Evening Wrap: ASX 200 stacks on over 100 points as it cruises into the 9,000s and to a new record close

The S&P/ASX 200 closed 101.1 points higher, up 1.13%.

A smashing performance from the Australian stock market today... Literally smashing! 💪💪💪

It smashed through 9000 – and it smashed to a new record high close.

All 11 of the major sectors logged gains, with Industrials (XNJ) (+3.4) (led by Brambles (BXB) (+13.2%), Consumer Staples (XSJ) (+2.1%) (a broad based move here...), and Consumer Discretionary (XDJ) (+2.1%) (led by Super Retail (SUL) (+12.3%)) at the forefront of the gains.

For those who were biting their nails over the carnage in the battery metals and rare earths sectors yesterday – good news – many recouped most of their losses. Here, Pilbara Minerals (PLS) (+5.2%) and Lynas Rare Earths (LYC) (+4.5%) were notable.

To make sense of all the above, I have detailed technical analysis on the Nasdaq Composite, the S&P/ASX 200, and the SSE Composite (SSEC) (China) in today's ChartWatch.

Be sure to click/scroll through for the usual reporting of the major sector and stock-specific moves, the broker responses to them, as well as all the key economic data in tonight's Evening Wrap.

Let's dive in!

Today in Review

Thu 21 Aug 25, 5:22pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 9,019.1 | +1.13% |

| All Ords | 9,284.2 | +1.16% |

| Small Ords | 3,506.0 | +1.18% |

| All Tech | 4,295.5 | +0.68% |

| Emerging Companies | 2,505.4 | +1.25% |

| Currency | ||

| AUD/USD | 0.6417 | -0.25% |

| US Futures | ||

| S&P 500 | 6,414.25 | +0.02% |

| Dow Jones | 44,965.0 | -0.07% |

| Nasdaq | 23,345.5 | +0.09% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Industrials | 8,780.4 | +3.43% |

| Consumer Staples | 12,884.6 | +2.14% |

| Consumer Discretionary | 4,620.6 | +2.05% |

| Energy | 9,165.4 | +1.56% |

| Health Care | 41,060.2 | +0.87% |

| Financials | 9,766.4 | +0.87% |

| Materials | 17,613.6 | +0.80% |

| Utilities | 10,206.7 | +0.78% |

| Information Technology | 2,979.8 | +0.53% |

| Communication Services | 1,976.0 | +0.51% |

| Real Estate | 4,244.7 | +0.19% |

Markets

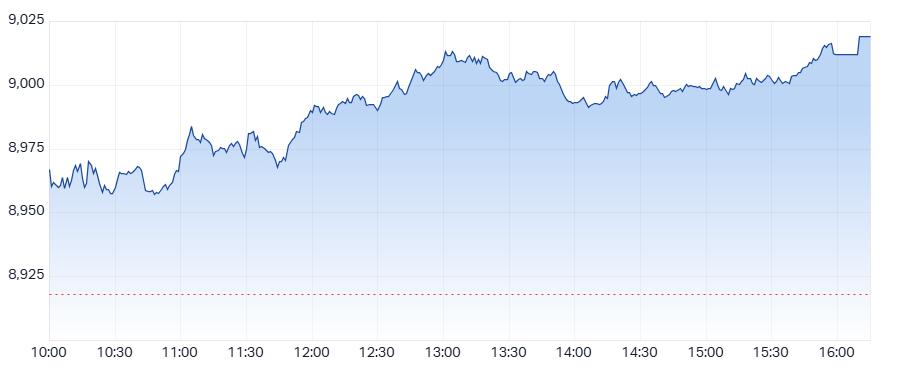

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 101.1 points higher at 9,019.1, 1.13% from its session low and smack–bang on its session high 💪. In the broader-based S&P/ASX 300 (XKO) advancers beat decliners by a resounding 208 to 69 💪.

