Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!

Xauusdsignal

Gold Tests Key Support – Time to Buy or More Downside Ahead?🌐 Market Overview

Gold remains under pressure following yesterday’s sharp sell-off, driven largely by macro-political tensions and profit-taking at recent highs.

🔻 On July 24th, former President Trump made a surprise visit to the Federal Reserve headquarters — a move interpreted by markets as subtle pressure on the Fed to start cutting rates.

While the Fed hasn’t signaled any immediate easing, short-term bond yields have dipped slightly — reflecting growing rate-cut expectations.

The US Dollar, however, remains firm, showing markets are still hesitant to fully price in a Fed pivot after strong economic data.

📊 Technical Outlook

On the H2 timeframe, gold continues to trade within a broader bullish structure, but price action is now hovering near a critical Keylevel at 3338, aligned with a rising trendline and VPOC zone. A breakdown below this level could open the door for deeper liquidity grabs toward 332x and even 329x.

Volatility is high, and price is moving in wide ranges — ideal conditions for short-term scalp setups.

🎯 Trading Strategy

🔽 Scalp Buy (Short-Term Bounce Opportunity)

Entry: 3338 – 3336

Stop Loss: 3332

Targets: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 Buy Zone (Deeper Pullback, Reversal Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Targets: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 Sell Zone (If Price Retests Resistance)

Entry: 3374 – 3376

Stop Loss: 3380

Targets: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🧭 Key Price Levels

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Management & Notes

As we head into the weekend, the market is prone to unexpected liquidity sweeps and sharp reversals.

Only consider short-term BUY positions for today. Avoid holding long-term buys until there's confirmation that the lower liquidity zones have been fully swept.

Strictly follow TP/SL discipline to protect capital — especially in volatile, low-news sessions like this.

💬 Enjoying these detailed trade plans?

📈 Follow the MMF TradingView channel for daily market updates, high-probability trade setups, and pro-level insights designed for serious traders.

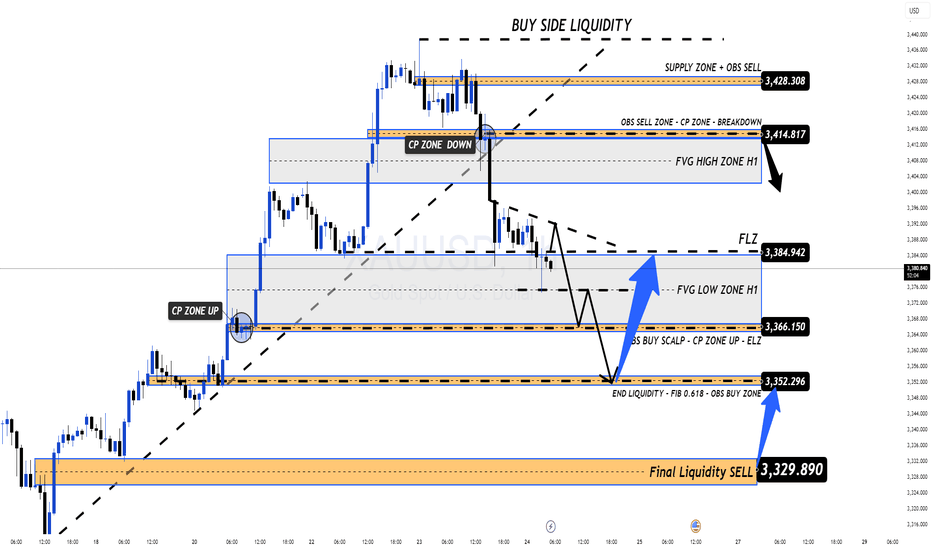

Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead🟡 XAUUSD 24/07 – Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead

🧭 Market Overview

Gold dropped sharply from the 343x area, exactly as anticipated, after breaking the rising channel on the H1 chart and starting to sweep liquidity zones below.

Key factors influencing price action today:

Global markets are awaiting the final outcome of US-EU-China tariff negotiations.

Focus now shifts to next week’s FOMC meeting, where talks of potential rate cuts are intensifying.

