XAUUSD H1 – Bullish Continuation After Support RetestMarket Overview:

Gold on the 1H timeframe is maintaining a short-term bullish structure after forming a higher low near the 4,700 region and breaking previous consolidation highs. Price is currently trading above the 5,000 psychological level, which is acting as a key demand zone.

Technical Structure:

Clear bullish recovery from the recent swing low.

Break of short-term resistance followed by consolidation.

Strong support zone around 4,980–5,020.

Major resistance positioned near 5,200.

Price recently rejected higher levels and is pulling back toward the marked support zone, suggesting a potential liquidity sweep before continuation.

Trade Idea:

Entry Zone: 5,000–5,030 (support retest)

Stop Loss: Below 4,950 (below structure support)

Target: 5,180–5,220 (resistance / previous supply area)

Bias: Bullish while price remains above 4,950.

A clean bounce from support with bullish confirmation (strong bullish candle or rejection wick) would increase the probability of continuation toward the 5,200 resistance level.

Xauusdupdates

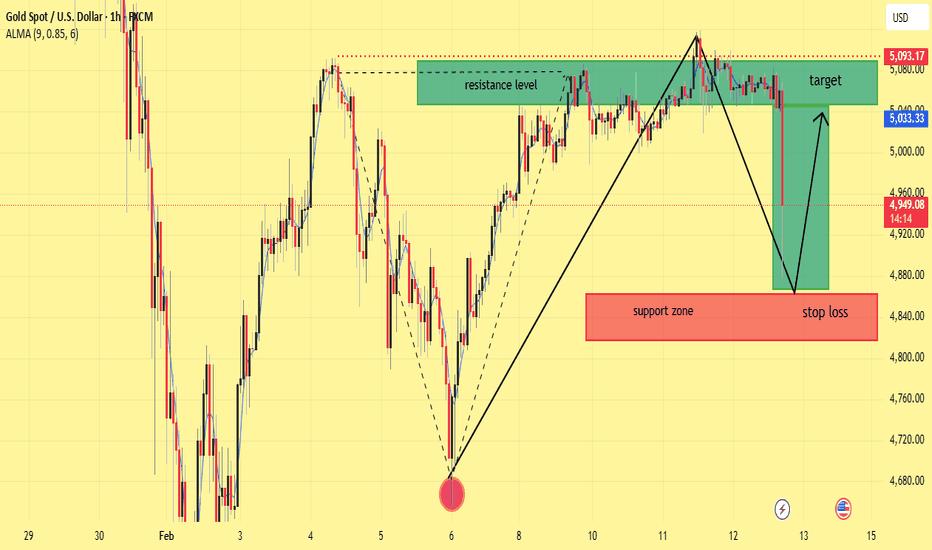

XAUUSD H1 – Resistance Rejection and Pullback Toward Key SupportMarket Overview:

On the H1 timeframe, Gold faced strong rejection near the 5,090–5,100 resistance zone after completing a sharp impulsive move from the 4,680 swing low. The failure to sustain above resistance triggered a bearish retracement toward the 4,900 region.

Technical Structure:

A clear bullish impulse leg formed from 4,680 to approximately 5,120.

Price entered consolidation beneath the 5,100 resistance and failed to break decisively.

A lower high structure developed, followed by strong bearish momentum.

The ALMA (9) has turned downward, confirming short-term bearish pressure.

Key Levels:

Resistance Zone: 5,080–5,100

Immediate Support: 4,900–4,880

Major Support Zone: 4,850 area

Invalidation for Bears: Sustained move back above 5,100

Trade Scenario:

The current structure favors a corrective move toward the marked support zone around 4,880–4,850. If buyers defend this area and bullish confirmation appears, a potential rebound toward the 5,050–5,100 region could follow.

However, a clean H1 close below 4,850 would weaken the broader bullish structure and expose 4,800 as the next downside objective.

Conclusion:

Gold is undergoing a technical pullback after rejection at resistance. The 4,880–4,850 support zone is critical for determining whether this move is a healthy retracement within an uptrend or the beginning of a deeper bearish correction.

