OPEN-SOURCE SCRIPT

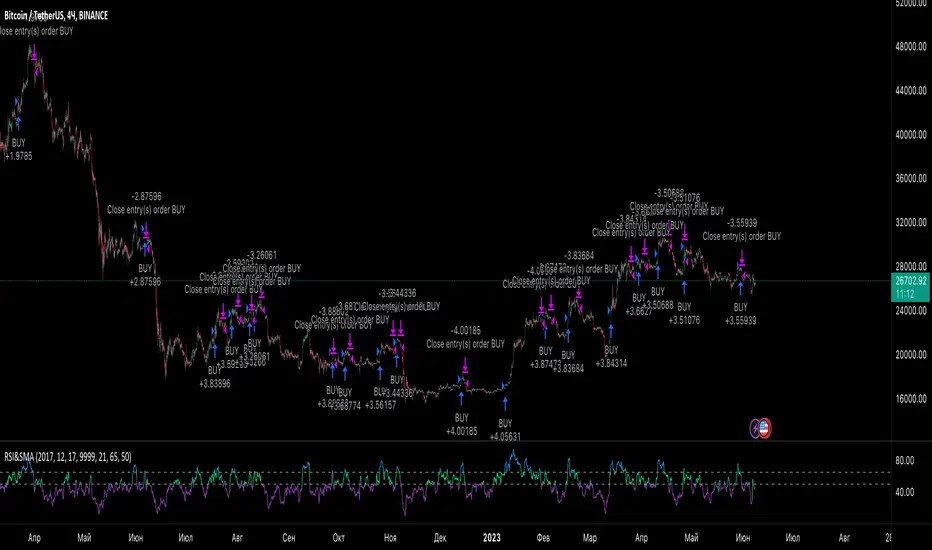

Updated RSI Strategy

Simple way how to use RSI and MA indicators for trading.

What we use:

• RSI

• SMA calculated by RSI (title: SMA_RSI)

• Delta of RSI and SMA_RSI (title: delta)

• SMA calculated by delta of RSI and SMA & RSI (title: SMA_RSI2)

Logic:

Upon the fact that we use the difference between two indicators that have similar values ( RSI and SMA_RSI), we get number around zero. Next, result is smoothed by calculated the SMA . This is the blue/purple line that appears on the chart - SMA_RSI2.

The trade open when SMA_RSI2 cross over the threshold. The trade close when SMA_RSI2 cross under the threshold below.

Also, the usual EMA 200 is used as a filter, which you can switch on or switch off.

What we use:

• RSI

• SMA calculated by RSI (title: SMA_RSI)

• Delta of RSI and SMA_RSI (title: delta)

• SMA calculated by delta of RSI and SMA & RSI (title: SMA_RSI2)

Logic:

Upon the fact that we use the difference between two indicators that have similar values ( RSI and SMA_RSI), we get number around zero. Next, result is smoothed by calculated the SMA . This is the blue/purple line that appears on the chart - SMA_RSI2.

The trade open when SMA_RSI2 cross over the threshold. The trade close when SMA_RSI2 cross under the threshold below.

Also, the usual EMA 200 is used as a filter, which you can switch on or switch off.

Release Notes

Additional plots addedOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.