OPEN-SOURCE SCRIPT

Updated True Liquidity Blocks

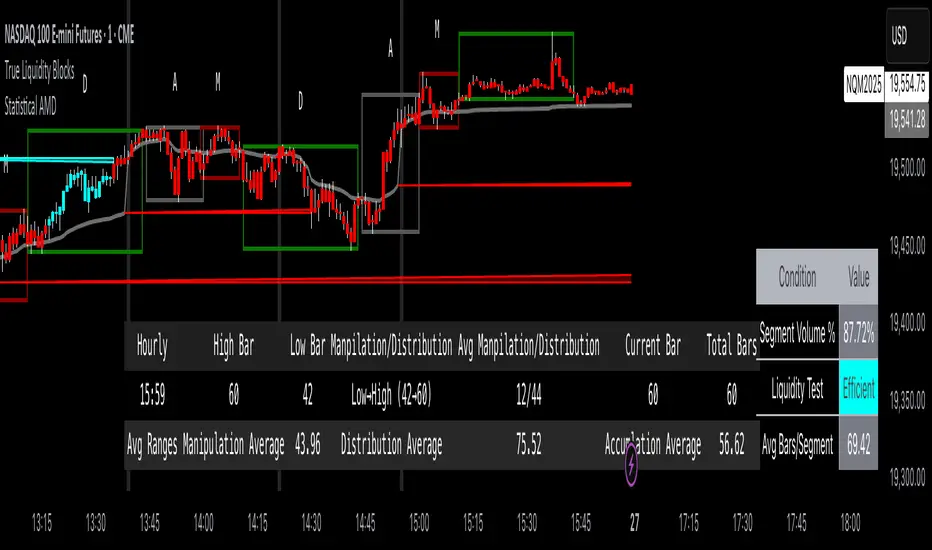

So basically I've been deep diving into liquidity trading concepts similar to ICT (Inner Circle Trader) and developed an indicator that breaks down market movement through a volume-centric lens.

Key Concept:

Markets move not just by price, but by resolving trapped positions

Volume segments, not time intervals, show true market dynamics

VWAP (Volume Weighted Average Price) becomes a key structural reference

What Makes This Different:

Tracks volume segments instead of fixed time frames

Identifies "trapped" trader positions

Measures liquidity level efficiency

Color-codes bars based on nearest liquidity zone

Indicator Features:

Cyan/Red liquidity levels showing buy/sell pressure

Efficiency tracking for each level

Dynamic volume-based segmentation

Bar coloring to show nearest liquidity zone

Theoretical Inspiration: Viewed markets as energy systems where:

Positions create potential energy

Price movement resolves this energy

Trends form through systematic position liquidation

VWAP Recalculation in Each Segment:

Segment Start:

VWAP resets when volume threshold User Inputtable (600,000) is reached

Uses the last 4 price values (High, Low, Close, Close) for calculation

Weighted by volume traded during that segment

Calculation Method:

pineCopy[_vwap, _, _] = ta.vwap(hlcc4, na(segment_start) ? true : na, 1)

hlcc4: Combines high, low, close prices

na(segment_start): Ensures reset at new segment

Weighted by volume, not equal time intervals

Key Points:

Dynamic recalculation each segment

Reflects most recent trading activity

Provides real-time fair price reference

Tracks positioning

Essentially, VWAP resets and recalculates with each new volume segment, creating a rolling, volume-weighted average price that maps trader positioning.

BSL (Buy Side Liquidity) and SSL (Sell Side Liquidity) Explained:

When a volume segment closes relative to VWAP, it creates natural positioning traps:

BSL (Cyan) - Created when price closes BELOW THAT SEGMENT'S VWAP:

Bulls are positioned BELOW VWAP (trapped)

Shorts are positioned ABOVE VWAP (In Profit)

SSL (Red) - Created when price closes ABOVE THAT SEGMENT"S VWAP:

Bulls are positioned ABOVE VWAP (trapped)

Shorts are positioned BELOW VWAP (trapped)

Core Mechanism:

VWAP acts as a reference point for trader positioning

Trapped positions create inherent market tension

Levels expand to show accumulating pressure

Color-coded for quick identification of potential move direction

The goal: Visualize where traders are likely "stuck" and must eventually resolve their positions or liquidate other's, driving market movement.

It was just a fun experiment but If ya'll have any thoughts on it or what I could do to improve it, I would appreciate it.

Just a little note, It's optimized for futures, but if u uncheck the "Rest at Futures Open ?" setting, it allow full reign of any asset with volume data.

Key Concept:

Markets move not just by price, but by resolving trapped positions

Volume segments, not time intervals, show true market dynamics

VWAP (Volume Weighted Average Price) becomes a key structural reference

What Makes This Different:

Tracks volume segments instead of fixed time frames

Identifies "trapped" trader positions

Measures liquidity level efficiency

Color-codes bars based on nearest liquidity zone

Indicator Features:

Cyan/Red liquidity levels showing buy/sell pressure

Efficiency tracking for each level

Dynamic volume-based segmentation

Bar coloring to show nearest liquidity zone

Theoretical Inspiration: Viewed markets as energy systems where:

Positions create potential energy

Price movement resolves this energy

Trends form through systematic position liquidation

VWAP Recalculation in Each Segment:

Segment Start:

VWAP resets when volume threshold User Inputtable (600,000) is reached

Uses the last 4 price values (High, Low, Close, Close) for calculation

Weighted by volume traded during that segment

Calculation Method:

pineCopy[_vwap, _, _] = ta.vwap(hlcc4, na(segment_start) ? true : na, 1)

hlcc4: Combines high, low, close prices

na(segment_start): Ensures reset at new segment

Weighted by volume, not equal time intervals

Key Points:

Dynamic recalculation each segment

Reflects most recent trading activity

Provides real-time fair price reference

Tracks positioning

Essentially, VWAP resets and recalculates with each new volume segment, creating a rolling, volume-weighted average price that maps trader positioning.

BSL (Buy Side Liquidity) and SSL (Sell Side Liquidity) Explained:

When a volume segment closes relative to VWAP, it creates natural positioning traps:

BSL (Cyan) - Created when price closes BELOW THAT SEGMENT'S VWAP:

Bulls are positioned BELOW VWAP (trapped)

Shorts are positioned ABOVE VWAP (In Profit)

SSL (Red) - Created when price closes ABOVE THAT SEGMENT"S VWAP:

Bulls are positioned ABOVE VWAP (trapped)

Shorts are positioned BELOW VWAP (trapped)

Core Mechanism:

VWAP acts as a reference point for trader positioning

Trapped positions create inherent market tension

Levels expand to show accumulating pressure

Color-coded for quick identification of potential move direction

The goal: Visualize where traders are likely "stuck" and must eventually resolve their positions or liquidate other's, driving market movement.

It was just a fun experiment but If ya'll have any thoughts on it or what I could do to improve it, I would appreciate it.

Just a little note, It's optimized for futures, but if u uncheck the "Rest at Futures Open ?" setting, it allow full reign of any asset with volume data.

Release Notes

Updated to input own market hoursRelease Notes

Updated to show each segments average number of barsOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.