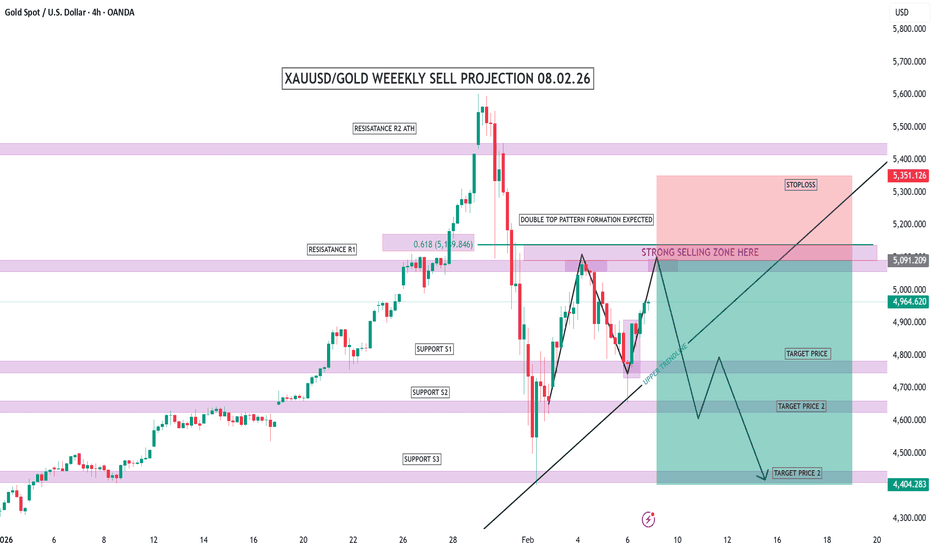

XAUUSD/GOLD WEEKLY SELL PROJECTION 08.02.26XAUUSD Weekly Sell Projection – 08.02.26

This is the XAUUSD weekly chart, and this analysis is based on 08 February 2026.

Gold is currently trading near a major resistance zone, where strong selling pressure was seen earlier.

After a sharp rejection from the R2 resistance area, price dropped aggressively, indicating institutional selling activity.

Now, price has retraced back into the 0.618 Fibonacci retracement level, which also aligns with a previous resistance zone.

In this area, we are expecting a Double Top pattern formation, which is a strong bearish reversal signal on the weekly timeframe.

This highlighted zone is marked as a strong selling zone.

As long as price stays below this level, the sell bias remains intact.

The upper trendline is acting as dynamic resistance, and price is reacting close to that trendline.

🔴 Stop Loss:

If price breaks and closes above 5,351, this sell setup will be invalidated.

🎯 Target Levels:

First target near 4,964

Second target around 4,700

Final target near 4,404, which is a strong weekly support area

Price is expected to move with pullbacks and continuations, not in a straight line.

Xauusdwave

XAUUSD / GOLD – 1H SELL PROJECTION (05-02-2026)

Gold was moving inside a rising channel, respecting the uptrend line.

However, price failed to sustain bullish momentum and clearly broke the uptrend, indicating a market structure shift.

After the breakdown:

Price retraced back into a Fair Value Gap (FVG)

The retracement got rejected near Resistance (R1)

A Three Black Crows candlestick pattern formed, confirming strong bearish pressure

This rejection from the FVG zone after an uptrend break signals a high-probability sell continuation setup.

🔍 Confluences Used

Broken uptrend line

Fair Value Gap (Sell zone)

Resistance rejection

Three Black Crows pattern

Bearish market structure

🎯 Trade Expectation

Sell from FVG zone

Stop Loss: Above recent high

Targets:

TP1: Previous support

TP2: Lower liquidity / Support S3

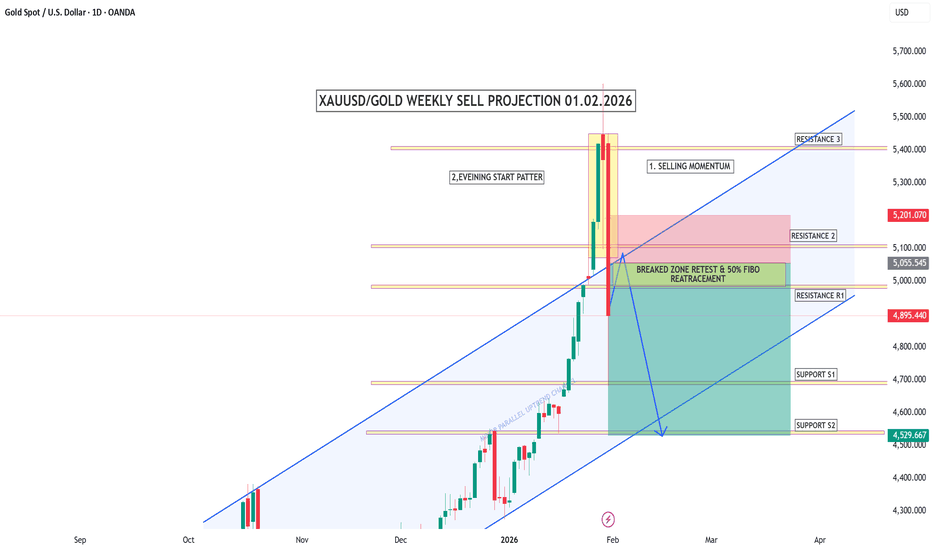

XAUUSD/GOLD WEEKLY SELL PROJECTION 01.02.26“This is the weekly sell projection for Gold, XAUUSD.

Price has reached a major resistance zone and shows clear selling momentum.

An evening star pattern is formed at the top, which indicates a potential trend reversal.

The market has broken the previous support and is now retesting the broken zone.

This area also aligns with the 50% Fibonacci retracement, making it a strong sell zone.

As long as price stays below this resistance, the bearish bias remains valid.

Downside targets are the next support levels, Support S1 and Support S2.

Risk management is very important.

Always use proper stop loss and trade with confirmation.

This is a technical analysis, not financial advice.

Trade smart, stay disciplined, and protect your capital.”

XAUUSD/GOLD CORRECTION BUY PROJECTION 29.01.26XAUUSD / Gold – Correction Buy Setup (29-01-2026)

Market View:

Gold is in a strong bullish trend. The current move is a normal correction, not a trend reversal.

Buy Zone:

Support S2 + Fair Value Gap (FVG)

0.618 Fibonacci Golden Ratio

Area around 5396 – 5400

Trade Plan:

Look for buy confirmation in the marked support zone.

Expect price to respect the uptrend line and move higher.

Targets:

First target: Resistance R1

Main target: 5600+

Stop Loss:

Below Support S2 / below recent structure low.

XAUUSD/GOLD WEEKLY BUY PROJECTION 21.01.26Resistance R1: 4826.190

✅ Target Price 1: Around 4900 zone

✅ Target Price 2: Around 5000 zone

✅ Long-Term Resistance Target: 2.618 Fibonacci = 4996.920

🟩 Best Buy / Entry Zone

📍 Broken trendline + Resistance retest area

If price pulls back into this zone,

fills the Fair Value Gap (FVG),

and gives a strong bullish confirmation candle,

✅ then it becomes a high-probability buy entry.

🟥 Stoploss Area

📍 Stoploss should be placed below the Fair Value Gap / retest zone

Safer stoploss: below the last swing low.

XAUUSD/GOLD 15MIN BUY PROJECTION 20.01.26Market Structure

Bullish continuation pattern formed

Clear BOS (Break of Structure) confirming buyers strength

Support Zones

Day Opening acting as Support

Day Low Support (S2) – strong demand base

Resistance

Yesterday High acting as Resistance

Price is trying to break & hold above this level

Entry Plan

✅ Entry only AFTER RETEST

Wait for price to retest the breakout zone

Confirm with bullish candle / rejection wick

Targets

🎯 Target Zone: Top green box area

Expect price to push higher towards target price zone

Stoploss

🛑 Stoploss Zone: Red box

Below retest support area / below structure low

🎙️ NARRATION (For YouTube / Telegram)

“XAUUSD Gold 15-minute chart shows a strong bullish continuation setup.