Tonight’s PMI and Jobless Claims from the US could introduce unexpected volatility.

📊 Technical Outlook

While the broader trend remains bullish on D1 and H4 timeframes, the short-term H1 chart shows a clear break in structure. Price is currently exploring key FVG zones and OBS levels below.

If these liquidity zones are fully filled, it could set up a highly attractive long-term BUY opportunity, especially as markets price in future Fed rate cuts.

🎯 Today’s Trading Strategy

📌 Short-Term SELL Opportunity

→ Look for early entries at resistance zones, but only with proper confirmation.

📌 Long-Term BUY Setup

→ Target strong technical confluences at deeper levels. Be patient — focus on clean RR setups, don’t rush into early longs.

🔎 Key Price Levels to Watch

🔺 Resistance Zones (Above):

3393 – 3404 – 3414 – 3420 – 3428

🔻 Support Zones (Below):

3375 – 3366 – 3352 – 3345 – 3330

🔽 Trade Scenarios

✅ BUY ZONE: 3352 – 3350

SL: 3345

TP: 3356 → 3360 → 3364 → 3370 → 3375 → 3380 → 3390 → 3400

🔻 SELL ZONE: 3414 – 3416

SL: 3420

TP: 3410 → 3406 → 3400 → 3395 → 3390 → 3380

⚠️ News Alert

Stay cautious with tonight’s US PMI and Jobless Claims releases — these could cause sharp spikes.

✔️ Use proper SL/TP

✔️ Avoid emotional trades

✔️ Let structure confirm before entries

📣 From MMF Team – Trade Smarter Together

If you find this analysis helpful and want more daily trading plans like this:

👉 Follow the MMF channel right here on TradingView — we deliver real, actionable market strategies, not just generic analysis.

🎯 Updated daily. Straight from the charts. Built for traders.

Gold breaks 61.8% Fibonacci retracement level 3358

**Gold Positional Trade Setup:**

If Gold breaks 61.8% Fibonacci retracement level and closes above **3358**, consider initiating a **long position**.

* **Entry:** Above 3358 (after a confirmed close)

* **Target:** 3440

* **Note:** Maintain a proper risk-reward ratio and adhere to your risk management strategy.

---

Gold Price Setup: Bullish Continuation or Rejection? 🧠 Chart Analysis (XAU/USD – 1H):

Key Structure Highlights:

CHoCH (Change of Character) zones marked both up and down indicate a battle between bulls and bears.

Recent bullish CHoCH followed by a fair value gap (FVG) retest suggests potential continuation to the upside.

Price recently bounced strongly from demand zone, shown by the green arrows and strong candle reaction.

Ichimoku Cloud:

Price is trying to break back above the Kumo (cloud), a sign of bullish momentum building.

However, resistance is still present with the Kijun and Tenkan lines converging.

FVG (Fair Value Gap):

The current price is attempting to fill and break above the FVG zone.

A successful breakout above this area confirms bullish intention.

Fibonacci Levels:

Price is hovering around the 0.5 - 0.618 retracement zone, often a strong reversal or continuation point.

Upside targets lie near the 0.786 retracement (3352) and ultimate target at 3391, a major resistance level.

Risk Management:

Trade setup shows an excellent Risk:Reward ratio.

Stop-loss placed just below the last structure low.

Potential downside to 3290–3258 if breakout fails.

🟢 Possible Next Move:

Bullish Scenario: If price clears the FVG and breaks above 3353, expect continuation to 3391.

Bearish Rejection: If rejected at FVG/0.618 level, watch for a drop back to 3290 or even 3259.

Gold/USD Bullish Breakout Toward Target Zone Gold/USD Bullish Breakout Analysis 🚀🟢

The chart illustrates a strong bullish breakout from a consolidation zone, signaling upward momentum:

🔍 Key Technical Observations:

Support Zone: The price respected the support area around 3,325 – 3,330 USD, forming a solid base for reversal.

Bullish Structure: Series of higher lows and higher highs indicate a bullish trend formation.

Breakout Confirmation: Price broke above short-term resistance with a strong bullish candle, indicating buying pressure.

Trendline Support: The ascending trendline has held well, confirming trend continuation.

