OPEN-SOURCE SCRIPT

Updated BTC 1m Chop Top/Bottom Reversal (Stable Entries)

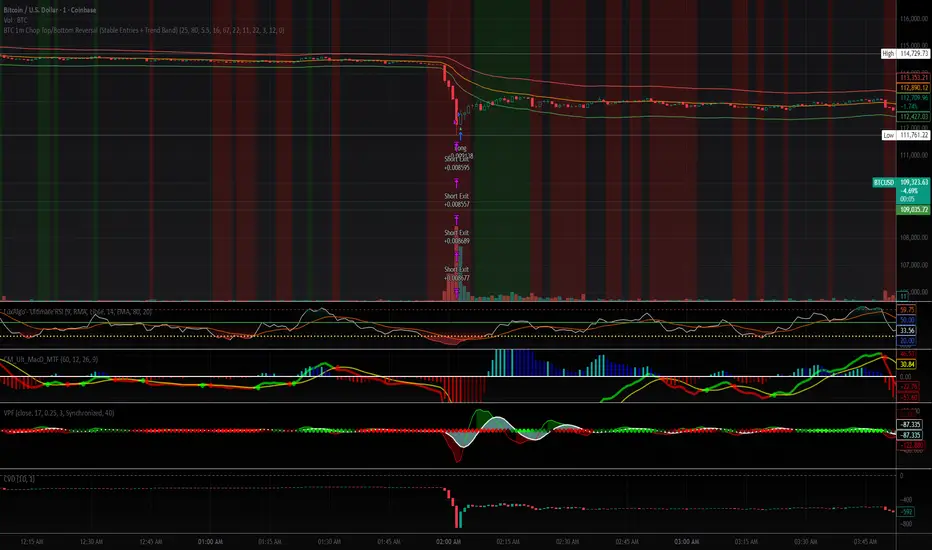

Strategy Description: BTC 5m Chop Top/Bottom Reversal (Stable Entries)

This strategy is engineered to capture precise reversal points during Bitcoin’s choppy or sideways price action on the 5-minute timeframe. It identifies short-term tops and bottoms using a confluence of volatility bands, momentum indicators, and price structure, optimized for high-probability scalping and intraday reversals.

Core Logic:

Volatility Filter: Uses an EMA with ATR bands to define overextended price zones.

Momentum Divergence: Confirms reversals using RSI and MACD histogram shifts.

Price Action Filter: Requires candle confirmation in the direction of the trade.

Locked Signal Logic: Prevents repaints and disappearing trades by confirming signals only once per bar.

Trade Parameters:

Short Entry: Above upper band + overbought RSI + weakening MACD + bearish candle

Long Entry: Below lower band + oversold RSI + strengthening MACD + bullish candle

Take Profit: ±0.75%

Stop Loss: ±0.4%

This setup is tuned for traders using tight risk control and leverage, where execution precision and minimal drawdown tolerance are critical.

This strategy is engineered to capture precise reversal points during Bitcoin’s choppy or sideways price action on the 5-minute timeframe. It identifies short-term tops and bottoms using a confluence of volatility bands, momentum indicators, and price structure, optimized for high-probability scalping and intraday reversals.

Core Logic:

Volatility Filter: Uses an EMA with ATR bands to define overextended price zones.

Momentum Divergence: Confirms reversals using RSI and MACD histogram shifts.

Price Action Filter: Requires candle confirmation in the direction of the trade.

Locked Signal Logic: Prevents repaints and disappearing trades by confirming signals only once per bar.

Trade Parameters:

Short Entry: Above upper band + overbought RSI + weakening MACD + bearish candle

Long Entry: Below lower band + oversold RSI + strengthening MACD + bullish candle

Take Profit: ±0.75%

Stop Loss: ±0.4%

This setup is tuned for traders using tight risk control and leverage, where execution precision and minimal drawdown tolerance are critical.

