OPEN-SOURCE SCRIPT

Dynamic Intensity Transition Oscillator (DITO)

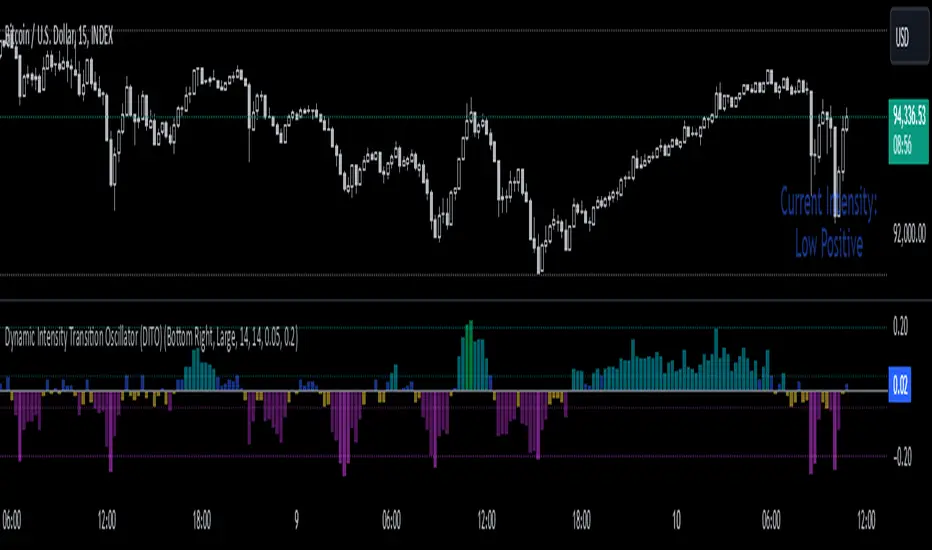

The Dynamic Intensity Transition Oscillator (DITO) is a comprehensive indicator designed to identify and visualize the slope of price action normalized by volatility, enabling consistent comparisons across different assets. This indicator calculates and categorizes the intensity of price movement into six states—three positive and three negative—while providing visual cues and alerts for state transitions.

Components and Functionality

1. Slope Calculation

- The slope represents the rate of change in price action over a specified period (Slope Calculation Period).

- It is calculated as the difference between the current price and the simple moving average (SMA) of the price, divided by the length of the period.

2. Normalization Using ATR

- To standardize the slope across assets with different price scales and volatilities, the slope is divided by the Average True Range (ATR).

- The ATR ensures that the slope is comparable across assets with varying price levels and volatility.

3. Intensity Levels

- The normalized slope is categorized into six distinct intensity levels:

High Positive: Strong upward momentum.

Medium Positive: Moderate upward momentum.

Low Positive: Weak upward movement or consolidation.

Low Negative: Weak downward movement or consolidation.

Medium Negative: Moderate downward momentum.

High Negative: Strong downward momentum.

4. Visual Representation

- The oscillator is displayed as a histogram, with each intensity level represented by a unique color:

High Positive: Lime green.

Medium Positive: Aqua.

Low Positive: Blue.

Low Negative: Yellow.

Medium Negative: Purple.

High Negative: Fuchsia.

Threshold levels (Low Intensity, Medium Intensity) are plotted as horizontal dotted lines for visual reference, with separate colors for positive and negative thresholds.

5. Intensity Table

- A dynamic table is displayed on the chart to show the current intensity level.

- The table's text color matches the intensity level color for easy interpretation, and its size and position are customizable.

6. Alerts for State Transitions

- The indicator includes a robust alerting system that triggers when the intensity level transitions from one state to another (e.g., from "Medium Positive" to "High Positive").

- The alert includes both the previous and current states for clarity.

Inputs and Customization

The DITO indicator offers a variety of customizable settings:

Indicator Parameters

Slope Calculation Period: Defines the period over which the slope is calculated.

ATR Calculation Period: Defines the period for the ATR used in normalization.

Low Intensity Threshold: Threshold for categorizing weak momentum.

Medium Intensity Threshold: Threshold for categorizing moderate momentum.

Intensity Table Settings

Table Position: Allows you to position the intensity table anywhere on the chart (e.g., "Bottom Right," "Top Left").

Table Size: Enables customization of table text size (e.g., "Small," "Large").

Use Cases

Trend Identification:

- Quickly assess the strength and direction of price movement with color-coded intensity levels.

