Futures market

Silver Price structure like a Clockwork?TVC:SILVER prices recently made a blow-off top, touching $121, before receding 25%.

While on the one hand, TVC:GOLDSILVER touched the lower boundary of 46 before rising sharply (suggesting Gold may outperform Silver in the near future), on the other hand, the long-term chart of Silver may repeat history and fall to the previous all-time high of $50 by Q3 of 2026.

If the historical patterns are to be believed, that would be an excellent point to enter long positions in Silver. We may have a second leg of the bull market in silver, which could push prices to $275-$300 levels by Q1 2020.

And that will complete the typical bull cycle of 9 years for Silver.

Getting Creative on SilverThe RSI on Silver is now above 80/90 on all time frames, putting it in bubble territory. With the sixth consecutive day of gains going on, I am looking at the parallel channel and potential wedge formation for the next few days. Let us see if these trendlines can offer any resistance here. A reversal in the dollar could be one catalyst.

Massive crash in the market⚠️ Massive sell-off across global markets ⚠️

A sharp wave of panic hit both metals and equities within the last hour, wiping out trillions in market value:

• Gold plunged 8.2%, erasing nearly $3 trillion in market capitalization

• Silver crashed 12.2%, losing around $760 billion

• S&P 500 slipped 1.23%, wiping out $780 billion

• Nasdaq dropped over 2.5%, cutting roughly $760 billion

Heavy risk-off sentiment is clearly dominating as investors rush to reduce exposure across asset classes.

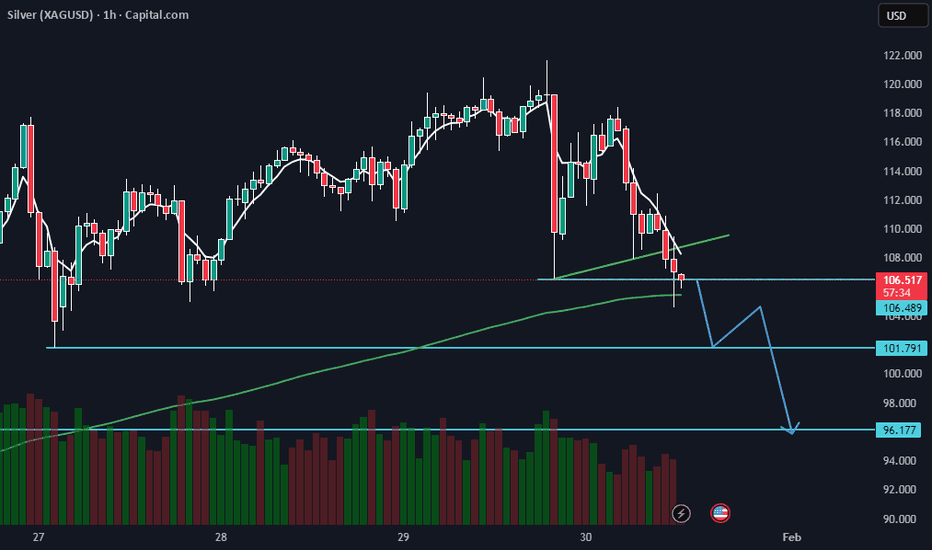

SILVER (XAGUSD) 1HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

SILVER (XAGUSD) Looking good for Downside..

When it break level 106.86 and sustain.. it will go Downside...

SELL @ 106.86

Target

1st 101.79

2nd 96.177

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

XAUUSD (H1) – Liam PlanUptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the highs, increasing the likelihood of short-term pullbacks and two-sided price action.

➡️ The broader trend stays bullish, but execution should now be level-driven and reaction-based, not momentum chasing.

Technical view

Price is currently trading at elevated levels relative to recent structure, where prior buying activity has already been absorbed.

Key price areas to watch:

Short-term sell area: 5520 – 5530

Upper resistance area: around 5600

Pullback buy area: 5405 – 5420

Primary buy zone: 5150 – 5155

The current structure favors a pullback and rebalancing phase before any sustained continuation higher.

Trading scenarios

SELL – short-term reaction trades

Look for sell reactions around 5520 – 5530 if price shows weakness.

Downside targets sit near 5420, with further extension possible if the pullback develops.

These sells are tactical and short-term, not calls for a trend reversal.

BUY – aligned with the main trend

Primary scenario

Buy pullbacks into 5405 – 5420 if the area holds.

Targets back toward 5520 and higher.

