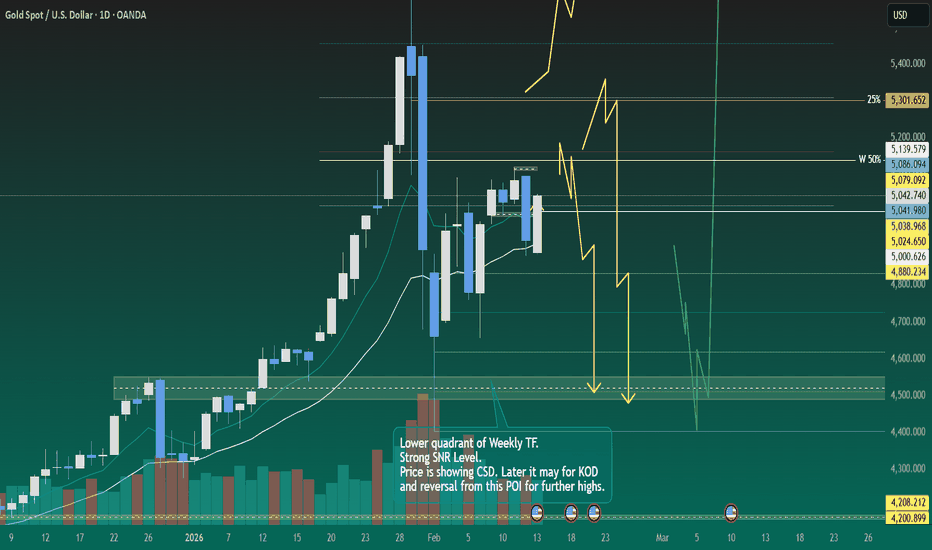

Weekly Analysis with buy/Sell scenarios in Gold/XAUUSD👋👋👋 Friends, What's your view on Gold???

Last week, global gold prices showed a volatile but upward bias, with spot gold recovering after a dip and ending the week with gains of roughly 1–2%, holding near the $5,000–$5,050 zone;

As per the current scenario we may further expect consolidation in this zone and range bound trading in coming days till it reaches to 4500 or take the liquidity of 5150 level.

If price breaks 5150 level and sustain above, we may see new high. Though the level of 5300 is also critical

Critical notes.

1. 4500, 5150 and 5300 level are critical and should be monitored for high probability trade opportunities.

2. 4500 is very strong level for any buy opportunity with high probability and reward.

3. 5150 is equilibrium level of previous week candle, which makes it critical level of reversal.

4. 5300 is strong level of first quadrant of range. It is critical make or break level.

5. Price will for any or some sort of PD arrays at these level followed by entry models.

6. Most probably price will take liquidity of Key Level/FVG/RDRB level and create MSS/CISD/TS/iFVG in LTF.

7. Price should show rejection/reversal in respective LTF (1h/15m) at Key Level/FVG zone.

8. Take the trade only once clear entry model i.e. turtle soup. iFVG break, CDS or MSS happens on LTF

All these combinations are signalling a high probability and high RnR trade scenario.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

Xauusdsignal

XAUUSD H1 – Triangle Breakdown Confirmed | Range ResolvedAfter several sessions of compression inside a symmetrical triangle, Gold has finally resolved the range with a decisive downside expansion.

The prolonged sideway structure between 5,070 and 5,020 has now transitioned into a momentum-driven breakdown, confirming liquidity sweep and structural shift on M30.

🧠 Market Structure Update

Multi-day sideway compression inside triangle

Liquidity resting above 5,070 and below 5,020

Strong impulsive candle broke below 5,043 and 5,020

Clean expansion through 5,000 psychological level

This is no longer accumulation — this is distribution confirmed.

Short-term structure has shifted bearish.

📌 Key Zones From Current Chart

🔴 Broken Support Zone – 5,043

Former triangle support

Now acting as intraday supply on pullback

Rejection here favors continuation lower

🔴 Major Supply – 5,000 – 5,005

Psychological level

Previous consolidation base

Now resistance if retested

🔵 Immediate Reaction Level – 4,956

Intraday retracement zone

Potential lower high formation area

🔵 Primary Demand / Liquidity Target – 4,882 – 4,885

Major liquidity pocket

Projected downside expansion objective

🎯 Trading Scenarios

🔽 Bearish Continuation Scenario (Primary Bias)

Condition:

Price holds below 5,000

Rejection at 5,000 or 5,043 supply

Entry:

On bearish rejection after pullback

Targets:

TP1: 4,956

TP2: 4,920

TP3: 4,882 liquidity zone

Structure favors continuation unless 5,000 is reclaimed with strength.