Today's best blue chip gainers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Brambles (BXB) | $26.30 | +$3.07 | +13.2% | +12.0% | +67.4% |

Telix Pharmaceuticals (TLX) | $18.10 | +$1.18 | +7.0% | -15.1% | -7.3% |

Downer EDI (DOW) | $7.34 | +$0.41 | +5.9% | +6.4% | +51.0% |

Pilbara Minerals (PLS) | $2.21 | +$0.11 | +5.2% | +20.8% | -23.3% |

Lynas Rare Earths (LYC) | $14.61 | +$0.63 | +4.5% | +44.1% | +131.9% |

Mineral Resources (MIN) | $36.87 | +$1.58 | +4.5% | +20.3% | -16.6% |

The A2 Milk Company (A2M) | $8.82 | +$0.33 | +3.9% | +13.5% | +54.7% |

Stockland (SGP) | $6.34 | +$0.22 | +3.6% | +15.7% | +36.1% |

The Lottery Corporation (TLC) | $5.85 | +$0.19 | +3.4% | +7.3% | +19.0% |

Transurban Group (TCL) | $14.77 | +$0.47 | +3.3% | +8.2% | +10.0% |

Whitehaven Coal (WHC) | $6.63 | +$0.2 | +3.1% | -7.7% | -10.5% |

Challenger (CGF) | $8.79 | +$0.26 | +3.0% | +6.3% | +19.3% |

IGO (IGO) | $5.29 | +$0.15 | +2.9% | +1.5% | +6.2% |

Woolworths Group (WOW) | $33.61 | +$0.87 | +2.7% | +7.6% | -2.6% |

Bendigo and Adelaide Bank (BEN) | $13.05 | +$0.33 | +2.6% | +5.7% | +5.5% |

Wesfarmers (WES) | $94.76 | +$2.29 | +2.5% | +14.0% | +27.7% |

Hub24 (HUB) | $107.43 | +$2.59 | +2.5% | +2.5% | +111.1% |

CSL (CSL) | $226.00 | +$5.26 | +2.4% | -14.9% | -26.6% |

Dyno Nobel (DNL) | $3.11 | +$0.07 | +2.3% | +6.5% | +4.0% |

Treasury Wine Estates (TWE) | $8.15 | +$0.18 | +2.3% | +1.0% | -33.4% |

Today's worst blue chip losers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

Sonic Healthcare (SHL) | $25.05 | -$3.69 | -12.8% | -10.4% | -10.1% |

James Hardie Industries (JHX) | $28.98 | -$3.02 | -9.4% | -30.7% | -42.9% |

Insurance Australia Group (IAG) | $8.75 | -$0.35 | -3.8% | +2.8% | +17.8% |

Goodman Group (GMG) | $35.62 | -$0.52 | -1.4% | +1.1% | +3.8% |

AGL Energy (AGL) | $8.54 | -$0.12 | -1.4% | -13.4% | -28.7% |

AMP (AMP) | $1.750 | -$0.02 | -1.1% | +5.7% | +34.6% |

Washington H Soul Pattinson (SOL) | $42.09 | -$0.43 | -1.0% | +2.7% | +21.9% |

Car Group (CAR) | $40.89 | -$0.38 | -0.9% | +9.6% | +12.2% |

Xero (XRO) | $169.00 | -$1.3 | -0.8% | -6.2% | +20.1% |

Light & Wonder (LNW) | $140.05 | -$1.07 | -0.8% | -7.0% | -10.9% |

QBE Insurance Group (QBE) | $21.43 | -$0.15 | -0.7% | -6.5% | +31.7% |

Amcor (AMC) | $13.26 | -$0.07 | -0.5% | -11.2% | -15.4% |

Steadfast Group (SDF) | $6.32 | -$0.03 | -0.5% | +5.9% | -2.2% |

Qube (QUB) | $4.48 | -$0.02 | -0.4% | +3.0% | +15.5% |

Life360 (360) | $43.61 | -$0.12 | -0.3% | +16.3% | +140.7% |

Pro Medicus (PME) | $306.91 | -$0.66 | -0.2% | -5.3% | +104.6% |

ChartWatch

Nasdaq Composite Index

Nasdaq Composite Index chart (

Two black candles in a row… the zebra’s run ends at 13 this time 🦓🚫!

But it’s not like last night’s candle was a total supply-side controlled washout. Quite the contrary – and I suspect this is what the XJO and some of the other Asian markets worked off today.

Sure, the S&P 500, Comp, and Russell 2000 were down, on Wednesday – but they were far from out.

That long downward pointing shadow suggests the demand-side did step in to mop up what was to be fair – a rather unsupported supply-side push (look at the very low volume on the session). Supply was motivated (i.e., clearly the price moved down at the start of the session), but there wasn’t much of it.

