OPEN-SOURCE SCRIPT

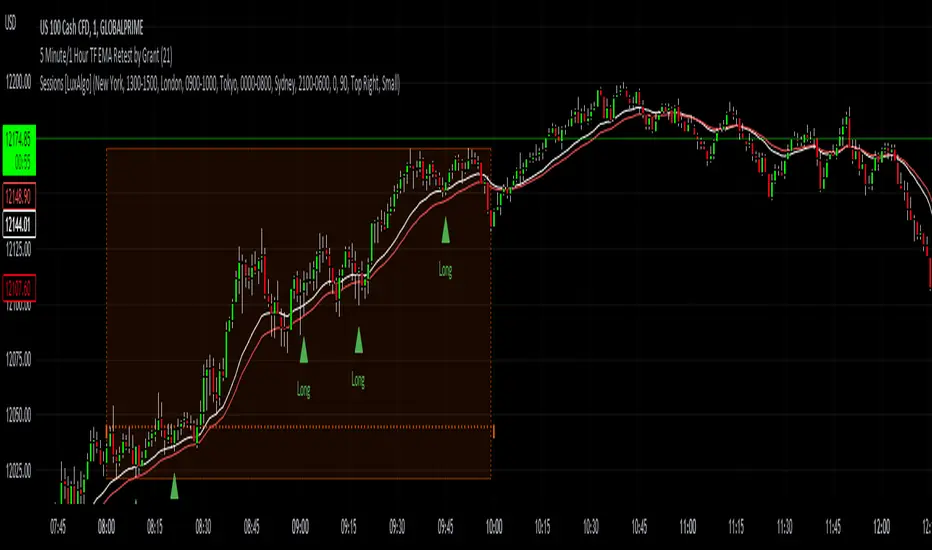

Updated 5 Minute TF 200 EMA Retest by Grant

https://www.tradingview.com/chart/C3tWAVeT/

This indicator is a simple script meant to find retests on the 200 period moving average. It's current state is optimized for the 5 minute timeframe.

This works in all markets and all timeframes as long as you adjust certain rules for higher timeframes.

It's strengths and weaknesses

- Good at trend continuation in strong markets

- Bad in ranging markets (not surprising)

How does it work?

- It first identifies an overall trend by using the 200 ema.

- For long positions, it waits for price to close below the 200 ema, and then shortly closing back above the ema. For short positions its the opposite.

- For lower timeframes there are some other factors that help filter out bad signals that include:

- Makes sure that volume is increasing.

- Makes sure that volume is higher than average volume.

- For higher timeframes, the more specific factors aren't required.

How to use this indicator:

- Green triangles mean long positions

- Red triangles mean short positions

- Always trade with stoplosses and never risk too much of your account, please practice proper risk managment.

DISCLAIMER: Trading is inherently dangerous and carries lot's of risk. What you decide to do with my script has nothing to do with me. I am not responsible for any financial gains or losses made using this script. It is important to recognize other factors in the market to make better decisions.

This indicator is a simple script meant to find retests on the 200 period moving average. It's current state is optimized for the 5 minute timeframe.

This works in all markets and all timeframes as long as you adjust certain rules for higher timeframes.

It's strengths and weaknesses

- Good at trend continuation in strong markets

- Bad in ranging markets (not surprising)

How does it work?

- It first identifies an overall trend by using the 200 ema.

- For long positions, it waits for price to close below the 200 ema, and then shortly closing back above the ema. For short positions its the opposite.

- For lower timeframes there are some other factors that help filter out bad signals that include:

- Makes sure that volume is increasing.

- Makes sure that volume is higher than average volume.

- For higher timeframes, the more specific factors aren't required.

How to use this indicator:

- Green triangles mean long positions

- Red triangles mean short positions

- Always trade with stoplosses and never risk too much of your account, please practice proper risk managment.

DISCLAIMER: Trading is inherently dangerous and carries lot's of risk. What you decide to do with my script has nothing to do with me. I am not responsible for any financial gains or losses made using this script. It is important to recognize other factors in the market to make better decisions.

Release Notes

Changed the length of the long term trend detector. This should improve the accuracy. It was not looking far back enough but it now looks much further back.Release Notes

Added alerts.Release Notes

- Added the ability to change the length of the ema. If you decrease the length, it will print more signals but will be less accurate. I still recommend 200 length. - Changed some rules regarding volume, now volume has to be above average but not greater than previous volume bar. This is because volume can be kind of skewed on the lower timeframes.

- New rule states that candles must be bullish for long and bearish for short

- Frequency of alerts are now on bar open which will give you time to get ready to enter trade. (Make sure to still wait for candle to close)

- Side note: If you want to improve the win rate, I recommend waiting for a big move in one direction, then taking the first signal. This will help to stay out of consolidating markets. Good luck!

Release Notes

- Added the ability to toggle the volume filter, will give user ability to generate more/fewer signals.- Added slow ema to filter out some bad signals, It takes the ema you entered and makes a slightly slower one. For example if you enter 21 as your length then it would add a 30 period moving average as well.

Release Notes

Volume filter is now off as default.Release Notes

- Implemented the ability to use RSI as a filter.- Implemented a new condition: if there was recently an ema crossover, the signal is invalidated. (This HELPS to avoids consolidating markets)

Release Notes

- Added the ability to toggle whether multiple signals can generate at once, which could overlap.Release Notes

- Made stricter entry rules for the retest. Instead of waiting for 2 candles to see a rejection, the price must immediately reject.Release Notes

Tweaked settings regarding printing multiple signals. Release Notes

- Added option to use wick rejections alone. This rule is more strict. Fundamentally, this is a much better rejection type.Release Notes

- Removed a specific rule because it overlapped with the logic of the indicator. It was checking if the price was above the ema however it was also looking for price to close below it temporarily. Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.