Release Notes

Purpose: Identify high-confidence short-term reversal points during consolidation or choppy markets, with minimal repainting and clear visual cues.⚙️ How It Works

🔹 Reversal Detection

The strategy uses a combination of:

ATR bands around an EMA (34) to define overextended price zones

RSI (12) to detect overbought (>70) and oversold (<30) conditions

MACD Histogram for short-term momentum flips

🔽 Long Signal (Bottom Entry)

Triggered when:

Price dips below Lower ATR Band

RSI is oversold

MACD Histogram starts rising (bullish momentum)

Candle closes green (bullish body)

🔼 Short Signal (Top Entry)

Triggered when:

Price exceeds Upper ATR Band

RSI is overbought

MACD Histogram starts falling (bearish momentum)

Candle closes red (bearish body)

Both signals require confirmation on a fresh bar to reduce noise and false entries.

🎯 Exit Conditions

Long TP: +0.75%

Long SL: –0.4%

Short TP: –0.75%

Short SL: +0.4%

These tight risk/reward levels are tuned for 30x leverage, giving potential for fast scalps with limited downside.

🟦 Trend Strength Zone (Context Filter)

A trend score is calculated using MACD momentum and RSI deviation from neutral:

Green background = Bullish strength (avoid shorting)

Red background = Bearish strength (avoid longing)

Gray background = Neutral / choppy (ideal for this strategy)

This helps you avoid entering against strong trend momentum and focus on true chop conditions.

📈 How to Use

Best Timeframes: 1m–5m (optimized for scalping BTC chop zones)

Ideal Market: Sideways/consolidation

Entry Strategy:

Watch for green triangle (long) or red triangle (short)

Confirm background is gray (neutral)

Exit Strategy:

Strategy automatically closes trades at the TP/SL levels

Monitor volatility—can adjust ATR multiplier or RSI thresholds to suit market speed

Release Notes

Purpose: Identify high-confidence short-term reversal points during consolidation or choppy markets, with minimal repainting and clear visual cues.⚙️ How It Works

🔹 Reversal Detection

The strategy uses a combination of:

ATR bands around an EMA (34) to define overextended price zones

RSI (12) to detect overbought (>70) and oversold (<30) conditions

MACD Histogram for short-term momentum flips

🔽 Long Signal (Bottom Entry)

Triggered when:

Price dips below Lower ATR Band

RSI is oversold

MACD Histogram starts rising (bullish momentum)

Candle closes green (bullish body)

🔼 Short Signal (Top Entry)

Triggered when:

Price exceeds Upper ATR Band

RSI is overbought

MACD Histogram starts falling (bearish momentum)

Candle closes red (bearish body)

Both signals require confirmation on a fresh bar to reduce noise and false entries.

🎯 Exit Conditions

Long TP: +0.75%

Long SL: –0.4%

Short TP: –0.75%

Short SL: +0.4%

These tight risk/reward levels are tuned for 30x leverage, giving potential for fast scalps with limited downside.

🟦 Trend Strength Zone (Context Filter)

A trend score is calculated using MACD momentum and RSI deviation from neutral:

Green background = Bullish strength (avoid shorting)

Red background = Bearish strength (avoid longing)

Gray background = Neutral / choppy (ideal for this strategy)

This helps you avoid entering against strong trend momentum and focus on true chop conditions.

📈 How to Use

Best Timeframes: 1m–5m (optimized for scalping BTC chop zones)

Ideal Market: Sideways/consolidation

Entry Strategy:

Watch for green triangle (long) or red triangle (short)

Confirm background is gray (neutral)

Exit Strategy:

Strategy automatically closes trades at the TP/SL levels

Monitor volatility—can adjust ATR multiplier or RSI thresholds to suit market speed

Release Notes

Updated values and order conditions. Pyramiding orders, fill on bar close, and comission set to typical market orders of 0.06%Drastically improved drawdown, profitability and profit factor. Enjoy.

Tips appreciated. Made this script after I zeroed.

BTC Address: 3LnyrKTRyeTwW2t567wa1HhcRduc1ysqy4

SOL address: Eoa1H1XDjE47WK14ZQebHApKXckpJCP7fTj8ixbMyEJ7

Release Notes

Updated settings for current market data. Script must be tuned throughout time as historical data changesOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.