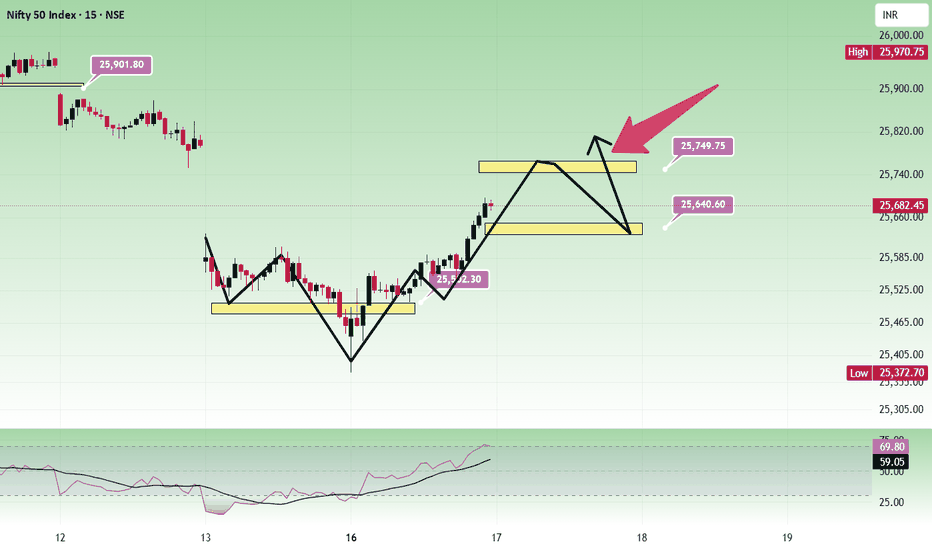

Nifty Analysis for Feb 16-18, 2026Wrap up:-

Nifty is now in wave 3 of major wave c, in which wave 1 is completed at 25641 and wave 2 is in progress which is making a abc/wxy corrected pattern of which wave a or w is completed at 25685 and currently, wave x or b is expected to be completed at 25444 once nifty breaks and sustains above 25660. Thereafter, wave c or y will head towards for a Probable target i.e. 25932.

What I’m Watching for Feb 16-18, 2026 🔍

Once nifty breaks and sustains above 25660, low risk entry range is 25523-25577 for a Probable target i.e. 25932 with a stoploss of 25444.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Market indices

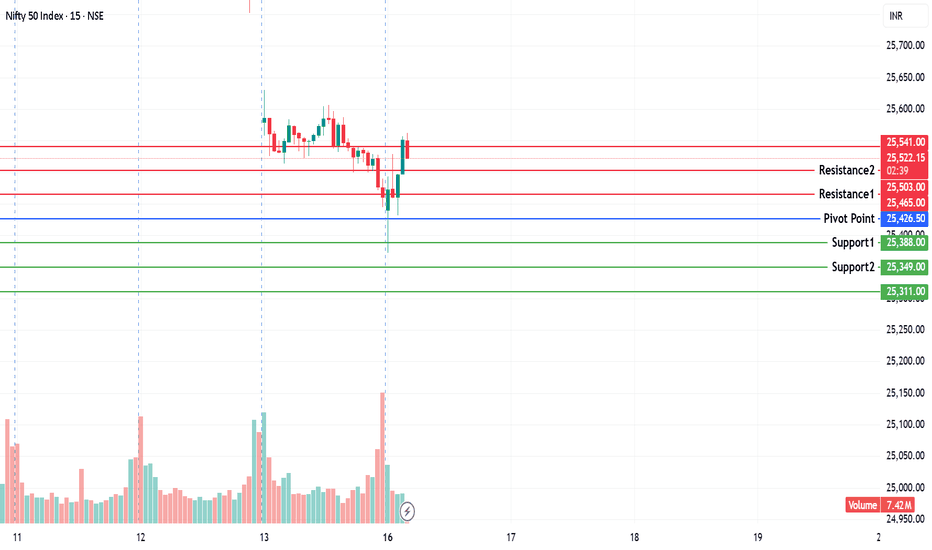

NIFTY KEY LEVELS FOR 16.02.2026NIFTY KEY LEVELS FOR 16.02.2026

Timeframe: 3 Minutes

Post Delayed due to a technical glitch.. sorry for the delayed post..