But! Nor really, was there all that much demand around in the subsequent push back up. 🤔

We’ll take the win in terms of the candle shadow pointing the right direction – and the fact that it occurred at a logical place – the dynamic demand of the short term uptrend ribbon… But one thing is crystal clear here:

US investors are refusing to commit in terms of size.

Price is a different matter, however, as prices are moving up and down over the last few sessions – but I think it’s safe to conclude this is because of a lack of size in the way (either way). So, thin markets, a bit of motivation from whoever’s still prepared to trade = volatility during the last couple of sessions.

We’ve discussed at length all this week the potential reasons for this lack of committal, FOMC Meeting Minutes (now out of the way), and the BIG ONE – this weekend’s Jackson Hole Symposium during which Fed Chairman Jerome Powell will either make or break the market’s expectation for a September (and possibly December?) rate cut.

So, despite the encouraging candle shadow pointing in the preferred direction last night – I propose we get more of the same tonight and Friday: A market devoid of committed traders, with whoever’s left over flicking bits of stock into a thin market that’s susceptible to decent-sized swings either way.

If I put aside the potential underlying reasons for the recent price action – and just focus solely on the price action itself (which is what I really should be doing), then I see a decent hold of the short term uptrend ribbon, demand-side control largely maintained in the very short term, and otherwise still definitely intact in a broader sense.

Conclusion: Notwithstanding yesterday’s calls for “piqued” alertness and a more circumspect approach, it’s still – Stay the course = FRP.

S&P/ASX 200 (XJO)

S&P/ASX 200 chart (click here for full size image)

What can I say (wipes tear from the corner of eye), I’m just so proud of our little Golden Le Creuset! 🥲

Sure, I’ve given it a hard time over the years – labelling it a Tin Pot of a market that has just a few banks, a few resources, Wesfarmers and Telstra… If US stocks were rampaging, you’d almost guarantee we were sucking our thumbs in comparison, or at best, begrudgingly trudging a long way behind…

But today it’s done me, ahem, all of us proud 💪.

It’s shrugged off less than ideal leads from US markets and lower base metals prices, to surge the better part of one percent and smash to another record high. Just look at that chart with all of its green ribbons, zig-zagging upwards price action, and swathe of white candles.

It’s a picture of excess demand. It’s a picture of beauty 🥰.

I don’t care why (nor do I care if it’s still cheap or the most expensive it’s been in history).

I’ll leave all of that to the smart people who care to work it out.

Knowing that when they do, they’ll either become part of the demand-side or supply-side.

And based upon how those sides interact… (D + S = P)…

The chart above magically appears…candle by candle.

When the collective smarty pants fundamental analysis brigade grow concerned en masse, I will know:

First I’ll see the candles switch from white-bodies and or downward pointing shadows to black-bodied and upward pointing shadows

Then I’ll see the upward zig-zag of price action flatten – say with a lower peak first, and then a lower trough to match

Then I’ll see the price close below the short term trend ribbon, that ribbon flatten, turn amber…and quite a bit down the track, turn pink.

Eventually, I may even see a similar interaction with the long term trend ribbon…

But I will see it. It must happen this way. There really is no other way.

The good news is, if you keep reading this part of the Evening Wrap (or if you want to look at the XJO chart yourself!), then you’ll see it too 🧐.

In the meantime, there isn’t a single thing in the chart above that doesn’t scream demand-side control – which leads me to the only conclusion I am allowed to draw: Stay the course – FRP.

