XAUUSD H1 – Pullback at Demand, Bulls Ready for Next Move?Gold is trading in a high-volatility recovery phase after the recent selloff, with price now pulling back into a clear H1 demand zone. This is a reaction-based market, where structure + fundamentals must align before continuation.

📌 Market Context (Fundamentals)

Gold remains highly sensitive to macro headlines as markets reassess:

Fed rate path expectations

US data momentum vs. slowing growth signals

Ongoing safe-haven demand on volatility spikes

No clear hawkish shift so far → downside moves look corrective, not impulsive.

➡️ Bias: Wait for confirmation at demand, not chase price.

📊 H1 Structure & Technicals

Prior selloff has lost momentum

Price is forming a technical pullback, holding above the last reaction low

Current move = rebalancing phase within a broader recovery

Key demand aligns with Fibonacci discount area

🎯 Key Trading Zones (H1)

🟢 BUY Zone (Primary Demand):

4,720 – 4,700

(Strong reaction base + discount zone)

❌ Invalidation:

H1 close below 4,700 → bullish recovery is invalidated

🎯 Upside Targets

TP1: 5,080 (first recovery resistance)

TP2: 5,345 (major H1 extension / liquidity target)

Xauusdstrategy

XAUUSD H1 – Trendline retest may trigger next bullish moveMarket Context (Macro → Flow) Gold remains highly sensitive to macro headlines as markets continue to price in policy uncertainty around the Fed path and real yields. While no major shock hit today, flows show defensive positioning returning on dips, keeping gold supported despite recent volatility. ➡️ This environment favors buying on the reaction, not chasing breakouts.

Technical Structure (H1)

Price is still trading below a descending trendline, but momentum to the downside is weakening.

Current move is a technical pullback into Fibonacci discount + structure support.

No confirmed bearish continuation — sellers are losing follow-through.

➡️ This is a decision zone, where reaction will define the next leg.

Key Trading Zones & Levels

🔹 BUY ZONE (Reaction Area): 4,880 – 4,870 (Trendline support + Fib 0.618–0.786 + prior reaction zone)

🔹 Invalidation: H1 close below 4,820 → bullish idea weakens

Upside Targets (If Bullish Reaction Holds): 🎯 TP1: 5,070 🎯 TP2: 5,333 (1.618 extension / major recovery target)

Execution Notes

No blind entries → wait for bullish candle reaction or higher-low confirmation

Expect volatility spikes; manage size accordingly

Structure > headlines

Summary Gold is compressing at a high-confluence support zone. If buyers defend this area, a strong recovery leg toward 5,070 → 5,333 is in play. If not, patience beats prediction.

📌 Trade reactions, not expectations.

Gold flipped structure — real reversal or liquidity trap?Gold has just delivered a clear structural shift after weeks of heavy downside pressure — but this is not the time to chase.

Market Structure (M30)

Price printed a bullish CHoCH, ending the prior bearish sequence.

Followed by a BOS to the upside, confirming short-term bullish control.

Momentum is strong, but price is now approaching a key reaction zone.

Key Zones to Watch

FVG Support: ~4,950 – 4,980

→ Ideal area for pullback continuation if bullish structure holds.

Mid Resistance / Reaction: ~5,100 – 5,150

→ Expect volatility and possible shakeout.

Upper Target Zone: 5,270 – 5,450

→ Fibonacci 0.5 → 0.786 retracement of the prior sell-off.

Trading Scenarios

Bullish continuation:

Wait for pullback into FVG + higher low → continuation toward 5,27x → 5,45x.

Failure scenario:

Loss of FVG + M30 close back below ~4,95x → bullish structure invalid, range or reversal risk.

🧠 Trading Mind

This is a reaction market, not a prediction market.

After a structure flip, pullbacks pay — breakouts trap.

GOLD BULLISH OR BEARISH?Gold is bouncing — but context matters.

