Groww overtakes Zerodha as top brokerage in active investors

Fintech startup Groww surpassed Zerodha to become India's leading brokerage in terms of number of active investors.

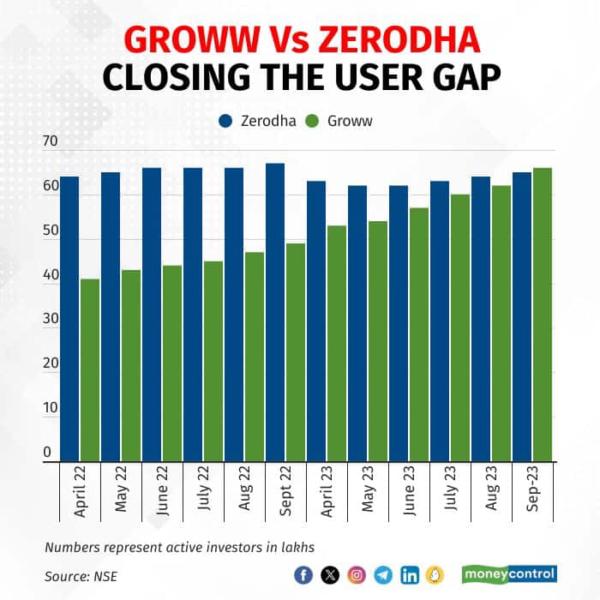

According to NSE, Bengaluru-based Groww has 6.63 million active investors while Zerodha has 6.48 million at the end of September 2023. In March 2021, Zerodha had 3.4 million customers, whereas Groww had 0.78 million. Since then, Zerodha's user base has only doubled, growing at a steady pace and even stagnating over the last couple of years, Groww saw its customer base surge by 750 percent.

At the end of FY23, the country’s first and largest discount broker by revenue, Zerodha grew to 6.39 million customers, while Groww had 5.37 million. Groww has witnessed substantial growth, going from approximately 0.78 million users in FY21 to 3.85 million in FY22 and 5.78 million investors in FY23. This growth has also attracted formidable competitors, such as HDFC Bank, which launched the Sky discount broking app.

Read: Zerodha's FY23 profit and revenue up nearly 39% to Rs 2,907 cr and Rs 6,875 cr

The venture capital-backed platforms like Groww and Upstox have gained popularity as they don’t charge customers for account opening or annual maintenance. PhonePe, with over 200 million active payment customers, has also entered the investment space with its Share.Market platform.

By the end of September, there were approximately 12.97 crore demat accounts in the country. Interestingly, NSE data reveals that only 3.34 crore Indians actively trade at least once a year on the exchange.

User growth vs Revenue

Interestingly, Zerodha’s revenue is more than five times that of Groww. During FY 23, Zerodha reported a 39 percent growth in revenue at Rs 6,875 crore compared with the previous financial year. It also reported an identical growth in profits, which stood at Rs 2,907 crore during the last fiscal.

Read: The F&O edge: Why Zerodha will sit pretty at top

Meanwhile, Nextbillion Technology Private Limited, which runs Groww, has recorded a revenue of Rs 1,294 crore in FY23, more than three-fold growth from Rs 367 crore it reported in FY22. It reported a net profit of Rs 73 crore.

The sizeable difference in revenue is mostly due to Zerodha’s dominance in the Futures & Options trading, a highly profitable segment. Groww started as a platform that focussed on attracting new customers with long-term investment products and mutual funds, especially systematic investment plans (SIPs) and then moved on to direct equity investment on its broking platform. Its entire customer acquisition and marketing strategy is anchored on this premise. However, the company is trying to attract daily as well as F&O traders.

Recently, in a Moneycontrol report, Zerodha CEO Nithin Kamath cautioned against high valuations, comparing them to setting unrealistic expectations in a marriage. He argued that overstating opportunities often leads to problems and urged founders to be cautious about raising money at unrealistic valuations, as it can force unnecessary spending and growth expectations that may not align with reality.

"Trading the markets is a serious business with serious risks involved. Collecting an account opening fee right at the start also, in a way, helps set this expectation with a potential customer, filtering out users who may not be serious about trading or investing with us," Kamath wrote in a recent blog post.

Read: Groww’s revenue rises 3.5 times, net profit grows 10x to Rs 73 crore

The profit figure is one of the highest for technology startups and more than double than that of its nearest competitor and discount broker Angel One, which had reported a consolidated revenue of Rs 3,021 crore for FY23 and a net profit of Rs 1,192 crore.Kamath had also acknowledged that despite markets hitting new highs, the growth has plateaued for the company. “There’s still phenomenal interest in the markets, especially in futures and options. This has been the primary reason for the increase in revenue and profitability over the last three years. We continued to see phenomenal growth even in FY 22/23. That said, the business has plateaued in terms of revenue and profitability this financial year until now," Kamath added.