:R = 1:3.17

Validation: The setup relies on the price holding the key support zone and bouncing higher, targeting the next major resistance.

⚠️ Considerations

Monitor for bullish candlestick patterns near the entry zone.

Keep an eye on macroeconomic news (like BoJ or Fed updates) that could cause volatility in USD/JPY.

Confirm momentum shift with RSI or MACD if using indicators.

USD/JPY Rebounds from Key Support – Eyes on 150.035 Target Support Zone:

The price is currently respecting a strong support area between 144.459 - 145.101. This zone aligns closely with the 200 EMA (145.101), increasing its validity.

EMAs:

50 EMA (146.059) is slightly above the current price.

200 EMA (145.101) is acting as dynamic support.

Price is currently trading just above the 200 EMA and below the 50 EMA — a neutral-to-bullish bias, especially since it bounced off support.

Bullish Signal:

The price has rejected the support zone and is attempting to break higher, supported by the bullish arrow projection.

Target Point:

Clearly marked at 150.035, which is a previous resistance level. This gives a potential upside of around 460 pips from the support area.

🧭 Trade Idea (if bullish bias is maintained)

Entry: Around 145.40–145.10 (current area)

Stop Loss: Below 144.459 (support base)

Take Profit: Around 150.035

Risk-Reward: ~1:3 or higher, depending on exact entry/exit.

⚠️ Caution

Watch for resistance at 146.059 (50 EMA); a clean break and retest would further confirm upside potential.

If price closes below 144.459, bullish invalidation could lead to a deeper correction

USD/JPY Bullish Setup – Demand Zone Buy Opportunity Toward 151.5🔍 Chart Overview (4H Timeframe):

Currency Pair: USD/JPY

Trend: 📈 Uptrend

EMA 70: 🔴 (144.776) – Price is trading above it = Bullish Bias

---

🟦 Demand Zone

📌 Zone: 144.804 – 146.324

💡 What it means: Strong buying interest expected here

🟢 Support line + EMA = Confluence zone!

---

✅ Entry Point:

📍 Between: 146.324 – 146.423

🎯 Best area for long (buy) position

📊 Wait for a pullback to this area before entering

---

❌ Stop Loss:

📉 Below demand zone

🔻 Range: 144.705 – 144.776

🛡️ Helps protect against unexpected drop

---

🎯 Target Point:

📈 151.500

🟩 Big reward area

🔥 Previous resistance zone = Ideal profit-taking point

---

🧭 Summary:

✅ Entry: 146.324

❌ Stop: 144.776

🎯 Target: 151.500

Risk-to-Reward: Excellent!

USD/JPY4H Analysis:Demand Zone ReTest Before Bullish Continuatio1. Trend Channel

🔼 Uptrend: The pair is moving inside an ascending channel.

▪️ Support: Lower boundary of the channel.

▪️ Resistance: Upper boundary of the channel.

2. Recent Price Action

🔴 Pullback: After reaching the top at 146.199, price is retracing.

📉 Price is now heading toward the Demand Zone.

3. Demand Zone

🟦 Demand Zone (142.405 – 143.180):

This zone could act as a strong support

Buyers might step in here

Watch for bullish patterns or rejections around this area

4. EMA 70

📏 EMA 70 (143.568) is slightly below current price (143.949) — this may offer temporary support/resistance.

5. Target

🎯 Target Point: 146.194

If price bounces from demand zone, this is the next bullish target.

Possible Scenario

1. 🔽 Price dips into the Demand Zone

2. 🟢 Bullish bounce → Confirm with candlestick signals

3. 🚀 Upside move targeting 146.194

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

Technical Analysis USD/JPY suggests a bullish outlook based on the following key technical components:

1. Buying Zone: The chart identifies a green rectangular area labeled "BUYING ZONE" just above the 200 EMA (blue line at 144.079). This implies that price retracement into this zone could be an opportunity to go long (buy).

2. Support & Resistance:

Support Level: Clearly marked around 143.00, showing a previous demand area.

Resistance Level: Around the 145.800–146.000 region, price previously rejected here.

3. Bullish Pattern: The curved arrow suggests the formation of a bullish continuation pattern (possibly a cup & handle or flag), with the expectation of a breakout toward the upside.

4. Target Point: The target is projected at 148.153, implying a potential move of approximately 291.7 pips from the buying zone—suggesting a favorable risk-reward ratio.

5. RSI Indicator: The RSI (Relative Strength Index) is currently around 55, not in the overbought zone, indicating more room for upside movement.

Mr SMC Trading point

Summary of Idea:

Strategy: Buy near 145.00–145.20 (Buying Zone).

Stop Loss: Just below the 200 EMA or the lower bound of the green zone.