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research

Nifty - Weekly Review Feb 16 to Feb 20We have two unfilled gaps. 25630 to 25750 and 25440 to 25110. These gaps can act as strong support or resistance. The price sustaining above or below these levels can decide the trend direction.

Buy above 25520 with the stop loss of 25460 for the targets 25560, 25600, 25660, 25720, 25800, and 25860.

Sell below 25400 with the stop loss of 25460 for the targets 25360, 25300, 25240, 25180, 25120, 25060 and 25020.

Always do your analysis before taking any trade.

NIFTY : Trading levels and Plan for 16-Feb-2026📘 NIFTY Trading Plan – 16 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 25,727 – Last Intraday Resistance

🟢 25,622 – Opening Resistance

🟠 25,350 – 25,427 – Opening Support Zone (Consolidation)

🟢 25,120 – 25,207 – Buyer’s Demand Zone

🟢 25,460 – Current Reference Price

🧠 Market Structure & Price Psychology

NIFTY has completed a short-term ABC corrective decline and is now reacting from a demand accumulation zone.

👉 This suggests dip buying interest emerging

👉 However, confirmation requires acceptance above resistance

Market is currently in a reversal attempt phase, not a confirmed uptrend yet.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,600)

🧠 Psychology

Gap up indicates short covering + demand follow-through, but supply overhead may trigger profit booking.

🟢 Bullish Plan

🔵 Sustaining above 25,622 (15-min close)

🔵 Upside opens towards 25,727

🔵 Break & hold above → Trend reversal confirmation

🔴 Rejection Plan

🔴 Failure near 25,727

🔴 Pullback towards 25,622 → 25,427

📌 Why this works

Reversal rallies need acceptance above supply, not just gap spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,420 – 25,550)

🧠 Psychology

Flat opening inside consolidation reflects base formation & liquidity absorption.

🟠 Consolidation Zone

🔸 25,350 – 25,427

🔸 Expect sideways chop until breakout

🟢 Upside Plan

🔵 Break & hold above 25,622

🔵 Targets: 25,727

🔴 Downside Plan

🔴 Breakdown below 25,350

🔴 Drift towards 25,207 → 25,120

📌 Why this works

Bases resolve with expansion — patience improves entries.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,350)

🧠 Psychology

Gap down signals fear sentiment continuation, but strong demand zones attract institutional buying.

🟢 Bounce Setup

🔵 If 25,120 – 25,207 holds

🔵 Expect sharp short-covering bounce towards 25,350 → 25,622

🔴 Breakdown Setup

🔴 Clean break below 25,120

🔴 Downside momentum may accelerate

📌 Why this works

Demand zones create either V-shaped reversals or panic breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Wait for first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile openings

🟢 Avoid trading inside consolidation zones ❌

🟢 Risk only 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY reacting from ABC corrective demand zone

📌 25,622 & 25,350 are key intraday triggers

📌 Break above 25,727 confirms reversal continuation

📌 Trade reaction, not bias 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

Part 1 Institutional Option Trading VS. Technical Analysis Core Philosophy

Institutional Option Trading (IOT)

Institutions like hedge funds, quant desks, proprietary trading desks, banks, and market makers trade options based on:

Order-flow dominance

Risk-neutral hedging

Volatility arbitrage

Liquidity extraction

Portfolio hedging strategies

Macro + quantitative modeling

They don’t focus on chart patterns.

They focus on controlling volatility, absorbing liquidity, and managing large risk exposure.

Technical Analysis (TA)

Retail and discretionary traders use price charts to:

Find patterns

Identify support & resistance

Predict breakouts

Understand market psychology

Time entries and exits

Trendlines, indicators, candlestick patterns = core decision drivers.

👉 TA looks at price.

IOT looks at order flow + volatility.

Nifty - Expiry day analysis Feb 17The price is between the important zone(gap) 25650 and 25750. Once this gap is filled, the price has to decide the trend direction.

The past few days' price movement has formed an inverted head-and-shoulder pattern. And the price gave the movement to fill the gap.

Buy above 25640 with the stop loss of 25580 for the targets 25680, 25720, 25780, 25820 and 25860.

Sell below 25480 with the stop loss of 25530 for the targets 25440, 25400, 25360, 25300 and 25260.