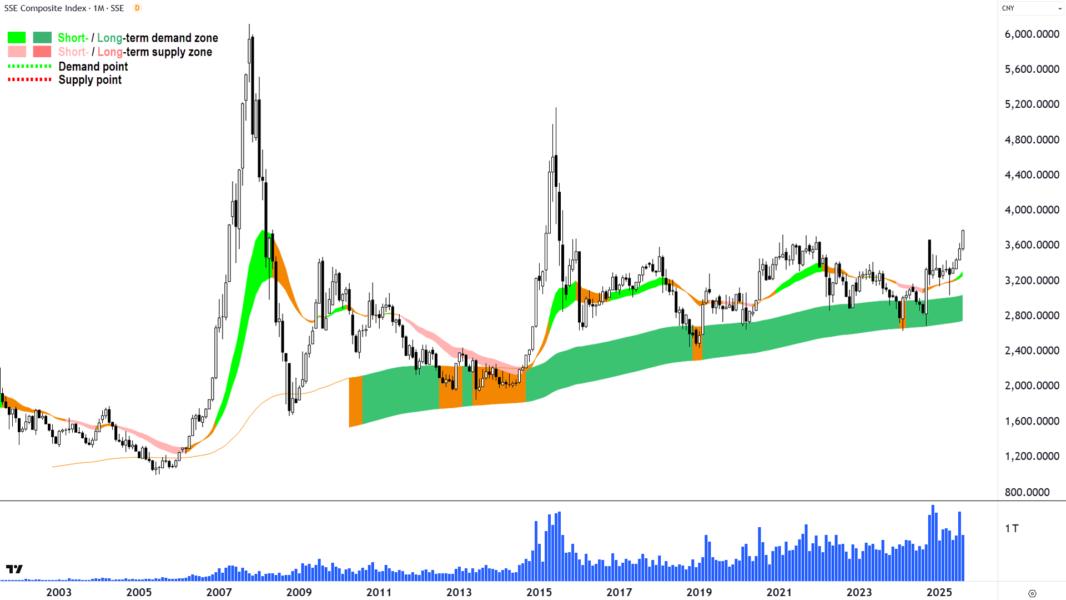

SSE Composite (SSEC) (China)

An interesting chart! (click here for full size image)

I can’t help but think this is helping…

How else do you explain our increasing decoupling from US markets over the last few weeks?

Go on… Explain it! 🤔

The Shanghai Composite Index (or "SSE Composite") tracks Chinese A-shares (i.e., Yuan denominated, traded by domestic and foreigners) and B-shares (foreign currency denominated, traded by foreigners). It’s the broadest major Chinese stock index, hosting well over 2,000 constituents.

And it’s starting to move. As in properly move now.

I suggest we’re getting some international capital flows as a result – as in, it will be in a cell in some smarty pants major fund manager’s spreadsheet: SSEC +1%⬆️ vs ASX 200 +X%⬆️ [hits Enter] = +$X billion⬆️ allocation for Australian equities!

The thing is, because we really are a total Tin Pot of a market – it doesn’t take a big shift in these marginal flows to have a massive positive impact (consider that our market is very thin in terms of liquidity just for local fundies!).

If you also keep track of my work in ChartWatch ASX Scans, you’ll now that the Vaneck FTSE China A50 ETF CETF and the Vaneck China New Economy ETF

CNEW have been making frequent appearances over the last 3 weeks. They are a couple of ways to play this theme from home.

Shanghai Composite Index (SSEC) monthly chart (click here for full size image)

The chart above shows why I think this recent move is even more interesting. We could be on the cusp of a major breakout here. I have a theory when it comes to Chinese stocks: Nothing makes Chinese stocks go up more than Chinese stocks going up. It’s that kind of beast 🤑!

At some point, of course, the Chinese government will step in to spoil the party with various curbs to stop the then-prevailing rampant speculation – but I suggest we’re still a long way from that.

For now, my guess is that the snowball has just been pushed off the top of the mountain… and let’s see where it rolls!

As always, the usual disclaimers before you rush out and load up on Chinese stocks: I have no idea what’s going to happen next because I can’t predict the future… The trend is your friend – so watch it like a hawk for signs it’s starting to bend… And all that stuff!

Economy

Today

AUS August S&P Global Flash Australia PMI (Purchasing Managers Index)

Composite PMI (Services & Manufacturing): 54.9 vs 53.8 in July ⬆️

Services PMI: 55.1 vs 54.1 in July ⬆️

Manufacturing PMI: 52.9 vs 51.3 in July ⬆️

Notes:

Readings above 50 indicate expansion in a sector vs below 50 indicate contraction. So survey suggests a broad-based improvement in Australian business conditions over the last month with growth in both the services and manufacturing sectors accelerating.

Both manufacturing output and services activity rose at their fastest rates in 40 months, matching the Consumer Sentiment survey out earlier in the week that showed the strongest increase in 42 months (the Aussie economy appears to be hotting up! 🔥)

S&P Global said this was due to "higher new work inflows, including a renewed expansion in exports" and that in response "Australian private sector firms raised their staffing levels at a faster rate to cope with additional workloads". Stronger employment is bullish for the Australian economy. S&P Global also noted that business sentiment also improved "slightly" from July.