Take Profit: Near the 148.153 target.

Confirmation: Wait for bullish confirmation/candlestick reversal in the buying zone.

Pelas support boost 🚀 analysis follow)

USDJPY Cup & Handle – Eyes on 147.883Entry Point: 143.525 (unchanged)

Stop Loss: 141.847 (unchanged)

Target Point One (TP1): 145.063 (unchanged)

Final Target (TP2): Now refined to 147.883 instead of 147.894 — a small, precise update.

📈 Pattern and Structure:

Cup-and-handle formation still intact, indicating a continuation pattern.

Support confirmation at the 143.5 zone, showing a potential base for a bullish reversal.

The chart shows strong upside projection toward the resistance band near 147.8–148.0, highlighted with the upper purple zone.

📊 Risk-Reward Profile:

Risk (Entry to SL): 143.525 – 141.847 = 1.678

Reward (Entry to TP2): 147.883 – 143.525 = 4.358

Reward-to-Risk Ratio: 4.358 / 1.678 ≈ 2.6R — a favorable risk/reward setup.

🧠 Trade Notes:

Entry is slightly above a demand zone.

First target is conservative, near a known resistance.

Final target aligns with prior highs and the broader ascending wedge’s upper bound.

Timing suggests the bullish push may unfold over the next few sessions (likely May 6–8 range, as curved arrow indicates a rounded retest/bounce scenario)

USD/JPY) Bullish trand analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY on the 2-hour timeframe, and it presents a bullish continuation setup. Here's a breakdown of the key elements and the idea behind the analysis:

---

1. Ascending Channel Formation

The price is trading within an ascending channel, suggesting a controlled uptrend.

Higher highs and higher lows confirm the trend structure.

2. Key Support and Fair Value Gap (FVG)

There’s a well-identified support level where price has bounced before (highlighted in yellow).

A Fair Value Gap (FVG) zone is marked slightly above the support level, which could act as a short-term demand area.

Price is currently pulling back into this zone, potentially setting up a buying opportunity.

3. EMA 200 Support

The 200 EMA (~143.78) is acting as dynamic support just below the current price.

If price drops further, this level may offer strong technical support.

4. RSI Momentum

RSI is above 50 (currently 56.37), supporting the bullish trend and showing room for continued upside.

5. Target Point

The chart anticipates a bounce off the support/FVG zone and a rally toward the upper boundary of the channel, targeting 147.153.

Mr SMC Trading point

---

Summary of the Idea:

This is a bullish continuation setup within an uptrend channel. The analyst expects a potential long entry around the FVG/support zone, with a target at the channel top (147.15). Confluence from the EMA 200, RSI, and previous structure supports this bullish bias.

Pales support boost 🚀 analysis follow)

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY chart shows a bullish reversal setup. Here’s a breakdown behind the analysis:

1. Downtrend & Channel Breakout:

Price was trending downward within a descending channel (marked “channel trend”).

Recently, the price broke out of the channel, signaling a potential trend reversal.

2. Demand Zone (Diamond Zone):

The yellow box labeled “Diamond Zone” represents a demand/support zone where price previously found buyers.

A retest of this zone is expected before the bullish move.

3. EMA (200):

The EMA (200) is currently above the price but close. A break above this level (142.522) could add to bullish momentum.

4. RSI Indicator:

RSI is showing a bounce off a mid-level (~50), suggesting bullish momentum is gaining.

5. Target Level:

The analysis targets 147.838, which aligns with a prior resistance zone.

The move projects a 5.19% gain (~778.5 pips) from the current setup.

Trading Idea Summary:

Entry: Around the “Diamond Zone” after a successful retest.

Confirmation: Watch for bullish candlestick patterns or a break above EMA 200.

Target: 147.838

Stop Loss (implied): Below the Diamond Zone (~140.000)

Pales support boost 🚀 analysis follow)

USD/JPY Bullish Reversal Setup – Long Entry at 141.964 Targeting ahemdsaeed25: USD/JPY Long Setup – Eyeing 150.537 Target"

"Potential Bullish Reversal on USD/JPY"

"Swing Trade Alert: USD/JPY Long from 141.964"

"USD/JPY Breakout Play – Buy Zone Identified"

Let me know your tone preference (technical, casual, professional, etc.) and I can tailor the title further.

ahemdsaeed25: This chart is for the USD/JPY (U.S. Dollar / Japanese Yen) pair on the 1-hour timeframe, and it's displaying a bullish setup with a clear trade idea. Here's a breakdown of the analysis:

Key Components:

Current Price: Around 142.574.

Entry Point: 141.964

Stop Loss: 140.547

Take Profit / Target Point: 150.537

Reward-to-Risk Ratio: Favorable (approximately 5.94% upside, large potential move).

