OPEN-SOURCE SCRIPT

RSI of MAs

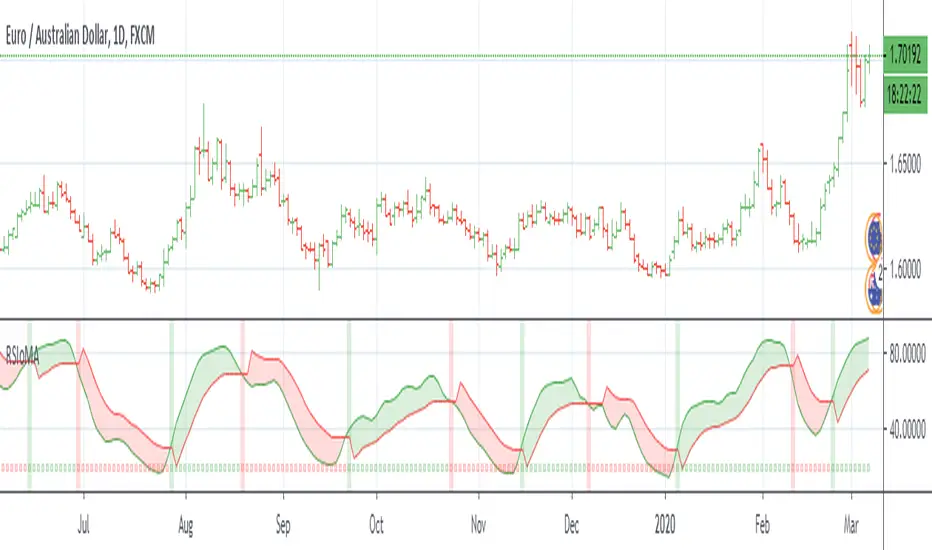

RSI of MAs is designed to calculate the moving average for a specific period, and then take the RSI of that value. This script allows the user to select which moving average they would like to utilize for the calculation, as well as customizing how the Signal Line is calculated. There are many combinations available and you will need to tune the indicator to fit your trading style. The Signal Line is designed to indicate when there is a potential change in price action. If the Signal Line is below RSIoMA, price is bullish. If the Signal Line is above RSIoMA, price is bearish.

MA Period is the length/period the moving average is calculated with

RSI Period is the length/period the RSI is calculated with

RSI MA Mode determines which moving average is applied to the MA period

Signal Line determines which moving average or QQE is used to calculate the signal line

Signal Line Period is the length/period the Signal Line is calculated with

As always, trade at your own risk.

Multiple MA Options Credits to Fractured

Signal Line Options Credits to lejmer

Bits and Pieces from alexgrover, montyjus, and jiehonglim

MA Period is the length/period the moving average is calculated with

RSI Period is the length/period the RSI is calculated with

RSI MA Mode determines which moving average is applied to the MA period

Signal Line determines which moving average or QQE is used to calculate the signal line

Signal Line Period is the length/period the Signal Line is calculated with

As always, trade at your own risk.

Multiple MA Options Credits to Fractured

Signal Line Options Credits to lejmer

Bits and Pieces from alexgrover, montyjus, and jiehonglim

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.