Bitcoin sees most fear since $83K as analysis eyes ‘turning point’

Key points:

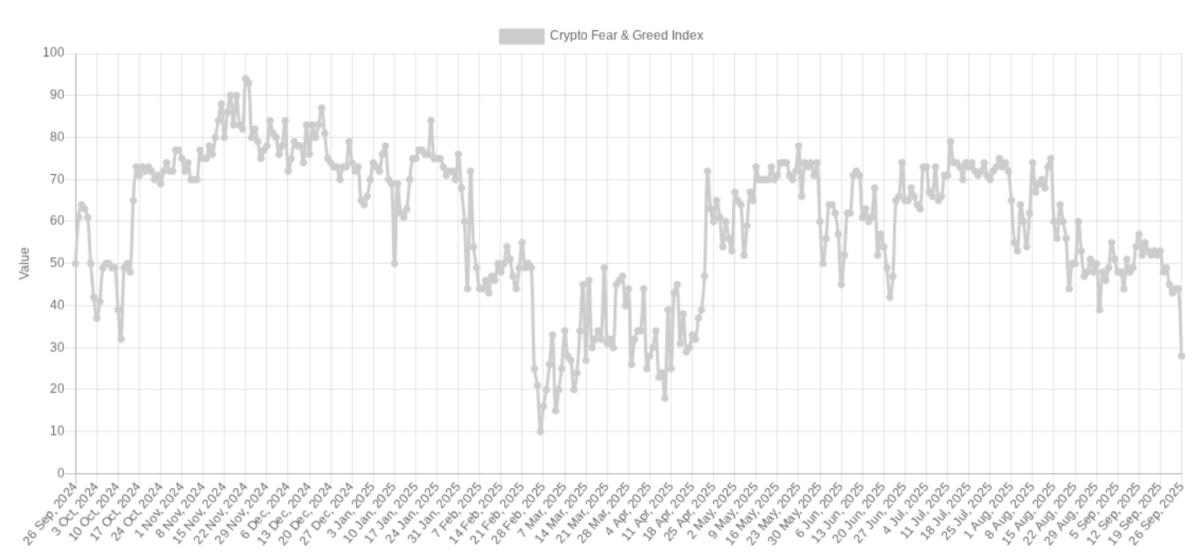

The Crypto Fear & Greed Index is back at levels not seen since Bitcoin traded at $83,000.

Analysis wonders whether the BTC price “turning point” is already here.

Social media user behavior already suggests that a price rebound should take place next.

Bitcoin BTCUSD sentiment collapsed overnight Thursday as the latest BTC price dip forced fresh liquidations.

New data from the Crypto Fear & Greed Index shows that “fear” now drives the mood.

Bitcoin sentiment echoes April lows

Bitcoin, nearing new monthly lows under $109,000, had a near-instant impact on market sentiment.

The Fear & Greed Index, which lags market movements, hit just 28/100 on Friday, marking its lowest level since April 11. The index fell 16 points in a single day.

“MORE fear and a HIGHER price,” crypto YouTube channel host Michael Pizzino said in an X post.

Pizzino referred to the emerging divergence between price and sentiment.

The last time that the Fear & Greed Index was below 30/100, BTCUSD traded at about $83,000, days after its recovery from $75,000 lows, data from Cointelegraph Markets Pro and TradingView confirmed.

As a result, accompanying analysis argued that the time is right for a market reversal.

“Could this be the turning point Bitcoin and Crypto has been waiting for? The analysis looks good, but it has not been confirmed,” Pizzino added.

Fear & Greed has been no stranger to erratic moves in 2025. As Cointelegraph reported in February, the Index collapsed to just 10/100 thanks to macroeconomic uncertainty focused on US trade tariffs.

“Impatience and bearishness” rule BTC price takes

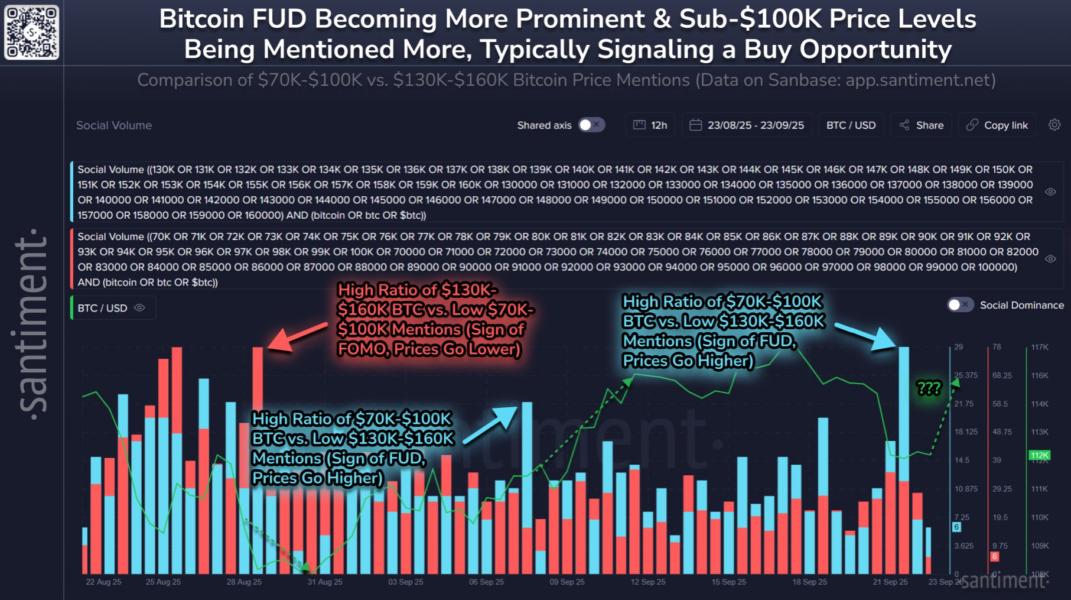

Some signals of an impending BTC price rebound emerged even before the latest dip.

On Tuesday, research platform Santiment showed that social media users were already convinced that lower prices would soon come.

“As usual, social media is vocal on where Bitcoin will head next. Historically, lower price predictions increase the likelihood, and higher predictions imply lower future prices,” it explained to X followers.

Santiment described a “high amount of impatience and bearishness emerging from the retail crowd.”

At the same time, data revealed that large-volume traders have been adding exposure in recent days.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.