Indicators:

EMA 50 (Red Line): 142.798 — acting as near-term dynamic resistance.

EMA 200 (Blue Line): 144.699 — major resistance and a trend filter (downward trend visible).

Zone Analysis:

Support Zone (Purple Box near 141.964 - 140.547): This is the accumulation/buy zone.

USD/JPY Bullish Breakout Setup – Entry, Stop Loss & Target AnalyPair: USD/JPY

Timeframe: 15 minutes

Indicators Used:

EMA (30-period) – Red line

EMA (200-period) – Blue line

Chart Features:

Downward channel (declining trendline)

Identified entry point, stop loss, and target

Key support/resistance zones shaded in purple

🟢 Trade Idea Summary:

🔹Entry Point: 143.126

🔹Stop Loss: 142.702

🔹Target (Take Profit): 148.249

🔹Risk/Reward Ratio: ~1:5 (Excellent R/R)

🔍 Technical Analysis:

✅ Bullish Breakout Signal

Price has broken above the descending channel and has retested the breakout area (highlighted purple zone) – a classic bullish breakout structure.

The breakout retest near 143.126 is acting as support, with potential to launch a new bullish move.

📈 Moving Average Analysis

EMA 30 is starting to flatten and curve up – indicating potential shift in momentum.

EMA 200 is still above price, but a breakout above it could strengthen the bullish case.

🔁 Support and Resistance

Strong support zone around 143.000 – 143.200 area (highlighted zone).

Major resistance and target zone is between 148.000 – 148.250.

🔔 Trade Plan Suggestion:

Go Long at or near 143.126

Place Stop Loss below support at 142.702

Target 148.249 for profit

Reasoning:

This setup offers a trend reversal potential from a downtrend to uptrend, with a clean breakout-retest-confirmation pattern. The wide take profit range gives room for extended upside as momentum builds.

⚠️ Watch For:

Reaction to the 144.325 (EMA 200) level

Increased buying volume to confirm breakout

Any re-entry into the channel (would invalidate setup)

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

This chart is for USD/JPY on the 1-hour timeframe, and it presents a bullish trade setup. Let’s break down the idea

---

Key Observations:

1. Current Price:

USD/JPY is trading around 146.281.

2. Overall Bias:

Bullish setup expecting a bounce from demand into a higher target zone.

3. EMA 200:

Price is currently below the 200 EMA (147.942), which usually suggests a bearish trend — but this setup is aiming for a short-term bullish retracement.

4. Demand Zone (Buy Area):

Marked in yellow between 145.822 and slightly above.

Labeled as "FVG orders" (Fair Value Gap), suggesting institutional interest or imbalance fill.

5. Trendline Support:

The price is approaching a rising trendline, adding confluence for a potential bounce.

6. Expected Move:

Price is expected to bounce from the demand zone, form a higher low, and then move up toward the target zone at 148.221.

Two upside targets are drawn:

First Move: ~1.12% (30.6 pips)

Full Target: ~1.76% (256.1 pips)

Mr SMC Trading point

7. RSI (Relative Strength Index):

RSI is around 37.66, nearing oversold territory, supporting a bullish reversal idea.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Around 145.822 (fair value gap & trendline support)

Target Zone: 148.221

Stop Loss: Likely just below the demand zone or trendline

Confluence Factors:

Trendline support

RSI nearing oversold

Fair value gap zone

EMA 200 overhead (target acts as resistance)

---

Pelas support boost 🚀 analysis follow

USD/JPY 4H Chart Analysis:Trend Break & Support-Based Long Setup1. Previous Uptrend Channel

📈

Price moved in a rising channel

Lower trendline acted as support ✅

Then came the trend line break ⚠️ — signal of trend reversal

2. Major Drop

🔻💥

After breaking support, the price fell sharply

Strong bearish momentum took over

Sellers dominated the market

3. Support Zone Identified

🟦 Support Box (146.110 - 145.156)

Buyers stepped in at this level

Possible bounce or consolidation

Price currently at 147.014 — just above support

4. Trade Setup Idea

🛒 Buy Opportunity (if price holds support)

📌 Entry Zone: Around 146.110

🎯 Target: 150.260

🛑 Stop Loss: 145.156

📊 Risk:Reward = ~1:2 — solid R:R setup!

5. Indicators & Confirmations

🟠 DEMA (9): Sitting at 146.110 — aligns with support!

✅ Extra confluence for the bounce!