🔼 Counter-Trend Recovery Scenario

Condition:

Strong M30 close back above 5,000

Acceptance above 5,043

Targets:

5,070 prior range boundary

Without reclaiming 5,000, upside remains corrective only.

📊 Tactical Summary

Sideway compression has completed.

Liquidity sweep below range triggered momentum expansion.

Bias: Bearish while below 5,000.

Pullbacks into broken structure are opportunities, not reversals — unless reclaimed decisively.

From compression → expansion → continuation phase.

Gold H1: Trendline Retest Before Next Move?Gold is pulling back into a key confluence zone while macro volatility remains elevated. Is this a breakdown… or just a liquidity reload before continuation?

📊 Technical Overview (H1)

Overall structure: Higher highs & higher lows intact

Price broke below short-term support → now retesting ascending trendline

Current pullback approaching major H1 FVG demand

This is a classic trendline retest + imbalance reaction area.

🟢 Key Support Zone

Major FVG Demand:

4,800 – 4,820

This zone aligns with:

Ascending trendline

Prior bullish impulse origin

Liquidity resting below recent lows

If price sweeps liquidity into 4,805 and shows strong H1 rejection → bullish continuation probability increases.

🔴 Resistance & Upside Targets

Near-Term Resistance:

4,983 – 5,000

Expansion Target:

5,080 – 5,120

If bullish continuation confirms:

TP1: 4,983

TP2: 5,080

TP3: 5,120

❌ Invalidation

Sustained H1 close below 4,780

→ Trendline failure

→ Structure shifts to deeper correction

XAUUSD H1 – False Break or Expansion to 5,448?Gold is compressing beneath a major imbalance while macro uncertainty keeps volatility elevated. This is a classic liquidity environment — either a fake breakdown to sweep stops or a clean expansion toward higher liquidity.

📊 Technical Structure (H1)

Short-term structure: Bullish recovery intact

Price holding above prior demand base

Consolidation forming under internal resistance

Market is trading between two major imbalances (FVG zones), preparing for expansion.

🟢 Key Demand & Support

Internal Support / Reaction Zone: 4,987 – 5,000

Major Demand (FVG): 4,800 – 4,820

This lower zone is critical. A sweep into 4,800 followed by strong rejection = high probability false break setup.

🔴 Resistance & Liquidity Targets

Near-Term Resistance: 5,097

Major FVG Supply: 5,430 – 5,448

If bullish continuation confirms, price is likely targeting this upper imbalance.

🎯 Trading Scenarios

Scenario 1 – False Break (Liquidity Sweep)

Price dips into 4,800 zone

H1 closes back above 4,900

Then continuation toward:

TP1: 5,097

TP2: 5,430

TP3: 5,448

Scenario 2 – Direct Breakout

H1 acceptance above 5,100

Momentum continuation into upper FVG 5,430–5,448

Invalidation

Sustained H1 close below 4,780 → structure shifts bearish

🌍 Macro Context

Gold remains sensitive to:

Fed rate expectations

US Treasury yields

USD strength

Geopolitical risk flows

Any shift in inflation expectations or dovish Fed signals increases upside probability. Stronger USD / rising yields may trigger the liquidity sweep first.

XAUUSD H1 – Sideway Compression Before Expansi Gold is currently trading in a tight H1 range after the previous impulsive bullish move. Momentum has slowed, and price action has shifted from trending to accumulation.

This is no longer a “chase-the-trend” environment. It is a range-based market waiting for confirmation.

🧠 Market Structure Context

Short-term bullish structure remains intact as long as price holds above the rising trendline.

Multiple small-bodied candles with wicks on both sides reflect indecision.

Volatility compression suggests a potential expansion phase ahead.

➡️ Current state: Compression before breakout.

📌 Key Price Levels

🔴 Resistance Zones

5,071 → Range high, breakout trigger level

5,026 → Mid-range resistance

🔵 Support Zones

4,984 → Near-term range low

4,948 → Critical structural support

🎯 Analytical Outlook

Holding above 4,984 keeps the range biased toward bullish continuation.

A confirmed H1 close below 4,948 signals structural weakness and potential downside expansion.

A clean break and hold above 5,071 activates the next bullish impulse leg.

