One weird trick to avoid stock market pain

- DJI, S&P 500 modestly higher, Nasdaq slips

- Energy leads S&P 500 sector gainers; tech, healthcare decline Euro

- Gold rises, crude up >2%; dollar, bitcoin ~flat

- U.S. 10-Year Treasury yield rises to ~3.75%

ONE WEIRD TRICK TO AVOID STOCK MARKET PAIN (1330 EST/1730 GMT)

With the year winding down, one thing is clear: It's not been a great year to be invested in stocks. But what if there was a way for investors to have owned stocks without taking big losses?

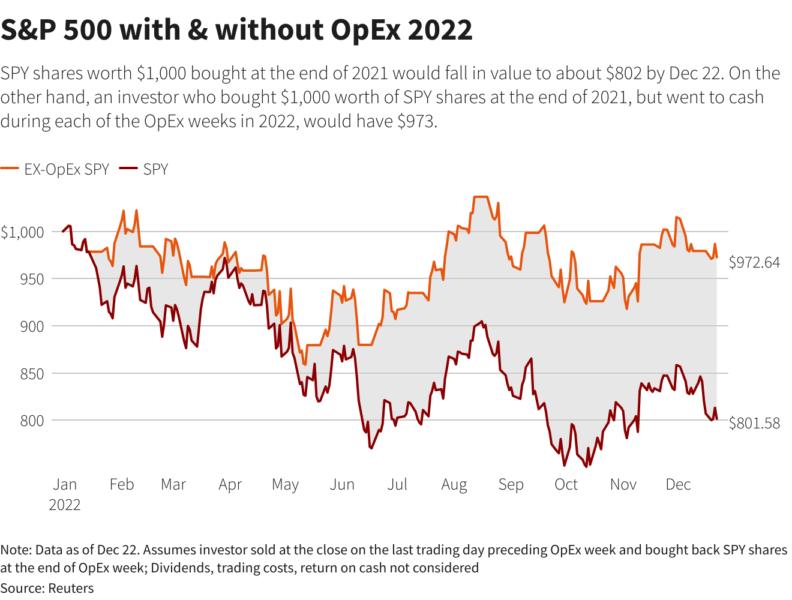

Turns out, if an investors stayed invested in the S&P 500 Index SPX for all but the 12 weeks that mark monthly options expirations, they could have escaped a majority of the pain felt by stock market bulls this year.

The SPDR S&P 500 ETF Trust SPY shares worth $1,000 bought at the end of 2021 fell in value to $801.58 by Dec 22, a loss of 19.8%. On the other hand, an investor who bought $1,000 worth of SPY shares at the end of 2021, but went to cash during each of the options expiration weeks in 2022, would be left with $972.64, or a loss of just 2.7%.

While it is tough to say with a great deal of certainty why stocks fared so badly during options expiration weeks, Garrett DeSimone, head of quantitative research at OptionMetrics, said it may have something to do with many of these expiration weeks coinciding with FOMC days and the release of economic data/projections.

Looking back at 2021, when stocks soared, investors would still have done well to avoid options expiration weeks, with a gain of 36% versus just 27% for someone invested in stocks all year round.

"Expiration week is a big week for liquidity as well, so investors might have been using it to book some profits in 2021 or to get out in 2022," said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

So, will this trend hold in 2023?

"I think a lot of it is due to noise as well and will unlikely remain a trend, especially if more investors begin to notice it," Murphy said.

(Saqib Ahmed)

FRIDAY DATA STORM: PCE, DURABLE GOODS, NEW HOME SALES, UMICH (1150 EST/1650 GMT)

With many investors already in holiday weekend mode, the Commerce Department has had a busy morning.

Just a day after cranking up the GDP heat, the department released a dog's breakfast of economic data

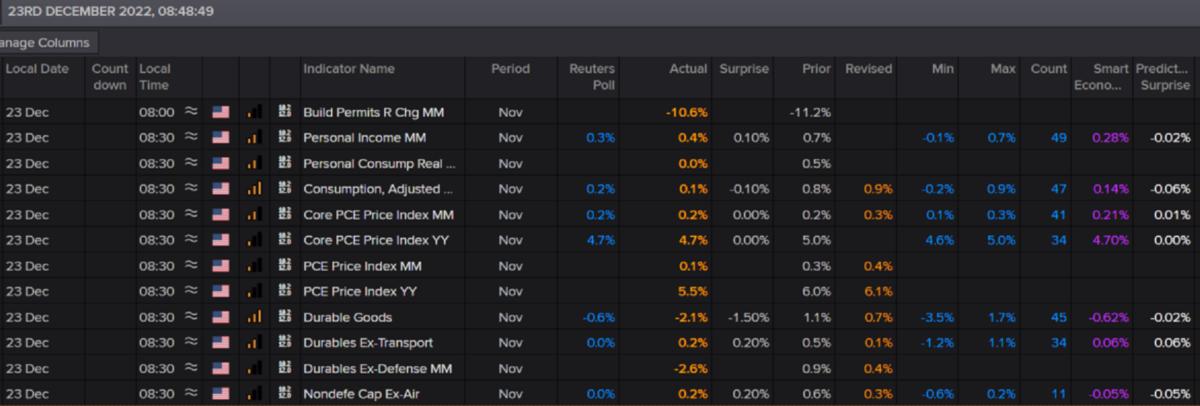

The closely watched and wide ranging personal consumption expenditures (PCE) report showed the prices Americans pay for a basket of goods (USPCE=ECI) cooled by more than expected last month, rising by a mere 0.1%.