Summary

If price holds above support:

Buyers might push toward 150.260

If it breaks below 145.156:

Sellers may regain control

USD/JPY Bullish Trade Setup – Key Support & Target ProjectionThe chart represents a USD/JPY (U.S. Dollar / Japanese Yen) 30-minute timeframe trade setup. Below is the analysis:

Technical Analysis:

Key EMAs:

200 EMA (Blue Line): 150.367 – Serves as dynamic support.

30 EMA (Red Line): 150.753 – Currently acting as resistance.

Support & Resistance Zones:

Entry Zone: 150.356 - 150.367 (Highlighted in purple).

Stop Loss: 150.022 (Below the key support).

Target Point: 151.269 (Near previous highs).

Market Structure & Price Action:

The price is pulling back into the highlighted demand zone.

A possible bullish reaction is expected at this level, leading to an upside push toward 151.269.

If the support holds, the price may bounce and confirm an uptrend continuation.

Trade Plan:

Entry: Around 150.367 after confirmation of price rejection.

Stop Loss: Below 150.022 (to protect against downside risk).

Take Profit: 151.269 (Aligns with previous high and resistance).

Conclusion:

The setup favors a buy trade if price action confirms a bounce from the demand zone.

A break below the stop-loss level may invalidate the setup, signaling a potential bearish continuation.

USD/JPY Bullish Outlook – Targeting Key Resistance at 150.155USD/JPY Technical Analysis – Bullish Outlook Toward Resistance

Chart Insights:

The price is currently in a recovery phase after a significant drop.

A Fair Value Gap (FVG) zone has been identified, suggesting a potential pullback before further movement.

The target point aligns with the resistance level around 150.155, which acts as a key supply zone.

Potential Scenario:

Price may retrace into the FVG zone around 148.704 – 148.956.

A bullish rebound from this level could drive price toward the resistance at 150.155.

If price reaches the resistance level, further rejection or continuation will depend on market conditions.

Key Levels:

Support Zone: 148.167 – 148.315

FVG Area: 148.704 – 148.956

Resistance Zone: 150.007 – 150.155 (Target area)

Conclusion:

The current structure suggests a bullish bias if price respects the FVG zone for a push higher. However, a break below the FVG could signal further downside movement

USD/JPY Breakout Trade Setup – Bullish Potential Ahead!📉 Trend Analysis:

The pair has been in a downtrend 📉 since early February, following the descending trendline.

Now, price is breaking out above the trendline 📈, indicating a potential reversal or bullish move.

📊 Trade Setup:

🔹 Entry: Around 149.731 (current price)

🔹 Take Profit Targets:

🎯 TP1: 150.170 (First resistance)

🎯 TP2: 151.028 (Stronger resistance)

🚀 Final Target: 152.309 - 152.319 (Main bullish goal)

🔹 Stop Loss: 148.567 - 148.549 (Below recent support) ❌

⚖ Risk-Reward Ratio:

✅ Good reward-to-risk setup since stop-loss is tight, but the upside potential is higher.

USD/JPY Breakout Trade Setup – Bullish Potential Ahead!📉 Trend Analysis:

The pair has been in a downtrend 📉 since early February, following the descending trendline.

Now, price is breaking out above the trendline 📈, indicating a potential reversal or bullish move.

📊 Trade Setup:

🔹 Entry: Around 149.731 (current price)

🔹 Take Profit Targets:

🎯 TP1: 150.170 (First resistance)

🎯 TP2: 151.028 (Stronger resistance)

🚀 Final Target: 152.309 - 152.319 (Main bullish goal)

🔹 Stop Loss: 148.567 - 148.549 (Below recent support) ❌

⚖ Risk-Reward Ratio:

✅ Good reward-to-risk setup since stop-loss is tight, but the upside potential is higher.

USDJPY - TRADING AT SUPPORT LEVELSSymbol - USDJPY

USDJPY has encountered support and appears to have staged a false breakdown of the lower boundary of the prevailing local trend. At present, the dollar is strengthening, which could present an opportunity for the currency pair to appreciate. The price is consolidating in a strong support zone, and the fundamental environment has been volatile recently, with a predominant influence from U.S. economic factors. Meanwhile, the prospect of interest rate hikes in Japan has largely been disregarded, with market participants focusing more on economic data from the West.

From a technical perspective, there are two potential triggers on the chart: one signaling a buy and the other signaling a sell. However, given the prevailing upward global and local trends, the preference is to take a long position. Should the currency pair manage to secure a close above the 151.90 - 151.95 range, we can anticipate further upward movement towards the target levels shown on the chart in both the short and medium terms.

Resistance levels: 151.95, 153.70, 154.00

Support levels: 151.00, 149.52

However, if the dollar continues its correction and the bulls fail to maintain the false support breakdown, a price return to 150.95 could trigger a support break, leading to a potential decline towards 148.60

USDJPY SHOWING A GOOD UP MOVE WITH 1:10 RISK REWARDUSDJPY SHOWING A GOOD UP MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you