Expected expiry day range is 25500 to 25900.

Always do your analysis before taking any trade.

Part 2 Institutional Option Trading VS. Technical AnalysisData Inputs

Institutional Option Trading

Data used:

Option chain microstructure

Vega, vanna, charm, gamma profiles

Dealer hedging flows

Open interest shifts

Dark-pool and block trades

Implied vs. realized volatility

Risk-neutral distributions

Market-wide liquidity depth

Institutions trade by anticipating where hedging pressure will push price.

Technical Analysis

Data used:

Candlesticks

Chart patterns

Indicators (RSI, MACD, Bollinger Bands, Volume etc.)

Moving averages

Price structure

Trendlines

TA traders react to visible price behavior, not volatility structure.

Part 1 Institutionaal Intraday Trading The Infrastructure: Speed and Connectivity

Institutional traders don’t use standard web-based brokers. They operate on direct market access (DMA) systems, connecting directly to stock exchange servers.

Co-location: Many firms pay premium fees to house their servers in the same data center as the exchange’s servers. This reduces "latency"—the time it takes for data to travel—to microseconds.

Dark Pools: To avoid moving the market price against themselves, institutions often trade in "Dark Pools." These are private exchanges where buy and sell orders are hidden from the public until the trade is executed.

High-Frequency Trading (HFT): A subset of institutional trading where algorithms execute thousands of orders per second. These firms don't look for big price moves; they look for fractions of a cent across millions of trades.

Part 5 Advance Trading Tips Smart Money Concepts (SMC)

SMC studies how banks and institutions trap retail traders.

Core Elements

Liquidity Sweeps (stop-hunt areas)

Order Blocks (institutional supply-demand zones)

Fair Value Gaps (FVG)

Displacement (powerful institutional candle)

How To Trade SMC

Identify liquidity (swing highs/lows).

Wait for sweep (price grabs liquidity).

Look for BOS (trend shift).

Enter at Order Block / FVG.

Place stop-loss beyond liquidity.

Sensex - Weekly review Feb 16 to Feb 20The price is between the resistance at 83k and the support at the 81700 zone. The gap towards the 81700 zone will get filled if the price gets more bearish. In the daily chart, there is a trend line support at the 81700 zone.

If the price opens flat, buy above 82620 with the stop loss of 82500 for the targets 82740, 82860, 82980, 83120, 83280, 83400, 83540 and 83760.

Sell below 82400 with the stop loss of 82540 for the targets 82280, 82140, 82020, 81840, 81700 and 81540.

Please always do your analysis before you take any trade.

#BANKNIFTY PE & CE Levels(16/02/2026)Bank Nifty is expected to open with a gap down around the 60100–60050 zone, indicating early weakness compared to the previous close. Price has already shown selling pressure in the last session and is now approaching a key intraday support area. The opening reaction near 60050 will be very important to decide the next directional move.

On the upside, 60050–60100 is acting as an immediate support band. If price sustains above 60050 and forms strong bullish candles on the 15-minute timeframe, a recovery trade can be considered by buying CE around 60050–60100 with upside targets at 60250, 60350, and 60450+. A strong breakout and hold above 60450 can further extend the rally toward 60550 and higher levels.

On the downside, if price fails to hold 60000 and breaks below 59950, fresh selling pressure may trigger. In that case, PE can be considered below 59950 with targets at 59750, 59650, and 59550. A sustained move below 59550 would confirm deeper intraday weakness.

Overall, with a gap down opening near support, avoid chasing trades in the middle range. Either wait for a confirmed bounce above 60050 or a clean breakdown below 59950. Maintain strict stop loss and trail profits according to momentum.

NIFTY Intraday Trade Setup For 17 Feb 2026NIFTY Intraday Trade Setup For 17 Feb 2026

Bullish-Above 25700

Invalid-Below 25650

T- 25915

Bearish-Below 25490

Invalid-Above 25540

T- 25245

NIFTY has closed on a bullish note with 0.82% gain, making an engulfing candle in daily TF. Index took support from 25500. Next time index will be gripped by bears if this base breaks below 25490. Since its an engulfing candle above 25700 we can expect a move till 25915-50, intraday resistance for the day. 25245 will be target below 25490.

Plan on a 15 Min candle close on the breakout levels, 25700 and 25490.