Target Point 🎯: Projected target is near 3,365 USD, which aligns with a previous resistance and Fibonacci confluence zone.

✅ Conclusion:

The breakout above resistance, supported by a bullish structure and momentum, suggests further upside potential toward the 3,365 USD target zone. As long as price holds above the breakout level, bullish bias remains valid.

🛑 Watch for invalidation if price falls back below 3,330 USD zone.

tXAU/USD Bullish Reversal from Key SupportXAU/USD Bullish Reversal from Key Suppor 📈🟢

📊 Chart Analysis:

Rounded Bottom Structure ⬆️

The price has formed a rounded bottom pattern, indicating potential trend reversal from bearish to bullish.

Multiple bounces (🟠 circles) from the curved support trendline confirm the validity of this structure.

Support Zone Rejection ✅

Price recently rejected from a major horizontal support zone (around 3,303.796 USD) with a strong bullish wick.

This zone has acted as a springboard for prior upward moves.

Falling Wedge Breakout 💥

A falling wedge (bullish pattern) has formed and is breaking to the upside.

Breakout confirmation is underway, indicating momentum shift.

Target Projection 🎯

The projected move from the breakout suggests a potential target at 3,385.820 USD.

This aligns with previous resistance areas.

Key Levels to Watch:

Resistance: 3,385.820 USD (target) and 3,425–3,450 USD (major resistance zone)

Support: 3,303.796 USD (short-term), followed by 3,225–3,250 USD zone

🔔 Conclusion:

Price action suggests a bullish bias with a possible upward continuation if it sustains above the wedge breakout.

Confirmation above 3,330 USD with volume can fuel a rally toward the 3,385–3,400 USD target zone.

📌 Risk Management Tip: Watch for fakeouts near wedge resistance or a re-test of 3,303 USD for better entries.

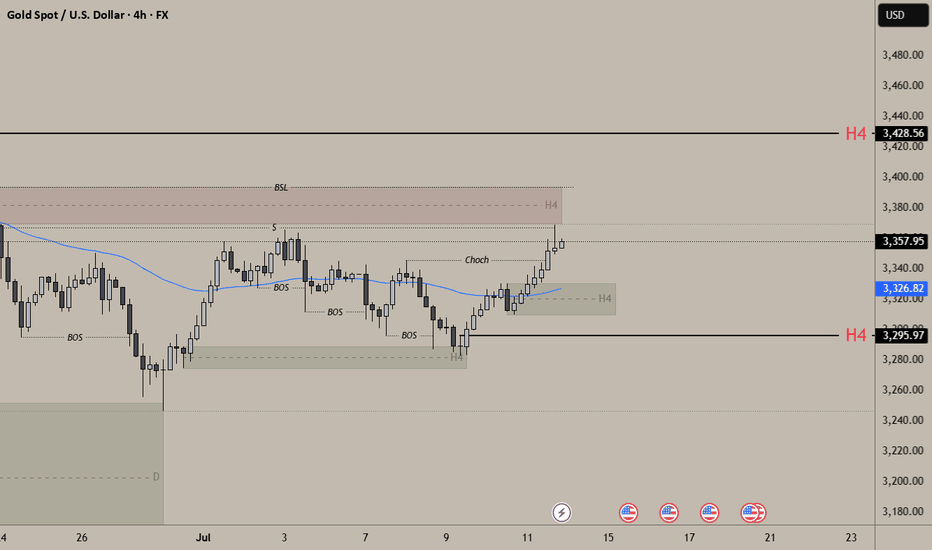

Gold (XAU/USD) Technical Analysis – Bearish Breakdown in Play📉 Gold (XAU/USD) Technical Analysis – Bearish Breakdown in Play | June 20, 2025 🟡

🕒 Timeframe: 4-Hour

📍 Asset: Gold Spot / U.S. Dollar (XAU/USD)

🖼️ Chart Source: TradingView by AngelaFxTrading

🔍 Chart Overview

The 4H chart displays a clear bearish breakdown from an ascending trendline (blue), followed by a rejection at a key horizontal resistance zone (highlighted in purple).

