Gold (XAU/USD) Bullish Outlook: Key Levels & Trade Setup📊 Gold (XAU/USD) 1H Chart Analysis 📈

🔹 Current Price & Trend:

📍 Price: 3,077.46 USD

📈 Uptrend in play (Higher Highs & Higher Lows)

📊 9-period DEMA: 3,078.47 USD (showing bullish momentum)

🔹 Key Levels:

📍 Demand Zone (Support) 📥: 🟦 3,030 - 3,040 USD (Potential Buy Area)

📍 Fair Value Gap (FVG) ⚡: 🟦 Price may retrace here before continuing up

📍 Resistance Zone (Short-term) 🚧: 🟦 3,085.15 USD

🎯 Target Price: 🔵 3,110.09 USD

🔹 📉 Possible Scenario:

1️⃣ Price retraces to the FVG zone 🟦 (Healthy pullback)

2️⃣ 📈 Bullish continuation toward the 3,110 target 🎯

Xauusdupdates

XAUUSD/GOLD 4H SELL PROJECTION 28.03.25Trendline Resistance: The price is projected to reverse after reaching this resistance level.

Sell Entry: Positioned near the trendline resistance, anticipating a downward move.

Take Profit (TP) Levels:

TP 1: First target near the Support S1 level.

TP 2: Second target near the Support S2 level.

Stop Loss (SL): Positioned above the trendline resistance in a red zone to limit risk.

Breakout Zone Retest: Potential price action area before further movement.

Parallel Trendline: The price is moving within a channel, and a possible break could indicate further downside momentum.

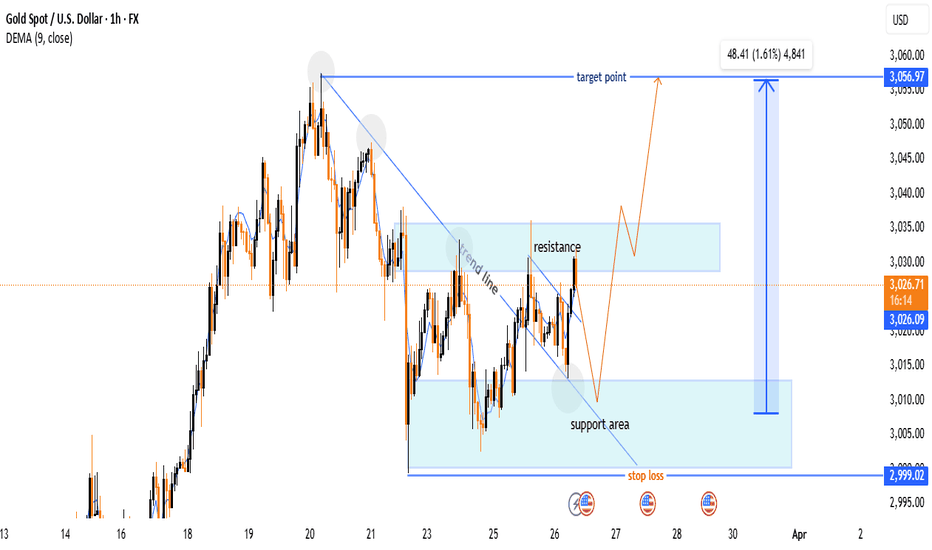

Gold (XAU/USD) Bullish Breakout – Trade Setup & Key Levels🔍 Key Observations:

🔹 Trend Line Breakout:

📉⬇️ A downward trend line was broken, signaling a potential bullish reversal.

📈✅ The price has moved above the trend line, confirming the breakout.

🔹 Support & Resistance Zones:

🟦 Support Area: $3,000 - $3,010 (Buy Zone)

🟥 Resistance Area: $3,030 - $3,040 (Sell Pressure)

📊 Trade Setup:

✅ Buy Plan:

🔄 Wait for a pullback to the support zone (🟦 light blue area) before entering.

🎯 Target: $3,056.97 📈🏁

🛑 Stop Loss: $2,999.02 ❌🚨

📈 Indicators & Confirmation:

📊 DEMA (9-period) = $3,026.48 (near the current price, suggesting a neutral-to-bullish trend).