I am Not SEBI Registered

This is my personal analysis for my personal trading. Kindly consult your financial advisor before taking any actions based on this.

Nifty Analysis for Feb 17-19, 2026Wrap up:-

Nifty is now in wave 3 of major wave c, in which wave 1 is completed at 25641 and wave 2 is in progress which is making a wxy corrected pattern of which wave w is completed at 25685.

Earlier, we have taken breakout above 25660 will complete wave x of inner wave 2 but now, after today low counts have been changed.

Now, wave x is completed at 25372, as nifty breaks and sustains above 25615 and therefore, wave y will head towards for a Probable target i.e. 25932.

What I’m Watching for Feb 17-19, 2026 🔍

As nifty breaks and sustains above 25615, low risk entry range is 25522-25470 for a Probable target i.e. 25932 with a stoploss of 25372.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

NIFTY : Expiry Day Trading levels and Plan for 17-Feb-2026

Current Context: Nifty closed at 25,682.75 on Feb 16, rebounding strongly by ~0.83%. The index is currently sitting right at the "Flat Opening Case" level shown on your chart, sandwiching itself between the 25,554 - 25,691 decision zone.

🟢 Scenario 1: Gap Up Opening (Above 25,780)

A Gap Up of 100+ points would open the index near 25,780 - 25,800, approaching the 25,873 resistance level shown on your chart.

🔸 Plan Action:

Wait for Resistance Test: Do not chase the gap immediately. Watch for price action at 25,873.

Bullish Breakout: If the first 15-minute candle closes above 25,873, initiate long positions targeting the upper red line at 26,089.

Rejection Play: If price faces rejection at 25,873 (forming a shooting star or bearish engulfing), look for a short trade back towards the gap fill at 25,691.

Educational Logic: A gap up into a resistance zone often invites profit booking from overnight bulls. A "sustained" breakout above 25,873 confirms that buyers are ready to attack the 26,000 psychological barrier (Call Writer's Zone).

🟡 Scenario 2: Flat Opening (Range 25,650 - 25,720)

A flat opening keeps the price inside the Opening Support/Resistance Zone (25,554 - 25,691) marked in beige on your chart.

🔸 Plan Action:

No Trading Zone: The area between 25,554 and 25,691 is a volatility trap. Avoid aggressive trades here.

Buy the Dip: If price dips to the lower boundary of 25,554 and forms a bullish hammer, take a low-risk CALL trade.

Sell the Rip: If price struggles at 25,691, look for a PUT trade targeting the lower end of the box.

Educational Logic: In a flat opening, the market often oscillates within the previous day's value area. The 25,554 level is crucial because it aligns with the recent breakout zone; holding this level keeps the "Buy on Dips" structure intact.

🔴 Scenario 3: Gap Down Opening (Below 25,580)

A Gap Down of 100+ points would threaten the 25,554 support level marked as "Opening Support (Negative Opening Case)."

🔸 Plan Action:

Crucial Support Test: Watch the 25,554 level closely. If the opening candle closes below this level, the bullish structure is damaged.

Bearish Momentum: A sustained break below 25,554 opens the door for a slide to 25,442 (Last Intraday Support). Aggressive shorts can trigger here.

Panic Level: If 25,442 is broken, the next major support is substantially lower at 25,205.

Educational Logic: A large gap down that breaks the 25,554 support traps the late bulls who bought the Feb 16 recovery. Their stop-loss triggers will fuel a sharper decline towards the 20-day Moving Average or lower support zones.

🛡️ Risk Management for Options Trading

🔹 Position Sizing: Volatility (VIX) is around 13.3, meaning premiums are not very expensive but spikes can be sudden. Use only 30-40% of your capital for overnight positions.

🔹 The "Zone" Rule: strictly avoid trading inside the 25,554 - 25,691 box if you are an option buyer. Theta decay will eat your premium. Wait for the breakout/breakdown.

🔹 Stop Loss Trail: If you are long above 25,691, trail your SL to cost once the index moves 40 points in your favor.

🔹 Hedge for Gap Downs: Since global cues can be mixed, always carry a hedge (like a far OTM Bear Put Spread) if holding heavy long positions overnight.

