OPEN-SOURCE SCRIPT

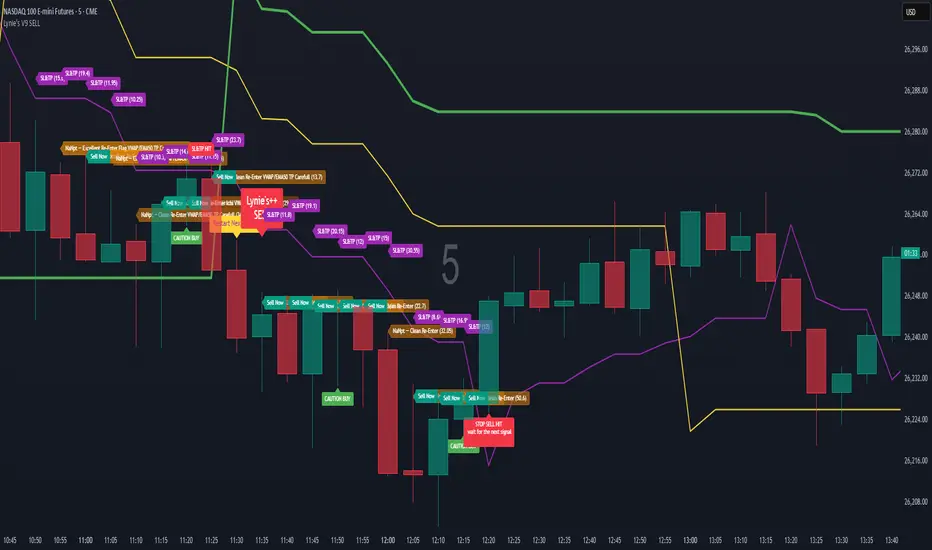

Lynie's V9 SELL

🟢🔴 Lynie’s V8 — BUY & SELL (Mirrored, Interlocking System)

Lynie’s V8 is a paired long/short engine built as two mirrored scripts—Lynie’s V8 BUY and Lynie’s V8 SELL—that read price the same way, flip conditions symmetrically, and manage trades with the exact logic on opposite sides. Use either one standalone or run both together for full two-sided automation of entries, re-entries, caution states, and adaptive SL/TP.

✳️ What “mirrored” means here

Supertrend Tri-Stack (10/11/12):

BUY: ST10 primary pierce; ST12 fallback; “PAG Buy” when price pierces any ST while above the other two.

SELL: Exact inverse—ST10 primary pierce down; ST12 fallback; “PAG Sell” when price pierces any ST while below the other two.

Re-Enter Clusters:

BUY: Ratcheted up (Heikin-Ashi green holds/tightens).

SELL: Ratcheted down (Heikin-Ashi red holds/tightens).

Both sides use the same cluster age/decay math, care penalties, session awareness, and fast-candle tightening.

Care Flags (context risk):

Ichimoku, MACD, RSI combine into single and paired flags that tighten or widen offsets on both sides with the same scoring.

VWAP–EMA50 (5m) cluster gate:

Identical distance checks for BUY/SELL. When the mean cluster is present, offsets and labels adapt (tighter/“riskier scalp” messaging).

Golden Pocket A/B/C (prev-day):

Same fib boxes & labeling (gold tone) on both sides to call out TP-friendly zones.

SL/TP Envelope:

Shared dynamic engine: per-bar decay, fast-candle expansion, and care-based compress/relax—all mirrored for up/down.

Caution Labels:

BUY side prints CAUTION SELL if HA flips red inside an active long cluster.

SELL side prints CAUTION BUY if HA flips green inside an active short cluster.

Same latching & auto-release behavior.

🧠 Core workflow (both sides)

Primary trigger via ST10 pierce (structure shift) with an ST12 fallback when ST10 didn’t qualify.

PAG Mode when price is already on the right side of the other two STs—strongest conviction.

Cluster phase begins after a signal: ratcheted re-entry level, session-aware offsets, dynamic tightening on fast bars.

Care system shapes every re-entry & SL/TP label (Ichi/MACD/RSI combos + VWAP/EMA gate + QQE).

Protective layer: SL-wick and SL-body logic, caution flips, and “hold 1 bar” cluster carry after SL to avoid whipsaw spam.

🔎 Labels & messages (shared vocabulary)

Lynie’s / Lynie’s+ / Lynie’s++ — strength tiers (ST12 involvement & clean context).

Re-Enter / Excellent Re-Enter — cluster pullback quality; ratchet shows the “must-hold” zone.

SL&TP (n) — live offset multiplier the engine is using right now.

CAUTION BUY / CAUTION SELL — HA flip against the active side inside the cluster.

Restart Next Candle — visual cue to re-arm after a confirmed signal bar.

⚡ Why run both together

Continuity: When a long cycle ends (SL or caution degradation), the SELL engine is already tracking the inverse without re-tuning.

