OPEN-SOURCE SCRIPT

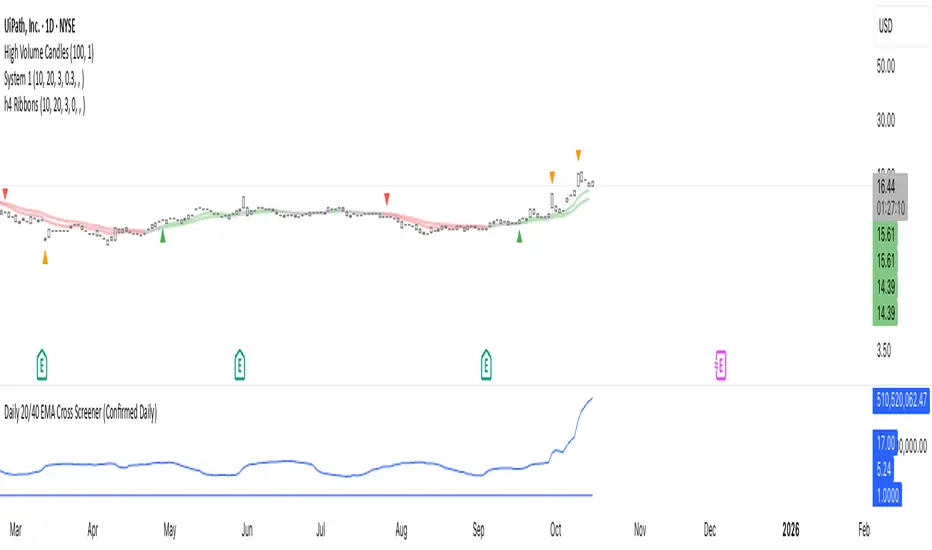

Daily 20/40 EMA Cross Screener (Confirmed Daily)

Description:

This indicator screens for daily 20/40 EMA crossovers, designed specifically to work seamlessly with TradingView’s Pine Screener. It calculates signals and metrics on the closed daily bar only — ensuring non-repainting, stable screener values.

Features:

✅ Long Signal: triggered when 20-day EMA crosses above 40-day EMA on the daily close.

⏳ Days Since Long: counts the number of trading days since the most recent bullish crossover.

📈 ATR% (20-day): measures average volatility as a percentage of price.

💵 Average $ Volume (20-day): filters for liquidity to focus on higher-quality setups.

How to use:

Add the indicator to your chart and Favorite it.

Open Pine Screener (Daily timeframe).

Filter by:

Long = 1 for active bullish signals

DaysSinceLong (e.g., < 3) to find fresh breakouts

AvgATR%_20d to define volatility ranges

Avg$Volume_20d for liquidity thresholds.

Perfect for trend-following and momentum traders looking to catch early daily trend shifts with strong volume and clean confirmation.

This indicator screens for daily 20/40 EMA crossovers, designed specifically to work seamlessly with TradingView’s Pine Screener. It calculates signals and metrics on the closed daily bar only — ensuring non-repainting, stable screener values.

Features:

✅ Long Signal: triggered when 20-day EMA crosses above 40-day EMA on the daily close.

⏳ Days Since Long: counts the number of trading days since the most recent bullish crossover.

📈 ATR% (20-day): measures average volatility as a percentage of price.

💵 Average $ Volume (20-day): filters for liquidity to focus on higher-quality setups.

How to use:

Add the indicator to your chart and Favorite it.

Open Pine Screener (Daily timeframe).

Filter by:

Long = 1 for active bullish signals

DaysSinceLong (e.g., < 3) to find fresh breakouts

AvgATR%_20d to define volatility ranges

Avg$Volume_20d for liquidity thresholds.

Perfect for trend-following and momentum traders looking to catch early daily trend shifts with strong volume and clean confirmation.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.