Deeper scenario

If volatility increases, wait for price to retrace toward 5150 – 5155.

This area offers the best risk-to-reward for trend continuation.

Key notes

Strong trends still correct; patience matters.

Avoid entries in the middle of the range where risk outweighs reward.

Short positions are tactical only while the broader structure remains bullish.

What’s your plan:

selling reactions near 5520 – 5530, or patiently waiting for a pullback into 5405 – 5420 to rejoin the uptrend?

— Liam

XAUUSD Gold Next Move In Upcoming 2 Weeks ExpectedGold is Now Moving to 5600 to 5615 Which is Retracement level of 1.618 For Golds Previous Swing Extension levels and can expect a retracement of till 5000 to 5100 Levels In Upcoming Weeks Lets See WhatS Going to Happen..........# XAUUSD .. Check My 4hr chart Frame

If You Want to Catch the Bottom, First Wait for RSI.To Do Nothing.

Right now, staying out is already a win.

The market is moving fast, noisy, and uncomfortable. Both buyers and sellers are getting trapped — not because direction is unclear, but because the market has not finished its process yet.

This is a moment to stay calm and observe, not to force a trade.

Observe how price begins to slow down.

Observe how selling pressure fades.

Note:

Stay focused on RSI behavior. When price decelerates and RSI shows clear convergence / stabilization, that’s when it makes sense to start thinking about potential long ideas — not before.

Until then, observation comes first.

Sometimes, doing nothing is the most disciplined decision you can make.

XAUUSD 30 MIN T/F ANALYSIS---

📊 Market Structure Explanation (Gold – 30 Min)

The price show heavy selling so we can measure recent top supply and copy it

after retesting we can measure from retesting top and past previous supply and match current supply so supply will be completed --

🔍 What the market can do next:

Scenario 1 – Pullback / Reversal (Needs Confirmation):

For any meaningful reversal to occur, the market must first show clear bullish candlestick confirmation.

This includes patterns such as:

bullish engulfing candles

Strong rejection wicks (lower shadows)

morning star formations

Consecutive bullish closes

Short lower-wick rejection candles showing bullish pressure

Without these bullish structures, any upside move should be treated as a temporary pullback, not a reversal.

Scenario 2 – Continuation:

If sellers stay strong and bullish confirmation does not appear, price can break down this zone and continue lower with another impulsive bearish move.

Scenario 3 – Range formation:

Market may form a small sideways structure near this level before choosing a clear direction.

🧭 Summary:

The trend is bullish, but price is at a sensitive support zone.

Reversal is only valid if bullish candlestick patterns and bullish pressure appear.

Otherwise, the structure favors continuation or short-term consolidation before the next move.

XAUUSD/GOLD CORRECTION BUY PROJECTION 29.01.26XAUUSD / Gold – Correction Buy Setup (29-01-2026)

Market View:

Gold is in a strong bullish trend. The current move is a normal correction, not a trend reversal.

Buy Zone:

Support S2 + Fair Value Gap (FVG)

0.618 Fibonacci Golden Ratio

Area around 5396 – 5400

Trade Plan:

Look for buy confirmation in the marked support zone.

Expect price to respect the uptrend line and move higher.

Targets:

First target: Resistance R1

Main target: 5600+

Stop Loss:

Below Support S2 / below recent structure low.

Silver Futures: Parabolic Breakdown & Bearish LiquidationSilver Futures: Parabolic Breakdown & Bearish Liquidation (Analysis)

Part 1: Historical Context (The "Why") To understand this violent -17% move, we must look at Silver's distinct "personality" compared to Gold.

1. The "Beta" Factor (Silver vs. Gold) Silver is often called "Gold on steroids." While Gold is a monetary metal held by Central Banks for stability, Silver is 50% industrial and 50% speculative. It has a much smaller market cap, meaning it takes less liquidity to push the price up or down violently.

Historical Rule of Thumb: When Gold drops 5%, Silver often drops 10-15%. This chart confirms a classic high-beta liquidation event.

2. Historical Comparisons

The 2011 Crash: In April 2011, Silver went parabolic to nearly $50/oz before crashing ~17.7% in a single day (the "Sunday Night Massacre"). This was caused by exchange margin hikes, forcing leveraged longs to liquidate.

The 2020 Covid Crash: In March 2020, Silver fell ~30% in weeks due to a liquidity crisis where traders sold precious metals to cover equity losses.