Symmetry: Same math, same signals, opposite direction—no hidden biases.

Coverage: Trend hand-offs are cleaner; you don’t miss early shorts after a long fade (and vice versa).

🔧 Recommended usage

Intraday futures (ES/NQ) or any liquid market.

Keep the VWAP–EMA cluster ON; it filters FOMO chases.

Honor Caution flips inside cluster—scale down or wait for the next clean re-enter.

Treat Golden Zones as TP magnets, not guaranteed reversals.

📌 Notes

Both scripts are Pine v6 and independent. Load BUY and SELL together for the full experience.

All offsets (re-enter & SL/TP) are visible in labels—so you always know why a zone is where it is.

Alerts are provided for signals, re-enter hits, caution, and SL events on both sides.

Summary: Lynie’s V8 BUY & SELL are vice-versa twins—one framework, two directions—delivering consistent entries, adaptive re-entries, and contextual risk management whether the market is pressing up or breaking down.

Lynie’s V8 is a paired long/short engine built as two mirrored scripts—Lynie’s V8 BUY and Lynie’s V8 SELL—that read price the same way, flip conditions symmetrically, and manage trades with the exact logic on opposite sides. Use either one standalone or run both together for full two-sided automation of entries, re-entries, caution states, and adaptive SL/TP.

✳️ What “mirrored” means here

Supertrend Tri-Stack (10/11/12):

BUY: ST10 primary pierce; ST12 fallback; “PAG Buy” when price pierces any ST while above the other two.

SELL: Exact inverse—ST10 primary pierce down; ST12 fallback; “PAG Sell” when price pierces any ST while below the other two.

Re-Enter Clusters:

BUY: Ratcheted up (Heikin-Ashi green holds/tightens).

SELL: Ratcheted down (Heikin-Ashi red holds/tightens).

Both sides use the same cluster age/decay math, care penalties, session awareness, and fast-candle tightening.

Care Flags (context risk):

Ichimoku, MACD, RSI combine into single and paired flags that tighten or widen offsets on both sides with the same scoring.

VWAP–EMA50 (5m) cluster gate:

Identical distance checks for BUY/SELL. When the mean cluster is present, offsets and labels adapt (tighter/“riskier scalp” messaging).

Golden Pocket A/B/C (prev-day):

Same fib boxes & labeling (gold tone) on both sides to call out TP-friendly zones.

SL/TP Envelope:

Shared dynamic engine: per-bar decay, fast-candle expansion, and care-based compress/relax—all mirrored for up/down.

Caution Labels:

BUY side prints CAUTION SELL if HA flips red inside an active long cluster.

SELL side prints CAUTION BUY if HA flips green inside an active short cluster.

Same latching & auto-release behavior.

🧠 Core workflow (both sides)

Primary trigger via ST10 pierce (structure shift) with an ST12 fallback when ST10 didn’t qualify.

PAG Mode when price is already on the right side of the other two STs—strongest conviction.

Cluster phase begins after a signal: ratcheted re-entry level, session-aware offsets, dynamic tightening on fast bars.

Care system shapes every re-entry & SL/TP label (Ichi/MACD/RSI combos + VWAP/EMA gate + QQE).

Protective layer: SL-wick and SL-body logic, caution flips, and “hold 1 bar” cluster carry after SL to avoid whipsaw spam.

🔎 Labels & messages (shared vocabulary)

Lynie’s / Lynie’s+ / Lynie’s++ — strength tiers (ST12 involvement & clean context).

Re-Enter / Excellent Re-Enter — cluster pullback quality; ratchet shows the “must-hold” zone.

SL&TP (n) — live offset multiplier the engine is using right now.

CAUTION BUY / CAUTION SELL — HA flip against the active side inside the cluster.

Restart Next Candle — visual cue to re-arm after a confirmed signal bar.

⚡ Why run both together

Continuity: When a long cycle ends (SL or caution degradation), the SELL engine is already tracking the inverse without re-tuning.

Symmetry: Same math, same signals, opposite direction—no hidden biases.

Coverage: Trend hand-offs are cleaner; you don’t miss early shorts after a long fade (and vice versa).

🔧 Recommended usage

Intraday futures (ES/NQ) or any liquid market.

Keep the VWAP–EMA cluster ON; it filters FOMO chases.

Honor Caution flips inside cluster—scale down or wait for the next clean re-enter.

Treat Golden Zones as TP magnets, not guaranteed reversals.

📌 Notes

Both scripts are Pine v6 and independent. Load BUY and SELL together for the full experience.

All offsets (re-enter & SL/TP) are visible in labels—so you always know why a zone is where it is.

Alerts are provided for signals, re-enter hits, caution, and SL events on both sides.

Summary: Lynie’s V8 BUY & SELL are vice-versa twins—one framework, two directions—delivering consistent entries, adaptive re-entries, and contextual risk management whether the market is pressing up or breaking down.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

PAG

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

PAG

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.