Gold (XAU/USD) Breakout Setup – Bullish Reversal from RBR Zone!🔹 Trade Idea: Long (Buy) Setup

📈 Targeting a price rally from a demand zone!

---

🔵 .ENTRY ZONE (Buy Area)

🟦 Marked between 3,039.773 – 3,043.052

📍 Located in the RBS + RBR zone (Resistance becomes Support + Rally-Base-Rally)

💡 Price dipped here and bounced — showing bullish intent

🔻 .STOP LOSS

🚨 Placed at 3,014.537

🛡️ Protects you in case the price drops below the zone

✋ Risk is clearly defined here

🎯 .TARGET POINT (Take Profit)

🚀 Aiming for 3,115.910

💸 A high reward area if momentum continues

🔥 Great R:R ratio (~1:3) — solid risk/reward

📊 .Technical Confirmation

📌 Price has moved above the 9-period DEMA (3,043.052)

⚡ Signals bullish momentum

🕯️ Strong bullish candles forming after the bounce — confirming entry.

🔍 .Market Structure Notes

⬇️ Previous trend was down

🔄 Now forming a potential reversal

🧱 Support holding strong near 3,014–3,030

✅ Summary: 💥 Buy idea from demand zone

🔝 Targeting new highs

🛑 Stop loss tightly managed

⚖️ Clean setup with momentum on your side

Xauusdsignal

XAUUSD INTRADAY WISE CHANCE UPTO 12.50 POINTSXauusd strong buy above zone 3130.50..

There is no resistance upto 3143.40

Wait for active zone

current mkt price 3122.10

Buy above 3130.50

Stoploss.......3123.50....7 points

Target1........3135.50....5 points

Target2........3143.50....12.50+++ points

If active only above this level applicable

Disclaimer - This level only for education purpose . Do ur own analysis

"Gold Price Rejection Setup – Trendline + Resistance Combo"XAU/USD 1H Chart Analysis 🪙📉

🔹 Trendline 📐

* Descending trendline marked by 3 touches

* Shows consistent bearish pressure

* Price is respecting it—watch for rejections

🔹 Resistance Area ⛔

* Blue zone between $3,014 - $3,025

* Strong supply zone—price failed to break it before

* Potential reversal zone if price touches again

🔹 Entry Point 🎯

* Suggested short entry at $3,014.29

* Just under resistance + near trendline

* Great spot for catching a downward move

🔹 Stop Loss ⚠️

* Placed at $3,025.13

* Above resistance = smart protection

* Keeps risk under control if breakout happens

🔹 Target Point 💰

* Take-profit marked around $2,964.45

* Down at a key support level

* Clean risk-to-reward around 1:5 (sweet setup!)

🔹 Moving Average (DEMA 9) 📈

* Dynamic resistance (line hugging candles)

* If price closes below, confirms bearish move

Summary ✅

This setup is a classic trendline + resistance short. You're betting on price respecting resistance and heading lower.

Bias: Bearish 🔻

Entry: $3,014.29

SL: $3,025.13 🛑

TP: $2,964.45 ✅

XAUUSD 1H SELL PROJECTION 08.04.25Instrument: Gold Spot / U.S. Dollar (XAUUSD)

Timeframe: 1 Hour (1H)

Current Price: ~$2,995.25

Projection Date: April 8, 2025

Analysis Type: Bearish/Sell Projection

📊 Technical Elements:

🔹 Trend Analysis:

A 1H downtrend is marked with a descending trendline.

Price previously broke a key support zone, retested it (now acting as resistance), and is expected to drop again.

🔹 Trade Setup:

Entry: Near current price ($2,995.25)

Stop Loss: Above Resistance R1 at $3,010.27

Take Profit Targets:

TP1: At Support S1 (~$2,980)

TP2: At Support S2 (~$2,957)

📈 Indicators:

📍 Stochastic Oscillator (5, 3, 3):

Reading: 79.61 (green) and 80.17 (red)

Interpretation: Just above 80 → Overbought Zone

Signal: Potential reversal downwards

📍 Relative Strength Index (RSI - 14):

Value: 44.84

Interpretation: Below neutral 50, not oversold

Signal: Bearish momentum building

🧠 Conclusion / Strategy:

The chart suggests a short/sell setup for XAUUSD.