We got a clear break of structure, confirming buyers are in control.

Day opening is acting as support and day low support zone is holding strongly.

Right now price is approaching yesterday’s high resistance, so the best plan is to take entry only after a clean retest of the breakout zone.

Once the retest confirms with bullish rejection, we can expect price to continue upside towards the target zone.

Stoploss will remain below the retest support to protect the trade.”

If you want, I will also make this into short 15-sec voice style script for YouTube Shorts 🎬

XAUUSD/GOLD 30MIN SELL PROJECTION 12.01.26Chart reading (simple)

Supply zone la price reject aagudhu → sell bias

Current price ~ 4574 (chart right side)

Resistance line near 4583–4584 area

Swing low target near 4546

✅ Best Next Move (30M Plan)

🔥 Sell Entry Zone

➡️ 4573 – 4576 (Entry zone chart-la mark panniruka range)

🛡 Stoploss (safe SL)

➡️ 4586 – 4588 (Supply/Stoploss zone top)

🎯 Targets

TP1: 4565 (support zone touch)

TP2: 4555

Final TP: 4546 (Swing Low) ✅

XAUUSD/GOLD WEEKLY SELL PROJECTION 04.01.26Price was moving inside a parallel uptrend channel

That channel is clearly broken, which is the first early warning of trend weakness

After the break, price failed to continue higher → bullish momentum exhausted

2️⃣ Major Reversal Patterns

Double Top Formation

Price tested the same resistance zone twice

Both tops were rejected strongly

This confirms buyers are unable to push price higher

M Pattern Confirmation

After the second top, price breaks below the neckline

This confirms trend reversal

3️⃣ Candlestick Confirmation (Very Strong)

At the resistance zone:

Evening Star (Triple Candlestick Pattern) → Classic reversal signal

Bearish Engulfing Candle → Sellers completely overpower buyers

These patterns together give a high-probability SELL confirmation

4️⃣ Resistance Zones

Resistance R2 → Major rejection zone (double top area)

Resistance R1 → Previous supply zone

Price respected resistance and obeyed the trendline → SELL zone

5️⃣ Entry Logic (SELL)

Sell after:

Trendline break

Double top confirmation

Bearish engulfing close

This is a swing low sell setup

6️⃣ Targets & Risk Management

Support S1 → First target / partial booking zone

Support S2 → Final target

Risk : Reward = 1 : 2

XAUUSD/GOLD 4H BUY PROJECTION 28.12.25Pair: XAUUSD / Gold

Timeframe: 4H

Bias: Bullish (Buy continuation)

Date: 28-12-2025

Market is in a strong uptrend, respecting a parallel ascending channel.

📈 Technical Structure Explained

1️⃣ Trend & Pattern

Price is moving inside a Parallel Uptrend Channel

A Bullish Flag formed after a strong impulsive move

Then price formed a V-Continuation Pattern → strong bullish sign

Breakout happened with momentum candles

👉 This confirms trend continuation, not reversal

2️⃣ Key Levels Marked

🟦 Supports

Support S1: ~4520

Support S2: ~4500

These are dip-buy zones if price retraces.

🟥 Resistance / Breakout Area

Immediate Resistance: ~4530

Price broke & retested this zone

Also aligns with Fibonacci retracement + structure break

👉 This level is now acting as support

3️⃣ Entry Logic (Buy Setup)

✅ Buy Confirmation Zone

After breakout + retest

Strong bullish candle close above 4530

Momentum continuation (higher highs & higher lows)

🟩 Safe Buy Area:

4525 – 4535 (retest zone)

4️⃣ Targets (Upside Projection)

🎯 Target 1 (R1 / Previous High): ~4560

🎯 Target 2 (Expected ATH): ~4620

🎯 Extended Target: ~4660 – 4680

(Top of the channel / projected ATH)

5️⃣ Stop Loss (Risk Management)

🛑 SL Options:

Conservative SL: below 4500

Aggressive SL: below 4510

ATR-based SL preferred for volatility control

XAUUSD/GOLD 1H BUY PROJECTION 10.12.25“Character Invalid Here” (Lower Pink Zone)

This zone represents heavy sell pressure.