🧠 Key Technical Insights

📌 1. Resistance Zone Rejection

Price Level: ~$3,370 - $3,390

Price attempted multiple breakouts above the resistance zone but consistently failed, indicating strong seller presence. The red arrow marks a lower high, suggesting waning bullish momentum.

📈 2. Trendline Break

The rising blue trendline has been decisively broken. This signals a potential trend reversal from bullish to bearish.

🧭 3. Support Levels to Watch

Minor Support: $3,294.43 (short-term reaction zone)

Major Support: $3,244.87 (target of the projected drop)

🔮 4. Bearish Projection

Blue arrows indicate a measured move expectation, targeting the $3,244.87 level.

A bearish flag/pennant formation post-break suggests continuation lower.

⚠️ Key Considerations

Fundamentals: Note the icons at the bottom — upcoming USD-related news/events 📅 could inject volatility.

Confirmation: For bears, a clean rejection from the resistance retest would confirm entry zones.

🧭 Trading Bias:

🔻 Short-term Bearish

As long as price remains below the purple resistance and under the broken trendline, selling pressure dominates.

🛑 Invalidation Zone

A daily close above ~$3,390 would invalidate this bearish setup and suggest a return to bullish momentum.

XAU/USD Bearish Pattern Analysis XAU/USD Bearish Pattern Analysis 📉

The chart presents a potential bearish continuation setup in the XAU/USD pair, highlighted by technical structures and key price levels:

📊 Technical Breakdown:

🔸 Bearish Rejection from Resistance

Price rejected strongly from the 3,440.000 resistance zone, marked with a red arrow.

This area has acted as a historical supply zone, triggering repeated reversals.

🔸 Descending Channel Formation 📉

A clear bearish flag/channel structure is visible post-rejection.

Price action broke down from the channel, signaling potential trend continuation.

🔸 Target Level 🎯

The expected target is around 3,304.374, aligning with previous support zones and structure lows.

This level coincides with a measured move from the channel breakdown.

🔸 Higher Lows Pattern Before Reversal ⭕

Prior to the current decline, the market formed a series of higher lows, highlighted with orange circles — suggesting a buildup before reversal.

🧭 Key Levels to Watch:

Resistance: 3,440.000 – 3,420.000 🔼

Current Price: 3,368.750

Short-Term Target: 3,304.374 🎯

Major Support: 3,140.000 – 3,160.000 🛡️

📌 Outlook:

The rejection from resistance coupled with the descending channel breakdown indicates bearish momentum. If the market maintains below the recent high, further downside towards 3,304 is expected. Break below this may expose deeper support zones.

📉 Bias: Bearish

⏳ Short-term Action: Watch for breakdown confirmation and momentum continuation.

📉

The chart presents a potential bearish continuation setup in the XAU/USD pair, highlighted by technical structures and key price levels:

📊 Technical Breakdown:

🔸 Bearish Rejection from Resistance

Price rejected strongly from the 3,440.000 resistance zone, marked with a red arrow.

This area has acted as a historical supply zone, triggering repeated reversals.

🔸 Descending Channel Formation 📉

A clear bearish flag/channel structure is visible post-rejection.

Price action broke down from the channel, signaling potential trend continuation.

🔸 Target Level 🎯

The expected target is around 3,304.374, aligning with previous support zones and structure lows.

This level coincides with a measured move from the channel breakdown.

🔸 Higher Lows Pattern Before Reversal ⭕

Prior to the current decline, the market formed a series of higher lows, highlighted with orange circles — suggesting a buildup before reversal.

🧭 Key Levels to Watch:

Resistance: 3,440.000 – 3,420.000 🔼

Current Price: 3,368.750

Short-Term Target: 3,304.374 🎯

Major Support: 3,140.000 – 3,160.000 🛡️

📌 Outlook:

The rejection from resistance coupled with the descending channel breakdown indicates bearish momentum. If the market maintains below the recent high, further downside towards 3,304 is expected. Break below this may expose deeper support zones.

📉 Bias: Bearish

⏳ Short-term Action: Watch for breakdown confirmation and momentum continuation.