Later this week

Thursday

17:15 (from) EU Various July Flash Manufacturing and Services Sectors PMIs

23:45 USA July Flash Manufacturing and Services Sectors PMIs

Friday

00:00 USA Jackson Hole Symposium Day 1

Saturday

00:00 USA Federal Reserve Chairman Jerome Powell speaks at Jackson Hole Symposium Day 2

Latest News

Reporting Season mp1

Megaport posted solid numbers for FY25. So why did the stock tank 20%?

Thu 21 Aug 25, 12:57pm (AEST)

Technical Analysis anz apx

ChartWatch ASX Scans: Big Bank Brilliance as ANZ, NAB and WBC power gains, but Real Estate CHC, SCG and SGP also surging

Thu 21 Aug 25, 9:00am (AEST)

Market Wraps

Morning Wrap: ASX 200 to rise, S&P 500 falls for a fourth day + A massive day for corporate earnings

Thu 21 Aug 25, 8:36am (AEST)

Market Wraps

ASX 200 Live Today - Thursday, 21st August

Thu 21 Aug 25, 8:09am (AEST)

Market Wraps a2m arb

Evening Wrap: ASX 200 ekes gain on strong Consumer, Banking stocks, as Lithium and Rare Earths run comes to crushing end

Wed 20 Aug 25, 5:54pm (AEST)

Reporting Season bhp

BHP pays its lowest dividend since 2018. Here's what analysts are thinking

Wed 20 Aug 25, 4:20pm (AEST)

More News

Interesting Movers

Trading higher

+37.7% Artrya (AYA) – FDA clearance of Salix Coronary Plaque module, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+23.8% Redox (RDX) – Redox FY25 Results.

+22.4% Radiopharm Theranostics (RAD) – Radiopharm to host key opinion leader webinar series.

+20.7% Ausgold (AUC) – Transformative Land Acquisition at Katanning Gold Project, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+20.5% Objective Corporation (OCL) – Full Year Results FY2025, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+16.7% Step One Clothing (STP) – Continued positive response to 20-Aug FY25 Results.

+13.8% MA Financial Group (MAF) –1H25 Results, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+13.2% Brambles (BXB) – 2025 Full-Year Result, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+13.1% Autosports Group (ASG) – FY25 Results, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+12.3% Super Retail Group (SUL) – 2025 Full Year Results and Macpac executive leadership transition, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+11.9% Vault Minerals (VAU) – Full-Year Financial Results.

+11.8% Gorilla Gold Mines (GG8) – High Grade Discovery at Happy Jack.

+11.7% Sunrise Energy Metals (SRL) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+11.6% Lindian Resources (LIN) – No news since 20-Aug Investor Presentation - Institutional Placement and FID, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+10.7% Codan (CDA) – Full Year Results, rise is consistent with prevailing short and long term uptrends, one of the most Featured (highest conviction) stocks in ChartWatch ASX Scans Uptrends list 🔎📈

+10.0% Novonix (NVX) – No news, general strength across the broader Battery Materials sector today.

+10.0% Metal Powder Works (MPW) – Becoming a substantial holder from MQG, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+10.0% Novonix (NVX) – No news, general strength across the broader Battery Materials sector today.

Trading lower

-19.5% IPH Ltd (IPH) – FY25 Results.

-13.6% Healius Ltd (HLS) – FY25 Results.

-12.8% Sonic Healthcare Ltd (SHL) – Full Year Results.

-12.1% Veem (VEE) - FY25 Results.

-9.4% James Hardie Industries Plc (JHX) – Continued negative response to 20-Aug Q1 FY26 Results.

-8.0% Australian Clinical Labs Ltd (ACL) – No news, fall is consistent with prevailing short and long term downtrends, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-6.8% Retail Food Group (RFG) – Continued negative response to 20-Aug FY25 Results.

-6.1% Euroz Hartleys Group (EZL) – Full Year Statutory Accounts.

-5.9% GWA Group Ltd (GWA) – No news, ex-dividend $0.08 fully franked.

-5.9% Amareo Ltd (3DA) – Amaero Secures A$50 Million to Accelerate Growth Initiatives.

-5.6% Electro Optic Systems Holdings Ltd (EOS) – No news, continued weakness in Defence stocks...

-5.6% Southern Cross Electrical Engineering Ltd (SXE) – Continued negative response to yesterday's Full year results.

-5.5% Lycopodium Ltd (LYL) – No news since yesterday's FY2025 Financial Report.