Part 2: Visual & Technical Analysis

A. Daily Timeframe (The "Map")

Step 1: The Parabolic Arc Break: The rally followed a steep, unsustainable curve (Blue Arc on chart). When price cuts vertically through such an arc—as the recent Red Candle has done—the bullish momentum is technically broken.

Step 2: The "Supply Zone" Rejection: The long wick at the top (near 422,000) represents a "concrete ceiling." Buyers were exhausted, and trapped longs at this level will likely sell into any recovery to break even.

Step 3: Bearish Engulfing Candle: The massive red candle has "engulfed" (wiped out) the gains of the previous 7-10 trading sessions. This shifts market psychology from "Buy the Dip" to "Sell the Rally."

Step 4: Momentum Warning (RSI Divergence): Before this drop, while price was making Higher Highs, the RSI likely failed to confirm with a Higher High (Bearish Divergence). This signaled buyer exhaustion before the crash occurred.

B. Intraday / Short-Term Strategy (The "Path") Since the daily trend is broken, the strategy shifts to defensive management.

1. The "Dead Cat Bounce" Scenario: After a vertical drop, the RSI is oversold. A bounce is expected, but it is often a trap. We use Fibonacci Retracement levels from the Swing High to Low to identify resistance:

0.382 Level: The first zone where aggressive bears often reload shorts.

0.5 - 0.618 (Golden Pocket): Historically the highest probability area for a "Lower High" to form.

2. The "Bear Flag" Pattern: In strong liquidations, price rarely recovers in a V-shape. Watch for a "Flag" pattern (slow drift upward on low volume). A break below the flag's support triggers the next leg down.

Part 3: Trading Strategy Summary & Risk Management

Volume Confirmation: Check the volume on the breakdown candle. If it is the highest of the year, it indicates "Capitulation" (potential temporary bottom). If volume is average, the "real" panic selling may still be ahead.

Invalidation Level (When is this view wrong?): This bearish outlook is negated ONLY if we get a Daily Candle close back above the 400,000 supply zone. Until then, the market structure remains corrective.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading futures involves significant risk.

CRUDE OIL Moving towards 6700+CRUDE OIL Moving towards 6700+ after 5 Years ... Are we near the breakout of CRUDEOIL?

Crude OIL MCX is seen rising towards 6700+ Level post correction for 5 Months.

We seen big Rally in 2020-2021 on Crude OIL post COVID - post that we have seen 4 Years of correction on it. Now are we ready for upmove on Crude again.

LTP - 5667

Possible Targets - 6700+

If we see breakout from 6700+ Levels we can see crude moving above ATH of 7900+

ChartsBoltaHai.

#XAUUSD Hello Friends 👋

Today You See Big Crisis In Gold & Silver, But My Study Was Say That It's A Temporary Crash Like a Just Profit Booking.

Very Negetive News Coming Side By Globle Market But Demand Was More Then Supply So I think Ones Again We See Big Rally in Gold & Silver.

I Mark Some Demand Zone Levels On Chart 📉

just A Study

Please Discuss Your Financial Adviser Before Investment Or Trade. 📊

Thank you

XAUUSD (Gold) – Bullish ViewGold is showing a bullish reaction from the Fibonacci demand zone (0.786 area). Price respected support and is attempting a reversal. Momentum looks favorable for an upside move.

📌 Buy Zone: 5,000 – 5,020

🎯 Target: 5,240 – 5,250

🛑 Stop Loss: 4,940

📊 Logic:

• Strong support near 0.786 Fibonacci

• Rejection from lower levels

• Risk–reward setup is favorable

⚠️ Trade with proper risk management.

📉 Not financial advice – for educational purposes only

Elliott Wave Analysis XAUUSD – January 30, 2025

1. Momentum

Weekly timeframe (W1)

Weekly momentum is currently rising. With this condition, the market is likely to continue moving higher or remain sideways for at least the next 1–2 weeks.

Daily timeframe (D1)

Daily momentum is currently declining. This suggests that over the next 1–2 days, price may continue to fall or move sideways until D1 momentum reaches the oversold zone.

H4 timeframe

H4 momentum is compressed and overlapping in the oversold area. This indicates that the current bearish or sideways phase may continue, however, the probability of a bullish reversal on H4 is relatively high.

2. Wave Structure

Weekly Wave Structure (W1)

On the weekly chart, the five-wave structure (1–2–3–4–5) in blue is still forming.