Gold Eyes Breakout from Ascending Channel Toward $3,500📈 Chart Analysis

1. Rising Channel Structure

Gold (XAU/USD) has been trading within an upward-sloping channel, marked by the blue trendlines connecting interior lows and highs, culminating at point C (~$3,497). The latest bounce off the lower channel near “B” reinforces bullish bias – if this trendline holds, another leg higher toward resistance around $3,497–$3,500 is likely.

2. Support & Resistance Confluence

The purple trendline and the dotted horizontal green level (~$3,498) converge near the projected breakout point. This synergy provides a strong pivot zone — a successful breakout would validate targets near channel highs.

3. Harmonic Pattern in Play

The chart displays a bullish harmonic structure (likely a Bat or Gartley formation), with retracement ratios (0.719, 1.627) anchoring reversal areas. These reinforce the bounce at B and the potential move toward point C.

4. Trade Scenarios

Bullish Scenario (primary): A bounce off the trendline triggers a rally to the channel top and resistance zone ($3,497–$3,500).

Bearish Caution: A drop below the trendline invalidates the pattern, potentially bringing prices back to horizontal support around $3,296 or even $3,120, as indicated at point A.

🛠️ Technical & Market Context

Technicals: Daily trend remains bullish as long as price holds above ~$3,340–$3,350, with resistance forming in the $3,380–$3,400 range

.

Fundamentals: Geopolitical tension (e.g., Middle East conflict) and safe-haven inflows continue to underpin gold — though Citi expects prices to eventually correct toward $3,300–$3,500 mid‑term

Sentiment: Some analysts advocate “selling the rallies,” especially into the $3,450–$3,500 zone . But central banks’ ongoing buying and potential Fed rate cuts support a stronger floor

.

✅ Trade Strategy

Scenario Entry Zone Target Stop Loss Placement

Play the Bounce ~$3,350–$3,360 $3,497–$3,500 Below trendline near B zone (~$3,320)

Breakout Trade On momentum above $3,400 $3,497–$3,550 Below breakout (sub-$3,380)

Bearish Trigger Break & close below trendline Back to $3,296 / 3,120 Just above trendline ($3,360)

🔍 Summary

Gold remains in a structurally bullish setup inside an ascending channel. The confluence of harmonic reversal, strong trendline support, and pending fundamental catalysts presents a high-probability opportunity to push toward the $3,500 area—provided the trendline and $3,340–$3,350 support hold. A drop below would invalidate the bullish outlook and favor deeper retracement.

XAU/USD Price Action Analysis – June 12, 2025 XAU/USD Price Action Analysis – June 12, 2025 🪙📈

📊 Technical Overview:

The chart presents a clear range-bound market structure with well-defined zones of support and resistance:

📍 Key Levels:

🔴 Resistance Zone: $3,380 – $3,400

Price has been rejected multiple times from this level, as indicated by red arrows. It marks a strong supply zone.

🟢 Support Zone: $3,280 – $3,300

Price has bounced several times from this demand area, forming a reliable support base.

📏 Intermediate Level: $3,319.38

Marked with a purple line, this is likely a mid-range liquidity zone or a previous minor structure level.

🔄 Price Action Insights:

Double Bottom Formation: Notable at the support zone, confirming strong buying interest (highlighted with orange circles and green arrows). This pattern often signals a bullish reversal.

Current Price: Trading near $3,375.645, approaching the resistance area again.

Projected Scenarios:

Bullish Continuation 📈: Break and close above the resistance could trigger momentum to the upside — watch for a breakout with strong volume.

Pullback Scenario 🔁: A rejection from resistance could cause a retest of $3,319.38 or even the support zone, forming a higher low before a potential rally.

🧠 Strategy Outlook:

Bullish Bias 🐂 as long as price holds above $3,319.38.

Watch for Breakout 🚀 above resistance with volume confirmation for long entries.

Caution ⚠️ near resistance; ideal to wait for either a breakout or clear rejection.

📌 Conclusion:

The chart reflects accumulation within a range, with bullish structure emerging. A break above $3,400 could shift market sentiment decisively upward, while a failure at resistance invites a deeper pullback.