Broker Moves

AIC Mines (A1M)

Retained at buy at Shaw and Partners; Price Target: $0.70

Audinate Group (AD8)

Upgraded to buy from neutral at UBS; Price Target: $7.10 from $10.85

Amplitude Energy (AEL)

Retained at buy at Bell Potter; Price Target: $0.29 from $0.28

Retained at outperform at Macquarie; Price Target: $0.38

ANZ Group Holdings (ANZ)

Retained at neutral at Macquarie; Price Target: $30.00 from $27.50

APA Group (APA)

Downgraded to hold from buy at Jefferies; Price Target: $8.79 from $8.44

Retained at outperform at Macquarie; Price Target: $9.23 from $8.14

Retained at accumulate at Ord Minnett; Price Target: $8.70 from $8.60

ARB Corporation (ARB)

Retained at neutral at JPMorgan; Price Target: $36.00 from $36.50

Retained at outperform at RBC Capital Markets; Price Target: $47.50 from $45.00

Retained at overweight at Wilsons; Price Target: $44.92 from $40.83

Arafura Rare Earths (ARU)

Downgraded to neutral from overweight at JPMorgan; Price Target: $0.19 from $0.11

Autosports Group (ASG)

Retained at neutral at UBS; Price Target: $1.80 from $3.20

Bega Cheese (BGA)

Retained at outperform at Macquarie; Price Target: $6.40

Retained at neutral at UBS; Price Target: $6.15

Breville Group (BRG)

Retained at positive at E&P; Price Target: $41.19 from $39.17

Retained at overweight at Jarden; Price Target: $31.00

Retained at neutral at JPMorgan; Price Target: $33.30 from $32.60

Retained at outperform at Macquarie; Price Target: $39.20 from $40.20

Retained at overweight at Morgan Stanley; Price Target: $38.20 from $36.50

Downgraded to hold from accumulate at Ord Minnett; Price Target: $35.00

Retained at buy at UBS; Price Target: $39.80 from $35.50

Brightstar Resources (BTR)

Retained at buy at Shaw and Partners; Price Target: $1.14

Brambles (BXB)

Retained at neutral at Citi; Price Target: $23.60

Retained at outperform at RBC Capital Markets; Price Target: $25.00 from $21.00

Commonwealth Bank of Australia (CBA)

Retained at underperform at Macquarie; Price Target: $105.00

Charter Hall Group (CHC)

Retained at buy at Citi; Price Target: $22.50

Chalice Mining (CHN)

Retained at neutral at UBS; Price Target: $1.70 from $1.00

Centuria Capital Group (CNI)

Downgraded to hold from buy at Moelis Australia; Price Target: $2.45 from $1.95

COSOL (COS)

Retained at buy at Bell Potter; Price Target: $0.85 from $0.80

Retained at buy at Ord Minnett; Price Target: $1.05

CSL (CSL)

Retained at buy at Goldman Sachs; Price Target: $311.00 from $333.60

Retained at overweight at Jarden; Price Target: $298.13 from $313.12

Retained at overweight at JPMorgan; Price Target: $282.00 from $305.00

Retained at sector perform at RBC Capital Markets; Price Target: $280.00 from $283.00

Cleanaway Waste Management (CWY)

Retained at overweight at Morgan Stanley; Price Target: $3.18

Retained at accumulate at Morgans; Price Target: $3.11 from $3.12

Downer EDI (DOW)

Retained at outperform at RBC Capital Markets; Price Target: $7.00

Retained at neutral at UBS; Price Target: $5.80

Deterra Royalties (DRR)

Downgraded to hold from outperform at CLSA; Price Target: $4.30 from $4.35

Dexus (DXS)

Retained at neutral at Citi; Price Target: $7.80

Retained at outperform at Macquarie; Price Target: $7.96 from $7.50

Retained at underweight at Morgan Stanley; Price Target: $7.75

The Environmental Group (EGL)

Retained at buy at Bell Potter; Price Target: $0.38 from $0.40

Emeco Holdings (EHL)

Retained at outperform at Macquarie; Price Target: $1.40 from $1.18

Goodman Group (GMG)

Retained at buy at Citi; Price Target: $40.00

HMC Capital (HMC)

Downgraded to hold from buy at Bell Potter; Price Target: $3.60 from $8.15

Upgraded to hold from underperform at CLSA; Price Target: $3.40 from $4.60

Retained at buy at Ord Minnett; Price Target: $5.35 from $5.55

Harmoney Corp (HMY)