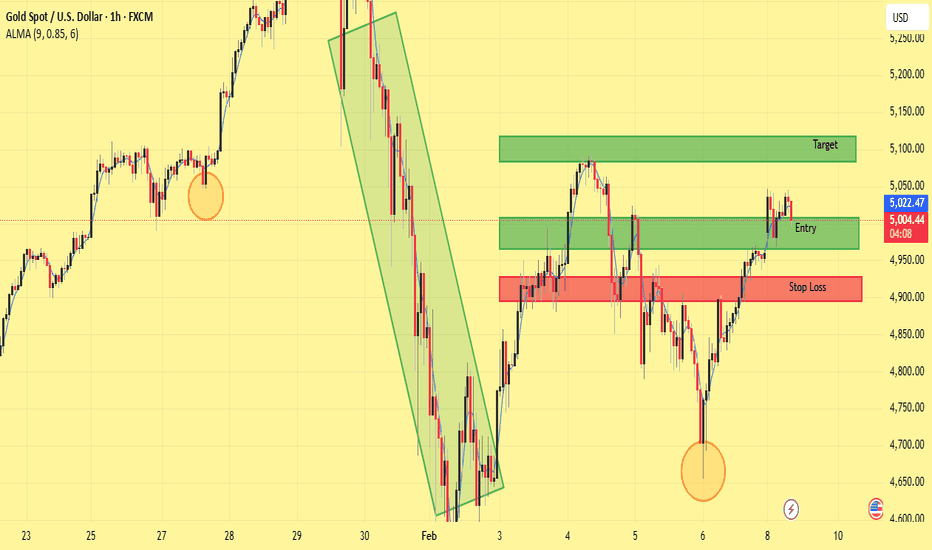

XAUUSD (Gold Spot) – 1H Chart Analysis & Trade Idea Gold has shifted into a short-term bullish structure after forming a higher low and reclaiming the key support zone. Price is consolidating above the former resistance, which is now acting as support—a typical continuation setup.

Key Levels

Support / Entry Zone: 5,000 – 5,030 (blue zone, prior resistance turned support)

Stop Loss: Below 4,950 (red zone, structure invalidation)

Target: 5,100 – 5,150 (green demand/supply objective)

Trade Idea

Bias: Bullish continuation

Entry: Buy on pullback into the support zone or on bullish confirmation above it

Stop Loss: Below the marked stop-loss zone to protect against a breakdown

Take Profit: Target the upper demand zone for continuation upside

Confluence

Break-and-retest of resistance as support

Higher low formation on H1

Momentum holding above the support line

Risk Management

Maintain disciplined position sizing. If price closes decisively below the support zone, the bullish setup is invalidated.

This idea is based on technical structure and zone analysis. Always manage risk according to your trading plan.

XAUUSD (Gold) – 1H timeframe, and the chart is structured

🔎 Market Structure

1️⃣ Overall Bias: Bullish

Price formed a V-shaped recovery from ~4,720.

Higher highs and higher lows are forming.

Price is trading above ALMA (moving average) → short-term bullish momentum.

Currently consolidating above previous resistance → potential breakout continuation.

📊 Key Zones on Your Chart

🟢 Demand Zone (Buy Area)

Around 5,135 – 5,150

Institutional support area.

Marked as BUY zone.

If price pulls back here, it’s a high-probability reaction area.

🔵 Resistance (Now Being Tested)

Around 5,085 – 5,100

Previously rejected price.

Now acting as breakout level.

If price holds above it → bullish continuation confirmed.

🔴 Stop Loss Zone

Around 5,000 – 5,020

Below structure support.

If price breaks this, bullish structure weakens.

📐 Fibonacci Extension Targets

From your fib projection:

🎯 1.618 → ~5,146

🎯 2.618 → ~5,237

🎯 3.618 → ~5,327

🎯 4.236 → ~5,384

Your primary target appears near 5,146 – 5,160, with extended targets above.

💡 Trade Idea (Based on Your Chart)

Option A – Breakout Continuation

Entry: Above 5,090–5,100 after confirmed close

Stop: Below 5,020

Target 1: 5,146

Target 2: 5,237

RR: Good structure-based RR if momentum continues

Option B – Pullback Entry (Safer)

Wait for retrace to:

5,050–5,060 (minor support), OR

5,135 demand zone if deeper pullback

Look for bullish rejection candle

Same upside targets

⚠️ What Would Invalidate This?