🔥 Conclusion:

🔵 Bullish Setup Active 🚀

⚠️ Wait for price reaction at support before entering.

❌ If price drops below $2,999, the setup is invalidated.

📌 Final Tip: Watch for a bullish candlestick pattern 📊 at support before executing the trade! 🎯

GOLD - BULLISH STRUCTURE INTACTSymbol - XAUUSD

CMP - 3018

Gold is currently undergoing a corrective phase, having broken through channel resistance and is now consolidating above the downtrend line. Market participants are awaiting key economic data and potential developments in the ongoing tariff dispute.

President Trump has confirmed plans to implement retaliatory tariffs on April 2, with limited exemptions. These new duties have raised concerns regarding the impact on the US economy, leading to a weakening of the US dollar and increased demand for gold. Additionally, market attention remains focused on ongoing discussions between the US, Ukraine, and Russia. There is also significant focus on US durable goods orders data, as a strong reading could temper expectations of a Federal Reserve rate cut, potentially limiting further gains in gold.

Resistance levels: 3033, 3045, 3056

Support levels: 3013, 3004

Gold may test the support zone before resuming its upward movement. Market attention is concentrated on the current consolidation range of 3033 to 3013. A decisive break of this zone could pave the way for further upward momentum, with key resistance levels at 3045 and 3056.

Gold (XAUUSD) 3100 Or 2900 ?🔍 15M Chart Analysis

📊 Trend: Ranging market

🔑 Key Levels:

✅All-Time High Zone ($3,057) – Major resistance

✅Support at $3,006-$3,010 – Key demand area

✅Current Range: $3,020 - $3,035

🚨 EMA Analysis:

✅ Price is fluctuating around the 50 EMA and 200 EMA, confirming consolidation.

Conclusion:

✅Market is in a ranging phase; a breakout above $3,035 could push the price toward the all-time high.

✅A drop below $3,020 could see price testing $3,006 support.

🔍 1H Chart Analysis

📊Trend: Short-term bearish to neutral

🔑 Key Observations:

✅Descending trendline (Orange Line) was broken, indicating potential bullish recovery.

✅POI Level ($3,006-$3,007) – Strong demand zone, price bounced from here.

✅Resistance Area ($3,035-$3,040) – If price reaches here, sellers may step in.

🚨 EMA Analysis:

✅Price broke above the 50 EMA (Red Line), indicating early bullish momentum.

200 EMA (Blue Line) still below, confirming overall bullish trend.

Conclusion:

✅If price sustains above the trendline breakout, next target would be $3,035-$3,040 resistance zone.

✅A rejection from the current level could push the price back to $3,006 POI.

🔍 4H Chart Analysis

📊Trend: Bullish (Price above 50 EMA & 200 EMA)

🔑 Key Support Levels:

✅$2,983 – Previous support level

✅$2,957 – Strong support zone

✅$2,930 – Near the 200 EMA, potential major support

Key Resistance Levels:

✅$3,022-$3,023 – Immediate resistance zone

🚨 EMA Analysis:

✅50 EMA (Red Line) is acting as dynamic support, price is currently hovering around it.

✅200 EMA (Blue Line) far below, indicating strong bullish momentum.

Conclusion:

✅As long as price holds above the 50 EMA, bulls remain in control.

✅A break below 50 EMA could lead to a retest of $2,983 or $2,957 support zones.

Overall Summary & Trade Ideas

✅ Bullish Bias on higher timeframes (4H), but short-term market is ranging (15M).

📌 🔑 Key Levels to Watch:

Above $3,035 → Bullish breakout towards $3,050+

Below $3,020 → Bearish pressure towards $3,006

⚠️ Trading Plan:

🔵For Long Positions : Buy above $3,025 with a target of $3,040-$3,050.

🔵For Short Positions : Sell below $3,020, targeting $3,006.

