OPEN-SOURCE SCRIPT

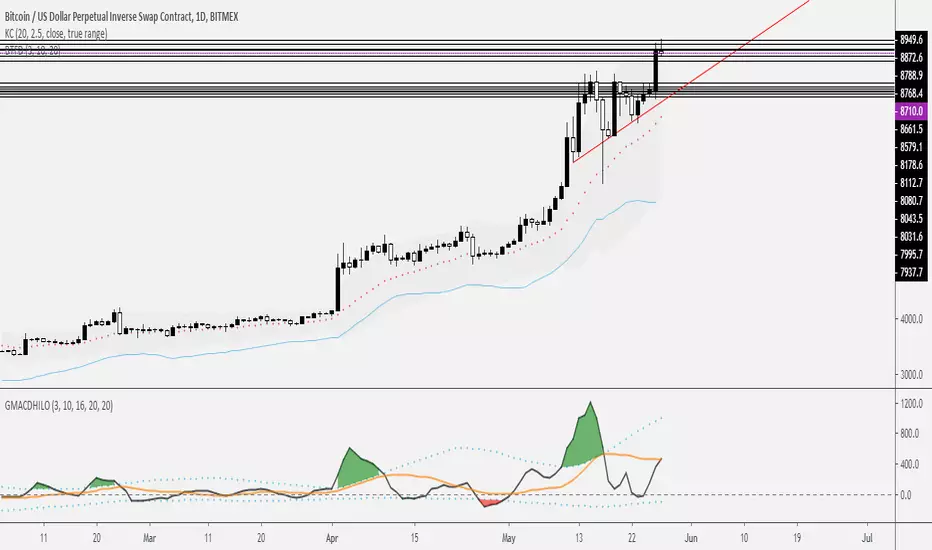

Updated Buy The Dip - Does It Work?

Buying the dip has become a meme in crypto, but does it actually work?

Using this script you can find out.

The dip is defined here as the average true range multiplied by a number of your choosing (dipness input) and subtracted from the low.

When price crosses under the dip level, a long is initiated. The long is then closed using a timestop (default value 20 bars), no fancy exits here.

A general rule for buying the dip should be to be more passive in a bull market and aggressive in a bear market.

Same goes for all counter trend trading.

Heres a few other examples of dip buying statistics using the H4 timeframe:

50% profitable, 1.692 Profit Factor

PIVXBTC

PIVXBTC

56.52% profitable, 1.254 Profit Factor

$BINANCE:KMDBTC

27.27% Profitable, 0.257 Profit Factor... yikes!

$BINANCE:BTSBTC

73.33% Profitable, 13.627 Profit Factor... o.O

MANABTC

MANABTC

Using this script you can find out.

The dip is defined here as the average true range multiplied by a number of your choosing (dipness input) and subtracted from the low.

When price crosses under the dip level, a long is initiated. The long is then closed using a timestop (default value 20 bars), no fancy exits here.

A general rule for buying the dip should be to be more passive in a bull market and aggressive in a bear market.

Same goes for all counter trend trading.

Heres a few other examples of dip buying statistics using the H4 timeframe:

50% profitable, 1.692 Profit Factor

56.52% profitable, 1.254 Profit Factor

$BINANCE:KMDBTC

27.27% Profitable, 0.257 Profit Factor... yikes!

$BINANCE:BTSBTC

73.33% Profitable, 13.627 Profit Factor... o.O

Release Notes

Had accidentally hard coded the forward looking number.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.