Strong bearish candle closing below 5,020

Failure to hold above previous resistance

Momentum divergence forming on 1H

🧠 What This Setup Represents

This is a:

Breakout → Retest → Continuation pattern

combined with Fibonacci extension targeting.

It’s a classic intraday bullish continuation structure.

If you’d like, I can:

Refine it into a scalping plan

Convert it into a swing trade plan

Or calculate exact position sizing based on your risk %**

Just tell me your account size and risk per trade.Create your first imageGot an idea? Try one of our new curated styles and filters or imagine something from scratch.Try nowCaricature TrendCamcorderNeon fantasyNorman RockwellIconicPost-rain sunsetFlower petalsGoldCrayonPaparazziCloudsDepartment photoshootIridescent metal portraitSketchDramaticPlushieRetro animeBaseball bobbleheadDoodle3D glam dollSugar cookieFisheyeInkworkPop artOrnamentArt school

XAUUSD H1 – Sideway Compression Before Expansi Gold is currently trading in a tight H1 range after the previous impulsive bullish move. Momentum has slowed, and price action has shifted from trending to accumulation.

This is no longer a “chase-the-trend” environment. It is a range-based market waiting for confirmation.

🧠 Market Structure Context

Short-term bullish structure remains intact as long as price holds above the rising trendline.

Multiple small-bodied candles with wicks on both sides reflect indecision.

Volatility compression suggests a potential expansion phase ahead.

➡️ Current state: Compression before breakout.

📌 Key Price Levels

🔴 Resistance Zones

5,071 → Range high, breakout trigger level

5,026 → Mid-range resistance

🔵 Support Zones

4,984 → Near-term range low

4,948 → Critical structural support

🎯 Analytical Outlook

Holding above 4,984 keeps the range biased toward bullish continuation.

A confirmed H1 close below 4,948 signals structural weakness and potential downside expansion.

A clean break and hold above 5,071 activates the next bullish impulse leg.

We’re looking at Gold vs USD on the 1-hour chartPrice recently completed a deep pullback after a strong bullish leg.

That pullback formed a rounded / cyclical bottom (purple curve), which often signals trend continuation, not reversal.

🧠 Structure & Price Action

What stands out:

Higher low formed after the sell-off → bullish market structure

Strong impulsive bullish candles off the lows → buyers in control

Price reclaimed and is holding above a key mid-range level (~4960)

This tells us:

The correction phase is likely complete, and price is transitioning back into an impulse phase upward.

🎯 Trade Idea (Based on Your Chart)

✅ Entry

Buy around 4,960 – 4,970

This is a pullback entry inside bullish continuation

🛑 Stop Loss

Below the recent structure low

Around 4,840 – 4,860

If price breaks here, the bullish idea is invalidated

🎯 Target

5,050 – 5,100 zone

This aligns with:

Prior resistance

Projected impulse leg (measured move)

Liquidity resting above highs

Risk–Reward:

Roughly 1:2.5 to 1:3, which is solid for an intraday/swing setup.

🔍 Why This Setup Makes Sense

Bullish continuation after correction

Structure shift confirmed (higher low)

Strong momentum candles

Clear invalidation level (clean risk)

The blue projected path you drew fits perfectly with a pullback → continuation → expansion model.

⚠️ Invalidation Clue

If price:

Breaks and closes below the stop zone

Or starts printing lower highs + strong bearish momentum

→ bullish bias is off, and we reassess.

XAUUSD/GOLD 1H BUY PROJECTION 10.02.26First, look at the market structure.

We can clearly see a Head and Shoulders pattern forming on the one-hour timeframe.

This is the left shoulder,

this is the head,

and now price is forming the right shoulder.

At the same time, the market has printed an Evening Star candlestick pattern near the top, which is a strong bearish reversal signal.

After that, price moved up and swept liquidity above the highs.

This move is important because it trapped late buyers.

Once liquidity was taken, price started rejecting from the resistance zone.

Now look at this area — this is Resistance R1,

this zone is our sell entry area.

Above this, we have Resistance R2, which will act as our stop loss zone.

As long as price stays below the resistance,

the bias remains bearish.

If price breaks the neckline zone,

we can expect a strong impulsive move to the downside.

Our first target will be near Support S2,

and the extended target is at the lower support zone, which is marked as TP2.