XAUUSD H1 – Compression before expansion? Key zones determine moGold is coiling inside a tightening structure — volatility expansion is approaching

📊 Market Structure & Technical Outlook (H1)

Price is trading inside a symmetrical compression formed by:

Descending trendline from prior high

Rising demand trendline from February lows

Previous CHOCH + BOS indicate the bearish momentum has weakened

Current price is balancing, waiting for liquidity to be taken on either side

➡️ This is a reaction market — patience > prediction

🧱 Key Price Zones

🟢 Primary BUY ZONE (Demand)

4,860 – 4,835

Strong H1 demand

Reaction zone from prior impulse

Confluence with ascending trendline

🟡 Decision / Mid Zone

5,020 – 4,980

Structure pivot

Acceptance above favors upside continuation

🔴 SELL / Liquidity Zones (FVG)

FVG 1: 5,265

FVG 2 (Major Target): 5,350

🎯 Trade Scenarios

🔵 Primary Scenario – Buy the Dip

Look for bullish confirmation inside 4,860 – 4,835

Entry only after:

Strong rejection

Bullish H1 / M30 candle close

Upside Targets:

TP1: 5,100

TP2: 5,265

TP3: 5,350 (Major FVG + liquidity)

🔴 Alternative Scenario – Break & Fail

If price fails to hold above 4,835, expect deeper pullback toward lower structure

No blind buys below demand

❌ Invalidation

H1 close below 4,780 → bullish bias invalid

🌍 Fundamental Context

Gold remains sensitive to:

Fed policy uncertainty

Expectations around future rate cuts

Ongoing demand for safe-haven assets

With high-impact US events ahead, liquidity grabs and fake moves are likely before direction is confirmed

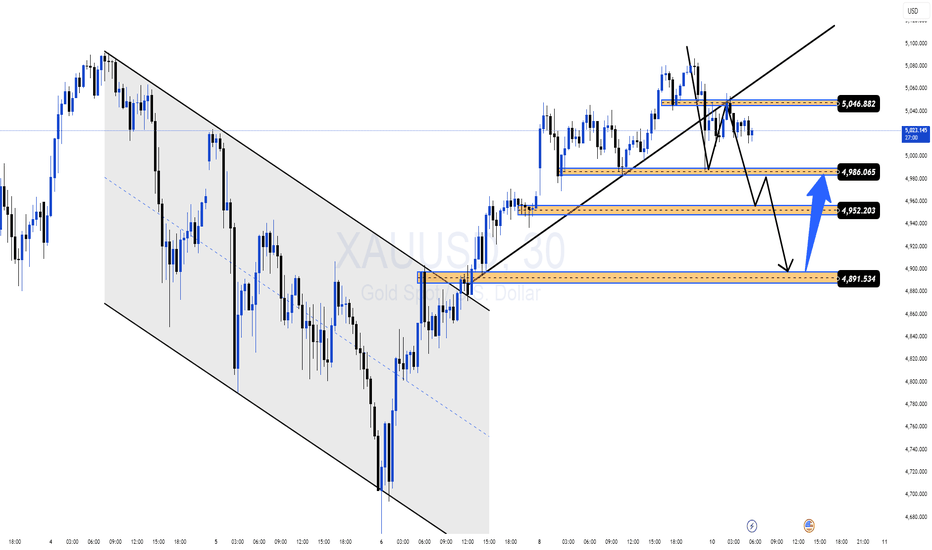

XAUUSD M30 – High Volatility | Trade by ZonesGold is trading in a strong volatile phase on M30 after breaking out of the descending channel and shifting into a short-term bullish structure. However, price is now entering a decision area, where fake breakouts and deep pullbacks are highly likely.

➡️ This is a two-way market: reactions at key zones will define the next move.

🧠 Market Context (M30)

Previous bearish channel breakout confirmed

Price is holding above the rising trendline → bullish structure still valid

Volatility remains elevated → expect deep pullbacks before continuation

Intraday Bias: Bullish above key demand, but not a straight move up.

📐 Key Zones on Chart

🔴 Supply / Resistance Zones

5,046 – 5,050

→ Major intraday supply & trendline confluence

4,986 – 4,990

→ Short-term resistance / reaction zone

🔵 Demand / Support Zones

4,952 – 4,945

→ Intraday demand, pullback buy zone

4,891 – 4,880

→ Strong demand + structure support (critical zone)

🎯 Trade Scenarios

🔵 BUY Scenario – Demand Reaction (Preferred)

Only consider buys after clear bullish confirmation (rejection wicks, strong M30 close).

Buy Zone 1: 4,952 – 4,945

Buy Zone 2: 4,891 – 4,880

Targets

TP1: 4,986

TP2: 5,046

TP3: 5,080 – 5,100 (extended if momentum holds)

🔴 SELL Scenario – Supply Rejection (Counter-trend)

Short only if price fails to hold above supply and shows bearish rejection.