Year-over-year, the PCE index landed at 5.5%, a half-percent cool-down from October

Stripping away volatile food and energy prices, the index was up on monthly and annual bases by 0.2% and 4.7%, respectively, in-line with consensus.

The bad news is that the October PCE inflation data was upwardly revised.

"The Federal Reserve will continue to increase rates but likely at a slower pace," says Jeffrey Roach, chief economist for LPL Financial. "Monetary policy operates on a long and variable lag so we do not believe the economy is feeling the full effects of the current tightening cycle."

As shown in the graphic below, all five major indications showed price growth cooled in December, but with the exception of import prices, they all have a lot of cooling still to do before approaching the Fed's average annual 2% inflation target:

Elsewhere in the report, personal income (USGPY=ECI) increased by 0.4%, shaving 0.3 percentage points off the October reading, while the all-important personal consumption measure (UGPCS=ECI) decelerated to a mere 0.1% from 0.9% the month prior.

"The Federal Reserve’s preferred measure of inflation continues to go down, which is good news for their most important objective," writes Chris Zaccarelli, Chief Investment Officer, Independent Advisor Alliance. "But unfortunately for the market, it is happening at the same time as consumers continue to reduce their spending."

Zaccarelli is right; the saving rate - one of Treasury Secretary Janet Yellen's favorite indicators - bounced off a record low to land at 2.4% of disposable income. That's still a low reading, and suggests consumers are dipping into savings to cope with rising prices.

The Commerce Department wasn't all comfort and joy.

In a separate report, new orders for durable goods (USDGN=ECI) - which include long-lasting, American made goods ranging from waffle irons to fighter jets - fell more than expected in November, dropping 2.1%.

"The plunge in total orders was entirely due to the volatile transport component, largely reflecting a slump in civilian aircraft orders, in line with Boeing data," says Ian Shepherdson, chief economist at Pantheon Macroeconomics, who adds that "core capital goods orders are faring far better than we had feared, but sharp falls in the months ahead are still a decent bet."

Indeed, the core capital items print, which excludes aircraft and defense items and is considered a barometer of U.S. business spending plans, surprised to the upside by rising 0.2%.

Next, sales of freshly constructed U.S. homes (USHNS=ECI) unexpectedly surged by 5.8% in November, defying the 4.7% drop economists expected.

While the surprise might have been driven by recent pause in the upward trajectory of mortgage rates, the sector remains under pressure as inventories remain tight, home price growth and rising cost of borrowing are bringing the erstwhile star of the pandemic economy back down to earth.

"While sales were revised down for the prior three months, new home sales are still holding up better than expected given the erosion in homebuying affordability that has occurred this year," says Nancy Vanden Houten, lead U.S. economist at Oxford Economics. "We see limited upside for new home sales in the months ahead, but the incentives offered by homebuilders and the recent decline in mortgage rates may keep a floor under sales."

And finally, University of Michigan took its final stab at consumer sentiment (USUMSF=ECI) this month, revising it higher to 59.7.

"Sentiment remains relatively downbeat at 15% below a year ago, but consumers’ extremely negative attitudes have softened this month on the basis of easing pressures from inflation," says Joanne Hsu, director of UMich's surveys of consumers.

The cooling near- and long-term inflation expectations were the star of the show, easing to 4.4% and 2.9%, respectively.

Wall Street is fluttering between red and green in a light volume session.

(Stephen Culp)

*****

BEARS POP TO A 9-WEEK HIGH - AAII (1053 EST/1553 GMT)