XAUUSD (Gold) – 1H Chart Analysis & Trade Idea

Gold has completed a strong corrective phase after the sharp bearish impulse and is now showing signs of trend reversal and bullish continuation. Price respected the recent swing low (marked with the circle), forming a higher low, which confirms improving market structure.

After the rebound, price pushed above the short-term moving average and successfully retested a key demand zone, which now acts as support. This area aligns with previous consolidation, increasing the probability of bullish continuation.

Trade Idea

Entry: Buy from the highlighted green support / entry zone

Stop Loss: Below the red support zone (below recent higher low)

Target: Upper green resistance zone (prior supply area)

Technical Confluence

Higher low formation (bullish structure shift)

Strong rejection from demand zone

Moving average support holding

Previous resistance turned support

Favorable risk-to-reward setup

Conclusion

As long as price holds above the stop-loss zone, the bullish bias remains valid. A sustained move toward the marked target zone is expected. A break below support would invalidate this setup.

This analysis is for educational purposes only. Always manage risk properly.

If you want, I can also:

Rewrite this in short TradingView post style

Translate it into German, French, Spanish, Italian, Turkish, or Polish

Create a title-only version for quick posting

BTCUSD (1H) – Range Support Bounce | Bullish Reversal SetupBTCUSD (1H) – Range Support Bounce | Bullish Reversal Setup

Bitcoin is trading on the 1-hour timeframe after completing a corrective decline and forming a clear range structure. Price has recently reacted strongly from the lower demand/support zone, indicating buyer interest at this level.

Technical Breakdown:

Support Zone: Price bounced from a well-defined green demand area, aligning with a cyclical low and previous accumulation.

Structure Shift: After making a higher low, BTC is attempting to reclaim the mid-range, suggesting a short-term bullish reversal.

ALMA Indicator: Price is stabilizing around the ALMA, which often acts as a dynamic trend filter. Holding above it favors upside continuation.

Cycle Projection: The curved projection highlights a potential move toward the upper range resistance, following previous cyclical behavior.

Momentum: The oscillator shows recovery from oversold conditions, supporting the bullish bounce scenario.

Trade Idea:

Entry: Near current levels or on a minor pullback above the support zone

Target: Upper resistance / range high area

Invalidation: A clean break and close below the demand zone would invalidate the bullish setup

Bias:

📈 Bullish toward range high, as long as price holds above support.

⚠️ Always wait for confirmation and manage risk accordingly.

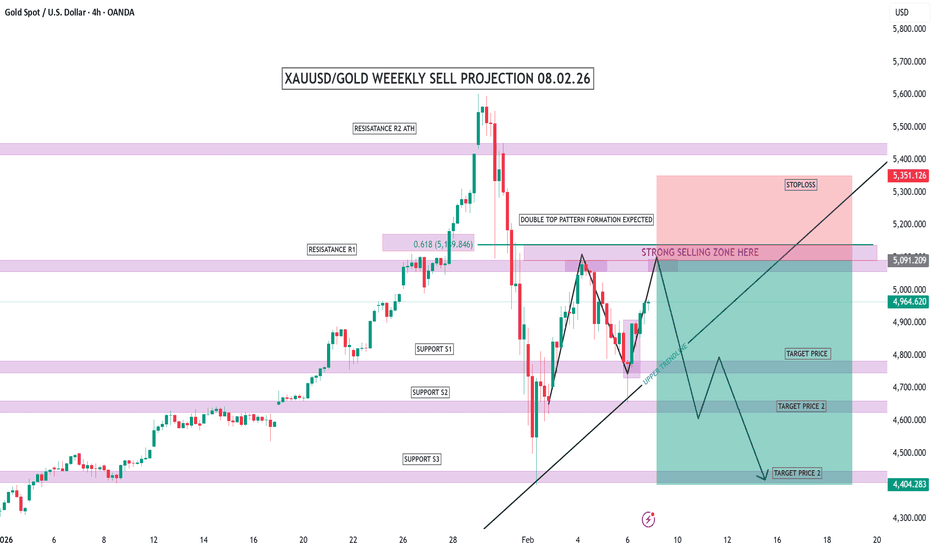

XAUUSD/GOLD WEEKLY SELL PROJECTION 08.02.26XAUUSD Weekly Sell Projection – 08.02.26

This is the XAUUSD weekly chart, and this analysis is based on 08 February 2026.