The price has retested the broken support (now resistance) and formed a rejection candle at the trendline.

Indicators support a potential downward move (Stochastic overbought + RSI weak).

Targeting lower supports for potential exit points.

XAUUSD READY TO FLY 22 POINTS IN INTRADAYXAUUSD strong zone above 3032

There is no resistance upto 3048....16 points

CURRENT MKT PRICE 3028.70

wait for active zone

Buy above 3032

Stoploss..........3024....8 points

Target1..............3038...6 points

Target2...............3048...16 points

Target3...Risk..........22 points

Disclaimer - This level only for education purpose and papertrade purpose only. Do ur own analysis

XAUUSD INTRADAY TARGET 22 POINTS...3032 TO 3054+XAUUSD strong zone above 3032

There is no resistance upto 3048....16 points

wait for active zone

Buy above 3032

Stoploss..........3024....8 points

Target1..............3038...6 points

Target2...............3048...16 points

Target3...Risk..........22 points

Disclaimer - This level only for education purpose and papertrade purpose only. Do ur own analysis

XAUUSD Next Move 2800 ? 🪙 FUNDAMENTALS:

✅China on Friday struck back at the U.S tariffs imposed by Trump with a slew of counter-measures including extra levies of 34% on all U.S. goods and export curbs on some rare-earths, deepening the trade war between the world's two biggest economies.

✅ More than 50 nations have reached out to the White House to begin trade talks since Trump rolled out sweeping new tariffs, top officials said on Sunday as they defended levies that wiped out nearly $6 trillion in value from U.S. stocks last week.

✅ Federal Reserve Chairman Jerome Powell said tariffs increased the risk of higher inflation and slower growth, highlighting the difficult path ahead for policymakers at the U.S. central bank

________________________________________

🔍 4H Hour Timeframe Analysis

📊 Trend & Price Action :

• Previous Trend: Clear uptrend inside a rising channel (marked by red lines).

• Recent Price Movement: Price broke down below the ascending channel, signaling trend weakness or possible reversal.

• Strong bearish candles show increased selling pressure recently.

📉 Key Technical Levels:

• Support Zone: Around $2,979–$2,957 (green and grey lines) — price bounced here, showing buyer interest.

• Resistance Zone: Around $3,057–$3,077 — a previous support zone now acting as resistance after the breakdown.

• Moving Averages:

o Red Line (likely 50 EMA): Recently broken down, now acting as dynamic resistance.

o Blue Line (likely 200 EMA): Around $2,990, price tested and bounced — this is often a key support in a trend.

🧠 Interpretation:

• Price broke structure (channel and EMAs), signaling a shift from bullish to bearish bias.

• The bounce from the 200 EMA and support zone suggests a potential short-term retracement or consolidation.

• If price fails to reclaim $3,057–$3,077, sellers may re-enter.

________________________________________

🔍 15-Minute Timeframe Analysis

📊 Trend & Price Action:

• Sharp intraday recovery from the low of around $2,957 to the current $3,033.

• But price is now facing resistance from a supply zone (highlighted in red).

• You’ve marked an Order Block (OB) around $3,125–$3,140 — a zone where institutional selling might have started.

📉 Key Levels:

• Resistance Zones:

o $3,076 (blue line) – likely 200 EMA, strong resistance.

o $3,057–$3,076 – supply area and previous breakdown zone.

o Order Block (OB) near $3,125–$3,140 – strong institutional resistance zone.

• Support Zones:

o $3,000, $2,978, and $2,957 – these are lower supports where price previously bounced.

🧠 Interpretation:

• Short-term, the price is retracing from a heavy drop.

• Watch how price behaves at $3,057–$3,076:

o Rejection = possible short setup.

o Break & close above = retracement could continue toward OB ($3,125).

• The OB is a potential reversal zone, where price could get heavily rejected if tested.