Sell Zone: 5,046 – 5,080

Targets

TP1: 4,986

TP2: 4,952

TP3: 4,891

❌ Invalidation Levels

M30 close below 4,880 → bullish structure breaks

Clean breakout & hold above 5,080 → bearish scenario invalid

XAUUSD H1: Structure Holds — Pullback Before Next Rise?Market Context (Macro)

Gold remains sensitive to Fed expectations, USD flows, and yields. With rate-cut uncertainty still unresolved, dips continue to attract defensive flows rather than aggressive selling. This keeps gold bid on pullbacks, especially at technical discount zones.

📊 Technical Structure – H1

Bullish structure remains intact after a clear CHoCH → BOS sequence.

Price is consolidating above the last BOS, suggesting pause, not reversal.

A pullback into FVG / demand would be technically healthy before expansion.

🎯 Key Trading Zones

🔵 BUY Zone (Reaction Area):

4,820 – 4,800

• FVG overlap

• Prior BOS base

• Fibonacci discount support

➡️ Look for H1 rejection or bullish reaction (no blind entries).

🎯 Upside Targets (Liquidity Objectives)

TP1: 4,985

TP2: 5,064

TP3: 5,325 (Major liquidity / swing target)

❌ Invalidation

H1 close below 4,760 → bullish structure weakened, reassess bias.

XAUUSD – High Volatility, Trade Reaction Zones (M30)Gold is currently experiencing strong volatility on the M30 timeframe after a sharp rebound from the recent lows. At this stage, the market is no longer trending smoothly but is shifting into a liquidity-driven, two-way environment, where price reacts aggressively at key Supply & Demand zones.

👉 This is not a FOMO market. Priority should be given to trading by levels and waiting for confirmation.

📌 Market Context

The broader structure is still capped by a descending trendline from above.

The latest bullish leg shows active demand, but no clear trend reversal confirmation yet.

Price is ranging within a wide band, making liquidity sweeps on both sides highly likely.

➡️ Short-term bias: Neutral → trade reactions at key zones.

📊 Structure & Price Action (M30)

Price is consolidating between well-defined demand and supply zones.

Each touch of a zone has produced sharp reactions → ideal for short-term MMFlow-style trades.

No confirmed CHoCH yet to validate a sustained bullish trend.

🎯 Trading Plan – MMFlow Style

🔵 BUY Scenario – Focus on Demand Reactions

Only look for BUY setups after bullish confirmation (bullish candles / Higher Low structure on M30).

BUY Zone 1: 4,819 – 4,800

(Short-term demand, multiple strong reactions)

BUY Zone 2: 4,733 – 4,710

(Major demand zone + liquidity low)

Target Zones (TP):

TP1: 4,900

TP2: 4,955

TP3: 5,018

Extended TP: 5,100 – 5,105 (major supply above)

🔴 SELL Scenario – Supply Reaction Trades

If price rallies into supply and fails to sustain bullish momentum:

SELL Zone 1: 4,955 – 4,965

SELL Zone 2: 5,018 – 5,105

Downside Targets:

TP1: 4,900

TP2: 4,819

TP3: 4,733

❌ Invalidation Conditions

Strong M30 close above 5,105 → bearish structure invalidated, reassess overall bias.

M30 close below 4,710 → risk of deeper downside expansion.

🧠 Summary

Gold is in a high-volatility, structure-building phase. The edge comes from:

Trading precise price zones, not chasing candles

Waiting for clear confirmation

Prioritizing risk management over trade frequency

📌 In volatile markets, discipline always beats prediction.

XAUUSD H1 – Trendline retest may trigger next bullish moveMarket Context (Macro → Flow) Gold remains highly sensitive to macro headlines as markets continue to price in policy uncertainty around the Fed path and real yields. While no major shock hit today, flows show defensive positioning returning on dips, keeping gold supported despite recent volatility. ➡️ This environment favors buying on the reaction, not chasing breakouts.

Technical Structure (H1)

Price is still trading below a descending trendline, but momentum to the downside is weakening.

Current move is a technical pullback into Fibonacci discount + structure support.

No confirmed bearish continuation — sellers are losing follow-through.

➡️ This is a decision zone, where reaction will define the next leg.