Yesterday, price experienced a strong decline. However, to confirm that blue wave 5 has completed, price needs to produce a bearish close below the 4282 level.

At the moment, since W1 momentum remains bullish, this decline is more likely a corrective move within blue wave 5, rather than a completed top.

Daily Wave Structure (D1)

Daily momentum is declining, therefore price may continue to move lower or sideways for another 1–2 days until D1 momentum reaches oversold conditions.

Within the context of blue wave 5, price is likely forming yellow wave 4, which belongs to the internal 1–2–3–4–5 yellow structure of blue wave 5.

Once yellow wave 4 is completed, price is expected to resume its advance to form yellow wave 5, thereby completing blue wave 5.

From the RSI perspective, the previous rally reached extremely overbought conditions. This suggests that buying pressure remains strong enough to support at least one more push to a new high, potentially accompanied by bearish divergence at the top. This further supports the scenario that yellow wave 5 will form, and that the market is currently in yellow wave 4.

H4 Wave Structure

The current decline has already reached the 0.382 Fibonacci retracement of yellow wave 3.

From a momentum standpoint, D1 momentum is still declining, so in the near term, another 1–2 days of decline or sideways movement remain possible. Meanwhile, H4 momentum is compressed in the oversold zone, indicating a high probability of a bullish reversal on H4.

Therefore, the most likely scenario is continued sideways movement on H4, or a minor continuation lower before a bullish reaction develops.

RSI from the prior bullish leg remains in a strongly overbought condition, reinforcing the idea that the current decline is corrective in nature, and that the market may still form a new high afterward.

3. Trading Plan

Swing setups:

At this stage, there are no attractive swing positions, as the market is currently in the late phase of an extended wave, where price behavior becomes difficult to predict.

Additionally, today is Friday and also the monthly candle close, which significantly increases volatility risk. The appropriate approach is to remain patient and observe, waiting for D1 momentum to reach the oversold zone, at which point higher-probability swing setups can be considered.

GOLD Next Move PossibilitiesThis is a **2-hour Gold (XAUUSD) chart**

### 📈 Overall Trend

* Price was in a **strong bullish move** (higher highs + higher lows)

* Riding above moving averages (blue/green = fast MAs, red = long MA)

* Momentum peaked near **5595** (marked resistance)

---

### 🔴 Major Resistance

**5595 area (red line at top)**

➡️ Strong selling zone

➡️ If price breaks and holds above this = **big bullish continuation (“to the moon”)**

---

### 🟠 Key Break Level

**5373 zone – “above new long”**

This was:

* Previous support

* Now acting as **resistance**

👉 Bulls need price back above **5373** to regain strength

---

### 🟢 Current Support

**5126 (Support now)**

This is where price is reacting currently.

* If holds → possible bounce

* If breaks → more downside likely

---

### ⚠️ Immediate Support Below

**5016**

Marked as:

> “new shorts below”

Meaning:

* If price breaks 5016 → sellers likely push it lower

---

### 🧱 Bigger Supports (if crash continues)

| Level | Meaning |

| -------- | ----------------- |

| **4857** | medium support |

| **4654** | final big support |

---

### 📊 Moving Averages Signal

* Fast MAs crossed **downward**

* Price dropped below them

👉 This shows **short-term bearish pullback**, not full trend reversal yet

---

### ✅ Simple Interpretation

**Bullish long-term**

**Bearish short-term correction**

#### Scenarios:

🔼 Bullish:

* Hold above 5126

* Break back above 5373

* Then target 5595+

🔽 Bearish:

* Break 5126 → go to 5016

* Break 5016 → likely 4857 → 4654

---

In short:

> Gold had a strong rally, hit heavy resistance at 5595, and is now pulling back to supports. Trend is still bullish overall, but short-term momentum is weak.

BANK NIFTY 15m – Liquidity Levels in FocusThe marked levels are derived from prior session liquidity and repeated price reactions.

Price has continued to respect these zones, confirming them as important reference areas.

For the next session, price behavior around these levels will be key.

Acceptance above or rejection below will help define intraday bias and potential continuation or retracement scenarios.

US Oil Has just broken out of Inverted H&S PatternTVC:USOIL has broken the neckline at $62 on a daily chart and, along with other commodities, is ready to climb to $70 levels in the coming weeks.

We keep $58 is the hard stop if the price recedes below the neckline.

Historically, rallies in Gold, Silver, and Crude Oil go hand in hand, though this time Oil started late.