Price dropped deeply here → buyers were weak → sellers dominated.

From this area, the market started recovering upward slowly.

2️⃣ Day High as Resistance R1 (Middle Pink Zone)

This is a strong resistance level.

Price tested this zone multiple times and faced rejection.

This confirms it as a key intraday resistance.

Once price breaks and retests this area, bullish confirmation becomes stronger.

3️⃣ Bounce Back Area (Green Horizontal Zone)

This area is where you expect the pullback (retracement) to happen.

When price returns to this zone:

✔ Buyers re-enter the market

✔ Trend continues upward

✔ You get safe entry confirmation

This is a high-probability buy zone.

4️⃣ Entry After Bounce Back (Red Zone)

This is the ideal buy entry area after confirmation.

Your structure shows:

Price breaks the resistance

Pulls back for retest

Holds the major trendline

Respects the curved support (cup structure)

This indicates a strong bullish continuation setup.

5️⃣ Target Price (Weekly High Resistance & TP)

This is the weekly high, which acts as the final target.

The price is expected to reach this level due to:

Strong bullish momentum

Breakout + retest confirmation

Trendline support

Clean upside liquidity

This is a realistic and high-probability target.

XAUSD/GOLD 4H SELL PROJECTION 07.12.251. Major Rejection Zone

Price tapped into the Huge Liquidity Collection Zone (yellow zone).

Strong rejection with bearish candlestick formations (Engulfing + Spinning Top).

2. Pattern Confirmation

Double Top formation at Resistance R1–R2.

Neckline broken and candle closed below – confirming trend reversal.

Break of a major triangle pattern also supports bearish continuation.

3. Entry Zone

Entry marked at 4,207.97 zone after retest and bearish confirmation.

Confluence with:

Resistance Rejection

Structure Break

Bearish candle patterns

4. Stop Loss (SL)

SL placed at 4,243.17, above the wick and liquidity grab zone.

5. Take Profit (TP)

Targeting Premium Zone around 4,146.62.

Risk–Reward Ratio: 1 : 2

🎯 Final Sell Projection

Expecting price to drop towards 4,146–4,150 zone after rejection from liquidity and break of structure.

Bearish candlestick confirmation increases probability of continuation move.

XAUUSD/GOLD 1H BUY PROJECTION 02.12.25“Gold is currently reacting strongly from the premium weekly support zone.

A clear bullish engulfing candle has formed at the bottom, indicating strong buying pressure.”

Next:

Price was moving inside a parallel downtrend channel, but

The bearish structure has now broken, confirming a potential trend reversal.

The market has also broken the trendline, showing strong momentum from buyers.

After breaking the trendline, price is expected to:

Retest the break level (support turning from resistance).

Continue bullish towards Resistance R1 around 4228–4232.

If momentum holds, the move may extend towards Resistance R2 at 4255–4260.

This structure aligns with a clean liquidity grab, followed by trend reversal and bullish continuation.

🎯 Key Points (Easy to Explain on YouTube)

✅ Premium Weekly Support Zone Hit – strong reversal area

✅ Bullish Engulfing Formed – confirmation of buyer strength

✅ Downtrend Channel Broken – trend reversal confirmation

✅ Expecting Retest → Buy Continuation

🎯 Target 1: Resistance R1 (4230 level)

🎯 Target 2: Resistance R2 (4260 level)

⛔ Stop Loss: Below Weekly Support Zone (around 4185)

📌 Summary for Your Video / Telegram Post

“Gold is showing a strong bullish reversal from the premium weekly support zone.