Cross-Asset Comparisons:

- Use the normalized slope to compare momentum across different assets, regardless of price scale or volatility.

Dynamic Alerts:

- Receive timely alerts when the intensity transitions, helping you act on significant momentum changes.

Consolidation Detection:

- Identify periods of low intensity, signaling potential reversals or breakout opportunities.

How to Use

- Add the indicator to your chart.

- Configure the input parameters to align with your trading strategy.

Observe:

The Oscillator: Use the color-coded histogram to monitor price action intensity.

The Intensity Table: Track the current intensity level dynamically.

Alerts: Respond to state transitions as notified by the alerts.

Final Notes

The Dynamic Intensity Transition Oscillator (DITO) combines trend strength detection, cross-asset comparability, and real-time alerts to offer traders an insightful tool for analyzing market conditions. Its user-friendly visualization and comprehensive alerting make it suitable for both novice and advanced traders.

Disclaimer: This indicator is for educational purposes and is not financial advice. Always perform your own analysis before making trading decisions.

Components and Functionality

1. Slope Calculation

- The slope represents the rate of change in price action over a specified period (Slope Calculation Period).

- It is calculated as the difference between the current price and the simple moving average (SMA) of the price, divided by the length of the period.

2. Normalization Using ATR

- To standardize the slope across assets with different price scales and volatilities, the slope is divided by the Average True Range (ATR).

- The ATR ensures that the slope is comparable across assets with varying price levels and volatility.

3. Intensity Levels

- The normalized slope is categorized into six distinct intensity levels:

High Positive: Strong upward momentum.

Medium Positive: Moderate upward momentum.

Low Positive: Weak upward movement or consolidation.

Low Negative: Weak downward movement or consolidation.

Medium Negative: Moderate downward momentum.

High Negative: Strong downward momentum.

4. Visual Representation

- The oscillator is displayed as a histogram, with each intensity level represented by a unique color:

High Positive: Lime green.

Medium Positive: Aqua.

Low Positive: Blue.

Low Negative: Yellow.

Medium Negative: Purple.

High Negative: Fuchsia.

Threshold levels (Low Intensity, Medium Intensity) are plotted as horizontal dotted lines for visual reference, with separate colors for positive and negative thresholds.

5. Intensity Table

- A dynamic table is displayed on the chart to show the current intensity level.

- The table's text color matches the intensity level color for easy interpretation, and its size and position are customizable.

6. Alerts for State Transitions

- The indicator includes a robust alerting system that triggers when the intensity level transitions from one state to another (e.g., from "Medium Positive" to "High Positive").

- The alert includes both the previous and current states for clarity.

Inputs and Customization

The DITO indicator offers a variety of customizable settings:

Indicator Parameters

Slope Calculation Period: Defines the period over which the slope is calculated.

ATR Calculation Period: Defines the period for the ATR used in normalization.

Low Intensity Threshold: Threshold for categorizing weak momentum.

Medium Intensity Threshold: Threshold for categorizing moderate momentum.

Intensity Table Settings

Table Position: Allows you to position the intensity table anywhere on the chart (e.g., "Bottom Right," "Top Left").

Table Size: Enables customization of table text size (e.g., "Small," "Large").

Use Cases

Trend Identification:

- Quickly assess the strength and direction of price movement with color-coded intensity levels.

Cross-Asset Comparisons:

- Use the normalized slope to compare momentum across different assets, regardless of price scale or volatility.

Dynamic Alerts:

- Receive timely alerts when the intensity transitions, helping you act on significant momentum changes.

Consolidation Detection:

- Identify periods of low intensity, signaling potential reversals or breakout opportunities.

How to Use

- Add the indicator to your chart.

- Configure the input parameters to align with your trading strategy.

Observe:

The Oscillator: Use the color-coded histogram to monitor price action intensity.

The Intensity Table: Track the current intensity level dynamically.

Alerts: Respond to state transitions as notified by the alerts.

Final Notes

The Dynamic Intensity Transition Oscillator (DITO) combines trend strength detection, cross-asset comparability, and real-time alerts to offer traders an insightful tool for analyzing market conditions. Its user-friendly visualization and comprehensive alerting make it suitable for both novice and advanced traders.

Disclaimer: This indicator is for educational purposes and is not financial advice. Always perform your own analysis before making trading decisions.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.