Coinbase tops $1 billion in bitcoin-backed onchain loans via Morpho

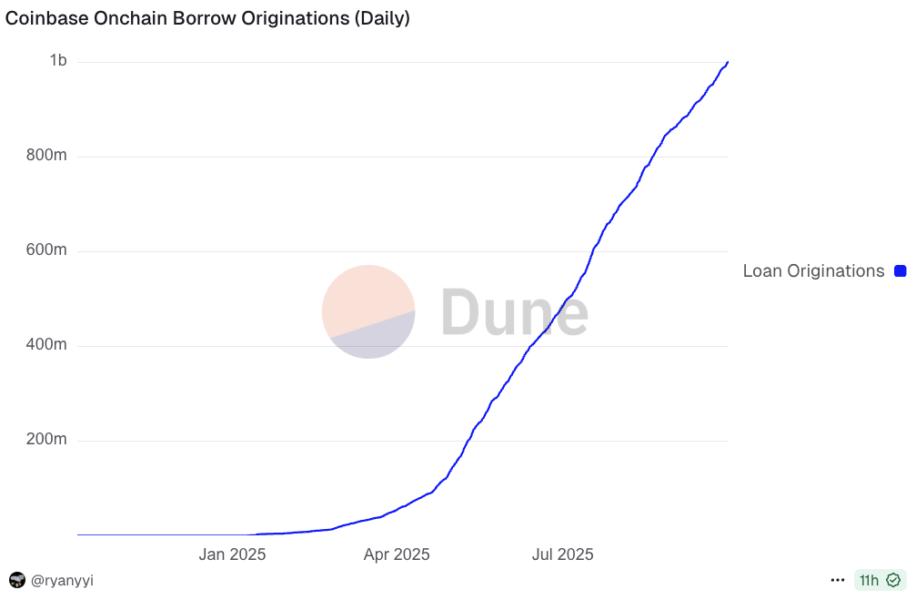

Coinbase surpassed $1 billion worth of bitcoin-backed onchain loan originations on Tuesday, just eight months after the service launched in January.

"Next goal: $100B in onchain borrow originations," Coinbase CEO Brian Armstrong posted on X. "These adoption charts are what every product manager wants to see: hockey stick growth. The onchain economy is thriving."

Coinbase onchain borrow originations. Image: Dune.

Powered by DeFi protocol Morpho, a Coinbase Ventures portfolio project, the crypto exchange originally offered borrowers up to $100,000 in USDC using their bitcoin holdings on Coinbase as collateral, without having to sell the underlying and incur a taxable event. "The integration of bitcoin-backed loans on Coinbase is 'TradFi in the front, DeFi in the back,'" Coinbase VP of Product Max Branzburg said at the time.

By April, this limit had been lifted to $1 million after generating $130 million in originations in the first few months, with plans to increase it further. "The onchain economy is growing, so we're growing with it," Coinbase posted to X on Tuesday. "Loan limits are increasing — get up to $5M in USDC against your bitcoin. Rolling out soon."

Coinbase previously offered a bitcoin-backed loan program for retail customers that was sunset in November 2023 amid a legal battle with the Securities and Exchange Commission under the Biden administration. However, with this revamped service, Coinbase simply provides an interface to access Morpho on its Ethereum Layer 2 Base, but does not directly manage the loans itself.

How Coinbase's onchain loans work

When a Coinbase customer opts for an onchain loan, their bitcoin collateral is converted 1:1 into Coinbase-wrapped bitcoin (cbBTC) with no fee and transferred to Morpho. The DeFi protocol then disburses the USDC loan to the customer's Coinbase account.

Loans must be over-collateralized with at least a 133% collateral ratio, though borrowers can select any higher loan-to-value level they prefer. If the loan balance climbs to 86% of the collateral's market value, the position is liquidated to repay the debt and cover a penalty fee.

Interest rates adjust automatically with each block on Base, while repayment remains flexible with no minimums or deadlines, provided users maintain a healthy LTV.

While bitcoin is currently the only collateral option for the onchain loan service, Coinbase previously said it aims to support more cryptocurrencies in the future. The service is currently available to U.S. users, excluding residents of New York.

Earlier in September, Coinbase rolled out a new feature allowing users to lend their USDC onchain, offering yields of up to 10.8%.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.