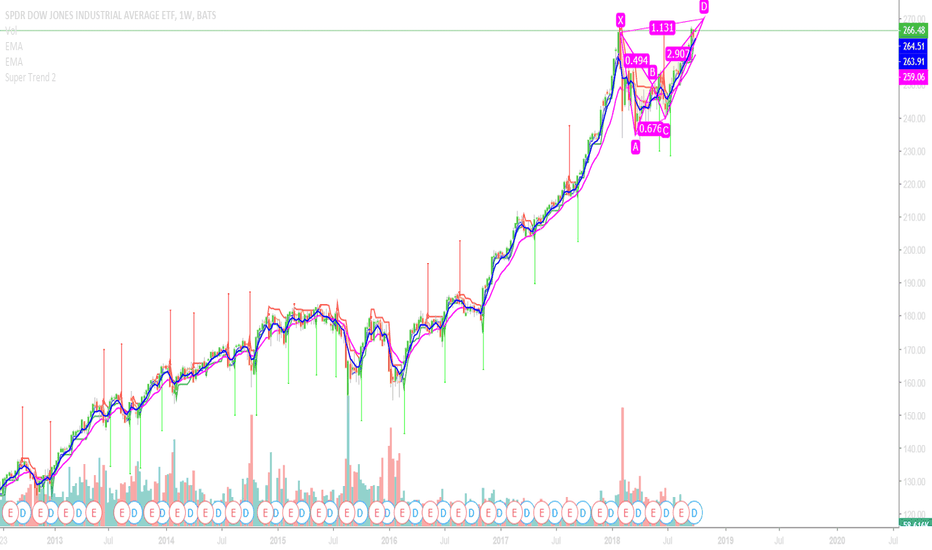

ETF market

hidden bearish divergence This counter rally is running into a hidden bearish divergence. Volume is declining. The trendline breakout didnt bring in a lot of buyers. I expect the stock market to go down, trying to continue it's downtrend.

Going straight back to the all time high without looking back would be very surprising.