Key Trading Zones & Levels

🔹 BUY ZONE (Reaction Area): 4,880 – 4,870 (Trendline support + Fib 0.618–0.786 + prior reaction zone)

🔹 Invalidation: H1 close below 4,820 → bullish idea weakens

Upside Targets (If Bullish Reaction Holds): 🎯 TP1: 5,070 🎯 TP2: 5,333 (1.618 extension / major recovery target)

Execution Notes

No blind entries → wait for bullish candle reaction or higher-low confirmation

Expect volatility spikes; manage size accordingly

Structure > headlines

Summary Gold is compressing at a high-confluence support zone. If buyers defend this area, a strong recovery leg toward 5,070 → 5,333 is in play. If not, patience beats prediction.

📌 Trade reactions, not expectations.

XAUUSD H1 – Pullback at Demand, Bulls Ready for Next Move?Gold is trading in a high-volatility recovery phase after the recent selloff, with price now pulling back into a clear H1 demand zone. This is a reaction-based market, where structure + fundamentals must align before continuation.

📌 Market Context (Fundamentals)

Gold remains highly sensitive to macro headlines as markets reassess:

Fed rate path expectations

US data momentum vs. slowing growth signals

Ongoing safe-haven demand on volatility spikes

No clear hawkish shift so far → downside moves look corrective, not impulsive.

➡️ Bias: Wait for confirmation at demand, not chase price.

📊 H1 Structure & Technicals

Prior selloff has lost momentum

Price is forming a technical pullback, holding above the last reaction low

Current move = rebalancing phase within a broader recovery

Key demand aligns with Fibonacci discount area

🎯 Key Trading Zones (H1)

🟢 BUY Zone (Primary Demand):

4,720 – 4,700

(Strong reaction base + discount zone)

❌ Invalidation:

H1 close below 4,700 → bullish recovery is invalidated

🎯 Upside Targets

TP1: 5,080 (first recovery resistance)

TP2: 5,345 (major H1 extension / liquidity target)

XAUUSD / GOLD – 1H SELL PROJECTION (05-02-2026)

Gold was moving inside a rising channel, respecting the uptrend line.

However, price failed to sustain bullish momentum and clearly broke the uptrend, indicating a market structure shift.

After the breakdown:

Price retraced back into a Fair Value Gap (FVG)

The retracement got rejected near Resistance (R1)

A Three Black Crows candlestick pattern formed, confirming strong bearish pressure

This rejection from the FVG zone after an uptrend break signals a high-probability sell continuation setup.

🔍 Confluences Used

Broken uptrend line

Fair Value Gap (Sell zone)

Resistance rejection

Three Black Crows pattern

Bearish market structure

🎯 Trade Expectation

Sell from FVG zone

Stop Loss: Above recent high

Targets:

TP1: Previous support

TP2: Lower liquidity / Support S3

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective

Gold flipped structure — real reversal or liquidity trap?Gold has just delivered a clear structural shift after weeks of heavy downside pressure — but this is not the time to chase.

Market Structure (M30)

Price printed a bullish CHoCH, ending the prior bearish sequence.

Followed by a BOS to the upside, confirming short-term bullish control.

Momentum is strong, but price is now approaching a key reaction zone.

Key Zones to Watch

FVG Support: ~4,950 – 4,980

→ Ideal area for pullback continuation if bullish structure holds.

Mid Resistance / Reaction: ~5,100 – 5,150

→ Expect volatility and possible shakeout.

Upper Target Zone: 5,270 – 5,450

→ Fibonacci 0.5 → 0.786 retracement of the prior sell-off.

Trading Scenarios

Bullish continuation:

Wait for pullback into FVG + higher low → continuation toward 5,27x → 5,45x.

Failure scenario:

Loss of FVG + M30 close back below ~4,95x → bullish structure invalid, range or reversal risk.

🧠 Trading Mind

This is a reaction market, not a prediction market.

After a structure flip, pullbacks pay — breakouts trap.

XAUUSD – Trade key zones with discipline, volatility up.XAUUSD – Volatility Expansion, Trade Key Zones With Discipline (H1)

Market Context

Gold is trading in a high-volatility recovery phase after a sharp sell-off, with price now rotating aggressively between key technical zones. This behavior reflects liquidity rebalancing under macro uncertainty, rather than a clean trend.

Ongoing uncertainty around Fed leadership changes, future monetary policy direction, and headline risk keeps gold highly sensitive to flows. In this environment, reaction at levels matters more than direction.

➡️ Market state: fast moves, deep pullbacks, strong reactions – avoid emotional entries.

Structure & Price Action (H1)

Price is holding inside a rising corrective channel, indicating a recovery structure.

Higher lows are forming, but bullish structure is still conditional, not fully confirmed.

Upper zones show hesitation and rejection, while lower zones attract strong demand.

Expect sharp swings and fake breaks during this phase.

