OPEN-SOURCE SCRIPT

Advanced Price Ranges ICT

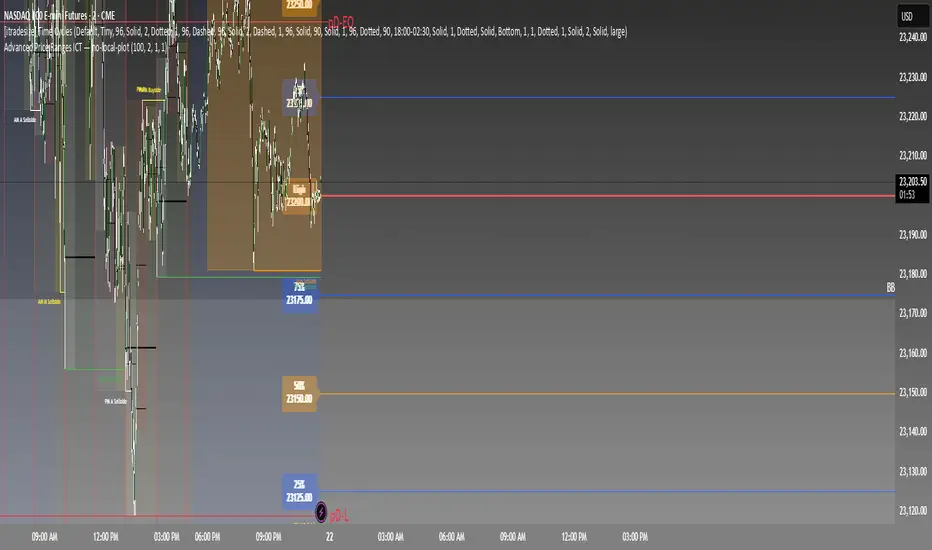

This indicator automatically divides price into fixed ranges (configurable in points or pips) and plots important reference levels such as the high, low, 50% midpoint, and 25%/75% quarters. It is designed to help traders visualize structured price movement, spot confluence zones, and frame their trading bias around clean range-based levels.

🔹 Key Features

Custom Range Size: Define ranges in points (e.g., 100, 50, 25, 10) or in Forex pips.

Forex Mode: Automatically adapts pip size (0.0001 or 0.01 for JPY pairs).

Dynamic Anchoring: Price ranges automatically align to the current price, snapping into blocks.

Multiple Ranges: Option to extend visualization above and below the current active block for a complete grid.

Level Types:

High / Low of the range

50% midpoint

25% and 75% quarters

Custom Styling: Adjustable line colors and widths for each level type.

Labels: Optional right-edge labels showing level type and exact price.

Alerts: Built-in alerts for when price crosses the range high, low, or 50% midpoint.

🔹 Use Cases

Quickly map out 100/50/25/10 point structures like Zeussy’s advanced price range method.

Identify key reaction levels where liquidity is often built or swept.

Support ICT-style concepts like range-based bias, fair value gaps, and liquidity pools.

Works for indices, futures, crypto, and forex.

🔹 Customization

Range increments can be set to any size (default 100).

Toggle which levels are shown (High/Low, Midpoint, Quarters).

Adjustable line widths, colors, and label visibility.

Extend ranges above and below for broader market context.

🔹 Key Features

Custom Range Size: Define ranges in points (e.g., 100, 50, 25, 10) or in Forex pips.

Forex Mode: Automatically adapts pip size (0.0001 or 0.01 for JPY pairs).

Dynamic Anchoring: Price ranges automatically align to the current price, snapping into blocks.

Multiple Ranges: Option to extend visualization above and below the current active block for a complete grid.

Level Types:

High / Low of the range

50% midpoint

25% and 75% quarters

Custom Styling: Adjustable line colors and widths for each level type.

Labels: Optional right-edge labels showing level type and exact price.

Alerts: Built-in alerts for when price crosses the range high, low, or 50% midpoint.

🔹 Use Cases

Quickly map out 100/50/25/10 point structures like Zeussy’s advanced price range method.

Identify key reaction levels where liquidity is often built or swept.

Support ICT-style concepts like range-based bias, fair value gaps, and liquidity pools.

Works for indices, futures, crypto, and forex.

🔹 Customization

Range increments can be set to any size (default 100).

Toggle which levels are shown (High/Low, Midpoint, Quarters).

Adjustable line widths, colors, and label visibility.

Extend ranges above and below for broader market context.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.