XAUUSD Bearish Rejection Setup Unfolding – June 11, 2025XAUUSD Bearish Rejection Setup Unfolding – June 11, 2025 🧠🔍

📊 Technical Breakdown:

🔴 Resistance Rejection Zone (Supply Area)

Price recently tested the $3,440 - $3,460 resistance zone, marked with red arrows. This zone previously acted as a strong supply area, leading to aggressive sell-offs.

📉 Bearish Rejection Candle

A rejection occurred near the same supply zone again, hinting at a potential double top or failure to break structure. Sellers seem to defend this area aggressively.

📍 Current Price: $3,338.6

Price is hovering below mid-range resistance at $3,396.5, indicating weakness after a failed breakout.

📉 Bearish Plan in Motion:

🔁 Scenario Highlighted:

Price might retest the $3,396.5 level (purple line) before resuming the downward move (illustrated by the blue and black arrows).

A breakdown below the $3,290.3 support zone will likely trigger further downside.

🎯 Target Levels:

1st Target: $3,290.3 – Key structural support. A close below this level will confirm the bearish momentum.

2nd Target: $3,207.0 – Final support area aligned with previous accumulation zone.

🛑 Invalidation Point:

A sustained breakout above $3,460 would invalidate the bearish bias and suggest continuation to the upside.

✅ Summary:

Bias: Bearish 📉

Strategy: Sell on pullback to $3,396.5 with stops above $3,460.

Targets: 🎯 $3,290.3 ➡️ $3,207.0

Watch for a strong bearish confirmation candle below $3,290.3 to load in shorts.

🔔 Stay alert for volume spikes and lower time-frame breakdowns to fine-tune entries! 💼📊

XAUUSD/GOLD WEEKLY PROJECTION 07.06.25Strong Selling Zone: Area near the top, where price has been rejected multiple times.

Strong Buying Zone: Area near the bottom, suggesting demand or potential price support.

Trend Line: Uptrend line intersecting around the strong buying zone — potential bounce area.

Resistance & Support Levels:

Resistance 1 & 2

Support 1, 2, & 3

Gold Uptrend Continues June 6, 2025As yesterday Gold made high of 3403, I was expecting to cross upto 3430 but it dropped sharply. News was strong and as it made cautious to investors and safe heaven asset declines moved back to riskers market to 3340.

Now today you can check a pattern and gold is moving in that support and resistance, expecting it to move upward. Currently the situation is unexpected as gold may come down to 3340 and then move upward or directly upward from 3358. Our target is 3375-3389-3400.

Key point.

Resistance - 3360, 3375, 3389, 3400

Support - 3340, 3354

Any Query Reach Us or comment down

Rudra Vasaikar Wishes You A Great And Very Amazing Trading Life. Trade Safe, Trade Right.

RISK WARNING 🔴 🔴 🔴

There is high risk of loss in Trading Forex, Crypto, Indices, CFDs, Features and Stocks. Choose your trade wisely and confidently, please see if such trading is appropriate for you or not. Past performance is not indicative of future results. Highly recommended - Information provided by Pro Trading Point are for Educational purpose only. Do your investment according to your own risk. Any type of loss is not our responsibility.

HAPPY TRADING.

#gold #xauusd #xauusdtrading #goldtrading #goldanalysis #forextrading #forex #trendline #goldsignals #goldnews goldlatestanalysis #xauusdtradesetup #forextradingguide #fxgold

XAUUSD – Bearish Outlook from Resistance Zone📊 XAUUSD – Bearish Outlook from Resistance Zone

🕒 Date: June 5, 2025

💰 Instrument: Gold (XAUUSD)

📍 Current Price: 3,352.730 USD

🟨 Key Resistance Level

🔴 Price has sharply reacted from the 3,375–3,400 USD zone, highlighted as a strong resistance area.

📉 This zone has previously triggered significant sell-offs, confirmed again by the current bearish rejection (red arrow 🔻).

📉 Bearish Market Structure

The price structure suggests a classic lower high rejection scenario with potential for further downside:

🔻 Immediate Drop Expected

After rejection from resistance, the price shows early signs of breakdown. A minor pullback is expected before continuation.