A bullish engulfing followed by a clean trendline break confirms a potential buy setup.

As long as price holds above the retest zone, we expect upside targets towards 4230 and 4260.”

If you want, I can also prepare:

✔ YouTube Title + Description

✔ Thumbnail text (big bold letters)

✔ Short-form script (30–45 sec)

✔ Hashtags

✔ PDF or PNG formatted analysis

Just tell me “make title, description & thumbnail” and I’ll generate it.

XAUUSD/GOLD 1H BUY PROJECTION 02.12.25Market Structure

Price has broken the uptrend line, causing a corrective move inside a descending channel.

The correction is respecting channel boundaries (multiple rejections on top & bottom).

🔹 Key Zones

Support Zone: 4180 area

→ Confluence of FVG (Fair Value Gap) + Demand Zone + Channel Bottom.

Target Zone: 4218–4220

→ Retest of the broken structure zone.

🔹 Buy Setup Logic

Price dipped into OBEY CHANNEL + FVG + SUPPORT zone (blue/purple box).

Expectation: Price should bounce from support and move higher.

First target aligns with:

Channel Top

Breaked zone retest

Previous minor structure level.

🔹 Projection Outcome

A bullish push towards 4218.89 zone is projected if support holds.

SL should be placed below the 4168–4170 zone under channel + FVG.

WILL GOLD CONTINUE TO RISE?I. BASIC CONTEXT

On November 10, 2025, gold prices surged after the market reacted positively to news of the U.S. government reopening.

The current market sentiment expects the FED to cut interest rates soon as recent economic data indicates a weakening U.S. economy.

Lower interest rates mean cheaper money, a weaker USD, thereby driving funds into safe-haven assets like gold.

The current rally is seen as a news-based pullback, potentially extending to key resistance areas before the market establishes a medium-term trend.

II. TECHNICAL ANALYSIS

Main timeframe: H2

Market structure:

Gold prices have broken out of the accumulation triangle pattern.

Formation of an Inverse Head and Shoulders pattern → signaling the correction phase has ended.

III. TRADING SCENARIOS

✅ Main scenario: WATCH TO BUY THE TREND (BUY THE DIP)

Trend expectation: Prices continue to extend the pullback to resistance areas 4180–4220.

Buy zones (BUY ZONES):

Zone 4105–4103 (near old H2 resistance → becoming new support).

Zone 4115–4116 (confirmation area post-breakout).

Deeper zone: 407x – 405x (Fib 0.618, trendline confluence area).

If prices retest the H2 structure: 4040 – 4035.

Buy stop:

When prices break through the 416x area with strong candle force → a buy stop can be placed to follow the breakout momentum.

Note to check the timing and candle force on H2/M30 to confirm momentum.

⚠️ Alternative scenario: WATCH TO SELL REACTION

If clear signs of weakness appear at resistance, consider a short SELL reaction at:

4180–4185

4205–4220

These are potential profit-taking areas for the current pullback wave.

IV. RISK MANAGEMENT

Stop Loss (SL): 10 points

Take Profit (TP): 10–12–13 points depending on setup

RR ratio: 1:1 – 1:1.3

Prioritize capital management according to the principle R ≤ 1% account/order.

Additionally, monitor news on Mr. Trump's actions during this period.

The U.S. government has reopened this week, so expect a fair amount of news, stay alert.

Trade effectively

XAUUSD/GOLD 1H SELL PROJECTION 11.11.25XAUUSD/GOLD 1H Sell Projection (11.11.25) chart.

Here’s a quick technical breakdown of what this chart represents:

🟣 Setup Overview

Pair: XAUUSD (Gold)

Timeframe: 1 Hour (H1)

Bias: Bearish (Sell Setup)

🧩 Key Levels

Resistance / High: 4148.82

Stoploss: ~4141.63

Entry Zone: ~4129.45–4128.32

Target 1 (TP1): Around 4110 (S1 + FVG zone)

Target 2 (TP2): Around 4081 (S2 zone)

📉 Projection Logic

Price rejected from major resistance at 4148.