________________________________________

📌 Beginner Takeaways:

Trend is weakening – the uptrend broke, and the market is forming lower highs and lower lows.

Price is trying to recover from key support zones but facing resistance overhead.

Volume is increasing near support — shows interest from buyers but not a confirmed trend reversal yet.

The Order Block is a great place to watch for reversal trades (supply zone = potential sell).

________________________________________

✅ Suggested Actions for Practice:

Mark key support/resistance zones on your own chart to develop your structure-reading skills.

Scenario 1: Short if price rejects at $3,057–$3,076 zone.

Scenario 2: Long only if price closes above $3,077 and holds support.

Observe how price behaves near moving averages and OB zones

.

________________________________________

👉 Always follow TP/SL to protect your capital and maximize profits!

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

XAUUSD/GOLD WEEKLY PROJECTION 06.04.25April 10 – China to impose 34% tax on US goods

→ Trade tension increases risk-off sentiment, potentially lowering gold prices if USD strengthens.

US Manufacturing Tax (NO - 37%)

→ Negative manufacturing data or tax burden could weaken USD sentiment but also stir market uncertainty.

BRICS exploring an alternative currency (moving away from USD)

→ Could signal reduced demand for USD-backed assets like gold in the long term.

NFP XAUUSD ANALYSIS 58 PTS -TP -3178- WORLD CLASS ACCURACY ??XAUUSD STRONG BUY ZONE ABOVE 3120

There is no resistance upto 3178

current mkt price 3111

Wait for active zone

Buy above 3120

Stoploss…….3103………17 points

Target1…………3135……….15 points

Target2…………3168……….48 points

Target3… Risk………………..3178...58 points

Disclaimer - This level only for education purpose. Do ur own analysis

Gold Price Analysis:Key Supply & Demand Zones with Potential Bkl🔥 Key Levels & Zones

🔵 Supply Zone (3,135-3,140 USD) 📉

Acts as resistance where selling pressure increases.

If price reaches here, expect a potential pullback.

🟢 Demand Zone (3,085-3,095 USD) 📈

Strong support area with buying interest.

Price has tested this zone multiple times = accumulation.

🎯 Target Point (~3,167 USD) 🚀

If price breaks out, it may rally towards this level!

❌ Stop Loss (~3,080 USD) ⛔

Marked below demand zone to limit risk.

---

📊 Trend Analysis

🔹 Trend Line Break ⚡

The price broke the previous uptrend = potential reversal or deeper correction.

🔹 Market Structure 🏗️

Price consolidating inside the demand zone = possible bullish move ahead.

🔹 Double Bottom Formation (DBF) at Supply Zone 🔄

Shows failed breakout attempts = strong resistance.

---

🔍 Indicators & Insights

📌 DEMA (9 close) at 3,099 USD 📈

Price hovering around this moving average = market indecision.

---

🚦 Possible Scenarios

✅ Bullish Scenario:

If price holds the demand zone & breaks above 3,110 USD, it could rally to supply zone (~3,135 USD).

A breakout above 3,140 USD could lead to the target zone (~3,167 USD) 🚀.

❌ Bearish Scenario:

If price breaks below 3,085 USD, it may hit stop loss (3,080 USD) and continue lower.

---

🎯 Trading Plan

🟩 Long Entry ➡️ Around 3,090-3,100 USD 📊

🛑 Stop Loss ➡️ Below 3,080 USD 🚨

🎯 Target ➡️ 3,135-3,167 USD 🎉

XAUUSD READY TO FLY 17 POINTS UPSIDE POSSIBLE ABOVE 3099.20 XAUUSD Strong above 3099.20

There is no resistance upto 3116....17 points

Wait for active zone

Buy above 3099.20

Stoploss...........3091.....8 points

Target1........3103.30......4 points

Target2........3109...........10 points

Target3........3116.............17 points

Disclaimer - This level only for education and papertrade purpose. Do ur own analysis