📝 Summary & Conclusion

The Nifty 50 has shown resilience by reclaiming 25,680, but the battle is not won. The key for Feb 17 is the 25,554 support. As long as price stays above this, the bulls have a chance to test 25,873 and 26,089. A breach of 25,554 invalidates the recovery and puts the bears back in control targeting 25,442.

⚠️ Disclaimer: I am not a SEBI registered analyst. This post is for educational purposes only. Trading involves financial risk; please consult a financial advisor before taking any trades.

silver dowjones ratio charthi

this is ratio chart

showacsingwe are at the verge of repeating 1968-1980

this ratio chart

hi

this is ratio chart

showacsingwe are at the verge of repeating 1968-1980

this ratio chart

hi

this is ratio chart

showacsingwe are at the verge of repeating 1968-1980

this ratio chart

hi

this is ratio chart

showacsingwe are at the verge of repeating 1968-1980

this ratio chart

NIFTY Scalping / Short Range Level Analysis for 17th FEB 2026NIFTY Scalping / Short Range Level Analysis for 17th FEB 2026

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

⚪Weekly PCR Analysis:

17 Feb 2026 EXP. Weekly Basis =>

Put OI: 30,07,563, Call OI: 28,22,123, PCR: 1.07. Trend Strength: ⚪NEUTRAL.

Intraday Change in Weekly Basis Data =>

Put OI Change: 12,12,597,Call OI Change: -11,45,868, Change OI PCR: -1.06. Trend Strength: ⚪NEUTRAL.

🟣FEB EXP. Monthly PCR Analysis:

Put OI: 10,98,791, Call OI: 11,27,430, PCR: 0.97. Trend Strength: ⚪NEUTRAL.

Intraday Change in Monthly Basis Data =>

Put OI Change: -2,24,033, Call OI Change: -12,76,400, Change OI PCR: 0.18. Trend Strength: 🔴 Bearish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

Some Technical Parameter:

🛑 VWap vs Price: Price Below.

🟢 Rsi(14): 50.87

🟡 Stoch Rsi(14): 62.79, 61.15 (Down but Neutral though Bearish Cross Over)

🟢 MACD Bias (12,26): 13.81 (Bullish)

🟡 Williams %R: -37.21 (Perfect Reversal Point Near -80)

🟠 ROC: 1.34

Time Frame basis Trend:

🟢1 Min: Bear, 🟢5 Min: Bear, 🟢15 Min: Bear, 🟢30 Min: Bear, 🛑1 Hour Bear,

🛑2 Hour: Bear, 🟢4 Hour: Bullish, 🟢Daily : Bullish, 🟢Weekly: : Bullish, 🟢Monthly: Bullish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

MA (Moving Averages) Analysis:

⬛Period - 🟨SMA - 🟦EMA

🟥 MA 9 - 25758.87 - 🟩 25679.28

🟩 MA 20 - 25472.87 - 25635.14

🟥 MA 50 - 25765.06 - 🟩 25677.64

🟩 MA 100 - 25688.76 - 25583.76

🟩 MA 200 - 25299.65 - 25220.75

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

👇🏼Screenshot of NIFTY Spot All-day(16th FEB 2026) in 5 min TF with perodical update.

🚀Follow GIFTNIFTY Post for NF levels

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"🔔As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.________________^^^^^^^^^^^^^^^^_________________

#NIFTY Intraday Support and Resistance Levels - 16/02/2026Nifty is expected to open with a gap down around the 25470–25450 zone, indicating initial bearish sentiment compared to the previous close. Price is currently trading below the immediate resistance zone of 25550 and has shown consistent selling pressure in the last session. The early reaction near 25450 will be crucial to determine whether this gap down extends further or results in a bounce.

On the upside, 25550 is acting as an important resistance level. If price reclaims 25550 with strong bullish momentum and sustains above it on the 15-minute timeframe, a long position can be considered above 25550 with targets at 25650, 25700, and 25750+. A clean breakout above 25750 may further push the index toward 25800 and higher levels. However, unless 25550 is decisively broken and sustained, upside moves should be treated as pullback rallies.

On the downside, if price breaks and sustains below 25450, fresh selling pressure may accelerate. Short positions can be considered below 25450 with targets at 25350, 25300, and 25250. If 25250 is breached with strong momentum, the next support zone near 25200–25180 could come into play. Traders should watch for strong bearish candles or breakdown retests for confirmation rather than entering on the first spike.

