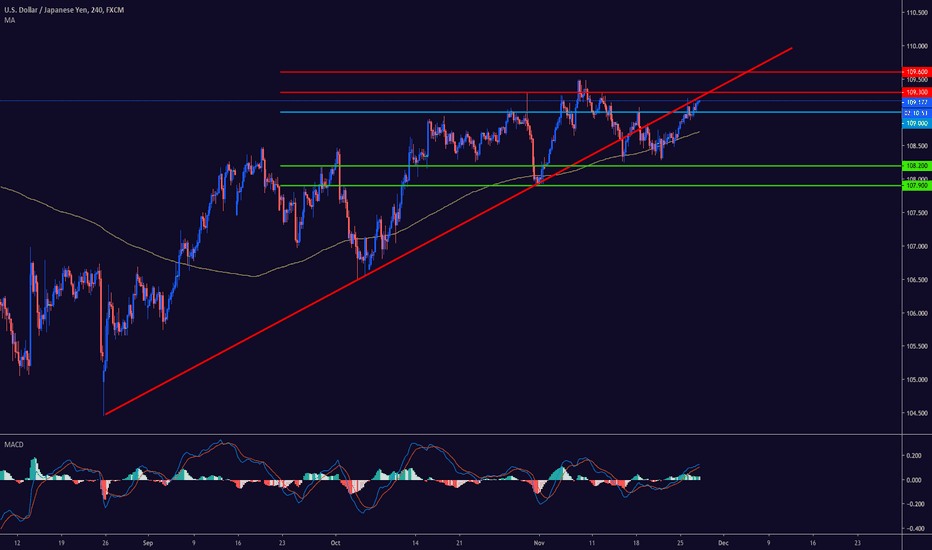

USDJPY 110.00 possibleThe US dollar continues to target towards 110.00 level against the Japanese yen as the greenback remains well-supported across the board. The recent high around the 109.60 level provided a signal that the USDJPY intends to push higher over the shor-term. The 110.90 level could be the overall upside objective for medium-term bulls if the 110.00 resistance level is overcome.

• The USDJPY pair is only bullish while trading above the 109.30 level, key resistance is found at the 109.60 and 110.0 levels.

• The USDJPY pair is only bearish while trading below the 109.30 level, key technical support is found at the 109.15 and 109.00 levels.

Yen

USDJPY trendline watchThe US dollar has moved back towards key trendline resistance against the Japanese yen currency, although price has so far rejected the upside attack. The USDJPY pair is still vulnerable to further downside while trading below the October monthly price high. Overall, Sino-US trade news is dictating the moves in the USDJPY pair, the short-term trend is now neutral.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 108.20 and 107.90 levels.

USDJPY sell ralliesThe US dollar remains vulnerable to further losses against the Japanese yen currency as market sentiment towards Sino-US trade talks is fragile. The USDJPY pair is likely to suffer a strong decline once a confirmed breakout below the 107.90 level occurs. Going forward, selling any rallies towards the 109.00 resistance level appears to be the best short-term trading strategy.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 107.90 and 107.50 levels.

USDJPY 107.50 possibleThe US dollar remains under pressure against the Japanese yen, following reports that the first phase of the Sino-US trade deal could be delayed until next year. The USDJPY pair is increasingly likely to test towards the 107.50 support level, with the 106.90 level extended weekly support. Going forward, USDJPY traders have few reasons to be bullish while price trades under the 109.00 level.

• The USDJPY pair is only bullish while trading above the 109.00 level, key resistance is found at the 109.30 and 109.60 levels.

• The USDJPY pair is only bearish while trading below the 109.00 level, key technical support is found at the 107.50 and 106.90 levels.

USDJPY possible breakdownThe US dollar is starting to appear weak against the Japanese yen currency, following multiple technical rejections and bearish lower highs. The USDJPY pair is likely to target the 107.50 level at a minimum this week if a breakout below the 108.20 level occurs. Going forward, only a sustained breakout above the 109.30 level can negate the bearish outlook surrounding the USDJPY pair.