Key insight:

This is a reaction-driven market. Trade the zones, not the noise.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Pullback (Reaction-Based)

BUY Zone 1: 5,008 – 4,990

• Short-term demand

• 0.618 Fib retracement

• Channel support

BUY Zone 2: 4,670 – 4,650

• Major demand

• Prior liquidity sweep area

• Strong structural base

➡️ Only consider BUYs after:

Clear bullish rejection candles

Or a Higher Low confirmed on H1

🔴 Alternative Scenario – Sell at Upper Reaction Zones

SELL Zone 1: 5,250 – 5,275

• Prior resistance

• Mid-channel reaction zone

SELL Zone 2: 5,560 – 5,575

• Major extension / supply zone

• Fibonacci expansion resistance

➡️ Look for:

Rejection wicks

Loss of bullish momentum on H1

🎯 Targets (TP Zones)

Upside Targets (from BUY setups):

TP1: 5,253

TP2: 5,573

Downside Targets (if SELL scenario plays out):

TP1: 5,008

TP2: 4,670

❌ Invalidation

A confirmed H1 close below 4,650 invalidates the recovery structure

Requires a full reassessment of bias

GOLD BULLISH OR BEARISH?Gold is bouncing — but context matters.

After a strong selloff, price is now retracing into a key resistance zone, not breaking structure. This is where many traders get trapped chasing a “bottom” while smart money distributes.

Market Structure

Clear downtrend: Lower Highs & Lower Lows remain intact

Current move = retracement, not impulsive bullish continuation

Price is reacting below the descending trendline

Key Technical Zone

FVG / Supply zone around 5.26x → high-probability reaction area

This zone aligns with retracement levels and prior imbalance

If–Then Scenarios

If price rejects 5.26x:

→ Downtrend continuation toward 4.63x → 4.51x → 4.40x

If price breaks and holds above 5.26x (H1 close):

→ Bearish bias weakens, wait for new structure before trading

Trading Mindset

This is distribution after a selloff, not accumulation.

Don’t confuse a bounce with a trend change.

📌 Strong trends don’t reverse quietly — they test patience first.

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price moves sharply between key technical zones.

With ongoing changes in Fed leadership and uncertainty around future monetary policy direction, gold remains extremely sensitive to expectations, flows, and headlines.

➡️ Current state: Volatile conditions – wait for confirmation, avoid emotional trades.

📊 Structure & Price Action (M30)

The prior bearish impulse is losing momentum, with short-term higher lows starting to form.

Price is currently in a technical recovery phase, not a confirmed trend reversal yet.

Market continues to respect Demand and Key Levels, producing sharp reactions.

No confirmed bullish CHoCH at this stage — further validation is required.

🔎 Key insight:

Gold is trading inside a decision zone, where each key level can trigger strong directional moves.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Technical Pullback

Focus on reaction-based execution, not anticipation.

BUY Zone 1: 4,667 – 4,650

(Near-term demand + first recovery base)

BUY Zone 2: 4,496 – 4,480

(Deep demand + prior liquidity sweep low)

➡️ Execute BUYs only if:

Clear bullish candle reaction appears

Or a Higher Low structure forms on M30

Upside Targets:

TP1: 4,932

TP2: 5,124 (Major recovery resistance/supply zone)

🔴 Alternative Scenario – Sell at Resistance Reaction

If price retraces into supply and fails to hold bullish momentum:

SELL Zone: 5,120 – 5,140

→ Look for short-term rejection following M30 structure

❌ Invalidation

A confirmed M30 close below 4,480 invalidates the recovery structure and requires a full reassessment.

🧠 Summary

Gold is in a high-volatility, structure-building phase, not an environment for emotional or aggressive positioning. The edge lies in:

Trading key levels, not impulses

Waiting for price confirmation

Prioritizing risk management over prediction

📌 In volatile markets, discipline outperforms frequency.

