Janus buyout epitomizes plight of alpha-seekers

By Jeffrey Goldfarb

The quest for alpha springs eternal. Sensing there’s an edge yet to be mined at Janus Henderson JHG, Nelson Peltz is teaming up with venture capital firm General Catalyst to make a $7 billion takeover bid for the professional investment shop. The pushy fund manager's behind-the-scenes agitation has failed to generate outsized returns over the past five years. It’s hard to see how taking the company private will beat the market.

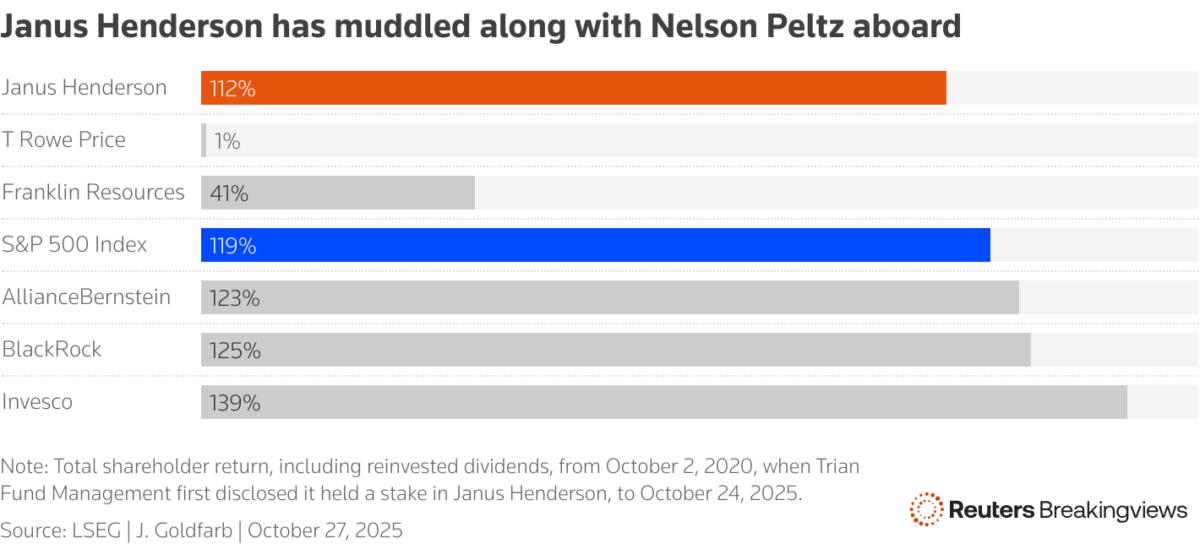

Peltz’s Trian Fund Management first reported holding a stake in Janus Henderson in October 2020. It later filled two seats on the board and helped recruit former AllianceBernstein Chief Financial Officer Ali Dibadj to be CEO. In the nonbinding acquisition offer, Peltz notes that the stock price has more than doubled since his shop first disclosed its stake. The S&P 500 Index SPX, however, did a little better over the same period.

This relative parity is emblematic of how stock pickers like those employed by Janus Henderson have struggled, making it more challenging to justify the higher fees they charge compared to passive funds. Over the past decade, for example, 86% of large-cap equity funds have underperformed the benchmark U.S. index, according to S&P Dow Jones Indices. The performance isn’t much better for mid-cap and small-cap portfolio managers.

Janus Henderson has at least rebounded from the ill-fated cross-border merger that created the company in 2017. Seven consecutive years of net outflows recently swung to money coming in. Dibadj also struck a deal in April to oversee a $45 billion fixed income portfolio for Guardian Life Insurance, helping to diversify a $460 billion pot under management that is more than half in equities but less than 4% in more lucrative and less liquid non-traditional assets.

Trian, which already owns 20% of Janus Henderson, and General Catalyst plan to beef up investments in new products and technology, which is more suitably done out of the public spotlight. Shareholders will also have to weigh up the $46-a-share cash offer against the risk of market downturn, which could shrink assets and fee income. Given how difficult it has become to pick individual stocks, investors could be forgiven for leaving it to Peltz and Dibadj and sticking the money in an index fund instead.

Follow Jeffrey Goldfarb on X and Linkedin.

CONTEXT NEWS

Trian Fund Management, the hedge fund firm led by Nelson Peltz, on October 26 submitted an offer to buy the approximately 80% of Janus Henderson it does not already own, alongside investment firm General Catalyst, for $46 a share in cash, valuing the active fund manager at about $7.2 billion.

Janus Henderson, which manages about $460 billion, said on October 27 that it intends to appoint a special committee of directors not affiliated with Trian or General Catalyst to consider the proposal. Janus Henderson shares, which closed on October 24, at $41.63, were trading near $49 apiece at 1000 EDT on October 27.

Peltz and General Catalyst CEO Hemant Taneja wrote in a letter to the Janus Henderson board that they believe the company could improve by “significantly increasing” its long-term investment in products, customer service and technology.

Josh Frank, the co-chief investment officer of Trian, and Brian Baldwin, Trian’s head of research, sit on Janus Henderson’s board.