🧭 TP1 – First Target Zone:

📍 3,245.560 USD

This level aligns with a previous demand area (light red box), likely to act as temporary support or reaction point.

🎯 TP2 – Final Bearish Target:

📍 3,127.527 USD

This blue demand zone is a major support level, previously a strong rally base (green arrow 🟢). Expect buyers to step in here again.

🔄 Trade Idea Summary

💼 Setup Type: Resistance Rejection

🛑 Bias: Bearish

📍 Entry Zone: ~3,350–3,360 USD (confirmed rejection)

🎯 Take Profit 1: 3,245.560 USD

🎯 Take Profit 2: 3,127.527 USD

🔒 Stop Loss: Above 3,400 USD (outside resistance zone)

📌 Observations:

🔁 The market repeated its previous pattern: bouncing from the blue demand zone and rejecting at the yellow resistance zone.

🧱 A solid breakdown below TP1 could accelerate movement toward TP2.

🔍 Watch for any bullish reaction around TP2 for potential reversal setups.

📉 Bias: Bearish

📆 Outlook: Short-term to mid-term swing

Chart Overview Instrument: Gold Spot (XAU/USD)🔍 Chart Overview

Instrument: Gold Spot (XAU/USD)

Timeframe: 2H (2-hour candles)

Date/Time: Chart ends on June 5th, 2025, 19:14 UTC.

🟩 Support & Resistance Zones

✅ Resistance Zone

Level: Around 3,355 – 3,375 USD

📌 This zone has seen repeated tests and rejections, indicating strong selling pressure.

✅ Support Zone

Level: Around 3,160 – 3,180 USD

🛡️ Price bounced from this zone previously, confirming it as a strong support area.

⚙️ Key Observations

📈 Range-Bound Trading

The price is currently trapped between the strong support and resistance zones.

Multiple rejections at the resistance zone suggest sellers are active above 3,355 USD.

💡 Horizontal Consolidation

Price has formed a horizontal range (sideways movement) in recent sessions.

This range-bound behavior signals market indecision or a buildup before a potential breakout.

📉 Previous Price Action

🔽 Sharp Reversal Drop

Around the middle of May, there was a strong rejection at resistance, followed by a rapid sell-off to the support zone.

This shows that the resistance zone is significant and that sellers are quick to act.

🔮 Potential Scenarios

✅ Bullish Breakout

If price closes above 3,375 USD with strong momentum, expect a potential bullish rally toward 3,400+ USD.

✅ Bearish Rejection

If price fails to close above 3,355 USD and shows rejection candles (like dojis or bearish engulfing patterns), price may retest 3,280 USD and even support at 3,160 USD.

🔔 Key Takeaway & Trader’s Tip

⚠️ Watch for breakout signals near resistance and support.

✅ Volume spikes and momentum indicators will help confirm true breakouts or fakeouts.

🔍 Neutral to Bearish Bias

Given repeated rejections at resistance, short-term bias is neutral to bearish unless a breakout occurs.

📝 Summary with Emojis

🔴 Resistance Zone: 🔝💪

🟩 Support Zone: 🛡️🟢

📉 Bearish Momentum likely below 3,355 USD

📈 Bullish Breakout above 3,375 USD

🕵️♂️ Watch for consolidation and breakout setups!

XAU/USD Bearish Rejection at Resistance – Potential Drop Ahead!XAU/USD Bearish Rejection at Resistance – Potential Drop Ahead! 💥

🔍 Technical Analysis:

Instrument: Gold vs US Dollar (XAU/USD)

Timeframe: Daily

Current Price: $3,363.26

Resistance Zone: $3,380 – $3,470

Support Zone: $2,970 – $3,100

🧠 Market Context:

Gold has recently approached a well-defined resistance zone near the $3,380–$3,470 range. Price action shows multiple rejection wicks and failed attempts to break above this level, indicating strong selling pressure from bears. 🐻

The current candlestick structure suggests the market is printing lower highs, which may indicate a transition from a consolidation phase into a potential bearish trend.