A short-term pullback / retracement is expected into the entry zone.

After possible retest, price is expected to drop towards TP1 and TP2.

The setup suggests a Risk-Reward Ratio (RRR) of roughly 1:2.5 to 1:3, favoring the sell side.

⚙️ Trading Idea Summary

Parameter Value

Bias Sell

Entry Range 4128–4130

Stop Loss 4141

Take Profit 1 (TP1) 4110

Take Profit 2 (TP2) 4081

R:R Ratio ≈ 1:3

Confirmation Bearish engulfing or rejection from resistance zone

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 28.10.251H Sell Limit Projection Chart for XAU/USD (Gold):

📝 Chart Summary (28.10.25)

Timeframe: 1 Hour

Setup Type: Sell Limit Projection

Market Structure: Bearish

📈 Key Levels:

Sell Limit Zone (Entry Area): Around $3,958 (Resistance R1)

Stop Loss: Around $3,982 (Top of FVG + Trendline)

Target 1 (TP1): Support S1 – around $3,920

Target 2 (TP2): Support S2 – around $3,883

📉 Technical Confluences:

🔹 1H Downtrend Line acting as dynamic resistance

🔹 FVG (Fair Value Gap) aligning with entry zone

🔹 Fibonacci retracement zone overlap

🔹 Resistance R1 matches previous supply zone

🧭 Trading Plan Idea:

Wait for price to retrace back to $3,958 zone.

Place Sell Limit order in the zone.

Stop loss: Above $3,982 zone to protect from fakeouts.

Take Profit: First target at $3,920 (partial booking), second target at $3,883 (runner).

⚠️ Risk Notes:

Watch for liquidity grabs above R1 before rejection.

Avoid market entry — wait for price confirmation near the zone.

Adjust SL if price structure shifts on lower timeframes.

XAUUSD/GOLD WEEKLY SELL PROJECTION 26.10.25Here’s a clear explanation of the 4H SELL SETUP shown in your chart 📊👇

📌 Chart Breakdown (XAU/USD — Gold 4H)

Pattern: Rising wedge / structure breakdown

Trendline: “4H Uptrend Line – Broken” ✅

Candle signal: Bearish Engulfing at ATH (strong reversal confirmation)

🧭 Key Levels

🟥 Stop Loss: Around 4,225.640 (above structure high)

🟡 Entry Zone: ~4,192 (below trendline break)

🟢 Targets:

TP1: 4,125

TP2: 4,075

TP3: 4,031

🧠 Trading Logic

Market formed a Bearish Engulfing at the top.

The main trendline was broken, indicating possible trend reversal.

After a retest of the broken structure, price is expected to continue downward.

Multiple TPs (TP1, TP2, TP3) help scale out profits gradually.

SL is placed above the previous high to protect against a fake breakout.

XAUUSD / GOLD WEEKLY BUY PROJECTION – 12.10.25The market is currently showing strong bullish momentum after a clean V-shaped reversal from the support zone around $3,960–$3,980.

✅ Key Technical Highlights:

Support S2 Zone held well, forming a reversal V pattern, confirming buyers stepping in.

Price has broken and retested the breakout zone around $4,000, indicating buying strength.

A bullish momentum candle confirms continuation towards higher levels.

Fibonacci 0.5–0.618 retracement zone aligned perfectly with the support, giving more confluence for long entries.

If momentum sustains, price is projected to push towards:

📍 Resistance R1: $4,060 zone (first TP)

📍 Resistance R2 / New ATH Zone: $4,120 zone (final TP)

🛡️ Invalidation:

A clean break below the $3,960 support and the fair value gap would signal weakening momentum and cancel the bullish outlook.