• The USDJPY pair is only bullish while trading above the 109.30 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 109.30 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY upside failureThe US dollar has come back under pressure against the Japanese yen currency after suffering a heavy technical rejection around the 109.00 level. The balance of power is with sellers while price trades below the rising trendline on the daily time frame. Overall, a break below the 108.20 support level exposes the USDJPY pair to further losses towards the 107.50 level.

• The USDJPY pair is only bullish while trading above the 108.68 level, key resistance is found at the 109.00 and 109.40 levels.

• The USDJPY pair is only bearish while trading below the 108.68 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY trendline breakThe US dollar is still trading on the defensive against the Japanese yen currency as the pair continues to fall back from the 109.00 resistance are. Major trendline support for the USDJPY pair has now been broken and is currently located at around the pivotal 108.60 level. Going forward, the USDJPY pair could fall towards the 107.50 level if the 108.20 support level is broken.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.20 and 107.50 levels.

USDJPY testing lowerThe US dollar is trading lower against the Japanese yen currency after a technical break below the 108.90 support level. Further intraday losses towards the 108.20 level remain possible while the USDJPY pair trades below the important 108.90 level. Overall, sustained gains above the 109.30 level are needed to encourage a technical test of the 110.00 resistance level.

• The USDJPY pair is only bullish while trading above the 108.90 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.90 level, key technical support is found at the 108.60 and 108.20 levels.

USDJPY 110.00 still possibleThe US dollar is increasingly bullish against the Japanese yen currency, following a sharp bounce from the pivotal 108.60 support level. The USDJPY pair is likely to test towards the 110.00 level if the 109.60 resistance level is overcome later today. Overall, an even stronger rally towards the 110.80 level is still possible, as the USDJPY pair continues to exhibit bullish price action.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.60 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.20 and 107.90 levels

USDJPY 109.30 test comingThe US dollar continues to press higher against the Japanese yen currency, following the recent reversal from the 107.90 support. An upcoming technical test of the 109.30 level is on the horizon, with a breakout above the October high likely to spark a rally towards the 110.00 level. Overall, the daily time frame shows the presence of an extremely large inverted head and shoulders pattern.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.30 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 107.90 and 107.30 levels

USDJPY new lowThe US dollar is coming under increasing pressure against the Japanese yen, with the pair falling to a fresh multi-week trading low. The USDJPY pair risks a deeper decline towards the 107.30 level if the 107.90 support level is broken over the coming sessions. Overall, USDJPY sellers now have the upper hand in the short-term while price trades below the 108.60 resistance level.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.00 and 109.30 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 107.90 and 107.30 levels

USDJPY 109.30 neededThe US dollar is trading around the 109.00 level against the Japanese yen as overall market sentiment towards the pair increases. The USDJPY pair now needs to rally above the 109.30 resistance level to encourage a major upside technical breakout towards the 110.00 level. Caution is still advised when trading the USDJPY pair until a breakout above the 109.30 level takes place.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.30 and 110.00 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.25 and 107.90 levels

USDJPY data to decideThe US dollar is trading sideways against the Japanese yen, as traders and investors await a slew of US economic data releases this week. The USDJPY pair could become extremely volatile to trade, leading to plenty of two-way trading opportunities. Traders are likely to continue to buy any dips in the USDJPY pair while the price continues to trade above the pivotal 107.90 technical level.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.00 and 109.30 levels.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support is found at the 108.25 and 107.90 levels

USDJPY bearish patternThe US dollar is struggling to move above the 108.80 level against the Japanese yen, leaving the pair under pressure going into the European trading session. The four-hour time frame is currently showing that a bearish head and shoulders pattern has formed. A sustained break under the 108.55 level will trigger the bearish pattern, with the 108.10 level the overall target.

• The USDJPY pair is only bullish while trading above the 108.55 level, key resistance is found at the 108.80 and 109.30 levels.

