OPEN-SOURCE SCRIPT

Updated KD compare strategy (交易策略對照組)

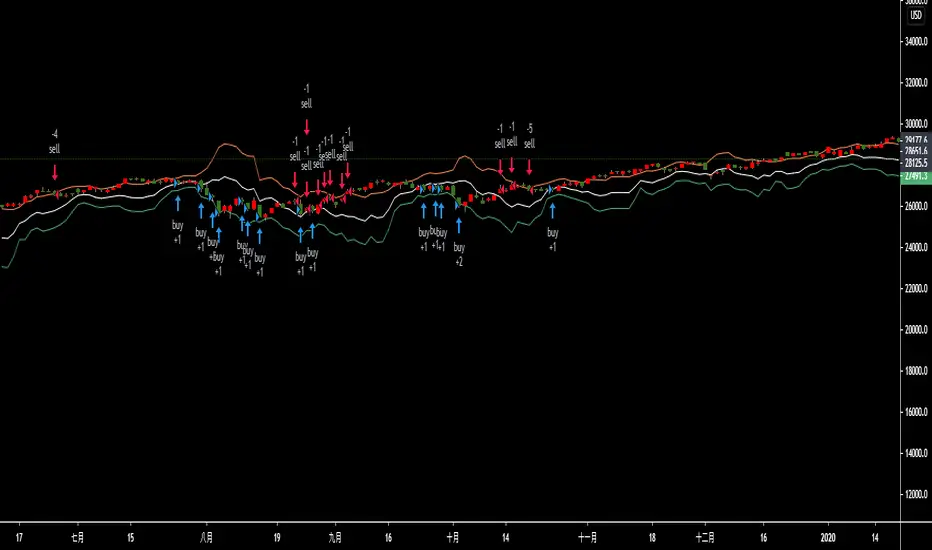

This is a base and easy trading strategy for comparing my other strategy.

The strategy consider K >= 80 is strong target in the last high period,

and consider K <=20 is the weak target in the last low period.

In the strong target, the strategy may increase long at the first day when K < 50, until 2/3 max order limitation or strong target become to weak.

In the weak target, the strategy may increase short at the first day when K > 50, until 2/3 max order limitation or strong target become to strong.

there are three orders for this strategy.

when the strong become to weak, it may use the remain 1/3 to save itself, and change the direction at the next k > 50

when the weak become to weak, it may use the remain 1/3 to save itself, and change the direction at the next k < 50

這是一個簡單的雙向交易策略,用來對照我其他的策略。

當 K>=80 它會認為目前是強勢股,偏多操作

當 K<=20 它會認為目前是強勢股,偏空操作

當標的為強勢股時,當第一次 K<50 會加碼多單,最多買進2/3的持股,直到轉弱

當標的為弱勢股時,當第一次 K>50 會加碼空單,最多買進2/3的持股,直到轉強

當強勢轉弱勢時,會使用剩下的1/3來拯救持股,在下次 k > 50 出清持股

當弱勢轉強勢時,會使用剩下的1/3來拯救持股,在下次 k < 50 出清持股

The strategy consider K >= 80 is strong target in the last high period,

and consider K <=20 is the weak target in the last low period.

In the strong target, the strategy may increase long at the first day when K < 50, until 2/3 max order limitation or strong target become to weak.

In the weak target, the strategy may increase short at the first day when K > 50, until 2/3 max order limitation or strong target become to strong.

there are three orders for this strategy.

when the strong become to weak, it may use the remain 1/3 to save itself, and change the direction at the next k > 50

when the weak become to weak, it may use the remain 1/3 to save itself, and change the direction at the next k < 50

這是一個簡單的雙向交易策略,用來對照我其他的策略。

當 K>=80 它會認為目前是強勢股,偏多操作

當 K<=20 它會認為目前是強勢股,偏空操作

當標的為強勢股時,當第一次 K<50 會加碼多單,最多買進2/3的持股,直到轉弱

當標的為弱勢股時,當第一次 K>50 會加碼空單,最多買進2/3的持股,直到轉強

當強勢轉弱勢時,會使用剩下的1/3來拯救持股,在下次 k > 50 出清持股

當弱勢轉強勢時,會使用剩下的1/3來拯救持股,在下次 k < 50 出清持股

Release Notes

update the descriptionread line is close transform to k = 80

white line is close transform to k = 50

green line is close transform to k = 20

更新說明

紅線代表 k=80 趨勢轉強

白線代表 k=50 執行策略操作

綠線代表 k=20 趨勢轉弱

Release Notes

update the exampleRelease Notes

remove rule 5, 6rule 3, 4, clear share

Release Notes

set transp=100, (share, direction, k), only show the valueRelease Notes

add tomorrow value, k80, k50, k20Release Notes

1. enhance the order strategy2. change rule 1 and rule 2

Release Notes

1. update the tagRelease Notes

add the shadow arrow, if you want to buy or sell more.加入加碼點箭頭

Release Notes

update the exampleRelease Notes

1. add rule 5 ~ rule 102. add rate to enhance the effectiveness

3. remove the shadow

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.