OPEN-SOURCE SCRIPT

Updated BTC Volume Contango Index

Based on my previous script "BTC Contango Index" which was inspired by a Twitter post by Byzantine General:

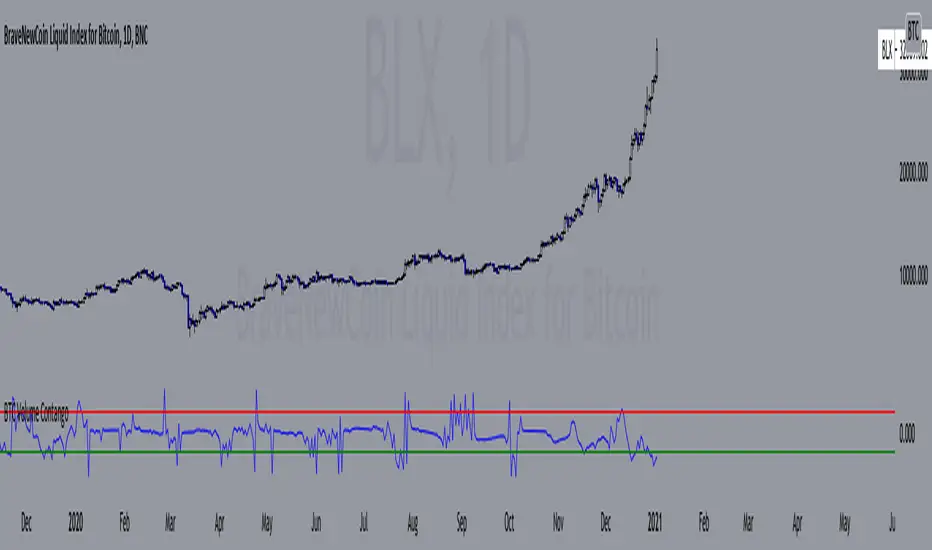

This is a script that shows the contango between spot and futures volumes of Bitcoin to identify overbought and oversold conditions. When a market is in contango, the volume of a futures contract is higher than the spot volume. Conversely, when a market is in backwardation, the volume of the futures contract is lower than the spot volume.

The aggregate daily volumes on top exchanges are taken to obtain Total Spot Volume and Total Futures Volume. The script then plots (Total Futures Volume/Total Spot Volume) - 1 to illustrate the percent difference (contango) between spot and futures volumes of Bitcoin. This data by itself is useful, but because aggregate futures volumes are so much larger than spot volumes, no negative values are produced. To correct for this, the Z-score of contango is taken. The Z-score (z) of a data item x measures the distance (in standard deviations StdDev) and direction of the item from its mean (U):

Z-score = (x - U) / StDev

A value of zero indicates that the data item x is equal to the mean U, while positive or negative values show that the data item is above or below the mean (x Values of +2 and -2 show that the data item is two standard deviations above or below the chosen mean, respectively, and over 95.5% of all data items are contained within these two horizontal references). We substitute x with volume contango C, the mean U with simple moving average ( SMA ) of n periods (50), and StdDev with the standard deviation of closing contango for n periods (50), so the above formula becomes: Z-score = (C - SMA (50)) / StdDev(C,50).

When in contango, Bitcoin may be overbought.

When in backwardation, Bitcoin may be oversold.

The current bar calculation will always look incorrect due to TV plotting the Z-score before the bar closes.

This is a script that shows the contango between spot and futures volumes of Bitcoin to identify overbought and oversold conditions. When a market is in contango, the volume of a futures contract is higher than the spot volume. Conversely, when a market is in backwardation, the volume of the futures contract is lower than the spot volume.

The aggregate daily volumes on top exchanges are taken to obtain Total Spot Volume and Total Futures Volume. The script then plots (Total Futures Volume/Total Spot Volume) - 1 to illustrate the percent difference (contango) between spot and futures volumes of Bitcoin. This data by itself is useful, but because aggregate futures volumes are so much larger than spot volumes, no negative values are produced. To correct for this, the Z-score of contango is taken. The Z-score (z) of a data item x measures the distance (in standard deviations StdDev) and direction of the item from its mean (U):

Z-score = (x - U) / StDev

A value of zero indicates that the data item x is equal to the mean U, while positive or negative values show that the data item is above or below the mean (x Values of +2 and -2 show that the data item is two standard deviations above or below the chosen mean, respectively, and over 95.5% of all data items are contained within these two horizontal references). We substitute x with volume contango C, the mean U with simple moving average ( SMA ) of n periods (50), and StdDev with the standard deviation of closing contango for n periods (50), so the above formula becomes: Z-score = (C - SMA (50)) / StdDev(C,50).

When in contango, Bitcoin may be overbought.

When in backwardation, Bitcoin may be oversold.

The current bar calculation will always look incorrect due to TV plotting the Z-score before the bar closes.

Release Notes

Changed the contango calculation to instead include the On Balance Volume of aggregate spot and futures exchanges. Contango = (Futures OBV / Spot OBV) - 1

Also changed the sma period (n) in the Z-score calculation to 20.

Release Notes

Updated to show real-time data - just select your current timeframe in the dropdown menu.Release Notes

Added more markets to aggregate volume from. Also added an option to use regular volume in the calculation, just click the box in the menu. Release Notes

Added options in the menu to select which exchanges are included in the calculation.Release Notes

Simplified the code. Because of the logic, some exchanges are paired - may find a way to unpair them later.Release Notes

Repaired the three paired exchanges so they make more sense:Coinbase/Deribit --> Coinbase/Bitmex

Bitfinex/Bitmex --> Bitfinex/Bybit

Bitstamp/Bybit --> Bitstamp/Deribit

Release Notes

Removed the timeframe input to simplify the script.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.