If any doubt dm me

XAUUSD HUGE 36 POINTS UPSIDE POSSIBLE NEW ALL TIME HIGH 3171++XAUUSD strong again buy mode chance above 3134.60

there is no resistance upto new all time high 3171++++

wait for active zone

Buy above 3134.60

Stoploss...............3124.....10 points

Target1.........3141.......6 points+++

Target2.........3151.......16 points+++

Target3..........3161.......26 points+++

Target4...........3171+++ new all time high ....upto 3178+++

Disclaimer - This level only for educationa purpose and papertrade . Do ur own analysis. Thank u

Gold (XAU/USD) Bullish trend Demand Zone – Trend Analysis🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

XAUUSD 18 points up NEXT ALL TIME HIGH 3170++XAUUSD strong above 3152.30

There is no resistance upto 3170++

wait for active zone

Buy above 3152.30

Stoploss...........3144.70.....7.60 points

Target1...........3158....6 points

Target2............3160...8 points

Target3............3168...16 points

Target4 Risk.......3170...18 points

Final expect 3178 to 3185 only maximum

I suggest buy above only mode 3152.30

below this levels downtrends

Disclaimer - This level only for educational purpose and papertrade . Do ur own analysis

XAUUSD 1% FALL CHANCE 38 + POINTSXAUUSD weak below only 3116.50

There is no suport 3116.50 to 3078

wait for active zone

Sell below only 3116.50

Stoploss...............3126...10.50 points

Target1................3108....8 points

Target2................3093....23.50 points

Target3...Risk.........3078....38.50 points

1 % fall chance

Disclaimer - This level only for educational purpose only. Do or own analysis.

XAUUSD NEW ALLHIGH CHANCE INTRADAY WISE 11 POINTS UPSIDE TARGETXAUUSD strong above 3128.30

intraday wise there is no resistance upto 3139++

wait for active

Buy above 3128.30

Stoploss........3124.30...........4 points

Target1........3131.30............3 points

Target2........3135................7 points

Target3........3139+...............11 points

Next Target open.......New all time high

Disclaimer - This level only for education and paper trade purpose only. Do ur own analysis

IF any doubt dm me

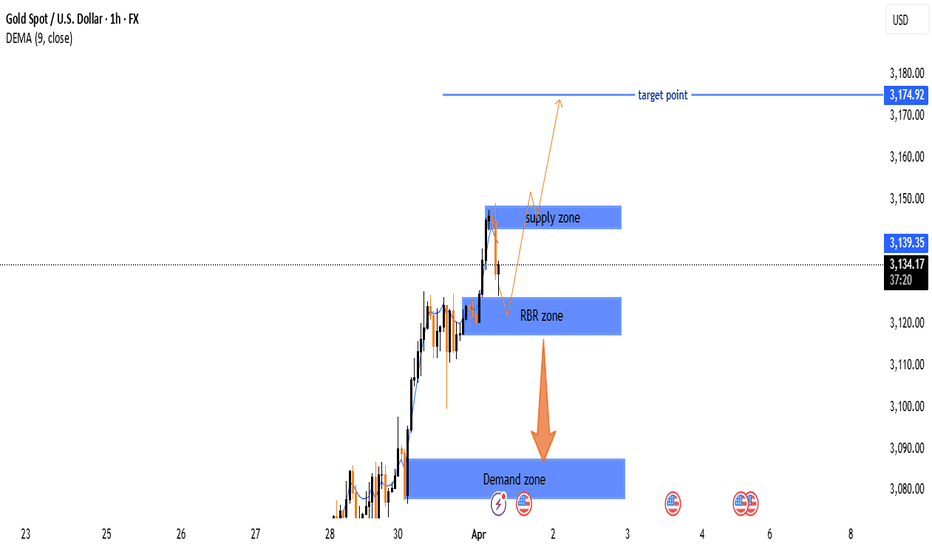

Gold Spot (XAU/USD) Price Analysis –Key Zones & Potential Movemt🔵 Key Price Levels:

Current price: 🟠 $3,130.99

DEMA (9): 🔵 $3,138.21

Target price: 🎯 $3,174.92

📌 Zones Identified:

🟢 Demand Zone (Support) ⬇️: Strong buying interest, potential bounce area. If price falls here, buyers may step in.