Wait for a breakout from the range for a clearer trade setup.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

📢Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:5 RISK REWARD XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:5 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

"XAU/USD Price Action Analysis: Targeting $3,063 or Reversal to Alright! Let's break down the chart analysis. 📊

🔹 Chart Overview:

Pair: XAU/USD (Gold vs. US Dollar)

Timeframe: 1-hour (H1)

Price Level: Current price at $3,030.44

Target Point: $3,063.97

🔥 Key Observations:

Supply and Demand Zones:

The highlighted blue zones suggest resistance (supply) where price was rejected twice (blue arrows).

The larger gray zones below indicate potential demand/support.

Double Top Formation:

The double blue arrows point to a possible double-top pattern, hinting at a bearish reversal. However, the price hasn't strongly broken below the neckline yet.

Scenario Analysis:

Bullish Scenario: If the price holds the current demand zone and breaks above the immediate resistance, we could see a rally towards the target of $3,063.97. 💹🚀

Bearish Scenario: If it fails to hold the support zone, it may drop to the lower demand area around $3,000. 🔻

📉 Conclusion:

Entry Idea: Long above the supply zone break with a target of $3,063.97.

Stop Loss: Below the current demand zone at around $3,020.

Risk Management: Watch for strong price action before entering.

Gold (XAU/USD) Trade Setup – Bullish Momentum Ahead?Gold Spot (XAU/USD) 1H Chart Analysis

🔹 Entry Point: 3,026.90 🔵

🔹 Stop Loss: 3,019.58 - 3,019.07 ❌ (Risk Zone)

🔹 Take Profit Levels:

TP1: 3,034.64 🎯

TP2: 3,041.72 🚀

Final Target: 3,053.04 🏆

📈 Trend Analysis:

🔸 The market has been in a strong uptrend 📈 before pulling back to the entry zone.

🔸 The trade setup suggests a buy (long) position, aiming for higher levels.

🔸 If momentum continues, price may reach TP1 → TP2 → Final Target.

⚠️ Risk-Reward Ratio:

✅ Potential Reward: ~27 points 🏅

❌ Risk: ~7-8 points 🚨

💰 Risk-to-Reward Ratio: 1:3 (Favorable setup)

🔻 Risk Factor:

If price drops below 3,019.58, the trade will hit stop loss and may indicate a trend reversal 🔄.

📢 Conclusion:

Bullish trade setup looking promising if price holds above the entry point and moves towards TP targets! 🚀🔥

Gold (XAU/USD) Trade Setup – Bullish Breakout AnalysisGold Spot (XAU/USD) 1-Hour Chart Analysis

🔹 Entry Point: $3,014.47 - $3,017.24 ✨ 🔹 Stop Loss: $3,005.86 ❌ 🔹 Take Profit Levels: ✅ TP1: $3,020.67 📈 ✅ TP2: $3,027.23 🚀 ✅ Final Target: Above $3,036 🎯

📉 Trend Analysis

🔸 Strong Bullish Momentum 📊🔥 🔸 Price Breakout from Consolidation 📢✅ 🔸 Higher Highs Formation ⬆️📈

⚖️ Risk-Reward Ratio

✔️ Low Risk: Tight Stop Loss 📉🚨 ✔️ High Reward Potential: Profit targets significantly higher 📊💰 ✔️ Favorable Risk-to-Reward Setup ⚖️🔄

🚀 Trading Plan

🟢 Bullish Scenario: ✔️ If price holds above $3,014.47, it could hit TP1 & TP2 🎯🚀

🔴 Bearish Scenario: ❌ If price drops below $3,005.86, stop-loss triggers & trade is invalidated ⚠️📉

💡 Conclusion: This setup suggests a long (buy) trade with a strong bullish bias 📊💎. A breakout above $3,017 could push the price towards higher profit levels 🚀💰.

XAUUSD 4H BUY PROJECTION – March 18, 2025This chart presents a bullish projection for Gold (XAU/USD) on the 4-hour timeframe, indicating a potential buying opportunity based on trend analysis and key levels of support and resistance.

Key Components of the Analysis:

Uptrend Confirmation:

The price is moving within an ascending channel marked by two parallel blue lines.

The 4H parallel trendline suggests a continuation of bullish momentum.

Possible Buy Zone:

The chart highlights a potential buying area around the trendline, where price may pull back before resuming the uptrend.