• The USDJPY pair is only bearish while trading below the 108.55 level, key technical support remains at the 108.10 and 107.90 levels

USDJPY 109.30 major resistanceThe US dollar has moved to fresh multi-month trading high against the Japanese yen currency after buyers broke through the 108.60 level on Tuesday. The USDJPY pair may test the 109.30 resistance level if bulls can maintain price above the 108.60. Overall, medium-term analysis shows that the USDJPY pair could reach the 110.00 level if bullish momentum continues to build.

• The USDJPY pair is only bearish while trading below the 108.60 level, key technical support remains at the 107.90 and 106.90 levels.

• The USDJPY pair is only bullish while trading above the 108.60 level, key resistance is found at the 109.00 and 109.30 levels

USDJPY 108.90 breakThe US dollar is trading towards the best levels of the month against the Japanese yen currency, following the recent announcement of a Sino-US trade deal. The USDJPY pair could soar toward the 110.20 level if we see a sustained break above the 108.90 level this week. Any technical pullbacks in the USDJPY pair should find strong technical support from the 107.45 level.

The USDJPY pair is only bearish while trading below the 107.45 level, key technical support remains at the 106.90 and 106.00 levels.

The USDJPY pair is only bullish while trading above the 107.45 level, key resistance is found at the 108.80 and 110.20 levels

Don't miss the great buy opportunity in EURJPYTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (119.03). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. EURJPY is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 81.

Take Profits:

TP1= @ 120.00

TP2= @ 120.78

TP3= @ 122.22

SL= Break below S2

USDJPY 108.45 importantThe US dollar is trading towards the best levels of the week against the Japanese yen, following reports that a minor Sino-US trade deal may be on the cards. The 108.50 level is now the key technical area that bulls will need to break to encourage a test of the 108.80 level. Overall, the USDJPY pair now has a strong bullish bias while trading above the 107.45 resistance level.

• The USDJPY pair is only bearish while trading below the 107.45 level, key technical support remains at the 106.90 and 106.00 levels.

• The USDJPY pair is only bullish while trading above the 107.45 level, key resistance is found at the 108.50 and 108.80 levels

Don't miss the great buy opportunity in AUDJPYTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (72.40). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. AUDJPY is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 62.

Take Profits:

TP1= @ 73.10

TP2= @ 73.90

TP3= @ 75.90

SL= Break below S2

Don't miss the great buy opportunity in EURJPYTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (118.16). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. EURJPY is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 70.

Take Profits:

TP1= @ 118.65

TP2= @ 119.80

TP3= @ 120.80

SL= Break below S2

USDJPY moving higherThe US dollar is moving higher against the Japanese yen currency after bearish momentum faded below the pivotal 106.90 support level. If USDJPY bulls can maintain price above the 107.45 level the pair could advance towards at least the 108.00 technical region. Overall, the resumption of Sino-US trade talks later today is likely to decide the overall direction of the USDJPY pair.

• The USDJPY pair is only bearish while trading below the 106.90 level, key technical support remains at the 106.40 and 105.50 levels.

• The USDJPY pair is only bullish while trading above the 106.90 level, key resistance is found at the 107.45 and 108.00 levels

EURJPY Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=117.35.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=117.9.

TP4: R2=118.3.

Set the stoploss of these orders at breakout of S2=117.15.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=117.15.

In this situation, there is an expectation to reach the target S3=116.3.

Set the stoploss of reverse orders at breakout of S1=117.35.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

USDJPY trade talk buzzThe US dollar is attempting to recover above the 106.90 level against the Japanese yen, with the pair appearing to have found an interim price floor. The USDJPY could drift higher towards 107.45 level this week, as initial Sino-US trade talk optimism dominates market sentiment. Overall, the USDJPY pair is technically bearish while trading under the important 106.90 support level.

• The USDJPY pair is bearish while trading below the 106.90 level, key technical support remains at the 106.40 and 105.50 levels.

• The USDJPY pair is only bullish while trading above the 106.90 level, key resistance is found at the 107.45 and 107.70 levels