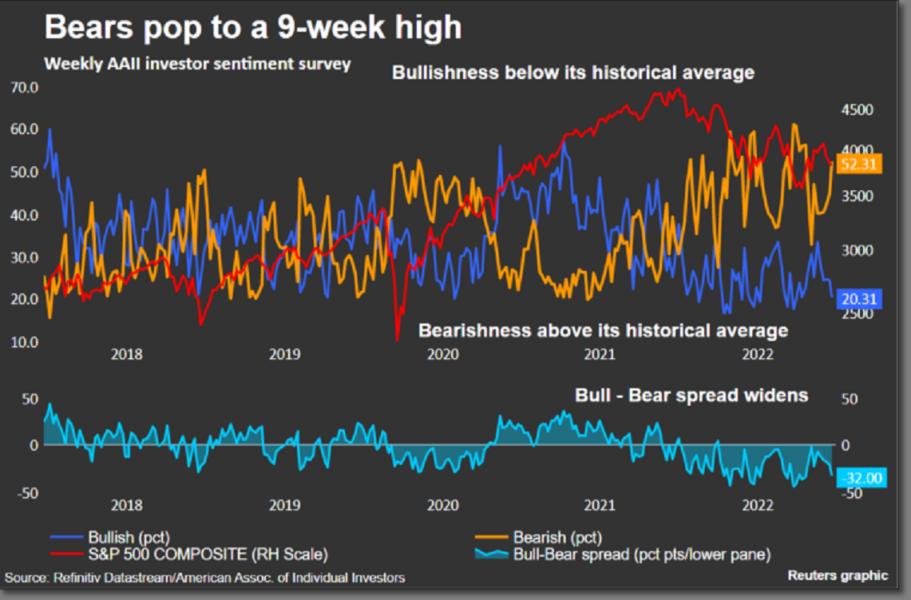

Individual investor pessimism over the short-term direction of the U.S. stock market climbed to a nine-week high in the latest American Association of Individual Investors (AAII) Sentiment Survey. With this, both bullish and neutral sentiment declined.

AAII reported that bearish sentiment, or expectations that stock prices will fall over the next six months, jumped 7.7 percentage points to 52.3%. Pessimism is at its highest level since October 20, 2022 (56.2%). Bearish sentiment is also above its historical average of 31.0% for the 54th time out of the past 57 weeks and is at "an unusually high level for the third consecutive week."

Bullish sentiment, or expectations that stock prices will rise over the next six months, fell 4 percentage points to 20.3%. This week’s reading is the 52nd lowest recorded since the survey started in 1987. Bullish sentiment remains below its historical average of 37.5% for the 51st consecutive week. "It is at an unusually low level for the fourth consecutive week."

Neutral sentiment, or expectations that stock prices will stay essentially unchanged over the next six months, declined by 3.7 percentage points to 27.4%. The decline keeps neutral sentiment below its historical average of 31.5% for the second consecutive week.

With these changes, the bull-bear spread widened to –32.0 percentage points from -20.3 percentage points last week. This is well below the historical average of 6.7%, and "is unusually low":

AAII noted that "Historically, the S&P 500 index has gone on to realize above-average and above-median returns during the six- and 12-month periods following unusually low readings for bullish sentiment and the bull-bear spread."

AAII added that "Unusually high bearish sentiment readings historically have also been followed by above-average and above-median six-month returns in the S&P 500."

(Terence Gabriel)

*****

U.S. STOCK FUTURES LITTLE CHANGED AFTER THE LATEST INFLATION DATA (0900 EST/1400 GMT)

U.S. equity index futures are now roughly flat in choppy trading in the wake of the release of the latest economic data, including the Fed's preferred inflation measure which came in in-line with estimates.

Meanwhile, the U.S. 10-Year Treasury yield is rising slightly, while the dollar is flat.

Among the data points, the November core PCE price index month-over-month and year-over-year were in-line with the Reuters Poll. The year-over-year print, at 4.7%, is a decline from the prior reading of 5.0%. November durable goods were weaker-than-expected, while the ex-transports reading was above the estimate:

The data has not moved the dial much in terms of expectations for a Fed rate hike at the conclusion of the February 1-2, 2023 FOMC meeting. According to the CME's FedWatch Tool, the probability of a 25 basis point rate hike is now at 66% from 67% just before the numbers were released. There is now a 34% chance of a 50 basis point move vs 33% from just before the data came out.

E-mini Nasdaq 100 futures NQ1! were up around 0.4% before the numbers were released. After gyrating, they are now off around 0.1% on the day.

That said, the 11 S&P 500 sector SPDR ETFs are mixed in premarket trade with energy XLE posting the biggest gain. The XLE is up around 1%. Tech

XLK and communication services

XLC are lower.

Regarding the data Ken Polcari, managing partner at Kace Capital Advisors said, "I’m not really sure what to make of it, it is just the end of the year, I don’t think anyone is really paying attention."

Polcari added "The story that the Fed is going to continue down that path (of rate hikes), yesterday’s data and today’s data is not going to change the narrative. If the futures are backing off now it’s just because they realize the Fed isn’t going to change. It is just too volatile today to point to any one thing that is going to cause the action. I do think we are going to go higher today because I think we are going to get the rally today into next week.”

Here is a snapshot of where markets stood just over 20 minutes after the numbers came out:

(Terence Gabriel, Chuck Mikolajczak)

*****

FOR FRIDAY'S LIVE MARKETS' POSTS PRIOR TO 0900 EST/1400 GMT - CLICK HERE