Support & Resistance Levels:

Support S1: Around $3,015, where buyers might step in.

Resistance R1: Around $3,030, which could act as the first hurdle for price movement.

Resistance R2: Near $3,053, serving as a major target for bullish movement.

Target Prices:

Target Price 1: Around $3,030 (first take-profit level).

Target Price 2: Around $3,053 (second take-profit level).

Stop Loss:

Set at approximately $2,997, below key support, to limit downside risk.

Market Structure & Price Action:

The chart indicates higher highs and higher lows, confirming an uptrend.

A possible W pattern (double bottom) suggests a strong bullish breakout.

Trading Plan Summary:

Buy Entry: Around the support/trendline zone.

Take Profit Levels: First at $3,030, second at $3,053.

Stop Loss: Below $2,997 to manage risk.

GOLD HOLDS ABOVE $3,000 – BIG MOVE AHEAD?📌 Market Overview

Gold remains stable above the $3,000 mark as traders await the March 19 FOMC meeting. The Federal Reserve is expected to keep interest rates unchanged, but speculation about a rate cut in June 2025 continues. Amid global economic uncertainty, gold maintains its position as a safe-haven asset, benefiting from a low-interest-rate environment.

🔹 Key Fundamental Factors

1️⃣ Fed’s Economic Projections

The upcoming forecasts will provide insights into how policymakers assess Trump’s fiscal policies.

A dovish Fed stance could push gold to new highs.

2️⃣ Safe-Haven Demand for Gold

Low interest rates increase gold’s attractiveness as a non-yielding asset.

Geopolitical tensions continue to support gold’s long-term bullish outlook.

3️⃣ Interest Rate & Inflation Impact

Traders anticipate a rate cut by June, fueling gold’s rally.

However, if inflation remains strong, the Fed may delay cuts, causing short-term pullbacks in gold.

📊 Technical Analysis – Key Levels to Watch

🔺 Resistance (Upside Targets)

$3,034 - $3,050: If gold holds above $3,000, a test of this zone is likely.

Breakout Alert: A move past $3,050 could trigger stronger bullish momentum.

🔻 Support (Pullback Zones)

$3,000: A critical psychological level.

$2,985 - $2,975: A potential dip zone where buyers might step in.

$2,945 - $2,950: Strong long-term support—breaking below could indicate a shift in trend.

🎯 Trading Plan

🟢 BUY ZONE: 2986 - 2984

📍 SL: 2980

🎯 TP: 2990 - 2994 - 3000 - 3005 - 3010

🔴 SELL ZONE: 3033 - 3035

📍 SL: 3039

🎯 TP: 3028 - 3024 - 3020 - 3015 - 3010

⚠ Market Caution!

Gold is consolidating above $3,000, but volatility is expected ahead of the Fed meeting.

Watch for potential breakouts or pullbacks—stick to risk management strategies!

📢 Will gold maintain momentum above $3,000, or is a correction coming? Share your thoughts below! 🚀🔥

Gold (XAU/USD) 1H Chart Analysis: Bullish Continuation Towards $This chart represents the XAU/USD (Gold vs. US Dollar) on a 1-hour timeframe, and it includes key technical levels and projections. Here’s an analysis of what it suggests:

Key Observations:

Current Price: $2,983.43 📍

H1 Support Zone: Marked in purple, showing a key short-term support level where buyers may step in.

Previous All-Time High (ATH): The black horizontal line below the support level indicates a former record high, which now acts as a psychological support level.

Target Levels:

First target: $2,998.65 (Blue line)

Final target: $3,020.97 (Higher blue line) 📈

Potential Price Action:

If price holds the H1 support, there is a bullish setup, targeting $2,998 first and then $3,020 if momentum continues. 🚀

If support breaks, price could retest the previous ATH before bouncing back or moving lower.

Market Sentiment:

The overall trend is strongly bullish, indicated by the sharp breakout seen around March 14-15.

A small consolidation is happening, likely forming a base for the next move up.

Conclusion:

Bullish bias remains intact as long as price stays above the H1 support zone.

A break above $2,998 could accelerate movement toward $3,020.

Watch out for any breakdown below previous ATH, as it may indicate a short-term reversal.