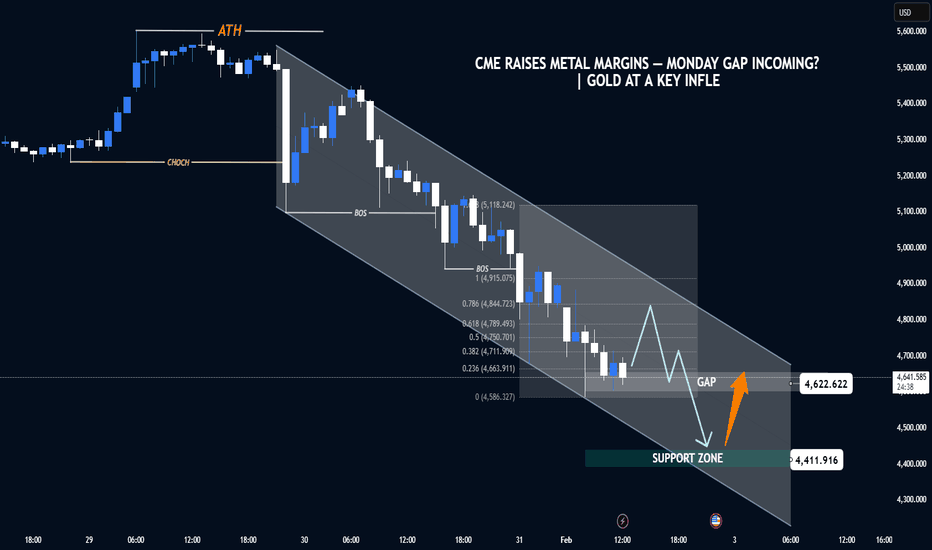

CME raises metal margins, Monday gap risk? Gold key influence.Gold is no longer trending freely — it’s correcting with structure.

After printing ATH, XAUUSD delivered a clear CHoCH, followed by a sequence of bearish BOS, confirming a controlled pullback, not panic selling. Price is now respecting a descending corrective channel, which typically appears before the market decides its next major leg.

🧠 Fundamental Context (Flow > Headlines)

CME raised margin requirements for metals

Higher margins = forced position reduction for leveraged traders

This often creates liquidity-driven gaps at the weekly open

Important: this is mechanical pressure, not a macro trend flip

➡️ Expect volatility first, clarity later.

📊 Technical Structure (HTF → LTF)

ATH rejection + CHOCH = bullish momentum paused

Multiple BOS inside the channel = distribution phase

Price is compressing toward key liquidity zones

🔑 Key Levels to Watch

5,090 – 5,120: Upper channel / sell-side reaction zone

4,620 GAP area: High-probability liquidity magnet if Monday gaps

4,410 Support zone: HTF demand & channel base (critical level)

🎯 Scenarios (If – Then)

If Monday gaps into 4,620

→ Expect sharp moves and fake breaks

→ Wait for acceptance / absorption before any long bias

If price loses 4,620 cleanly

→ Next draw = 4,410 support

If price reclaims 4,900+ quickly

→ Gap likely becomes a trap → squeeze back into range

XAUUSD (H1) – Below $5,000: Correction or Quick Recovery?Market Context – Gold Enters a Critical Repricing Zone

Gold has officially slipped below the psychological $5,000 level, triggering renewed debate: Is this the start of a deeper corrective phase, or simply a liquidity reset before a sharp rebound?

The timing is crucial.

With speculation around changes in Fed leadership and future monetary policy direction, the market is repricing risk aggressively. This has injected exceptional volatility into Gold, where liquidity is being rapidly redistributed rather than trending cleanly.

➡️ This is no longer a low-volatility trend market — it’s a decision zone.

Structure & Price Action (H1)

The previous bullish H1 structure has failed, confirming a short-term corrective phase.

Price is trading below former demand, now acting as supply.

Current rebounds are technical pullbacks, not confirmed reversals.

Downside momentum remains active until price reclaims key structure levels.

Key insight: 👉 Below $5,000, Gold is trading in rebalancing mode, not trend continuation.

Key Technical Zones (H1)

Major Supply / Rejection Zone:

• $5,030 – $5,060

→ Former structure + Fibonacci confluence

→ Likely area for sellers to defend

Mid-Range Reaction Zone:

• $4,650 – $4,700

→ Short-term demand / potential bounce zone

Deep Liquidity Demand:

• $4,220 – $4,250

→ Major liquidity absorption zone

→ High probability area for a technical or structural rebound

Trading Plan – MMF Style

Scenario 1 – Sell the Pullback (Primary While Below $5,030)

Favor SELL setups on rallies into supply.

Wait for rejection / failure patterns.

Do not chase price lower.

➡️ Bias remains bearish-corrective while below $5,030.

Scenario 2 – Buy Only at Deep Liquidity

BUYs are considered only at major demand with confirmation:

• $4,650 – $4,700 (scalp / reaction only)

• $4,220 – $4,250 (higher-probability swing zone)

➡️ No blind bottom picking

➡️ Confirmation > prediction

Macro Risk Outlook

Fed leadership uncertainty = policy expectation volatility.

Any shift toward dovish credibility could trigger a violent short-covering rally.

Conversely, prolonged uncertainty keeps Gold under pressure short-term.

➡️ Expect fast moves, fake breaks, and wide ranges.