📉 Projection:

The chart projects a move down toward the support zone, around $2,970–$3,100, possibly due to:

Repeated rejections at the resistance zone 🔄

Lack of bullish momentum near highs ⚠️

Bearish engulfing or reversal candlestick formations 🔻

✅ Key Levels to Watch:

Level Type Price Zone Action

🔴 Resistance $3,380 – $3,470 Strong rejection expected

🟢 Support $2,970 – $3,100 Major demand zone; potential bounce

🧭 Trading Outlook:

⚠️ If price fails to break above the resistance zone, short opportunities may develop with a target near the support zone. A confirmed break and close below $3,300 would strengthen bearish sentiment.

📌 Bearish Bias Maintained Until Resistance Breaks

Smart Trade Insight – XAU/USD Technical BreakdownKey Levels & Technical Zones:

🔹 Resistance Zone (🔼 SELL Area):

📌 3,315 – 3,340

This area has been tested and rejected multiple times, as highlighted by the strong bearish wicks. The recent price action failed to break above it, triggering short interest.

🔹 Minor Support Zone:

📌 Around 3,243

Acted as intraday bounce area previously, now likely to offer weak support in the coming move down.

🔹 Major Demand Zone (💚 BUY Interest Zone):

📌 3,120 – 3,140

Labelled as "BEST SUPPORT DEMANDING ZONE" – historical demand visible with strong bounce history. Ideal for monitoring bullish reversal opportunities.

📈 EMA Levels:

🔴 50 EMA: 3,299

🔵 200 EMA: 3,254

Current price action is hovering near the EMAs. The rejection at the resistance while below the 50 EMA indicates weakening bullish momentum.

🔍 Market Structure Overview:

The double-top formation near the resistance shows exhaustion in buying.

Lower highs forming → structure turning bearish short-term.

Solid rejection confirms that this is a valid zone to initiate short positions 🛑📉.

📉 Forecast Path:

🔮 Projected Move:

Price is expected to break below minor support at 3,243.

Intermediate target: 3,206, then 3,167 🟠.

Final destination: Demand Zone at 3,120 – 3,140 🟩 for potential bounce 📈.

💬 "Market not break the resistance level and rejected solid — this is a good entry for short-term sell trades." ✅

✅ Trade Idea Summary:

🟥 Bias: Short

🎯 TP Targets: 3,206 → 3,167 → 3,122

📉 SL Suggestion: Above 3,340 resistance zone

🧭 Risk-Reward Setup: Favorable for short-term traders

Key Levels & Technical Zones:

🔹 Resistance Zone (🔼 SELL Area):

📌 3,315 – 3,340

This area has been tested and rejected multiple times, as highlighted by the strong bearish wicks. The recent price action failed to break above it, triggering short interest.

🔹 Minor Support Zone:

📌 Around 3,243

Acted as intraday bounce area previously, now likely to offer weak support in the coming move down.

🔹 Major Demand Zone (💚 BUY Interest Zone):

📌 3,120 – 3,140

Labelled as "BEST SUPPORT DEMANDING ZONE" – historical demand visible with strong bounce history. Ideal for monitoring bullish reversal opportunities.

📈 EMA Levels:

🔴 50 EMA: 3,299

🔵 200 EMA: 3,254

Current price action is hovering near the EMAs. The rejection at the resistance while below the 50 EMA indicates weakening bullish momentum.

🔍 Market Structure Overview:

The double-top formation near the resistance shows exhaustion in buying.

Lower highs forming → structure turning bearish short-term.

Solid rejection confirms that this is a valid zone to initiate short positions 🛑📉.

📉 Forecast Path:

🔮 Projected Move:

Price is expected to break below minor support at 3,243.

Intermediate target: 3,206, then 3,167 🟠.

Final destination: Demand Zone at 3,120 – 3,140 🟩 for potential bounce 📈.

💬 "Market not break the resistance level and rejected solid — this is a good entry for short-term sell trades." ✅

✅ Trade Idea Summary:

🟥 Bias: Short

🎯 TP Targets: 3,206 → 3,167 → 3,160

📉 SL Suggestion: Above 3,340 resistance zone

🧭 Risk-Reward Setup: Favorable for short-term traders