15-minute (15M) analysis of XAU/USD (Gold vs. USD) with a "W" paHere's a breakdown:

W Pattern Formation: A bullish reversal pattern has been identified.

Entry Point: The price has broken above the resistance zone, confirming the pattern.

Stop-Loss (SL): Placed below the recent low at 2,985.73.

Take Profit (TP) Targets:

TP1: Around 2,994 (Resistance R1).

TP2: Around 3,002.02 (Resistance R2 & All-Time High).

The projected path suggests a breakout and retest of Resistance R1 before pushing towards TP2.

GOLD - CONSOLIDATING AT HIGHER LEVELS - MORE UPSIDE AHEAD?Symbol - XAUUSD

CMP - 2913

Gold continues to strengthen amidst escalating economic uncertainties and the aggressive sell-off in the US dollar. The metal is currently encountering resistance at the 2921 level and appears poised for further upward movement.

The US dollar has broken its bullish structure following comments from the US Department of the Treasury regarding potential interest rate reductions. This verbal intervention, perceived by some as market manipulation, has had a pronounced impact on the markets. Given the risks associated with trade tensions and expectations of a dovish Federal Reserve policy, further declines in gold appear unlikely. Additionally, weaker-than-expected ADP employment data and PMI figures could provide further upward momentum for gold.

Gold is currently testing two critical liquidity zones: 2913 and 2903. The nearest of these zones has already been tested, and attention is now on the 2921 level. If this level holds, gold may retrace back to the 2913-2903 support range. However, if this resistance is breached, it could set the stage for a stronger upward momentum.

Resistance levels: 2921, 2942, 2954

Support levels: 2913, 2903

Currently, gold is testing 2913, with a rebound forming as liquidity is absorbed. In the short term, the focus is on the 2921 level. A break above this level and a sustained price above it would likely trigger a continuation of the upward movement toward the 2942-2954 range.

GOLD STUCK IN A RUT - A MAJOR CORRECTION LIKELY? POSITIONAL VIEWSymbol - XAUUSD

CMP - 2907

Gold is currently consolidating and trading sideways within a defined support zone of 2892 and resistance at 2921. The metal is showing no signs of further growth as it remains stuck within this range. While there has been an aggressive sell-off in the US dollar, a typical scenario that would support gold, the precious metal has failed to show any upward momentum, suggesting a lack of bullish sentiment in the market.

From a technical perspective, the larger time frames indicate strong resistance levels at 2921, 2942 and 2954. These levels are acting as significant barriers to any substantial upward movement, and it appears that gold is attempting to make lower lows in its price action - A bearish indication in the current trend. This behavior supports the notion that the market may be gearing up for further downward pressure.

Furthermore, there is an expectation of a rebound in the US dollar from its current level around 104. Such a rebound would exert additional downward pressure on gold, reinforcing the ongoing bearish structure. Market participants are also anticipating the upcoming NFP (Non-Farm Payroll) data release, which could have a significant impact on the trajectory of the dollar, gold and, by extension, Fed policy. Should the data point toward a stronger labor market, it could trigger a rally in the dollar, further dampening gold's potential upside.

Despite the weaker dollar and expectations of potential Fed policy easing, gold has struggled to capitalize on these factors, likely due to the pause in Trump's tariff measures. The absence of significant external catalysts for growth means gold remains largely range-bound. If the bearish structure continues, a larger correction toward the 2800 levels could be on the horizon positionally.

However, if gold manages to break through the resistance zone at 2921 and move upward due to any unexpected news, there is potential for a rise towards the 2960 and even 3000 levels. That said, this scenario seems less likely given the current market conditions, with the overall outlook remaining tilted towards further downside.

Key Support Levels: 2892, 2881

Key Resistance Levels: 2921, 2942, 2954,

Overall, the market remains in a corrective phase, with the risk of further downside outweighing the chances of a breakout to the upside unless significant catalysts arise.

XAUUSD Big Breakout Incoming in NFP XAUUSD Big Breakout Incoming in NFP

Currently Xauusd Gold is consolidating within the big range.