Gold is currently trading near a major resistance zone, where strong selling pressure was seen earlier.

After a sharp rejection from the R2 resistance area, price dropped aggressively, indicating institutional selling activity.

Now, price has retraced back into the 0.618 Fibonacci retracement level, which also aligns with a previous resistance zone.

In this area, we are expecting a Double Top pattern formation, which is a strong bearish reversal signal on the weekly timeframe.

This highlighted zone is marked as a strong selling zone.

As long as price stays below this level, the sell bias remains intact.

The upper trendline is acting as dynamic resistance, and price is reacting close to that trendline.

🔴 Stop Loss:

If price breaks and closes above 5,351, this sell setup will be invalidated.

🎯 Target Levels:

First target near 4,964

Second target around 4,700

Final target near 4,404, which is a strong weekly support area

Price is expected to move with pullbacks and continuations, not in a straight line.

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 06.02.26XAUUSD – 1H Sell Limit Projection | 06.02.26

“In this one-hour XAUUSD analysis, gold is currently moving within a broader corrective structure after a strong bearish impulse.

Price is approaching a key descending trendline, where we can also observe a double top formation developing near the resistance zone. This confluence area acts as a high-probability sell limit zone, aligned with previous price rejections.

The marked Resistance R1 and R2 levels highlight strong institutional supply, where sellers are expected to step back into the market. As long as price respects this trendline resistance, bearish continuation remains valid.

On the downside, the projected move targets Support S1, followed by the final bearish objective at Support S2, which also aligns with an upward trendline target acting as liquidity support.

Risk is clearly defined above the resistance zone, while reward is projected toward the lower supports, maintaining a favorable risk-to-reward structure.

This setup is purely based on price action, trendline confluence, and market structure, not indicators.

Always remember: manage risk properly and never exceed your predefined risk per trade.”

BTCUSD (1H) – Bearish Continuation | Trendline Breakdown IdeaMarket Structure

Bitcoin remains in a clear descending channel on the 1H timeframe. Price has consistently respected the downward sloping trendline, confirming a strong bearish structure with lower highs and lower lows.

Technical Confluence

Trendline Resistance (Red): Multiple rejections validate seller dominance.

Auto Pitchfork: Price is trading below the median line, indicating continuation toward the lower parallel.

Dynamic Support (Green): The recent breakdown below channel support signals bearish continuation rather than a reversal.

Balance of Power (BoP): Reading around -0.38 reflects sustained selling pressure with no bullish divergence.

Price Action

A brief consolidation failed to hold, followed by a strong bearish impulse that broke key intraday support. The current move suggests momentum-driven continuation, not exhaustion.

Trade Idea

Bias: Bearish

Sell Zone: Pullback toward broken support / descending trendline

Targets:

First target: Previous minor low

Extended target: Lower pitchfork boundary / demand zone

Invalidation: Sustained close above the descending trendline

Conclusion

As long as BTC remains below the descending trendline and pitchfork median, the path of least resistance is downward. Any retracement into resistance is likely to be a selling opportunity unless market structure shifts.

Always manage risk and wait for confirmation.

XAU/USD – Bullish Continuation Above Key POI, Targeting Range 🔍 Technical Analysis (45M)

🟢 Market Structure

After a strong bearish impulse, Gold formed a solid base and shifted structure to bullish.

A sequence of higher highs & higher lows is now respected along the upward trendline ✔️

Multiple pivot points confirm buyers are defending higher price levels.

📦 POI & Key Zones

Extreme POI Point (Demand Zone): Major accumulation area that triggered the reversal 🟩

High POI Point (Supply → Mitigation Zone): Price broke above and is now holding as support — bullish sign.

As long as price remains above this High POI zone, continuation is favored.

📈 Breakout & Price Action

Earlier bearish breakouts to the downside failed, followed by strong bullish displacement.

Current structure shows bullish consolidation above the High POI, suggesting continuation rather than reversal.

Pullbacks into the High POI / trendline area are viewed as buy-the-dip opportunities.

🎯 Targets

🎯 Primary Target:

5,120 – 5,150 (Range High / Liquidity Grab Zone)

🎯 Extended Target (if momentum accelerates):

5,180 – 5,220

🛑 Invalidation Level:

Sustained close below 4,950 would weaken the bullish continuation scenario.