🟡 RBR Zone (Rally-Base-Rally) 🔄: A mid-level area where price could consolidate before moving up.

🔴 Supply Zone (Resistance) ⬆️: Sellers might emerge, causing a reversal or slowdown in price movement.

📈 Potential Price Action:

🔹 Scenario 1 (Bullish 🐂): A retrace to the RBR Zone 🟡 could lead to a bounce 📈 toward the Target 🎯 at $3,174.92.

🔹 Scenario 2 (Bearish 🐻): If price drops below the Demand Zone 🟢, it may signal a trend reversal 📉.

🔹 Breakout Confirmation: If price breaks above the Supply Zone 🔴, it may continue rallying 🚀 toward the target point.

XAUUSD 23 POINTS FALL SHARF FALL BELOW 3113.30...UPTO 3090XAUUSD weak below zone 3113.30

There is no suport upto 3090

wait for active mode

Sell below only 3113.30

Stoploss 3021......8 points

Target1.....3109........4.30 points

Target2.....3100........13.30 points

Target3......3090.........23++ points

Disclaimer - This level only my view and education purpose only. Do ur own analysis

XAUUSD 20 PTS SHARP FALL SURE BELOW 3113.50XAUUSD weak below 3113.50

sharp fall will chance upto 3093.....20 points

weak zone there is no suport zone below 3113.50 letsee

wait for active zone

Sell below...................3113.50

Stoploss.....................3121....7.50 points

Target1.........3109.50.....4points

Target2.........3100.........13.50 points

Target3..........3093........20+ points

Disclaimer- This level only for education purpose . Do ur own analysis

XAUUSD 14 POINTS SELL BELOW 3114 SHARP FALL UPTO 3100..XAUUSD weak below only 3114

below 3114 there is no suport so sharp fall will hapen

wait for active zone

sell below 3114

stoploss..3121.......7 points

Target1........3109.50...4.50 points

Target2........3100........14 points

Disclaimer - This level only for education purpose only

Gold (XAU/USD) Bullish Outlook: Key Levels & Trade Setup📊 Gold (XAU/USD) 1H Chart Analysis 📈

🔹 Current Price & Trend:

📍 Price: 3,077.46 USD

📈 Uptrend in play (Higher Highs & Higher Lows)

📊 9-period DEMA: 3,078.47 USD (showing bullish momentum)

🔹 Key Levels:

📍 Demand Zone (Support) 📥: 🟦 3,030 - 3,040 USD (Potential Buy Area)

📍 Fair Value Gap (FVG) ⚡: 🟦 Price may retrace here before continuing up

📍 Resistance Zone (Short-term) 🚧: 🟦 3,085.15 USD

🎯 Target Price: 🔵 3,110.09 USD

🔹 📉 Possible Scenario:

1️⃣ Price retraces to the FVG zone 🟦 (Healthy pullback)

2️⃣ 📈 Bullish continuation toward the 3,110 target 🎯

Gold (XAU/USD) Bullish Outlook: Key Levels & Trade Setup📊 Gold (XAU/USD) 1H Chart Analysis 📈

🔹 Current Price & Trend:

📍 Price: 3,077.46 USD

📈 Uptrend in play (Higher Highs & Higher Lows)

📊 9-period DEMA: 3,078.47 USD (showing bullish momentum)

🔹 Key Levels:

📍 Demand Zone (Support) 📥: 🟦 3,030 - 3,040 USD (Potential Buy Area)

📍 Fair Value Gap (FVG) ⚡: 🟦 Price may retrace here before continuing up

📍 Resistance Zone (Short-term) 🚧: 🟦 3,085.15 USD

🎯 Target Price: 🔵 3,110.09 USD

🔹 📉 Possible Scenario:

1️⃣ Price retraces to the FVG zone 🟦 (Healthy pullback)

2️⃣ 📈 Bullish continuation toward the 3,110 target 🎯