Retained at buy at Ord Minnett; Price Target: $1.14 from $1.02

Hansen Technologies (HSN)

Retained at buy at Shaw and Partners; Price Target: $7.30

Retained at buy at UBS; Price Target: $7.20 from $7.00

HUB24 (HUB)

Upgraded to neutral from underweight at Jarden; Price Target: $97.00 from $84.50

Retained at underperform at Jefferies; Price Target: $94.00 from $84.00

Retained at sell at Ord Minnett; Price Target: $57.20 from $51.00

Iluka Resources (ILU)

Downgraded to hold from buy at Argonaut Securities; Price Target: $6.00

Retained at buy at Canaccord Genuity; Price Target: $6.80 from $5.85

Retained at neutral at Citi; Price Target: $5.30

Downgraded to neutral from outperform at Macquarie; Price Target: $6.30 from $6.50

Downgraded to hold from accumulate at Ord Minnett; Price Target: $6.00 from $5.50

Retained at neutral at UBS; Price Target: $5.45

Judo Capital Holdings (JDO)

Retained at buy at Jefferies; Price Target: $2.16 from $2.22

Retained at overweight at JPMorgan; Price Target: $2.20 from $2.15

James Hardie Industries Plc (JHX)

Retained at neutral at Citi; Price Target: $35.00 from $42.10

Retained at outperform at Macquarie; Price Target: $36.90 from $46.80

Retained at overweight at Morgan Stanley; Price Target: $41.00 from $53.00

Retained at accumulate at Morgans; Price Target: $37.10 from $49.00

Downgraded to sell from hold at Ord Minnett; Price Target: $29.00 from $41.50

Downgraded to neutral from buy at UBS; Price Target: $36.00 from $50.00

Lynch Group Holdings (LGL)

Downgraded to neutral from overweight at Jarden; Price Target: $2.25 from $2.00

MA Financial Group (MAF)

Retained at buy at UBS; Price Target: $9.20 from $8.90

Macmahon Holdings (MAH)

Retained at buy at Bell Potter; Price Target: $0.50 from $0.40

Magellan Financial Group (MFG)

Retained at underweight at Morgan Stanley; Price Target: $7.65 from $7.40

Downgraded to hold from accumulate at Morgans; Price Target: $10.74 from $8.73

Downgraded to neutral from buy at UBS; Price Target: $10.70 from $9.50

MAAS Group Holdings (MGH)

Retained at outperform at Macquarie; Price Target: $4.95

MLG Oz (MLG)

Retained at speculative buy at Morgans; Price Target: $1.00 from $0.90

Megaport (MP1)

Retained at sector perform at RBC Capital Markets; Price Target: $13.00

Retained at neutral at UBS; Price Target: $12.00

National Storage REIT (NSR)

Retained at buy at Citi; Price Target: $2.70

Retained at buy at UBS; Price Target: $2.57

Neurizon Therapeutics (NUZ)

Retained at speculative buy at Morgans; Price Target: $0.42

NRW Holdings (NWH)

Retained at buy at UBS; Price Target: $3.55

Netwealth Group (NWL)

Retained at neutral at Citi; Price Target: $33.65

Retained at sector perform at RBC Capital Markets; Price Target: $31.00 from $29.00

Objective Corporation (OCL)

Retained at neutral at UBS; Price Target: $16.00

Qube Holdings (QUB)

Retained at buy at Citi; Price Target: $4.65

Retained at sector perform at RBC Capital Markets; Price Target: $4.30 from $4.10

Redox (RDX)

Retained at buy at UBS; Price Target: $3.25

Retail Food Group (RFG)

Retained at buy at Bell Potter; Price Target: $2.60 from $3.60

Retained at buy at Shaw and Partners; Price Target: $2.50 from $3.00

Regal Partners (RPL)

Retained at buy at Bell Potter; Price Target: $3.55

SEEK (SEK)

Retained at buy at Citi; Price Target: $31.65 from $28.50

Sims (SGM)

Retained at underperform at Jefferies; Price Target: $12.00 from $11.70

Retained at underweight at JPMorgan; Price Target: $14.40 from $15.10

Retained at sector perform at RBC Capital Markets; Price Target: $14.50 from $15.75

Stockland (SGP)

Retained at buy at Citi; Price Target: $6.90 from $6.00

Retained at neutral at Macquarie; Price Target: $5.90 from $5.20

SHAPE Australia Corporation (SHA)