✅ Conclusion

Gold remains structurally bullish, supported by strong demand and trendline respect. Holding above the High POI keeps the path open toward the range high target. Expect shallow pullbacks before continuation 📊✨XAU/USD – Bullish Continuation Above Key POI, Targeting Range High

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective

XAUUSD (Gold) – H1 Chart Idea & AnalysisGold previously printed a strong impulsive rally, followed by an aggressive sell-off that broke short-term structure. After the sharp drop, price formed a volatility spike and is now in a corrective phase, retracing into a key supply / resistance zone.

Key Zones

Entry Zone (Sell Area): ~4,880 – 4,930

This zone aligns with prior consolidation and acts as a bearish order block where sellers previously stepped in.

Target Zone: ~5,000 – 5,060

This is the next major liquidity pool / imbalance zone above, marked as the profit target on the chart.

Trade Bias

Primary Bias: Short-term bullish retracement into resistance, followed by potential bearish reaction.

Price is currently testing the entry zone, suggesting a sell-from-resistance setup if bearish confirmation appears.

Technical Confluence

Retracement after an impulsive bearish move

Previous support flipped into resistance

Presence of imbalance / supply zone

Corrective structure rather than impulsive bullish continuation

Trade Plan

Entry: Sell within the marked resistance zone

Invalidation: Strong H1 close above the zone

Target: Upper marked target zone (partial or full, depending on risk management)

Summary

This setup is based on a corrective pullback into a strong resistance area after a sharp bearish displacement. As long as price remains below the resistance zone, the probability favors a rejection and continuation move. Wait for confirmation and manage risk strictly.

XAU/USD – Bullish Recovery From Demand Zone, Targeting Range 🔍 Technical Analysis (H1)

🟢 Market Structure

After a strong bearish move, Gold found solid support at the Extreme POI Demand Zone.

Price respected the pivot point, forming a clear higher low — an early sign of bullish recovery ✔️

Buyers stepped in aggressively from the demand zone, confirming institutional interest.

📦 POI & Key Zones

Extreme POI Point (Demand Zone): Strong rejection → base for reversal 🟩

High POI Point (Supply / Mitigation Zone): Current reaction area; price is consolidating above it.

Successful hold above this zone increases probability of continuation.

📈 Momentum & Price Action

Breakout from the minor bearish structure suggests trend shift to bullish.

Price is forming a bullish consolidation (flag / step pattern) before continuation.

As long as price stays above the High POI zone, bullish bias remains intact 💪

🎯 Targets

🎯 Primary Target:

5,050 – 5,100 (Range High / Liquidity Zone)

🎯 Extended Target (if momentum continues):

5,180 – 5,220

🛑 Invalidation Level:

Sustained close below 4,750 would weaken the bullish scenario.

✅ Conclusion

Gold is showing a healthy bullish recovery from a major demand zone. Holding above the High POI increases the probability of a move toward the range high target. Expect minor pullbacks before continuation — buy-the-dip structure 📊🚀

XAUUSD – Trade key zones with discipline, volatility up.XAUUSD – Volatility Expansion, Trade Key Zones With Discipline (H1)

Market Context

Gold is trading in a high-volatility recovery phase after a sharp sell-off, with price now rotating aggressively between key technical zones. This behavior reflects liquidity rebalancing under macro uncertainty, rather than a clean trend.

Ongoing uncertainty around Fed leadership changes, future monetary policy direction, and headline risk keeps gold highly sensitive to flows. In this environment, reaction at levels matters more than direction.

➡️ Market state: fast moves, deep pullbacks, strong reactions – avoid emotional entries.

Structure & Price Action (H1)

Price is holding inside a rising corrective channel, indicating a recovery structure.

Higher lows are forming, but bullish structure is still conditional, not fully confirmed.

Upper zones show hesitation and rejection, while lower zones attract strong demand.

Expect sharp swings and fake breaks during this phase.