Invalidation & Confirmation

Bearish bias weakens if H1 reclaims and holds above $5,060.

Deeper correction opens if $4,220 fails decisively.

Summary

Gold below $5,000 is not weakness — it’s repricing. This is a market where liquidity hunts traders, not the other way around.

The edge right now is patience and precision:

Sell rallies into supply.

Buy only where liquidity is proven.

Let structure confirm before committing risk.

➡️ In high volatility, survival beats prediction.

Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.

XAUUSD – H1 volatility surge | liquidity reset ongoingMarket Context

Gold is entering a high-volatility phase after an extended bullish run. The recent sharp impulse down from the upper zone is not random — it reflects liquidity distribution and aggressive profit-taking near highs, amplified by fast USD flows and event-driven positioning.

In this environment, Gold is no longer trending smoothly. Instead, it is rotating between liquidity zones, creating two-way risk intraday.

➡️ Key mindset: trade reactions at levels, not direction.

Structure & Price Action (H1)

The prior bullish structure has been temporarily broken by a strong bearish impulse.

Price failed to hold above 5,427 – 5,532, confirming this area as active supply / distribution.

The move down shows range expansion, typical after ATH phases.

Current price action suggests rebalancing and liquidity search, not a confirmed macro reversal yet.

Key read:

👉 Above supply = rejection

👉 Below supply = corrective / bearish bias until proven otherwise

Trading Plan – MMF Style

🔴 Primary Scenario – SELL on Pullback (Volatility Play)

While price remains below key supply, selling reactions is favored.

SELL Zone 1: 5,427 – 5,432

(Former demand → supply flip + trendline rejection)

SELL Zone 2: 5,301 – 5,315

(Mid-range supply / corrective retest)

Targets:

TP1: 5,215

TP2: 5,111

TP3: 5,060

Extension: 4,919 (major liquidity pool)

➡️ Only SELL after clear rejection / bearish confirmation.

➡️ No chasing breakdowns.

🟢 Alternative Scenario – BUY at Deep Liquidity

If price sweeps lower liquidity and shows absorption:

BUY Zone: 4,920 – 4,900

(Major demand + liquidity sweep zone)

Reaction targets:

5,060 → 5,215 → 5,300+

➡️ BUY only if structure stabilizes and bullish reaction appears.

Invalidation

A clean H1 close back above 5,432 invalidates the short-term bearish bias and shifts focus back to bullish continuation.

Summary

Gold is transitioning from trend extension to volatility expansion.

This is a market for discipline and level-based execution, not prediction.

MMF principle:

Volatility = opportunity, but only for those who wait for reaction.

Trade the levels. Control risk. Let price confirm.

XAUUSD – Bullish trend, focus on Buy pullbacks to 5,700Market Context (M30)

Gold continues to trade in a strong bullish continuation after a clean impulsive leg higher. The recent consolidation above former resistance shows acceptance at higher prices, not exhaustion. This behavior suggests the market is rebalancing liquidity before the next expansion leg.

On the macro side, USD remains under pressure, while safe-haven demand stays firm. Even though bond yields are relatively stable, capital flows continue to favor gold, keeping the upside bias intact.

➡️ Intraday bias: Bullish – trade with the trend, not against it.

Structure & Price Action

• Market structure remains bullish with Higher Highs – Higher Lows

• Previous resistance has flipped into demand and is being respected

• No bearish CHoCH or structural breakdown confirmed

• Current pullbacks are corrective moves within an active uptrend

Key takeaway:

👉 As long as price holds above key demand, pullbacks are opportunities for continuation.

Trading Plan – MMF Style

Primary Scenario – Buy the Pullback

Patience is key. Avoid chasing price into extensions.

• BUY Zone 1: 5,502 – 5,480

(Minor demand + short-term rebalancing zone)

• BUY Zone 2: 5,425 – 5,400

(Trendline support + deeper liquidity zone)

➡️ Only execute BUYs after clear bullish reaction and structure confirmation.

➡️ No FOMO at highs.

Upside Targets

• TP1: 5,601

• TP2: 5,705 (upper Fibonacci extension / expansion target)

Alternative Scenario

If price holds above 5,601 without a meaningful pullback, wait for a break & retest to join the next continuation leg.

Invalidation

A confirmed M30 close below 5,400 would weaken the bullish structure and require reassessment.

Summary

Gold remains in a controlled bullish expansion supported by both structure and macro flow. The edge lies in discipline — buying pullbacks into demand while the trend stays intact, not predicting tops.

➡️ As long as structure holds, higher prices remain the path of least resistance.