Overall, with a gap down opening and price trading below key resistance, the bias remains slightly bearish unless 25550 is reclaimed. Avoid trading in the consolidation zone between 25450 and 25550. Wait for a clear breakout or breakdown, maintain strict stop loss, and trail profits as per momentum to manage risk effectively.

NIFTY Rejection Zone at 25515–25535 – Sell on Rise SetupNifty is showing clear bearish intent, and price action suggests that 25515–25535 is emerging as a strong supply zone. This area has previously attracted selling pressure, and we expect sellers to defend it aggressively again.

As long as NIFTY trades below this resistance band, momentum favors the downside.

📌 Trade Plan:

Strategy: Sell on Rise

Resistance Zone: 25515 – 25535

Targets:

🎯 25450

🎯 25410

🎯 Extended target below 25400

Bias: Bearish below 25535

If price fails to sustain above the resistance zone, sellers could push the index back toward 25400 levels and potentially lower.

⚠️ Watch for rejection candles / lower high formation near resistance for better confirmation.

📌 Disclaimer

This analysis is strictly for educational purposes and not financial advice. Please consult your financial advisor and follow your own trading plan before taking any trades.

If you find this idea useful, hit the like button and share your views—your feedback helps us create better trading insights for the community.

🚀 Trade smart. Trade disciplined.

Happy Trading,

– The InvestPro Team

NIFTY Levels for Today

Here are the NIFTY's Levels for intraday (in the image below) today. Based on market movement, these levels can act as support, resistance or both.

Please consider these levels only if there is movement in index and 15m candle sustains at the given levels. The SL (Stop loss) for each BUY trade should be the previous RED candle below the given level. Similarly, the SL (Stop loss) for each SELL trade should be the previous GREEN candle above the given level.

Note: This idea and these levels are only for learning and educational purpose.

Your likes and boosts gives us motivation for continued learning and support.

Bulls on the Backfoot as Nifty Breaks Key Support - What Next?After trading in a narrow range, Indian markets finally cracked under pressure from weak global cues and rising concerns around AI’s long-term impact on global outsourcing demand.

The Nifty 50 slipped nearly 0.9% for the week, closing at 25,471, while volatility spiked sharply.

The fear gauge, India VIX, jumped 11% to 13.29 — a clear sign that nervousness is creeping back into the system.

◉ Technical Structure

Nifty oscillated within roughly a 570-point range last week but ended below the crucial 25,500 level, which had previously acted as immediate support.

This breakdown slightly weakens the short-term setup and shifts the tone from neutral to cautious.

◉ Key Levels to Watch

Immediate Resistance: 25,500 – 25,600

Strong Resistance: 26,000 – 26,100

Strong Support Zone: 25,000 – 24,900

◉ Key Triggers for the Week Ahead

1. IT Stocks in Focus

The IT sector was the worst performer, falling over 8% last week.

Investors are increasingly worried that generative and agentic AI technologies may structurally reduce demand for traditional outsourcing services — impacting long-term earnings visibility.

If IT continues to weaken, index recovery may remain capped.

2. US Fed Minutes

Markets will track the latest policy minutes from the Federal Reserve, along with upcoming U.S. GDP data.

Any hawkish surprise could add to global pressure.

3. RBI MPC Minutes

The Reserve Bank of India will release its latest MPC minutes this week. Investors will look for clarity on inflation outlook, liquidity conditions, and future policy direction.

◉ Outlook

The index now appears vulnerable near current levels. A test of 25,350–25,300 looks possible in the near term. Failure to hold that zone may push Nifty toward 25,000.

Until the index sustains above 25,600, upside momentum is likely to remain limited. Traders should focus on protecting gains and maintaining disciplined risk management rather than aggressively chasing longs.

BANKNIFTY Levels for Today

Here are the BANKNIFTY’s Levels for intraday (in the image below) today. Based on market movement, these levels can act as support, resistance or both

Please consider these levels only if there is movement in index and 15m candle sustains at the given levels. The SL (Stop loss) for each BUY trade should be the previous RED candle below the given level. Similarly, the SL (Stop loss) for each SELL trade should be the previous GREEN candle above the given level.

Note: This idea and these levels are only for learning and educational purpose.

Your likes and boosts gives us motivation for continued learning and support.