📈 Summary:

Entry: After retest of breakout zone ($4,000–$4,010)

TP1: $4,060

TP2: $4,120

SL: Below $3,960 (Fair value gap)

🚀 Bias: Bullish

📅 Timeframe: 4H / Weekly

⚠️ Note: Always manage risk with proper position sizing and SL discipline

XAUUSD/GOLD WEEKLY BUY PROJECTION 28.09.25XAUUSD/Gold Weekly Buy Projection (27.09.25). Here’s a breakdown of what it shows:

Current Price Level: Around 3,759.85.

Technical Zones Marked:

Broke the Uptrend Line (earlier support turned resistance).

Bearish Engulfing Failed (bullish strength seen).

Fair Value Gap (FVG) near 3,740–3,750 zone, acting as a demand zone.

Projection Path:

Price expected to bounce from the FVG/demand area.

Then follow an upward zigzag movement toward the target zone around 3,860.

Trend Channel:

Multiple parallel blue channels drawn indicate a bullish structure.

Projection suggests continuation of the uptrend.

Target Price:

Marked close to 3,860, aligning with the upper channel line.

🔑 Summary of Projection:

Bias: Bullish

Entry Zone: 3,740–3,760 (Fair Value Gap zone)

Target Zone: 3,860

Risk Area: If price breaks below 3,720, projection may fail.

👉 Do you want me to prepare a trading plan (entry, SL, TP, and risk %) based on this projection for you?

XAUUSD/GOLD 1H BUY PROJECTION – 18.09.25The 1-hour chart of Gold shows a recent V pattern formation, signaling a strong bullish reversal after a sharp drop.

A downtrend breakout is confirmed, supported by a Three White Soldiers pattern, strengthening the bullish momentum.

Entry Zone: Around 3,668 (current price).

Support (S1): 3,655 – strong demand zone where buyers are likely to defend.

Resistance (R1): 3,685 – key target level for this bullish move.

Risk-to-Reward Setup: Stop-loss below support (S1) at 3,655, with take-profit at resistance (R1) near 3,685.

🔑 Conclusion: Gold (XAUUSD) is showing bullish signs with breakout confirmation. As long as price holds above support at 3,655, the projection favors upside movement towards 3,685.

XAUUSD / Gold FOMC Interest Rate Update – 18.09.25Fundamental Reason for Bullish:

The Federal Reserve cut rates from 4.25% → 4.00%.

This supports gold’s bullish momentum since lower rates reduce the opportunity cost of holding gold.

Technical Structure:

Potential Reversal Zone: Highlighted in yellow. Price is currently testing this area around 3645–3655.

A bounce from this zone aligns with the 3-month uptrend line (black trendline).

If price respects this support, bullish continuation is expected.

Bullish Projection Path:

First, a rebound from the reversal zone.

Then, a push towards 3700–3720 with a possible retest.

Final Target Price Zone: ~3750–3780.

Risk Area (Stop Loss Zone):

If price breaks below the reversal zone and trendline (~3640–3635), bullish outlook weakens and downside risk opens.

🎯 Summary

Bias: Bullish (Fundamental + Technical confluence).

Reason: Rate cut + uptrend line support.

Targets: 3700 → 3750 → 3780.

Invalidation: Break below 3640.

XAUUSD/GOLD 1H SELL PROJECTION 15.09.25XAUUSD/Gold 1H Sell Projection (15.09.25). Here’s a structured breakdown of what the chart indicates:

🔎 Chart Analysis

Entry Zone: Around 3646 – 3647 (confluence of trendline + 0.618 Fibonacci retracement = "Golden Ratio").

Stop Loss: Around 3653.16 (above trendline & key resistance).

Take Profit Targets:

TP1 (Support S1): Around 3639 – 3640

TP2 (Support S2): Around 3630 – 3631

🧭 Trade Idea (Sell Bias)

Reasoning:

Price has rejected the descending trendline resistance.

Confluence with Fibonacci 0.618 retracement level (3647).

Bearish projection towards support zones.

📌 Summary

Setup: Short/Sell

Entry Zone: 3646 – 3647

Stop Loss: 3653

Target 1: 3640

Target 2: 3630