After a strong selloff, price is now retracing into a key resistance zone, not breaking structure. This is where many traders get trapped chasing a “bottom” while smart money distributes.

Market Structure

Clear downtrend: Lower Highs & Lower Lows remain intact

Current move = retracement, not impulsive bullish continuation

Price is reacting below the descending trendline

Key Technical Zone

FVG / Supply zone around 5.26x → high-probability reaction area

This zone aligns with retracement levels and prior imbalance

If–Then Scenarios

If price rejects 5.26x:

→ Downtrend continuation toward 4.63x → 4.51x → 4.40x

If price breaks and holds above 5.26x (H1 close):

→ Bearish bias weakens, wait for new structure before trading

Trading Mindset

This is distribution after a selloff, not accumulation.

Don’t confuse a bounce with a trend change.

📌 Strong trends don’t reverse quietly — they test patience first.

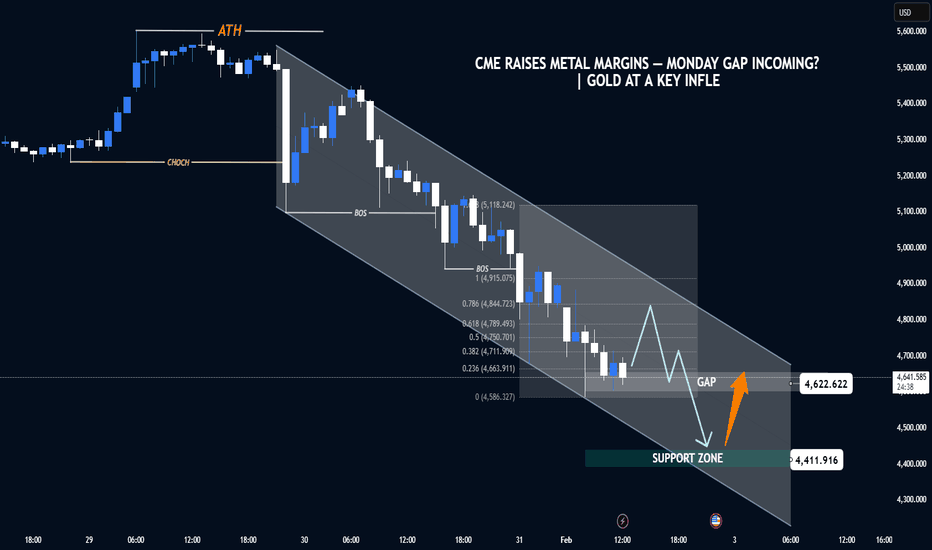

CME raises metal margins, Monday gap risk? Gold key influence.Gold is no longer trending freely — it’s correcting with structure.

After printing ATH, XAUUSD delivered a clear CHoCH, followed by a sequence of bearish BOS, confirming a controlled pullback, not panic selling. Price is now respecting a descending corrective channel, which typically appears before the market decides its next major leg.

🧠 Fundamental Context (Flow > Headlines)

CME raised margin requirements for metals

Higher margins = forced position reduction for leveraged traders

This often creates liquidity-driven gaps at the weekly open

Important: this is mechanical pressure, not a macro trend flip

➡️ Expect volatility first, clarity later.

📊 Technical Structure (HTF → LTF)

ATH rejection + CHOCH = bullish momentum paused

Multiple BOS inside the channel = distribution phase

Price is compressing toward key liquidity zones

🔑 Key Levels to Watch

5,090 – 5,120: Upper channel / sell-side reaction zone

4,620 GAP area: High-probability liquidity magnet if Monday gaps

4,410 Support zone: HTF demand & channel base (critical level)

🎯 Scenarios (If – Then)

If Monday gaps into 4,620

→ Expect sharp moves and fake breaks

→ Wait for acceptance / absorption before any long bias

If price loses 4,620 cleanly

→ Next draw = 4,410 support

If price reclaims 4,900+ quickly

→ Gap likely becomes a trap → squeeze back into range

Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.