Key insight:

This is a reaction-driven market. Trade the zones, not the noise.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Pullback (Reaction-Based)

BUY Zone 1: 5,008 – 4,990

• Short-term demand

• 0.618 Fib retracement

• Channel support

BUY Zone 2: 4,670 – 4,650

• Major demand

• Prior liquidity sweep area

• Strong structural base

➡️ Only consider BUYs after:

Clear bullish rejection candles

Or a Higher Low confirmed on H1

🔴 Alternative Scenario – Sell at Upper Reaction Zones

SELL Zone 1: 5,250 – 5,275

• Prior resistance

• Mid-channel reaction zone

SELL Zone 2: 5,560 – 5,575

• Major extension / supply zone

• Fibonacci expansion resistance

➡️ Look for:

Rejection wicks

Loss of bullish momentum on H1

🎯 Targets (TP Zones)

Upside Targets (from BUY setups):

TP1: 5,253

TP2: 5,573

Downside Targets (if SELL scenario plays out):

TP1: 5,008

TP2: 4,670

❌ Invalidation

A confirmed H1 close below 4,650 invalidates the recovery structure

Requires a full reassessment of bias

XAUUSD/GOLD 1H RISING WEDGE SELL PROJECTION 03.02.26XAUUSD / GOLD – 1H Rising Wedge Sell Projection

Date: 03-02-2026

Hello traders,

In this video, I’m going to explain a clear sell setup on XAUUSD (Gold) based on price action and chart patterns.

📉 Market Structure Overview

Gold is currently trading under a 1-hour major downtrend line, which shows the overall bearish market structure.

Price has moved up inside a Rising Wedge pattern, which is a bearish reversal pattern when it forms during a downtrend.

⚠️ Key Technical Observations

At the top of the rising wedge, price is facing a strong resistance zone (R1).

We can clearly see a double top formation expectation, which signals weak buying strength.

This area also aligns with the trendline rejection, increasing the probability of a downside move.

🔴 Sell Trade Plan

Sell Entry: Near the wedge top and resistance zone

Stop Loss: Above the resistance and wedge breakout area

Target Price: Support S1 zone (previous demand area)

This setup offers a good risk-to-reward ratio, with sellers likely to take control after rejection.

XAUUSD/GOLD 1H BUY PROJECTION 03.02.26XAUUSD / GOLD – 1H BUY PROJECTION (03-02-2026)

Hello traders,

Let’s break down today’s XAUUSD 1-hour buy setup step by step.

🔍 Market Structure Analysis

Gold was moving inside a symmetrical triangle pattern, showing strong price compression.

Recently, price has broken above the descending trendline, which signals a potential bullish reversal.

This breakout confirms that buyers are stepping back into the market.

📌 Key Levels

Support Zone: Strong buying area around the previous consolidation

Resistance 1: Near the breakout retest zone

Resistance 2: Upper resistance acting as the next bullish checkpoint

Price is currently holding above support, which increases the probability of continuation to the upside.

🟢 Trade Plan (Buy Setup)

Entry: After confirmation above the breakout zone

Stop Loss: Below the support and triangle base

Target (TP): Previous high / upper resistance zone

Risk is clearly defined, and the risk-to-reward ratio is favorable.

🚀 Projection Logic

If price respects the support and continues higher:

Expect a pullback → continuation move

Momentum can accelerate once Resistance 1 is broken

Final move projected toward the TP zone

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price moves sharply between key technical zones.

With ongoing changes in Fed leadership and uncertainty around future monetary policy direction, gold remains extremely sensitive to expectations, flows, and headlines.

➡️ Current state: Volatile conditions – wait for confirmation, avoid emotional trades.

📊 Structure & Price Action (M30)

The prior bearish impulse is losing momentum, with short-term higher lows starting to form.

Price is currently in a technical recovery phase, not a confirmed trend reversal yet.

Market continues to respect Demand and Key Levels, producing sharp reactions.

No confirmed bullish CHoCH at this stage — further validation is required.

🔎 Key insight:

Gold is trading inside a decision zone, where each key level can trigger strong directional moves.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Technical Pullback

Focus on reaction-based execution, not anticipation.

BUY Zone 1: 4,667 – 4,650

(Near-term demand + first recovery base)

BUY Zone 2: 4,496 – 4,480

(Deep demand + prior liquidity sweep low)

➡️ Execute BUYs only if:

Clear bullish candle reaction appears

Or a Higher Low structure forms on M30

Upside Targets:

TP1: 4,932

TP2: 5,124 (Major recovery resistance/supply zone)

🔴 Alternative Scenario – Sell at Resistance Reaction

If price retraces into supply and fails to hold bullish momentum:

SELL Zone: 5,120 – 5,140

→ Look for short-term rejection following M30 structure

❌ Invalidation

A confirmed M30 close below 4,480 invalidates the recovery structure and requires a full reassessment.