Range is from 2895 to 2930 , this range is not for precious trading opportunity , Wise idea is wait for today's big event which is Non Farm Payroll. So we might easily identify the trend. Before NFP i will share the trade.

This trade idea for scalping purpose only not for swing , because the trend is still highly bullish.

XAUUSD H2 : Analysis GOLD!📈 #BUY GOLD: 2893/2890

Stoploss: 2885 / Target: 2940

📉 #SELL GOLD: 2944/2947

Stoploss: 2952 / Target: 2920

Analysis: If Gold price runs into offers, immediate support is seen at the 2850 psychological barrier as the 21-day SMA at 2911 gives way.

The demand area near 2835 could be a tough nut to crack for sellers.

Gold On Monday💡Gold could breach $3,000 level soon, analyst says

💡Trumpdeclinedto predict if U.S. could face a recession

💡U.S. CPI data on Wednesday, PPI data on Thursday

15-Minute Chart Analysis

Key Zones:

Order Block (OB) at $2,895 - $2,900 – Strong demand zone

Order Block (OB) at $2,925 - $2,930 – Strong supply zone

Fair Value Gap (FVG) at $2,918 - $2,922 – Potential retracement area

📊Price Behavior:

Price is currently consolidating below the FVG area, which often acts as a magnet for price action.

📊 Conclusion: A potential bullish move may occur if price reclaims the FVG zone, targeting the OB at $2,925. Conversely, a break below $2,895 may trigger further downside pressure.

🔍1-Hour Chart Analysis

Key Resistance Levels:

$2,924 – Immediate resistance zone

$2,942 – Strong resistance with previous rejection

Key Support Levels:

$2,879 – Key support zone

$2,863 – Critical support below

Price Behavior: The market is moving in a consolidation phase, with multiple rejections from the resistance at $2,924.

Conclusion: The market is currently indecisive, consolidating between $2,900 and $2,924. A breakout in either direction may signal the next move.

🔍 4-Hour Chart Analysis

Key Resistance Levels:

$2,954 – Significant resistance zone

Key Support Levels:

$2,880 – Intermediate support

$2,846 – Major support zone

Market Condition: The market is clearly in a ranging phase between $2,880 and $2,925. This suggests indecision and a potential breakout on either side.

Conclusion: The range-bound structure favors breakout strategies. Monitoring volume and price action near these levels is crucial.

Trading Strategy Considerations

📌 Bullish Scenario

✅Wait for a breakout above $2,924 with strong volume confirmation.

📍Target: $2,942 or higher.

❌Stop Loss: Below $2,911 to manage risk.

📌 Bearish Scenario

✅Watch for a rejection at $2,924 or a breakdown below $2,900.

📍Target: $2,880 or lower.

❌Stop Loss: Above $2,924 for protection.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

📢Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

Weekly Buy Projection for XAUUSD (Gold) as of March 9, 2025This chart presents a **weekly buy projection** for **XAUUSD (Gold) as of March 9, 2025**. Here are some key takeaways:

### **Key Zones & Levels:**

- **Entry Zone:** Around **2,892.189 - 2,892.277** (aligned with a major trendline and support).

- **Support Levels:**

- **S1:** Weekly low acting as support.

- **S2:** Stronger support at **2,859.812** (also the stop-loss level).

- **Resistance Levels:**

- **R1:** Weekly high acting as resistance.

- **R2:** **2,956.190** (all-time high resistance).

- **Target Prices:**

- **Target 1:** **2,929.162**

- **Target 2:** **2,956.190** (major resistance zone).

### **Trend Analysis:**

- The chart highlights a **V-pattern formation**, confirming a **buy signal**.

- The **4H uptrend line was breached**, but the **daily timeframe trendline remains intact**.

- **Sideways movement** expected before continuation upwards.

- **Braked resistance retest** suggests a bullish continuation if price holds above support.

### **Trade Plan:**

- **Buy Entry:** Around **2,892.189 - 2,892.277** (as long as it respects the trendline and support).

- **Stop Loss:** Below **2,859.812** to manage risk.

- **Take Profit:**

- **Target 1:** 2,929.162 (first resistance)

- **Target 2:** 2,956.190 (major resistance & ATH)