Retained at buy at Shaw and Partners; Price Target: $5.40

Sonic Healthcare (SHL)

Retained at sector perform at RBC Capital Markets; Price Target: $30.00 from $32.00

Superloop (SLC)

Retained at buy at Citi; Price Target: $3.75 from $3.55

Retained at outperform at Macquarie; Price Target: $3.60 from $3.30

Retained at accumulate at Morgans; Price Target: $3.60 from $3.50

Retained at buy at UBS; Price Target: $3.90 from $3.80

Smart Parking (SPZ)

Retained at buy at Shaw and Partners; Price Target: $1.30 from $1.25

SRG Global (SRG)

Retained at buy at Argonaut Securities; Price Target: $2.00 from $1.75

Retained at buy at Moelis Australia; Price Target: $2.00

Retained at buy at Unified Capital Partners; Price Target: $2.22 from $2.00

Service Stream (SSM)

Retained at buy at Citi; Price Target: $2.45 from $2.35

Retained at outperform at Macquarie; Price Target: $2.42 from $2.22

Downgraded to accumulate from buy at Ord Minnett; Price Target: $2.35 from $2.15

Step One Clothing (STP)

Retained at buy at Bell Potter; Price Target: $0.85 from $1.25

Retained at speculative buy at Morgans; Price Target: $0.87 from $1.50

Super Retail Group (SUL)

Retained at buy at Citi; Price Target: $16.50

Retained at neutral at Macquarie; Price Target: $14.10

Transurban Group (TCL)

Upgraded to buy from neutral at Citi; Price Target: $16.10 from $14.30

The Lottery Corporation (TLC)

Downgraded to hold from outperform at CLSA; Price Target: $6.00 from $5.80

Downgraded to hold from buy at Jefferies; Price Target: $6.15 from $6.05

Downgraded to neutral from outperform at Macquarie; Price Target: $5.50 from $5.40

Universal Store Holdings (UNI)

Retained at sector perform at RBC Capital Markets; Price Target: $8.65 from $8.60

Vicinity Centres (VCX)

Downgraded to underperform from neutral at Bank of America; Price Target: $2.35 from $2.40

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| OMG | OMG Group Ltd | $0.015 | +114.29% |

| T3D | 333D Ltd | $0.014 | +55.56% |

| JNS | Janus Electric Ho... | $0.145 | +46.47% |

| XGL | Xamble Group Ltd | $0.03 | +42.86% |

| BPM | BPM Minerals Ltd | $0.085 | +39.34% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| KLR | Kaili Resources Ltd | $0.19 | -82.41% |

| PPY | Papyrus Australia... | $0.015 | -53.13% |

| IPH | IPH Ltd | $4.50 | -19.50% |

| OEC | Orbital Corporati... | $0.255 | -17.74% |

| GRL | Godolphin Resourc... | $0.014 | -17.65% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| AYA | ARTRYA Ltd | $1.79 | +37.69% |

| TMB | Tambourah Metals Ltd | $0.059 | +25.53% |

| HMY | Harmoney Corp Ltd | $0.79 | +21.54% |

| OCL | Objective Corpora... | $22.90 | +20.53% |

| SHPDB | South HARZ Potash... | $0.035 | +16.67% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| EQS | Equity Story Grou... | $0.017 | -15.00% |

| MAY | Melbana Energy Ltd | $0.019 | -13.64% |

| HLS | Healius Ltd | $0.70 | -13.58% |

| JHX | James Hardie Indu... | $28.98 | -9.44% |

| ONE | Oneview Healthcar... | $0.22 | -8.33% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| OZBD | Betashares Austra... | $45.33 | +0.20% |

| WVOL | Ishares MSCI Worl... | $44.71 | +1.02% |

| MTS | Metcash Ltd | $4.14 | -0.48% |

| IAGPF | Insurance Austral... | $105.41 | +0.06% |

| GCI | Gryphon Capital I... | $2.12 | +0.95% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| MHK | Metal Hawk Ltd | $0.175 | 0.00% |

| BOE | Boss Energy Ltd | $1.625 | +1.88% |

| JHX | James Hardie Indu... | $28.98 | -9.44% |

| IPH | IPH Ltd | $4.50 | -19.50% |

| AGL | AGL Energy Ltd | $8.54 | -1.39% |

View all RSI oversold