🧠 Summary

Gold is in a high-volatility, structure-building phase, not an environment for emotional or aggressive positioning. The edge lies in:

Trading key levels, not impulses

Waiting for price confirmation

Prioritizing risk management over prediction

📌 In volatile markets, discipline outperforms frequency.

XAUUSD/GOLD PMI NEWS FORECAST 02.02.26XAUUSD / GOLD – ISM Manufacturing PMI Trade Plan

Date: 02-02-2026

Hello traders,

Welcome back to Tamil Trading Education.

Today we are analyzing XAUUSD (Gold) based on the ISM Manufacturing PMI news.

This is a news-based breakout and retest strategy, so please avoid emotional or early entries.

🔑 Key Levels Marked on the Chart

Resistance R2 – Major upside target

Resistance R1 – Breakout decision zone

Support S1 – First downside confirmation

Support S2 – Major bearish target

We will trade only after confirmation.

📈 Scenario 1: ISM PMI is NEGATIVE (Bullish for Gold)

If the ISM Manufacturing PMI comes out negative:

Gold is expected to move upward

Wait for a clear breakout above Resistance R1

After breakout, wait for a proper retest

👉 BUY Entry:

Enter BUY only after breakout and retest confirmation

🎯 Targets:

First target near Resistance R

XAUUSD (H1) – Below $5,000: Correction or Quick Recovery?Market Context – Gold Enters a Critical Repricing Zone

Gold has officially slipped below the psychological $5,000 level, triggering renewed debate: Is this the start of a deeper corrective phase, or simply a liquidity reset before a sharp rebound?

The timing is crucial.

With speculation around changes in Fed leadership and future monetary policy direction, the market is repricing risk aggressively. This has injected exceptional volatility into Gold, where liquidity is being rapidly redistributed rather than trending cleanly.

➡️ This is no longer a low-volatility trend market — it’s a decision zone.

Structure & Price Action (H1)

The previous bullish H1 structure has failed, confirming a short-term corrective phase.

Price is trading below former demand, now acting as supply.

Current rebounds are technical pullbacks, not confirmed reversals.

Downside momentum remains active until price reclaims key structure levels.

Key insight: 👉 Below $5,000, Gold is trading in rebalancing mode, not trend continuation.

Key Technical Zones (H1)

Major Supply / Rejection Zone:

• $5,030 – $5,060

→ Former structure + Fibonacci confluence

→ Likely area for sellers to defend

Mid-Range Reaction Zone:

• $4,650 – $4,700

→ Short-term demand / potential bounce zone

Deep Liquidity Demand:

• $4,220 – $4,250

→ Major liquidity absorption zone

→ High probability area for a technical or structural rebound

Trading Plan – MMF Style

Scenario 1 – Sell the Pullback (Primary While Below $5,030)

Favor SELL setups on rallies into supply.

Wait for rejection / failure patterns.

Do not chase price lower.

➡️ Bias remains bearish-corrective while below $5,030.

Scenario 2 – Buy Only at Deep Liquidity

BUYs are considered only at major demand with confirmation:

• $4,650 – $4,700 (scalp / reaction only)

• $4,220 – $4,250 (higher-probability swing zone)

➡️ No blind bottom picking

➡️ Confirmation > prediction

Macro Risk Outlook

Fed leadership uncertainty = policy expectation volatility.

Any shift toward dovish credibility could trigger a violent short-covering rally.

Conversely, prolonged uncertainty keeps Gold under pressure short-term.

➡️ Expect fast moves, fake breaks, and wide ranges.

Invalidation & Confirmation

Bearish bias weakens if H1 reclaims and holds above $5,060.

Deeper correction opens if $4,220 fails decisively.

Summary

Gold below $5,000 is not weakness — it’s repricing. This is a market where liquidity hunts traders, not the other way around.

The edge right now is patience and precision:

Sell rallies into supply.

Buy only where liquidity is proven.

Let structure confirm before committing risk.

➡️ In high volatility, survival beats prediction.